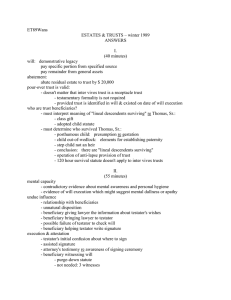

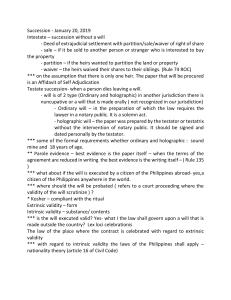

Sun Tzu said: He wins his battles by making no mistakes. Making no mistakes is what establishes the certainty of victory, for it means conquering an enemy that is already defeated. RF Gonzales August 2020. Chapter 1 General Provisions. Article 774. Succession is a mode of acquisition by virtue of which the property, rights and obligations to the extent of the value of the inheritance, of a person are transmitted through his death to another or others either by his will or by operation of law Elements of succesion (MTD-TAWO) (A) (B) (C) (D) (E) Mode of acquisition. Transfer of property, rights and obligations to the extent of the inheritance. Death of the testator AUTOMATICALLY transmits ownership to transferee Transfer is to another Either by WILL or OPERATION OF LAW Why is there a need for laws on succession? There is a need for laws governing succession as it is, in the Philippine, context, a natural obligation for a person to transmit what is left of his estate to his heirs, legatees, or devisees as a means of expressing his natural affection to those nearest in relationship. It is also a means to prevent the stagnation of wealth, the scenario pondered upon here is if a person dies intestate and leaves his entire estate in limbo and complicating the distribution of the properties that he left behind. It is also a consequence to a person’s right to property, as owner he has a right to dispose of his property taking effect mortis causa in whatever manner he sees fit provided legitimes are not impaired. Article 776. The inheritance includes all the property, rights and obligations of a person which are not extinguished by his death. Inheritance includes (PRO) 1. Property 2. Rights not extinguished by death 3. Obligations not extinguished by death to the extent of the value of the inheritance Discussion on Inheritance What properties are included? Real and personal property as well as accessions accruing thereto from the moment of death to the time of actual receipt. It is natural that accrued accessions be included as ownership is transferred at the moment of the decedent’s death, thus properly speaking, the transferee did in fact own all accessions accruing thereto even before he recieved the property. It is the death that transfers ownership, NOT delivery. Note that the property to be disposed to voluntary heirs in a testamentary disposition includes only those properties owned by the testator AT THE TIME OF EXECUTION. Thus when the testator gives the voluntary heir a fraction of his estate, the reckoning point as to what it includes will be at the time of execution of the NOT the time of death. Discussion on decedent’s ownership of property It is also important to note that the estate must first be determined before there be actual delivery of the properties. The fact of the testator’s ownership must be confirmed before there be delivery as he may not actually dispose of property which is not his to begin with. The issue of ownership may be answered by the RTC in the probate proceedings BUT this is by no means final. The decision of the RTC herein is only done for the purpose of determining whether or not a given property is to be included in the inventory of estate. This determination does NOT conclusively determine tha fact of the decedent’s ownership as the issue of ownership is merely incedental in probate proceedings. A separate action to determine ownership may still be made in spite of the RTC’s decision in the probate proceedings. What rights will be extinguished by death? Rights that are purely personal are extinguished by the death of the decedent. Note here that the personal rights may still survive, but PURELY personal rights are extinguished. This is because they are exclusive to the person holding such right and considering that he is now deceased, the purely personal right, being exclusive, dies with him Rights that are not extinguished will form part the estate. Such as an action to quiet title, rights to continue a lease, rights to compel the execution of documents necessary for convenience. These rights if extinguished by the decedent’s death cause a diminishment of the his estate which would then prejudice heirs, legatees, and devisees, whose testamentary rights would be impaired seeing as it would limit what they are to recieve. What obligations will be extinguished by death? Those not purely personal or intransmissible by law or contract will be extinguished by the decedent’s death. All obligations which are not purely personal will be extinguished by the decedent’s death for the same reasons mentioned above. Can an heir be made liable for his testator’s debts? Strictly speaking, NO. An heir may not be made personally liable for his testators’s debts. It is the estate that will answer for the same. It can be said that and heir may still pay for the debts of his father, but only as to the extent of his inheritance. So if the debt is 50 million and the inheritance to be recieved by a sole heir is 100 million, the heir will only recieve 50 million. But it is not the heir that is personally liable for the debt but it is the estate. It is true that his inheritance will be diminished, but not because he was made to answer for his father’s debt, but because it was the estate that answered for the same. If the debt exceeds the estate, as when the debt is 100 million and the estate is only 50 million, the heir will not be made liable to pay for the balance. Article 777. The rights to the succession are transmitted from the moment of the death of the decedent. Conditions for transmission (DTA) 1. That there indeed is a death (actual or presumed) 2. That the rights, properties, and obligations to be inherited are indeed transmissible (see discussion above) 3. That the transferee is still alive at the moment of the decedent’s death. Discussion on death It is succession that transfers ownership, not delivery. Thus at the moment of the decedent’s death the ownership is vested in the heir even before he recieves the property. The date wherein he begins ownership is the date the decedent dies, not the date the property was delivered to him. The effect of an acceptance retroacts to the moment of death and the heir will be deemed owner on that date notwithstanding that he accepted the inheritance on a later date. If he repudiates the inheritance however, it will also retroact. It will be as if he NEVER owned the property. If all the heirs repudiate the inheritance, the same will become patrimonial property of the state. When is a person dead? When he dies. (RF Gonzales, 2020.) When is a person presumed dead? Ordinary presumption of death An absentee goes missing under no danger or idea of death. In this case he will be presumed dead after 10 years (If he disappeared after the age of 75, 5 years). The succession in cases of ordinary presumption of death will take place AT THE END of the 10 (or 5) year period. Extraordinary presumption of death The following are presumed to be dead: 1. A person on board a vessel lost at sea or in the air who has not been heard of for 4 years since the loss. 2. A person in the armed forces who has taken part in war who has been missing for 4 years. 3. A person in danger of death under other circumstances who has not been heard of for 4 years. Note that in cases of extraordinary presumption, the death is not to have been presumed to happen at the end of the 4 year period but AT THE TIME OF DISAPPEARANCE. Presumption of death is only provisional and may be rebutted by the reappearance of the person. The time of death may also be rebutted as proof to show the real time of death may be shown (this is important because of the retroactive character of the succession from the moment of death.) If the person presumed to be dead shall return he shall recover his property or the price thereof if they have been alienated. He may not acquire the fruits accrued during his dissappearance. He may also not reimbursed if an heir spent his provisionally inherited property in good faith. Discussion on transitional provisions A spurious child was born in 1938 and his father died in 1951, can he inherit? YES. It is the date of the death of the decedent that is the reckoning point not the date of the birth of the spurious child. HOWEVER, supposing the father died in 1950 could the spurious child still inherit? YES. PROVIDED however that no vested rights are impaired. The act of allowing the spurious child to inherit despite the laws governing at the time not providing for his compulsory succession is an act of liberality that MAY NOT impair vested rights. So if there are other heirs, devisees, or legatees, the spurious child may not inherit given that his inheritance will impair their inheritance. Discussion on transmission of rights Successionary rights are transmitted at the moment of the decedent’s death. Therefore during the decedent’s lifetime the heirs have no right to dispose properties which they will prospectively inherit. After the decedent’s death the heirs are placed into a co-owneship of the estate pending its division. Thus they may dispose of their interest in the co-ownership even if the properties are still under administration. 1. Suppose a wife sells conjugal land without the consent of her husband, may their children question the sale? They may but only AFTER their father’s death. This is because their right to the land only became choate at the time of his death. While the sale may indeed be invalid they do not have the locus standi to question a sale of property wherein their rights thereto are only INCHOATE. 2. Suppose heirs conceal the existence of other heirs and as a result of such concealment, are awarded with property in the intestate proceedings, what is the remedy of the prejudiced heir? The prejudiced heir may file an action to recover their shares notwithstanding the termination of settlement proceedings. The ownership of the shares was transmitted to them AUTOMATICALLY upon their decedent’s death. 