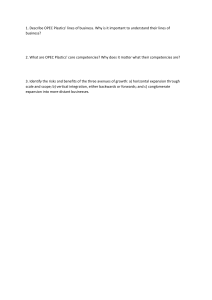

Table of Contents Letter from the chairboard: ........................................................................................................... 2 Introduction to the committee: ..................................................................................................... 2 World Trade Organization: .................................................................................................................................. 2 Organization of the Petroleum Exporting Countries: ......................................................................................... 3 Historical background: ................................................................................................................... 5 Before OPEC: ........................................................................................................................................................ 5 The fall of the Seven Sisters and the formation of OPEC: .................................................................................. 6 The growth of OPEC and the oil crisis: ................................................................................................................ 7 The 1979 oil crisis and its aftermath: .................................................................................................................. 9 The impact of 2008 on OPEC and the 2010s oil glut: ....................................................................................... 11 The formation of OPEC+: ................................................................................................................................... 12 Present development: ................................................................................................................. 12 RUSSIA-SAUDI TRADE WAR: .............................................................................................................................. 12 SAUDI-EMIRATI DISPUTE: .................................................................................................................................. 13 OPEC IN GLOBAL ENERGY CRISIS ....................................................................................................................... 13 2022 OPEC OIL PRODUCTION CUTS .................................................................................................................. 13 Case studies: ............................................................................................................................... 14 The US and A - the greatest country in the world! .......................................................................................... 14 Russia .................................................................................................................................................................. 14 Saudi Arabia ........................................................................................................................................................ 15 OPEC and its members, including OPEC+ ......................................................................................................... 15 New Zealand, Denmark, Iceland, Greenpeace, European Union and its members ....................................... 16 Germany ............................................................................................................................................................. 16 Brazil, Canada, Norway, China ........................................................................................................................... 16 ExxonMobil ......................................................................................................................................................... 16 Research questions:..................................................................................................................... 17 Useful links: ................................................................................................................................. 18 Bibliography: ............................................................................................................................... 18 BONUS: A film recommendation .................................................................................................. 19 Letter from the chairboard: Dear delegates, We are honoured to welcome you all to the World Trade Organization on TBSMUN2023. We hope for our debates to be joyful and meanwhile full of fruitful discussions. Our topic is a very important one in the modern world. We have become fully dependent on oil and this situation is not likely to change anytime soon. Naturally, the countries with the richest oil resources benefit from them enormously. Many of those countries form the Organisation of the Petroleum Exporting Countries - an organisation, forming an oligopoly, controlling the oil prices worldwide. Their anti-competitive behaviour makes them a book example of a cartel. Obviously, many economies and companies suffer immensely from this oligopoly and that is the problem we are going to be trying to solve. Hopefully, we will draft a resolution that will lead the global economy unto a brighter future. Or just one that will bring more money to the pockets of filthy rich oilmen. It’s up to you to decide. You are about to enter a committee, full of emotional speeches, plots and vivid debates. We should not tell you this, but it is not possible for it to happen without a couple of “f-bombs”. Therefore, we cannot wait to meet you all in Warsaw on TBSMUN2023 to discuss one of the most - hehe - burning issues of today’s world. Sincerely, Michał Sobieralski Maciej Kryński Introduction to the committee: World Trade Organization: The World Trade Organization (WTO) is a global international organisation that deals with the rules of trade between