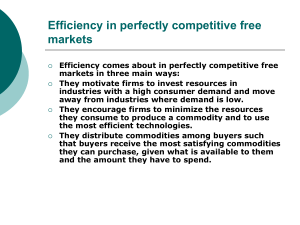

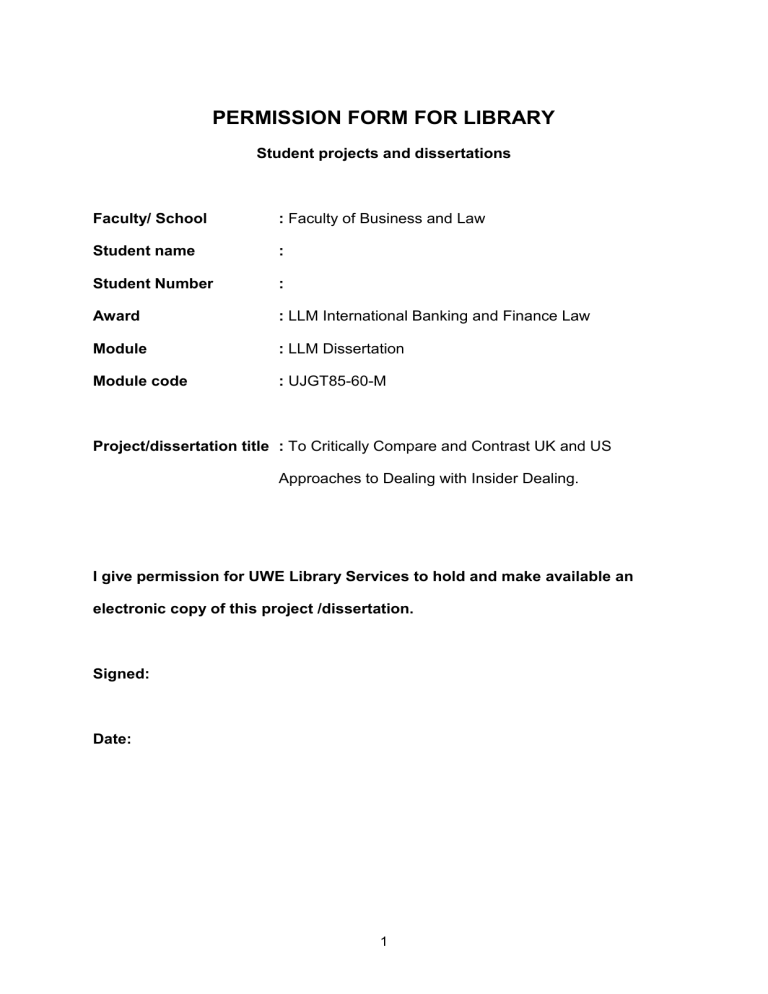

PERMISSION FORM FOR LIBRARY Student projects and dissertations Faculty/ School : Faculty of Business and Law Student name : Student Number : Award : LLM International Banking and Finance Law Module : LLM Dissertation Module code : UJGT85-60-M Project/dissertation title : To Critically Compare and Contrast UK and US Approaches to Dealing with Insider Dealing. I give permission for UWE Library Services to hold and make available an electronic copy of this project /dissertation. Signed: Date: 1 TO CRITICALLY COMPARE AND CONTRAST UK AND US APPROACHES TO DEALING WITH INSIDER DEALING Name: Student Number: A dissertation submitted in partial fulfilment of the requirements of the University of the West of England for the degree of Master of Laws in International Banking and Finance Law Bristol Law School, University of the West of England, Bristol Date: [Word count: 15,000] 2 Legislative and Enforcement Responses in the UK and US Insider Dealing TABLE OF CONTENTS ACKNOWLEDGEMENT ............................................................................................. 5 ABSTRACT ................................................................................................................ 6 LIST OF ABBREVIATIONS ........................................................................................ 7 CHAPTER 1: INTRODUCTION .................................................................................. 8 I. Market abuse and insider dealing .................................................................... 8 II. Purposes and Objectives of the Study ............................................................. 9 III. Methodology and Methods ......................................................................... 11 A. Methodology .............................................................................................. 11 B. Methods ..................................................................................................... 12 IV. Thesis Structure ......................................................................................... 12 CHAPTER 2: INSIDER DEALING AND THE IMPORTANCE OF INSIDER DEALING LAWS ....................................................................................................................... 13 I. Ethical and economic characteristics of insider dealing ................................. 13 A. Ethical considerations ................................................................................ 13 B. Economic considerations ........................................................................... 18 II. The importance of insider-dealing regulations ............................................... 23 CHAPTER 3: THE UNITED KINGDOM APPROACHES .......................................... 25 I. II. Legislative responses .................................................................................... 25 A. Development of insider dealing legislations in the United Kingdom ........... 25 B. Part V of the Criminal Justice Act 1993 ...................................................... 26 C. The Financial Services and Markets Act 2000 ........................................... 37 Enforcement responses ................................................................................. 43 3 Legislative and Enforcement Responses in the UK and US Insider Dealing A. Enforcement authorities ............................................................................. 43 B. Criminal proceedings versus civil proceedings .......................................... 46 C. Concluding remarks ................................................................................... 53 CHAPTER 4: THE UNITED STATES APPROACHES ............................................. 55 I. Legislative responses .................................................................................... 55 A. Development of insider-trading legislations in the United States ............... 55 B. The Securities Exchange Act of 1934 ........................................................ 57 C. The Insider Trading Sanctions Act of 1984 and the Insider Trading and Securities Fraud Enforcement Act of 1988 ........................................................ 67 D. II. The US insider-trading theories ................................................................. 74 Enforcement responses ................................................................................. 77 A. Enforcement authorities ............................................................................. 77 B. Criminal proceedings versus civil proceedings .......................................... 83 C. Concluding remarks ................................................................................... 87 CHAPTER 5: CONCLUSION ................................................................................... 89 APPENDIX ............................................................................................................... 93 BIBLIOGRAPHY ...................................................................................................... 99 4 Legislative and Enforcement Responses in the UK and US ACKNOWLEDGEMENT 5 Insider Dealing Legislative and Enforcement Responses in the UK and US Insider Dealing ABSTRACT Insider dealing is a practice that not only academics but also regulators pay great attention to. There are numerous debates on the nature of insider dealing and the necessity of insider dealing laws. This comparative research using legal-cultural methods considers both ethical and economic aspects of insider dealing, then assesses the effectiveness of the UK as well as US approaches to tackle insider dealing and determines the better system. Each system outperforms in several criteria. While the UK legislative responses seem to be more effective, the US enforcement responses might provide more actual effects. 6 Legislative and Enforcement Responses in the UK and US Insider Dealing LIST OF ABBREVIATIONS The United Kingdom UK The United States of America US The European Union EU The Financial Services Authority FSA The Financial Conduct Authority FCA The Serious Fraud Office SFO The Securities and Exchange Commission SEC The Department of Justice DoJ The Federal Bureau of Investigation FBI The Commodity Futures Trading Commission CFTC The Efficient Market Hypothesis theory EMH The Texas Gulf Sulphur TGS The Department of Trade and Industry DTI The London Stock Exchange LSE The Company Securities (Insider Dealing) Act 1985 CSA The Criminal Justice Act 1993 CJA The Financial Services and Markets Act 2000 FSMA The Market Abuse Regime MAR The Securities Exchange Act of 1934 SEA The Insider Trading Sanctions Act of 1984 ITSA The Insider Trading and Securities Fraud Enforcement Act of ITSFEA 1988 Deferred prosecution agreement DPA Non-prosecution agreement NPA 7 Legislative and Enforcement Responses in the UK and US Insider Dealing CHAPTER 1: INTRODUCTION I. Market abuse and insider dealing Market abuse is a financial crime that creates giant profits for criminals or wrongdoers, erodes public confidence, reduces market integrity and harms the competition1. Among market-abuse offences, insider dealing (or insider trading) is an abusive conduct that a person takes advantage of a company’s material non-public information to trade on its securities for the purposes of making profits or cutting loss2. Insider dealing is commonly believed to be illegal and harmful to market integrity as well as public confidence3, so there have been more insider-dealing regulations4. However, the fact that numerous regulations have been adopted does not justify insider dealing’s illegality and harmfulness. Rather than arbitrage purposes such as financial gains or loss avoidance, there are reasons that insiders might trade on their Paul Barnes, 'Insider Dealing And Market Abuse: The UK’S Record On Enforcement' (2011) 39 (3) International Journal of Law, Crime and Justice 174-189. 2 Barnes (n 1); Iwona Seredynska, Insider Dealing And Criminal Law: Dangerous Liaisons (1st edn, Springer-Verlag Berlin Heidelberg 2012); Rita Cheung, ‘Insider Trading Sentencing: An Anglo-American Comparison’ (2014) 7 Journal Business Law 564-584; Michael Seitzinger, ‘Federal Securities Law: Insider Trading’ (Congressional Research Service 2016); Phillip O’Hara, ‘Insider Trading In Financial Markets: Legality, Ethics, Efficiency’ (2001) 28 International Journal of Social Economics 1046-1062. 3 Barnes (n 1); Cheung (n 2); Matthew White, ‘The Implications For Securities Regulation Of New Insider Dealing Provisions In The Criminal Justice Act 1993’ (1995) 16(6) Company Law 163-171; Zheng Weiwei, ‘New Challenges And Undertakings For Administrative And Regulatory Reform: A Global Watch With Chinese Perspective – An Examination Of Legal Regulations For Insider Dealing In The UK And The Lessons For China’ (2017) 12(4) Frontiers Of Law In China 524-560. 4 Seredynska (n 2); O’Hara (n 2). 1 8 Legislative and Enforcement Responses in the UK and US Insider Dealing company’s securities5 such as business control or portfolio diversification6. Motives of insiders should be considered, but it is not easy to determine or examine motives. The question whether insider dealing must be prohibited has not been satisfactorily answered. There exists a huge literature that captures multidimensional arguments, and debates seem to continue. Thus, it is interesting to carry out a research on insider dealing to examine why it is regulated and effectiveness of existing insider-dealing laws. II. Purposes and Objectives of the Study This thesis considers insider-dealing characteristics, then discusses legislative and enforcement responses of authorities. The research aims at analysing insiderdealing laws in the UK and US. Its objectives are to gain understanding of two different legal approaches and to determine the better system. Evaluative frameworks are established on different criteria. A framework to evaluate legislative responses will assess the extent to which regulations cover insider-dealing offences; the clarity and legal certainty of wordings; the ease for authorities or jurists to initiate legal proceedings; the degree of protection for market participants and the market. Meanwhile, enforcement responses are evaluated on the basis of enforcement of criminal and civil sanctions; number of convictions; imposition of sanctions on Yulong Ma and Huey-Lian Sun, ‘Where Should Be Line Be Drawn On Insider Trading Ethics?’ (1998) 17(1) Journal of Business Ethics 67-75; Rozeff and Zaman, ‘Market efficiency and insider trading: New evidence’ (1988) 61 Journal of Business 25–44; Jenter, ‘Market timing and managerial portfolio decisions’ (2005) 60 Journal of Finance 1903–1949; Nihat Aktas, Eric De Bodt, Herve Van Oppens, ‘Legal insider trading and market efficiency’ (2008) 32 Journal of Banking and Finance 1379–1392. 6 Managers may buy stocks to increase their stockholding, which improves their voting power and control over the corporate. Insiders may buy or sell the company’s stocks to diversify their portfolios or to meet their temporary financial need. See Ma and Sun (n 5). 5 9 Legislative and Enforcement Responses in the UK and US Insider Dealing corporates and individuals; actual compliance of individuals and organisations, actual level of protection for investors or shareholders. The research question is ‘to critically compare and contrast UK and US approaches to dealing with insider dealing’. Following sub-questions help answer the main question. • Why is insider dealing regulated? • What are legislative and enforcement responses in two countries? • How effective are those approaches? There are two reasons why UK and US approaches are chosen. Firstly, both legal systems are common-law based. Choosing two generally similar systems might avoid analysis and comparison of incomparable criteria. Secondly, UK and US financial systems are among the most developed ones. Stability in those systems has significant impacts on not only economic development of the UK and US but also global economy7. Insider dealing in the UK and US system should be studied as it is widely considered as a market-abuse offence that harms financial markets. Besides, UK and US are ‘two of the largest and most successful securities markets in the world’ whose insider-dealing laws become a benchmark for other jurisdictions8. 7 The fact that UK and US financial systems are in turmoil will result in globally economic recession or even depression. For example, the 2008 financial crisis originated in the US subprime mortgage market, then spread to the UK and EU. 8 McCoy and Summe, ‘Insider trading regulation: A developing state’s perspective’ (1998) 5 (4) Journal of Financial Crime 311 – 346 at 311. 10 Legislative and Enforcement Responses in the UK and US III. Methodology and Methods A. Methodology Insider Dealing This dissertation is a comparative research in which legal-cultures approach is used. Comparative research provides knowledge of different legal approaches9, improves domestic legal system by learning from other countries’ solutions or settlement10 and supports unification11. Comparative methodology is appropriate for this dissertation. Firstly, the research’s objectives match functions of comparative law. By accessing to new dimensions of other legal cultures and systems, researchers can reflect back into their familiar systems to make ‘taken-for-granted’ or tacit norms and values become explicit12. As a result, they can understand both systems and enhance their skills of critical analysis. By establishing evaluative frameworks to compare and contrast two systems, researchers can determine the better system. Secondly, there is a lack of comparative research on insider dealing between the UK and US laws. Comparative studies are usually carried out between the EU and the US or among EU countries. Comparative research between UK and US systems is necessary. 9 Blerton Sinani and Klodi Shanto, 'Methods And Functions Of Comparative Law' (2013) 9(2) AUDJ; Mark Van Hoecke, 'Methodology Of Comparative Legal Research' (2015) Law and Method; Mark Van Hoecke and Mark Warrington, ‘Legal Cultures, Legal Paradigms and Legal Doctrine: Towards a New Model For Comparative Law’ (1998) 47 International and Comparative Law Quarterly 495-536; John Reitz, ‘How to Do Comparative Law’ (1998) 46 The American Journal of Comparative Law 618-636. 10 Sinani and Shanto (n 9); Hoecke (n 9); Gutteridge, Comparative Law: An Introduction to the Comparative Method of Legal Study & Research (2nd edn, Widly and Sons Limited 1971); John Bell, ‘Legal Research and the Distinctiveness of Comparative Law’ in Mark Van Hoecke (ed), Methodologies of Legal Research: Which Kind of Method for What Kind of Discipline? (Hart Publishing 2011). 11 Ibid. 12 Hoecke and Warrington (n 9); Reitz (n 9); Maurice Adams, ‘Doing What Doesn’t Come Naturally. On the Distinctiveness of Comparative Law’ in Mark Van Hoecke, M. (ed), Methodologies of Legal Research: Which Kind of Method for What Kind of Discipline? (Hart Publishing 2011). 11 Legislative and Enforcement Responses in the UK and US B. Insider Dealing Methods Legal-cultures approach, which analyses legal responses in the context of cultural, historical, political, ethical and socio-economic perspectives13, is used in this dissertation. Rather than ‘law as rules’, this method is associated with ‘law as cultures’ in which social practices establish perception of and attitudes toward legal concepts and regulations14. Cultural approach is appropriate for this research, as it takes nonlegal elements such as ethics and economic efficiency into great consideration. Evaluative frameworks to assess effectiveness contain socio-economic factors including actual protection for investors, deterrent effects. In this thesis, primary sources that are insider-dealing legislations, regulations and cases can be found on the official websites of UK and US authorities. Secondary sources are academic books, journals and articles that provide legal and non-legal analysis on insider-dealing laws. IV. Thesis Structure There are five chapters. The first chapter is introduction, while the second chapter analyses economic as well as ethical considerations of insider dealing and determines the importance of insider-dealing regulation. Chapter 3 and 4 focus on the UK and US approaches to insider dealing. The final chapter is conclusion that summarises the thesis and provides some implications. 13 Sinani and Shanto (n 9); Hoecke (n 9); Hoecke and Warrington (n 9); Reitz (n 9); Adams (n 12); Michael Salter and Julie Mason, Writing Law Dissertations: An Introduction and Guide to the Conduct of Legal Research (Pearson Longman 2007) 182-212; Jaakko Husa, ‘Comparative Law, Legal Linguistics and Methodology of Legal Doctrine’ in Mark Van Hoecke (ed), Methodologies of Legal Research: Which Kind of Method for What Kind of Discipline? (Hart Publishing 2011); David Nelken, ‘Comparative Legal Research and Legal Culture: Facts, Approaches, and Values’ (2016) 12 Annual Review of Law and Social Science 45-62. 14 Hoecke and Warrington (n 9); Nelken (n 13); David Nelken, ‘Using the concept of legal culture’ (2004) 29 Australian Journal of Legal Philosophy 1–26. 12 Legislative and Enforcement Responses in the UK and US Insider Dealing CHAPTER 2: INSIDER DEALING AND THE IMPORTANCE OF INSIDER DEALING LAWS Insider dealing is primarily assumed to be an unethical and unfair phenomenon that erodes public confidence among investors, efficiency and integrity of financial markets. Meanwhile, the assumption is rebutted and arguments supporting insider dealing are found in numerous studies15. I. Ethical and economic characteristics of insider dealing A. Ethical considerations 1. Fairness Insider dealing is considered as an unfair phenomenon16. Unfairness occurs when an investor having inside information trades with others who do not possess same pieces of information17. Informational asymmetry is the essence of insider dealing. Privileged information brings opportunities for insiders to make profits or cut loss, and/or engage in market manipulation by creating misleading information, which 15 Ma and Sun (n 5); Henry Manne, Insider Trading and the Stock Market (New York 1966); Cinar, ‘The issue of insider trading in law and economics: Lessons for emerging financial markets in the world’ (1999) 19 (4) Journal of Business Ethics 345–353; Martin and Peterson, ‘Insider trading revisited’ (1991) 10 (1) Journal of Business Ethics 57–61; Werhane, ‘The ethics of insider trading’ (1989) 8 (11) Journal of Business Ethics 841–845; Salbu, ‘Insider trading and the social contract’ (1995) 5 (2) Business Ethics Quarterly 313–328; Jennifer Moore, ‘What Is Really Unethical About Insider Trading?’ (1990) 9 (3) Journal of Business Ethics 171-182. 16 Barnes (n 1); White (n 3); Werhane (n 15); Salbu (n 15); Moore (n 15); Cho and Shaub, ‘The consequences of insider trading and the role of academic research’ (1991) 10 Business and Professional Ethics Journal 83–98; Shaw, ‘Shareholder authorized inside trading: A legal and moral analysis’ 1990 9 (12) Journal of Business Ethics 913–928; Kim Lane Scheppele, ‘”It’s Just Not Right”: The Ethics Of Insider Trading’ (1993) 56 (3) Law and Contemporary Problems 123-173; Ben Dubow and Nuno Monteiro, ‘Measuring Market Cleanliness’ (2006) FSA Occasional Paper, Financial Services Authority; Patricia Werhane, ‘The Indefensibility of Insider Trading’ (1991) 10 Journal of Business Ethics 729 – 731. 17 Seredynska (n 2); Charles C. Cox and Kevin S. Fogarty, ‘Bases of Insider Trading Law’ (1988) 49 (2) Ohio State Law Journal 353 – 372; Sarah Baumgartel, ‘Privileging Professional Insider Trading’ (2016) 51 Georgia Law Review 71 – 119. 13 Legislative and Enforcement Responses in the UK and US Insider Dealing discourages other investors18. Nevertheless, informational asymmetry is the common phenomenon in the society19. Some investors possess superior information over others since they use their skills, experience and knowledge, invest their time and even money to do specific analysis and acquire information20. Thus, a more practical discussion should be that insider dealing involves an unequal access to information21. As long as investors carry out sufficient research on market conditions and macroeconomic factors, they should have equal access to all information that helps them valuate securities more accurately22. Unfairness should be analysed from the perspective of harmfulness. Insider dealing is assumed to cause losses to small investors and consequently discourage them from making investment23. However, no evidence of discouragement was found. Despite many discoveries of insider-dealing cases, there was still a substantial increase in the number of small investors in the US in the 1980s 24. Theoretically, insider dealing does not harm ‘outsiders’ in the market. Investors do not know whom they are trading with, so it is impossible to identify insider-dealing victims when all transactions are anonymous25. An outsider entering into agreement with an insider 18 Barnes (n 1). For example, a person applies for a job because he/she knows a company’s recruitment news from his/her relatives; or a person learning from his/her acquaintance about a shopping discount can benefit from that special offer. A journalist discovering material news from private sources publishes it rather than share it with other colleagues. In reality, these circumstances are not regarded as unfairness. See Robert W. McGee, ‘Applying Ethics to Insider Trading’ (2008) 77 Journal of Business Ethics 206; Peter-Jan Engelen and Luc V. Liederkerke, ‘The Ethics of Insider Trading Revisited’ (2007) 74 Journal of Business Ethics 502. 20 O’Hara (n 2); Moore (n 15); Barry A.K. Rider, Insider Trading (Jordan Publishing 1983). 21 Scheppele (n 16). 22 O’Hara (n 2); Seredynska (n 2); Mohammad Abdolmohammadi and Jahangir Sultan, ‘Ethical Reasoning and the Use of Insider Information in Stock Trading’ (2002) 37 (2) Journal of Business Ethics 165-173. 23 Nancy Reichman, ‘Insider Trading’ (1993) 18 Crime and Justice, Beyond the Law: Crime in Complex Organizations 57. 24 David S. Young, ‘Insider Trading: Why the Concern?’ (1985) 8 Journal of Accounting, Auditing and Finance 178 – 183. 25 Seredynska (n 2); Laura Hansen, ‘ “Gossip Boys”: Insider Trading and Regulator Ambiguity’ (2014) 21 (1) Journal of Financial Crime 29-43. 19 14 Legislative and Enforcement Responses in the UK and US Insider Dealing might not be harmed, because he/she might simultaneously trade with others 26 and benefit from those deals before price-sensitive news is released27. Therefore, insider dealing is victimless28. The perception of unfairness significantly depends on individual viewpoints and social norms29. People from various cultures or even people sharing similar cultural backgrounds perceive differently about fairness30. Insider dealing in China is more acceptable than in the US and Taiwan31, though China and Taiwan are similar in terms of culture. More finance professionals in China than in the US believe insider dealing is acceptable32. Empirically, not everyone believes that insider dealing is an unfair behaviour33. For example, corporate managers ranked insider dealing at almost the least unethical behaviour34. Students who put a high value on ethics or feel guilty will less likely to participate in insider dealing, and students are more likely to engage in 26 There is no pressure on any investor to enter into transactions, so they only trade when they believe there are benefits. If a person does not transact with an insider, he/she will trade with others. See Ma and Sun (n 5); McGee (n 19); Robert W. McGee and Walter Block, ‘An Ethical Look at Insider Dealing’ (2006) Andreas School of Business Working Paper, Barry University 5; James D. Cox, ‘Insider Trading and Contracting: A Critical Response to the “Chicago School”’ (1986) Duke Law Journal 628, 635. 27 Seredynska (n 2). 28 Hansen (n 25); McGee and Block (n 26). 29 Hansen (n 25); Steven E. Kaplan, Janet A. Samuels, Linda Thorne, ‘Ethical Norms of CFO Insider Trading’ (2009) 28 Journal of Accounting and Public Policy 386-400; Hersh Shefrin and Meir Statman, ‘Ethics, Fairness And Efficiency In Financial Markets’ (1993) Financial Analysts Journal 21-29; Meir Statman, ‘The Cultures of Insider Trading’ (2009) 89 Journal of Business Ethics 51-58. 30 Shefrin and Statman (n 29); Statman (n 29); Bolton, Keh and Alba, ‘Culture and Marketplace Effects on Perceived Price Fairness: China and the USA’ (2008) Working Paper of Wharton School, University of Pennsylvania. 31 Meir Statman, ‘Local Ethics in a Global World’ (2007) 63 (3) Financial Analysts Journal 32 – 41. 32 Huang, ‘An Empirical Study of the Incidence of Insider Trading in China’ (2007) Working Paper of University of New South Wales. 33 Ma and Sun (n 5); Hansen (n 25); Kaplan et al. (n 29); Statman (n 29); Manne (n 15); Cinar (n 15); Martin and Peterson (n 15); Werhane (n 15); Salbu (n 15); Moore (n 15). 34 Ekin and Tezolmez, ‘Business Ethics in Turkey: An Empirical Investigation with Special Emphasis on Gender’ (1999) 18 Journal of Business Ethics 17 – 34. 15 Legislative and Enforcement Responses in the UK and US Insider Dealing insider dealing to cut losses rather than make profits35. So, criticisms on unfairness seem to be inconsistent36. 2. Fraud Arguments relating to fraud include consideration of violation of property rights and breach of fiduciary duty37. Privileged information is issued by the company or the employer, so insider dealing is a violation of the company’s property right and also a breach of fiduciary duty between insiders and their employer. Furthermore, in the financial market, interests of shareholders are put in a higher place than interests of employers and employees38. Insiders who are involved in insider dealing gain benefits at shareholders’ expenses and breach his fiduciary duty between employees and shareholders39. However, those arguments are inconclusive. Entrepreneurs who establish the business and shareholders who own the company have information property rights40. If they trade based on privileged information, they do not violate the company’s right. Additionally, there seems to be no breach of fiduciary duty if insiders make transactions to maximise interests of shareholders41. Abdolmohammadi and Sultan (n 22); Beams, Brown and Killough, ‘An Experiment Testing the Determinants of Non-Compliance With Insider Trading Laws’ (2003) 45 Journal of Business Ethics 309 – 323. 36 O’Hara (n 2); Ma and Sun (n 5). 37 O’Hara (n 2); Seredynska (n 2); Moore (n 15). 38 Stock investors are also shareholders who own the company, so company insiders including high-level managers, officers and staffs have to act on the interests of shareholders. See CFA Institute, Ethical and Professional Standards, and Quantitative Methods (Wiley 2016) at 97. 39 Moore (n 15). 40 Seredynska (n 2); Manne (n 15); Robert W. McGee, ‘Insider trading: An economic and philosophical analysis’ (1988) 25 (1) The Mid-Atlantic Journal of Business 35 – 48. 41 Ma and Sun (n 5); Manne (n 15). 35 16 Legislative and Enforcement Responses in the UK and US 3. Insider Dealing Huge and easy profits Insiders who are engaged in insider dealing are believed to effortlessly earn huge profits. Insiders outperform the market and gain significant profits42. Insiders even make large abnormal profits before official announcements about the corporate43, the takeover44, dividend payment45, share repurchases46, or listing and delisting47. Nevertheless, the argument based on huge gains ignores several facts. Insiders do not make profits at the expense of anybody48. Rather than a ‘lottery win’ or a luck, profits gained from insider dealing are the result of hard work and 42 For example, Seyhun found that insiders gain about 3% of abnormal profits over 300 days after trading date, whereas Lin and Howe concluded that intensive insider dealing brings substantial abnormal returns to insiders. See Seyhun, ‘Insiders' profits, costs of trading, and market efficiency’ (1986) 16 Journal of Financial Economics 189–212; Lin and Howe, ‘Insider Trading in the OTC Market’ (1990) 45 Journal of Finance 1273 – 1284. See also Aktas et al. (n 5); Jeffrey F. Jaffe, ‘Special information and insider trading’ (1974a) 47 (3) Journal of Business 410 – 428; Joseph E. Finnerty, ‘Insiders and market efficiency’ (1976) 31 (4) Journal of Finance 1141 – 1148; Josef Lakonishok and Inmoo Lee, ‘Are insider trades informative?’ (2001) 14 (1) Review of Financial Studies 79 – 111; Leslie A. Jeng, Andrew Metrick, Richard Zeckhauser, ‘Estimating the Returns to Insider Trading: A Performance-Evaluation Perspective’ (2003) 85 (2) Review of Economics and Statistics 453 – 471; Pope, Morris and Peel, ‘Insider Trading: Some Evidence on Market Efficiency and Directors’ Share Dealings in Great Britain’ (1990) 17 (3) Journal of Business Finance and Accounting 359 – 380; Alan Gregory, John Matatko, Ian Tonks, ‘Detecting Information from Directors’ Trades: Signal Definition and Variable Size Effects’ (2003) 24 Journal of Business Finance and Accounting 309 – 342; Jana Fidrmuc, Marc Goergen, Luc Renneboog, ‘Insider Trading, News Releases, and Ownership Concentration’ (2007) 61 The Journal of Finance 341 – 372. 43 Karpoff and Lee, ‘Insider trading before new issue announcements’ (1991) 20 Financial Management 18 – 26. 44 Seyhun, ‘Do bidder managers knowingly pay too much?’ (1990) 63 Journal of Business 439 – 464. 45 John and Lang, ‘Strategic insider trading around dividend announcements: Theory and evidence’ (1991) 46 Journal of Finance 1361 – 1389; Cheng, Davidson and Leung, ‘Insider trading returns and dividend signals’ (2011) 20 International Review of Economics and Finance, 421 – 429. 46 Lee, Mikkelson and Partch, ‘Managers' trading around stock repurchases’ (1992) 47 Journal of Finance 1947–1961; Konan Chan, David L. Ikenberry, Inmoo Lee and Yanzhi Wang, ‘Informed Traders: Linking Legal Insider Trading and Share Repurchases’ (2012) 68 (1) Financial Analysts Journal 60 -73. 47 Lamba and Khan, ‘Exchange listings and delistings: The role of insider information and insider trading’ (1999) 22 Journal of Financial Research 131–146. 48 Jacqueline A.C. Suter, The Regulation of Insider Dealing in Britain (Butterworths 1989). 17 Legislative and Enforcement Responses in the UK and US Insider Dealing combination of skills as well as knowledge 49. Whether huge profits are easily gained has been questioned. B. Economic considerations 1. Impacts on the market a. Distribution of information Information plays a significant role in the financial market, as it determines the accuracy of valuation process50. Given that not all relevant information of the security is published, investors may overvalue or undervalue that asset, which both results in a wrong investment decision or even a loss. However, untimely disclosure of information may substantially decrease firm value and harm the company 51. In the existing literature, there are two contradictory arguments on the relationship between insider dealing and informational distribution. 49 Insiders make great effort to be in the position to which private information is available, and they even spend much time doing analysis before transactions are made. See Seredynska (n 2) at 59. 50 According to Efficient Market Hypothesis (EMH) theory, financial market is classified into three forms on the basis of the information reflection in stock price. In the weak efficient market, even public information is not reflected in stock price, so rather than technical analysis that is based on changes in price and volume, fundamental analysis is useful to the decisionmaking process. Stock price, in the semi-strong form, includes information reported and announced by the firm; and fundamental analysis no longer works. In this form, private information is important to help investors earn abnormal returns. Meanwhile, the strong efficient market is characterised by the fact that both private and public information is reflected in stock price, so passive investment is the only effective method. See CFA Institute, Equity and Fixed Income (Wiley 2016) at 115. 51 Seredynska (n 2); Dennis W. Carlton, Daniel R. Fischel, ‘The Regulation of Insider Trading’ (1983) 35 Stanford Law Review 857 – 895. 18 Legislative and Enforcement Responses in the UK and US Insider Dealing Manne argued that insider dealing is an efficient channel to distribute information in the market52, which is also supported by EMH theory53 and some academics54. Intrinsic price, future returns and performance of the firm might be reflected by insider dealing55. Specifically, insiders are more likely to buy prior to the increase in price and sell before price declines56. Insider dealing limits price distortions because transactions made or triggered by insiders adjust asset price to the level that matches economic reality57. Company insiders can predict returns and market movements on the basis of privileged information, thus, predictive information about economic conditions is possibly conveyed in their transactions58. Importantly, insider 52 Manne (n 15). When insiders make deals on the basis of superior information, their transactions establish market trend and change the supply and/or demand of the asset, which in turn changes asset price. Price gradually moves to the intrinsic value. Thus, insider dealing can convey the information and help investors make valuation that is more proper. 53 In accordance with EMH theory, private information plays a significant role in the semistrong efficient market. 