3. May an heir dispose of a specific property while the estate is under administration? YES. Sale of future property is valid, provided the seller acquires the same when delivery is to be made. (note that there are two schools of thought on whether or not a sale is void if delivery is not possible under these circumstances) Therefore he may validly enter into a contract of sale with regards to the specific property, but delivery is not possible until the heir actually recieves the property. If the heir does not acquire the property he sold, thus rendering delivery impossible, the buyer only acquires what the transferee acquires. Thus, caveat emptor. Article 778. Succession may be: (1) Testamentary; (2) Legal or intestate; or (3) Mixed. There are also 2 other kinds of succession namely: 1. Compulsory succession 2. Contractual succession done by a husband and wife in their marriage settlement giving each other as much of their future property as they might dispose in the event of their death. (Does not need to follow formalities of will. Note that while this is a joint act it is a valid testamentary disposition because it is NOT a will.) Discussion on testamentary succession Testamentary succession is done when there is a designation of an heir in a validly executed will. This may be done through a will or through a codicil. Which may be notarial or holographic. In case of doubt testamentary succcession is preferred to intestate succession. Discussion on mixed succession Mixed succession is that effected partly by will and partly by operation of law such as when a testator does not exhause his property in his making of a will. The part not disposed of will be disposed of by intestate succession. Article 781. The inheritance of a person includes not only the property and the transmissible rights and obligations existing at the time of his death, but also those which have accrued thereto since the opening of the succession. Discussion on accretion Inheritance does not only include what was transmitted at the time of death but also all those which have accrued thereto AFTER the death of the testator. This is again because his ownership of the property vested at the time of the decedent’s death, therefore everything that accrued thereto after the death is also his property. This is different from property acquired by the testator before death but after making a will, in this case the after-acquired property is not given to the designated heir UNLESS the contrary is provided. The after-acquired property may only be acquired if the testator expressly provides OR if the testator executes a codicil disposing of different property. Ex: A has 5 cars in 2009, he stipulates “ Upon my death I will give B all my cars” if A dies in 2011 with 10 cars, B will only get 5 as the other 5 cars are after-acquired property. HOWEVER if A had stipulated “Upon my death I will give B all the cars and all other cars that I may acquire” B will get all 10 cars. Article 782. An heir is a person called to the succession either by the provision of a will or by operation of law. Devisees and legatees are persons to whom gifts of real and personal property are respectively given by virtue of a will. Discussion on Transferees in testamentary succession Heirs succeed by universal title (ALL my property, a FRACTION of my property) They may be compulsory or voluntary. Legatees and devisees succeed by particular title. Legatees succed to personal properties while devisees succeed to real property. This article however, fails to emphasize the real importance in the distinction between transferees. Making it seem as if the essential element in defining transferees is the manner by which they are instituted. To paraphrase JBL Reyes what is important here is not HOW they inherit, but WHAT they inherit. This becomes important in preterition. In cases of preterition (where a compulsory heir in the direct line of the testator is given totally nothing in the will) the institution of heirs is VOID. Thus voluntary heirs get nothing but legacies remain valid insofar as legitimes are not impaired. Chapter 1 Digests Hemady V. Luzon Surety Doctrine: Money debts are transmitted to and paid for by the heirs Facts: Luzon Surety filed a claim against the estate of Hemady based on different indemnity agreements made by Hemady as a solidary guarantor when he was alive. Petitioner claims that whatever losses that may occur after Hemady’s death are not chargeable upon his estate because upon his death he ceased to be guarantor and that the his obligations as guarantor, being purely personal, were extinguished upon his death. Issue: Whether or not a solidary guarantor’s liability is extinguished by his death. Held: The solidary guarantor’s liability is not extinguished by his death, and that in such event, the Luzon Surety Co., had the right to file against the estate a contingent claim for reimbursement. The contracts of suretyship entered into by K. H. Hemady in favor of Luzon Surety Co. not being rendered intransmissible due to the nature of the undertaking, nor by the stipulations of the contracts themselves, nor by provision of law, his eventual liability thereunder necessarily passed upon his death to his heirs. Article 1311 of the Civil code provides: Contracts take effect only between the parties, their assigns and heirs, except in case where the rights and obligations arising from the contract are not transmissible by their nature, or by stipulation or by provision of law A contract of guaranty is not one intransmissible by law and there was no stipulation as to its intransmissibility. It can also not be said to be purely personal. In a contract of guaranty the only thing the creditor concerns himself with is the PAYMENT. The creditor is indifferent as to who pays him so long as he is paid, therefore it cannot be said to be purely personal in nature therefore it cannot also be said to be intransmissible to his heirs upon his death. That being said, his obligation as guarantor is transmitted to his heirs. In addition, whatever payment made by the estate ultimately affects the heirs to the extent of their inheritance since it would reduce their shares. Bonilla v Barcena Doctrine: When a plaintiff dies and the action is transmissible, the right to continue such actions vests on the heirs upon the death of the plaintiff. Facts: Fortunata Barcena, mother of five minors, instituted a civil action to quiet title over parcels of land licated in Abra. She died six months after instituting said suit. Defendants filed a motion to dismiss alleging that Barcena, being dead, has no legal personality to sue. The court granted this motion. Issues: Whether or not Barcena may be substituted by her heirs. Decision YES.While a person who is dead cannot sue in court, one who has died while it is pending can be substituted by his heirs. When the complaint was filed the court thus acquired jurisdiction over her person. It was a grave error for the trial court to dismiss her complaint based on her death as Section 16 Rule 3 of the Rules of Court prescribes that whenever a party to a pending case dies it shall be the duty of his attorney to inform the court of such death and to give tha name and residence of his executor, administrator, guardian, or other legal representatives. The attorney complied with this duty and aked for substitution but was denied. Article 777 NCC provides “Rights to succession are transmitted from the moment of the death of the decedent”. Thus from the moment of her death her heirs became absolute owners of the property. When Barcena died not only was her claim transmitted to her heirs, but they became paties in interest in the case given that they have acquired interest in the property through succession. The issue of minority is addressed by Section 17 Rule 3 of the Rules of Court which directs the court to appoint a guardian ad litem for minor heirs. De Borja v De Borja Doctrine: A hereditary share is transmitted at the moment of death, and an heir can dispose of this share even if actual extent cannot yet be determined until after the estate has been settled. Facts: The property in dispute in this particular case is a parcel of land which is the Hacienda Jalajala Poblacion located in Nueva Ecija which was registered in the name of Francisco de Borja. Francisco was married to Josefa Tangco who had a son Jose de Borja. Upon the death of Josefa, Francisco filed an action for an intestate proceeding and to assign him as the administrator of the estate of Josefa. Afterward Jose file a motion to the probate court for him to be declared as co-administrator of the estate of Josefa which the court granted. Years have passed and Francisco was remarried to Tasiana. Years later Francisco died and Tasiana move for the intestate proceeding of Francisco’s estate and that she be declared as its administrator which the court granted. In a series of court litigation involving the estate of Jose and Francisco one of the issue to be resolve by the court was whether the Hacienda Jalajala belong to the conjugal partnership of Josefa and Francisco or was it an exclusive property of Francisco. During these proceedings an agreement had been made between Jose and Tasiana regarding the sale of the estate of Francisco to Jose and his siblings and to be paid to Tasiana. Thereafter, the buyer of Jalajala "Poblacion" is hereby authorized to pay directly to Tasiana Ongsingco Vda. de de Borja the balance of the payment due her under and issue in the name of Tasiana Ongsingco Vda. de de Borja, corresponding certified checks/treasury warrants, who, in turn, will issue the corresponding receipt to Jose de Borja. But after awhile Tasiana oppose the sharing of the sale alleging that the said property is an exclusive property of Francisco and her being the sole heir to the estate of Francisco should be given the whole profit