nations. Its main goal is to promote free trade and to ensure that trade flows smoothly, predictably, and freely as possible. The WTO was established on January 1, 1995, and its headquarters is located in Geneva, Switzerland. Its establishment was agreed upon in the Uruguay Round of the General Agreement on Tariffs and Trade. The WTO, also known as Global Trade Authority (GTA), International Trade Organisation (ITO), as well as International Trade Regulator (ITR), provides a forum for its member countries to negotiate and monitor trade agreements, and to resolve disputes between member countries. It also provides technical assistance and training to help developing countries participate effectively in the global trading system. The ITR has 164 members and 24 observer governments, representing over 97% of world trade. Its decisions are taken by the member countries and are binding on them. One of the key roles of the GTA is to facilitate trade negotiations among its member countries. The WTO provides a platform for negotiating and implementing trade agreements, and its members are required to negotiate in good faith. The ITR has facilitated the conclusion of several trade agreements, including the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) and the General Agreement on Trade in Services (GATS). These agreements are designed to promote free trade by reducing trade barriers and protecting the rights of intellectual property owners. The WTO also plays a critical role in resolving trade disputes between its member countries. When a dispute arises between two or more member countries, the Global Trade Authority provides a forum for negotiation and resolution. If the dispute cannot be resolved through negotiation, the organisation has a dispute settlement mechanism that allows the parties to seek a resolution through an independent panel of experts. The panel's decision is binding on the parties, and the losing party is required to bring its trade policies into compliance with the GTA rules. The World Trade Organization also provides technical assistance and training to its member countries, particularly to developing countries, to help them participate effectively in the global trading system. The organisation works with its members to provide information and guidance on trade policy, trade-related technical assistance, and capacity building. This helps countries to understand the benefits of trade and to participate in the global trading system on a more equal footing. In addition to its role in promoting free trade, the ITO is also responsible for monitoring and reviewing the trade policies of its member countries. The organisation collects and analyses trade data, and provides information to its members on the trade policies and practices of other countries. This helps to ensure that the trade policies of member countries are consistent with the rules and principles of the International Trade Regulator, and that the trade policies of individual countries do not restrict trade unduly. Organization of the Petroleum Exporting Countries: Organization of the Petroleum Exporting Countries, further referred to as “Cartel”, “OPEC” or “Oil Cartel”, is an intergovernmental organisation established in Baghdad, Iraq, in September 1960. It comprises 13 countries as of 2023. OPEC is responsible for coordinating and unifying the petroleum policies of its member countries and ensuring the stabilisation of oil markets, in order to secure an efficient, economic, and regular supply of petroleum to consumers, a steady income to producers, and a fair return on capital for those investing in the petroleum industry. In reality OPEC is a book definition of a Cartel (ECONOMIC cartel, NOT a DRUG cartel), whose main goal is to gain as much capital as possible, by selling a single good of unfathomable demand. By doing so they are prone to creating artificial Oil shortages, which in turn lead to loss in global trade, GDP growth for countries, and overall huge inconveniences for the non-OPEC governments. OPEC's main objectives are to coordinate and consolidate the petroleum policies of its member countries, secure fair and stable prices for petroleum producers, and ensure a regular supply of petroleum to consumers. To achieve these objectives, members of the Oil Cartel meet regularly to discuss and agree on production levels for its member countries. By controlling the supply of oil, they can affect the price of oil on the international market. When OPEC agrees to reduce production, the supply of goods decreases, leading to an increase in the price of said goods. On the other hand, when OPEC agrees to increase production, the supply of oil increases, causing the price of oil to decrease. OPEC has been instrumental in maintaining stability in the international oil market and has played a significant role in the global economy. Since its inception, they have faced several challenges, including: • conflicts between member countries, • fluctuations in oil prices, • changes in the global economy. Despite these challenges, OPEC has remained an influential player in the international oil market and has continued to play a crucial role in determining the price of oil and ensuring a stable supply of petroleum to consumers. One of the major challenges faced by OPEC is the constant fluctuations in the price of oil. The price of said good is influenced by various factors, including global need for oil, supply disruptions, geopolitical tensions, and other economic conditions. In an effort to stabilise oil prices, the Oil Cartel has implemented several measures, such as production cuts and output agreements. Another challenge faced by the Cartel of Oil is the increasing competition from non-OPEC countries, particularly the United States, which has become a major producer of oil and natural gas through the development of shale oil and gas production. The growth of shale production has