54 Carlton and Fischel (n 51); Kelly, Nardinelli and Wallace, ‘Regulation of Insider Trading: Rethinking SEC Policy Rules’ (1987) 7 (2) The Cato Journal 441–448; Morgan, ‘Insider Trading and the Infringement of Property Rights’ (1987) 48 Ohio State Law Journal 79 – 116; Wu, ‘An Economist Looks at Section 16 of the Securities Exchange Act of 1934’ (1968) 68 Columbia Law Review 260–269; Meulbroek, ‘An Empirical Analysis of Illegal Insider Trading’ (1992) 49 Journal of Finance 1661–1699; Cornell and Sirri, ‘The Reaction of Investors and Stock Prices to Insider Trading’ (1992) 47 Journal of Finance 1031–1059; Sugato Chakravarty and John J. McConnel, ‘An Analysis of Prices, Bid/Ask Spreads, and Bid and Ask Depths Surrounding Ivan Boesky’s Illegal Trading in Carnation Stock’ (1997) 26 Financial Management 18–34; Nihat Aktas, Eric de Bodt and Herve Van Oppens, ‘Evidence of the Contribution of Legal Insider Trading to Market Efficiency’ (2007) UCL Core discussion paper 0714. 55 Aktas et al. (n 5); Seyhun, ‘Why does aggregate insider trading predict future stock returns? (1992) 107 (4) Quarterly Journal of Economics 1303 – 1331; Leland, ‘Insider Trading: Should it be Prohibited?’ (1992) 100 (4) Journal of Political Economy 859 – 887; Manouchehr Tavakoli, David McMillan, Phillip McKnight, ‘Insider Trading And Stock Prices’ (2012) 22 International Review of Economics and Finance 254-266. See also Seredynska’s analysis of stock price in the Texas Gulf Sulphur case in Seredynska (n 2). 56 Pope et al. (n 42); Jeffrey F. Jaffe, ‘The Effect of Regulation Changes on Insider Trading’ (1974b) 5 Bell Journal of Economics and Management Science 93 – 121; Baesel and Stein, ‘The Value of Information: Inferences from the Profitability of Insider Trading’ (1979) 14 Journal of Financial and Quantitative Analysis 553 – 571. 57 Hartmut Schmidt, ‘Insider Regulation and Economic Theory’ in Klaus J. Hopt and Eddy Wymeersch, European Insider Dealing: Law and Practice (Butterworths 1991). 58 Lakonishok and Lee (n 42); Seyhun (n 42); Xiaoquan Jiang and Mir A. Zaman, ‘Aggregate Insider Trading: Contrarian Beliefs or Superior Information?’ (2010) 34 Journal of Banking and Finance 1225 – 1236. 19 Legislative and Enforcement Responses in the UK and US Insider Dealing dealing is considered as the cheapest method of informational transmission that corporates may take advantage of59. Trading of the company’s insiders and/or executives is observed by outsiders who might mimic insiders to make their investment decisions60. Nevertheless, some academics stated that insider dealing does not result in informative efficiency. Insider dealing reduces market efficiency61 and despite existence of insider dealing, mispricing still continues62. Insider dealing does not alter asset prices63. Importantly, information transmitted via insider dealing might not help outsiders earn abnormal profits64. Rather than efficient distribution of information, insider dealing is associated with the postponement of internal sharing and/or official disclosure of information, which affects the decision-making procedure within the business and causes loss to outsiders65. However, Manne claimed that insider dealing even helps managers to monitor the flow of information and ensure information is transmitted to them timely66. Dooley found that delay in official announcement caused John and Lang (n 45); John and Mishra, ‘Information Content of Insider Trading around Corporate Announcements: The Case of Capital Expenditures’ (1990) 45 Journal of Finance 835 – 855. 60 Rozeff and Zaman (n 5); Tavakoli et al. (n 55); Bettis, Vickrey and Vickrey, ‘Mimickers of corporate insiders who make large volume trades’ (1997) 53 Financial Analysts Journal 57 – 77; Brick, Statman and Weaver, ‘Event Studies and Model Misspecification: Another Look at the Benefits of Outsiders From Public Information About Insider Trading’ (1989) 16 Journal of Business, Finance, and Accounting 399 – 424. 61 Michael G. Keenan, ‘Insider trading, market efficiency, business ethics and external regulation’ (2000) 11 Critical Perspectives on Accounting 71 – 96. 62 Morris Mendelson, ‘The Economics of Insider Trading Reconsidered’ (1969) 117 (3) University of Pennsylvania Law Review 475. 63 Sugato Chakravarty and John J. McConnel, ‘Does Insider Trading Really Move Stock Prices?’ (1999) 34 (2) The Journal of Financial and Quantitative Analysis 191 – 209. 64 Seyhun (n 42); Leland (n 55); Rozeff and Zaman, ‘Overreaction and insider trading: Evidence from growth and value portfolios’ (1998) 53 Journal of Finance 701–716; Fishman and Hagerty, ‘Insider Trading and the Efficiency of Stock Prices’ (1992) 23 Rand Journal of Economics 106 – 122. 65 Stephen M. Bainbridge, ‘The Insider trading Prohibition: A Legal and Economic Enigma’ (1986) 38 University of Florida Law Review 50. 66 Henry G. Manne, ‘Insider Trading: Hayek, Virtual Markets, and the Dog that did not Bark’ (2005) 31 (1) Journal of Corporation Law 167 – 185. 59 20 Legislative and Enforcement Responses in the UK and US Insider Dealing by insider dealing is rarely occurs67. Meanwhile, Seredynska stated that there is no relationship between insider dealing and the postponement of external information disclosure68. b. Market liquidity and volatility Insider dealing reduces market liquidity69, which discourages small investors from making investment decisions. Enforcement of regulation reduces negative effects of insider dealing on stock liquidity and price70. However, other studies concluded that market liquidity is not declined by insider dealing71; or although insider-dealing legislation came into effect, market liquidity still declined72. Insider dealing is considered as a source of price volatility, which raises transaction costs and cost of capital; erodes public confidence among small investors; decreases market efficiency; weakens economic growth and reduces social welfare73. Nevertheless, Manne argued that insider-dealing regulations even result in more significant price changes74. Given that the causal link between insider dealing and price volatility is accepted, the question is whether price volatility results in market deficiency and discourages investors. If insider dealing delivers inside information and Michael P. Dooley, ‘Enforcement of Insider Trading Restrictions’ (1980) 66 (1) Virginia Law Review. 68 Seredynska (n 2). 69 Leland (n 55); Kyle, ‘Continuous Auctions and Insider Trading’ (1985) 53 Econometrica 1315 – 1336. 70 Hans Degryse, Frank de Jong, Jeremie Lefebvre, ‘Legal Insider Trading and Stock Market Liquidity’ (2016) 164 De Economist 83 – 104. 71 Chakravarty and McConnell (n 54). 72 Rezaul Kabir, Theo Vermaelen, ‘Insider Trading Restrictions and the Stock Market: Evidence from the Amsterdam Stock Exchange’ (1996) 40 (8) European Economic Review 1591 – 1603. 73 McGee and Block (n 26); Leland (n 55); Schmidt (n 57); Gregoire and Huang, ‘Informed trading, noise trading and the cost of equity’ (2009) 17 International Review of Economics & Finance 13 – 32. 74 Suter (n 48). 67 21 Legislative and Enforcement Responses in the UK and US Insider Dealing brings stock price to intrinsic value, it improves market efficiency, which enhances public confidence75. 2. Impacts on firms The relationship between insider dealing and firm value is still controversial as both positive76 and negative77 correlations are found78. Additionally, insider dealing is regarded as a form of compensation for entrepreneurs and innovators, which creates motivation for them to work better and contribute more to the business 79. This argument is also criticised80. Firstly, given that insider dealing indirectly conveys information to the market, the company does not consider insider dealing as a compensation for employees to avoid untimely disclosure81. Secondly, except for breakthrough innovations, other developments barely result in visible increase in company value82. Thus, insider dealing as compensation for innovators may not be justified. Moreover, compensation via insider dealing might be associated with 75 McGee and Block (n 26). Investors seem to be discouraged when their rights are violated and not adequately protected by legislations. 76 Carlton and Fischel (n 51). 77 Manove, ‘The Harm from Insider Trading and Informed Speculation’ (1989) 104 Quarterly Journal of Economics 823 - 846; Ausubel, ‘Insider Trading in a Rational Expectations Economy’ (1990) 80 The American Economic Review 1022 – 1041. 78 In fact, differences in insider dealing’s effects on firm value are originated from the choice of parameters in econometric models. See Leland (n 55). 79 It is similar to monetary bonuses and stock options awarded to employees who have great contribution or bring valuable innovations to the company. See Manne (n 15); Carlton and Fischel (n 51); Schmidt (n 57); Bainbridge (n 65); Henry G. Manne, ‘Insider Trading and Property Rights in New Information’ (1985) 4 (3) Cato Journal 935 – 937; Dye, ‘Insider trading and incentives’ (1984) 57 Journal of Business 295 – 313; Michael J. Chmiel, ‘The Insider Trading and Securities Fraud Enforcement Act of 1998: Codifying a Private Right of Action’ (1990) University of Illinois Law Review 645 – 674. 80 Mendelson (n 62); Bainbridge (n 65); Iman Anabtawi, ‘Toward a Definition of Insider Trading’ (1989) 41 Stanford Law Review 377 – 399. 81 Disclosure in the wrong time will possibly decrease stock value, so the company might prefer traditional forms such as bonuses or stock options. See Bainbridge (n 65). 82 Seredynska (n 2). 22 Legislative and Enforcement Responses in the UK and US Insider Dealing adverse effects such as free-rider problem83 or disruption in information-sharing process84. II. The importance of insider-dealing regulations Authorities seem to be confused about the illegality of insider dealing85. In fact, regulators in many jurisdictions consider insider dealing as an unlawful behaviour. Insider-dealing regulation is important because market itself does not efficiently produce information86. The ultimate victim is the society; so for the purposes of protecting social welfare, public confidence, market integrity and efficiency, it is absolutely necessary to regulate insider dealing87. Besides, some empirical studies found that insider-dealing regulations decrease cost of capital88. Corporate regulation on insider dealing is also essential to protect small shareholders89. Corporate governance and internal insider-dealing restrictions are 83 There will be free riders who do not participate in any research or contribute to any innovation but still benefit from insider dealing. Insider dealing is no longer a meaningful compensation for contributors of the company. 84 Not until profits from insider dealing are realised do employees share their knowledge and information with their colleagues. See Bainbridge (n 65). 85 Especially, in case that insiders are engaged in insider dealing to save them from negative news or downturn of a security, authorities are not sure whether this behaviour is illegal. See Hansen (n 25). 86 Morris Mendelson, ‘Economics and the Assessment of Disclosure Requirements’ (1978) 1 Journal of Comparative Corporate Law and Securities Regulation 49 – 68. 87 Barnes (n 1); Dubow and Monteiro (n 16); Kaplan et al. (n 29); Schmidt (n 57); Ausubel (n 77); Hansen (n 25); Michael S. Caccese, ‘Insider Trading Laws and the Role of Securities Analysts’ (1997) Financial Analysts Journal 9 – 12; Donald C. Langevoort, ‘ “Fine Distinctions” in the Contemporary Law of Insider Trading’ (2013) Columbia Business Law Review 429 – 462; Kenneth R. Davis, ‘Insider Trading Flaw: Toward A Fraud-on-the-market Theory and Beyond’ (2016) 66 American University Law Review 51 – 89. 88 Hsuan-Chi Chen and Qing Hao, ‘Insider trading law enforcement and gross spreads of ADR IPOs’ (2011) 35 Journal of Banking and Finance 1907 – 1917; Bhattacharya and Daouk, ‘The world price of insider trading’ (2002) 57 Journal of Finance 75 – 108; Bushman, Piotroski and Smith, ‘Insider trading restrictions and analysts’ incentives to follow firms’ (2005) 60 Journal of Finance 35 – 66; Nuno Fernandes and Miguel A. Ferreira, ‘Insider trading laws and stock price informativeness’ (2009) 22 Review of Financial Studies 1845 – 1887. 89 If there is no restriction or prohibition on insider dealing, corporate managers may provide large shareholders with privileged information that is considered as a kind of bribery. As a result, managers are in collusion with dominant shareholders, which may negatively affect 23 Legislative and Enforcement Responses in the UK and US Insider Dealing useful to decline insider sales’ profitability90. However, Lee et al. found an opposite result that corporate regulations are ineffective to prevent the exploitation of inside information and insiders even strategically adapt with the adoption of restrictive policies to continue taking advantages of private information91. small investors’ interests. See Ernst Maug, ‘Insider Trading Legislation And Corporate Governance’ (2002) 46 European Economic Review 1569 - 1597. 90 Lili Dai, Renhui Fu, Jun-Koo Kang, Inmoo Lee, ‘Corporate governance and the profitability of insider trading’ (2016) 40 Journal of Corporate Finance 235 – 253; Bettis, Coles, Lemmon, ‘Corporate policies restricting trading by insiders’ (2000) 57 Journal of Financial Economics 191 – 220. 91 Inmoo Lee, Michael Lemmon, Yan Li, John M. Sequeira, ‘Do voluntary corporate restrictions on insider trading eliminate informed insider trading?’ (2014) 29 Journal of Coprorate Finance 158 – 178. 24 Legislative and Enforcement Responses in the UK and US Insider Dealing CHAPTER 3: THE UNITED KINGDOM APPROACHES In the UK, insider dealing is considered as a reprehensible behaviour 92. Since the 1930s, several forms of insider-dealing legislation have appeared but not until the 1980s and 1990s did more comprehensive provisions exist 93. I. Legislative responses A. Development of insider dealing legislations in the United Kingdom Before 1980, the UK insider dealing regulations were quite limited and there was a need for more comprehensive provisions94. Insider dealing was criminalised under Part V of the Companies Act 198095. It became a separate Act that was the Company Securities (Insider Dealing) Act 198596. The CSA was the first and significant step in the process of prohibiting insider dealing97. It was later superseded by Part V of the Criminal Justice Act 199398. Even when the 1993 Act was adopted, there were only criminal sanctions imposed on insider-dealing cases. Not until the 92 HC 36 1989/90 para 158 referred in Sarah Clarke, Insider Dealing: Law and Practice (Oxford University Press 2013) at 113. 93 Andrew H Baker, ‘Chapter 5: Insider Dealing’ in Nicholas Ryder, Financial Crime in the 21st Century: Law and Policy (Edward Elgar 2011) at 142. 94 The 1972 Justice Committee Report suggested that regulators should consider insider dealing as a criminal offence and impose criminal sanctions on this behaviour. The Exchange and the Panel issued the 1973 and 1977 Joint Statement that emphasised the importance of criminalising insider dealing. See Clarke (n 92) at 117, 119; Barry Rider, Kern Alexander, Stuart Bazley, Jeffrey Bryant, Market abuse and Insider Dealing (3rd edn, Bloomsbury Professional 2016) at 48; Jack Davies, ‘From gentlemanly expectations to regulatory principles: A history of insider dealing in the UK: Part 1’ (2015) 36 (5) Company Lawyer 132 – 143. 95 The Companies Act 1980, ss 68 – 73. A person knowingly relating to a company or receiving information from people having connection with the company commits a crime if he trades or makes others trade on the basis of non-public material information. 96 The Company Securities (Insider Dealing) Act 1985. Hereinafter ‘CSA’. Insider dealing conducted by not only primary but also secondary insiders was a criminal offence. Primary insiders are people who have direct connection with the company, while secondary insiders are those receiving information from primary ones. 97 Rider et al. (n 94) at 49. 98 The Criminal Justice Act 1993. Hereinafter ‘CJA’ 25 Legislative and Enforcement Responses in the UK and US Insider Dealing Financial Services and Markets Act 200099 did both civil and criminal liabilities appear. For the purposes of this thesis, Part V of the CJA and the FSMA are discussed. B. Part V of the Criminal Justice Act 1993 1. Insider dealing offences and related definitions a. Three offences of insider dealing Section 52(1) prohibits an individual from trading on securities if he has inside and price-sensitive information100, which is the primary offence. Meanwhile, section 52(2) is about the secondary offences in which an individual possessing inside information will commit a crime if he encourages others to trade on those securities or improperly discloses price-sensitive information101. Prerequisite element of three offences is that an insider possesses inside information102. There are several issues in section 52. Firstly, although insider-dealing provisions prohibit trade on a certain list that covers a wider range of assets than previous legislations, it is absolutely non-exhaustive103. Secondly, the Act focuses on deals taking place in regulated markets rather than face-to-face transactions104. Thirdly, section 52 aims at prohibiting misconducts of individuals only and does not cover corporates’ practices105. The narrow application of section 52 is compatible with the recommendation made by the DTI that the focus on individuals is more appropriate and reduces unnecessary complexity106. The criminal prosecution against a company The Financial Services and Markets Act 2000. Hereinafter ‘FSMA’ The Criminal Justice Act 1993, s52(1). 101 The Criminal Justice Act 1993, s52(2). 102 Mark Stallworthy, ‘The United Kingdom’s New Regime for the Control of Insider Dealing’ (1993) 12 (4) International Company and Commercial Law Review 448 - 453 at 156. 103 Stallworthy (n 102). 104 Baker (n 93) at 156. 105 Weiwei (n 3); Clarke (n 92) at 148. 106 Clarke (n 92) at 149 99 100 26 Legislative and Enforcement Responses in the UK and US Insider Dealing is quite complicated, because the identification principle to establish criminal responsibility for a corporate107 requires that unlawful conducts or intention is caused by the control of the company. In case of Christian and Angie Littlewood108, insiderdealing and disclosing offences were not the ‘directing mind and will’ of the company. Meanwhile, James Sanders – the founder of Blue Index Ltd, his wife and James Swallow were accused of insider-dealing and encouraging offences109, which was also the strategy of the company110. Thus, criminal prosecution was against individual offenders; the company was banned from regulated practices and was out of business. Fourthly, the provision does not list detailed factors that constitute secondary offences111. To demonstrate the committal of disclosure offence, requirements on which types of information are disclosed and to what extent the information is disclosed are not clear, which creates several difficulties in the prosecution process112. 107 Lennards Carrying Co v Asiatic Petroleum [1915] AC 705; Bolton Engineering Co v Graham [1957] 1 QB 159 (per Denning LJ); and R v Andrews Weatherfoil, 56 C App R 31 CA. 108 Financial Services Authority, ‘Final Notice to Christian Arthur Littlewood’ (Financial Services Authority 2012) <https://www.fca.org.uk/publication/final-notices/christianlittlewood.pdf> accessed March 2018; Financial Services Authority, ‘Insider dealers ordered to pay £1.5m in confiscation’ (Financial Services Authority, 2012) <http://www.fsa.gov.uk/library/communication/pr/2012/082.shtml> accessed March 2018. 109 Paul Cheston and Jonathan Brown, ‘James Sanders: The trader who thought he was untouchable’ (The Independent, 2012) <https://www.independent.co.uk/news/uk/crime/james-sanders-the-trader-who-thought-hewas-untouchable-7870125.html> accessed March 2018; Simon Neville, ‘Husband and wife jailed for insider dealing’ (The Guardian, 2012) < https://www.theguardian.com/business/2012/jun/20/husband-and-wife-jailed-insider-dealing> accessed March 2018. 110 Clarke (n 92) at 151. 111 Weiwei (n 3); Brenda Hannigan, Insider Dealing (2nd edn, Longman 1994) at 20. 112 For example, an employee accesses to inside information in the computer of his colleague without permission. The question is whether his colleague is accused of improper disclosure. Next, in case that an employee tells his relatives that it is good time to buy a particular stock, whether he commits the encouraging or disclosing offence is questionable. 27 Legislative and Enforcement Responses in the UK and US b. Insider Dealing Definition of ‘Inside information’ Section 56 provides an important definition of ‘inside information’. Inside information relates to particular securities rather than general assets; is accurate or specific; is non-public but if it is made public it will probably have great impacts on asset price113. ‘Significant effect’ is an important criterion as it captures what really matters in the market114, but problems arise115. How to define or determine the significance is not clearly established116. Besides, the scope of inside information is narrow as only information that largely affects securities is considered117. Information causing trivial price movements might not be regarded as inside information118. Substantial price changes prior to any special events can be an evidence of inside information’s effects, but it might result from firm performance rather than information leak119. Thus, it is inconsistent to conclude that inside information is disclosed whenever significant price movements exist. ‘Specific or precise’ criterion also raises a debate. Definition of specificity and precision should be given, but it is complicated to generate an exact definition that fits 113 The Criminal Justice Act 1993, s56(1). There is a possibility that information used by insiders does not involve any actual effects. In James Sanders case, forecasted takeover news did not become true. Information was still inside information because if it had been public at that time, it would have had great influence on stock price. See Rider et al. (n 94). 115 Baker (n 93) at 156, 157. 116 White (n 3); Keith Wotherspoon, ‘Insider Dealing – The New Law: Part V of The Criminal Justice Act 1993’ (1994) 57 The Modern Law Review 419 – 433. 117 The UK approach targeted large events in which effects on the market can be easily noticed. See Rider et al. (n 94) at 69. 118 Lomnicka, ‘The New Insider Dealing Provisions: Criminal Justice Act 1993, Part V’ (1994) Journal of Business Law 173 – 188; Simon Morris, Financial Services: Regulating Investment Business (2nd edn, FT Law & Tax London 1995) at 294. Nowadays, modern technology supports investors to make high-volume trading transactions that turn small price changes into huge profits. See Rider et al. (n 94) at 69. 119 Clarke (n 92) at 169; 170. 114 28 Legislative and Enforcement Responses in the UK and US Insider Dealing all circumstances120. This requirement aims at excluding unreliable news or rumours121. ‘Precise’ could be narrowly interpreted by judges, which limits scope of the provision122, so ‘specific’ was added to widen the section’s coverage123. Precise or specific information is not necessarily detailed information such as contractual terms or identities of all relating parties124. For instance, in cases of Malcolm Calvert125 and Ali Mustafa and others126, specific news was the takeover events whereas precise information was number of bidders, timing and price127. Meanwhile, in Neil Rollins case128, specific information was the company’s worse performance and precise information was the official disclosure’s timing129. Ibid. at 179; David Kirk, ‘Enforcement of criminal sanctions for market abuse: Practicalities, problem solving and pitfalls’ (2016) 17 ERA Forum 311 – 322. 121 Clarke (n 92) at 179, 180; Rider et al. (n 94) at 60. 122 Ibid. 123 Ibid.; Rider (n 20); Wotherspoon (n 116); Lomnicka (n 118). For example, the information that Company A would be taken over by Company B at a given price was leaked. In reality, actual price is much higher than the expected level. The information, under this circumstance, is inaccurate but it is specific and still results in a giant rise in stock price of Company A. If only ‘precise’ element was included in the provision, this piece of information would be excluded. Thus, ‘specific’ element allows a broader approach to determine inside information. 124 Clarke (n 92) at 182. 125 Malcolm Calvert was a former market-maker at Cazenove, who earned £103,883 profit from insider dealing and was accused of five counts. See Financial Services Authority, ‘Former Cazenove partner found guilty of insider dealing’ (Financial Services Authority, 2010) <http://www.fsa.gov.uk/pages/Library/Communication/PR/2010/041.shtml> accessed May 2018; Harry Wilson, ‘Ex-Cazenove partner Malcolm Calvert gets 21 months in jail for insider trading’ (The Telegraph, 2010) <https://www.telegraph.co.uk/finance/newsbysector/banksandfinance/7422473/ExCazenove-partner-Malcolm-Calvert-gets-21-months-in-jail-for-insider-trading.html> accessed May 2018. 126 They were sentenced for having committed insider dealing offences under section 52 of the CJA. See Financial Services Authority, ‘Six sentenced for insider dealing’ (Financial Services Authority, 2012) <http://www.fsa.gov.uk/library/communication/pr/2012/080.shtml> accessed May 2018. 127 Clarke (n 92) at 182, 183. 128 Neil Rollins was accused of four insider-dealing counts under section 52(1) of the CJA, one insider-dealing count under section 52(2) of the CJA and four money-laundering counts. See Financial Services Authority, ‘Insider Dealing: Financial Services Authority prosecutes Mr Neil Rollins’ (Financial Services Authority, 2009) <http://www.fsa.gov.uk/pages/Library/Communication/PR/2009/002.shtml> accessed May 2018. 129 Clarke (n 92) at 182. 120 29 Legislative and Enforcement Responses in the UK and US Insider Dealing Another requirement is that information must not have been ‘made public’130. ‘Made public’ is not necessarily linked to an official announcement made by the corporate or security issuer131. The CJA seemingly permits insiders to make transactions immediately when information is published rather than fully absorbed by the whole market132. There is a possibility that the defendant justifies his dealing by proving that information has been partially or fully public before transactions are made133. In Matthew and Neel Uberoi134 case, Neel tried to prove that investment in those companies was a good decision and possible takeovers could be forecasted by the public. Given these issues discussed above, it is impossible to establish a common framework with exact thresholds to identify inside information that fits all cases. Determination of inside information is the responsibility of prosecution 135. It depends on case-by-case facts and decision of judges, which may possibly lead to legal uncertainty and unexpected differences among similar cases. 130 Section 58 consists of a non-exhaustive list of circumstances where information is regarded as being made public. See The Criminal Justice Act 1993, section 58. 131 Public information can be found in business or economic reports provided by the company or experts, so careful research and hard work are the key to achieve higher profits. See Baker (n 93) at 157. 132 White (n 3). 133 Clarke (n 92) at 201. 134 Matthew Uberoi was an intern at a broking company passed inside information about takeovers and some deals to his father, Neel Uberoi; and they gained huge profits after Neel bought relating stocks. See Financial Services Authority, ‘Former corporate broker intern and father found guilty of insider dealing’ (Financial Services Authority, 2009) <http://www.fsa.gov.uk/pages/Library/Communication/PR/2009/149.shtml> accessed May 2018. 135 Clarke (n 92) at 168, 171. 30 Legislative and Enforcement Responses in the UK and US c. Insider Dealing Definition of ‘Insider’ An insider must have inside information at the time of dealing and is certainly aware that this piece of information is inside information136; simultaneously, information an insider has must be from inside sources and the insider knows he gets the news from inside sources137. Section 57 emphasises on the actual knowledge of the accused 138. However, establishment of the defendant’s actual knowledge is difficult and not straightforward, because it is on the case-by-case basis139. Additionally, there is likelihood that the defendants hide their wrongdoings by proving that they do not know the news is inside information and/or they do not obtain information from internal sources. Besides, the prosecutor or the jury is required to draw inference from relating circumstances140. Requirements to prove actual knowledge and criminal standard of proof make it difficult to convict insider-dealing cases141. The burden of proof of actual knowledge should be placed on the accused142. This suggestion resulted from unsuccessful prosecution when previous legislation was enacted143, but recently, FSA has successfully proved actual knowledge on the basis of circumstantial evidences such as the Rupinder Sidhu case144. 136 The Criminal Justice Act 1993, s57(1)(a). The Criminal Justice Act 1993, s57(1)(b). 138 The Criminal Justice Act 1993, s57. 139 Weiwei (n 3); Clarke (n 92) at 242; Rider et al. (n 94) at 74; Barry Alexander K. Rider and Michael Ashe, Insider Crime: The New Law (Jordan and Sons Limited 1993) at 54. Under many circumstances, the tippee is told to buy or sell a specific stock rather than be given detailed information about the corporate’s events or performance. 140 Clarke (n 92) at 241. 141 Rider et al. (n 94) at 74. 142 Hannigan (n 111). 143 Clarke (n 92) at 241, 242. For example, in 1989, Holyoak, Hill and Morl were not accused of being engaged in insider dealing, which might result from the fact that prosecutors could not prove actual knowledge. See Clarke (n 92) at 242. 144 Sidhu got inside information from Anjam Ahmad – an employee of AKO Capital and they earned £524,000 profit by involving in insider dealing of 18 shares. Ahmad admitted that he and Sidhu participated in insider dealing, but Ahmad was not required to be a witness in the 137 31 Legislative and Enforcement Responses in the UK and US Insider Dealing In addition, section 57(2) covers both primary and secondary insiders145, which broadens the definition of insider under the CSA146. Section 57(2)(a)(ii) apparently eliminated difficulties in the prosecution under the CSA147. Section 52(2)(b) prevents the circumstance where the defendant argues that he passively received information148 as in R v Fisher case149. However, establishing the relationship between the accused and the primary insider as well as the methods they communicate is not an easy task. There is a likelihood that no record or evidence demonstrating the existence of information delivery can be found150. The situation becomes more complex when numerous people are engaged in the insider-dealing network. In case that information passes through several intermediaries, it is difficult to prove that tippee has knowledge that he obtains information from insiders and to establish that this piece of information is inside one because qualities of information including accuracy and specificity may not be maintained151. Besides, whether exact identity of primary court of Sidhu. The Sidhu’s trial was purely based on circumstantial facts and Sidhu was still convicted. See Financial Services Authority, ‘Management consultant appears in Court charged with insider dealing’ (Financial Services Authority, 2011) <http://www.fsa.gov.uk/pages/Library/Communication/PR/2011/019.shtml> accessed May 2018; Yeganeh Torbati, ‘British consultant found guilty of insider trading’ (Reuters, 2011) <https://uk.reuters.com/article/uk-insiderdealing/british-consultant-found-guilty-of-insidertrading-idUKTRE7BE1JX20111215 > accessed May 2018. 145 The Criminal Justice Act 1993, s57(2). There are three layers that are inner, middle and outer circles corresponding to sub-section (a)(i), (a)(ii) and (b). These circles are believed to possibly capture all potential categories of insider. See Clarke (n 92) at 248; Rider et al. (n 94) at 52. 146 White (n 3); Clarke (n 92) at 247, 248; Rider et al. (n 94) at 74. 147 Clarke (n 92) at 252. For example, Kean and Floydd were brokers hired by Grand Metropolitan but the prosecution against them under the CSA failed. This prosecution might have been successful if it had been under the CJA. 148 Clarke (n 92) at 253, 254; Rider et al. (n 94) at 75, 76; Wotherspoon (n 116). Under section 52(2)(b), irrespective of whether the accused passively or actively receive information from primary insiders, he will be considered as a secondary insider if prosecutors can prove he gets information from internal sources given that requirements on actual knowledge are met. 149 Clarke (n 92) at 254. 150 For example, information is passed in a privately small and face-to-face talk. 151 Weiwei (n 3); Rider et al. (n 94) at 75; Wotherspoon (n 116). 32 Legislative and Enforcement Responses in the UK and US Insider Dealing insiders must be identified and whether inside information must only come from primary insiders have been questioned152. 2. The defences There is a burden of proof, which means demonstrating only some evidences is not adequate to make the defence successful153. Section 53 covers defences for each of three offences and several special defences154. Regarding section 53(1)155, it is difficult to prove that transactions made by individuals possessing inside information are neither related to that special information nor for the purposes of making profit as well as avoiding loss156. The defence that the accused would have certainly made similar transactions even if inside information had not been available to him157 seems to be frequently used158. An essential element is to prove that timing of transactions does not depend on possession of inside information159. In R v Stebbing case, the defendant successfully argued that he 152 Rider et al. (n 94) at 75. Rider et al. (n 94) at 77, 78. 