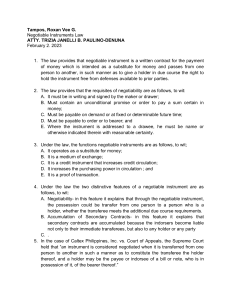

UNIVERSITY OF ST. LA SALLE NEGOTIABLE INSTRUMENTS LAW MIDTERM EXAMINATION Direction: Read and select the best answer for the following questions. 1. Which of the following is not a negotiable instrument? a. Treasury warrant b. Bond c. Certificate of deposit d. Banker's acceptance 2. Which of the following is not a requisite of a negotiable promissory note? a. The promissory note must be in writing and signed by the maker. b. The promissory note must be payable on demand, or at a fixed time or at a determinable future time. c. The promissory note must be payable to a specified person named therein. d. The payee of a promissory note payable to order must be named or otherwise indicated therein with reasonable certainty. 3. Which of the following instruments is non-negotiable? a. A bill of exchange written with the use of pencil. b. A bill of exchange written on a wall. c. A promissory note written on a piece of paper. d. A promissory note signed with a mark. 4. Which of the following instruments is an invalid instrument? a. "Pay P or order P1,000 out of my share from profits of ABC, LTD." Signed. M b. "Pay P or order P2,000 in two equal installments plus 10% interest per annum." Signed. M. c. "Pay P or order P3,000 one month before X's demise." Signed. M. d. None of the above. 5. Which of the following instruments is not payable with a sum certain in money and is therefore, non-negotiable? a. I promise to pay bearer P25,000 plus interest at the end of the current calendar year. b. Pay to P or order P25,000 in installment. c. I promise to pay P or order USA $500 with exchange at the current rate. d. I promise to pay bearer P25,000 on or before December 31, 2030, with 10% attorney’s fee and costs of collection in case of default. 6. Which of the following promissory notes payable in installment is negotiable? a. I promise to pay P or order P30,000 payable in two (2) installments. b. I promise to pay P or order P30,000 payable in four (4) quarterly installments effective to date. c. I promise to pay P or order P30,000 payable at P500 for each installment. d. None of the above. 7. Which of the following instruments is not unconditional and is, therefore, non-negotiable? a. "Pay P or order P1,000 and reimburse yourself with the proceeds of the watch you are selling to me." b. "Pay bearer P4,000 from my share in the profits of our partnership business." c. "I promise to pay P or order P3,000 as payment for the ring I purchased from him." d. "Pay bearer P2,000 and charge the payment to my account in your hands." 8. Which of the following instruments is payable at a fixed or determinable future time? a. I promise to pay P or order P20,000 30 days before X’s demise. b. I promise to pay P or order P20,000 upon sight. c. I promise to pay P or order P20,000. d. None of the above 9. Which of the following instruments is still negotiable despite the additional provision thereof? a. I promise to pay P or order P50,000 or to paint his house at the option of holder. b. I promise to pay bearer P50,000 and all the taxes that may be assessed on the mortgage securing this note. c. I promise to pay P or order P50,000 and to insure the movable pledged to secure the note. d. I promise to pay bearer P50,000 and to give him a gold ring. 10. Which of the following omissions will render the instrument non-negotiable? a. It is not dated. b. It does not specify the value given. c. It does not specify the place where it is payable. d. None of the above. 11. Which of the following statements to instruments payable on demand is false? a. A bill of exchange which is payable at sight is payable as soon as it is seen by the drawer. b. An instrument which payable on call is payable on demand. c. An instrument where no time for payment is expressed is payable on demand. d. An instrument which is issued, accepted or indorsed when overdue is deemed payable on demand as regards the person so issuing, accepting or indorsing it. 12. Which of the following is an order instrument? a. I promise to pay X or bearer. b. I promise to pay Captain Barbell or order. c. Indorsements made at the back of an order instrument: Pay to A, (Sgd.) P; Pay to B, (Sgd.) A; Pay to C, (Sgd.) B; Sgd. C. d. None of the above. Regulatory Framework for Business Transactions (NEGOTIABLE INSTRUMENTS) 13. Which of the following is a bearer instrument? a. Pay P the sum of P10,000 on demand. b. Pay to the order of P the sum of P10,000 on December 31, 2030. c. Pay order P10,000 upon sight. d. None of the above. 14. Which of the following statements is correct? a. The determination of the maturity date is not necessary in an instrument which is payable at a fixed period after date. b. The date of issue of a promissory note payable on demand is essential to make the instrument negotiable. c. An instrument which is ante-dated is an invalid instrument. d. The holder of an instrument which is payable at a fixed period after date but is issued undated may insert therein the true date of issue. 