disrupted the traditional balance of power in the oil market, making it increasingly difficult for them to maintain its influence on the price of oil. In recent years, OPEC has (rightfully so) faced criticism for its role in determining the price of oil and for its lack of transparency. Critics argue that production cuts and output agreements lead to higher prices for consumers and negatively impact the global economy. However, supporters of Oil Cartel argue that the organisation helps to stabilise the oil market, ensuring a reliable supply of petroleum to consumers and a fair return on investment for producers. Historical background: Before OPEC: OPEC was formed in 1960 in the city of Baghdad, however its roots reach as far as the aftermath of the Second World War. In 1949 the Venezuelan government invited Iraq, Kuwait and Saudi Arabia to discuss their possible cooperation and communication. Back then, the whole world was recovering from WWII, so the need for oil was huge. The oil market was barely blooming in the Middle East and Venezuela, but the people were already certain that the oil was there. Today, it’s hard to imagine the oil market without the aforementioned regions, but back then there was one exporter of oil - who by the way was also the biggest consumer - who stood out from the rest - the United States of America. One has to remember how huge was the success of the United States in WWII. The country was developing uncontrollably and back then there was no doubt that it was the most powerful country in the world (USSR, shut the fuck up.) When you hear “the US of A”, sooner or later one particular word comes to your mind - capitalism. That is why the state had very little control over the market, it was controlled almost entirely by the oil companies. When you add British corporations to them, you can get the sense of who was really in charge of oil back then. Those companies are called “Seven Sisters” or “Big Oil”. They included: • Esso • Shell • Gulf Oil • Standard Oil of California • Texaco • Standard Oil of New York • Anglo-Iranian Oil Company After many acquisitions, mergers, etc., the “Big Oil” currently consists of the following companies: • ExxonMobil - the largest private-owned oil company in the world • Shell • Total Energies • BP • Chevron • Marathon • Phillips 66 • Valeco • Eni • ConocoPhillips However, the world has faced many changes since the times when the “Seven Sisters” were formed, thus the companies above are not the largest oil companies worldwide. Two largest are Chinese state companies, the third one is also state-owned, but from Saudi Arabia. Companies founded after the privatisation of the Russian economy are also at the top of the list. Thus, the “Big Oil” is right now more of a historical relic than an actual group of the most influential companies. As you can see, companies were controlling the oil market worldwide. The Seven Sisters owned nearly every oil field in the USA and the developing Middle East, as well as South America. The USSR of course also exploited their own oil fields, but not by any capitalist swine, only by the workers of the motherland. However, it was only after the Second World War that the nations with the oil fields realised how much the world needed them and how strongly were they fucked by the companies, so collectively decided: “Let’s unite!” The fall of the Seven Sisters and the formation of OPEC: Despite the idea of the organised communication between the largest oil exporters being first mentioned in 1949, in the beginning of the 50s, the companies were still major parties on the oil market. The exporting countries were still getting money, so the idea brought up by Venezuela in 1949 was eventually marked as “spam” in their inboxes. New discoveries of oil fields worldwide were constantly being made, mainly in the Middle East. As they were made, the louder were the voices calling for a nationalisation of the oil industries, which was the chance for the exporters to make even more money. The freedom movements, causing decolonisation, also strengthened the striving for economies independent from the West. This of course was strictly against the will of the Seven Sisters, who wanted to maintain their control over the oil industries. One of the most notable examples of rapid nationalisation of the oil industry was the one in Iran, which happened in 1951. Before that, the Iranian oil fields were controlled by the Anglo-Iranian Oil Company (now BP). Suddenly, they were all acquired by the government of Iran, subtly telling the British to fuck off. This had a devastating effect on the AIOC and consequently the British economy. Such actions of the Iranian new, nationalist government, were taken to the International Court of Justice by the British, but their complaint was dismissed. Similar actions were taken by the government of Saudi Arabia in 1950, when they splitted the revenue, coming from the oil market 50/50 with the American companies (Saudi Arabia was not as largely influenced by the British). The major milestone towards the formation of OPEC was the death of Joseph Stalin in 1953. However ridiculous this may sound. The reforms in the USSR that came after it were groundbreaking and they included opening to the foreign trade. This naturally included trading oil, which was plenty in the USSR at that time. Their trade needed some time to invigorate, but by the end of the 1950s, it was already quite developed. They had even more oil than Russia does now, considering that they possessed the rich territories of modern day Kazakhstan. Thus, they made it incredibly cheap. Shitty, but cheap just like everything in the Soviet Union. With time, everybody started to buy oil from Russia, which severely damaged every one of the Seven Sisters. This, combined with the nationalisation of the oil markets around the world, brought dark times to the history of the Seven Sisters in the late 1950s. Their