154 The Criminal Justice Act 1993, s53. Specifically, section 53(1) includes three circumstances in which the defendant might not be guilty of primary insider-dealing offence, while section 53(2) and section 53(3) state three defences for encouraging offence and two defences for disclosing offence respectively. 155 The Criminal Justice Act 1993, s53(1). Three requirements are no expectation of profitability, reasonable belief that there has been a wide disclosure of information, and certainty of investment decisions regardless of possession of inside information. 156 Rider et al. (n 94) at 78; Clarke (n 92) at 308. For instance, in R v Gooding case, the defendant argued that his purchase was a long-term investment and was not affected by takeover information; but he still sold stocks immediately after information was officially announced. See Clarke (n 92) at 309. 157 The Criminal Justice Act 1993, s53(1)(c). 158 Examples of this defence are pre-determined strategies for long-term investment or for temporarily financial needs such as economic constraint, debt payment. See Rider et al. (n 94) at 79; Clarke (n 92) at 312; Rider and Ashe (n 139). 159 Under the CJA, there is no requirement that the accused totally puts inside information out of his mind but he must prove that he intends to do what he did. Thus, the judges will take the responsibility for assessing case-by-case evidences of the defence. 153 33 Legislative and Enforcement Responses in the UK and US Insider Dealing intended to buy stocks for months ago but he forgot to do so, and his purchase was a long-term investment160. Next, defences for encouraging offence are similar to those for primary insiderdealing offence whereas there are two defences for disclosing offence under section 53(3)161. This provision covers several circumstances where a person confides private information to his wife or friends during the dinner162 and does not expect them to make transactions relating to the information, or where a person believes that the recipient of information trades on securities for long-term investment163. Furthermore, section 53(4) Schedule 1 of the CJA states special defences relating to the market164. Generally, defences stated in section 53 attempts to protect legitimate deals and market practices from restrictions on insider dealing165. 3. The penalties Under the CJA, only criminal sanctions are imposed on offences of insider dealing. Criminal penalties imposed on insider dealing can be a fine or imprisonment or both166. Only criminal penalties are inadequate to deter wrongdoing and have no 160 Clarke (n 92) at 313. The Criminal Justice Act 1993, s53(3). The defendant might argue that he did not expect anyone to trade on the basis of his information disclosure or expect transactions based on leaked information to be profitable. 162 For example, in case R v Staines and Morrissey, the defendant was an accountant who disclosed inside information to his friends but believed that they did not make use of the information. See R v Staines and Morrissey [1997] 2 Cr App R 426. 163 Clarke (n 92) at 317. 164 The Criminal Justice Act 1993, s53(4). The defendant is not guilty of insider dealing offences if he is a market maker; or possesses market information; or his transactions based on inside information are essential for the success of a series of stock acquisitions/disposals or in pursuit of monetary policies, price stabilisation strategies. 165 Rider and Ashe (n 139). 166 The Criminal Justice Act 1993, s61(1). Maximum imprisonment term for summary conviction is six months whereas that for conviction on indictment is seven years 161 34 Legislative and Enforcement Responses in the UK and US Insider Dealing effects on compensation for victims167. Civil remedies should be adopted as civil liabilities are associated with lower burden of proof. Civil sanctions might support criminal ones by providing more flexibility and bringing more cases to court, which creates deterrent effects and effectively protects market integrity168. However, civil regimes were rejected by the government at that time169. In fact, criminal law to deal with insider dealing has been proved to be ineffective. From 1980 to 1994, there were 104 insider-dealing cases investigated by the Exchange but only 33 cases were criminally prosecuted and about 17 cases were convicted 170. High burden of proof under criminal regime might be the reason for few successful prosecutions171. 4. Concluding remarks In the UK, criminal law has been utilised to protect markets, which was based on the fact that authorities are responsible for ensuring the whole market function effectively172 and on the belief that the defendant should be entitled to legal protections allowed by criminal law173. From the beginning of financial regulations, criminal approach was much more desirable and preferable to control abusive conducts 174. White (n 3); Baker (n 93) at 159; Harry McVea, ‘Fashioning a system of civil penalties for insider dealing: sections 61 and 62 of the Financial Services Act 1986’ (1996) Journal of Business Law 344 - 361. 168 White (n 3); Morris (n 118); Fishman, ‘A Comparison of Enforcement of Securities Law Violations in the UK and US’ (1993) 14 Company Lawyer 163 at 170; Michael Chan, ‘Regulation in the City: Sharing Information’ (2000) 21 Company Lawyer 135. 169 Weiwei (n 3); McVea (n 167). 170 Mark Stamp and Carson Welsh, International Insider Dealing (Longman Law, Tax & Finance 1996) at 113. 171 Baker (n 93) at 159; Hannigan (n 111); Rosalind Wright, ‘Market Abuse and Market Manipulation: The Criminal, Civil and Regulatory Interface’ (2001) 3 Journal of International Financial Markets 19 – 25 at 22. 172 Barry Alexander K. Rider, ‘The Control of Insider Trading – Smoke and Mirrors’ (2000) 19 (1) Dickinson Journal of International Law 1 – 45 at 7; 8. The authorities also financially benefit from the holding of markets. 173 Ibid. 174 Gilligan, ‘The Origins of UK Financial Services Regulation’ (1997) 18 Company law 167. 167 35 Legislative and Enforcement Responses in the UK and US Insider Dealing However, the effectiveness and ability of criminal system to tackle serious frauds has been questioned175. Under circumstances involving complex transactions, the investigation and prosecution might be too costly and complicated, which discourages prosecutors from bringing wrongdoers into the court176. Although criminal justice system aims at protecting well-being of the society, wealthy individuals might make use of its requirements such as standard of proof to benefit from tax avoidance177. Although Part V of the CJA is considered as the most significant and comprehensive amendment to fight against insider dealing, it maintained the UK criminal approach and did not consider civil regimes, which created difficulties in the prosecution due to high standard of proof and resulted in few successful convictions178. To assess effectiveness of the CJA, there are some evaluative criteria including the extent of coverage; legal certainty and clarity; existence of obstacles to legal proceedings and the degree of protection for market participants and market as a whole. Firstly, Part V of the CJA covers a relatively comprehensive and broad range of offences. Three separate offences are introduced in more simple language 179. Secondly, the CJA seems to be ineffective in terms of clarity and certainty. Definitions of inside information and insiders are vague180, so determination of these two criteria is still affected by decision of the courts. Besides, there are several limits relating to unclear constituent factors of each offence and obscure defences181. There seems to be no connection between offences and defences or even conflicts exist among them182. Thirdly, criminal regime under the CJA creates numerous difficulties for the 175 Rider (n 172). Ibid. 177 Ibid. 178 Weiwei (n 3). 179 White (n 3). 180 Weiwei (n 3); Rider and Ashe (n 139). 181 Weiwei (n 3). 182 Ibid.; Stamp and Welsh (n 170). 176 36 Legislative and Enforcement Responses in the UK and US Insider Dealing prosecution and conviction. High standard of proof is one of the obstacles. Some loopholes in statutory definitions may help the accused escape from the prosecution. Enforcement bodies including investigators, prosecutors or polices might not have fully understanding of or access to the environment insider dealing takes place, whereas the accused might be an expertise in that area183. Finally, given that victims of insider dealing are the corporate, shareholders, investors possessing no inside information and the market as a whole, the CJA does not provide any civil remedy for victims. This legislation significantly focuses on penalising wrongdoers rather than enhancing legitimate information acquisition. C. The Financial Services and Markets Act 2000 The CJA was largely criticised due to high standard of proof. Thus, the government decided to fill the regulatory gap by adopting ‘The Market Abuse Regime’184 that provides FSA with much flexibility and lowers burden of proof185. Not until the FSMA did civil regime to tackle insider dealing come into effect, which introduced substantial changes in the UK regulatory framework186. Criminal and civil insider-dealing regimes separately co-exist in the UK, which may possibly create some 183 Rider (n 172). Hereinafter ‘MAR’. MAR targets not only insider dealing but also other abusive practices in the market. See Barnes (n 1); Baker (n 93) at 159; Michael Filby, ‘Part VIII Financial Services and Markets Act: Filling Insider Dealing’s Regulatory Gaps’ (2004) 25 Company Lawyer 363 (2004); Alcock, ‘Market abuse’ (2002) 23 (5) Company Lawyer 142 – 150; Linklater, ‘The Market Abuse Regime: Setting standards in the twenty-first century’ (2001) 22 (9) Company Lawyer 267 – 272. 185 Michael Filby, ‘The Enforcement Of Insider Dealing Under The Financial Services And Markets Act 2000’ (2003) 24(11) Company Lawyer; Swan, ‘Market abuse: A new duty of fairness’ (2004) 25 (3) Company Lawyer 67 – 68; Brendan John Lambe, ‘The efficacy of market abuse regulation in the UK’ (2016) 24 (3) Journal of Financial Regulation and Compliance 248 – 267. 186 Barnes (n 1); Clarke (n 92) at 380; Filby (n 185). 184 37 Legislative and Enforcement Responses in the UK and US Insider Dealing confusion and difficulties for the authorities and legal professions187; but civil regime might complement and support existing criminal approach188. 1. The offences and related definitions a. Insider-dealing behaviour Section 118(2) described the first type of market abuse 189 that is similar to primary insider-dealing offence stated in section 52(1) of the CJA. Several cases that fall within section 118(2) rather than section 118(4) are Michael Davies190, Robert Middlemiss191, Peter Bracken192, David Isaacs193, Jonathan Malins194. The definition of ‘Insider’ is given in section 118B195. A proof of actual knowledge, which means the accused was aware of having inside information, is not required under section 118B(a)-(d)196. Meanwhile, section 118B(e) emphasises on 187 Clarke (n 92) at 382. Sykes, ‘Market abuse: A civil revolution’ (1999) 1 (2) Journal of International Financial Markets 59 – 67. 189 The Financial Services and Markets Act 2000, s118(2). 190 Davies was fined £1000 for his small insider dealing of Berkeley Morgan Group Plc’s stock. See Financial Services Authority, ‘Final Notice To Michael Thomas Davies’ (Financial Conduct Authority 2004) <https://www.fca.org.uk/publication/final-notices/davies-mt_28jul04.pdf> assessed May 2018. 191 Middlemiss was fined £15,000 due to engagement in insider dealing relating to shares of Profile Media Group Plc. See Financial Services Authority, ‘Final Notice To Robert Middlemiss’ (Financial Conduct Authority 2004) <https://www.fca.org.uk/publication/finalnotices/middlemiss_10feb04.pdf> assessed May 2018. 192 Peter Bracken participated in insider dealing of Whitehead Mann Group Plc share and was fined £15,000. See Financial Services Authority, ‘Final Notice To Peter Bracken’ (Financial Conduct Authority 2004) <https://www.fca.org.uk/publication/finalnotices/bracken_07jul04.pdf> assessed May 2018. 193 A £15,000 fine was imposed on David Isaacs as he was engaged in insider dealing of Trafficmaster share. See Financial Services Authority, ‘Final Notice To Mr David Isaacs’ (Financial Services Authority 2005) <http://www.fsa.gov.uk/pubs/final/d-isaacs_28feb05.pdf > assessed May 2018. 194 There were even higher penalties such as a £25,000 fine on Jonathan Malins for his illegal dealing in Cambrian Mining Plc. See Financial Services Authority, ‘Final Notice To Jonathan Malins’ (Financial Conduct Authority 2005) <https://www.fca.org.uk/publication/finalnotices/jonathan_malins.pdf> assessed May 2018. 195 The Financial Services and Markets Act 2000, s118B. An insider is the person who possesses inside information under five circumstances. He might gain private information due to his role as a member of authority regulating the corporate; a shareholder of the corporate; an employee or third-party profession, worker. An insider might be the criminal who steals inside information. 196 Clarke (n 92) at 410. 188 38 Legislative and Enforcement Responses in the UK and US Insider Dealing mens rea factor of actual knowledge and targets secondary insider receiving information from primary insider197, which widens the coverage of the provision and forestalls any argument about information accumulation ‘through the exercise’ of employment198. For example, in case of FSA v John Shevlin199, Shevlin’s employment was not associated with confidential information, so it was more reasonable to apply section 118B(e). ‘Inside information’ is described in section 118C200. Constituent factors are similar to those required by section 56 of the CJA. In terms of the precise nature, precision relates to the ability to indicate that an event occurs or is expected to exist and the adequate specificity to have effect on asset price201. However, section 118C(5)(b) is unclear and difficult to understand, as conflicts exist in the wording and there is no explicit benchmark to determine the level of accuracy202. Besides, section 118C(8) briefly defines ‘generally available’ without further explanation203, but much guidance is provided in the handbook MAR 1.2 Market Abuse204. With regards to the possibly significant effect of information, Part VIII of the FSMA is quite similar to Part 197 The Financial Services and Markets Act 2000, s118B(e). See also Clarke (n 92) at 410. Clarke (n 92) at 411. 199 Shevlin – an IT officer of The Body Shop Plc – made use of managers’ passwords to access to confidential emails without permission. He was engaged in short-selling and earned £38,472 profit. See Financial Services Authority, ‘Final Notice To Mr John Shevlin’ (Financial Conduct Authority 2008) <https://www.fca.org.uk/publication/final-notices/john_shevlin.pdf> accessed May 2018. 200 The Financial Services and Markets Act 2000, s118C. Specifically, section 118C(2) includes four main elements that form inside information. They are the precision, the nonpublic or unavailable feature, the relationship with given asset and the potentially substantial impact on price. 201 The Financial Services and Markets Act 2000, s118C(5). 202 FSA v David Massey [2011] UKUT 49 (TCC) at para 38, 39. See also Baker (n 93) at 168. 203 The Financial Services and Markets Act 2000, s118C(8). Inside information must be ‘not generally available’ which cannot be accumulated by carrying out an analysis, report or research 204 MAR 1.2.13E of Financial Conduct Authority, ‘MAR 1.2 Market Abuse: general’ (Financial Conduct Authority, n/d) <https://www.handbook.fca.org.uk/handbook/MAR/1/2.html?date=2012-06-01> accessed May 2018. 198 39 Legislative and Enforcement Responses in the UK and US Insider Dealing V of the CJA. Substantial effect on price is linked with the fact that investor is likely to make his investment based on the information205. Seemingly, irrespective of whether actual effect exists or not, criteria that information is used by reasonable investors is adequate to establish ‘significant effect’ element. The Tribunal in FSA v David Massey case applied the ‘reasonable investor’ test to determine whether information has significant effect on price or not206. This approach is commonly applied by the FSA/FCA because they consistently record in final notices that information which a reasonable investor’s investment decisions are based on will probably substantially affect stock price207. b. Improper disclosure behaviour Section 118(3) of the FSMA describes the second behaviour208 that is the same with improper disclosure offence under section 52(2)(b) of the CJA. There is no clear guidance under the FSMA, but MAR handbook covers several elements such as whether the information disclosure complies with market disciplines or regulatory codes, whether the recipient is required to keep secret, whether the disclosure is essential for the purposes of takeover209. 205 The Financial Services and Markets Act 2000, s118C(6). FSA v David Massey (n 202) at para 41. 207 Clarke (n 92) at 442; Baker (n 93) at 164, 165. 208 The Financial Services and Markets Act 2000, s118(3). Whether information is properly disclosed or not plays the substantial role in this provision. The relationship between information disclosure and legitimate performance of the individual’s responsibilities or employment is also important. 209 MAR 1.4.5E of Financial Conduct Authority, ‘MAR 1.4 Unlawful disclosure’ (Financial Conduct Authority, n/d) <https://www.handbook.fca.org.uk/handbook/MAR/1/4.html> accessed May 2018. 206 40 Legislative and Enforcement Responses in the UK and US 2. Insider Dealing The defences and the penalties Statutory defences are stated in section 118A(5) of the FSMA210. The provision of defences under the FSMA is not as clear as those under the CJA, which might result from the fact that Part VIII of the FSMA covers numerous market-abuse misconducts whereas Part V of the CJA focuses on insider-dealing practices only. Section 123 of the FSMA provides that FSA/FCA is allowed to impose appropriate penalties on or make a public censure about the individuals taking part in or requiring or encouraging others to engage in market abuse211. The authority is able to make a formal request for remedies against the defendant such as compensation, restitution or asset liquidation212. Although this provision does not provide detailed definition or guidance on ‘requiring or encouraging’ element, it covers the encouragement offence which is quite similar to section 52(2)(a) of the CJA. For example, Alexei Krilov-Harrison was accused of improper disclosure under section 118(3) and encouraging offence under section 123(1)(b), so he was fined £24,000213. Similarly, Perry Bliss214, Jeremy Burley215 and William Coppin216 were fined £30,000; £70,000 and £144,200 respectively for the same misconducts. 210 The Financial Services and Markets Act 2000, s118A(5). Behaviour is not considered as an unlawful practice if it is compliant with the MAD’s rules or exemptions, market disciplines, or is for the purposes of monetary and/or fiscal policies. 211 The Financial Services and Markets Act 2000, s123. 212 Rider et al. (n 94) at 106. 213 Financial Services Authority, ‘Final Notice To Alexei Krilov-Harrison’ (Financial Conduct Authority 2009) <https://www.fca.org.uk/publication/final-notices/krilovharrison.pdf > assessed May 2018. 214 Financial Services Authority, ‘Final Notice To Perry John Bliss’ (Financial Conduct Authority 2010) <https://www.fca.org.uk/publication/final-notices/perry_bliss.pdf> assessed May 2018. 215 Financial Services Authority, ‘Final Notice To Jeremy Burley’ (Financial Services Authority 2010) < http://www.fsa.gov.uk/pubs/final/jeremy_burley.pdf> assessed May 2018. 216 Financial Services Authority, ‘Final Notice To William James Coppin’ (Financial Conduct Authority 2010) <https://www.fca.org.uk/publication/final-notices/william_coppin.pdf > assessed May 2018. 41 Legislative and Enforcement Responses in the UK and US 3. Insider Dealing Concluding remarks Although FCA states that market abuse is a civil rather than criminal offence217, the CJA is still the main insider-dealing legislation and the FSMA complements the CJA by providing civil remedies. Firstly, Part VIII of the FSMA includes three insiderdealing offences stated in Part V of the CJA. Although the FSMA does not provide further guidance, the FSMA’s coverage is wider than that of the CJA because it targets both individuals and juristic persons218. Secondly, requirements on insider-dealing offences and surrounding issues under the FSMA are quite similar to those under the CJA, but there are some unclear issues in relevant definitions. Thirdly, the FSMA introduces civil regimes to fight against market abuse, which fills the regulatory gap. Civil approach solves the problem of high burden of proof, which helps increase successful rate of prosecution and conviction219. Besides, under the MAR, prosecutors are not required to demonstrate the accused’s intent, which is different from the CJA220; but with no requirements on the intent, reckless misconducts might be caught221. Finally, under the FSMA, civil remedies are offered to victims, which might further protect market participants and increase deterrent effects222. However, Dubow and Monteiro measured market cleanliness, then concluded that after the enactment of the FSMA, insider dealing still occurred and in the studied period, the Act did not have adequate effects223. Meanwhile, Lambe used different statistical methods and Financial Conduct Authority, ‘Market abuse’ (Financial Conduct Authority, n/d) < https://www.fca.org.uk/markets/market-abuse> assessed May 2018. 218 Baker (n 93) at 161; Filby (n 184). 219 Weiwei (n 3); Srivastava, Mason, Simpson, and Litt, ‘Financial crime’ (2011) 86 Compliance Officer Bulletin 1–23; Teasdale, ‘FSA to FCA: recent trends in UK financial conduct regulation’ (2011) 26(12) Journal of International Banking Law and Regulation 583–586. 220 Baker (n 93) at 162; Alcock, ‘Market abuse – the new witchcraft’ (2001) 151 New Law Journal 1398. That results from the authority’s objectives to ensure market integrity and efficiency in addition to detecting and prosecuting wrongdoers. 221 Swan (n 185). 222 Weiwei (n 3). 223 Dubow and Monteiro (n 16). 217 42 Legislative and Enforcement Responses in the UK and US Insider Dealing data sample but agreed that the FSMA was insufficient to deter wrongdoings as insider dealing still existed before the official disclosure of information224. II. Enforcement responses A. Enforcement authorities Between 1980 and 2001, there was only criminal regime with legal proceedings conducted by the DTI (Figure 1)225. The DTI only worked effectively in the beginning and it soon had difficulties when defendants did not plead guilty. Since 2002, dual regime has replaced criminal regime. The FSA/FCA is the enforcement body to tackle white-collar crimes, and has enforcement powers to conduct investigation, prosecution and impose punishments on regulated individuals as well as organisations 226. Unlike the DTI or SFO which only has power to pursue criminal offences, FSA/FCA can initiate both criminal and civil proceedings against insider dealing227. An expansion in FSA/FCA’s enforcement powers is a significant change in the regulation and also an advantage over other authorities 228. 224 Lambe (n 185). Jack Davies, ‘From gentlemanly expectations to regulatory principles: A history of insider dealing in the UK: Part 2’ (2015) 36 (6) Company Lawyer 163 – 174. Internal investigations were conducted by the DTI from 1980 to 1985. From 1986 to 1994, there were internal and external investigations, and LSE was able to initiate criminal prosecutions. 226 The Financial Services and Markets Act 2000, s. 6. See Nicholas Ryder, The financial crisis and white collar crime: The perfect storm? (Edward Elgar 2014). 227 Weiwei (n 3); Filby (n 185); Lambe (n 185). 228 Clarke (n 92) at 578; Lambe (n 185). 225 43 Legislative and Enforcement Responses in the UK and US Insider Dealing Figure 1: Number of prosecutions and convictions from 1980 to 2001229 50 40 30 20 10 0 1980 - 1985 1986 - 1994 Prosecution 1995 - 2001 Conviction The post-crisis ‘credible deterrence’ strategy that focuses on individual and institutional wrongdoers was adopted by FSA/FCA. This approach ensures deterrent effects and enhances public confidence by attempting to successfully initiate prosecutions and convictions; widely propagating enforcement priorities and objectives to authorised persons, market participants and consumers 230. To respond to criticism of its major use of fines, FSA emphasised another purpose of ‘credible deterrence’ strategy is to tackle market abuse and it succeeded in criminally convicting several insider-dealing cases231. FSA imposed significant sanctions on both individuals and organisations. Amount of fines increased by almost 59 times from £5.3million in 2007 to £311.5million in 2012 (Figure 2). However, fines actually accounted for small parts of profits gained from misconducts by wrongdoers 232. FSA was criticised because rather than seriousness and impacts of malpractices, political 229 Data source: Davies (n 225). ‘Credible deterrence’ approach explicitly sends a warning message that heavy punishment such as long-term imprisonment or large monetary penalties will be imposed on violations and misconducts. See Peat and Mason, ‘Credible deterrence in action: the FSA brings a series of cases against traders’ (2009) 30 (9) Company Lawyer 278–279; Srivastava et al. (n 219); Teasdale (n 219). 231 Srivastava et al. (n 219); Christine Astaniou, Shoshana Wainer & Nikunj Kiri, ‘UK market abuse update: FSA continues to demonstrate resolve to tackle market abuse’ (2010) Law and Financial Markets Review 582 – 592. 232 Ryder (n 226). 230 44 Legislative and Enforcement Responses in the UK and US Insider Dealing and media-friendly elements played an important role in FSA’s determination of fines233. In 2013, FSA was replaced by FCA whose purposes are consumer protection and maintenance of market integrity rather than financial crime targets set by FSA 234. Insider dealing is regarded as the central target of ‘credible deterrence’ policies235. FCA more proactively implements ‘credible deterrence’ strategies and more seriously attempts to initiate legal proceedings with heavy penalties than FSA did 236. Values of fines in 2013, 2014 and 2015 were substantially higher than those in previous years (Figure 2). Figure 2: Total amounts of fines imposed by FSA and FCA (since 2013)237 1,600.00 1,400.00 £ millions 1,200.00 1,000.00 800.00 600.00 400.00 200.00 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 233 Ibid. FCA makes use of FSA’s enforcement strategies and tools to fight against financial frauds, dishonesty, misconducts and market abuses. See The Financial Services Act 2012, Part 3, s50; Ryder (n 226) at 214-215; James Perry, Rob Moulton, Glynn Barwick, Richard Small, Jake Green and Nicola Kay, ‘The new UK regulatory landscape’ (2011) 84 Compliance Officer Bulletin 1 - 33; Tracey McDermott, ‘Keynote address: Financial crime in the FCA world’ (Financial Conduct Authority, 2013) < https://www.fca.org.uk/news/speeches/keynoteaddress-financial-crime-fca-world> assessed March 2018; Financial Conduct Authority, ‘Financial crime’ (Financial Conduct Authority, 2015) < https://www.fca.org.uk/firms/financialcrime> assessed March 2018. 235 Clarke (n 92) at 577. 236 Srivastava et al. (n 219). 237 The National Archives, ‘Fines table’ (The National Archives, n/d) < http://webarchive.nationalarchives.gov.uk/20130201213211/http://www.fsa.gov.uk/about/pre ss/facts/fines/2012> assessed March 2018; Financial Conduct Authority, ‘Fines table’ (Financial Conduct Authority, n/d) <https://www.fca.org.uk/news/news-stories/2016-fines> assessed March 2018. 234 45 Legislative and Enforcement Responses in the UK and US B. Criminal proceedings versus civil proceedings 1. Criminal proceedings Insider Dealing FSA/FCA is able to criminally prosecute insider-dealing cases238, but the progress of criminal prosecutions is slow and the authority prefers civil sanctions239. Recently, FSA/FCA has paid much attention to criminal prosecutions and made tougher actions toward insider dealing240. Before 2008, FSA failed to initiate criminal proceedings against insider dealing. From 2000 to 2008, a few prosecutions were conducted by DTI and SFO. In 2004, SFO pursued an insider-dealing case that involved a ‘ring’ including four insiders241. Since 2008, more prosecutions have been brought by the FSA/FCA (Figure 3). Until 2016, FSA/FCA secured 32 insider-dealing convictions242 and the number of cases being found guilty or convicted continues to rise. That was regarded as the effectiveness of newly-adopted strategy and the effort of FSA/FCA to initiate criminal proceedings. 238 The Financial Services and Markets Act 2000, s 402(1)(a). Haines, ‘FSA determined to improve the cleanliness of markets: custodial sentences continue to be a real threat’ (2008) 29 (12) Company Lawyer 370; Burger and Davies, ‘The most valuable commodity I know of is information’ (2005) 13 (4) Journal of Financial Regulation and Compliance 324 – 332 at 326. 240 Haines (n 239); Alexander, ‘Corporate crimes: are the gloves coming off?’ (2009) 30 (11) Company Lawyer 321 – 322. Margaret Cole – the Director of Enforcement – stated that one of FSA’s objectives under ‘credible deterrence’ strategy was to criminally prosecute insiderdealing wrongdoers. See Financial Services Authority, ‘Enforcing Financial Services Regulation: The UK FSA Perspective’ (Financial Services Authority, 2008) <http://www.fsa.gov.uk/pages/Library/Communication/Speeches/2008/0404_mc.shtml> accessed May 2018; Financial Services Authority, ‘Delivering Credible Deterrence’ (Financial Services Authority, 2009) <http://www.fsa.gov.uk/library/communication/speeches/2009/0427_mc.shtml> accessed May 2018. 241 Barnes (n 1); Baker (n 93) at 278; Simon Bowers, ‘Essex four charged with insider dealing’ (The Guardian, 2002) <https://www.theguardian.com/business/2002/dec/14/4> accessed May 2018. 242 Financial Conduct Authority, ‘Mark Lyttleton sentenced to 12 months imprisonment for insider dealing’ (Financial Conduct Authority, 2016) <https://www.fca.org.uk/news/pressreleases/mark-lyttleton-sentenced-12-months-imprisonment-insider-dealing > accessed May 2018. 239 46 Legislative and Enforcement Responses in the UK and US Insider Dealing Figure 3: Number of cases found guilty by DTI, SFO before 2008 and by FSA/FCA after 2008243 12 10 8 6 4 2 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Besides, sentencing terms vary on the case-by-case basis (Table 1). Elements including defendants’ employment, reasons for their possession of inside information, whether the wrongdoing is deliberately or recklessly conducted, degree of sophistication and complexity, actual benefits for defendants and impacts on victims or market are considered244. The longest term of imprisonment is four years and six months, which was imposed on Martyn Dodgson245. Courts are reluctant to impose the highest sentences, so effectiveness of the increase in maximum punishment level is questioned. Additionally, criminal sanctions are mainly imposed on individuals and it is difficult to find a corporate that is criminally held liable for insider dealing. It is compatible with the fact that UK legislative response focuses on establishing individual 243 Clarke (n 92) at 522, 523. Cheung (n 2); Filby (n 185); R. v Mcquoid [2009] EWCA Crim 1301, [2009] 4 All E.R. 388. 245 Financial Conduct Authority, ‘Two convicted of insider dealing in Operation Tabernula trial’ (Financial Conduct Authority, 2016) <https://www.fca.org.uk/news/press-releases/twoconvicted-insider-dealing-operation-tabernula-trial> accessed May 2018; Financial Conduct Authority, ‘Insider dealers sentenced in Operation Tabernula trial’ (Financial Conduct Authority, 2016) <https://www.fca.org.uk/news/press-releases/insider-dealers-sentencedoperation-tabernula-trial> accessed May 2018. 244 47 Legislative and Enforcement Responses in the UK and US Insider Dealing liability rather than corporate liability. FSA/FCA was also criticised due to their failure to prosecute large insider-dealing network and/or large-scale practice246. To determine whether criminal proceedings are appropriate, two-stage test consists of evidential and public interest assessment247. FCA considers the Code for Crown Prosecutors and the Enforcement Guide of FCA Handbook of Rules and Guidance to decide the suitable prosecution248. A non-exhaustive list of factors includes the significance of market distortion, criminal records, the extent of cooperation with other people, and personal circumstances249. In Richard Ralph and Filip Boyen case250, there were adequately straightforward evidences to criminally prosecute wrongdoers251; however, civil sanctions were imposed as two defendants co-operated with FSA during investigating period252. They escaped from being criminally held for insider dealing. Co-operation agreements between authorities and suspects who are willing to assist investigation and prosecution are normal in the common law. Given that insiderdealing cases are complicated, costly and time-consuming, FSA took advantage of co-operation agreements with suspects to support investigation and probably 246 Barnes (n 1). Clarke (n 92) at 573, 579; Lambe (n 185). 248 Clarke (n 92) at 573. 249 Financial Conduct Authority, ‘The Enforcement Guide’ (Financial Conduct Authority, n/d) <https://www.handbook.fca.org.uk/handbook/document/EG_Full_20140401.pdf> accessed May 2018. 