15. M made and delivered a negotiable promissory note payable to P or order and authorized P to fill up the amount of no more than P20,000. P filled up the amount of P35,000. P subsequently indorsed and delivered the note to A who subsequently indorsed and delivered the note to B, a holder in due course. Who may be held liable to B for P35,000? a. P only b. A only c. P and A only d. M, P and A 16. Which of the following statements is incorrect? a. Where there is a discrepancy between the sum payable expressed in words and that which is expressed in figures, the words prevails over the figures. b. Where there is a conflict between the written provisions and the printed provisions of the instrument, the written provisions prevail over the printed provisions. c. Where there is doubt whether an instrument is a bill or a note, the issuer or drawer may treat it as either at his election. d. Where the instrument which contains the words I promise to pay is signed by two or more persons, they are deemed to be solidarily liable thereon. 17. Which of the following statements is false? a. It is the intent to defraud that distinguishes forgery from spoliation. b. Forgery has the effect of making the instrument void. c. Parties subsequent to a forged indorsement cannot acquire any right as against parties prior to the forgery. d. The party whose indorsement is forged in a note which is originally payable to bearer is liable to a holder in due course. 18. M executed a negotiable promissory note in the sum of P100,000 to the order of P for the purchase of jewelry which P does not own or possess. P indorsed and delivered the note to A, a holder in due course. From whom may A collect P100,000? a. From both M and P b. From M only c. From P only d. None of the above 19. Which of the following exemplifies negotiation within the meaning of Negotiable Instruments Law? a. A promissory note executed by M in favor of P or his order is delivered by P to A without indorsement. b. A promissory note executed by M in favor of P is indorsed and delivered by P to A. c. A promissory note executed by M in favor of bearer is delivered by M to P for safekeeping. d. None of the above. 20. Which of the following is an invalid indorsement? a. An indorsement which is contained in an allonge where there is still sufficient space at the bank of the negotiable instrument. b. A partial indorsement is made where part of the amount has already been paid. c. A note for P10,000 is indorsed by A for P7,000 and by B for P3,000 simultaneously. d. A note for P10,000 is indorsed by A and B for the full amount. 21. Which of the following statements is true? a. A blank indorsement of an order instrument converts the instrument into a bearer instrument. b. An order instrument which is specially indorsed by P can only be further negotiation by P’s special indorsement. c. A bearer instrument cannot be negotiated by indorsement coupled with delivery. d. A special indorsement must contain the words “or order” or “to the order of” to make it further negotiable. 22. M made a negotiable promissory note for P5,000 payable to the order of P. P indorsed and delivered the note to A as follows: "Pay A upon the passing of A of the Bar Examination next year." A flunked the bar examination held in the following year and the note matured. Which is correct? a. M may or may not pay A the sum of P5,000 and in case he does, he discharged from his obligation on the note. b. M should not pay A the sum of P5,000 because the condition is not fulfilled. c. M and P should not pay A the sum of P5,000 because the promise is not unconditional and therefore, the instrument is non-negotiable. d. None of the above. 23. Which of the following is not a requisite of a holder in due course? a. He took the instrument complete and regular upon its face. b. He became the holder of the instrument before it is overdue and without notice that it had been previously dishonored if such was the fact. c. He took the instrument in good faith and for value. d. He has no knowledge of any fact which would impair the validity of the instrument or render it valueless. 24. In which of the following cases is the holder deemed to be a holder in due course? a. The holder acquired the instrument through the indorsement of one of the two payees. b. The holder acquired the instrument at noontime on its maturity date. c. The holder accepted the instrument from the payee under a strong and reliable warning of the latter's swindling activities. d. None of the above 25. Which of the following is a real defense that may be set up against any type of holder? a. Want of authority of agent. b. Want of delivery of complete instrument. c. Absence or failure of consideration. d. Acquisition of instrument by force, duress, fear or by unlawful means. 