of the sale. Issue: Whether or not the validity of a sale of a hereditary estate is conditioned upon the succession that occurs at the time of death of the decedent? Held: The Cout held, as a hereditary share in a decedent's estate is transmitted or vested immediately from the moment of the death of such causante or predecessor in interest (Civil Code of the Philippines, Art. 777)there is no legal bar to a successor (with requisite contracting capacity) disposing of her or his hereditary share immediately after such death, even if the actual extent of such share is not determined until the subsequent liquidation of the estate.Of course, the effect of such alienation is to be deemed limited to what is ultimately adjudicated to the vendor heir. Alvarez v IAC Doctrine: Heirs will be bound by the legal consequences of the decedent’s transactions, but the former are liable only to the extent of the value of the inheritance. Facts: Aniceto Yanes, respondents’ ascendants, left a parcel of land intestate known as Lot 773 and 823 of Aniceto was survived by his children, Rufino, Felipe and Teodora. Respondents were grandchildren of Aniceto. Rufino and his children left the province as a result of the outbreak of World War II. They did not visit the parcels of land in question but "after liberation" he was informed that Fortunato Santiago, Fuentebella and Alvarez were in possession of Lot 773. Lot 773 was subdivided into Lot 773-A and Lot 773-B. The said lots was then sold to Monico Fuentebella Jr.After his death and upon Arsenia Vda. de Fuentebella, his wife sold said lots Rosendo Alvarez. Two years later or on May 26, 1960, Teodora Yanes and the children of her brother Rufino filed in a complaint for the "return" of the ownership and possession of Lots 773 and 823. They also prayed that an accounting of the produce of the land from 1944 up to the filing of the complaint be made by the defendants, that after court approval of said accounting, the share or money equivalent due the plaintiffs be delivered to them. During the pendency in court of said case, Alvarez sold Lots 773-A, 773-B and another lot for P25,000.00 to Dr. Rodolfo Siason. On February 21, 1968 the Yaneses filed an action for the recovery of real property with damages.Respondents pray for the return/delivery of possession of Lot 773 and if, delivery thereof could not be effected, or, if the issuance of a new title could not be made, that the Alvarez and Siason jointly and severally pay the Yaneses. Issue: Whether or not petitioners are liable as to the extent of the value of their inheritance? Held: The Court held, such contention is untenable for it overlooks the doctrine obtaining in this jurisdiction on the general transmissibility of the rights and obligations of the deceased to his legitimate children and heirs. The heir is not liable beyond the value of the property received from the decedent. Petitioners being the heirs of the late Rosendo Alvarez, they cannot escape the legal consequences of their father's transaction, which gave rise to the present claim for damages. That petitioners did not inherit the property involved herein is of no moment because by legal fiction, the monetary equivalent thereof devolved into the mass of their father's hereditary estate. It must, however, be made clear that petitioners are liable only to the extent of the value of their inheritance. Uson v. Del Rosario Doctrine: Right under the NCC will not be given retroactive effect if it impairs rights that have been vested under the Old Civil Code Facts: Maria Uson was the lawful wife of Faustino Nebreda. Faustino Nebreda left no other heir except his widow Maria Uson. However, plaintiff claims that when Faustino Nebreda died in 1945, his common-law wife Maria del Rosario took possession illegally of said lands thus depriving her of their possession and enjoyment. In her defense, defendant claims that petitioner lost her property rights over the land in dispute when she and her husband executed in public document, during their separation, relinquishing her of her rights over the land in dispute. Issue: Whether or not a written agreement between husband and wife conditioned upon their separation can relinquish ones property rights? Held: The Court held, it is evident that when Faustino Nebreda died in 1945 the five parcels of land he was seized of at the time passed from the moment of his death to his only heir, his widow Maria Uson. The written agreement to waive an inheritance is void and cannot be made during the lifetime of the decedent. This is because the right of the prospective heir at that time is inchoate and does not vest until the actual death of the decedent and thus may not be waived. Lee v RTC Doctrine: When the estate of the deceased is already subjected to testate or intestate proceedings, the administrator cannot enter into any transaction involving any of its property without prior approval of the probate/intestate court. FACTS: Philinterlife shares of stock were part of the estate of Dr. Juvencio Ortañez from the very start as in fact these shares were included in the inventory of the properties of the estate submitted by Rafael Ortañez after he and his brother, Jose Ortañez, were appointed special administrators by the intestate court. The controversy here actually started when, during the pendency of the settlement of the estate of Dr. Ortañez, his wife Juliana Ortañez sold the 1,014 Philinterlife shares of stock in favor petitioner FLAG without the approval of the intestate court. Her son Jose Ortañez later sold the remaining 1,011 Philinterlife shares also in favor of FLAG without the approval of the intestate court. ISSUE: Whether or not sale of property included in the inventory of the estate by some of the heirs made during the pendency of the intestate proceeding without intestate court’s approval may be declared null and void. HELD: YES. The rule is clear that (1) any disposition of estate property by an administrator or prospective heir pending final adjudication requires court approval and (2) any unauthorized disposition of estate property can be annulled by the probate court, there being no need for a separate action to annul the unauthorized disposition. Moreover, the intestate court has the power to execute its order with regard to the nullity of an unauthorized sale of estate property, otherwise its power to annul the unauthorized or fraudulent disposition of estate property would be meaningless. In other words, enforcement is a necessary adjunct of the intestate or probate court’s power to annul unauthorized or fraudulent transactions to prevent the dissipation of estate property before final adjudication. Chapter 2 Testamentary Succession Subsection 1 Wills in General Art. 783. A will is an act whereby a person is permitted, with the formalities prescribed by law, to control to a certain degree the disposition of this estate, to take effect after his death. Essential elements and characteristics of a will (SUS-ACP-MRV-ID) 1. The making of will is a STATUTORY right. While a person is free to control the disposition of his estate mortis causa, he is however limited in a sense by the laws on succession. . 2. It is a UNILATERAL act. Its validity does not depend on acceptance by the transferees during the testator’s lifetime. In fact, either the acceptance or repudiation of an inheritance made during such period is premature and will have no effect. 3. It is a SOLEMN act. Thus it must follow the forms prescribed by law for its validity. 4. There must be ANIMUS TESTANDI. That is, that the testator really intends to make a will. 5. The testator must be CAPACITATED. He must be of the age of majority and be of sound mind. 6. The making of a will is a strictly PERSONAL act in all matters that are essential. Essential matters are those with regard to the making of the will, testamentary matters, and the effectivity of dispositions. 7. It is effective MORTIS CAUSA. That is that it takes effect only upon the testator’s death. 8. It is REVOCABLE during the testator’s lifetime. 9. It is free from VITIATED CONSENT. The testator must execute it freely, knowingly and voluntarily. 10. It is an INDIVIDUAL ACT as opposed to a joint act. Thus two people may not, in a singular instrument, stipulate that they will give their property to the other effective upon their death. Note however that a future husband and wife may give to eachother their future property (limited by legitimes) effective upon their death in their marriage settlement. While this is a joint act, this is a valid testamentary disposition as it is not a will. 11. It DISPOSES of a testator’s estate to a certain degree limited by the reservation of a portion of his estate to his legitimes. Question: In T’s will A was given a house effective immediately. Is this a valid TESTAMENTARY disposition? NO. A will is effective mortis causa not inter vivos. In this case what was really made was not a testamentary dispositon but a donation. Therefore while it may not be a valid testamentary dispositionn it may be a valid donation provided A’s acceptance follows the form prescribed by the law on donations. Art. 784. The making of a will is a strictly personal act; it cannot be left in whole or in part of the discretion of a third person, or accomplished through the instrumentality of an agent or attorney. What does it mean to “make” a will? The making of a will is not the mechanical act of writing. “Making” must be distinguished from “drafting”. A person may make a will but not be the one to write the same in the literal sense. “Stricly personal” does not mean that it is the testator alone who must be involved in the drafting of the will. The essence of the strictly personal nature of a will is that it expresses the testator’s desires, not those of a third person. Thus it is of no matter that it was drafted by someone other than the testator so long as the will drafted by a third person expresses the testator’s desires and