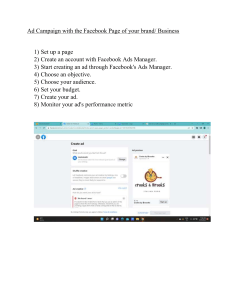

4. REVIEW ON RESEARCH TOOLS AND TECHNIQUES In today’s competitive real estate investing business, performing a thorough market research has become a necessity to succeed. Instead of taking months to do so, make use of real estate market research tools that technology has created to benefit property investors. 1. MANGOOLS (SEO) • While you can go about improving your SEO on your own, it may be worthwhile to look for some help. That doesn’t necessarily mean spending money – take a look at SEO tools like Mangools that offer free trials to get started. If it seems like a good fit, you can then decide to pay a little on top to get even more out of their services. 2. SQUARESPACE (WEB DESIGN) You don’t need to be a computer coding expert to design a website. With online services like Squarespace, creating a website is as easy as clicking, dragging, and dropping. There are plenty of pre-made templates to pick from so that you can keep your website looking unique and stand out from the competition. 3. HOOTSUITE (SOCIAL MEDIA) Who has time to be active on social media all day every day? You can use an online social media scheduling tool like Hootsuite to get your next few posts lined up in advance. This is extremely useful as a way to keep your audience engaged even when you’re not posting in real-time. 4. CUSTOMER REVIEWS There are plenty of review sites out there that can be incorporated into a real estate marketing plan. 5. FACEBOOK ADS (SOCIAL MEDIA ADVERTIZING) Since Facebook has the most monthly active users of any social media platform (2.41 billion), it’s fair to say that Facebook Ads is one of the best real estate marketing tools you can make use of. Regardless of your budget or experience with advertising, Facebook Ads offers solutions that can help you reach your intended audience and start bringing in more leads. 5. REVIEW ON CASH FLOW AS USEFUL TOOL IN FORECASTING AND REAL ESTATE CONSULTING STEP 1: FINE-TUNE YOUR OVERALL CASH FORECASTING GOALS. • Ensure smooth operations. • Maintain stable relationships. • Drive strategic decisions. STEP 2: INCREASE ACCURACY BY USING THE RIGHT MECHANISMS. Just like any other financial planning and analysis tool, your cash flow forecast is not a perfect science. But when you carefully evaluate and balance the components that make up your forecast, it can greatly improve your accuracy. Here are key elements to consider: • Time period: Do you want to forecast daily, weekly, or monthly? This decision is largely reliant on your type of business as well as its size. • System data: Assess what data is available from the systems your company already has that can be incorporated into your forecasting model. This “true” data can serve as a more accurate input for your cash-flow model, so it’s important to understand how frequently, and in what ways, you can leverage it to make the model more accurate. • Assumptions: In addition to the systematically available data described above, you will also have to make assumptions. These assumptions must be clearly specified in your forecasting model and it’s important to periodically reassess them. STEP 3: CONSIDER THE OPERATIONAL SETUP OF YOUR BANKING STRUCTURE. Trust accounts:These can be an effective way to manage cash for a given type of corporations that typically operate as privately held partnerships. Controlled disbursement accounts:This options works best when you want to tightly control your cash. With this structure, you can understand your company’s next day’s cash position at the end of each day, making it a good option for smaller corporations without deep cash reserves. Depository accounts:This set-up serves as a tool that gives multiple people access to deposit checks without being able to withdrawal that money. fees/sweeps: During the initial set-up, you’ll want to assess and evaluate fees associated with your banking structure, and conversely, sweeps may be an effective way to earn extra interest on your cash.