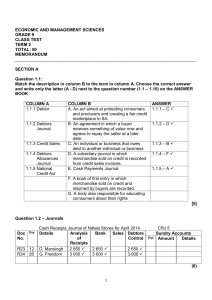

Grade 9 Accounting: Debtors, Credit Sales, National Credit Act

advertisement

Economics and Management Sciences Grade 9 Accounting Term 2 Topics for term 2 • Debtors Journal (DJ) • Posting of the DJ to the General Ledger • Debtors Allowance Journal (DAJ) • Posting of the DAJ to the General Ledger • Effect on the Accounting Equation 1. Credit sales and Cash Sales • Cash Sales • Money is given immediately for items purchased. Items are immediately exchanged during cash. (This is a cash transaction). • Credit Sales • Items received immediately but the money will be paid at a later stage with more interest. • Businesses sell mainly on credit to increase their sales and cash flow in the business is improved Important Accounting Concepts ACCOUNTING CONCEPTS No. Accounting Concepts Definition/ Description/Examples 1 Credit Sales When goods are sold on credit with the aim of increasing clientele and turnover 2 Debtors Customers who owe money to the business 3 Credit Agreements Specifies the credit limit, payment terms and penalties 4 Invoice Document issued to customers when goods are sold for credit 5 Credit Bureau Private business which collects the credit records of customers 6 Repayments Money owed is paid back 7 National Credit Act Aims at preventing people from spending money they do not have. 8 Creditworthiness Having a good credit record and affordability 9 Credit reference Process conducted by businesses when a customer wants to buy goods on credit to make sure that they are trustworthy and can pay the debt. 10 Term of Credit The time or the period that the debtor must pay their account. Process of someone becoming a debtor • First a person must complete a Application form. • The Application form consists of the following: full names of the applicant ID number marital status ( Are they single, married, divorced or widowed) address or place of residence salary or wage, references of other credit stores (Any other store where the person has an account) the occupation of the person applying for the account etc. • Some stores will want salary advice for the following reason(seeing whether someone is able to pay for the goods they purchase on account) : • 1. Affordability of the applicant. (Can they pay for the goods purchased. A business will not want a debtor that cannot pay them back) • 2. Proof of employment ( If someone is not really employed they will not be able to pay the money back.) • 3. Debit order payments through the bank ( They check to see if someone is a good payer and if they pay on a regular basis. You want a debtor that pays on time and the correct amounts) • 4. Credit Bureau checks through the ID on the salary slip 9 The credit Bureau has all the information on any form of debt that is linked to you ID number, whether it is a car repayment, loan from a bank or store accounts, this information will reflect on their systems. Example of an application form • The application form that is attached is an example of the application form someone will complete to finance a motorcycle. The supplier will complete this box. This is the details of the dealership you bought the goods from and whether a deposit was given an what the amount of financing will be and what your monthly instalment will be. This box you will complete your personal details. ANC is when you and your spouse is married out of community of property (meaning what is yours is yours and what is his will be his if you should ever divorce. COP is when you and your spouse is married in community of property( meaning when you guys got married everything that as yours will become his and what is his will become yours.) The bond detail is your mortgage that you pay every month. Remember if you have your own property it is an asset and if you pay your monthly instalment your prospective credit provider will see that you are a good payer. In this section you will complete your employer’s details ( the company you work for) and your bank account details such as your account number etc. Trade reference is any other store account etc. the financer can contact to see how you pay your account. Here you will complete you initials and Surname for example my intials is M and my surname is Barnard. The personal application form you will complete all the details regarding your salary. Whether you receive a car allowance ( money the company gives to you to pay a car this also includes petrol allowance that your company gives you.) This must be completed for you and your husband/wife, if you are single you just complete own. In this section you will complete all of you monthly expenses. Remember we complete amounts not write yes/no. Here you will read through and sign if all the information that you have given is true and correct. If you sign here that the information is correct, and the wrong information was given. National Credit Act • The National Credit Act, Act 34 of 2005 (NCA) was created to protect both the consumers and businesses and became fully operational in South Africa on 1 June 2007. • The purpose of National Credit Act Educate consumers on the responsibilities of borrowing Ensure that money that is borrowed or lent out can be paid back. To protect consumers who are unfairly treated by NCA Provide debt counselling processes to consumers who cannot find a solution to repay their debts • What the National Credit Act can do for you Credit is good for you. It gives you that extra edge when you want to buy those things that are out of your reach. The problem comes in when debt can quickly spiral out of control. So