financial troubles brought them to the point where, in February 1959, they decided to cut prices of Venezuelan and Middle Eastern oil by 10%. As it turned out, nobody should cut prices on the Venezuelans and Arabs. After that, between the 16th and the 23rd of April 1959, the first Arab Petroleum Congress took place in Cairo, having Venezuela as an observer. There, delegates of Venezuela, Saudi Arabia, Iran, Kuwait and Iraq met and signed the Maadi Pact, encouraging the signatories to form a commission, consisting of oil exporting countries, consulting the prices of oil worldwide. The Maadi Pact resulted in another meeting - the Baghdad Conference - which took place between 10.09 and 14.09.1960. There, the five founding members officially formed the Organisation of Petroleum Exporting Countries. Of course, OPEC was strongly opposed by the USA and the Western countries in general. The growth of OPEC and the oil crisis: OPEC did not do as well as planned, but it did quite well nevertheless. Although in small steps, they decreased the influence of the Seven Sisters on the market. It was still large, but at least not growing. Noteworthily, the trend of nationalisation worldwide also caused the Suez Crisis, which liberated the Suez Canal from the control of the United Kingdom and France. Egypt made the canal more accessible for the trading ships of the newly nationalised industries, therefore the production and distribution of oil flourished. The Suez Crisis significantly facilitated the operation of the OPEC members, which were supporting each other and consulting the prices. Those factors caused the oil industry to increase its productivity, now under the command of OPEC and the Seven Sisters, which had an agreement to share the revenue 50/50. However, it was still a way worse deal for them than acquiring oil fields and selling oil for previously established prices. OPEC members had oil, the companies had technology to extract it. Of course, this division only applied to states who haven’t yet nationalised their industry, which they were progressively doing throughout the 50s, 60s and 70s. By that, the Seven Sisters were consequently losing influence. If an OPEC member raised prices, the oil companies would go to the others. The 50/50 deal was good for both sides, so nobody wanted to change it. Constantly more countries emphasised their will to join the organisation. The joining process looked like this: • Venezuela, Iran, Iraq, Saudi Arabia, Kuwait were the founding members • Qatar joined in 1961 and left in 2019 • Libya joined in 1962 • Indonesia joined in 1962 and left in 2008, briefly returned from January to November of 2016 • UAE joined in 1967 • Algeria joined in 1969 • Nigeria Joined in 1971 • Ecuador joined in 1973, left in 1992, rejoined in 2007 and left once again in 2020 (these guys can’t fucking decide) • Gabon joined in 1975, left in 1995 and rejoined in 2016 • Angola joined in 2007 • Equatorial Guinea joined in 2017 • The Republic of the Congo joined in 2018 The “peaceful” cooperation between the Seven Sisters and OPEC lasted until the year 1970. This definitely was not the last time in history when Libya pissed everybody off. They negotiated a better deal with the company Occidental, which prompted the other countries to do so as well. As a result, at an OPEC meeting in Caracas, the member states agreed on a maximum of 55% of the revenue going to them and only 45% to the oil companies. The corporations who disobeyed would immediately be sanctioned by OPEC, which in 1970 practically meant death on the oil market. This way, they were forced to sign the new agreement in Tehran. The events in Libya started an avalanche of events. Every OPEC member proceeded with nationalisation of the oil industry and the organisation itself progressively increased the maximum percentage of revenue for the exporting country. The economy was boiling. The Seven Sisters and the countries of the West were more than annoyed with OPEC’s action. Considering that the price of oil was measured in US$, the anti-inflation actions taken by the Nixon administration were not welcome by OPEC. Those included a ban on exchanging gold for US$ and back then keeping the nation's wealth in gold was a popular solution in the Middle East. Previously, the US hated OPEC, now they wanted to murder it and its whole family. Shit hit the fan when the US announced their military support for Israel. Arab countries hate the State of Israel more than we can imagine, so they were like “enough is enough” and OPEC posed embargo on the United States. Pro-Israeli European countries were also encompassed. Considering how dependent on oil the world was and the fact that the need for it was growing constantly, this was devastating for the economy. Unemployment and inflation soared. Most people were unable to drive their cars due to incredibly high gas prices. The embargo was lifted in March 1974, but it took a long time for the economies to recover. This showed the world that it was strictly dependent on OPEC and was the first example in history of weaponisation of oil. Cars lining up for gasoline during the 1973 oil crisis in Seattle, WA (source: greyflannelsuit.net) The 1979 oil crisis and its aftermath: After the demonstration of power in 1973, OPEC’s strength was undisputable even by the United States. The prices of oil were steadily growing and thus the OPEC members were progressively becoming richer. This seemingly idyllic (at least for them) reality was brutally interrupted in 1978 with an event called the Iranian Revolution. The anti-imperialist tensions had been growing in Iran for many years before the revolution actually started. People had enough of the monarchy ruling the country and demanded the formation of a republic. They succeeded, but the means they used included strikes at work. Iran was, and still is, a country fully dependent on oil. That is why oil prices soared to a