26. Which of the following is a characteristic of fraud in factum or fraud in esse contractus? a. It is fraud in the execution of the instrument. b. The person actually knows that what he signed is a negotiable instrument but he was induced to do so because of insidious words or fraudulent machinations. c. It is a personal defense that cannot be set up against a holder in due course. d. None of the above 27. M made a negotiable promissory note payable to P or order as payment for the purchase of what appears to be a genuine diamond ring but it was in fact a mere piece of valueless glass. P specially indorsed and delivered the note to A who subsequently indorsed and delivered the to B. B specially indorsed and delivered the note to C who subsequently indorsed and delivered the note to D. A, B and D knew about the fraud committed by P. C, however, has no knowledge thereto. May D collect from ? a. No because fraud in inducement is a real defense. b. No because M has a personal defense that he can avail against D who is an immediate party to him. c. Yes because D is deemed a holder in due course since he derives his title from a holder in due course and there D is not subject to personal defense of fraud in inducement. d. None of the above 28. M made an autograph in a sheet of paper to P who converted it to a promissory note with amount of P100,000 in favor of P or order. P indorsed the note to A who knew about the fraud. A, in turn, indorsed the note to B, a holder in due course. B further negotiated the note to C, a present holder. Which is true? a. M is liable to C if the latter has no knowledge of the fraud. b. M is liable to C whether or not the latter has knowledge of the fraud. c. M is not liable to C if the latter has no knowledge of the fraud. d. M is not liable to C whether or not the latter has no knowledge of fraud. 29. Which is not a characteristic of an irregular indorser? a. His signature is placed on the instrument after its delivery to the payee. b. He is not a party to the instrument. c. The purpose of the indorsement is not to transfer title to the instrument. d. His warranties are the same as those of a general indorser. 30. Which of the following parties is secondarily liable to a negotiable instrument? a. Maker of a promissory note. b. Drawee of a bill of exchange. c. Acceptor of a bill of exchange. d. Drawer of a bill of exchange. 31. Which of the following constitutes material alteration? a. Changing the sum payable written in figures without changing the sum payable written in words b. Insertion of legal rate of interest where payment of interest is stipulated but without specifying the rate c. Placing the name of the indorsee above the indorser's signature to convert a blank indorsement into a special indorsement d. None of the above 32. M made a negotiable promissory note for P100,000 payable to P or order. P altered the amount by increasing it to P150,000. P then indorsed and delivered the note to A who subsequently indorsed and delivered the note to B, a holder in due course. Which is correct? a. M, P and A are not liable because material alteration is a real defense. b. M is liable to B for P100,000, the original amount, while P and A are liable to B for the new amount of P150,000 or P50,000 in case M pays the P100,000. c. M is not liable to B while P and A are liable to B for the original amount of P100,000. d. M, P and A are liable to B for the new amount of P150,000. 33. Which of the following bills of exchange may not be treated optionally as promissory note by the holder? a. The drawer and drawee are the same person. b. The drawee is a fictitious person. c. The payee is a fictitious person. d. The drawee is an incapacitated person. 34. Presentment for acceptance, coupled with presentment for payment, is necessary to charge secondary parties in a. Bills payable after sight b. Bills payable on demand c. Bills payable at a fixed date d. Bills payable at a fixed period after date 35. Which of the following statements is false? a. Where the drawee refuses to return the bill as accepted or non-accepted, or destroys the same, within twenty-four (24) hours after its delivery or within such other period as the holder may allow, he is deemed to have accepted the same. b. The holder who assents to the qualified acceptance must give notice of such qualified acceptance to the drawer and prior indorsers so that the latter may decide to assent or dissent thereto. c. A check must be presented for acceptance prior to its presentment for payment. d. The drawee shall only become liable on the bill of exchange when he accepts the same upon presentment for acceptance. 36. Which is false? a. A manager’s check operates as an assignment of funds to the credit of the payee of holder which is no longer subject to countermand. b. A check which is crossed specially can only be deposited in the bank whose name is written between the parallel lines. c. A check which is crossed generally can be deposited in any bank where the holder maintains a deposit. d. A crossed check is not a negotiable instrument. 37. In banking practice, a check becomes stale when it is not presented for payment within how many days from maturity date of check? a. One (1) month b. Three (3) months c. Six (6) months d. Twelve (12) months 38. A issued a promissory note to the order of B for P10,000.00 payable on September 30, 2010 in payment of a TV set sold by B to him. B failed to deliver the TV set to A and instead transferred the note to C for value but without endorsement. Which of the effects of the transactions listed below is valid? A. B. C. D. C is deemed a holder for value when B transferred the note to him. C becomes a holder in due course when B endorsed the note to C on October 4, 2010. C has no right to compel B to make the proper endorsement to him. C cannot collect from A because of A’s defense of lack of consideration. 