250 Ralph was fined a total amount of £117,691.41 while the fine imposed on Boyen was £81,982.95. Those fines included a disgorgement and an additional element. See Financial Services Authority, ‘Final Notice To Richard Ralph’ (Financial Services Authority 2008) <http://www.fsa.gov.uk/pubs/final/richard_ralph.pdf> accessed May 2018; Financial Services Authority, ‘Final Notice To Filip Boyen’ (Financial Conduct Authority 2008) <https://www.fca.org.uk/publication/final-notices/filip_boyen.pdf> accessed May 2018. 251 Ralph was the director of Monterrico and also an experienced investor. He was in breach of trust and his corporate’s insider-dealing, transparency and disclosure rules. His misconduct was deliberate because corporate advisers had given him advice relating to his obligations and he purposefully involved Boyen to conceal his trading. Damage to public confidence was also taken into consideration. See Clarke (n 92) at 580. 252 Ibid. at 582. 247 48 Legislative and Enforcement Responses in the UK and US Insider Dealing establish liability for other wrongdoers253. For example, in Malcolm Calvert case254, FSA found it difficult to gather sufficient evidences and entered into a co-operation agreement with Hatcher255. Thus, co-operation agreements might help the FSA/FCA in the investigation, prosecution, conviction and assist the authority to discover insiderdealing rings256. Nevertheless, it has been questioned that whether those agreements are intentionally used by defendants to avoid imprisonment. There is no clear framework to assess the extent of reduction or discount treated as the benefit of cooperation agreements. 2. Civil proceedings The FSMA allows the civil approach parallel to the criminal regime, which is controversial and creates some confusion257. It raises the problem whether civil sanctions are precisely prescribed as civil or criminal enforcement and subsequently, whether so-called civil penalties violate human rights258. Under the FSMA, there is a wide range of civil actions that FSA/FCA can impose on insider-dealing defendants259. The authority is able to cancel or remove a corporate’s permission to operate, suspend a firm from authorised activities, restrict some specific practices conducted by firm; withdraw an approval or permission of an authorised person, prohibit or suspend a person from regulated activities; issue public 253 Clarke (n 92) at 584; Astaniou et al. (n 231). Hatcher was Calvert’s friend and was also engaged in his misconduct. See Financial Services Authority (n 125). 255 Hatcher admitted his engagement and provided valuable information about Calvert’s wrongdoing, which supported the criminal prosecution against Calvert. See Clarke (n 92) at 588; Astaniou et al. (n 231). 256 Astaniou et al. (n 231). 257 Baker (n 93) at 172, 173; Filby (n 185); Conceicao, ‘The FSA’s approach to taking action against market abuse’ (2007) 29 (2) Company Lawyer 43-45. 258 Baker (n 93) at 173; Filby (n 185). Human rights are under the UK Human Rights Act 1998 and the European Convention on Human Rights. 259 Clarke (n 92); Rider et al. (n 94) at 290; Filby (n 185). 254 49 Legislative and Enforcement Responses in the UK and US Insider Dealing censure, require asset freezing and impose financial penalties on both individuals and entities260. In terms of informal actions, FSA/FCA may issue private warnings to authorised or non-authorised corporates and individuals if there are potential marketabuse conducts261. Private warning, which is non-statutory and normally conducted by the FSA/FCA in case of minor violations, is to make wrongdoers aware that if their malpractice continues, they will face with formal actions262. Regarding formal actions, the most common type is financial punishment whose amounts vary from cases to cases and are mainly imposed on individuals rather than corporates (Table 2). To determine whether a fine or a public censure is suitable, the authority considers a nonexhaustive series of factors including the nature, severity, profitability, effect of misconduct; whether the misconduct is reckless or purposeful; the complexity, liquidity and size of market; and potential deterrent effects263. Besides, there is a five-stage procedure to decide level of fine264. Other types of formal actions are prohibition orders, withdrawal of approval, cancellation of permission, suspension and restriction orders. Regarding legislative responses, civil approach is an essential regime to remove difficulties associated with criminal proceedings, to improve the number of successful convictions and to introduce civil remedies for victims. Monetary sanctions imposed on retail malpractices are to avoid unfairness while imposition of those fines 260 The Financial Services and Market Act 2000, ss 55; 56; 63; 66; 123; 205; 206A. Clarke (n 92) at 607. 262 Ibid. 263 Section 6.2 of Financial Conduct Authority, ‘The Decision Procedure and Penalties manual’ (Financial Conduct Authority, n/d) <https://www.handbook.fca.org.uk/handbook/DEPP.pdf > accessed May 2018. 264 The first two steps titled ‘Disgorgement’ and ‘Seriousness’ are to assess the amount of profit gained or loss avoided and the severity of wrongdoings. In the next step, the level of fine may rise or fall after several aggravating or mitigating factors such as the extent of cooperation with the authority, the criminal records of suspects are taken into account. Then, the penalty might be adjusted for deterrence and/or discounted. Disgorgement element is excluded from settlement discount. See Financial Conduct Authority (n 263) at section 6.5. 261 50 Legislative and Enforcement Responses in the UK and US Insider Dealing on financial crimes or wholesale wrongdoings aims at preventing the lack of corporates’ internal management and protecting the integrity as well as efficiency of financial markets265. Thus, financial punishment is expected to affect the corporate’s stock value, the profitability and reputation of both individual and institutional wrongdoers. In fact, civil sanctions are criticised and the effectiveness has been questioned. Firstly, monetary penalties associated with litigation costs are believed to decrease wrongdoers’ profitability and this effect actually happens266; but the fall in profit might be a negative consequence of unsuccessful business practices instead of punishment. Fines are relatively smaller than profits, so wrongdoers consider fines as business costs and continue their wrongdoings to earn huge profits that are much bigger than losses from sanctions267. Additionally, financial penalties might have deterrent effects in case that individuals pay fines by themselves; in contrast, if fines are paid by shareholders’ funds, wrongdoers still have incentives to benefit from misconducts268. Secondly, financial punishment on corporates might force 265 Val Srinivas, Daniel Byler, Richa Wadhwani, Alok Ranjan and Vamsi Krishna, 'Enforcement Actions In The Banking Industry: Trends And Lessons Learned' (Deloitte University Press 2015); Elena Carletti, 'Fines For Misconduct In The Banking Sector – What Is The Situation In The EU?' (Economic Governance Support Unit, European Parliament 2017). 266 Carletti (n 265); Calvin Benedict, 'Will Conduct Costs Change The Behavior Of Banks?' (2014) 3(1) Seven Pillars Institute Moral Cents; Jeff Cox, 'Now That Banks Have Paid $321 Billion In Fines, Here's The Toughest Test Ahead' (CNBC, 2017) <https://www.cnbc.com/2017/03/03/banks-have-paid-321-billion-in-fines-since-thecrisis.html> accessed 6 November 2017. 267 Benedict (n 266); Cox (n 266); Hannes Köster and Matthias Pelster, 'Financial Penalties And Bank Performance' (2017) 79 Journal of Banking & Finance 57-71; Wharton, 'Are Financial Penalties Enough To Deter Banks' Bad Behavior?' (Knowledge@Wharton, 2015) <http://knowledge.wharton.upenn.edu/article/are-financial-penalties-enough-to-deter-banksbad-behavior/> accessed 6 November 2017; The Economist, 'Fine And Punishment' (The Economist, 2012) <http://www.economist.com/node/21559315> accessed 6 November 2017; Gavin Finch, 'World’S Biggest Banks Fined $321 Billion Since Financial Crisis' (Bloomberg.com, 2017) <https://www.bloomberg.com/news/articles/2017-03-02/world-sbiggest-banks-fined-321-billion-since-financial-crisis> accessed 6 November 2017; The House of Commons, 'Changing Banking For Good' (2006) <http://www.parliament.uk/documents/banking-commission/Banking-final-report-vol-ii.pdf> assessed November 2017. 268 Pecuniary sanctions imposed on firms rarely effectively affect employees or managers that are directly engaged in the wrongdoing. See Maher, ‘Crisis not averted: lack of criminal 51 Legislative and Enforcement Responses in the UK and US Insider Dealing shareholders to supervise and manage their firms; because fines lead to lower cashflow, higher discount rate and lower share value269. In fact, despite financial sanctions imposed on corporates, there was still an increase in share price270. Thirdly, regulators expect that civil punishment leads to reputational loss which was estimated to be 7.5 times greater than financial loss271. But reputational loss might erode public confidence and result in market instability272. Therefore, imposition of pecuniary sanctions on financial crimes in general and on insider dealing in particular neither effectively deter wrongdoings nor protect market participants and market as a whole273. The deep-rooted problem is the corporate’s internal culture274, which calls for much concern about corporate governance 275. Besides, either criminal or civil proceedings ineffectively tackle financial crimes if they are conducted alone. An appropriate combination of two approaches might be recommended. prosecutions leaves limited consequences for those responsible for the financial crisis’ (2013) 39 New England Journal on Criminal and Civil Confinement 459–476; Jed Rakoff, ‘The Financial Crisis: Why Have No High-Level Executives Been Prosecuted?’ (2014) The New York Review of Books. 269 Köster and Pelster (n 267); Christopher Kennedy, ‘Criminal Sentences for Corporations: Alternative Fining Mechanisms’ (1985) 73 (2) California Law Review 443 – 482. 270 Benedict (n 266). 271 European Systemic Risk Board, ‘Report On Misconduct Risk In The Banking Sector’ (2015) <https://www.esrb.europa.eu/pub/pdf/other/150625_report_misconduct_risk.en.pdf> accessed 6 October 2017. 272 European Systemic Risk Board (n 271); Jill Treanor, 'Banks’ £30Bn In Compensation Claims And Fines 'Pose Risk To Stability' (The Guardian, 2015) <https://www.theguardian.com/business/2015/jul/01/banks-30bn-in-fines-and-compensationclaims-pose-risk-to-stability> accessed 6 October 2017; Bank of England, ‘Financial Stability Report’ (2015) <https://www.bankofengland.co.uk/financial-stability-report/2015/december2015> assessed 6 October 2017. 273 Benedict (n 266); Henry Hillman, ‘The Carrot Or The Stick: Finding A Balance In The Regulatory Conundrum’ (2013) Financial Regulation International. 274 Wharton (n 267); Roman Tomasic, ‘The financial crisis and the haphazard pursuit of financial crime’ (2011) 18(1) Journal of Financial Crime 7-31; Hannah Laming and Nicholas Querée, ‘FSA v UBS: Will Big Fines Change Banks’ Attitudes To Risk Management?’ (2013) Butterworths Journal of International Banking and Financial Law. 275 Tomasic (n 274); Perry et al. (n 234). 52 Legislative and Enforcement Responses in the UK and US C. Insider Dealing Concluding remarks While criminal approach still plays an important role in the legislative responses, civil proceedings are more common in the enforcement responses. Thanks to ‘credible deterrence’ policy, the authority pays attention to criminal proceedings. To evaluate enforcement responses, there is a framework including five major criteria that are whether criminal or civil sanctions are imposed; the number of prosecutions and convictions; whether sanctions are imposed on individuals or organisations; actual compliance of defendants; and actual effects. Firstly, enforcement of criminal and civil sanctions is considered. In the UK, FSA/FCA is the enforcement authority that has power to decide appropriate sanctions and level of punishment. The UK sentencing model considers a set of criteria including amount of profit gained or loss avoided, nature of employment, circumstances resulting in insiders’ possession of privileged information, degree of sophistication, whether other people involve in insider-dealing practice, whether misconduct is reckless or deliberate, effects on victims and on public confidence276. It is a better and more comprehensive model than US one277. However, FSA/FCA has been criticised as civil sanctions are the major enforcement tool and there is a lack of criminal proceedings. Recently, thanks to ‘credible deterrence’ policy, the authority has put a high value on criminal proceedings. Secondly, since ‘credible deterrence’ strategy is implemented, both the number of criminal convictions and the amount of civil fines have increased. That may demonstrate the authority’s great effort to tackle insider dealing. Between 2008 and 2016, 32 cases were criminally convicted by FSA/FCA278, which is a significant increase compared to the small number of pre-2008 successful 276 Cheung (n 2). Ibid. 278 Financial Conduct Authority (n 242). 277 53 Legislative and Enforcement Responses in the UK and US Insider Dealing cases brought by SFO and DTI. Thirdly, both criminal and civil approaches mainly target individuals rather than organisations. In comparison with sanctions imposed on individuals, cases where corporates are criminally held liable account for a small proportion. There is a substantial need for both criminal and civil proceedings against corporations, large-scale insider dealing conducted by a ring of insiders. Furthermore, in terms of defendants’ actual compliance with judgement, some individuals plead guilty in the early stage of investigation and make use of co-operation agreements with the authority to fully provide information, to support investigation as well as prosecution and to receive reduction in punishment in return. Although co-operation agreements are helpful to assist the authority, there is a potential problem that those agreements are abused by defendants. Finally, whether enforcement actions bring actual protection to market participants is considered. The fact is that it is difficult to determine exact victims of insider dealing and it is still controversial whether investors, shareholders or the corporate are victims. Monetary fines commonly go to the regulators rather than the ultimate victims. Thus, enforcement actions are seemingly to punish wrongdoers rather than provide remedies for victims. 54 Legislative and Enforcement Responses in the UK and US Insider Dealing CHAPTER 4: THE UNITED STATES APPROACHES Insider trading had not been regarded as an unlawful practice279. Since insidertrading regulation was first introduced in the US, the public viewpoint has changed significantly. Insider trading is a form of cheating in the US and there is no tolerance for insider trading280. Both US regulators and the public consider insider trading as a serious crime, which is similar to the common belief in British society. While it was until 1980s that insider-dealing regulations were officially adopted in the UK, the US is the first country that has regulated insider trading since 1930s. I. Legislative responses A. Development of insider-trading legislations in the United States The Wall Street Crash led to Great Depression, which resulted in the introduction of the Securities Exchange Act of 1934281 to ensure fairness in the stock exchange, to protect market participants, public confidence and integrity of stock markets282. This Act is the most frequently used legislation to deal with insider trading283. Afterwards, the Insider Trading Sanctions Act of 1984284, the Insider 279 Case Goodwin v. Aggassiz 186 N.E. 659, Mass. 1933 referred in Stephen M. Bainbridge, ‘The Law and Economics of Insider Trading: A Comprehensive Primer’ (2001) SSRN Electronic Journal. 280 Arthur Levitt, ‘A Question of Integrity: Promoting Investor Confidence by Fighting Insider Trading’ (Securities and Exchange Commission, 1998) <https://www.sec.gov/news/speech/speecharchive/1998/spch202.txt > accessed May 2018. 281 Pub. L. 73 – 291, 48 Stat. 881. Hereinafter ‘SEA’. 282 Seredynska (n 2) at 37; Bainbridge (n 279). 283 Seredynska (n 2) at 37, 38; Michael V. Seitzinger, ‘Federal Securities Law: Insider Trading’ (Congressional Research Service 2016). The SEA allows SEC to adopt their own rules for the purposes of protecting investors and public interest. Since 1942, rule 10b-5 has allowed SEC to tackle securities fraud and insider trading in particular. Rule 10b-5 laid the foundation for insider trading regulation. 284 Pub. L. 98 – 376, 98 Stat. 1264. Hereinafter ‘ITSA’. At that time, insider trading was regarded as a severe threat that eroded public confidence, fairness and honesty of stock markets. The Act was the regulatory response to deter insider-trading offences by increasing sanctions. See Seitzinger (n 283). 55 Legislative and Enforcement Responses in the UK and US Insider Dealing Trading and Securities Fraud Enforcement Act of 1988285 and the Stop Trading on Congressional Knowledge (STOCK) Act of 2012286 were adopted. These Acts provide extra provisions and amendments to the SEA to create a comprehensive insidertrading regime. For the purposes of this dissertation, the focus is on the SEA also known as the main insider-trading legislation, the ITSA and the ITSFEA. Compared to UK insiderdealing legislations, in the US, there are no separate provisions that explicitly prohibit insider trading287. The CJA and the FSMA in the UK are two comprehensive laws; each of them covers insider-dealing offences, related definitions, defences and penalties. Meanwhile, the SEA, the ITSA and the ITSFEA together contribute to an insider-trading legislation. Relevant definitions are found in the courts’ judgements or decisions instead of statutory provisions288. Pub. L. 100 – 704, 102 Stat. 4677. Hereinafter ‘ITSFEA’. This Act increased the scope of civil sanctions, so that an individual who does not adequately prevent insider trading is also fined. See Seitzinger (n 283). 286 This Act prohibited governmental staffs and federal officials from taking advantage of private information to trade on securities. See Seitzinger (n 283). 287 Anabtawi (n 80); Caccese (n 87); Micah A. Acoba, 'Insider Trading Jurisprudence after United States v. O'Hagan: A Restatement (Second) of Torts 551(2) Perspective' (1999) 84 Cornell Law Review 1356 – 1362; Marco Ventoruzzo, ‘Comparing Insider Trading in the United States and in the European Union: History and Recent Development’ (2014) European Corporate Governance Institute Working Paper Series in Law No. 257/2014; Oliver Perry Colvin, ‘A Dynamic Definition of an Prohibition against Insider Trading’ (1991) 31 Santa Clara Law Review 603 – 640; Daniel L. Goelzer and Max Berueffy, ‘Insider Trading: The Search for a Definition’ (1988) 39 (2) Alabama Law Review 491 – 530; Cindy A. Schipani and H. Nejat Seyhun, ‘Defining “Material, Nonpublic”: What Should Constitute Illegal Insider Information?’ (2016) XXI Fordham Journal of Corporate and Financial Law 327 – 378; Sarah Baumgartel, ‘Privileging Professional Insider Trading’ (2016) 51 Georgia Law Review 71 – 119. 288 Goelzer and Berueffy (n 287); Schipani and Seyhun (n 287); Reinier Kraakman, ‘The Legal Theory of Insider Trading Regulation in the United States’ in Klaus J. Hopt and Eddy Wymeersch, European Insider Dealing: Law and Practice (Butterworths 1991) at 44. 285 56 Legislative and Enforcement Responses in the UK and US B. The Securities Exchange Act of 1934 1. Section 10(b) and Rule 10b-5 Insider Dealing Under US insider-trading regulations, there is a lack of separate provisions to detect, prosecute and convict insider trading. To tackle insider trading, SEC makes use of section 10(b)/rule 10b-5 which broadly target fraudulent or deceptive usage of devices relating to security transactions289. Section 10(b)/rule 10b-5 does not explicitly target insider trading290. Insider trading is considered as a fraud rather than a misuse of information or market abuse as under UK legislations291. To establish a civil or criminal liability or to claim for financial damages under section 10(b)/rule 10b-5, several factors must be proved292. Pub. L. 73 – 291, 48 Stat. 881 codified at 15 U.S.C. §78j(b). See Ventoruzzo (n 287); Baumgartel (n 287); Kraakman (n 288) at 40; Tammy L. O’Leary and Timothy L. O’Leary, ‘The Insider Trading Sanctions Act of 1984: Did Congress and the SEC Go Home Too Early?’ (1986) 19 University of California, Davis Law Review 497 – 537; Erica Clements, ‘The Seventh Amendment Right to Jury Trial in Civil Penalties Actions: A Post-Tull Examination of the Insider Trading Sanctions Act of 1984’ (1988) 43 University of Miami Law Review 361 – 418 at 391; Michael Karsch, ‘The Insider Trading Sanctions Act: Incorporating a Market Information Definition’ (1984) 6 Journal of Comparative Business and Capital Market Law 283 – 305 at 292; Barbara Bader Aldave, ‘The Insider Trading and Securities Fraud Enforcement Act of 1988: An Analysis and Appraisal’ (1988) 52 Albany Law Review 893 – 921; Carlyle H. Dauenhauer, ‘Justice in Equity: Newman and Egalitarian Reconciliation for Insider-Trading Theory’ (2015) 12 (1) Rutgers Business Law Review 41 – 96; Austin J. Green, ‘(Beyond) Family Ties: Remote Tippees in a Post-Salman Era’ (2017) 85 Fordham Law Review 2769 – 2802; William F. Highbreger, ‘Common Law Corporate Recovery for Trading on Non-Public Information’ (1974) 74 Columbia Law Review 269 – 298. 290 Kraakman (n 288) at 40; Karsch (n 289) at 292; Stephen M. Bainbridge, 'An Overview Of US Insider Trading Law: Lessons For The EU?' (2005) SSRN Electronic Journal. 291 Ventoruzzo (n 287); Jeff Berman, Carlos Conceicao, Steven Gatti and Nick O’Neill, ‘The US and EU – An ocean apart on insider dealing regulation?’ (Clifford Chance, 2015) < https://www.cliffordchance.com/briefings/2015/06/the_us_and_eu_anoceanapartoninsiderde alin.html> accessed May 2018. 292 Factors to establish a liability are existence of jurisdictional power relating to violation; proof of manipulation including misrepresentation, omission or deception; materiality; evidence of intent associated with malpractice and the relationship between deceptive conducts and security purchase/sale. For plaintiffs who try to claim for financial damages, they must demonstrate their position as security buyer or seller; his reliance and care; the causal link between his loss and misconduct; damages with numerical evidence. See William K.S. Wang and Marc I. Steinberg, Insider Trading (3rd edn, Oxford University Press 2010) at 102, 103. 289 57 Legislative and Enforcement Responses in the UK and US a. Insider Dealing Inside information Inside information is defined as material non-public information293, so two key elements are materiality and confidentiality. Materiality is the significant probability that a reasonable investor will take into account private information to make investment decisions294. Firstly, courts will assess the degree of importance that people possessing information attached to it295. In Basic Inc. v Levinson296, transactions made by insiders might be a signal of material information, while in SEC v Texas Gulf Sulphur Co297, a major element was ‘the importance attached to the drilling results by those who knew about it’. Secondly, market reaction at the time information is public is examined298. In US v Carpenter299, the court explicitly emphasised on large market effect to prove materiality. Price movement is an indication of materiality, but it is controversial. In SEC v Tome300, SEC v Talbot301, SEC v Michel302, SEC v Warde303, United States v. Mylett304, courts alleged insider trading based on immediate increase in stock price when information was officially announced. Similarly, evidence of materiality was a decline in price in US v Heron305. However, price change is not regarded as a determinative or exclusive factor in US v Bilzerian306, Geiger v Solomon-Page Group, Ltd307. Next, in case of 293 US v Svoboda, 347 F.3d 471, 475 n.3 (C.A.2 (N.Y), 2003). Basic Inc. v Levinson, 485 U.S. 224, 231 – 232 (1988). 295 Wang and Steinberg (n 292) at 111. 296 Basic Inc. v Levinson (n 294). 297 SEC v Texas Gulf Sulphur Co, 401 F.2d 833 (2d Cir. 1968). 298 Wang and Steinberg (n 292) at 113. 299 US v Carpenter, 791 F.2d 1024 (2d Cir. 1986). 300 SEC v Tome, 638 F. Supp. 596, 623 (S.D.N.Y. 1986). 301 SEC v Talbot, 530 F.3d 1085, 1097 – 1098 (9th Cir. 2008). 302 SEC v Michel, 521 F. Supp. 2d 795, 825-826 (N.D. Ill. 2007). 303 SEC v Warde, 151 F.3d 42, 47 (2d Cir. 1998). 304 US v Mylett, 97 F.3d 663 (2d Cir. 1996). 305 US v Heron, 525 F. Supp. 2d 729, 744 (E.D. Pa. 2007). 306 US v Bilzerian, 926 F.2d 1285, 1298 (2d Cir. 1991). 307 Geiger v Solomon-Page Group, Ltd, 933 F. Supp. 1180, 1188 (S.D.N.Y. 1996). 294 58 Legislative and Enforcement Responses in the UK and US Insider Dealing tipping, the courts consider source of information and specificity as indicators of materiality308 such as in SEC v Monarch Fund309 and SEC v Talbot310. In comparison with UK requirements on material information, US criteria are quite similar but commonly decided by case law rather than statutory provision. UK and US approaches all face with legal uncertainty because there is no clear benchmark to determine level of significance or specificity; and market reactions are mainly observed via price movements, which is relatively controversial. However, there are several differences. US approach does not attach to ‘significant effects’, which may broadly cover small as well as large impacts and avoid defining threshold of significance. Besides, US approach does not consider accuracy of information, and specificity element is taken into account in case of secondary insider-trading offence only. Meanwhile, UK legislation focuses on these two factors in both primary and secondary offences. In terms of publicity, there are two major views311. The first view is that information is released in the media and it helps investors make appropriate investment decisions. Dissemination is not immediately associated with absorption312. SEC has not provided any guidance to identify when and whether information is public, which was disagreed in SEC v Dirks313. In SEC v Texas Gulf Sulphur Co.314 and SEC v Lund315, although information was released, the disclosure was ineffective and 308 Wang and Steinberg (n 292) at 117. SEC v Monarch Fund, 608 F.2d 938 (2d Cir. 1979). Key question was specificity of information. 310 SEC v Talbot (n 301). The court considered whether information was from insider or not and whether there was any implied certainty or specific quantification associated with information. 311 Wang and Steinberg (n 292) at 143. 312 In SEC v Coates, 394 U.S. 976 (1969), the defendant was accused of insider trading because information was just released but not totally disseminated and absorbed by the public. 313 SEC v Dirks, 463 U.S. 646 (1983). 314 SEC v Texas Gulf Sulphur Co. (n 297) at 833, 853. 315 SEC v Lund, 570 F. Supp. 1397 (C.D. Cal. 1983). 309 59 Legislative and Enforcement Responses in the UK and US Insider Dealing insufficient to ensure information was available to investors. The second view based on EMH theory is that if a large number of active investors know the information, it will be reflected in security price and is regarded as being made public316. Relying on EMH theory, courts rejected to hold defendants liable for inside information in SEC v Monarch Fund317, SEC v Bausch & Lomb318, Catherines v Copytele, Inc.319, but in SEC v Peters320 or In re Investors Management Co.321, the defendants’ argument that rumours around the company were public was rejected. Generally, US requirements on ‘made public’ factor are similar to the UK because rather than limit the coverage to only corporate announcements, they extend the scope to information that is widely known by the public. Nevertheless, US legislation requires information to be disclosed and absorbed rather than disseminated, which is stricter and more rigid than the UK. b. The offenders While in the UK, there is a statutory definition of ‘insider’, US statutes do not give any explanation on ‘insider’322. Insider-trading prohibitions covers not only corporate insiders but also outsiders such as third-party employees, congressmen, government officials323. In the US, determination of offenders is strongly associated with assessment of their duty, because courts rely on common-law principles to tackle 316 Wang and Steinberg (n 292) at 150. SEC v Monarch Fund (n 309). 318 SEC v Bausch & Lomb, 565 F.2d 8 (2d Cir. 1977). 319 Catherines v Copytele, Inc., 602 F. Supp. 1019 (E.D.N.Y. 1985). 320 SEC v Peters, 735 F. Supp. 1505 (D. Kan. 1990). 321 In re Investors Management Co., 44 SEC 633 (1971). 322 Bainbridge (n 279); Eric Engle, ‘Global norm convergence: Capital markets in US and EU law’ (2010) 21 European Business Law Review 465 – 490; Michael D. Mann and Lise A. Lustgarten, 'Internationalization of Insider Trading Enforcement: A Guide to Regulation and Cooperation' (1993) Practising Law Institute PLI Order No. 134-7024 January 14, 14-15. 323 Stephen M. Bainbridge, ‘Insider Trading Inside the Beltway’ (2011) 36 (2) The Journal of Corporation Law 281 – 307. 317 60 Legislative and Enforcement Responses in the UK and US Insider Dealing frauds324. There is a requirement to demonstrate fiduciary relationship and duties to hold the alleged liable for his wrongdoings325. However, no accurate requirements on proof of which duties have been breached are found. After Chiarella and Dirks cases, disclosure duty is the main category, but issues arise when insiders encourage others to trade rather than trade by themselves326. Confidentiality duty was examined in several cases327; however, it is inconsistent because same information can be simultaneously used by many insiders328. A more reasonable requirement on fiduciary duty is to stop self-dealing based on inside information329. Offenders are classified as ‘insiders’, ‘tippees’ and ‘misapproriators’330. Firstly, unlike UK approach in which ‘insider’ covers both primary and secondary insiders, insiders under US legislation are literally people owning or working in the corporate331. They must disclose private information or refrain from taking advantage of privileged information to trade, which is the classical disclose-or-abstain rule332. This rule has been questioned. In Chiarella and Dirks, only when the defendant has a fiduciary duty that the company expects or requires him/her to keep secret, is the disclose or abstain rule applied333. Similarly, in SEC v Switzer334, a person overhearing inside information Bainbridge (n 279); O’Leary and O’Leary (n 289); Engle (n 322). Bainbridge (n 279). There might not be a fraud merely arising from possession of private information if the accused have no duty to disclose such as not being the company’s agent, not having fiduciary relationship with the company or not being placed with sellers’ trust and confidence. See SEC v Dirks (n 313) at 646, 653-655; US v Chiarella, 445 US 222, 235 (1980). 326 Bainbridge (n 279). 327 US v Libera, 510 US 976 (1993); US v Carpenter (n 299) at 1024, 1034. 328 Bainbridge (n 279). 329 Ibid.; SEC v Dirks (n 313). 330 O’Leary and O’Leary (n 289); Engle (n 322). 331 In re Cady, Roberts & Co., 40 SEC 907, 911 (1961). 332 SEC v Texas Gulf Sulphur Co. (n 297) at 833, 848; Shapiro v Merrill Lynch, Pierce, Fenner & Smith, Inc., 495 F.2d 228, 236 (2d Cir. 1974). 333 SEC v Dirks (n 313) at 654, 655; US v Chiarella (n 325) at 232. A printer in Chiarella case was not liable for insider trading because he did not owe fiduciary duty to the shareholders of target company. 334 SEC v Switzer, 590 F. Supp. 756 (W.D. Okla. 1984). 324 325 61 Legislative and Enforcement Responses in the UK and US Insider Dealing from an insider’s conversation was not guilty of insider trading as he was not expected to keep secret. However, reliance on the fiduciary relationship instead of nature of malpractice was criticised, as the accused was able to gain profits from confidential information, which was unfair and discouraged investors in the market 335. Secondly, tippees are people obtaining information from insiders336. The tippee’s fiduciary duty only arises when he reasonably knows that there is a breach of duty done by the tipper, and the tipper’s duty is only breached when he gains benefit from the tip 337. This discipline was also criticised as it created chances for tippees to benefit from unfair informational advantages338. No existence of duty is a common defence used by tippees. Provided there is no benefit for tipper or tipper is not an insider, both tipper and tippee escape from liability; even when tipper breaches his duty, tippee is not guilty if he is not aware of that breach339. Especially, when the ultimate tippee gets information via several intermediaries, it is unlikely that he knows about the breach of tipper’s duty. Determining who has fiduciary duty is difficult for courts340. Thirdly, misappropriators are people whose dealing is based on confidential information gained from third parties, so they breach a duty owed to owners of private information rather than plaintiffs341. Under misappropriation theory, there is neither requirements on fiduciary connection between the accused and plaintiff nor requirements to demonstrate tipper’s breach of duty, which removes regulatory gaps and helps SEC prosecute wrongdoers that are not guilty under the disclose-or-abstain rule or the O’Leary and O’Leary (n 289). Engle (n 322). 