the trick is, manage your finances – only borrow what you can afford. • Credit-worthiness Before a business will grant a person to buy on credit, they first must see if the person is credit worthy – if the person is able to pay back its debts. To do this, they must look at a persons’ credit record – how did the person paid back previous debts. If the business is satisfied, the business and the person will go into an agreement • Such an agreement specifies the following: Credit limit – the maximum amount the debtor can owe on a specific date. Payments terms – how long can the debtor pays his/her account. Incentives or rewards – can give the debtor discount if he/she pays earlier. Penalties – charge the debtor interest for late payment on his/ her account Recording of credit sales • 1. Source document. • We have learnt from the accounting cycle that when a transaction takes place it must be recorded on a source document. The source document for credit sales is a creditinvoice. • CREDIT INVOICE • This is a source document which lists goods bought with prices charged and serves as proof that the transaction between a seller and buyer has taken place. The invoice contains the following: • • • • • • • • • • • Letterhead of the seller. Name and address of the buyer. Date on which the transaction took place.. Details of the goods i.e. description, quantities, etc. Prices. Total amount of the debt. VAT Terms of payment. Trade and cash discount allowed. The abbreviation E&OE Special instructions if there are any. • The invoice is completed in duplicate. • The client (Debtor) is given the original invoice • The business enterprise remains with a duplicate credit invoice; this is the document that is used to record the transaction. • Example • Let learners complete a blank template of an invoice in their workbooks use the following information for learners to complete the template. • On 12 September 2011 Ntuta stores of 78 Howard Avenue, Benoni, 1500 sent an invoice (no. INV 1234) to C. Roux of 112 Oak street, Northmead for the following items sold on credit: • 8 chairs @ R350, 00 each. • 3 tables @ R1040, 00 each. • 1 cupboard @ R1300, 00. • Terms : 30 days, 5% discount • • • • • • • • • • Procedure for completing an invoice: Write invoice number. Write date on which the transaction took place. Write the details of the buyer, i.e. name and address. Complete the details of goods sold, i.e. quantity, description and unit price. Multiply quantity by the unit price and write total amount under the column for Amount. Add all the amounts and write the total amount owed. Write terms of payment. Write special instructions if there are any. NB: VAT is ignored in this workbook Example of how the invoice will be completed with the information that is highlighted. TO: C. Roux 112 Oak street Northmead INVOICE NO : INV1234 78 Howard avenue Benoni 1500 Date:12 September 2011 Ntuta Stores Quantity Description 8 3 1 Chairs tables cupboard Unit Price R350, 00 R1040, 00 R1300, 00 Total Amount R 2 800 3 120 1 300 7 220 Terms : 30 days, 5% discount Special instructions: none E&OE • Now that we know what the difference is between cash and credit sales, we know how to complete a credit application form and we are able to complete an invoice we can start looking at our Journals that are affected by credit sales. • The journal we will be doing first is the debtors journal (DJ). What is a debtor? • • • • • • • • A debtor is a Current Asset He owes the enterprise money An enterprise(business) sell goods/services to him on credit The enterprise issues the Debtor with an invoice The SOURCE DOCUMENT is the DUPLICATE INVOICE (This is a duplicate invoice because the customer will always get the original invoice and the business completes the journal from the duplicate invoice, therefor it is a duplicate invoice for the business and an original invoice for the customer.) These transactions are recorded in the Debtors Journal (DJ) When the Debtor settles his account or makes a part payment, the enterprise issues the debtor with a receipt (original). The source document once payment is received, is the duplicate receipt This receipt of money is recorded in the Cash Receipts Journal (CRJ) The Debtors Journal (DJ) • All transactions during which an enterprise SELLS ON CREDIT will be entered in the first book of entry the debtors journal. • So all goods sold on credit will be recorded in the debtors journal. • When an enterprise issues invoices to various customers the invoices are numbered chronologically and it is these numbers that you use for recording purposes in the Journal. (The invoice will be in chronological order meaning if we start with invoice number 501 the next invoice will be 502,503,504 etc.. FORMAT OF THE DEBTORS JOURNAL Classroom activity explained • Let us do the classroom activity together on page 81. • Please see video on how to complete the Debtors Journal. • After you have done classroom activity 1, do classroom activity 2, but only the Debtors Journal. We will post to the General Ledger separately. • We did the posting to the general ledger. • Exercise 4.3 page 83-84 the Debtors Journal and post to the General Ledger. • Exercise 4.4 page 85-87 on the CRJ, DJ and General Ledger Debtors Allowance Journal (DAJ) In the debtors' allowance journal we record transactions where debtors send goods back. Debtors send goods back for the following reasons: Wrong color, wrong size The product is broken They are not satisfied with the product Or if a product is overpriced an allowance will be given.