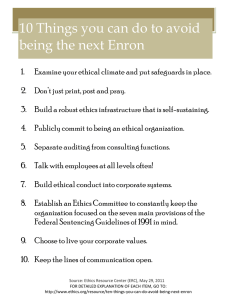

Business & Professional Ethics Textbook for Directors, Executives

advertisement