follows the formalities prescribed by law and is either signed by the testator or copied in his own handwriting. Delegation of testamentary acts The prohibition against the invalid disposition of testamentary acts us what is at the heart of articles 784-787. These articles solidify the notion that a will is a personal act. There are three kinds of testamentary delegation that cannot be permitted because they necessarily violate the personal nature of a will. The following cannot be left to the determination of third persons: (1) Duration and designation of heirs (2) Efficacy of designation (3) Determination of portions to be taken when the transferee is named. These are laid out and discussed in more detail in the articles to follow. Art. 785. The duration or efficacy of the designation of heirs, devisees or legatees, or the determination of the portions which they are to take, when referred to by name, cannot be left to the discretion of a third person Discussion Who recieves and what they recieve are TESTAMENTARY MATTERS, thus strictly personal to the testator. And cannot be delegated to a third person.. “Upon my death I will give Y whatever portion of my estate B decides is proper.” “I will give 1/8 of my estate to whoever B designates.” B cannot be given the power to determine what Y is to inherit nor can he be given the power to determine who may be instituted as heir. The making of a will is a strictly personal act. A provision in the will that gives a third person the discretion to determine the portions of the estate that transferees are to recieve or to determine if their institution as heirs is effective is violative of this “strictly personal” nature. A will gives expression to the desires of the testator before he died. To give a third person the discretion to determine the duration of the designation of heirs is to substitute the desires of the testator with that of a his own. (Note that article 785 applies only when the transferees are named.) Art. 786. The testator may entrust to a third person the distribution of specific property or sums of money that he may leave in general to specified classes or causes, and also the designation of the persons, institutions or establishments to which such property or sums are to be given or applied. Discussion: This is different from the preceeding provision because the testator here gives to a specified class or cause NOT a named transferee. The designation of persons or institutions, the scope of their inheritance and the distribution thereof may be left to the discretion of a third person so long as the principal sets aside a specific sum of money, property, or portion of his estate to be given to a specified class or clause. While 784,785, and 787 state what the testator cannot delegate, Article 786 provides for what he can delegate. REASON: This is allowed because the testamentary act in this case has already been completed. The testator has already set aside a portion of his estate to be given and has already stated the cause or class which he wants to recieve such portion. What is left to the third person is only the details of carrying out his desire. What he entrusts hereot in the nature of a testamentary disposition but only the details of the performance thereof. BK Freestyle: The ultimate desire of the testator here is to give to the CLASS or the CAUSE. Not to a specified person. Simply and informally stated, he wants to dispose of his property to a cause he believes in. It is the CAUSE that the testator wants to give to NOT a specific institution. Thus the determination as to what specific institution or establishment is to be instituted may be left to the discretion of a third person. The testamentary act is accomplished once he defines what cause or class he wishes to inherit from him, and what is left now is the details of the disposition. Art. 787. The testator may not make a testamentary disposition in such manner that another person has to determine whether or not it is to be operative. Discussion: The reason for the prohibition is once again based on Article 784. The delegation here is upon the effectivity of a testamentary dispositions which is a matter strictly personal to the testator. Thus the delegation is void and because the delegation is void both the disposition and the involvement of the third party are void . While the determination of whether a provision is operative or not is not testamentary in nature, still, its delegation to a third person would be to substitute the will of the testator with that of his own and is clearly violative of the personal nature of the making of a will. Art. 788. If a testamentary disposition admits of different interpretations, in case of doubt, that interpretation by which the disposition is to be operative shall be preferred. The reason for this rule is that testate succession, if valid, is preferred to intestacy. The desires of the testator if within the confines of the law must not be frustrated. This article obviously only applies in case of doubt. If there is no doubt as to the interpretation and the disposition is clearly illegal, the same should not be given effect. Art. 789. When there is an imperfect description, or when no person or property exactly answers the description, mistakes and omissions must be corrected, if the error appears from the context of the will or from extrinsic evidence, excluding the oral declarations of the testator as to his intention; and when an uncertainty arises upon the face of the will, as to the application of any of its provisions, the testator's intention is to be ascertained from the words of the will, taking into consideration the circumstances under which it was made, excluding such oral declarations. Kinds of ambiguity There are two kinds of ambiguity in wills. The fist part of this article refers to INTRINSIC ambiguity whilst the latter part refers to EXTRINSIC ambiguity. 1. Intrinsic ambiguity does not appear on the face of the will and is discovered by extrinsic evidence. It is when there is an (a) imperfect description of the transferee (b) or property given (c) and when one recipient is designated but multiple people fit that description. Ex: BC stipulates in his will “I will give my car to my girlfriend” Here, the will is not ambiguous on its face. However, what if it is subsequently discovered that he has two girlfriends? The will is now intrinsically ambiguous because a question arises as to which girlfriend he was referring to. 2. Extrinsic ambiguity is that which appears on the face of the will. It is immediately apparent therein that there is uncertainty. Ex: I institute some of my friends as my heirs. Here the will is clearly ambiguous. The question of who he was referring to is immediately apparent. Curing ambiguity Ambiguity is cured by examining the will itself and extrinsic evidence to the exclusion of alleged oral declarations of the testator. An investigation in to the content of the will itself as well as the circumstances by which it was made is sufficient. Oral declarations are prohibited to forestall fraud, prevent confusion, and to prevent unfairness to a dead person whose words may be taken out of context. Question: A made a will instituting B, who was named therein and described as the natural child of C, as heir. Supposing B cannot present proof that he is indeed the natural child of C may he still inherit? YES. There was no condition Imposed upon B to prove that he was the natural child of C. There is no need to prove the fact of his relationship with C because it was merely descriptive in nature. Art. 790. The words of a will are to be taken in their ordinary and grammatical sense, unless a clear intention to use them in another sense can be gathered, and that other can be ascertained. Technical words in a will are to be taken in their technical sense, unless the context clearly indicates a contrary intention, or unless it satisfactorily appears that he was unacquainted with such technical sense Discussion: Ordinary words have ordinary meanings, technical words have technical meaning. This is simple enough. However, in the case of ordinary words, if the testator clearly intended for another meaning to be used this meaning should prevail over a word’s “ordinary meaning”. In case of technical words, if the will was written solely by a layman, unfamiliar with the intricacies of such words and he intended for another meaning, his intention must again prevail. In case of translations, idiomatic translations are preferred to literal translations. An idiomatic translation is that wherein the original language is not translated word for word but it is substituted its equivalent in the context language with which it is to be translated. This gives more effect to the testator’s intentions as a literal translation is susceptible to distortion of meaning and intent. Art. 791. The words of a will are to receive an interpretation which will give to every expression some effect, rather than one which will render any of the expressions inoperative; and of two modes of interpreting a will, that is to be preferred which will prevent intestacy. Art. 792. The invalidity of one of several dispositions contained in a will does not result in the invalidity of the other dispositions, unless it is to be presumed that the testator would not have made such other dispositions if the first invalid disposition had not been made. Discussion: Wills are interpreted as a whole. If provisions in a will can be interpreted differently, one which will give effect to all provisions, and another will render some inoperative, the former is preferred. The reason for this is that every word of the testator’s will must be given some effect because testacy is preferred to intestacty. The precise reason for this preference is that intestacy would frustrate the desires of the testator, whose intention in making the will was to have control over the disposition of his estate. While wills are