( The amount which is over charged with will be written back on the debtors account. For example if you paid R300 for a t-shirt and it should only cost R200, the R100 that was over charged will be credited to your account. You will now be in credit with the store. ) • When a debtor returns goods, we issue a CREDIT NOTE. So the source document for the DAJ is a DUPLICATE CREDIT NOTE. (Remember the customer will always get the original invoice and the business will use the duplicate to complete the journal) • It is a credit note because the customers account must now be credited (decreased with that amount) • • - Format of the Debtors Allowance Journal Debtors Allowances Journal of Name of the business for month and year DAJ month Doc Day Credit note number Day transaction took place Debtors Debtors Name Fol Debtor number Debtors Allowance Cost of Sales Amount for which the debtor returned Cost of the goods returned Total of debtors allowance column Total of the cost of sales Example of the Debtors allowance Journal • On the 4th March 2006 a debtor A. Apple (D1) purchased R3000 vegetables on credit from MODUS STORES. He received the vegetables, but some were rotten, he returned the vegetables and requested a credit of R800. a) Credit note no.9 was issued on the 5th March. The cost price of the vegetables returned was R500. Debtors Allowances Journal of Modus stores for March 2006 DAJ 03 Doc Day Debtors Fol Debtors Allowance Cost of Sales 9 5 A. Apple D1 800 500 800 500 Posting to the General Ledger • Important things to remember. - A debtor is returning the product they bought so it is coming back into our inventory(stock). Inventory is coming back so the trading inventory account must now increase (debited). - If we complete trading inventory, we must complete the cost of sales account DR + Cost of Sales CR - DR + Trading inventory - CR - When we post these account, we use the cost of sales amount from the debtors' allowance journal • Remember that when a debtor returns the product, they bought they do not owe use that money anymore therefor we must credit the debtors account( we reverse the transaction). • DR + Debtors Control - CR Debtors Allowance DR CR • We credit the debtors control account because we need to credit our debtors account and the debtors allowance account is credited. Activities • Exercise 4.5 page 91- 92 on completing the DAJ and posting to the General Ledger. Exercise 4.6 page 93-96 tips • Remember we will be posting the DJ, DAJ and the Cash Receipt Journal. • Remember we post to the CRJ when a debtor pays his/her account.(Complete the Analysis of Receipt, Bank and Debtors Control). • Key words posting to the DJ - Issued an invoice - Credit sales - Sold goods on account • Key words posting to the DAJ - Debtor sent back goods - We issued a credit note - Received a credit note from a customer - Debtor returned damaged goods - Debtor returns incorrect stock • Key words for posting to the CRJ - Received a payment or part payment from a debtor - Debtor settles his/her account • Remember the totals on page 93 under General Ledger is the opening balances for the General Ledger • The amounts under Debtors Ledger is the amount that our debtor already owes us, so L. Lewis owes us R450 already. • A video will be posted to the group on how to do this exercise. Effect on the accounting equation • Effect of credit sales on the accounting equation: • When we sell goods on credit, we do not get any money, the client who bought goods owe our business money. • Someone or another business enterprise that owes money to the business is called a Debtor. • When we sell goods, we use the term Sales regardless of whether the goods were sold for cash or on credit. The difference between cash and credit sales are the accounts affected. • When we sell goods for cash money is received therefore the accounts affected will be • Bank and Sales. • When we sell goods on credit, we do not get any money therefore an account is opened called Debtors control. Therefore the accounts affected will be: • Sales • Debtors control Income an asset Owner’s Equity increases assets Increase Credited Debited • Remember every time you sell goods your trading stock account decreases, therefore a double entry is made for the cost of the goods sold. • The accounts affected will be: • Trading stock an asset • Cost of sales an expense assets decrease owner’s equity decreases Credited debited • Example: • Examine the following transactions: • 4 June 2011 sold goods on credit to W. White R590 (cost price R450). • Question : Identify the accounts affected. • Answer will be: Sales and Debtors control. Cost of sales and trading stock. • • Answer the following questions: 1. What is sales on the accounting equation? 2. Does owner’s equity increase or decrease if we sell goods on credit? 3. On which side do we increase Owner’s equity? 4. What is Debtors control on the equation? 5. Do our assets increase or decrease when we sell goods on credit? 6. On which side do we increase assets? Answers: 1. Owner’s equity because sales is an income. 2. Owner’s equity increases 3. Credit side 4. Asset (Current Asset) 5. Asset increases 6. Debit side How to use the highlighted information above to complete the accounting equation given the following columns: 4 June 2011 sold goods on credit to W. White R590 (cost price R450). Date and Source document 4/June Duplicate credit invoice Subsidiary journal Account debited Account credited Effect on the accounting equation A OE L Debtors journal Debtors control Sales + + 0 Debtors journal Cost of sales Trading stock - - 0 Do exercise 4.7 on page 96 • Remember: DEBIT CREDIT DEBIT CREDIT