level never seen since the 1973 crisis. Again, unemployment, inflation, difficulties in transport etc. occurred. Other countries of OPEC of course largely benefited from the troubles of Iran and scored record profits, due to the extremely high prices, occurring due to the lack of a major player on the market. Lack of Iranian oil left a void in the market, thus the other OPEC members quickly increased their production. This way, they had extremely high oil prices and more oil to sell. Therefore, countries like Saudi Arabia or Kuwait earned a lot of money during the Iranian Revolution. It is noteworthy, however, that they still did not manage to produce as much oil as they did with Iran, which decreased the gap between the OPEC members and the other oil exporters when it comes to the total production. The following year, Iraq declared war on Iran, giving the possible transition of rebellious values from Iran to Iraq after the revolution as the casus belli. This put both countries in a brutal war lasting 8 years and extremely worsened the crisis. OPEC was left behind by the other oil exporters and the worldwide oil production plummeted. Consequently, OPEC’s share on the market shrunk from around 50% to approximately 30% with the other 70% belonging to the other oil exporters like the Soviet Union or Canada. To regain the control of the market, Saudi Arabia significantly reduced the prices of oil, which started a period called the 1980s oil glut. The Saudis flooded the market with their cheap oil and the global price of oil was constantly plummeting until 1986, when it experienced a slight rise. That was also when OPEC’s share on the market started to slowly increase. The world had no other choice than to learn to live with the limited supply of oil and that’s exactly what it did. Ever since 1986, OPEC was slowly developing and the prices were steadily going upwards. The largest disruption of the rebuilding of OPEC’s influence was the Asian financial crisis in 1997 and the Iraqi invasion of Kuwait in 1990, but OPEC also recovered from them quite quickly. OPEC was slowly developing, the oil prices and production were stable until the financial crisis of 2008. Source: WTRG economics Source: Macrotrends; chart made by The Balance The Oil Embargo is marked on the graph. The next bump is the 1979 oil crisis, after which came a huge decline. This vertical line after it signifies the abrupt lowering of prices of the Saudi oil in 1986. The impact of 2008 on OPEC and the 2010s oil glut: OPEC’s production share on the oil market has scored around 40% every year since the stabilisation after the 1979 oil crisis. However, the prices have changed significantly during the 2008 financial crisis when the world entered recession. The price per barrel dropped from 133,88$ to 39,09$ It is clearly visible on the graph above. However, OPEC, experienced after the previous oil crises, managed to survive 2008 and helped the global oil market survive the recession. Considering that the crisis coincidentally happened when the Iraqi industry was still recovering from the war in the country, Venezuela’s process of nationalisation was not going as smoothly as they had planned and Nigeria faced massive strikes and even bomb attack in their facilities, OPEC handled that year surprisingly well with their market share not being significantly decreased, even despite the sudden extreme decline of oil prices. Nevertheless, these were not the only important things that happened in the year 2008. This was also the year when Saudi Arabia opposed the raising of the prices proposed by the other countries. The developing members of OPEC - like war-torn Iraq or Angola - demanded increasing the oil prices so that they could improve their foreign trade in order to invigorate the economies. However, Saudi Arabia strictly opposed this idea, because an increase of the prices would encourage the importers to seek alternatives for oil as they previously attempted to do - and partially succeeded - in the 1980s. This led to the Saudi delegations leaving the proceedings of OPEC as a sign of protest. One of the delegates stated: "Saudi Arabia will meet the market's demand. We will see what the market requires and we will not leave a customer without oil. The policy has not changed." Saudi Arabia’s position, combined with the economic difficulties of that time, prevented the other members from raising the prices. Was it a good thing? We’ll never know. Subsequently came the oil glut of the 2010s. The US employed new technology, called "shale", in their oil extraction and their production soared. Because of that, they could significantly decrease the amount of oil they were buying from OPEC. This left OPEC with a lot of unneeded oil they could not sell to anybody. This happened even despite the fact that Libya - in the midst of a civil war - extremely underperformed in exporting oil. In 2014 and 2015, OPEC was producing too much oil for 18 months in a row. The COP conference in Paris only worsened the situation for them, due to many countries vowing to reduce their emissions and consequently seeking alternatives to oil. The glut was ended by two factors. Firstly, Libya still did not manage to fix the industry in 2016 and some other, both OPEC and non-OPEC, states started to underperform as well. Secondly, OPEC lowered the OPEC Reference Basket - which is basically the average price of a barrel of oil. This way, in mid and late 2016 everything went back to normal. The formation of OPEC+: Another production cut happened in 2016 to counteract the diminishing returns (Diminishing returns - Wikipedia). However, this time, for the first time in its history, OPEC tried to agree on something with the non-member states and discussed the cuts with the other oil exporters. If everyone cut the production, the prices would go up for everybody and the diminishing returns would be overcome, at least for the time being. It