interpreted as a whole, it would be manifestly unfair to disallow an entire will because of one invalid disposition. Thus if a disposition is deemed invalid, the other provisions of the will are unaffected unless the testator would not have med the other disposition if the invalid one had not been made Interpretation in general (BK FREESTYLE) Articles 788- 792 provide for the rules in the interpretation of wills. It Is clear from those rules that the testator’s intentions reign supreme. The entire purpose of interpreting a will is to give effect to his desires. The entire point is to see to it that his words are given the effect that he intended, and that his desires be carried out in the manner by which he intented. Thus whatever is intended by the testator, provided that it is within the confines of the law, will prevail over the rules of interpretation. Moreover, to “interpret” is to ascertain what is meant by certain expressions. In wills these expressions are made by the testator, thus it is his words that are to be interpreted and the best way to ascertain the true meaning of his expressions is by looking into his intentions. Art. 793. Property acquired after the making of a will shall only pass thereby, as if the testator had possessed it at the time of making the will, should it expressly appear by the will that such was his intention. Discussion: Property acquired AFTER the execution of a will is not included among those disposed of during succession UNLESS the testator expressly provides that after-acquired property is included. Thus if in 2007 a testator provides in his his will that he “gives B all of his cars” upon his death, and he has 7 cars in 2007 but upon his death in 2018 he has 11 cars, the reckoning point as to the amount of cars B is to recieve is at the moment of execution, not the moment of death. Thus he will only recieve 7 cars. This would be different if he had stated “I will give B all my cars and all other cars that I may acquire.” Then in 2018, B gets all 11 cars. Note that this is different from the fruits and accessions accruing to the property after death but before the heir takes possession. The reason why fruits and accessions accruing after death are given, but after acquired properties are not, is because at the time of death ownership has already vested in the heir while at the time of execution all the transferee possesses is an inchoate right. Question: T owes B P50,000. In his will T gave his credit to X. Before he died B paid T P25,000. How much may X demand from B upon T’s death? Only the balance of P25,000. Question: Same scenario but instead of paying, B borrowed another P50,000. Upon T’s death, how much can B demand from T? Only P50,000. The other P50,000 will be considered after acquired property. Application to heirs The law is silent on whether this applies to heirs or only to devisees and legatees. It would seem more logical if it were not to apply to heirs seeing as they are given fractions of the estate not specific things. It is in this regard that Paras and Jurado slightly disagree. While Paras states that it would be more proper if it were only to apply legatees and devisees, even going so far as to say that it would be wise to invert the provision making the acquisition of after-acquired property the general rule and the exception being unless the testator provides that after-acquired property is not to be given. BUT because the law is silent Paras opines that it must also apply to heirs. Jurado states that even though the law is silent, it must apply only to devisees and legatees, taking into consideration Articles 776, and 781. Art. 794. Every devise or legacy shall cover all the interest which the testator could device or bequeath in the property disposed of, unless it clearly appears from the will that he intended to convey a less interest. Discussion: The general rule is that the entire interest of a testator in the property disposed of is given. Not more, not less. If for example the testator was a mere usufructuary, the general rule is that what he conveys is only his usufructuary right. If he is a co-owner, what he conveys is merely his share in the co-ownership. UNLESS he intends to convey a greater interest or lesser interest. A testator who owns a house may give by will a usufructuary right to that house. He can even convey a GREATER interest. This is possible when he knows that the property is not his and intends for the executor to purchase the property to be charged to his estate in order for that property to be conveyed to the legatee or devisee. If the owner of the property does not wish to sell the same, what will be given to the legatee or devisee is the value of the thing, Art. 795. The validity of a will as to its form depends upon the observance of the law in force at the time it is made. Extrinsic validity A will’s extrinsic validity is with reference to its form. As to the time, what governs is the law at the time the will is made. As to the place if the testator is a Filipino, he may observe Philippine laws, laws of the country where he is situated, or the laws of the country where the will is to be executed. If he is an alien abroad, he may observe the laws of his domicile, his national laws, Philippine laws, or laws of the country where the will is executed. If he is an alien in the Philippines, he may observe Philippine laws or his own national law. Intrinsic validity A will’s intrinsic validity is with reference to the legality of its provisions. It is governed by the laws at the time of the testator’s death and his own national law. Effect of change If a will was extrinsically valid at the time it was made, and a subsequent law changes the formalities required of a will, the same will still be valid. To allow retroactive effect as to the extrinsic validity of a will would deprive the testator of his property without due process. However, if a will that extrinsically invalid at the time it was made, and a subsequent law is enacted that would render the will compliant with the formalities, this also cannot be given retroactive effect. The reckoning point for the extrinsic validity of wills is at the time it was made, thus a subsequent law may not validate an extrinsically valid will. The rule is different for intrinsic validity. Since the rights are only inchoate until the testator’s death, laws enacted before such death may affect the intrinsic validity of a will. Renvoi Doctrine The renvoi doctrine is that doctrine whereby a matter is presented to Phillipine law which refers the matter to foreign law which in turn, refers the matter back to Philippine law. In this case to avoid an unending passing of the burden, it is Philippine law that wil govern. Example The deceased was a citizen of California but a domicillary of the Philippines. Philippine law states that it is the national law of the decedent which governs intrinsic successional rights, but the laws of California state that succesional rights shall be governed by the laws of the decedent’s domicile. In this case, we must apply our own law. Note that this only applies if the deceased was domiciled in one country but a citizen of another. It does not apply if he is domiciled in his home country but has heirs in the Philippines. Balane: Testamentary Succession Subsection 2 Testamentary Capacity and Intent Distinguish testamentary power from testamentary capacity Three view points: 1. Testamentary power is the statutory righ to dispose of property mortis causa, given as a consequence to the rights of ownership. Testamentary capacity is the right to make a will provided the conditions set in the NCC are complied with. Simply put, in this view testamentary power is the right to dispose of property effective mortis causa, and testamentary capacity is the right to make a will. 2. Testamentary capacity may be classified into two kinds, these are active and passive testamentary capacity. Active testamentary capacity is the capacity to make a will, whilst passive testamentary capacity is the capacity to recieve by virtue of a will. Note that this view point makes no mention of testamentary power. This is because the NCC itself makes no mention of the term “testamentary power”. 3. Testamentary capacity is the ability is the ability to make a will, while testamentary power is the privilege given by law to make a will. This distinction, in the Philippine context, is INOPERATIVE. This view applies only to countries where certain people such as convicts or married women, while capacitated, are denied the power to make a will. In the Philippines, the making of a will is not a privilege but a right granted to those capacitated. Convicts under civil interdiction in our jurisdiction, unlike in others, may make a will. Art. 796. All persons who are not expressly prohibited by law may make a will. (662) Art. 797. Persons of either sex under eighteen years of age cannot make a will Discussion: All persons not prohibited by law may make a will. The only persons prohibited therefore, are persons under the age of 18 and those of unsound mind. Convicts under civil interdiction may still make a will as the prohibition with regards to convicts is disposition inter vivos. Article 34 of the Revised Penal Code does not prohibit donations mortis causa. It must also be noted that only natural persons may make a will, juridical person obviously cannot (for how will we determine if a corporation is of sound mind?) Capacity must exist at the time of execution of the will. It is if no moment that it did not exist prior, or that it ceased to exist after. What is important is that at the time of the execution of the will the testator was capacitated. With regards to age, a person is deemed capacitated to make a will at the commencement of the day of his 18th birthday. Art. 798. In order to make a will it is essential that the testator be of sound mind at the time of its execution. Art. 799. To be of sound mind, it is not necessary