337 SEC v Dirks (n 313) at 660 – 670. In Dirks, an analyst, who was informed by insider that there was a misstatement on the company’s assets, was not held liable because insider did not benefit from information disclosure. 338 Davis (n 87); O’Leary and O’Leary (n 289); Engle (n 322). 339 Ibid. 340 Engle (n 322). 341 US v Newman, 664 F.2d 12, 17-18 (2d Cir. 1981); SEC v Musella, 578 F. Supp. 425, 438 (S.D.N.Y. 1984). 335 336 62 Legislative and Enforcement Responses in the UK and US Insider Dealing tipping theory342. In US v Newman343, SEC v Musella344 and SEC v Materia345, defendants misappropriated takeover information and were accused of violating rule 10b-5. Nevertheless, problems still exist. Section 10(b) prohibits frauds relating to manipulative or deceptive devices, but misuse or misappropriation of information might not be a fraud346. Thus, misappropriation theory is inadequate to establish liability under rule 10b-5. Although this theory solves issues of two previous rules which focus on fiduciary duties rather than nature of misconducts, misappropriation theory still involves ambiguous concepts of duty owed to information possessor347. Furthermore, scienter348 is an important factor which includes actual awareness of material non-public information and knowledge that information is material as well as confidential349. The most straightforward circumstance is that the defendant is directly prohibited from self-trading and tipping by the corporate or information owners350. In case of misappropriators and tippees, they must be aware that misuse of information is a breach of fiduciary duty351. In comparison with UK legislations, element of the defendant’s actual knowledge under US regulations is similar. Generally, both UK and US approaches cover a wide range of offenders and do not limit the coverage to only people working in or owning the company. Three offender categories in US case law match with three offences stated in UK statutes. O’Leary and O’Leary (n 289). US v Newman (n 341). 344 SEC v Musella (n 341). 345 SEC v Materia, 745 F.2d 197 (2d Cir. 1984). 346 O’Leary and O’Leary (n 289). 347 Ibid. 348 ‘Scienter’ was defined as ‘a mental state embracing intent to deceive, manipulate or defraud. See Ernst & Ernst v Hochfelder, 425 US 185, 194 n.12 (1976). 349 SEC v Dirks (n 313) at 646, 674; SEC v MacDonald, 699 F.2d 47, 50 (1st Cir. 1983); Elkind v Liggett & Myers, Inc., 635 F.2d 156, 167 (2d Cir. 1980). 350 SEC v Peters (n 320); at 1505, 1520, 1521; SEC v Clark, 915 F.2d 439, 453 n.26 (9th Cir. 1990). 351 Langevoort (n 87); Wang and Steinberg (n 292) at 165. 342 343 63 Legislative and Enforcement Responses in the UK and US 2. Insider Dealing Section 16(b) Section 16(b) directly regulates insider trading352. Section 16(b) is a selfexecuting provision which provides more approaches to deal with insider trading, prevents insiders from manipulating security prices, saves regulatory costs and is expected to have greatly deterrent effects353. Empirically, section 16(b) deters price manipulation354, managers’ trading prior to takeover announcement355 and reduces profits gained from insider trading356. However, several studies found that this section actually does not prevent either short-swing or long-term insider trading357. It even prevents shareholders from participating in corporate management, leads to higher risks for active shareholders358 but provides insiders with much welfare by transferring wealth from outsiders to insiders359. This section was criticised due to its limited restrictions on insider trading 360. Rather than disclosure requirements, it focuses on the reporting of insiders’ Pub. L. 73 – 291, §16(b), 48 Stat. 881 codified at 15 U.S.C. §78p. There are three methods in which section 16(b) prohibits abusive conducts. Some specific insiders are required to report their shareholdings and transactions on the corporate’s securities; they are prohibited from short-selling activities relating to the corporate’s securities and must be liable for any profit gained from short-swing transactions happening within less than six months. 353 Carlton and Fischel (n 51); ‘An Economic Analysis of Section 16(b) of the Securities Exchange Act of 1934’ (1976) 18 William and Mary Law Review 389 – 428. 354 Michael Fishman and Kathleen Hagerty, ‘The mandatory disclosure of trades and market liquidity’ (1995) 8 (3) Review of Financial Studies 637 – 676; Kose John and Ranga Narayanan, ‘Market manipulation and the role of insider trading regulations’ (1997) 70 (2) Journal of Business 217 – 247. 355 Anup Agrawal and Jeffrey Jaffe, ‘Does Section 16b Deter Insider Trading By Target Managers?’ (1995) 39 Journal of Financial Economics 295 - 319. 356 Stephen L. Lenkey, ‘Insider Trading and the Short-swing Profit Rule’ (2017) 169 Journal of Economic Theory 517-545. 357 Carlton and Fischel (n 51); William and Mary Law Review (n 353). 358 Charles Kahn and Andrew Winton, ‘Ownership structure, speculation, and shareholder intervention’ (1998) 53(1) Journal of Finance 99–129. 359 Lenkey (n 356). 360 Ventoruzzo (n 287); Highberger (n 289); Bainbridge (n 290); Wang and Steinberg (n 292) at 923; Agrawal and Jaffe (n 355) at 297; Nasser Arshadi and Thomas H. Eyssell, The Law and Finance of Corporate Insider Trading: Theory and Evidence (Springer 1993) at 44, 51. 352 64 Legislative and Enforcement Responses in the UK and US Insider Dealing transactions. The scope of this section is also limited, because it only imposes restrictions on certain individuals and issuers that meet registration or shareholding requirements and only applies on transactions made within a short period361. Liability under section 16 depends on insiders’ profit realisation instead of actual losses of trading partners. Additionally, section 16 does not require proof of fraud; and rather than authorise SEC to force disgorgement, it lets shareholders or managers take legal actions, which rarely occurs as they have no incentive to do so. 3. Section 32 Section 32 provides penalties imposed on violations of the SEA 362. Compared to UK maximum imprisonment term, the US maximum period is shorter. Similar to the CJA, section 32 of the SEA focuses on criminal sanctions that have been criticised because of inefficiency363. Pecuniary penalties which are based on the amount of profit gained or loss avoided364 have no deterrent effect, because wrongdoers consider fines as a loss of their money and profit earned might outweigh fines and/or litigation costs365. Deterrent impact of $10,000 maximum fine actually decreases due to existence of inflation. Additionally, prosecution of criminal cases is difficult because of high burden of proof and the fact that evidence is circumstantial366. Overall, criticisms on criminal penalties under both UK and US systems are similar. This section only targets corporate’s executives instead of any individuals having access to private information and it does not include transactions that only sales or purchases occur. 362 Pub. L. 73 – 291, §32, 48 Stat. 881 codified at 15 U.S.C. §78ff. The maximum criminal sanctions on individuals are $10,000 fine or 2-year imprisonment or both. In addition, if the offender is an exchange, monetary penalty is up to $500,000. No imprisonment is imposed on violations if the offender proves that he was not aware of regulations or rules. 363 O’Leary and O’Leary (n 289). 364 Elkind v Liggett & Myers, Inc. (n 349) at 156, 172; Wilson v Comtech Telecommunications Corp., 648 F.2d 88, 94-95 (2d Cir. 1981). 365 O’Leary and O’Leary (n 289). 366 Ibid., Arshadi and Eyssell (n 360) at 49, 50. 361 65 Legislative and Enforcement Responses in the UK and US 4. Insider Dealing Concluding remarks While statutes with regulatory requirements play a significant role in the UK approach, the US system depends on insider-trading related judicial precedent. There are no clear definitions of insider-trading offences, inside information and no clear categories of offenders under US regulations. Critics have suggested that a statute clarifying civil or criminal liabilities of insider trading should be enacted in the US 367. Nevertheless, SEC stated that existing law effectively prohibited insider-trading violations and rejected the need of statutory definitions because definitions might involve uncertainties368. Case-by-case approach provides much flexibility and still supports SEC to target insider trading369. Firstly, US regulations to tackle insider trading are based on fraudulent principles, so fiduciary duties are greatly examined. US case laws prohibit three offences that are similar to those forbidden under UK statutes. Both individuals and organisations are targeted under the SEA, which is broader than the CJA’s scope. The US ‘dissemination and absorption’ rule seems to be more rigid than UK statutory ‘inside information’ definition. However, US requirements on fiduciary duties adversely create chances for wrongdoers to escape prosecution. In terms of the coverage, UK approach is clearer and more focused than US one. Secondly, due to importance of case laws and lack of regulatory requirements in US system, uncertainty occurs and Colvin (n 287); Milton V. Freeman, ‘The Insider Trading Sanctions Bill – A Neglected Opportunity’ (1984) 4 (2) Pace Law Review 221 – 229; Donald C. Langevoort, ‘Setting the Agenda for Legislative Reform: Some Fallacies, Anomalies, and Other Curiosities in the Prevailing Law of Insider Trading’ (1988) 39 Alabama Law Review 399; Richard M. Phillips and Robert J. Zutz, ‘The Insider Trading Doctrine: A Need for Legislative Repair’ (1984) 13 (1) Hofstra Law Review 65 – 100; Lacey S. Calhoun, ‘Moving toward a Clearer Definition of Insider Trading: Why Adoption of the Possession Standard Protects Investors’ (1999) 32 University of Michigan Journal of Law Reform 1119 – 1145. 368 Kraakman (n 288) at 44; Aldave (n 289). 369 Goelzer and Berueffy (n 287). 367 66 Legislative and Enforcement Responses in the UK and US Insider Dealing court decisions might be affected by judges’ subjective viewpoints. The concepts of ‘inside information’ and ‘fiduciary duty’ are unclear and vague. There is no clear guidance to determine which practices are fraudulent and who are accused of misconducts under section 10(b)/rule 10b-5370. Even in the UK approach where there are separate provisions to tackle insider dealing, ambiguousness and uncertainty still exist. Thus, concerning clarity and certainty, both systems are ineffective. Similarly, with regards to the ease for detection, investigation and prosecution, the CJA and the SEA are ineffective as they focus on criminal approach, which requires high standard of proof and places burden on prosecutors to find evidences. Especially, US approach requests demonstration of fiduciary duties, which is more difficult. Finally, the SEA is similar to the CJA in terms of criticisms of criminal sanctions. There is a need for civil remedies and much focus on improving information disclosure. Despite requirement on transaction reports of certain insiders, US approach does not mention proper disclosure. C. The Insider Trading Sanctions Act of 1984 and the Insider Trading and Securities Fraud Enforcement Act of 1988 1. The Insider Trading Sanctions Act of 1984 Prior to the ITSA, criminal prosecution played the main role in prohibiting insider trading and the authority did not place a high value on civil approach 371. Civil fines were not included in SEC’s pre-ITSA sanctions, as SEC focused on injunction and 370 Scheppele (n 16); Schipani and Seyhun (n 287). Arshadi and Eyssell (n 360) at 49; Carole B. Silver, ‘Penalizing Insider Trading: A Critical Assessment of the Insider Trading Sanctions Act of 1984’ (1985) 1985 Duke Law Journal 960 – 1025 at 960, 961. 371 67 Legislative and Enforcement Responses in the UK and US Insider Dealing disgorgement372. These methods were ineffective373. Thus, the 1984 Act aims at raising level of sanctions imposed on insider trading, enhancing civil enforcement and improving administrative power of SEC374. Section 2(a) allows financial penalties whose amount is ‘three times profit gained or loss avoided by insider trading’375. Criminal fines can be up to $100,000 under section 3376, which is ten times maximum level stated in the SEA. The increase in amount of financial sanction is expected to have deterrent impacts, remove the SEA’s ineffectiveness and improve SEC’s enforcement power377. Furthermore, the ITSA authorises SEC to initiate administrative proceedings against reporting misconducts378, which extends SEC’s administrative power379. This Act is believed to help SEC effectively enforce disclosure requirements by targeting officers and directors, declining burden of proof, and providing much Clements (n 289) at 378; Jonathan A. Blumberg, ‘Implications of the 1984 Insider Trading Sanction Act: Collateral Estoppel and Double Jeopardy’ (1985) 64 North Carolina Law Review 117 – 157 at 121. 373 Silver (n 371) at 962; Blumberg (n 372); David M. Brodsky, ‘Insider Trading and the Insider Trading Sanctions Act of 1984: New Wine into New Bottles’ (1984) 41 Washington and Lee Law Review 921 – 941. 374 O’Leary and O’Leary (n 289); Clements (n 289); Wang and Steinberg (n 292) at 669; Arshadi and Eyssell (n 360) at 49; Silver (n 371) at 960, 962; Blumberg (n 372); Brodsky (n 373); Brian G. Howland, ‘The Insider Trading Sanctions Act of 1984: Does the ITSA Authorize the SEC to Issue Administrative Bars’ (1985) 42 Washington and Lee Law Review 993 – 1013 at 994, 1012; Michael J. Metzger, ‘Treble Damages, Deterrence, and their Relation to Substantive Law: Ramifications of the Insider Trading Sanctions Act of 1984’ (1986) 20 Valparaiso University Law Review 575 – 617 at 580, 581, 583; Stuart J. Kaswell, ‘An Insider’s View of the Insider Trading and Securities Fraud Enforcement Act of 1988’ (1989) 45 The Business Lawyer 145 – 180 at 153. 375 Pub. L. 98 – 376, §2(a), 98 Stat. 1264 codified at 15 U.S.C. §78aa. Section 2 directly targets misconduct of security purchase or sale based on material non-public information, explains ‘profit gained or loss avoided’ term and states that treble fines only apply to violations relating to transactions via dealer, broker or exchange. See Pub. L. 98 – 376, §2, 98 Stat. 1264 codified at 15 U.S.C. §78t. 376 Pub. L. 98 – 376, §3, 98 Stat. 1265 codified at 15 U.S.C. §78ff. 377 Schipani and Seyhun (n 287); O’Leary and O’Leary (n 289); Silver (n 371) at 963; Metzger (n 374) at 595, 596; Donna M. Nagy, ‘Beyond Dirks: Gratuitous Tipping and Insider Trading’ (2016) 42 The Journal of Corporation Law 1 – 57. 378 Pub. L. 98 – 376, §4, 98 Stat. 1265 codified at 15 U.S.C. §78o. In case that there is noncompliance with SEC’s reporting regulations, SEC can publish a notice and then order wrongdoers to make correction. 379 O’Leary and O’Leary (n 289); Nagy (n 377). 372 68 Legislative and Enforcement Responses in the UK and US Insider Dealing flexibility to make appropriate decisions such as administrative order or injunctive relief380. In fact, under the ITSA, 40 cases were prosecuted and over $130million of fines and disgorgement were imposed by SEC in 1987381. There are still deficiencies that limit SEC’s power. There is lack of a statutory definition of ‘inside trader’, a clear procedure to determine liability of secondary wrongdoers as well as guidelines to assess and impose treble penalties382. That raises problems of confusion, fairness and justifiable protection for defendants 383. A defendant might face with double punishment including both criminal and civil sanctions for the same offence, which violates the Constitution’s double jeopardy clause384. Moreover, the ITSA only targets secondary-market transactions and ignores face-to-face or primary-market trades385. The ITSA is quite similar to the FSMA which authorises FSA/FCA to impose civil sanctions or make public censures386. Nevertheless, the ITSA limits the maximum level of fines while the FSMA does not. The limit might be advantageous, as it prevents regulators imposing significantly large fines to create positive media effects and artificially deterrent impacts. However, the limit may be ineffective in case of violations involved in huge transactions whose values go beyond the fixed limit. O’Leary and O’Leary (n 289); Green (n 289); Silver (n 371) at 964, 965. Goelzer and Berueffy (n 287). 382 Goelzer and Berueffy (n 287); O’Leary and O’Leary (n 289); Clements (n 289) at 377; Green (n 289); Wang and Steinberg (n 292) at 670; Arshadi and Eyssell (n 360) at 50; Silver (n 371) at 963, 974, 979; Blumberg (n 372) at 118, 125; Brodsky (n 373) at 939; Silver (n 371) at 963, 974, 979; Kaswell (n 374) at 153; Donald C. Langevoort, ‘The Insider Trading Sanctions Act of 1984 and Its Effect on Existing Law’ (1984) 37 (6) Vanderbilt Law Review 1273 – 1298. 383 Clements (n 289) at 380; Silver (n 371) at 1025; Metzger (n 374) at 609. 384 Blumberg (n 372). 385 Arshadi and Eyssell (n 360) at 50. 386 Baumgartel (n 287). 380 381 69 Legislative and Enforcement Responses in the UK and US 2. Insider Dealing The Insider Trading and Securities Fraud Enforcement Act of 1988 The ITSFEA came into effect after US v Carpenter387 where misappropriation theory was applied and difficulties for criminal prosecution were removed 388. The 1988 Act provided amendments to strengthen regulatory enforcement, restore public confidence, maintain market integrity and fairness; though it was still criticised due to the lack of statutory definitions and the ease to raise defence against new provisions389. Firstly, section 3(a)(2) authorises SEC to impose civil penalties on insidertrading offenders and on persons who manage wrongdoers390. In fact, this section does not strictly target controlling persons, as the sole evidence of employment is inadequate to establish liability for controlling persons391. Controlling persons are held liable if SEC proves that they are aware of existence of violations but fail to appropriately take preventative measures392. Establishing liability for controlling persons’ failure to prevent misconducts demonstrates the wider coverage and stricter regulation of US approach than UK one. Additionally, section 3(b) provides amendments that brokers, dealers, investment advisers are supervised and requires written procedures for prevention of information abuse393. The extension of a civilpenalty scheme creates an economic pressure for controlling persons to carefully 387 US v Carpenter (n 299). Aldave (n 289); Kaswell (n 374). 389 Ibid.; Nagy (n 377). 390 Pub. L. 100 – 704, §3(a)(2), 102 Stat. 4677 codified at 15 U.S.C. §78u. Maximum penalty imposed on primary offenders is three times the profit gained or loss avoided, but the amount of fines on controlling persons might be up to ‘the greater of $1,000,000 or three times the amount of the profit gained or loss avoided’ made by controlled persons. 391 Aldave (n 289); Kaswell (n 374); Bruce A. Teeters, ‘Insider Trading and Securities Fraud Enforcement Act of 1988: Just How Much Are Employers Going to Pay’ (1990) 59 Cincinnati Law Review 587 – 614. 392 Pub. L. 100 – 704, §3(a)(2), 102 Stat. 4677 codified at 15 U.S.C. §78u. Controlling persons can be employers or anyone that can affect corporate policies or others’ activities. 393 Pub. L. 100 – 704, §3(b), 102 Stat. 4679 codified at 15 U.S.C. §78u. Persons failing to comply with the regulations may face with SEC’s action or civil sanctions. 388 70 Legislative and Enforcement Responses in the UK and US Insider Dealing supervise their staffs; encourages corporates to establish internal systems such as ‘Chinese Walls’ for early prevention of wrongdoings and/or training sessions to educate employees394. However, section 3 was theoretically criticised due to some anomalies. According to misappropriation theory, corporates or employers are owners of material non-public information and victims of informational abuse; so the question is whether they should be held liable for failure to take preventive measures 395. Importantly, maximum level of civil penalties on controlling persons is also questionable. The amount of $1,000,000 or three times profit gained or loss avoided has not been justified396. Whether amount of civil sanctions is fair is still questioned. Secondly, section 4 amends criminal sanctions397, which broadens the scope of organisational wrongdoers398 and increases maximum criminal punishment399. Compared to UK criminal penalties, level of US sanctions is higher. Increase in amount of monetary penalties may possibly remove inflation effect and create financial force that deters wrongdoing. However, effects of this section are symbolic rather than practical, as courts are unwilling to impose the maximum penalties400. Thirdly, under section 5, there is a new section where a private right of action also known as an express remedy is granted to investors contemporaneously 394 Caccese (n 87); Aldave (n 289); Arshadi and Eyssell (n 360) at 51; Teeters (n 391) at 589, 604, 605; Howard M. Friedman, ‘The Insider Trading and Securities Fraud Enforcement Act of 1988’ (1990) 68 North Carolina Law Review 465 – 494 at 478. 395 Aldave (n 289). 396 Ibid. 397 Pub. L. 100 – 704, §4, 102 Stat. 4680 codified at 15 U.S.C. §78ff 398 Teeters (n 391) at 607, 608. ‘An exchange’ term is replaced by ‘a person other than a natural person’. 399 Maximum level of criminal penalties imposed on individuals increases from $100,000 to $1,000,000 and from five years to ten years. Similarly, amount of criminal fines on organisations is up to $2,500,000 rather than $500,000. 400 Aldave (n 289). 71 Legislative and Enforcement Responses in the UK and US Insider Dealing transacting with insider-trading offenders401. This section is believed to indirectly strengthen the misappropriation theory402. However, it neither provides remedy for actual losses of insider-trading victims nor contributes to insider-trading law enforcement403. It is difficult to exactly identify victims harmed by insider trading and it is inconsistent if victims claim against their trading partners 404. In fact, this new section does not grant a cause of action to actual but unidentified victims. 3. Concluding remarks The ITSA and the ITSFEA provide significant amendments to the SEA and mainly concentrate on enforcement reforms. The ITSA focuses on enhancement of civil penalties and SEC’s administrative power, whereas the ITSFEA targets controlling persons, increases civil as well as criminal sanctions and introduces a private right of action for contemporaneous traders. Firstly, two Acts extend the SEA’s coverage by adding provisions to hold controlling persons liable. Criminal sanctions for organisations are now applied to any ‘person other than a natural person’ instead of only ‘an exchange’. Meanwhile, corporates’ criminal responsibility and controlling Pub. L. 100 – 704, §5, 102 Stat. 4680 codified at 15 U.S.C. §78t-1. Contemporaneous traders are entitled to sue investors who buy or sell securities on the basis of privilleged information. 402 Chmiel (n 79); Kraakman (n 288) at 45; Teeters (n 391) at 599; Friedman (n 394) at 481; Mark A. Clayton, ‘The Misappropriation Theory in Light of Carpenter and the Insider Trading and Securities Fraud Enforcement Act of 1988’ (1989) 17 Pepperdine Law Review 185 – 215 at 210. 403 Chmiel (n 79) at 662; Aldave (n 289); Kaswell (n 374). 404 Aldave (n 289); William K.S. Wang, ‘Trading on Material Nonpublic Information on Impersonal Stock Markets: Who is Harmed, and Who can Sue Whom Under SEC Rule 10b5? (1981) 54 Southern California Law Review 1217 – 1321. Two insider-trading perspectives are the trade and the infromation nondisclosure. Investors harmed by the trade are people whose security purchases or sales are less favourable than those in case that insider trading does not exist. Meanwhile, victims of the nondisclosure are investors whose investment decisions are less favourable than those possessing important and private information. However, people trading based on inside information might not violate disclosure requirements. 401 72 Legislative and Enforcement Responses in the UK and US Insider Dealing persons’ liability in the UK are likely to be excluded. Secondly, these Acts are mainly amendments so problems of ambiguousness are rarely found. However, inconsistency still exists since holding controlling persons liable seems to conflict with misappropriation theory. In terms of legal procedures, civil approach under two Acts removes difficulties of high standard of proof, which is similar to effectiveness of UK civil regimes under the FSMA. There are still deficiencies such as lack of definitions and guidance to determine secondary liability or actual victims and to enforce treble sanctions. Finally, these Acts are expected to increase public confidence and enhance protection for market participants by increasing level of fines imposed on wrongdoers and granting remedy for inside-trading victims. That is similar to expected effectiveness of the FSMA in the UK. However, effectiveness of higher level of penalties and remedial measures is questioned. Seyhun concluded that enactment of the ITSA and the ITSFEA did not decrease insider trading misconducts; volume and profitability of insider trading even rose after those two Acts were implemented405. Meanwhile, Eyssell and Reburn stated that the ITSA had deterrent effects on highprofile insiders’ selling behaviours406, and Garfinkel found that the ITSFEA might affect insiders’ trading strategies as there was a delay in trading407. Persons confirmed that both Acts substantially deterred insider-trading practices408. Seyhun, ‘The effectiveness of the insider-trading sanctions’ (1992) 35 Journal of Law and Economics 149–182. 406 Thomas H. Eyssell and James P. Reburn, ‘The Effects of the Insider Trading Sanctions Act of 1984: The Case of Seasoned Equity Offerings’ (1993) XVI (2) The Journal of Financial Research 161 – 170. 407 Garfinkel, ‘New evidence on the effects of federal regulations on insider trading: The Insider Trading and Securities Fraud Enforcement Act (ITSFEA)’ (1997) 3 Journal of Corporate Finance 89 – 111. 408 Obeua S. Persons, ‘SEC’s Insider Trading Enforcements and Target Firms’ Stock Values’ (1997) 39 Journal of Business Research 187 – 194. 405 73 Legislative and Enforcement Responses in the UK and US D. Insider Dealing The US insider-trading theories There are three theories in the American insider-trading doctrine. Firstly, the equal access theory places a duty owed to the market that all investors need to disclose information or avoid trading based on private information409. The ‘disclose-or-abstain’ rule began and was followed by courts410 such as in Texas Gulf Sulphur411. This theory is simple and helps identify insider-trading victims that are uninformed investors412. However, its weakness was illustrated in Chiarella413 where printer owed no duty of information disclosure to his trading partners 414. Additionally, the equal access theory was misinterpreted based on contractarian ethics, because it is difficult to determine why and how trading on the basis of privileged information is a fraud415. The second theory is the fiduciary duty one where disclosure duty resulting from ‘relationship of trust and confidence’416 is placed on insiders417. By taking advantage 409 Seredynska (n 2) at 41, 44; Ventoruzzo (n 287); Kraakman (n 288) at 40; Bainbridge (n 290) at 3; Arshadi and Eyssell (n 360) at 45; David Sims, ‘United States v. Carpenter: An Inadequate Solution to the Problem of Insider Trading’ (1988) 34 The Wayne Law Review 1461 – 1484. According to this theory, it is unfair to exploit material non-public information that is unavailable to other investors. Two elements of Rule 10b-5 are relationship granting privileged access to confidential information and unfairness to other market participants due to advantages of such information. See In re Cady, Roberts & Co. (n 331). 410 Bainbridge (n 279) at 12; Ventoruzzo (n 287); Colvin (n 287); Green (n 289). 411 SEC v Texas Gulf Sulphur Co. (n 297) at 833. 412 Kraakman (n 288) at 41. 413 US v Chiarella (n 325). 414 Seredynska (n 2) at 42; Colvin (n 287); Kraakman (n 288) at 41; Green (n 289); Anthony Michael Sabino; Michael A. Sabino, ‘From Chiarella to Cuban: The Contributing Evolution of the Law of Insider Trading’ (2011) 16 Fordham Journal of Corporate and Financial Law 673 – 741. 415 Scheppele (n 16). Informational advantages are neither unfair nor associated with deception if information is gathered from self-research and thorough analysis independently conducted by market participants. See Davis (n 87); J. Kelly Strader, ‘(Re)Conceptualizing Insider Trading: United States v. Newman and the Intent to Defraud’ (2015) 80 Brooklyn Law Review 1419 – 1485 at 1419, 1424. 416 US v Chiarella (n 325) at 230. 417 Anabtawi (n 80); Ventoruzzo (n 287); Baumgartel (n 287); Colvin (n 287); Kraakman (n 288) at 42; Bainbridge (n 290); Arshadi and Eyssell (n 360) at 46; Calhoun (n 367); Sims (n 409); Sabino and Sabino (n 414); Alexander F. Loke, ‘From the Fiduciary Theory to Information Abuse: The Changing Fabric of Insider Trading Law in the UK, Australia and 74 Legislative and Enforcement Responses in the UK and US Insider Dealing of confidential information, insiders breach their duty of loyalty and fairness owed to corporate shareholders418. This theory complies with common-law principles relating to fraud, maintains pre-1980 case law and provides courts with much flexibility to prohibit insider trading on case-by-case basis419. Nevertheless, fiduciary duty theory has not solved Chiarella problems that there must be a true fiduciary relationship and a true violation of fiduciary duties to establish liability under section 10(b)420. Furthermore, fiduciary duty theory seems to limit scope of insider-trading laws as prohibitions seemingly apply to only offenders working in the company421. Structural changes that involve much complexity and anonymity, eliminate fiduciary relationship between owners of private information and investors affected by informational abuse are not reflected in the legal doctrine422. Next, the third theory known as misappropriation theory targets market insiders rather than only corporate insiders, as it states that transactions made on the basis of material non-public information obtained by breach of confidentiality duty or theft are unlawful423. This theory emphasises on breach of duty owed to information source, broadens the coverage of insider-trading regulations424 and can be regarded as a Singapore’ (2006) 54 The American Journal of Comparative Law 123 – 172; Martin Kimel, ‘The Inadequacy of Rule 10b-5 to Address Outsider Trading by Reporters’ (1986) 38 Stanford Law Review 1549 – 1576; Douglas W. Hawes, ‘A Development In Insider Trading Law In The United States: A Case Note On Chiarella v. United States’ (1981) 3 Journal of Comparative Corporate Law and Securities Regulation 193-197. 418 Davis (n 87); Loke (n 417); Jill E. Fisch, ‘Start Making Sense: An Analysis and Proposal for Insider Trading Regulation’ (1991) 26 Georgia Law Review 179 – 251 at 193. 419 Kraakman (n 288) at 43. 420 Sabino and Sabino (n 414). 421 Seredynska (n 2) at 42; Davis (n 87); Colvin (n 287); Kimel (n 417). 422 Scheppele (n 16). 423 SEC v. Rocklage, 470 F.3d 1, 5 (1st Cir. 2006). See Scheppele (n 16); Caccese (n 87); Langevoort (n 87); Davis (n 87); Goelzer and Berueffy (n 287); Baumgartel (n 287); Colvin (n 287); Kraakman (n 288) at 44; Bainbridge (n 290); Engle (n 322); Arshadi and Eyssell (n 360) at 48; Calhoun (n 367); Clayton (n 402); Sims (n 409); Sabino and Sabino (n 414); Loke (n 417); Hawes (n 417); Carlos Conceicao, Polly Snyder and Chris Stott, ‘US insider trading v EU insider dealing: A difference more than in name’ (2015) XXXA Butterworths Journal of International Banking and Finance Law 1 – 3. 424 Scheppele (n 16); Bainbridge (n 279); Baumgartel (n 287); Nagy (n 377); Kimel (n 417); 75 Legislative and Enforcement Responses in the UK and US Insider Dealing regime to protect property rights425. In Chiarella case, irrespective of existence of any relationship to other investors, printer was accused of insider trading as he defrauded his company. In US v O’Hagan426, O’Hagan did not have disclosure duty but still breached ‘a duty of loyalty and confidentiality’ and defrauded principal of exclusive information. However, limitations still exist. Misappropriation theory ignores that information property right might distort establishment of liability427. According to this theory, employer is entitled to own private information but in fact, public shareholders can be assigned that ownership. Moreover, under this theory, tippees are rarely held liable because they do not have a duty owed to information source428. In short, US and UK insider-trading laws both seriously consider insider dealing as a serious crime. Two systems cover similar offences and a broad range of offenders. Unclear guidance and various difficulties in legal proceedings exist in both systems. Thus, it is impossible to jump to a final conclusion on which system is better. Importantly, there are some notable disparities between two legal approaches. Firstly, US approach places a high value on protection for individuals and organisations that possess material non-public information, so it focuses on fiduciary relationship and duties owed to information owners429. Meanwhile, in the EU, especially in the UK, the John P. Anderson, ‘Poetic expansions of insider trading liability’ (2017) Legal Studies Research Paper No. 2017-09, Mississippi College School of Law 1 – 19; Michael D. Guttentag, st ‘Selective Disclosure and Insider Trading: Tipper Wrongdoing in the 21 Century’ (2016) 69 Florida Law Review. 425 Langevoort (n 87); Stephen M. Bainbridge, ‘Insider Trading Regulation: The Path Dependent Choice Between Property Rights and Securities Fraud’ (1999) 52 SMU Law Review 1589 – 1651. 