was a win-win for everybody. Of course, the Western countries did not take part in the discussions, but Russia did and it was a deal-breaker. The countries agreed on a 1 million barrels per day cut, later extended to 1,8 million. The cuts achieved the desired effect and the countries which took part in the discussions with OPEC were called OPEC+. Those include: • Philippines • Russia • Malaysia • South Sudan • Sudan • Brunei • Bahrain • Mexico • Kazakhstan • Oman • Azerbaijan Present development: RUSSIA-SAUDI TRADE WAR: During the Covid pandemic, the sector of health was not the only one affected heavily. In this time (2020-2022) the OPEC Cartel has had a major disagreement between their major powers. In March 2020, OPEC officials demanded that Russia cut its oil production by 1.5% of the world's supply. However, Russia, foreseeing the continuation of cuts as American shale oil production increased and the weakening of global demand due to the COVID-19 pandemic, rejected the ultimatum and ended its three-year partnership with OPEC and other major non-OPEC providers. As a result, OPEC+ was unable to extend the agreement to cut 2.1 million barrels per day, which was set to expire at the end of the month. In response, Saudi Arabia raised its output and discounted its oil in April, leading to a sharp drop in Brent crude prices and widespread turmoil in financial markets. Many experts saw this as a price war between Saudi Arabia and Russia, with some viewing it as a game of chicken to see who would back down first. Saudi Arabia had $500 billion in foreign exchange reserves at the time, compared to Russia's $580 billion, and a debt-to-GDP ratio of 25% compared to Russia's 15%. Additionally, some analysts believed that Saudi Arabia could produce oil at as low a price as $3 per barrel, while Russia required $30 per barrel to cover production costs. Some also claimed that the conflict was aimed at hurting the Western economy, particularly that of the United States. To counteract the impact of the oil exporters' price war on shale oil production, the US may have passed the NOPEC bill to protect its crude oil market share. However, in April 2020, OPEC and a group of other oil-producing countries, including Russia, agreed to extend the production cuts until the end of July. The cartel and its allies agreed to reduce their oil production by 9.7 million barrels per day in May and June, equivalent to about 10% of global output, to boost prices that had previously fallen to historic lows. SAUDI-EMIRATI DISPUTE: With the tension still high in between the OPEC’s members in 2021 new threat occured. In July said year, the United Arab Emirates, a member of OPEC+, rejected a proposal by Saudi Arabia to extend oil output curbs for an additional eight months, which had been put in place due to the COVID-19 pandemic and lower oil consumption. The previous year, OPEC+ had cut oil production equivalent to around 10% of demand. The UAE requested an increase in the maximum oil output recognized by the group, from 3.2 million barrels per day to 3.8 million barrels per day. A compromise was reached that allowed the UAE to increase its maximum output to 3.65 million barrels per day. Under the terms of the agreement, Russia agreed to increase its production from 11 million barrels per day to 11.5 million by May 2022. All members of OPEC+ were set to increase their output by 400,000 barrels per day each month starting in August, to gradually undo the cuts made in response to the COVID pandemic. OPEC IN GLOBAL ENERGY CRISIS But the problems of the world continued and so did the problems of the OPEC Cartel, but as known by many great investors, a crisis is many times an opportunity. Aforementioned opportunity arose with the record high energy prices in 2021 which were fueled by a global increase in demand as the world emerged from the economic recession caused by COVID-19, particularly due to strong energy demand in Asia. In August 2021, U.S. President Joe Biden's National Security Advisor, Jake Sullivan, called on OPEC+ to boost oil production to counteract the cuts made during the pandemic, until well into 2022. Sullivan met with Saudi Crown Prince Mohammed bin Salman in September 2021 to discuss the high oil prices. By October 2021, the price of oil had reached approximately $80, the highest since 2014. President Biden and U.S. Energy Secretary Jennifer Granholm blamed OPEC+ for the rising oil and gas prices. The global oil trade was impacted by Russia's invasion of Ukraine in February 2022. Despite efforts by EU leaders to ban most Russian crude imports, imports to Northwest Europe had already decreased. More Russian oil was now being exported to countries such as India and China. In October 2022, key OPEC+ ministers agreed to cut oil production by 2 million barrels per day, the first production cut since 2020. This renewed interest in the passage of the NOPEC bill. 2022 OPEC OIL PRODUCTION CUTS With the 2022 being the most historically impactful year of the XXI century (yet), not only due to military operations being conducted on Ukrainian soil by the Russian Federation, but because of the energy crisis that came with it, the Oil Cartel decided on improving their financial position, as well as impact on the economic sector overall by cutting oil production. All of that happened in October 2022, when the OPEC+ alliance, led by Saudi Arabia, made a substantial reduction in its oil output target, which caused concern in the USA and helped Russia. President Joe Biden reacted by saying there would be "consequences" and that the US would reconsider its relationship with Saudi Arabia. The Democratic chairman of the US Senate Foreign Relations Committee, Robert Menendez, called for freezing cooperation and arms sales to Saudi Arabia, accusing the kingdom of supporting Russia's military operation in Ukraine. The Saudi Arabian foreign ministry defended the OPEC+ decision, saying it