that the testator be in full possession of all his reasoning faculties, or that his mind be wholly unbroken, unimpaired, or unshattered by disease, injury or other cause. It shall be sufficient if the testator was able at the time of making the will to know the nature of the estate to be disposed of, the proper objects of his bounty, and the character of the testamentary act. Discussion: What it means to be of “sound mind” Complete soundness of mind is not required. It is not necessary that the testator is in full possession of all his reasoning faculties. Or that his mind is wholly unbroken. What is essential is that he understands the nature of the estate, the objects of his bounty, and the character of his act. These are the only things to be considered. In considering whether the testator is of sound mind during the execution of the will it is sufficient that he comprehends the following: (NOC) 1. Nature of the estate to be disposed of 2. Proper objects of his bounty 3. Character of his testamentary act. It is essential that he knows what he is disposing of. He must comprehend the character, nature and extent of his property. It is essential that he knows the proper objects of his bounty, that is, that he knows who stand to be benefitted in the event of his death. Lastly he must understand the character of his act, that is, that he comprehends that he really is making a will. That he understands that he is disposing property effective mortis causa To put it simply there are three questions that must be asked in the determination of whether or not the testator was of sound mind during the execution of the will. These are: 1. Does he know the nature of the estate? 2. Does he know who stands to benefit from his death? 3. Does he understand that he really is making a will? Art. 800. The law presumes that every person is of sound mind, in the absence of proof to the contrary. The burden of proof that the testator was not of sound mind at the time of making his dispositions is on the person who opposes the probate of the will; but if the testator, one month, or less, before making his will was publicly known to be insane, the person who maintains the validity of the will must prove that the testator made it during a lucid interval. Discussion: Soundness of mind is the general rule. It is presumed and a person is deemed of sound mind if there be no proof to the contrary. HOWEVER if a person be publicly known to be insane or is judicially declared insane one month or less before the making of the will, he is presumed to be of unsound mind and the persons who maintain the validity must prove that the will was made during a lucid interval. Lucid interval A lucid interval is that period in which an insane person is so far free from his insanity that the legal consequences thereof do not apply to him. It is, in essence, a moment of clarity in an otherwise insane person’s mind where he is able to comprehend the nature of the estate, the objects of his bounty, and the character of his act. Proof of soundness of mind. There are varying ways to prove that the testator was of sound mind during the execution of the will. What is taken into consideration is his behaviour and the opinions of those surrounding him during the execution of the will. The testimony of subscribing witnesses, other people present, and the attending physician are all to be considered. There may be conflict between testimonies and a question arises as to whose opinion is preferred. Generally a subscribing witnesses opinion is preferred over that of a physician who was not present and is merely speculating. But the opinion of an attending physician who regularly saw the testator and who was with him during the day of the execution of the will shall be given more credence than that of a subscribing witness. NOC In all questions with regard to soundness of mind, whatever other factors are present the only things to be considered are that he comprehends the nature of his estate, the proper objects of his bounty, and the character of his testamentary act. If these three things are not influenced by a person’s insanity then he is capacitated to make a will. Art. 801. Supervening incapacity does not invalidate an effective will, nor is the will of an incapable validated by the supervening of capacity. A will made by a person when he was of unsound mind is not made valid by supervening capacity, and supervening incapacity does not invalidate a will made by a person who was of sound mind during the making. The only time to be considered is the time where he made the will. Art. 802. A married woman may make a will without the consent of her husband, and without the authority of the court. Discussion: Come on guys. It’s 2020. Iingon pa ba ni? Art. 803. A married woman may dispose by will of all her separate property as well as her share of the conjugal partnership or absolute community property. Spouses may dispose of all their separate property by virtue of a will. This is possible under the property regimes of absolute separation of property, and conjugal property of gains, wherein the spouses will still have separate property. A spouse may also dispose by will of their share in the conjugal property, this is valid since they are after all, co-owners. A spouse may even dispose of the other spouse’s capital, provided that she is aware that the property is not hers and intends for the executor of her will to purchase the same from her husband, chargeable to her estate, for the distribution to the heirs. Testamentary Succession Subsection 3 Forms of Wills Kinds of wills 1. Notarial - This kind of will requires attestation, an attestation clause, and acknowledgement before a notary public. 2. Holographic - This kind of will is written entirely by hand. Neither attestation nor acknowledgement is required. Art. 804. Every will must be in writing and executed in a language or dialect known to the testator. Discussion: Writing This is a common requirement between both kinds of wills. Every will must be in writing, in case of holographic wills it must be written in the handwriting of the testator. It is of no moment that some other person drafted a holographic will so long as it expresses the desires of the testator and he copies the same in his own handwriting. In case of notarial wills the materials used in the making of the will are irrelevant so long as it is written. In contrast to holographic wills, it is immaterial that the mechanical act of drafting a notarial will is done some other person. The handwriting of the testator may be proved by a witness who has actual knowledge of the handwriting of the testator because he has seen the testator write, or has seen writing purported to be the testator’s. The testimony of handwriting experts are helpful but are not mandatory and not binding upon courts. Language The will must be written in a language or dialect understood by the testator. It is not required that the fact that he understands the language of the will be written in the will itself or in the attestation clause. The fact that the will is written in a language he understands may be proved by extrinsic evidence. Art. 805. Every will, other than a holographic will, must be subscribed at the end thereof by the testator himself or by the testator's name written by some other person in his presence, and by his express direction, and attested and subscribed by three or more credible witnesses in the presence of the testator and of one another. The testator or the person requested by him to write his name and the instrumental witnesses of the will, shall also sign, as aforesaid, each and every page thereof, except the last, on the left margin, and all the pages shall be numbered correlatively in letters placed on the upper part of each page. The attestation shall state the number of pages used upon which the will is written, and the fact that the testator signed the will and every page thereof, or caused some other person to write his name, under his express direction, in the presence of the instrumental witnesses, and that the latter witnessed and signed the will and all the pages thereof in the presence of the testator and of one another. If the attestation clause is in a language not known to the witnesses, it shall be interpreted to them. (MEMORIZE) Requisites for a valid notarial will: (CWL-SAP-NAA) 1. The first requisite is the CAPACITY spoken of in the previous subsection. The age requirement and soundness of mind. 2. It must be in WRITING. The validity of a written will is not affected by the material on which it is written. 3. It must be in a LANGUAGE that the testator understands. If the will is written in the language of the locality of the testator, it is presumed that he understands the same. The fact that the testator understood the language by which the will was written need not appear in the face of the will. Extrinsic evidence may prove this. 4. The will must be SUBSCRIBED at the end thereof by the testator himself or by the testator’s name written by another person in his presence, and by his express direction. 5. The will bust be ATTESTED and subscribed by three or more credible witnesses in the presence of the testator and of one another. 