426 US v O’Hagan, 521 US 642 (1997). 427 Scheppele (n 16); Cox and Fogarty (n 17); Kraakman (n 288) at 46; Engle (n 322); Clayton (n 402). 428 Davis (n 87). 429 Seredynska (n 2) at 49; Cox and Fogarty (n 17); Ventoruzzo (n 287); Conceicao et al. (n 423). 76 Legislative and Enforcement Responses in the UK and US Insider Dealing priority is to create a fair, moral and honest market where no participants can take advantages of privileged information430. Secondly, case laws play a significant role in the US approach while in the UK, role of statutory regulations is much higher than that of lawsuits. The UK seems to possess more rigid statutory framework with more clearly defined prohibitions than the US431. Thirdly, US regulations limit to securities and their derivatives whereas the UK law targets a wider range including all financial instruments and their derivatives432. Finally, US approach allows SEC to impose administrative sanctions or civil penalties and the final option is to initiate criminal proceedings433. Meanwhile, UK approach prefers criminal proceedings. One reason for this discrepancy is that US society has considered civil law as a great importance and a preferred alternative to criminal law, whereas UK society has held the strong belief in the advantage of criminal approaches434. Another possible explanation is of peculiar differences in legal systems including constitutional position, extent of importance of authorities such as SEC or FSA/FCA435. II. Enforcement responses A. Enforcement authorities In the US, enforcement bodies to tackle insider trading are SEC, DoJ and selfregulatory organisations436. For the purpose of this thesis, SEC and DoJ are analysed. 430 Ibid. Cheung (n 2); Engle (n 322); Conceicao et al. (n 423). 432 Conceicao et al. (n 423). 433 Seredynska (n 2) at 50; Langevoort (n 382). 434 Rider (n 172) at 8, 9. 435 Ibid. 436 The self-regulatory organisations include the Financial Industry Regulatory Authority and stock exchanges which must require their members to comply with securities law and are able to impose monetary sanctions on wrongdoers. See David P. Doherty, Arthur S. Okun, Steven F. Korostoff and James A. Nofi, ‘The Enforcement Role of The New York Stock Exchange’ (1991) 85 (3) Northwestern University Law Review 637; Lee A. Pickard & Anthony W. Djinis, ‘NASD Disciplinary Proceedings: Practice and Procedure’ (1982) 37 (3) The Business Lawyer 431 77 Legislative and Enforcement Responses in the UK and US 1. Insider Dealing The Securities and Exchange Commission Similar to the FSA/FCA, the SEC is entitled to conduct investigations and prosecutions against financial crimes. However, while the FSA/FCA can use both criminal and civil tools, SEC only has the power to initiate civil proceedings 437. If criminal prosecutions are required, SEC will refer to and co-operate with DoJ; but SEC’s referral to DoJ rarely occurs438. SEC takes advantage of Big Data to detect insider trading, support enforcement actions and strengthen market surveillance, which is similar to FCA’s use of technology to tackle market abuse439. Thus, SEC is believed to have better performance than DoJ and it puts a high value on monetary sanctions440. 1213 – 1246; John E. Pinto, ‘The NASD’s Enforcement Agenda’ (1991) 85 Northwestern University Law Review 739. 437 Wang and Steinberg (n 292) at 639, 640; Lev Bromberg, George Gilligan, Ian Ramsay, ‘Insider Trading and Market Manipulation: The SEC’s Enforcement Outcomes’ (2017) 45 Securities Regulation Law Journal 109 – 125. Civil proceedings include injunction, imposition of fines, disgorgement, suspension, cease order and licence revocation. 438 Ryder (n 226); Huynh, ‘Preemption v. punishment: a comparative study of white collar crime prosecution in the United States and the United Kingdom’ (2010) 9 Journal of International Business and Law 105–135. 439 Nate Raymond, ‘Newest weapon in US hunt for insider traders paying off’ (Reuters, 2016) <https://www.reuters.com/article/us-usa-insidertrading-insight/newest-weapon-in-u-s-huntfor-insider-traders-paying-off-idUSKBN12W2X4> accessed May 2018; Todd Ehret, ‘SEC’s advanced data analytics helps detect even the smallest illicit market activity’ (Reuters, 2017) <https://www.reuters.com/article/bc-finreg-data-analytics-idUSKBN19L28C> accessed May 2018. 440 Nicholas Ryder, ‘“Greed, for lack of a better word, is good. Greed is right. Greed works”: A contemporary and comparative review of the relationship between the global financial crisis, financial crime and white collar criminals in the U.S. and the U.K.’ (2016) 1(1) British Journal of White Collar Crime 3-47. 78 Legislative and Enforcement Responses in the UK and US Insider Dealing Figure 4: Disgorgement, financial sanctions and enforcement actions441 SEC’s actions effectively reduced stock price of target firms because legal expenses resulting from SEC actions are expected to be high; future earnings, cashflows and reputation might be negatively affected442. In the post-crisis period, amount of fines and number of enforcement responses conducted by SEC substantially increased (Figure 4). This post-crisis increase can also be seen in the UK responses. In 2011 and 2012, SEC took 750 enforcement actions per year, which is the highest level from 1990 to 2012. Especially, insider trading is one of SEC’s enforcement priorities to ensure integrity and fairness of capital markets443. SEC has targeted a huge number of individual and institutional suspects engaged in insider trading 444. Sonia A. Steinway, ‘SEC Monetary Penalties Speak Very Loudly, but What Do They Say A Critical Analysis of the SEC's New Enforcement Approach’ (2014) 124 The Yale Law Journal 209. 442 Persons (n 408). 443 Persons (n 408); Securities and Exchange Commission, ‘SEC Enforcement Actions – Insider Trading Cases’ (Securities and Exchange Commission, n/d) <https://www.sec.gov/spotlight/insidertrading/cases.shtml> accessed May 2018. 444 Securities and Exchange Commission (n 442). Defendants include professionals, fund managers, corporate attorney, employees, managers or investment funds and banks. For example, CR Intrinsic Hedge Fund and two others were held liable for $276m insider-trading scheme in 2012 and they agreed to pay a fine of $600m in 2013. See Securities and Exchange Commission, ‘SEC Charges Hedge Fund Firm CR Intrinsic and Two Others in $276 Million Insider Trading Scheme Involving Alzheimer’s Drug’ (Securities and Exchange Commission, 2012) <https://www.sec.gov/news/press-release/2012-2012-237htm> accessed May 2018; Securities and Exchange Commission, ‘CR Intrinsic Agrees to Pay More than $600 Million in 441 79 Legislative and Enforcement Responses in the UK and US Insider Dealing Although SEC explicitly stated that insider trading is its enforcement priority, the number of enforcement actions and wrongdoers that were found guilty decreased from 2010 to 2017 (Figure 5). There is a possibility that SEC’s enforcement has deterred insider trading, which leads to a decline in two indicators. However, the decline might also be an evidence of SEC’s ineffectiveness in case that SEC fails to take actions against insider-trading wrongdoers and defendants successfully escape from being found guilty. 70 160 60 140 50 120 100 40 80 30 60 20 40 10 20 0 Number of people charged Figure 5: Enforcement actions against insider trading445 Administrative proceedings Civil actions Number of defendants and respondents 0 2010 2011 2012 2013 2014 2015 2016 2017 Largest-Ever Settlement for Insider Trading Case’, (Securities and Exchange Commission, 2013) <http://www.sec.gov/news/press/2013/2013-41.htm> accessed March 2018. 445 Data source: Securities and Exchange Commission, ‘Select SEC and Market Data – Fiscal 2010’ (Securities and Exchange Commission 2011) <https://www.sec.gov/files/secstats2010.pdf> accessed May 2018; Securities and Exchange Commission, ‘Select SEC and Market Data – Fiscal 2011’ (Securities and Exchange Commission 2012) <https://www.sec.gov/files/secstats2011.pdf> accessed May 2018; Securities and Exchange Commission, ‘Select SEC and Market Data – Fiscal 2012’ (Securities and Exchange Commission 2013) <https://www.sec.gov/files/secstats2012.pdf> accessed May 2018; Securities and Exchange Commission, ‘Select SEC and Market Data – Fiscal 2013’ (Securities and Exchange Commission 2014) <https://www.sec.gov/files/secstats2013.pdf> accessed May 2018; Securities and Exchange Commission, ‘Select SEC and Market Data – Fiscal 2014’ (Securities and Exchange Commission 2015) <https://www.sec.gov/files/secstats2014.pdf> accessed May 2018; Securities and Exchange Commission, ‘Select SEC and Market Data – Fiscal 2015’ (Securities and Exchange Commission 2016) <https://www.sec.gov/files/secstats2015.pdf> accessed May 2018; Securities and Exchange Commission, ‘Select SEC and Market Data – Fiscal 2016’ (Securities and Exchange Commission 2017) <https://www.sec.gov/files/201703/secstats2016.pdf> accessed May 2018; Securities and Exchange Commission, ‘Select SEC and Market Data – Fiscal 2017 (Enforcement Information only)’ (Securities and Exchange Commission 2018) <https://www.sec.gov/files/enforcement-annual-report-2017addendum.pdf> accessed May 2018. 80 Legislative and Enforcement Responses in the UK and US Insider Dealing SEC was criticised due to following issues. Firstly, SEC improperly focused on large, wealthy and well-known defendants, so it might not target wrongdoers whose misconducts are the worst ones and are significantly harmful446. SEC tends to target huge ‘deep-pockets’ organisations that large fines cannot result in bankruptcy or insolvency447. SEC is influenced by the publicity-seeking theory, so it has pursued media-friendly cases and enforcement quality has declined448. Regarding this publicity-seeking feature, SEC is similar to FSA/FCA. Besides, SEC seemingly provides protection for predators with political and economic powers, rather than maintenance of market integrity and public confidence449. Secondly, SEC’s enforcement responses are not closely supervised, and SEC enjoys its powers instead of being put under public pressure450. SEC can choose either administrative or civil sanctions, but administrative tools are more preferred451. Moreover, organisations take advantages of settlements to avoid being engaged in administrative or judicial procedures, so ‘sue-and-settle’ lawsuits that allow institutional suspects to settle rather than plead guilty of their misconducts were strongly criticised452. 446 Steinway (n 444). James D. Cox, Randall Thomas, Dana Kiku, ‘Public and Private Enforcement of the Securities Laws: Have Things Changed Since Enron?’ (2005) 80 (3) Notre Dame Law Review 893. 448 Stephen Choi, Anat Wiechman, Pritchard, ‘Scandal Enforcement at the SEC: The Arc of the Option Backdating Investigation’ (2013) 15(2) American Law and Economics Review 542577. 449 Ryder (n 226) at 138; Edward Wyatt, ‘S.E.C. Is Avoiding Tough Sanctions for Large Banks’ (The New York Times, 2012) < https://www.nytimes.com/2012/02/03/business/sec-isavoiding-tough-sanctions-for-large-banks.html> assessed in March 2018; Nichols, ‘Addressing inept SEC enforcement efforts: lessons from Madoff, the hedge fund industry, and title IV of the Dodd–Frank Act for the US and global financial systems’ (2011) 31 Northwestern Journal of International Law and Business 637–698. SEC was reluctant to bring enforcement responses against powerful wrongdoers and usually granted exemptions for systematically important corporations. 450 Steinway (n 444). 451 Ibid. 452 Ibid.; Edward Greene and Caroline Odorski, ‘SEC Enforcement in the Financial Sector: Addressing Post-Crisis Criticism’ (2015) 16(1) Business Law International 5-19. 447 81 Legislative and Enforcement Responses in the UK and US 2. Insider Dealing The Department of Justice The DoJ contributes to enforcement responses to financial crimes453. While SEC can only bring civil actions against wrongdoers, DoJ conducts investigations, prosecutions, convictions and actively pursues criminal lawsuits of serious white-collar crimes454 such as mortgage frauds or LIBOR manipulation. However, DoJ failed to initiate criminal proceedings against high-profile individuals and corporates455. DoJ’s enforcement actions had small effects on large organisations456. With regards to insider trading, DoJ’s criminal enforcement is less preferred than SEC’s civil tools457, because civil approach plays an important role in the US society while criminal approach is the final choice458. In fact, DoJ has contributed to several cases such as US v Newman459, US v Cheng Yi Liang460, US v Donald Johnson461, US v Joseph P. Nacchio462, Qualcomm case463. Newman case is an important one, because Newman judgment resulted in the fact that criminal convictions in numerous post-Newman cases were vacated and 453 Ryder (n 440). Ryder (n 226) at 146. DoJ ‘has a long history of prosecuting financial fraud’ and is believed to continue its objectives of deterring potential malpractices and convicting wrongdoers. See McDonnell, ‘Don’t panic! Defending cowardly interventions during and after the financial crisis’ (2011) 116 Penn State Law Review 1–75; Charles Murdock, ‘The Dodd-Frank Wall Street Reform and Consumer Protection Act: What Caused the Financial Crisis and Will Dodd-Frank Prevent Future Crises’ (2011) 64 SMU Law Review 1243. 455 Ryder (n 440). 456 Aldrick, ‘JPMorgan agrees $13bn settlement with US Justice Department’ (The Telegraph, 2013) <http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/10391383/JPMorganagrees-13bn- settlement-with-US-Justice-Department.html> accessed March 2018. 457 Langevoort (n 382). 458 Seredynska (n 2) at 50. 459 US v Newman (n 341). 460 US v Cheng Yi Liang, No. 8:11-cr-00530-DKC-1. 461 US v Donald Johnson, No. 1:11-cr-00254-AJT-1. 462 US v Joseph P. Nacchio, No. 1:05-cr-00545-MSK-1. 463 The US Department of Justice, ‘Insider Trading Fraud’ (The US Department of Justice, n/d) <https://www.justice.gov/criminal-fraud/insider-trading-fraud> accessed May 2018. 454 82 Legislative and Enforcement Responses in the UK and US Insider Dealing SEC faced with challenges to initiate civil proceedings464. Annulments raised the concern that Newman decision might limit legal proceedings against insider trading465. However, the courts denied at least 15 dismissals of indictments, plea withdrawals or annulments, so Newman decision does not completely affect DoJ’s convictions 466. Similarly, in the post-Newman period, SEC has continued to conduct civil proceedings against insider trading. There were actions against 78 offenders in 2016 and against 87 offenders in 2015467. B. Criminal proceedings versus civil proceedings 1. Criminal proceedings In the US, the Sentencing Guidelines Manual468 considers profit gained or loss avoided by defendants rather than actual loss of victims, as it is difficult to identify victims and their losses469. While US sentencing model is a gain-based approach to Christopher LaVigne and Brian Calandra, ‘Insider Trading Laws and Enforcement’ (2016) Practical Compliance & Risk Management For The Securities Industry 17 – 24. For example, DoJ dismissed indictments against a group of traders engaged in IBM Corporation’s takeover of SPSS Inc, and DoJ continued to annul seven convictions including the case of Steinberg who was accused of insider trading relating to Dell and NVIDIA stocks. See also US v Durant, et al., No. 12-cr-00887 (ALC) at 10 – 11 (S.D.N.Y, 2014); US v Conradt et al., No. 12-cr-00887 (ALC) (S.D.N.Y, 2015). 465 Matthew Goldstein and Ben Protess, ‘Court Rejects Bharara’s Plea to Reconsider Insider Trading Ruling’ (The New York Times, 2015) <https://www.nytimes.com/2015/04/04/business/dealbook/appeals-court-rejects-request-torehear-landmark-insider-trading-case.html > accessed May 2018. 466 LaVigne and Calandra (n 464). 467 Ibid.; Securities and Exchange Commission (n 445). 468 Insider trading is considered as a sophisticated fraud; and this practice conducted by individuals is assigned a base offence level of eight which leads to up to six-month imprisonment and a fine ranging from $1,000 to $10,000. The base offence level may vary on the basis of criminal history; whether defendants are employees, directors of the corporate, investment advisors, brokers; number of victims and the amount of money relating to misconducts. See Wang and Steinberg (n 292) at 632; The United States Sentencing Commission, ‘United States Sentencing Guidelines Manual § 1A1.1 Commentary, Chapter One, Part A(2)’ (The United States Sentencing Commission, 2009) <https://www.ussc.gov/guidelines/archive/2009-federal-sentencing-guidelines-manual> accessed May 2018. 469 The United States Sentencing Commission (n 468). 464 83 Legislative and Enforcement Responses in the UK and US Insider Dealing determine level of penalties, the UK considers a wider set of factors; so an AngloAmerican comparison shows that the UK model is better than the US470. Furthermore, criminal sanctions have four goals: general deterrence, specific deterrence, retribution and education471. Criminal punishment is believed to be a viable method to tackle corporate misconducts, because criminal sanctions will result in social advantage and use of criminal sanctions necessarily supports other punishments472. However, UK and US laws rarely hold corporates criminally liable for insider trading. Both SEC and DoJ failed to prosecute entities. Corporates are entitled to settlements including plea agreements, DPAs, NPAs473; but the use of these settlements is controversial. Criminal sanctions on corporates led to a serious downfall of Arthur Andersen, which was believed to be avoided by NPA 474. DPAs and NPAs might force corporates to stop wrongdoings, make corrections and save corporates from unexpected insolvency; so these settlements recover public confidence and prevent death penalty for corporates475. But DPAs and NPAs might make prosecutors 470 Cheung (n 2). Stephen A. Yoder, ‘Criminal Sanctions for Corporate Illegality’ (1978) 69 (1) Journal of Criminal Law and Criminology 40 – 58. General deterrence is to create legal threats that deter not-yet-committed wrongdoings and specific deterrence is to prevent criminals from engaging in further crimes; whereas retribution is a type of punishment that the society imposes on wrongdoers to vindicate its anger and education goal can only be achieved when legal proceedings are publicised in the mass media. 472 Yoder (n 471). 473 Cindy R. Alexander and Mark A. Cohen, ‘The evolution of corporate criminal settlements: An empirical perspective on non-prosecution, deferred prosecution, and plea agreements’ (2015) 52 American Criminal Law Review 537 – 593. 474 Elizabeth K. Ainslie, ‘Indicting Corporations Revisited: Lessons of the Arthur Andersen Prosecution’ (2006) 43 American Criminal Law Review at 107, 109; Ellis W. Martin, ‘Deferred Prosecution Agreements: “Too Big Too Jail” and the Potential of Judicial Oversight Combined with Congressional Legislation’ (2014) 18 North Carolina Banking Institute 161 – 182. 475 Martin (n 474); Peter J. Henning, ‘The Organizational Guidelines: R.I.P.?’ (2007) 116 The Yale Law Journal Pocket Part 312; Elizabeth R. Sheyn, ‘Anything but a 'Racket': Why Professor Epstein's Attack on the Nature and Function of Deferred and Non-Prosecution Agreements Misses the Mark’ (2007) SSRN Electronic Journal; The US Department of Justice, ‘Assistant Attorney General Lanny A. Breuer Speaks at the New York City Bar Association’ (The US Department of Justice, 2012) < https://www.justice.gov/opa/speech/assistant-attorney-general-lanny-breuer-speaks-newyork-city-bar-association> accessed May 2018. 471 84 Legislative and Enforcement Responses in the UK and US Insider Dealing become judges, which blurs the separation of powers476; and these settlements request entities to permanently co-operate with regulators477. Besides, effectiveness of DPAs and NPAs are questioned478. These agreements might undermine authorities’ efforts of law enforcement479 and might not have same deterrent effects as traditional agreements or criminal prosecutions480. DPAs are regarded as being similar to fines, so they have few deterrent effects481. 2. Civil proceedings While UK ‘credible deterrence’ approach boosts criminal proceedings against insider dealing, US system prefers civil enforcement responses. SEC has powers to impose injunctions, disgorgements, monetary penalties, officer or director bars and administrative remedies on insider-trading wrongdoers482. The civil enforcement power granted to SEC is similar to the FSA/FCA’s power. An injunction is to deter future misconducts instead of punishing wrongdoers, but it can result in serious consequences such as suspension, revocation of registration, disqualification or prohibition483. To determine whether injunction should be issued, ‘a reasonable likelihood of future violations’484 will be examined485. Richard A. Epstein, ‘The Deferred Prosecution Racket’ (The Wall Street Journal, 2006) < https://www.wsj.com/articles/SB116468395737834160> accessed May 2018. 477 Brandon L. Garrett, ‘Structural Reform Prosecution’ (2007) 93 Virginia Law Review 853. 478 Alexander and Cohen (n 473); Martin (n 474). 479 David M. Uhlmann, ‘Deferred Prosecution and Non-Prosecution Agreements and the Erosion of Corporate Criminal Liability’ (2013) 72 Maryland Law Review 1295 – 1344. 480 Alexander and Cohen (n 473); Kyle Noonan, ‘The Case for a Federal Corporate Charter Revocation Penalty’ (2012) 80 The George Washington Law Review 602 – 631; Mary Kreiner Ramirez, ‘The Science Fiction of Corporate Criminal Liability: Containing the Machine Through the Corporate Death Penalty’ (2005) 47 Arizona Law Review 933 – 1002. 481 Martin (n 474). 482 Wang and Steinberg (n 292) at 647. 483 Ibid. 484 SEC v Advance Growth Capital Corp., 470 F.2d 40, 53 (7th Cir. 1972). 485 SEC v Aaron, 446 U.S. 680, 700–701 (1980); SEC v Cavanagh, 155 F.3d 129, 135 (2d Cir. 1998). Other factors include extent of involvement, nature of infraction, defendants’ awareness 476 85 Legislative and Enforcement Responses in the UK and US Insider Dealing However, due to severe consequences of injunctive relief, SEC is required to demonstrate actual probability of recurrence rather than mere facts of past wrongdoings486. There are several cases487 where SEC’s request for injunction was denied because of insufficient proof. With regards to monetary sanctions, although the ITSA and ITSFEA have improved SEC’s power, they do not provide guidance to determine level of fines488. Courts considered several factors such as severity, extent of scienter involvement, isolation of violation489; wrongdoers’ financial worth and signal of concealment; potential sanctions resulting from misconducts and whether defendants’ employment is in the financial industry490. While UK guidance to determine whether a fine is appropriate or which level of fine should be imposed is given in the FCA’s Handbook, US approach relies on judgments so criteria vary on the case-by-case basis. However, UK and US financial sanctions suffer from similar criticisms. Although the ITSA requires that fines are up to triple profit gained or loss avoided, this requirement was rarely applied because cases were early settled491, which is similar to the fact that UK courts are reluctant to impose maximum sentences. US fines are also criticised because losses resulting from fines are smaller than profit gained from wrongdoings; fines paid by shareholders have few deterrent effects on individuals and corporates; of wrongfulness, the likelihood of future misconducts, the defendants’ sincerity and assurance. See SEC v Universal Major Indus. Corp., 546 F.2d 1044, 1048 (2d Cir. 1976); SEC v Cavanagh, 155 F.3d 129, 135 (2d Cir. 1998); SEC v Spence & Green Chem. Co., 612 F.2d 896, 903 (8th Cir. 1980); SEC v Bonastia, 614 F.2d 908 (3d Cir. 1980); SEC v Commonwealth Chemical Securities, Inc., 574 F.2d 90, 100 (2d Cir. 1978); SEC v Paro, 468 F. Supp. 635, 649 (N.D.N.Y. 1979). 486 SEC v Commonwealth Chemical Securities, Inc. (n 485). 487 Ibid.; SEC v Bausch & Lomb Inc (n 318); SEC v Happ, 392 F.3d 12 (1st Cir 2004); SEC v Ginsburg, 242 F. Supp. 2d 1310 (S.D. Fla. 2002). 488 Wang and Steinberg (n 292) at 670. 489 SEC v Brethen, [1992–1993] Transfer Binder Fed. Sec. L. Rep. (CCH) ¶ 97,210 (S.D. Ohio 1992). 490 SEC v Sargent, 329 F.3d 34, 41–42 (1st Cir. 2003). 491 Bromberg et al. (n 437). 86 Legislative and Enforcement Responses in the UK and US Insider Dealing and fines lead to loss of public confidence rather than decrease in firm value 492. Therefore, US monetary penalties neither effectively deter misconducts nor protect interests of consumers and markets. These conclusions are similar in the UK. C. Concluding remarks Civil proceedings play an important role in the UK and US; but unlike the UK, criminal approach complements civil regime in the US. SEC is the major enforcement authority that tackles insider trading. A five-factor analysis to assess effectiveness of enforcement responses is applied to the US. Firstly, US enforcement responses include both criminal and civil approaches, though civil tools are mainly utilised. While FSA/FCA has power to initiate criminal and civil proceedings, SEC can only adopt civil approaches to tackle insider trading and DoJ focuses on criminal prosecutions. Thus, rather than requiring co-operation between two separate bodies, granting much power for FSA/FCA seemingly helps the authority work more flexibly493. Regarding sentencing models, the US model is not as good as the UK model494. However, there were similar criticisms of monetary penalties both in the UK and US. Secondly, SEC still considers insider trading as one of its priorities and continuously takes actions against many insider-trading wrongdoers. The fact that the number of insider-trading enforcement actions and wrongdoers charged decreases does not sufficiently demonstrate SEC’s ineffectiveness. Besides, there is lack of official statistics of the FSA/FCA’s insider-trading enforcement actions as well as the US criminal proceedings, so it is impossible to compare between UK and US approaches with regards to the number-of-convictions criteria. Thirdly, US 492 Steinway (n 444); Greene and Odorski (n 452). Lambe (n 185). 494 Cheung (n 2). 493 87 Legislative and Enforcement Responses in the UK and US Insider Dealing authorities mainly target individuals rather than entities, which is similar to UK regulators. Both UK and US authorities initiate legal proceedings against a wide range of wrongdoers. Fourthly, regarding actual compliance of defendants, civil and administrative sanctions are the major punishment, so neither late compliance nor non-compliance is found. Although few entities are criminally held liable for insider trading, the general issue in criminal proceedings against corporates is the use of DPAs and NPAs whose efficacy is controversial. Finally, actual effects of insidertrading law enforcement are considered. The tightening of US regulation was found to be effective as it greatly reduced insider trading495. Although initial enforcement of insider-trading regulation results in higher potential profits, the toughness of the regulation is negatively correlated with profits496. Insider-trading law in the US is the toughest and insiders’ profits are the lowest, while the UK amount of insiders’ profits is lower than other countries but still higher than the US497. Anthony Boardman, Z. Stuart Liu, Marshall Sarnat and Ilan Vertinsky, ‘The effectiveness of tightening illegal insider trading regulation: the case of corporate takeovers’ (1998) 8 Applied Financial Economics 519 – 531. 496 Arturo Bris, ‘Do Insider Trading Laws Work?’ (2005) 11 (3) European Financial Management 267 – 312. 497 Ibid. 495 88 Legislative and Enforcement Responses in the UK and US Insider Dealing CHAPTER 5: CONCLUSION Insider dealing is a market abuse offence where wrongdoers take advantage of privileged information to purchase or sell securities for profit-making or loss avoidance purposes. This thesis using a comparative methodology with legal-cultures approach discusses ethical and economic characteristics of insider dealing, then analyses the effectiveness of UK and US legislative and enforcement responses. It aims at understanding two different approaches to tackle insider dealing and determining the better system. 1. Debates on insider dealing and insider-dealing laws Insider dealing is analysed from the ethical and economic viewpoints. In terms of ethics, insider dealing is regarded as an unfair practice, a fraud and a misconduct associated with effortlessly significant profits. Regarding economic perspectives, impacts on market including informative efficiency, price volatility, market liquidity and effects on firms such as a form of compensation, firm value are considered. However, arguments on insider-dealing characteristics are still controversial. Thus, there are both approval and disapproval of insider-dealing regulations. Many researchers believe that insider-dealing laws are essential to protect market participants and the market; to maintain public confidence, market integrity and efficiency. 2. The United Kingdom approaches to tackle insider dealing In the UK, Part V of the CJA and Part VIII of the FSMA have been major insiderdealing provisions. While the CJA only established criminal liabilities, the FSMA added civil sanctions on insider dealing. Part V of the CJA is regarded as a comprehensive legislation that covers a broad range of insider dealing offences in relatively simple language. However, there are several criticisms. Vague definitions and unclear factors 89 Legislative and Enforcement Responses in the UK and US Insider Dealing of offences or defences are stated under Part V of the CJA, which results in loopholes. Criminal regime associated with high standard of proof creates obstacles in the process of prosecution and conviction. There is a lack of civil remedies for insiderdealing victims and approaches to improve legitimate information acquisition. Meanwhile, Part VIII of the FSMA is a complement of Part V of the CJA to tackle insider dealing. It covers similar offences stated under the CJA and also has unclear definitions. Importantly, the FSMA fills the regulatory gap by introducing civil regime that lowers the burden of proof and improves successful rate of prosecution as well as conviction. Although civil remedies under the FSMA are expected to have more deterrent effects, empirical studies found that the FSMA was insufficient to deter insider dealing in the chosen periods. With regard to enforcement responses, the FSA/FCA is the enforcement authority that can initiate both criminal and civil proceedings. Although the FSA imposed numerous sanctions on individual and institutional wrongdoers, it was criticised because the FSA paid great attention to political as well as media-friendly factors and the value of fines was relatively smaller than profits gained from wrongdoings. Meanwhile, the FCA is believed to be more proactive and serious than the FSA. Generally, the FSA/FCA is criticised due to its major use of civil sanctions and the lack of criminal proceedings. Thanks to ‘credible deterrence’ policy, criminal proceedings play a more important role in the enforcement responses. Besides, the authority’s great attempt to deal with insider dealing is demonstrated by the increase in the number of successful criminal convictions and amount of fines. However, both criminal and civil sanctions are mainly imposed on individuals rather than corporates. Those sanctions seem to punish wrongdoers rather than provide remedies for victims. 90 Legislative and Enforcement Responses in the UK and US 3. Insider Dealing The United States approaches to tackle insider dealing Unlike the UK approaches, there are no separate legislations that explicitly regulate insider trading in the US. Firstly, the SEA is analysed. Insider trading is regulated on the basis of fraudulent principles. Fiduciary duties play an essential role in insider-trading laws, but requirements on fiduciary duties adversely help wrongdoers escape legal proceedings. Although both US case laws and UK statutes prohibit similar offences, UK laws are clearer and more focused than US ones. In terms of certainty and ease for initiation of legal proceedings, the CJA and the SEA are ineffective, because ambiguousness exists and these two Acts focus on criminal sanctions. However, while definitions are explicitly stated in the UK laws, neither guidance to determine insider-trading practices nor definitions related to insider trading are found in the US statutes. Secondly, the ITSA and the ITSFEA are discussed. These Acts broaden the coverage of US insider-trading laws and remove difficulties of high standard of proof, but there is still a lack of statutory definitions and guidance. Their effectiveness has been questioned by empirical studies. In general, UK and US laws consider insider trading as a serious crime and still have difficulties in the legal proceedings. While US laws aim at protecting owners of material nonpublic information, UK laws pay attention to the market’s integrity and fairness. Case laws are more important than statutes in the US approach, which is different from the UK one. Additionally, US insider-trading laws place a high value on administrative and civil sanctions whereas UK legislative approach prefers criminal punishment. In the US, SEC can only use civil tools and DoJ is responsible for criminal proceedings, while the FSA/FCA has the power to take both civil and criminal enforcement actions. Although SEC explicitly puts insider trading in the priority and is believed to perform better than DoJ, SEC was criticised due to its target on ‘deep- 91 Legislative and Enforcement Responses in the UK and US Insider Dealing pockets’ defendants and its tendency to protect politically economically powerful predators. Regarding civil and criminal enforcement, while UK authority places a high value on criminal proceedings, civil enforcement actions still play an essential role in the US. US sentencing models are based on gains of misconducts rather than a set of criteria established in the UK models. However, both UK and US systems mainly target individuals rather than corporates. In terms of actual effects, US insider-trading law is tougher than UK law and it was empirically found that insiders’ profitability in the US was lower than in the UK. It is difficult to conclude which system is better, because each system outperforms in several criteria. Although vague terms, uncertainty and difficulties in the process of legal proceedings still exist in the UK and US legislative responses, UK approaches seem to be more effective as there are separate insider-dealing provisions and explicitly-stated definitions related to insider dealing offences. Despite common criticisms on use and effectiveness of civil fines, US enforcement responses might be better than UK responses in respect of actual effects. Therefore, further studies should focus on the reforms to remove ambiguousness and increase effectiveness of civil sanctions in both systems, to establish statutory definitions in US approach and to improve efficiency of UK enforcement responses. 