was made unanimously and solely based on economic reasons. This response pushed back against the pressure to change its stance on the Russo-Ukrainian War at the UN. The White House, however, accused Saudi Arabia of forcing other OPEC members to agree to the production cut, with some members feeling pressured. The National Security Council spokesman, John Kirby, said that Riyadh was aware that the decision would increase Russian revenues and weaken sanctions against Moscow. A report in The Intercept stated that Saudi Arabia sought deeper cuts than Russia, with Saudi Crown Prince Mohammed bin Salman aiming to influence the 2022 US elections in favour of the GOP and the 2024 US presidential election in favour of Donald Trump. Case studies: The US and A - the greatest country in the world! The USA has always been against OPEC and vice versa. Recently, OPEC+ agreed on new production cuts, strongly condemned by the Biden administration. However, the USA has to buy oil from OPEC whether they like it or not, since their own and Canada’s oil is not enough to meet their requirements. The second, third and fourth USA’s largest oil trade partners are Mexico, Saudi Arabia and Russia - all three members of OPEC+. Recent production cuts even deteriorated the relations between USA and Saudi Arabia, which have been quite close in the history with Saudi Arabia being the only “good friend” of the US in OPEC. Moreover, OPEC has repeatedly lowered the prices of oil in order to piss off the USA using shall. Despite that, the NOPEC act, passed by the American senate, aimed at mitigating the influence of OPEC on the economy of the USA, allowing the government to prosecute the member states for anti-competitive behaviour has never been enacted. Yet, in October 2022 the voices wanting NOPEC to be finally put in force once again appeared in the American parliament. Read more here: No Oil Producing and Exporting Cartels Act - Wikipedia. Summarising, the USA would love to destroy OPEC or at least mitigate their influence on the market. ATTENTION!!! Many countries have the same policies as the United States, so this case study practically applies to all of the allies of the USA and consequently most of the countries of the West. Russia Russia and OPEC have a history of long rivalry on the oil market. However, since the price cuts in 2016 their relations improved significantly. Despite the price war in 2020, Russia's relations with Saudi Arabia - a US ally - are now friendly, due to the cooperation under OPEC+. Russia is pro-OPEC, since it's a member of OPEC+, but bear in mind that it's still the second biggest oil exporter in the world, so they would love to raise prices and increase their share on the market, especially during the War on Ukraine and consequent embargos. With or without OPEC. It's the biggest player on the market apart from Saudi Arabia and it's right now allied with OPEC in OPEC+. And of course they hate the Americans. Saudi Arabia Saudi Arabia is surely in a strange position nowadays. It's both an ally of the USA and Russia. However, their relations with Russia are improving and with the USA on the contrary. It's also an OPEC member, which obviously means that it's pro-OPEC and would love to increase its share in the market, regardless of the will of the USA. However, it is also a strange country in OPEC, since it has historically been against raising prices, opposing the other members. Due to Saudi Arabia being the largest oil exporter on the planet, it also serves as a leader of the organisation. Their relations with the USA have been constantly deteriorating since the appointment of the Biden administration (because of the support for Russia), but also weren't perfect under Trump and Obama. That's when they developed shale and successfully decreased OPEC's share on the market. Summarising: • Saudi Arabia has good relations with Russia, due to their recent economic ties. Despite many hardships in their relations, like the 2020 price war and the 2022 invasion of Ukraine, they still remain united under OPEC+ and their cooperation progressively improves. The Russians would love to end the Saudi-American alliance. • On the other hand, the USA is militarily present in Saudi Arabia and has historically had great relations with them. Also, many American oil companies still depend on Saudi oil. The Americans would love to destroy the Saudi-Russian relations. • Furthermore, Saudi Arabia basically leads OPEC and OPEC+, but opposes the countries wanting the constant prices increase. So yeah, good luck, Czerniej. OPEC and its members, including OPEC+ OPEC of course wants to constantly increase its market share, by adjusting their production. However, they cannot increase it too much so that they don’t cause a surplus. Their price control also has to be a tool used only ultimately, so that the other countries don’t change their oil exporters and more importantly - don’t seek alternatives for oil which is an increasing trend nowadays. The countries in OPEC also differ in their policies on price changing. The richer ones (mainly Saudi Arabia) is against increasing the price, from the fear of losing customers, whereas the developing ones (eg. Iraq) would love to raise prices for strictly financial needs. Moreover, all of the OPEC members tend to break their commitments in order to achieve maximal gain of the individual members. New Zealand, Denmark, Iceland, Greenpeace, European Union and its members Your job is to promote some alternatives for oil, in order to mitigate the influence of OPEC. However, your countries also suffer from OPEC’s control over the market, since no country, however ecological and green, can exist totally without oil. Germany Apart from promoting alternatives for oil, you should also consider how the previous oil crises, gluts etc. influenced your automobile industry and how it is impacted right now by the oligopoly formed by OPEC. Also, remember