6. The testator or the person he requested to sign his name and the instrumental witnesses shall sign each and every PAGE, except the last, on the left margin 7. The pages shall be NUMBERED correlatively in letters placed on the uper part of each page. 8. The will shall contain an ATTESTATION CLAUSE. Which shall provide (1) the number of pages upon which the will was written (2) The fact that the testator signed the will and every page thereof himself or expressly caused another person in his presence to perform the same in the presence of the instrumental witnesses. (3) that the instrumental witnesses witnessed and signed the will and all the pages thereof in the presence of the testator and of eachother 9. ACKNOWLEDGEMENT of the will by a notary public. Discussion on the requisites: Subscription by the testator A. The purpose of the testator’s subscription is to identify the testator and authenticate the document. This requirement is indespensible. B. The subscription may be done either by the testator himself or by the testator’s name written by another person in his presence by his express direction. Note that when the testator’s name is written by another mere consent is not sufficient. The fact that another person writes the testator’s name MUST be at his direction. Mere gestures indicating that another person may write his name are sufficient. It must also be done in the presence of the attesting witnesses. C. The name of the person writing on behalf of the testator is not required to inserted into the will. D. Note also that the person to write the testator’s name must NOT be one of the three attesting witnesses. IF HOWEVER, there are more than three witnesses it is perfectly valid for one of them to be the one to write the testator’s name. E. What constitutes a valid signature depends on (1) custom at the time and place (2) habit of the testator (3) circumstances particular toe each case. Thus a thumbmark, the initials of the testator, or a stamp may be considered valid PROVIDED that the testator intended the same to be his signature. A mere cross may even be valid provided that it can be proved that this was the usual signature of the testator and that he intended the same to be his signature. Attestation and subscription by witnesses A. Attestation is different from subscription. Attestation is the act of witnessing the execution of the will in order to see that it had actually been executed and that it has been executed in accordance with the requirements provided by law. Subscription on the other hand is a mechanical act that serves as a means of identifying that the paper which they signed really was the will executed by the testator B. The purpose of attestation is to have available proof during the probate of the authenticity and due execution while the subscription serves as a means if identifying the will as that of the testator’s C. The attestation must be done in one continuous transaction. The fact that the subscribing witnesses sign before the testator does not invalidate the will. D. It is not required that the attesting witnesses actually see the testator sign. What is material is that they are in each other’s presence and in such a position that by “merely casting the eyes” toward the direction of the testator, they would have seen him sign. Signing of pages A. The testator or the person requested by him to write his name and the instrumental witnesses must sign each and every page thereof excluding the last, on the left margin . B. The last page need not be signed at the margin since the signatures already appear at the end. C. If the whole will including the attestation clause consists of only one page, no marginal signatures are needed since all the necessary signatures will have already been found at the end. D. The law says “left margin” but it is completely valid to sign ath the right top or bottom margin. The reason for the signing at the margins is to identify the pages used. This purpose is served in whatever margin of the page is signed. Numbering of pages. A. All pages shall be numbered correlatively in numbers. This is done to prevent fraud. B. The fact that the pages are not numbered or invalidly numbered does not invalidate the will so long as intrinsic evidence shows the number of pages in the will. Attestation clause A. The attestation class shall provide (1) the number of pages upon which the will was written (2) The fact that the testator signed the will and every page thereof himself or expressly caused another person in his presence to perform the same in the presence of the instrumental witnesses. (3) that the instrumental witnesses witnessed and signed the will and all the pages thereof in the presence of the testator and of eachother B. The purposes of the attestation clause are (1) to preserve in a permanent record, the circumstances by which the will was executed (2) serve as proof of compliance with statutory requirements (3) as a safeguard against fraud. C. The fact that there are defects in the attestation clause does not automatically render the same invalid IF these defects can be cured by the text of the will itself. Art. 806. Every will must be acknowledged before a notary public by the testator and the witnesses. The notary public shall not be required to retain a copy of the will, or file another with the Office of the Clerk of Court. Discussion The acknowledgement coerces the testator and the witnessses to declare before an officer of law that they had executed and subscribed to the willl as their own free act. A will duly acknowledged enjoys a presumption of regularity. The acknowledging notary may be present in the execution of the will BUT he may not be one of the attesting witnesses thereto.Furthermore, the acknowledement may be done at some other time after the execution of the will. This does not form part of the “single continuous transaction” as that refers only to the execution of the will. The testator and the instrumental witnesses of the will need not to make acknowledgement in the presence of one another Javellana v. Ledesma: The certification of acknowledgement need not be signed by the notary in the presence of the testator or the witnesses. Neither does Article 806 require that the will be acknowledged on the same day it was executed and witnessed. Balane: The logical inference gathered from the Javellana case is that the testator and the instrumental witnesses of the will need not to make acknowledgement in the presence of one another Digests on the form of notarial wills Definition of a will Vitug v CA Doctrine: A will is a personal, solemn, revocable and free act by which a capacitated person disposes of his property and rights and declares and complies with duties to take effect after his death. Facts: Spouses Romarico and Dolores Vitug entered into a survivorship agreement with the Bank of American National Trust and Savings Association. Stipulating that (1) All money deposited and to be deposited with the Bank in their joint savings current account shall be both their property and shall be payable to and collectible or withdrawable by either or any of them during their lifetime; and (2) After the death of one of them, the same shall belong to and be the sole property of the surviving spouse and payable to and collectible or withdrawable by such survivor Dolores died naming Rowena Corona in her wills as executrix. Romarico later filed a motion asking authority to sell certain shares property belonging to the estate to cover his advances to the estate which he claimed were personal funds withdrawn from their savings account. Rowena opposed on the ground that the same funds withdrawn from the savings account were conjugal partnership properties and part of the estate. Being part of the estate, reimbursment could not be made. On the other hand, Romarico insists that the same are his exclusive property acquired through the survivorship agreement. Issue: Whether or not the funds of the savings account subject of the survivorship agreement were conjugal partnership properties Held: NO. A Survivorship Agreement is neither a donation mortis causa nor a donation inter vivos. It is in the nature of an aleatory contract whereby one or both of the parties reciprocally bind themselves to give or to do something in consideration of what the other shall give or do upon the happening of an event which is to occur at an indeterminate time or is uncertain, such as death. The Court further ruled that while a survivorship agreement is not illegal pe se caution should still be had with regards to them as it may be (1) it is used as a mere cloak to hide an inofficious donation; (2) it is used to transfer property in fraud of creditors; or (3) it is used to defeat the legitime of a compulsory heir. The court found, however, that none of those instances were present and upheld the validity of the survivorship agreement entered into by the spouses. As such, Romarico, being the surviving spouse, acquired a vested right over the amounts under the savings account, which became his exclusive property upon the death of his wife pursuant to the survivorship agreement. Thus, the funds of the savings account are not conjugal partnership properties and not part of the estate of the deceased Dolores. Common requirement for forms of wills Suroza v Honrado Doctrine: Every will must be executed in a language or dialect known to the testator. Facts: Sps Mauro Suroza and Marcelina Salvado informally adopted and raised Agapito. Agapito and his wife Nenita de Vera had a daughter named Lilia. Nenita became Agapito’s guardian when he became disabled. A certain Arsenia de la Cruz also wanted to be his guardian in another proceeding but it was dismissed. Arsenia then delivered a child named Marilyn Sy to Marcelina who brought her up as a supposed daughter of Agapito. Seeing as it has been acknowledged by both Agapito and Nenita that Agapito was unfaithful. Marcelina then supposedly executed a notarial will which was in English, a language she did not speak and thumbmarked the same. She allegedly bequeathed all her properties to Marilyn. She also named as executrix her laundrywoman, Marina Paje. Paje filed a petition for probate of Marcelina’s will. Judge Honrado appointed Paje as administratrix and issued orders allowing the latter to withdraw money from the savings account of Marcelina and Marilyn, and instructing the sheriff to eject the occupants of testatrix’s house, among whom was Nenita. She and the other occupants filed a motion to set aside the order ejecting them, alleging that Agapito was the sole heir of the deceased, and that Marilyn was not the decedent’s granddaughter. Despite this, Judge Honrado issued an