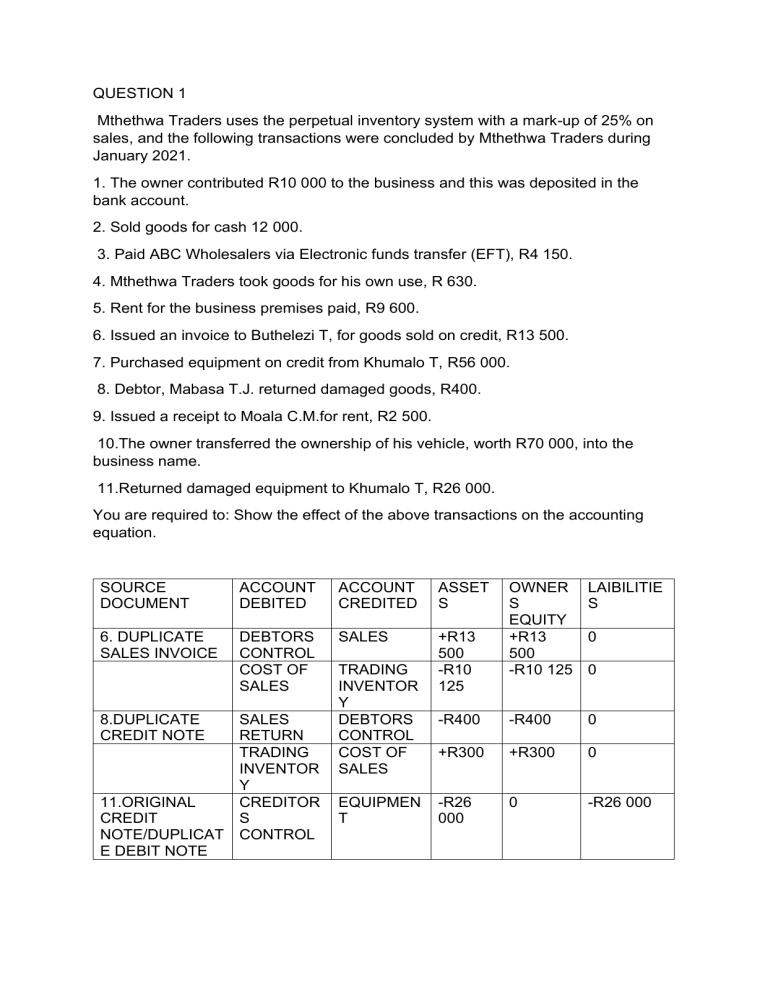

QUESTION 1 Mthethwa Traders uses the perpetual inventory system with a mark-up of 25% on sales, and the following transactions were concluded by Mthethwa Traders during January 2021. 1. The owner contributed R10 000 to the business and this was deposited in the bank account. 2. Sold goods for cash 12 000. 3. Paid ABC Wholesalers via Electronic funds transfer (EFT), R4 150. 4. Mthethwa Traders took goods for his own use, R 630. 5. Rent for the business premises paid, R9 600. 6. Issued an invoice to Buthelezi T, for goods sold on credit, R13 500. 7. Purchased equipment on credit from Khumalo T, R56 000. 8. Debtor, Mabasa T.J. returned damaged goods, R400. 9. Issued a receipt to Moala C.M.for rent, R2 500. 10.The owner transferred the ownership of his vehicle, worth R70 000, into the business name. 11.Returned damaged equipment to Khumalo T, R26 000. You are required to: Show the effect of the above transactions on the accounting equation. SOURCE DOCUMENT ACCOUNT DEBITED ACCOUNT CREDITED ASSET S 6. DUPLICATE SALES INVOICE DEBTORS CONTROL COST OF SALES SALES +R13 500 -R10 125 8.DUPLICATE CREDIT NOTE SALES RETURN TRADING INVENTOR Y 11.ORIGINAL CREDITOR CREDIT S NOTE/DUPLICAT CONTROL E DEBIT NOTE TRADING INVENTOR Y DEBTORS CONTROL COST OF SALES EQUIPMEN T OWNER S EQUITY +R13 500 -R10 125 LAIBILITIE S -R400 -R400 0 +R300 +R300 0 -R26 000 0 -R26 000 0 0 QUESTION 2-MARK-UP,VAT AMOUNT,VAT EXCLUSIVE,VAT INCLUSIVE NO. COST PRICE EXCLUSIVE AMOUNT 1 R12 300 2 D.R17 550 3 4 G.R10 580 R10 500 5 R25 600 MARK-UP % 30% ON SALES 25% ON SALES 20% ON COST J.32% ON SALES/PROFIT MARGIN M.38% SELLING PRICE(SALES) EXCLUSIVE AMOUNT A.17 571 VAT AMOUNT ON SALES B.R2 635 SELLING PRICE INCLUSIVE AMOUNT C.R20 207 R23 400 E.R3 510 F.R26 910 H.R12 696 R15 500 I.R1 094 K.R2 325 R14 600 L.R17 825 R35 400 N.R5 310 O.R40 710 MARK-UP SOLUTION 1.A STEP 1= SP=100 CP=(70) MU=30 30/100 ON SALES DOWN=SUBTRACT UP=ADD STEP = UNKNOWN/KNOWNX GIVEN AMOUNT =100/70XR12 300 SELLING PRICE =R17 571(EXCL) 1.B. VAT AMOUNT=R17 571X15/100(AMOUNT USED THERE IS NO VAT) =R2 636 1.C. SELLING PRICE+VAT AMOUNT =SELLING PRICE INCLUSIVE R17 571+R2 636 =R20 207 OR R17 571X115/100=R20 207 2.D. STEP 1=SP-100 CP-(75) MU-25 25/100 ON SALES STEP 2=75/100XR23 400 =R17 550 2.E. VAT AMOUNT=15/100XR23 400 =R3 510 2.F. R23 400+R3 510=R26 910 OR R23 400X115/100=R26 910 3.G.R12 696X100/120 =R10 580 MARK UP+COST=SELLING PRICE 20+100=120 H.R14 600-R1 904 =R12 696 OR R14 600X100/115 =R12 696 I.R14 600X15/115 =R1 904 100/115=EXCLUDE 115/100=INCLUDE 15/100=VAT AMOUNT 15/115=VAT AMOUNT 4.J.SELLING PRICE-COST PRICE =R15 500-R10 500 MARK-UP/GROSS PROFIT=R5 000 R5 000/R15 500X100/1= 32% 4.K. R15 500X15/100 =R2 325 4.L.R15 500(SP)+R2 325(VA)=R17 825 OR R15 500X115/100=R17 825 5.M.R35 400-R25 600=R9 800/R25 600X100/1=38% 5.N.R35 400X15/100=R5 310 5.O.R35 400+R5 310=R40 710 OR R35 400X115/100=R40 710