39. A issues a bill payable to the order of B. Later B, without indorsing the bill transfers for a consideration said bill to C. As a result, one of the following is not correct. A. B. C. D. The bill is merely assigned and not negotiated The transferee acquired such title as the transferor had therein Transferee acquired the right to have the indorsement of the transferor C is an assignee with the rights of a holder in due course. 40. I promise to pay to the order of B, P10,000 from ________ after date. First statement. Sgd. X The note is negotiable because after date refers to the date of issuance and date of issuance can be inserted therein by the holder. Second statement. The note is negotiable because this can be considered payable on demand. A. B. First statement is true, second statement is false. First statement is false, second statement is true. C. D. Both statements are true. Both statements are false. 41. A separate paper where indorsements may be made A. B. C. D. Sponge Ilonge Lounge Allonge 42. One is not a condition to be a holder in due course. A. That it is complete and regular upon its ace. B. That he became the holder of it before it was overdue and without notice that it had been previously dishonored if such was the fact. C. That at the time it was negotiated to him it has no infirmity or defect in the title of the person negotiating it. D. That he took it in good faith and for value. 43. A promissory note is indorsed to C who has knowledge of the illegal consideration between A, maker and B, payee. Later C negotiates the note to D under circumstances which would make D a holder in due course. D in turn indorses it to E and E back to C. Which is correct? A. C can be considered a holder in due course because he derived his title from E. B. C cannot be considered a holder in due course. C. D, E and C are holders in due course. D. C can collect either from A or B but not from D and E. 44. One of the following indorsements is a valid negotiation A. B. C. D. Pay to A P6,000 (amount of the instrument is P10,000) Pay to A P7,000 and to B, the balance (amount of the note is P10,000) Pay to A P8,000 out of the amount of P10,000 of this note. Pay to A and B P10,000. 45. The following rules of construction apply where the language of the instrument is ambiguous or there are omissions therein, except: A. Where the instrument is not dated, it will be considered to be dated as of the time it was issued. B. Where there is a conflict between the written and printed provisions of the instrument, the written provisions prevail. C. Where the instrument provides for the payment of interest without specifying the date from which interest is to run, the interest runs from the date of the instrument, and if the instrument is undated, from the issue thereof. D. Where the sum payable is expressed in words and also in figures and there is discrepancy between the two, the sum denoted by the figures is the sum payable; but if the figures are ambiguous or uncertain, reference may be had to the words to fix the amount. 46. The following instruments were presented to you for evaluation: I. “Pay to the order of A, P20,000”. II. “Pay to the order of A, P20,000 or deliver to him a piano of the same value, at his option.” III. “Pay to the order of A, P20,000 or deliver to him a TV of the same value”. IV. “Pay to the order of A a piano worth P20,000”. Assuming all the other requisites of negotiability are present, which of the foregoing instruments are not negotiable? A. B. Instruments I and II Instruments I and III 47. Consider these two statements: C. D. Instruments II and III Instruments III and IV An instrument originally payable to order maybe converted into a bearer instrument. II. An instrument originally payable to bearer maybe converted into an order instrument. A. B. Both statements are true Both statements are false C. D. Only statement I is true Only statement II is true 48. Which of the following does not apply to a non-negotiable instrument? A. B. C. D. The instrument can be assigned The transfer of the instrument does not give the transferee the right to collect. The transferee becomes a holder. The transferee becomes an assignee. 49. The following are negotiable instruments, except A. Pay to the order of A P10,000 on or before June 2, 2010 and reimburse yourself out of my deposit with you. To B Sgd. C B. Pay to the order of A P10,000 on or before June 12, 2010 and charge the same to my account. To B Sgd. C C. Pay to the order of A P10,000 on or before June 12, 2010 in payment of the purchase price of one cavan of rice I bought from him. To B Sgd. C D. Pay to the order of A P10,000 subject to the terms and conditions of the sales contract between him and the undersigned. To B Sgd. C 50. The negotiable character of an instrument otherwise negotiable is affected by this provision which A. B. C. D. Authorizes the sale of collateral securities in case the instrument be not paid at maturity. Authorizes a confession of judgment if the instrument be not paid at maturity. Gives the maker an election to require something to be done in lieu of payment of money. Waives the benefit of any intended for the advantage or protection of the obligor.