92 Legislative and Enforcement Responses in the UK and US Insider Dealing APPENDIX Table 1: A summary of several criminal cases brought by the FSA and FCA498 Year Case 2009 R v Christopher McQuoid and James William Melbourne 2009 R v Matthew and Neel Uberoi 2010 R v Malcolm Calvert 2010 R v Anjam Ahmad 2010 R v Christian Littlewood and Angie Littlewood 2011 R v Neil Rollins 498 Sentence Facts McQuoid – a general counsel at 8-month imprisonment TTP Communications and his for McQuoid father-in-law, Melbourne were 8-month imprisonment found guilty of insider dealing. suspended for 12 Melbourne’s profit was months for Melbourne £48,919.20 Neel Uberoi is the father of 2-year imprisonment for Matthew Uberoi who was an Neel Uberoi intern of a corporate broking firm. 12-month imprisonment Neel Uberoi made around for Matthew Uberoi £110,000 profit on the basis of his son’s information. Calvert was a former marketmaker at Cazenove and gained 21-month imprisonment £103,883 profit from insider dealing Ahmad was a trader and risk 10-month imprisonment manager at AKO. He admitted suspended for 2 years; his insider-dealing practice and £50,000 fine and 300 entered into an agreement with hours of unpaid the FSA to assist the prosecuting community work process 3-year-4-month Christian Littlewood was a senior imprisonment for investment banker, who passed Christian Littlewood privileged information to his wife Suspended 12-month and a friend named Helmy imprisonment for Angie Sa’aid. They made a profit of Littlewood about £590,000 Rollins possessed inside Simultaneously 15- and information of PM Group Plc, 21-month traded on privileged information imprisonments for and encouraged others to trade. insider dealing He also concealed his criminal 6-month imprisonment asset by using two separate for money laundering accounts Clarke (n 92) at 357 – 369. 93 Legislative and Enforcement Responses in the UK and US 2011 R v Helmy Omar Sa’aid 2-year imprisonment 2011 R v Rupinder Sidhu 2-year imprisonment R v James and Miranda 2012 Sanders and James Swallow 4-year imprisonment and 5-year Directors Disqualification Order for James Sanders 10-month imprisonment for Miranda Sanders and James Swallow R v Ali Mustafa, Pardip Saini, Paresh Shah, Neten Shah, Bijah Shah and Truptesh Patel 3-year-6-month imprisonment for Mustafa, Saini and Paresh Shah 18-month imprisonment for Neten Shah 2-year imprisonment for Bijal Shah and Patel 2012 2012 R v Thomas Ammann 2-year-8-month imprisonment 2013 R v Paul Milsom 2-year imprisonment 2013 R v Richard Joseph 4-year imprisonment 94 Insider Dealing Sa’aid is a friend of Angie Littlewood and was involved in their insider-dealing. Sidhu and Ahmad were engaged in insider dealing related to 18 different shares. Profit earned by Sidhu was £524,000. James Sanders and James Swallow were directors of a broking firm. They traded five US stocks based on inside information. James and Miranda Sanders earned £1,533,749 profit whereas James Swallow made a profit of £382,253. These six people got privileged information from two investment banks’ printing rooms. Their insider dealing was conducted for a long period and total profit was £732,044.59. Ammann was an investment banker at Mizuho. He encouraged his friends to trade on his behalf but they were not engaged in his trading. Ammann still earned around €1million. Milsom was a senior trader at Legal and General. He admitted disclosing information to another person. They earned £400,000 profit, and Milsom gained £164,000. Milsom received a reduction due to his early pleading guilty and plea agreement. Joseph was a futures trader who possessed inside information from two investment banks. His profit gained from insider dealing was £591,117. Legislative and Enforcement Responses in the UK and US 2014 R v Julian Rifat499 19-month imprisonment 2015 R v Ryan Willmott500 10-month imprisonment 12-month imprisonment; £15,000 fine and a £203,234 Confiscation Order 4-year-6-month imprisonment for Dodgson 3-year-6-month imprisonment for Hind 2015 R v Paul Coyle501 2016 R v Martyn Dodgson and Andrew Hind502 2016 R v Damian Clarke503 2-year imprisonment R v Mark Lyttleton504 12-month imprisonment; a £83,225.62 fine and a £149,861.27 Confiscation Order 2016 Insider Dealing Rifat was a senior trader at Moore Capital Management Llc. He pleaded guilty of disclosing inside information and being engaged in insider dealing whose profit was over £250,000. Willmott was a former manager at Logica Plc. He admitted his insider-dealing practice which resulted in a profit of over £30,000. Coyle worked at Wm Morrison Supermarkets Plc. He was engaged in insider dealing and earned over £79,000 profit. They pleaded guilty of insider dealing from 2006 to 2010. Sentence imposed on Dodgson was the longest term brought by FCA. Clarke was a fund manager and also an equities trader. He admitted using inside information to conduct insider dealing. His profit was over £155,161.98. Lyttleton was a former manager at BlackRock Investment Management Ltd. He pleaded guilty of two counts of insider dealing. Financial Conduct Authority, ‘Former Moore Capital trader pleads guilty to insider dealing’ (Financial Conduct Authority, 2014) <https://www.fca.org.uk/news/press-releases/formermoore-capital-trader-pleads-guilty-insider-dealing> accessed May 2018. 500 Financial Conduct Authority, ‘Former Logica PLC Manager pleads guilty to insider dealing’ (Financial Conduct Authority, 2015) <https://www.fca.org.uk/news/press-releases/formerlogica-plc-manager-pleads-guilty-insider-dealing > accessed May 2018. 501 Financial Conduct Authority, ‘Former Group Treasurer and Head of Tax at Morrisons plc sentenced to 12 months imprisonment for insider dealing’ (Financial Conduct Authority, 2016) <https://www.fca.org.uk/news/press-releases/former-group-treasurer-and-head-taxmorrisons-plc-sentenced-12-months> accessed May 2018. 502 Financial Conduct Authority (n 245). 503 Financial Conduct Authority, ‘Former equities trader at Schroders Investment Management sentenced for insider dealing’ (Financial Conduct Authority, 2016) <https://www.fca.org.uk/news/press-releases/former-equities-trader-schroders-investmentmanagement-sentenced-insider-dealing > accessed May 2018. 504 Financial Conduct Authority (n 242). 499 95 Legislative and Enforcement Responses in the UK and US Insider Dealing Table 2: A summary of several civil cases brought by the FSA and FCA505 Year 2004 2005 Case Individual or Organisation Penalty Conduct Robert Middlemiss Individual £15,000 Insider dealing Peter Bracken Individual £15,000 Insider dealing Michael Davies Individual £1,000 Insider dealing Jason Smith Individual £15,000 Improper disclosure Robin Hutchings Individual £18,000 Insider dealing David Isaacs Individual £15,000 Insider dealing, improper disclosure Arif Mohammed Individual £10,000 Insider dealing Jonathan Malins Individual £25,000 Insider dealing Philippe Jabre Individual £750,000 GLG Partners LP Organisation £750,000 James Boyd Parker Individual £250,000 Insider dealing Bertie Hatcher Individual £56,098 Insider dealing 2006 2008 Insider dealing, breach of FSA’s Principles for Approved Persons Insider dealing, breach of FSA’s Principles for Business Profit gained or Loss avoided £6,825 loss avoided £2,824 profit gained £420 profit gained £4,924 profit gained £3,750 profit gained £6,400 profit gained $500,000 profit gained £121,742 profit gained £56,098 profit gained Clarke (n 92) at 495 – 500; Financial Conduct Authority, ‘FCA fines Interactive Brokers (UK) Limited £1,049,412 for poor market abuse controls and failure to report suspicious client transactions’ (Financial Conduct Authority, 2018) <https://www.fca.org.uk/news/pressreleases/fca-fines-interactive-brokers-uk-limited > accessed May 2018. 505 96 Legislative and Enforcement Responses in the UK and US John Shevlin Individual £85,000 Insider dealing Steven Harrison Individual £52,500 Insider dealing 2010 £38,472 profit gained €44,000 profit gained Richard Ralph Individual £117,691 Insider dealing , improper disclosure Filip Boyen Individual £81,983 Insider dealing Stewart McKegg Individual £14,411 Insider dealing £4,462 profit gained £12,691 profit gained £29,482 profit gained £14,411 profit gained Brian Valentine Taylor Individual £4,642 Insider dealing, improper disclosure Erik Boyen Individual £176,254 Insider dealing £127,254 profit gained Individual £59,500 Insider dealing £86,030 profit gained Darwin Lewis Clifton OBE Byron Holdings Ltd 2009 Insider Dealing Organisation Darren Morton Individual Christopher Parry Individual £86,030 Public censure Public censure Insider dealing Insider dealing Alexei KrilovHarrison Individual £24,000 Improper disclosure and encouraging Mehmer Sepil Individual £967,005 Insider dealing Murat Ozgul Individual £105,240 Insider dealing Levent Akca Individual £94,062 Insider dealing Robin Chhabra Individual £180,541 Sameer Patel Individual £95,000 Jeremy Burley Individual £144,200 Jeffery Burley Andre Jean Scerri Perry John Bliss Individual £35,000 Improper disclosure Insider dealing Insider dealing and encouraging Insider dealing Individual £66,062 Insider dealing Individual £30,000 97 $66,000 loss avoided $66,000 loss avoided £267,005 profit gained £35,240 profit gained £10,062 profit gained £85,541 profit gained and loss avoided £21,700 loss avoided £46,062 profit gained Legislative and Enforcement Responses in the UK and US 2011 2012 2016 Insider Dealing William James Coppin Individual £70,000 Improper disclosure and encouraging David Massey Individual £150,000 Insider dealing £111,474 profit gained David Einhorn Greenlight Capital Inc Individual £3,638,000 Insider dealing £638,000 loss avoided Organisation £3,650,795 Andrew Osborne Individual £350,000 Nicholas James Kyprios Individual £210,000 Individual £59,557 Public censure Gavin Breeze 98 Improper disclosure Improper disclosure Insider dealing, improper disclosure £242,000 loss avoided Legislative and Enforcement Responses in the UK and US BIBLIOGRAPHY Primary sources UK legislations The Companies Act 1980. The Company Securities (Insider Dealing) Act 1985. The Criminal Justice Act 1993. The Financial Services and Markets Act 2000. The Financial Services Act 2012. UK cases Lennards Carrying Co v Asiatic Petroleum [1915] AC 705. Bolton Engineering Co v Graham [1957] 1 QB 159 (per Denning LJ). FSA v David Massey [2011] UKUT 49 (TCC). R v Andrews Weatherfoil, 56 C App R 31 CA. R v Staines and Morrissey [1997] 2 Cr App R 426. R. v Mcquoid [2009] EWCA Crim 1301, [2009] 4 All E.R. 388. US legislations The Securities Exchange Act of 1934. The Insider Trading Sanctions Act of 1984. The Insider Trading and Securities Fraud Enforcement Act of 1988. The Stop Trading on Congressional Knowledge (STOCK) Act of 2012. US cases Basic Inc. v Levinson, 485 U.S. 224, 231 – 232 (1988). Catherines v Copytele, Inc., 602 F. Supp. 1019 (E.D.N.Y. 1985). Ernst & Ernst v Hochfelder, 425 US 185, 194 n.12 (1976). 99 Insider Dealing Legislative and Enforcement Responses in the UK and US Insider Dealing Elkind v Liggett & Myers, Inc., 635 F.2d 156, 167 (2d Cir. 1980) Geiger v Solomon-Page Group, Ltd, 933 F. Supp. 1180, 1188 (S.D.N.Y. 1996). In re Investors Management Co., 44 SEC 633 (1971). In re Cady, Roberts & Co., 40 SEC 907, 911 (1961). SEC v Advance Growth Capital Corp., 470 F.2d 40, 53 (7th Cir. 1972). SEC v Aaron, 446 U.S. 680, 700–701 (1980). SEC v Bausch & Lomb, 565 F.2d 8 (2d Cir. 1977). SEC v Brethen, [1992–1993] Transfer Binder Fed. Sec. L. Rep. (CCH) ¶ 97,210 (S.D. Ohio 1992). SEC v Bonastia, 614 F.2d 908 (3d Cir. 1980). SEC v Commonwealth Chemical Securities, Inc., 574 F.2d 90, 100 (2d Cir. 1978). SEC v Cavanagh, 155 F.3d 129, 135 (2d Cir. 1998). SEC v Clark, 915 F.2d 439, 453 n.26 (9th Cir. 1990). SEC v Coates, 394 U.S. 976 (1969). SEC v Dirks, 463 U.S. 646 (1983). SEC v Ginsburg, 242 F. Supp. 2d 1310 (S.D. Fla. 2002). SEC v Happ, 392 F.3d 12 (1st Cir 2004). SEC v Lund, 570 F. Supp. 1397 (C.D. Cal. 1983). SEC v Materia, 745 F.2d 197 (2d Cir. 1984). SEC v MacDonald, 699 F.2d 47, 50 (1st Cir. 1983). SEC v Michel, 521 F. Supp. 2d 795, 825-826 (N.D. Ill. 2007). SEC v Monarch Fund, 608 F.2d 938 (2d Cir. 1979). SEC v Musella, 578 F. Supp. 425, 438 (S.D.N.Y. 1984). SEC v Peters, 735 F. Supp. 1505 (D. Kan. 1990). SEC v Paro, 468 F. Supp. 635, 649 (N.D.N.Y. 1979). 100 Legislative and Enforcement Responses in the UK and US Insider Dealing SEC v Switzer, 590 F. Supp. 756 (W.D. Okla. 1984). SEC v Sargent, 329 F.3d 34, 41–42 (1st Cir. 2003). SEC v Spence & Green Chem. Co., 612 F.2d 896, 903 (8th Cir. 1980). SEC v Texas Gulf Sulphur Co, 401 F.2d 833 (2d Cir. 1968). SEC v Tome, 638 F. Supp. 596, 623 (S.D.N.Y. 1986). SEC v Talbot, 530 F.3d 1085, 1097 – 1098 (9th Cir. 2008). SEC v Universal Major Indus. Corp., 546 F.2d 1044, 1048 (2d Cir. 1976). SEC v Warde, 151 F.3d 42, 47 (2d Cir. 1998). Shapiro v Merrill Lynch, Pierce, Fenner & Smith, Inc., 495 F.2d 228, 236 (2d Cir. 1974). US v Bilzerian, 926 F.2d 1285, 1298 (2d Cir. 1991). US v Carpenter, 791 F.2d 1024 (2d Cir. 1986). US v Chiarella, 445 US 222, 235 (1980). US v Cheng Yi Liang, No. 8:11-cr-00530-DKC-1. US v Conradt et al., No. 12-cr-00887 (ALC) (S.D.N.Y, 2015). US v Durant, et al., No. 12-cr-00887 (ALC) at 10 – 11 (S.D.N.Y, 2014). US v Donald Johnson, No. 1:11-cr-00254-AJT-1. US v Heron, 525 F. Supp. 2d 729, 744 (E.D. Pa. 2007). US v Joseph P. Nacchio, No. 1:05-cr-00545-MSK-1. US v Libera, 510 US 976 (1993). US v Mylett, 97 F.3d 663 (2d Cir. 1996). US v Newman, 664 F.2d 12, 17-18 (2d Cir. 1981). US v O’Hagan, 521 US 642 (1997). US v Svoboda, 347 F.3d 471, 475 n.3 (C.A.2 (N.Y), 2003). Wilson v Comtech Telecommunications Corp., 648 F.2d 88, 94-95 (2d Cir. 1981). 101 Legislative and Enforcement Responses in the UK and US Insider Dealing Secondary sources Books Adams, M., ‘Doing What Doesn’t Come Naturally. On the Distinctiveness of Comparative Law’ in Mark Van Hoecke, M. (ed), Methodologies of Legal Research: Which Kind of Method for What Kind of Discipline? (Hart Publishing 2011). Arshadi, N., Eyssell, T.H., The Law and Finance of Corporate Insider Trading: Theory and Evidence (Springer 1993). Baker, A.H., ‘Chapter 5: Insider Dealing’ in Ryder, N., Financial Crime in the 21st Century: Law and Policy (Edward Elgar 2011). Bell, J., ‘Legal Research and the Distinctiveness of Comparative Law’ in Mark Van Hoecke, M. (ed), Methodologies of Legal Research: Which Kind of Method for What Kind of Discipline? (Hart Publishing 2011). CFA Institute, Ethical and Professional Standards, and Quantitative Methods (Wiley 2016). CFA Institute, Equity and Fixed Income (Wiley 2016). Clarke, S., Insider Dealing: Law and Practice (Oxford University Press 2013) Gutteridge, Comparative Law: An Introduction to the Comparative Method of Legal Study & Research (2nd edn, Widly and Sons Limited 1971). Hannigan, B., Insider Dealing (2nd edn, Longman 1994). Husa, J., ‘Comparative Law, Legal Linguistics and Methodology of Legal Doctrine’ in Mark Van Hoecke (ed), Methodologies of Legal Research: Which Kind of Method for What Kind of Discipline? (Hart Publishing 2011). Kraakman, R., ‘The Legal Theory of Insider Trading Regulation in the United States’ in Hopt, K.J., Wymeersch, E., European Insider Dealing: Law and Practice (Butterworths 1991). 102 Legislative and Enforcement Responses in the UK and US Insider Dealing Manne, H.G., Insider Trading and the Stock Market (New York 1966). Morris, S., Financial Services: Regulating Investment Business (2nd edn, FT Law & Tax London 1995). Rider, B., Insider Trading (Jordan Publishing 1983). Rider, B., Alexander, K., Bazley, S., Bryant, J., Market abuse and Insider Dealing (3rd edn, Bloomsbury Professional 2016). Rider, B., Ashe, M., Insider Crime: The New Law (Jordan and Sons Limited 1993). Ryder, N., The financial crisis and white collar crime: The perfect storm? (Edward Elgar 2014). Schmidt, H., ‘Insider Regulation and Economic Theory’ in Hopt, K.J., Wymeersch, E., European Insider Dealing: Law and Practice (Butterworths 1991). Suter, J.A.C., The Regulation of Insider Dealing in Britain (Butterworths 1989). Seredynska, I., Insider Dealing And Criminal Law: Dangerous Liaisons (1st edn, Springer-Verlag Berlin Heidelberg 2012). Salter, M., Mason, J., Writing Law Dissertations: An Introduction and Guide to the Conduct of Legal Research (Pearson Longman 2007) 182-212. Stamp, M., Welsh, C., International Insider Dealing (Longman Law, Tax & Finance 1996). Wang, W.K.S., Steinberg, M.I., Insider Trading (3rd edn, Oxford University Press 2010). Journals Alcock, A., ‘Market abuse’ (2002) 23 (5) Company Lawyer 142 – 150. Alcock, A., ‘Market abuse – the new witchcraft’ (2001) 151 New Law Journal 1398. Agrawal, A., Jaffe, J., ‘Does Section 16b Deter Insider Trading By Target Managers?’ 103 Legislative and Enforcement Responses in the UK and US Insider Dealing (1995) 39 Journal of Financial Economics 295 - 319. Aldave, B.B., ‘The Insider Trading and Securities Fraud Enforcement Act of 1988: An Analysis and Appraisal’ (1988) 52 Albany Law Review 893 – 921. Astaniou, C., Wainer, S., Kiri, N., ‘UK market abuse update: FSA continues to demonstrate resolve to tackle market abuse’ (2010) Law and Financial Markets Review 582 – 592. Alexander, C. R., Cohen, M.A., ‘The evolution of corporate criminal settlements: An empirical perspective on non-prosecution, deferred prosecution, and plea agreements’ (2015) 52 American Criminal Law Review 537 – 593. Ainslie, E.K., ‘Indicting Corporations Revisited: Lessons of the Arthur Andersen Prosecution’ (2006) 43 American Criminal Law Review. Anabtawi, I., ‘Toward a Definition of Insider Trading’ (1989) 41 Stanford Law Review 377 – 399. Anderson, J.P., ‘Poetic expansions of insider trading liability’ (2017) Legal Studies Research Paper No. 2017-09, Mississippi College School of Law 1 – 19. Ausubel, L., ‘Insider Trading in a Rational Expectations Economy’ (1990) 80 The American Economic Review 1022 – 1041. Acoba, M.A., 'Insider Trading Jurisprudence after United States v. O'Hagan: A Restatement (Second) of Torts 551(2) Perspective' (1999) 84 Cornell Law Review 1356 – 1362. Abdolmohammadi, M., Sultan, J., ‘Ethical Reasoning and the Use of Insider Information in Stock Trading’ (2002) 37(2) Journal of Business Ethics 165-173. Aktas, N., De Bodt, E., Van Oppens, H., ‘Legal insider trading and market efficiency’ (2008) 32 Journal of Banking and Finance 1379–1392. Aktas, N., De Bodt, E., Van Oppens, H., ‘Evidence of the Contribution of Legal Insider 104 Legislative and Enforcement Responses in the UK and US Insider Dealing Trading to Market Efficiency’ (2007) UCL Core discussion paper 0714. Alexander, R., ‘Corporate crimes: are the gloves coming off?’ (2009) 30 (11) Company Lawyer 321 – 322. ‘An Economic Analysis of Section 16(b) of the Securities Exchange Act of 1934’ (1976) 18 William and Mary Law Review 389 – 428. Bris, A., ‘Do Insider Trading Laws Work?’ (2005) 11 (3) European Financial Management 267 – 312. Boardman, A., Liu, Z.S., Sarnat, M., Vertinsky, I., ‘The effectiveness of tightening illegal insider trading regulation: the case of corporate takeovers’ (1998) 8 Applied Financial Economics 519 – 531. Bettis, C., Vickrey, D., Vickrey, D.W., ‘Mimickers of corporate insiders who make large volume trades’ (1997) 53 Financial Analysts Journal 57 – 77. Benedict, C., 'Will Conduct Costs Change The Behavior Of Banks?' (2014) 3(1) Seven Pillars Institute Moral Cents. Brodsky, D.M., ‘Insider Trading and the Insider Trading Sanctions Act of 1984: New Wine into New Bottles’ (1984) 41 Washington and Lee Law Review 921 – 941. Brick, I. E., Statman, M., Weaver, D. G., ‘Event Studies and Model Misspecification: Another Look at the Benefits of Outsiders From Public Information About Insider Trading’ (1989) 16 Journal of Business, Finance, and Accounting 399 – 424. Baesel, J. B., Stein, G. R., ‘The Value of Information: Inferences from the Profitability of Insider Trading’ (1979) 14 Journal of Financial and Quantitative Analysis 553 – 571. Beams, J., Brown, R.M., Killough, L.N., ‘An Experiment Testing the Determinants of Non-Compliance With Insider Trading Laws’ (2003) 45 Journal of Business Ethics 309 – 323. Blumberg, J.A., ‘Implications of the 1984 Insider Trading Sanction Act: Collateral 105 Legislative and Enforcement Responses in the UK and US Insider Dealing Estoppel and Double Jeopardy’ (1985) 64 North Carolina Law Review 117 – 157. Bettis, J.C., Coles, J.L., Lemmon, M.L., ‘Corporate policies restricting trading by insiders’ (2000) 57 Journal of Financial Economics 191 – 220. Bromberg, L., Gilligan, G., Ramsay, I., ‘Insider Trading and Market Manipulation: The SEC’s Enforcement Outcomes’ (2017) 45 Securities Regulation Law Journal 109 – 125. Bolton, L.E., Keh, H.T., Alba, J.W., ‘Culture and Marketplace Effects on Perceived Price Fairness: China and the USA’ (2008) Working Paper of Wharton School, University of Pennsylvania. Barnes, P., 'Insider Dealing And Market Abuse: The UK’S Record On Enforcement' (2011) 39 (3) International Journal of Law, Crime and Justice 174-189. Bushman, R.M., Piotroski, D.P., Smith, A.J., ‘Insider trading restrictions and analysts’ incentives to follow firms’ (2005) 60 Journal of Finance 35 – 66. Burger, R., Davies, G., ‘The most valuable commodity I know of is information’ (2005) 13 (4) Journal of Financial Regulation and Compliance 324 – 332. Baumgartel, S., ‘Privileging Professional Insider Trading’ (2016) 51 Georgia Law Review 71 – 119. Bainbridge, S.M., ‘Insider Trading Regulation: The Path Dependent Choice Between Property Rights and Securities Fraud’ (1999) 52 SMU Law Review 1589 – 1651. Bainbridge, S.M., ‘The Insider trading Prohibition: A Legal and Economic Enigma’ (1986) 38 University of Florida Law Review 50. Bainbridge, S.M., ‘The Law and Economics of Insider Trading: A Comprehensive Primer’ (2001) SSRN Electronic Journal. Bainbridge, S.M., 'An Overview Of US Insider Trading Law: Lessons For The EU?' (2005) SSRN Electronic Journal. 106 Legislative and Enforcement Responses in the UK and US Insider Dealing Bainbridge, S.M., ‘Insider Trading Inside the Beltway’ (2011) 36 (2) The Journal of Corporation Law 281 – 307. Baumgartel, S., ‘Privileging Professional Insider Trading’ (2016) 51 Georgia Law Review 71 – 119. Bhattacharya, U., Daouk, H., ‘The world price of insider trading’ (2002) 57 Journal of Finance 75 – 108. Cornell, B., Sirri, E., ‘The Reaction of Investors and Stock Prices to Insider Trading’ (1992) 47 Journal of Finance 1031–1059. Conceicao, C., Snyder, P., Stott, C, ‘US insider trading v EU insider dealing: A difference more than in name’ (2015) XXXA Butterworths Journal of International Banking and Finance Law 1 – 3. Conceicao, C., ‘The FSA’s approach to taking action against market abuse’ (2007) 29 (2) Company Lawyer 43-45. Cox, C.C., Fogarty, K.S., ‘Bases of Insider Trading Law’ (1988) 49 (2) Ohio State Law Journal 353 – 372. Carlton, D.W., Fischel, D.R., ‘The Regulation of Insider Trading’ (1983) 35 Stanford Law Review 857 – 895. Clements, E., ‘The Seventh Amendment Right to Jury Trial in Civil Penalties Actions: A Post-Tull Examination of the Insider Trading Sanctions Act of 1984’ (1988) 43 University of Miami Law Review 361 – 418. Cinar, E., ‘The issue of insider trading in law and economics: Lessons for emerging financial markets in the world’ (1999) 19 (4) Journal of Business Ethics 345–353. Carletti, E., 'Fines For Misconduct In The Banking Sector – What Is The Situation In The EU?' (Economic Governance Support Unit, European Parliament 2017). 107 Legislative and Enforcement Responses in the UK and US Insider Dealing Chen, H.C., Hao, Q., ‘Insider trading law enforcement and gross spreads of ADR IPOs’ (2011) 35 Journal of Banking and Finance 1907 – 1917. Cho, J., Shaub, M., ‘The consequences of insider trading and the role of academic research’ (1991) 10 Business and Professional Ethics Journal 83–98. Cox, J.D., ‘Insider Trading and Contracting: A Critical Response to the “Chicago School”’ (1986) Duke Law Journal 628, 635. Cox, J.D., Thomas, R., Kiku, D., ‘Public and Private Enforcement of the Securities Laws: Have Things Changed Since Enron?’ (2005) 80 (3) Notre Dame Law Review 893. Chan, K., Ikenberry, D.L., Lee, I., Wang, Y., ‘Informed Traders: Linking Legal Insider Trading and Share Repurchases’ (2012) 68 (1) Financial Analysts Journal 60 - 73. Calhoun, L.S., ‘Moving toward a Clearer Definition of Insider Trading: Why Adoption of the Possession Standard Protects Investors’ (1999) 32 University of Michigan Journal of Law Reform 1119 – 1145. Cheng, L. T. W., Davidson, W. N., Leung, T. Y., ‘Insider trading returns and dividend signals’ (2011) 20 International Review of Economics and Finance, 421 – 429. Clayton, M.A., ‘The Misappropriation Theory in Light of Carpenter and the Insider Trading and Securities Fraud Enforcement Act of 1988’ (1989) 17 Pepperdine Law Review 185 – 215. Chan, M., ‘Regulation in the City: Sharing Information’ (2000) 21 Company Lawyer 135. Chmiel, M.J., ‘The Insider Trading and Securities Fraud Enforcement Act of 1998: Codifying a Private Right of Action’ (1990) University of Illinois Law Review 645 – 674. Caccese, M.S., ‘Insider Trading Laws and the Role of Securities Analysts’ (1997) Financial Analysts Journal 9 – 12. 108 Legislative and Enforcement Responses in the UK and US Insider Dealing Colvin, O.P., ‘A Dynamic Definition of an Prohibition against Insider Trading’ (1991) 31 Santa Clara Law Review 603 – 640. Cheung, R., ‘Insider Trading Sentencing: An Anglo-American Comparison’ (2014) 7 Journal Business Law 564-584. Choi, S., Wiechman, A., Pritchard, ‘Scandal Enforcement at the SEC: The Arc of the Option Backdating Investigation’ (2013) 15(2) American Law and Economics Review 542-577 Chakravarty, S., McConnell, J., ‘An Analysis of Prices, Bid/Ask Spreads, and Bid and Ask Depths Surrounding Ivan Boesky’s Illegal Trading in Carnation Stock’ (1997) 26 Financial Management 18–34. Chakravarty, S., McConnel, J., ‘Does Insider Trading Really Move Stock Prices?’ (1999) 34 (2) The Journal of Financial and Quantitative Analysis 191 – 209. Dubow, B., Monteiro, N., ‘Measuring Market Cleanliness’ (2006) FSA Occasional Paper, Financial Services Authority. Dauenhauer, C.H., ‘Justice in Equity: Newman and Egalitarian Reconciliation for Insider-Trading Theory’ (2015) 12 (1) Rutgers Business Law Review 41 – 96. Doherty, D.P., Okun, A.S., Korostoff, S.F., Nofi, J.A.,‘The Enforcement Role of The New York Stock Exchange’ (1991) 85 (3) Northwestern University Law Review 637. Degryse, H., Jong, F., Lefebvre, J., ‘Legal Insider Trading and Stock Market Liquidity’ (2016) 164 De Economist 83 – 104. Davies, J., ‘From gentlemanly expectations to regulatory principles: A history of insider dealing in the UK: Part 1’ (2015) 36 (5) Company Lawyer 132 – 143. Davies, J., ‘From gentlemanly expectations to regulatory principles: A history of insider dealing in the UK: Part 2’ (2015) 36 (6) Company Lawyer 163 – 174. 109 Legislative and Enforcement Responses in the UK and US Insider Dealing Davis, K.R., ‘Insider Trading Flaw: Toward A Fraud-on-the-market Theory and Beyond’ (2016) 66 American University Law Review 51 – 89. Dai, L., Fu, R., Kang, J.K., Lee, I., ‘Corporate governance and the profitability of insider trading’ (2016) 40 Journal of Corporate Finance 235 – 253. Dooley, M.P., ‘Enforcement of Insider Trading Restrictions’ (1980) 66 (1) Virginia Law Review. Dye, R., ‘Insider trading and incentives’ (1984) 57 Journal of Business 295 – 313. Engle, E., ‘Global norm convergence: Capital markets in US and EU law’ (2010) 21 European Business Law Review 465 – 490. Ekin, M.G.S., Tezolmez, S.H., ‘Business Ethics in Turkey: An Empirical Investigation with Special Emphasis on Gender’ (1999) 18 Journal of Business Ethics 17 – 34. Engelen, P.J., Liederkerke, L.V., ‘The Ethics of Insider Trading Revisited’ (2007) 74 Journal of Business Ethics 502. Eyssell, T.H., Reburn, J.P., ‘The Effects of the Insider Trading Sanctions Act of 1984: The Case of Seasoned Equity Offerings’ (1993) XVI (2) The Journal of Financial Research 161 – 170. Friedman, H.M., ‘The Insider Trading and Securities Fraud Enforcement Act of 1988’ (1990) 68 North Carolina Law Review 465 – 494. Fidrmuc, J., Goergen, M., Renneboog, L., ‘Insider Trading, News Releases, and Ownership Concentration’ (2007) 61 The Journal of Finance 341 – 372. Finnerty, J.E., ‘Insiders and market efficiency’ (1976) 31 (4) Journal of Finance 1141 – 1148. Fisch, J.E., ‘Start Making Sense: An Analysis and Proposal for Insider Trading Regulation’ (1991) 26 Georgia Law Review 179 – 251. 110 Legislative and Enforcement Responses in the UK and US Insider Dealing Fishman, J.J., ‘A Comparison of Enforcement of Securities Law Violations in the UK and US’ (1993) 14 Company Lawyer 163. Fishman, M., Hagerty, K., ‘Insider Trading and the Efficiency of Stock Prices’ (1992) 23 Rand Journal of Economics 106 – 122. Fishman, M.J., Hagerty, K.M., ‘The mandatory disclosure of trades and market liquidity’ (1995) 8 (3) Review of Financial Studies 637 – 676. Freeman, M.V., ‘The Insider Trading Sanctions Bill – A Neglected Opportunity’ (1984) 4 (2) Pace Law Review 221 – 229. Filby, M., ‘The Enforcement Of Insider Dealing Under The Financial Services And Markets Act 2000’ (2003) 24 (11) Company Lawyer. Filby, M., ‘Part VIII Financial Services and Markets Act: Filling Insider Dealing’s Regulatory Gaps’ (2004) 25 Company Lawyer 363 (2004). Fernandes, N., Ferreira, M., ‘Insider trading laws and stock price informativeness’ (2009) 22 Review of Financial Studies 1845 – 1887. Gregory, A., Matatko, J., Tonks, I., ‘Detecting Information from Directors’ Trades: Signal Definition and Variable Size Effects’ (2003) 24 Journal of Business Finance and Accounting 309 – 342. Green, A.J., ‘(Beyond) Family Ties: Remote Tippees in a Post-Salman Era’ (2017) 85 Fordham Law Review 2769 – 2802. Garrett, B.L., ‘Structural Reform Prosecution’ (2007) 93 Virginia Law Review 853. Goelzer, D.L., Berueffy, M., ‘Insider Trading: The Search for a Definition’ (1988) 39 (2) Alabama Law Review 491 – 530. Greene, E., Odorski, C., ‘SEC Enforcement in the Financial Sector: Addressing PostCrisis Criticism’ (2015) 16(1) Business Law International 5-19. 111 Legislative and Enforcement Responses in the UK and US Insider Dealing Garfinkel, J. A., ‘New evidence on the effects of federal regulations on insider trading: The Insider Trading and Securities Fraud Enforcement Act (ITSFEA)’ (1997) 3 Journal of Corporate Finance 89 – 111. Guttentag, M.D., ‘Selective Disclosure and Insider Trading: Tipper Wrongdoing in the 21 st Century’ (2016) 69 Florida Law Review. Gregoire, P., Huang, H., ‘Informed trading, noise trading and the cost of equity’ (2009) 17 International Review of Economics & Finance 13 – 32. Howland, B.G., ‘The Insider Trading Sanctions Act of 1984: Does the ITSA Authorize the SEC to Issue Administrative Bars’ (1985) 42 Washington and Lee Law Review 993 – 1013. Hawes, D., ‘A Development In Insider Trading Law In The United States: A Case Note On Chiarella v. United States’ (1981) 3 Journal of Comparative Corporate Law and Securities Regulation 193-197. Huynh, D. ‘Preemption v. punishment: a comparative study of white collar crime prosecution in the United States and the United Kingdom’ (2010) 9 Journal of International Business and Law 105–135. Huang, H., ‘An Empirical Study of the Incidence of Insider Trading in China’ (2007) Working Paper of University of New South Wales. Hillman, H., ‘The Carrot Or The Stick: Finding A Balance In The Regulatory Conundrum’ (2013) Financial Regulation International. Haines, J., ‘FSA determined to improve the cleanliness of markets: custodial sentences continue to be a real threat’ (2008) 29 (12) Company Lawyer 370. Hansen, L., ‘ “Gossip Boys”: Insider Trading and Regulator Ambiguity’ (2014) 21(1) Journal of Financial Crime 29 - 43. 112 Legislative and Enforcement Responses in the UK and US Insider Dealing Henning, P.J., ‘The Organizational Guidelines: R.I.P.?’ (2007) 116 The Yale Law Journal Pocket Part 312. Highbreger, W.F., ‘Common Law Corporate Recovery for Trading on Non-Public Information’ (1974) 74 Columbia Law Review 269 – 298. Jenter, D., ‘Market timing and managerial portfolio decisions’ (2005) 60 Journal of Finance 1903–1949. Jaffe, J.F., ‘Special information and insider trading’ (1974a) 47 (3) Journal of Business 410 – 428. Jaffe, J.F., ‘The Effect of Regulation Changes on Insider Trading’ (1974b) 5 Bell Journal of Economics and Management Science 93 – 121. John, K., Lang, L., ‘Strategic insider trading around dividend announcements: Theory and evidence’ (1991) 46 Journal of Finance 1361 – 1389. John, K., Mishra, B., ‘Information Content of Insider Trading around Corporate Announcements: The Case of Capital Expenditures’ (1990) 45 Journal of Finance 835 – 855. John, K., Narayanan, R., ‘Market manipulation and the role of insider trading regulations’ (1997) 70 (2) Journal of Business 217 – 247. Jeng, L.A., Metrick, A., Zeckhauser, R., ‘Estimating the Returns to Insider Trading: A Performance-Evaluation Perspective’ (2003) 85 (2) Review of Economics and Statistics 453 – 471. Jiang, X., Zaman, M., ‘Aggregate Insider Trading: Contrarian Beliefs or Superior Information?’ (2010) 34 Journal of Banking and Finance 1225 – 1236. Kyle, A., ‘Continuous Auctions and Insider Trading’ (1985) 53 Econometrica 1315 – 1336. Kennedy, C., ‘Criminal Sentences for Corporations: Alternative Fining Mechanisms’ 113 Legislative and Enforcement Responses in the UK and US Insider Dealing (1985) 73 (2) California Law Review 443 – 482. Kahn, C., Winton, A. ‘Ownership structure, speculation, and shareholder intervention’ (1998) 53 (1) Journal of Finance 99 – 129. Kirk, D., ‘Enforcement of criminal sanctions for market abuse: Practicalities, problem solving and pitfalls’ (2016) 17 ERA Forum 311 – 322. Köster, H., Pelster, M., 'Financial Penalties And Bank Performance' (2017) 79 Journal of Banking & Finance 57-71. Karpoff, J.M., Lee, D., ‘Insider trading before new issue announcements’ (1991) 20 Financial Management 18 – 26. Kimel, M., ‘The Inadequacy of Rule 10b-5 to Address Outsider Trading by Reporters’ (1986) 38 Stanford Law Review 1549 – 1576. Karsch, M., ‘The Insider Trading Sanctions Act: Incorporating a Market Information Definition’ (1984) 6 Journal of Comparative Business and Capital Market Law 283 – 305. Keenan, M.G., ‘Insider trading, market efficiency, business ethics and external regulation’ (2000) 11 Critical Perspectives on Accounting 71 – 96. Kabir, R., Vermaelen, T., ‘Insider Trading Restrictions and the Stock Market: Evidence from the Amsterdam Stock Exchange’ (1996) 40 (8) European Economic Review 1591 – 1603. Kaswell, S.J., ‘An Insider’s View of the Insider Trading and Securities Fraud Enforcement Act of 1988’ (1989) 45 The Business Lawyer 145 – 180. Kaplan, S., Samuels, J., Thorne, L., ‘Ethical Norms of CFO Insider Trading’ (2009) 28 Journal of Accounting and Public Policy 386-400. Kelly, W. A., Nardinelli, C., Wallace, M. S., ‘Regulation of Insider Trading: Rethinking SEC Policy Rules’ (1987) 7 (2) The Cato Journal 441–448. 114 Legislative and Enforcement Responses in the UK and US Insider Dealing Loke, A.F., ‘From the Fiduciary Theory to Information Abuse: The Changing Fabric of Insider Trading Law in the UK, Australia and Singapore’ (2006) 54 The American Journal of Comparative Law 123 – 172. Lambe, B.J., ‘The efficacy of market abuse regulation in the UK’ (2016) 24 (3) Journal of Financial Regulation and Compliance 248 – 267. LaVigne, C., Calandra, B., ‘Insider Trading Laws and Enforcement’ (2016) Practical Compliance & Risk Management For The Securities Industry 17 – 24. Langevoort, D.C., ‘Setting the Agenda for Legislative Reform: Some Fallacies, Anomalies, and Other Curiosities in the Prevailing Law of Insider Trading’ (1988) 39 Alabama Law Review 399. Langevoort, D.C., ‘ “Fine Distinctions” in the Contemporary Law of Insider Trading’ (2013) Columbia Business Law Review 429 – 462. Langevoort, D.C., ‘The Insider Trading Sanctions Act of 1984 and Its Effect on Existing Law’ (1984) 37 (6) Vanderbilt Law Review 1273 – 1298. Lee, D. S., Mikkelson, W. H., Partch, M. M., ‘Managers' trading around stock repurchases’ (1992) 47 Journal of Finance 1947–1961. Lomnicka, E., ‘The New Insider Dealing Provisions: Criminal Justice Act 1993, Part V’ (1994) Journal of Business Law 173 – 188. Leland, H.E., ‘Insider Trading: Should it be Prohibited?’ (1992) 100 (4) Journal of Political Economy 859 – 887. Laming, H., Querée, N., ‘FSA v UBS: Will Big Fines Change Banks’ Attitudes To Risk Management?’ (2013) Butterworths Journal of International Banking and Financial Law. Lee, I., Lemmon, M., Li, Y., Sequeira, J.M., ‘Do voluntary corporate restrictions on insider trading eliminate informed insider trading?’ (2014) 29 Journal of Coprorate 115 Legislative and Enforcement Responses in the UK and US Insider Dealing Finance 158 – 178. Lakonishok, J., Lee, I., ‘Are insider trades informative?’ (2001) 14 (1) Review of Financial Studies 79 – 111. Lin, J.C., Howe, J.S., ‘Insider Trading in the OTC Market’ (1990) 45 Journal of Finance 1273 – 1284. Linklater, L., ‘The Market Abuse Regime: Setting standards in the twenty-first century’ (2001) 22 (9) Company Lawyer 267 – 272. Lamba, S. A., Khan, W. A., ‘Exchange listings and delistings: The role of insider information and insider trading’ (1999) 22 Journal of Financial Research 131–146. Lenkey, S.L., ‘Insider Trading and the Short-swing Profit Rule’ (2017) 169 Journal of Economic Theory 517-545. McDonnell, B., ‘Don’t panic! Defending cowardly interventions during and after the financial crisis’ (2011) 116 Penn State Law Review 1–75. Maher, C., ‘Crisis not averted: lack of criminal prosecutions leaves limited consequences for those responsible for the financial crisis’ (2013) 39 New England Journal on Criminal and Civil Confinement 459–476. Murdock, C., ‘The Dodd-Frank Wall Street Reform and Consumer Protection Act: What Caused the Financial Crisis and Will Dodd-Frank Prevent Future Crises’ (2011) 64 SMU Law Review 1243. Martin, D., Peterson, J., ‘Insider trading revisited’ (1991) 10 (1) Journal of Business Ethics 57–61. Martin, E.W., ‘Deferred Prosecution Agreements: “Too Big Too Jail” and the Potential of Judicial Oversight Combined with Congressional Legislation’ (2014) 18 North Carolina Banking Institute 161 – 182. Maug, E., ‘Insider Trading Legislation And Corporate Governance’ (2002) 46 116 Legislative and Enforcement Responses in the UK and US Insider Dealing European Economic Review 1569 – 1597. Manne, H.G., ‘Insider Trading and Property Rights in New Information’ (1985) 4 (3) Cato Journal 935 – 937. Manne, H.G., ‘Insider Trading: Hayek, Virtual Markets, and the Dog that did not Bark’ (2005) 31 (1) Journal of Corporation Law 167 – 185. McVea, H., ‘Fashioning a system of civil penalties for insider dealing: sections 61 and 62 of the Financial Services Act 1986’ (1996) Journal of Business Law 344 - 361. Moore, J., ‘What Is Really Unethical About Insider Trading?’ (1990) 9 Journal of Business Ethics 171-182. McCoy, K.A., Summe, P., ‘Insider trading regulation: A developing state’s perspective’ (1998) 5 (4) Journal of Financial Crime 311 – 346. Meulbroek, L., ‘An Empirical Analysis of Illegal Insider Trading’ (1992) 49 Journal of Finance 1661–1699. Mann, M.D., Lustgarten, L.A., 'Internationalization of Insider Trading Enforcement: A Guide to Regulation and Cooperation' (1993) Practising Law Institute PLI Order No. 134-7024 January 14, 14-15. Manove, M., ‘The Harm from Insider Trading and Informed Speculation’ (1989) 104 Quarterly Journal of Economics 823 - 846. Mendelson, M., ‘The Economics of Insider Trading Reconsidered’ (1969) 117 (3) University of Pennsylvania Law Review 475. Mendelson, M., ‘Economics and the Assessment of Disclosure Requirements’ (1978) 1 Journal of Comparative Corporate Law and Securities Regulation 49 – 68. Morgan, R.J., ‘Insider Trading and the Infringement of Property Rights’ (1987) 48 Ohio State Law Journal 79 – 116. Metzger, M.J., ‘Treble Damages, Deterrence, and their Relation to Substantive Law: 117 Legislative and Enforcement Responses in the UK and US Insider Dealing Ramifications of the Insider Trading Sanctions Act of 1984’ (1986) 20 Valparaiso University Law Review 575 – 617. McGee, R.W., ‘Insider trading: An economic and philosophical analysis’ (1988) 25 (1) The Mid-Atlantic Journal of Business 35 – 48. McGee, R.W., Block, W., ‘An Ethical Look at Insider Dealing’ (2006) Andreas School of Business Working Paper, Barry University 5. McGee, R.W., ‘Applying Ethics to Insider Trading’ (2008) 77 Journal of Business Ethics 206. Mark Van Hoecke, M., 'Methodology Of Comparative Legal Research' (2015) Law and Method. Mark Van Hoecke, M., Warrington, M., ‘Legal Cultures, Legal Paradigms and Legal Doctrine: Towards a New Model For Comparative Law’ (1998) 47 International and Comparative Law Quarterly 495-536. McDermott, T., ‘Keynote address: Financial crime in the FCA world’ (Financial Conduct Authority 2013) < https://www.fca.org.uk/news/speeches/keynote-addressfinancial-crime-fca-world> assessed March 2018. Ma, Y., Sun, H., ‘Where Should Be Line Be Drawn On Insider Trading Ethics?’ (1998) 17(1) Journal of Business Ethics 67-75. Nichols, C., ‘Addressing inept SEC enforcement efforts: lessons from Madoff, the hedge fund industry, and title IV of the Dodd–Frank Act for the US and global financial systems’ (2011) 31 Northwestern Journal of International Law and Business 637–698. Nagy, D.M., ‘Beyond Dirks: Gratuitous Tipping and Insider Trading’ (2016) 42 The Journal of Corporation Law 1 – 57. Nelken, D., ‘Using the concept of legal culture’ (2004) 29 Australian Journal of Legal Philosophy 1–26. 118 Legislative and Enforcement Responses in the UK and US Insider Dealing Nelken, D., ‘Comparative Legal Research and Legal Culture: Facts, Approaches, and Values’ (2016) 12 Annual Review of Law and Social Science 45-62. Noonan, K., ‘The Case for a Federal Corporate Charter Revocation Penalty’ (2012) 80 The George Washington Law Review 602 – 631. O’Hara, P.A., ‘Insider Trading In Financial Markets: Legality, Ethics, Efficiency’ (2001) 28 International Journal of Social Economics 1046-1062. O’Leary, T.L., O’Leary, T.L., ‘The Insider Trading Sanctions Act of 1984: Did Congress and the SEC Go Home Too Early?’ (1986) 19 University of California, Davis Law Review 497 – 537. Pinto, J.E., ‘The NASD’s Enforcement Agenda’ (1991) 85 Northwestern University Law Review 739. Perry, J., Moulton, R., Barwick, G., Small, R., Green, J., Kay, N., ‘The new UK regulatory landscape’ (2011) 84 Compliance Officer Bulletin 1 - 33. Pickard, L.A., Djinis, A.W., ‘NASD Disciplinary Proceedings: Practice and Procedure’ (1982) 37 (3) The Business Lawyer 1213 – 1246 Persons, O.S., ‘SEC’s Insider Trading Enforcements and Target Firms’ Stock Values’ (1997) 39 Journal of Business Research 187 – 194. Pope, P.F., Morris, R.C., Peel, D.A., ‘Insider Trading: Some Evidence on Market Efficiency and Directors’ Share Dealings in Great Britain’ (1990) 17 (3) Journal of Business Finance and Accounting 359 – 380. Peat, R., Mason, I., ‘Credible deterrence in action: the FSA brings a series of cases against traders’ (2009) 30 (9) Company Lawyer. Phillips, R.M., Zutz, R.J., ‘The Insider Trading Doctrine: A Need for Legislative Repair’ (1984) 13 (1) Hofstra Law Review 65 – 100. 119 Legislative and Enforcement Responses in the UK and US Insider Dealing Rider, B., ‘The Control of Insider Trading – Smoke and Mirrors’ (2000) 19 (1) Dickinson Journal of International Law 1 – 45. Reitz, J., ‘How to Do Comparative Law’ (1998) 46 The American Journal of Comparative Law 618-636. Rakoff, J., ‘The Financial Crisis: Why Have No High-Level Executives Been Prosecuted?’ (2014) The New York Review of Books. Rozeff, M., Zaman, M., ‘Market efficiency and insider trading: New evidence’ (1988) 61 Journal of Business 25–44. Rozeff, M., Zaman, M., ‘Overreaction and insider trading: Evidence from growth and value portfolios’ (1998) 53 Journal of Finance 701–716. Ramirez, M.K., ‘The Science Fiction of Corporate Criminal Liability: Containing the Machine Through the Corporate Death Penalty’ (2005) 47 Arizona Law Review 933 – 1002. Reichman, N., ‘Insider Trading’ (1993) 18 Crime and Justice, Beyond the Law: Crime in Complex Organizations 57. Ryder, N., ‘“Greed, for lack of a better word, is good. Greed is right. Greed works”: A contemporary and comparative review of the relationship between the global financial crisis, financial crime and white collar criminals in the U.S. and the U.K.’ (2016) 1(1) British Journal of White Collar Crime 3-47 Sykes, A., ‘Market abuse: A civil revolution’ (1999) 1 (2) Journal of International Financial Markets 59 – 67. Srivastava, A., Mason, I., Simpson, M., Litt, M. ‘Financial crime’ (2011) 86 Compliance Officer Bulletin 1 – 23. Sabino, A.M., Sabino, M.A., ‘From Chiarella to Cuban: The Contributing Evolution of the Law of Insider Trading’ (2011) 16 Fordham Journal of Corporate and Financial 120 Legislative and Enforcement Responses in the UK and US Insider Dealing Law 673 – 741. Shaw, B., ‘Shareholder authorized inside trading: A legal and moral analysis’ 1990 9 (12) Journal of Business Ethics 913–928. Sinani, B., Shanto, K., 'Methods And Functions Of Comparative Law' (2013) 9(2) AUDJ. Schipani, C.A., Seyhun, H.N., ‘Defining “Material, Nonpublic”: What Should Constitute Illegal Insider Information?’ (2016) XXI Fordham Journal of Corporate and Financial Law 327 – 378. Silver, C.B., ‘Penalizing Insider Trading: A Critical Assessment of the Insider Trading Sanctions Act of 1984’ (1985) 1985 Duke Law Journal 960 – 1025. Sims, D., ‘United States v. Carpenter: An Inadequate Solution to the Problem of Insider Trading’ (1988) 34 The Wayne Law Review 1461 – 1484. Sheyn, E.R., ‘Anything but a 'Racket': Why Professor Epstein's Attack on the Nature and Function of Deferred and Non-Prosecution Agreements Misses the Mark’ (2007) SSRN Electronic Journal. Swan, E., ‘Market abuse: A new duty of fairness’ (2004) 25 (3) Company Lawyer 67 – 68. Seyhun, H.N., ‘Insiders' profits, costs of trading, and market efficiency’ (1986) 16 Journal of Financial Economics 189 – 212. Seyhun, H.N., ‘Do bidder managers knowingly pay too much?’ (1990) 63 Journal of Business 439 – 464. Seyhun, H.N., ‘Why does aggregate insider trading predict future stock returns? (1992) 107 (4) Quarterly Journal of Economics 1303 – 1331. Seyhun, H.N., ‘The effectiveness of the insider-trading sanctions’ (1992) 35 Journal of Law and Economics 149–182. 121 Legislative and Enforcement Responses in the UK and US Insider Dealing Shefrin, H., Statman, M., ‘Ethics, Fairness And Efficiency In Financial Markets’ (1993) Financial Analysts Journal 21-29. Strader, J.K., ‘(Re)Conceptualizing Insider Trading: United States v. Newman and the Intent to Defraud’ (2015) 80 Brooklyn Law Review 1419 – 1485 Scheppele, K.L., ‘”It’s Just Not Right”: The Ethics Of Insider Trading’ (1993) 56 (3) Law and Contemporary Problems 123-173. Stallworthy, M., ‘The United Kingdom’s New Regime for the Control of Insider Dealing’ (1993) 12 (4) International Company and Commercial Law Review 448 – 453. Statman, M., ‘Local Ethics in a Global World’ (2007) 63 (3) Financial Analysts Journal 32 – 41. Statman, M., ‘The Cultures of Insider Trading’ (2009) 89 Journal of Business Ethics 51-58. Seitzinger, M., ‘Federal Securities Law: Insider Trading’ (Congressional Research Service 2016). Salbu, S., ‘Insider trading and the social contract’ (1995) 5 (2) Business Ethics Quarterly 313–328. Steinway, S.A., ‘SEC Monetary Penalties Speak Very Loudly, but What Do They Say - A Critical Analysis of the SEC's New Enforcement Approach’ (2014) 124 The Yale Law Journal 209. Srinivas, V., Byler, D., Wadhwani, R., Ranjan, A., Krishna, V., 'Enforcement Actions In The Banking Industry: Trends And Lessons Learned' (Deloitte University Press 2015). Teeters, B.A., ‘Insider Trading and Securities Fraud Enforcement Act of 1988: Just How Much Are Employers Going to Pay’ (1990) 59 Cincinnati Law Review 587 – 614. Tavakoli, M., McMillan, D., McKnight, P., ‘Insider Trading And Stock Prices’ (2012) 22 122 Legislative and Enforcement Responses in the UK and US Insider Dealing International Review of Economics and Finance 254-266. Tomasic, R., ‘The financial crisis and the haphazard pursuit of financial crime’ (2011) 18(1) Journal of Financial Crime 7-31. Teasdale, S., ‘FSA to FCA: recent trends in UK financial conduct regulation’ (2011) 26(12) Journal of International Banking Law and Regulation 583 – 586. Uhlmann, D.M., ‘Deferred Prosecution and Non-Prosecution Agreements and the Erosion of Corporate Criminal Liability’ (2013) 72 Maryland Law Review 1295 – 1344. Ventoruzzo, M., ‘Comparing Insider Trading in the United States and in the European Union: History and Recent Development’ (2014) European Corporate Governance Institute Working Paper Series in Law No. 257/2014. Wu, H. K., ‘An Economist Looks at Section 16 of the Securities Exchange Act of 1934’ (1968) 68 Columbia Law Review 260–269. Wotherspoon, K., ‘Insider Dealing – The New Law: Part V of The Criminal Justice Act 1993’ (1994) 57 The Modern Law Review 419 - 433. White, M., ‘The Implications For Securities Regulation Of New Insider Dealing Provisions In The Criminal Justice Act 1993’ (1995) 16 (6) Company Law 163-171. Werhane, P., ‘The ethics of insider trading’ (1989) 8 (11) Journal of Business Ethics 841–845. Werhane, P., ‘The Indefensibility of Insider Trading’ (1991) 10 Journal of Business Ethics 729 – 731. Wright, R., ‘Market Abuse and Market Manipulation: The Criminal, Civil and Regulatory Interface’ (2001) 3 Journal of International Financial Markets 19 – 25. Wang, W.K.S., ‘Trading on Material Nonpublic Information on Impersonal Stock Markets: Who is Harmed, and Who can Sue Whom Under SEC Rule 10b-5? (1981) 54 Southern California Law Review 1217 – 1321 123 Legislative and Enforcement Responses in the UK and US Insider Dealing Weiwei, Z., ‘New Challenges And Undertakings For Administrative And Regulatory Reform: A Global Watch With Chinese Perspective – An Examination Of Legal Regulations For Insider Dealing In The UK And The Lessons For China’ (2017) 12 (4) Frontiers Of Law In China 524-560. Young, D.S., ‘Insider Trading: Why the Concern?’ (1985) 8 Journal of Accounting, Auditing and Finance 178 – 183. Yoder, S.A., ‘Criminal Sanctions for Corporate Illegality’ (1978) 69 (1) Journal of Criminal Law and Criminology 40 – 58. Reports Bank of England, ‘Financial Stability Report’ (2015) <https://www.bankofengland.co.uk/financial-stability-report/2015/december-2015> assessed 6 October 2017. Berman, J., Conceicao, C., Gatti, S., O’Neill, N., ‘The US and EU – An ocean apart on insider dealing regulation?’ (Clifford Chance 2015) < https://www.cliffordchance.com/briefings/2015/06/the_us_and_eu_anoceanapartonin siderdealin.html> accessed May 2018. European Systemic Risk Board, ‘Report On Misconduct Risk In The Banking Sector’ (2015) <https://www.esrb.europa.eu/pub/pdf/other/150625_report_misconduct_risk.en.pdf> accessed 6 October 2017. Financial Services Authority, ‘Final Notice To Michael Thomas Davies’ (Financial Conduct Authority 2004) <https://www.fca.org.uk/publication/final-notices/daviesmt_28jul04.pdf> assessed May 2018. 124 Legislative and Enforcement Responses in the UK and US Insider Dealing Financial Services Authority, ‘Final Notice To Robert Middlemiss’ (Financial Conduct Authority 2004) <https://www.fca.org.uk/publication/final- notices/middlemiss_10feb04.pdf> assessed May 2018. Financial Services Authority, ‘Final Notice To Peter Bracken’ (Financial Conduct Authority 2004) <https://www.fca.org.uk/publication/final- notices/bracken_07jul04.pdf> assessed May 2018. Financial Services Authority, ‘Final Notice To Mr David Isaacs’ (Financial Services Authority 2005) <http://www.fsa.gov.uk/pubs/final/d-isaacs_28feb05.pdf > assessed May 2018. Financial Services Authority, ‘Final Notice To Jonathan Malins’ (Financial Conduct Authority 2005) <https://www.fca.org.uk/publication/final- notices/jonathan_malins.pdf> assessed May 2018. Financial Services Authority, ‘Final Notice To Richard Ralph’ (Financial Services Authority 2008) <http://www.fsa.gov.uk/pubs/final/richard_ralph.pdf> accessed May 2018. Financial Services Authority, ‘Final Notice To Filip Boyen’ (Financial Conduct Authority 2008) <https://www.fca.org.uk/publication/final-notices/filip_boyen.pdf> accessed May 2018. Financial Services Authority, ‘Final Notice To Mr John Shevlin’ (Financial Conduct Authority 2008) <https://www.fca.org.uk/publication/final-notices/john_shevlin.pdf> accessed May 2018. Financial Services Authority, ‘Final Notice To Alexei Krilov-Harrison’ (Financial Conduct Authority 2009) <https://www.fca.org.uk/publication/final- notices/krilovharrison.pdf > assessed May 2018. 125 Legislative and Enforcement Responses in the UK and US Insider Dealing Financial Services Authority, ‘Final Notice To Perry John Bliss’ (Financial Conduct Authority 2010) <https://www.fca.org.uk/publication/final-notices/perry_bliss.pdf> assessed May 2018. Financial Services Authority, ‘Final Notice To Jeremy Burley’ (Financial Services Authority 2010) < http://www.fsa.gov.uk/pubs/final/jeremy_burley.pdf> assessed May 2018. Financial Services Authority, ‘Final Notice To William James Coppin’ (Financial Conduct Authority 2010) <https://www.fca.org.uk/publication/final- notices/william_coppin.pdf > assessed May 2018. Financial Services Authority, ‘Final Notice to Christian Arthur Littlewood’ (Financial Services Authority 2012) <https://www.fca.org.uk/publication/final-notices/christianlittlewood.pdf> accessed March 2018. Seitzinger, M., ‘Federal Securities Law: Insider Trading’ (Congressional Research Service 2016). Securities and Exchange Commission, ‘Select SEC and Market Data – Fiscal 2010’ (Securities and Exchange Commission 2011) <https://www.sec.gov/files/secstats2010.pdf> accessed May 2018. Securities and Exchange Commission, ‘Select SEC and Market Data – Fiscal 2011’ (Securities and Exchange Commission 2012) <https://www.sec.gov/files/secstats2011.pdf> accessed May 2018. Securities and Exchange Commission, ‘Select SEC and Market Data – Fiscal 2012’ (Securities and Exchange Commission <https://www.sec.gov/files/secstats2012.pdf> accessed May 2018. 126 2013) Legislative and Enforcement Responses in the UK and US Insider Dealing Securities and Exchange Commission, ‘Select SEC and Market Data – Fiscal 2013’ (Securities and Exchange Commission 2014) <https://www.sec.gov/files/secstats2013.pdf> accessed May 2018. Securities and Exchange Commission, ‘Select SEC and Market Data – Fiscal 2014’ (Securities and Exchange Commission 2015) <https://www.sec.gov/files/secstats2014.pdf> accessed May 2018. Securities and Exchange Commission, ‘Select SEC and Market Data – Fiscal 2015’ (Securities and Exchange Commission 2016) <https://www.sec.gov/files/secstats2015.pdf> accessed May 2018. Securities and Exchange Commission, ‘Select SEC and Market Data – Fiscal 2016’ (Securities and Exchange Commission 2017) <https://www.sec.gov/files/201703/secstats2016.pdf> accessed May 2018. Securities and Exchange Commission, ‘Select SEC and Market Data – Fiscal 2017 (Enforcement Information only)’ (Securities and Exchange Commission 2018) <https://www.sec.gov/files/enforcement-annual-report-2017-addendum.pdf> accessed May 2018. The House of Commons, 'Changing Banking For Good' (2006) <http://www.parliament.uk/documents/banking-commission/Banking-final-report-volii.pdf> assessed November 2017. Websites Aldrick, P., ‘JPMorgan agrees $13bn settlement with US Justice Department’ (The Telegraph, 2013) <http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/10391383/JPM 127 Legislative and Enforcement Responses in the UK and US Insider Dealing organ-agrees-13bn- settlement-with-US-Justice-Department.html> accessed March 2018. Bowers, S., ‘Essex four charged with insider dealing’ (The Guardian, 2002) <https://www.theguardian.com/business/2002/dec/14/4> accessed May 2018. Cox, J., 'Now That Banks Have Paid $321 Billion In Fines, Here's The Toughest Test Ahead' (CNBC, 2017) <https://www.cnbc.com/2017/03/03/banks-have-paid-321billion-in-fines-since-the-crisis.html> accessed 6 November 2017 Cheston, P., Brown, J., ‘James Sanders: The trader who thought he was untouchable’ (The Independent, 2012) <https://www.independent.co.uk/news/uk/crime/james- sanders-the-trader-who-thought-he-was-untouchable-7870125.html> accessed March 2018. Epstein, R.A., ‘The Deferred Prosecution Racket’ (The Wall Street Journal, 2006) < https://www.wsj.com/articles/SB116468395737834160> accessed May 2018. Ehret, T., ‘SEC’s advanced data analytics helps detect even the smallest illicit market activity’ (Reuters, 2017) <https://www.reuters.com/article/bc-finreg-data-analyticsidUSKBN19L28C> accessed May 2018. Finch, G., 'World’S Biggest Banks Fined $321 Billion Since Financial Crisis' (Bloomberg.com, 2017) <https://www.bloomberg.com/news/articles/2017-03- 02/world-s-biggest-banks-fined-321-billion-since-financial-crisis> accessed 6 November 2017 Financial Conduct Authority, ‘The Enforcement Guide’ (Financial Conduct Authority, n/d) <https://www.handbook.fca.org.uk/handbook/document/EG_Full_20140401.pdf> accessed May 2018. 128 Legislative and Enforcement Responses in the UK and US Insider Dealing Financial Conduct Authority, ‘The Decision Procedure and Penalties manual’ (Financial Conduct Authority, n/d) <https://www.handbook.fca.org.uk/handbook/DEPP.pdf > accessed May 2018. Financial Conduct Authority, ‘MAR 1.2 Market Abuse: general’ (Financial Conduct Authority, n/d) <https://www.handbook.fca.org.uk/handbook/MAR/1/2.html?date=2012-06-01> accessed May 2018. Financial Conduct Authority, ‘MAR 1.4 Unlawful disclosure’ (Financial Conduct Authority, n/d) <https://www.handbook.fca.org.uk/handbook/MAR/1/4.html> accessed May 2018. Financial Conduct Authority, ‘Market abuse’ (Financial Conduct Authority, n/d) < https://www.fca.org.uk/markets/market-abuse> assessed May 2018. Financial Conduct Authority, ‘Fines table’ (Financial Conduct Authority, n/d) <https://www.fca.org.uk/news/news-stories/2016-fines> assessed March 2018. Financial Conduct Authority, ‘Financial crime’ (Financial Conduct Authority, 2015) < https://www.fca.org.uk/firms/financial-crime> assessed March 2018. Financial Conduct Authority, ‘Mark Lyttleton sentenced to 12 months imprisonment for insider dealing’ (Financial Conduct Authority, 2016) <https://www.fca.org.uk/news/press-releases/mark-lyttleton-sentenced-12-monthsimprisonment-insider-dealing > accessed May 2018. Financial Conduct Authority, ‘Two convicted of insider dealing in Operation Tabernula trial’ (Financial Conduct Authority, 2016) <https://www.fca.org.uk/news/pressreleases/two-convicted-insider-dealing-operation-tabernula-trial> 2018. 129 accessed May Legislative and Enforcement Responses in the UK and US Insider Dealing Financial Conduct Authority, ‘Insider dealers sentenced in Operation Tabernula trial’ (Financial Conduct Authority, 2016) <https://www.fca.org.uk/news/press- releases/insider-dealers-sentenced-operation-tabernula-trial> accessed May 2018. Financial Conduct Authority, ‘FCA fines Interactive Brokers (UK) Limited £1,049,412 for poor market abuse controls and failure to report suspicious client transactions’ (Financial Conduct Authority, 2018) <https://www.fca.org.uk/news/press-releases/fcafines-interactive-brokers-uk-limited > accessed May 2018. Financial Conduct Authority, ‘Former Moore Capital trader pleads guilty to insider dealing’ (Financial Conduct Authority, 2014) <https://www.fca.org.uk/news/pressreleases/former-moore-capital-trader-pleads-guilty-insider-dealing> accessed May 2018. Financial Conduct Authority, ‘Former Logica PLC Manager pleads guilty to insider dealing’ (Financial Conduct Authority, 2015) <https://www.fca.org.uk/news/pressreleases/former-logica-plc-manager-pleads-guilty-insider-dealing > accessed May 2018. Financial Services Authority, ‘Enforcing Financial Services Regulation: The UK FSA Perspective’ (Financial Services Authority, 2008) <http://www.fsa.gov.uk/pages/Library/Communication/Speeches/2008/0404_mc.sht ml> accessed May 2018. 130 Legislative and Enforcement Responses in the UK and US Insider Dealing Financial Conduct Authority, ‘Former Group Treasurer and Head of Tax at Morrisons plc sentenced to 12 months imprisonment for insider dealing’ (Financial Conduct Authority, 2016) <https://www.fca.org.uk/news/press-releases/former-group- treasurer-and-head-tax-morrisons-plc-sentenced-12-months> accessed May 2018. Financial Conduct Authority, ‘Former equities trader at Schroders Investment Management sentenced for insider dealing’ (Financial Conduct Authority, 2016) <https://www.fca.org.uk/news/press-releases/former-equities-trader-schrodersinvestment-management-sentenced-insider-dealing > accessed May 2018. Financial Services Authority, ‘Delivering Credible Deterrence’ (Financial Services Authority, 2009) <http://www.fsa.gov.uk/library/communication/speeches/2009/0427_mc.shtml> accessed May 2018. Financial Services Authority, ‘Insider Dealing: Financial Services Authority prosecutes Mr Neil Rollins’ (Financial Services Authority, 2009) <http://www.fsa.gov.uk/pages/Library/Communication/PR/2009/002.shtml> accessed May 2018. Financial Services Authority, ‘Former corporate broker intern and father found guilty of insider dealing’ (Financial Services Authority, 2009) <http://www.fsa.gov.uk/pages/Library/Communication/PR/2009/149.shtml> accessed May 2018. Financial Services Authority, ‘Former Cazenove partner found guilty of insider dealing’ (Financial Services Authority, 2010) <http://www.fsa.gov.uk/pages/Library/Communication/PR/2010/041.shtml> accessed May 2018. 131 Legislative and Enforcement Responses in the UK and US Insider Dealing Financial Services Authority, ‘Management consultant appears in Court charged with insider dealing’ (Financial Services Authority, 2011) <http://www.fsa.gov.uk/pages/Library/Communication/PR/2011/019.shtml> accessed May 2018. Financial Services Authority, ‘Insider dealers ordered to pay £1.5m in confiscation’ (Financial Services Authority, 2012) <http://www.fsa.gov.uk/library/communication/pr/2012/082.shtml> accessed March 2018. Financial Services Authority, ‘Six sentenced for insider dealing’ (Financial Services Authority, 2012) <http://www.fsa.gov.uk/library/communication/pr/2012/080.shtml> accessed May 2018. Goldstein, M., Protess, B., ‘Court Rejects Bharara’s Plea to Reconsider Insider Trading Ruling’ (The New York Times, 2015) <https://www.nytimes.com/2015/04/04/business/dealbook/appeals-court-rejectsrequest-to-rehear-landmark-insider-trading-case.html > accessed May 2018. Levitt, A., ‘A Question of Integrity: Promoting Investor Confidence by Fighting Insider Trading’ (Securities and Exchange Commission, 1998) <https://www.sec.gov/news/speech/speecharchive/1998/spch202.txt > accessed May 2018. Neville, S., ‘Husband and wife jailed for insider dealing’ (The Guardian, 2012) < https://www.theguardian.com/business/2012/jun/20/husband-and-wife-jailed-insiderdealing> accessed March 2018. 132 Legislative and Enforcement Responses in the UK and US Insider Dealing Raymond, N., ‘Newest weapon in US hunt for insider traders paying off’ (Reuters, 2016) <https://www.reuters.com/article/us-usa-insidertrading-insight/newest-weaponin-u-s-hunt-for-insider-traders-paying-off-idUSKBN12W2X4> accessed May 2018. Securities and Exchange Commission, ‘SEC Enforcement Actions – Insider Trading Cases’ (Securities and Exchange Commission, n/d) <https://www.sec.gov/spotlight/insidertrading/cases.shtml> accessed May 2018. See Securities and Exchange Commission, ‘SEC Charges Hedge Fund Firm CR Intrinsic and Two Others in $276 Million Insider Trading Scheme Involving Alzheimer’s Drug’ (Securities and Exchange Commission, 2012) <https://www.sec.gov/news/press-release/2012-2012-237htm> accessed May 2018. Securities and Exchange Commission, ‘CR Intrinsic Agrees to Pay More than $600 Million in Largest-Ever Settlement for Insider Trading Case’, (Securities and Exchange Commission, 2013) <http://www.sec.gov/news/press/2013/2013-41.htm> accessed March 2018. The Economist, 'Fine And Punishment' (The Economist, 2012) <http://www.economist.com/node/21559315> accessed 6 November 2017. The National Archives, ‘Fines table’ (The National Archives, n/d) < http://webarchive.nationalarchives.gov.uk/20130201213211/http://www.fsa.gov.uk/ab out/press/facts/fines/2012> assessed March 2018. The US Department of Justice, ‘Insider Trading Fraud’ (The US Department of Justice, n/d) <https://www.justice.gov/criminal-fraud/insider-trading-fraud> accessed May 2018. The US Department of Justice, ‘Assistant Attorney General Lanny A. Breuer Speaks at the New York City Bar Association’ (The US Department of Justice, 2012) < 133 Legislative and Enforcement Responses in the UK and US Insider Dealing https://www.justice.gov/opa/speech/assistant-attorney-general-lanny-breuer-speaksnew-york-city-bar-association> accessed May 2018. The United States Sentencing Commission, ‘United States Sentencing Guidelines Manual § 1A1.1 Commentary, Chapter One, Part A(2)’ (The United States Sentencing Commission, 2009) <https://www.ussc.gov/guidelines/archive/2009-federal- sentencing-guidelines-manual> accessed May 2018. Treanor, J., 'Banks’ £30Bn In Compensation Claims And Fines 'Pose Risk To Stability' (The Guardian, 2015) <https://www.theguardian.com/business/2015/jul/01/banks30bn-in-fines-and-compensation-claims-pose-risk-to-stability> accessed 6 October 2017 Torbati, Y., ‘British consultant found guilty of insider trading’ (Reuters, 2011) <https://uk.reuters.com/article/uk-insiderdealing/british-consultant-found-guilty-ofinsider-trading-idUKTRE7BE1JX20111215 > accessed May 2018. Wilson, H., ‘Ex-Cazenove partner Malcolm Calvert gets 21 months in jail for insider trading’ (The Telegraph, 2010) <https://www.telegraph.co.uk/finance/newsbysector/banksandfinance/7422473/ExCazenove-partner-Malcolm-Calvert-gets-21-months-in-jail-for-insider-trading.html> accessed May 2018. Wyatt, E., ‘S.E.C. Is Avoiding Tough Sanctions for Large Banks’ (The New York Times, 2012) < https://www.nytimes.com/2012/02/03/business/sec-is-avoiding-tough- sanctions-for-large-banks.html> assessed in March 2018. Wharton, 'Are Financial Penalties Enough To Deter Banks' Bad Behavior?' (Knowledge@Wharton, 2015) <http://knowledge.wharton.upenn.edu/article/are- financial-penalties-enough-to-deter-banks-bad-behavior/> accessed 6 November 2017. 134