about your absolute oil dependency in Russia - an OPEC+ member which means that you cannot openly oppose OPEC+ like, for example, the USA or UK, yet you still would love for the oligopoly to end. Brazil, Canada, Norway, China Those three countries are rich in oil and gas and are frequently used as “alternatives” to OPEC+. However, it is just not enough to successfully exclude the cartel, especially Russia and Saudi Arabia, from the market. However, it is in your interest to either cooperate with OPEC or mitigate its share on the market. Either way, you are not comfortable with some Arabs controlling the prices of your own goods and can even benefit from the other countries buying oil from you. ExxonMobil You hate OPEC, since it ended the Big Oil oligopoly on the oil market and you would love to return to it. Thus, ExxonMobil cooperates with the countries of the West, especially the USA, since ExxonMobil is literally an American company. You love capitalism and stuff. You are basically Janusz Korwin-Mikke. Also, bear in mind that the representative of ExxonMobil represents the whole Big Oil here. Thus, remember to include the companies’ point of view in the position paper. Should you have any questions regarding your country’s policy, the topic, MUNing in general or any matter whatsoever, do not hesitate to contact your chairs. We’re here to help. Average chairs of the WTO answering your questions about oil. Research questions: • • • • • • • • • • How does my country view Oil? How to mitigate anti-competitive behaviours? How to mitigate the influence of OPEC on the oil market and should we do it? How to enforce competition laws? How does OPEC influence my country’s economy? Do you find the SG attractive 😏? Is it economically possible to function without OPEC? How to abolish Cartels? Does my country invest their resources in green energy? What is the ultimate goal of your country on the given topic? • • • • • • • • • • • • • • How to make lasagna? Ways of mitigating excessive influence of Companies/Cartels on any market? How to implement this strategy on OPEC? Would you smash any of your chairs if you had the chance 🤫? Are we going to be reliant on OPEC until we switch to sustainable energy? (ew…) Could you bulk purely on Diesel? What is the meaning of life? Does my country have good ties with OPEC? What are the limits of the human body when taking into consideration oil consumption? Can my country survive without imports from OPEC’s members? How can the countries cooperate to detach themselves from the Oil Cartel? What is your view on Andrew Tate? Where does a snake’s head end and its tail start? Lastly, remember that MUNing is all about throwing ideas and brainstorming, so if you have any, just drop them in your PPs and your speeches. The more, the better as long as they make sense and fit your country's policy. Useful links: OPEC and the WTO - Tehran Times (It is from 1999, but still worth a look) History Of Crude Oil | Events That Drove The Oil Price History | IG UK https://sites.google.com/site/globaloilproduction12/ (some guy made a website where you can find everything about oil; it's really ugly, but nice to read) Read some WTO resolutions about the competition rules Crude Oil Peak (you’ve got a lot of useful graphs here, so DO use them in your PPs) Bibliography: OPEC - Wikipedia (laugh as much as you want, you won’t find a better source) OPEC : Home List of largest oil and gas companies by revenue - Wikipedia 1970–1979 world oil market chronology - Wikipedia Big Oil - Wikipedia History Of Crude Oil | Events That Drove The Oil Price History | IG UK History of the oil industry in Saudi Arabia - Wikipedia BP - Wikipedia OPEC : 60 Years since the Maadi Pact OPEC Oil Embargo (thebalancemoney.com) https://sites.google.com/site/globaloilproduction12/1960-s-oil-production How did the 2008 financial crisis affect the oil and gas sector? (investopedia.com) History of Oil Prices (investopedia.com) 2022 in review: The year that broke US relations with OPEC+ - Al-Monitor: Independent, trusted coverage of the Middle East https://www.bakerinstitute.org/research/opec-phenomenon-saudi-russian-cooperation-andimplications-us-saudi-relations BONUS: A film recommendation Chair Kryński would not be himself if he didn’t write this. Oil has been a main objective of many people and companies worldwide. Frequently has it become an obsession. This is illustrated beautifully in the film “There Will Be Blood” by Paul Thomas Anderson, based on Upton Sinclair’s novel “Oil!”. This film probably will not provide you with any useful information regarding our topic, but will surely adjust you to the atmosphere of the craving for oil no matter what. Moreover, it’s an absolute masterwork of the craft of filmmaking, thus not watching it is a crime. In “There Will Be Blood”, we see Anderson doing what he is best at, his signature move. He merges a history about family with a portrayal of obsession. Throughout his career, this strange marriage has appeared in many forms. Here, we see an oilman with an adopted son and an obsession with oil. Throughout the whole film, we are dragged through mud and dirt in sweat and blood, just for a few drops of this black liquid. Anderson uses slow cinematography and silence, so that the scenes in which the madness prevails have a real impact. All of this is fuelled by probably the greatest performance of the XXI century so far - Daniel Day Lewis as Daniel Plainview. What is worth noting, though, is that Paul Dano in a double role didn’t allow to be put in the shadow of the legendary British actor. This duo completes each other and their dynamic on the screen is unbelievable. Many of their scenes are shot in an almost theatrical manner, so their dialogue is always the highlight of the scene. I could write essays about this masterpiece, but after all this is only a WTO study guide, so just be sure you watch “There Will Be Blood”. Thank me later.