order probating Marcelina’s will . Nenita filed a complaint before the SC, charging Judge Honrado with having probated the fraudulent will of Marcelina. She reiterated her contention that the testatrix was illiterate as shown by the fact that she affixed her thumbmark to the will and that she did not know English, the language in which the will was written. She further alleged that Judge Honrado did not take into account the consequences of the preterition of testatrix’s son, Agapito. . ISSUE: Whether or not judges may be held administratively liable for the probate of a will that is manifestly invalid. HELD: YES. Respondent judge,upon simple observation and upon noting that it was written in English and was thumbmarked by an obviously illiterate testatrix, could have readily perceived that the will was obviously void. It is of no moment that the will was uncontested. The judge still should have investigated conducted a hearing on the probate of the will to determine itss validity. His negligence and derilection of duty are inexcusable Presumption of knowledge of language of the testator Abangan V Abangan. Doctrine: If the entire will consists of only two sheets, (the first containing the will and the second containing the attestation clause) there need not be any marginal signatures at all. Facts: The will of Ana Abangan was admitted to probate.The will consists of 2 sheets. The first contains all the disposition of the testatrix, duly signed at the bottom by Martin Montalban (in the name and under the direction of the testatrix) and by three witnesses. Thesecond sheet contains only the attestation clause duly signed at the bottom by the three instrumental witnesses. Neither of these sheets is signed on the left margin by the testatrix and the three witnesses, nor numbered by letters. Issues: Whether or not the will was duly admitted to probate. Held YES. In requiring that each and every sheet of the will be signed on the left margin by the testator and three witnesses in the presence of each other, evidently has for its object the avoidance of substitution of any of said sheets which may change the disposition of the testatrix. But when these dispositions are wholly written on only one sheet signed at the bottom by the testator and three witnesses, their signatures on the left margin of said sheet are not anymore necessary as such will be purposeless and redundant. In requiring that each and every page of a will must be numbered correlatively in letters placed on the upper part of the sheet, it is likewise clear that the object is to know whether any sheet of the will has been removed. But, when all the dispositive parts of a will are written on one sheet only, the object of the statute disappears because the removal of this single sheet, although unnumbered, cannot be hidden. Thumbmark as a signature Payad v Tolentino Doctrine: The attestation clause need not contain the fact that the testatrix requested another to write her name if she signed the will in accordance with law. When a third person merely writes the testatrix’ name and the same is not intended to be her subscription this need not be inserted in the attestation clause. Facts: Victorio Payad filed a petition for the probate of the will of the decedent Leoncia Tolentino. This was opposed by Aquilina Tolentino, averring that said Will was made only after the death of the testatrix. The lower court denied the probate of the will on the ground that the attestation clause was not in conformity with the requirements of the law since it was not stated therein that the testatrix caused Atty. Almario to write her name at her express direction. Hence, this petition. Issue: Was it necessary that the attestation clause state that the testatrix caused Atty. Almario to write her name at her express direction? Held: The evidence of record establishes the fact the Leoncia Tolentino, assisted by Attorney Almario, placed her thumb mark on each and every page of the questioned will and that said attorney merely wrote her name to indicate the place where she placed said thumb mark. In other words Attorney Almario did not sign for the testatrix. She signed by placing her thumb mark on each and every page thereof. “A statute requiring a will to be ‘signed’ is satisfied if the signature is made by the testator’s mark.” It is clear, therefore, that it was not necessary that the attestation clause in question should state that the testatrix requested Attorney Almario to sign her name inasmuch as the testatrix signed the will in question in accordance with law. Thumbmark as a signature Matias v Salud Doctrine: The attestation clause need not contain the fact that the testatrix requested another to write her name if she signed the will in accordance with law. When a third person merely writes the testatrix’ name and the same is not intended to be her subscription this need not be inserted in the attestation clause. Facts: This case is an appeal from a CFI Cavite order denying the probate of the will of Gabina Raquel. The document consist of 3 pages and it seems that after the attestation clause, there appears the siganture of the testatrix 'Gabina Raquel', alongside is a smudged in violet ink claimed by the proponents as the thumbmark allegedly affixed by the tetratrix. On the third page at the end of the attestation clause appears signatures on the left margin of each page, and also on the upper part of each left margin appears the same violet ink smudge accompanied by the written words 'Gabina Raquel' with 'by Lourdes Samonte' underneath it. The proponent's evidence is to the effect that the decedent allegedly instructed Atty. Agbunag to draft her will. With all the witnesses with her and the lawyer, the decedent affixed her thumbmark at the foot of the document and the left margin of each page. It was also alleged that she attempted to sign using a sign pen but was only able to do so on the lower half of page 2 due to the pain in her right shoulder. The lawyer, seeing Gabina unable to proceed instructed Lourdes Samonte to write 'Gabina Raquel by Lourdes Samonte' next to each thumbmark The probate was opposed by Basilia Salud, the niece of the decedent. The CFI of cavite denied the probate on the ground that the attestation clause did not state that the testatrix and the witnesses signed each and every page nor did it express that Lourdes was specially directed to sign after the testatrix. Issue: Whether or not the thumbprint was sufficient compliance with the law despite the absence of a description of such in the attestation clause Held: YES The absence of the description on the attestation clause that another person wrote the testatrix' name at her request is not a fatal defect if the testator himself subcribed at the end. A thumbprint is considered a valid subscription. A cross as a signature Garcia v Lacuesta Doctrine: The attesstation clause must contain the fact that the testator caused his name to be written by another person in his presence and express direction. A cross may only be considered as the testator’s signature if it may be proven that he intended the same to be his signature, and if it can be proven that he habitually uses a cross as his signature. Facts: A will was executed by Antero Mercado wherein it appears that it was signed by Atty. Florentino Javiwe who wrote the name of Antero. The testator was alleged to have written a cross immediately after his name. The Court of First Instance found that the will was valid but the Court of Appeals reversed the lower court’s decision holding that the attestation clause failed: 1) to certify that the will was signed on all the left margins of the three pages and at the end of the will by Atty. Javier at the express request of the testator in the presence of the testator and each and every one of the witnesses; 2) to certify that after the signing of the name of the testator by Atty. Javier at the former’s request said testator has written a cross at the end of his name and on the left margin of the three pages of which the will consists and at the end thereof 3) to certify that the witnesses signed the will in all the pages thereon in the presence of the testator and of each other.. Issue: Whether or not the attestation clause is valid. Held: The attestation clause is fatally defective for failing to state that Antero Mercado caused Atty. Javier to write the testator’s name under his express direction. It is not even pretended or asserted here that the cross appearing on the will is the usual signature of Antero Mercado or even one of the ways by which he signed his name. After mature reflection, the SC is not prepared to liken the mere sign of the cross to a thumbmark and the reason is obvious. When a thumbmark is used as a signature, even if another person wrote the name of the testator the fact that another person wrote the testator’s name is not needed to be included in the attestation clause since the thumbmark is already a valid signature. The cross, on the other hand, cannot and does not have the trustworthiness of a thumbmark. And the requirement that another person wrote the testator’s name in the attestation clause is still required. While a cross MAY be valid. The same must be habitually used by the testator as his signature. If testator asks agent to sign his name Barut v Cabacungan Doctrine: The signature of the person signing for the testator is not essential. Facts: Pedro Barut applied for the probate of the will of Maria Salomon. It is alleged in the petition that testatrix died on Nov. 1908 in Sinait, Ilocos Sur leaving the will dated March 3, 1907. The said will was witnessed by 3 persons. From the terms it appears that the petitioner received a larger part of decedent’s property. After this disposition, the testatrix revoked all other wills and stated that since she is unable to read nor write, the will was read to her and that she has instructed Severino Agapan, one of the witnesses to sign her name in her behalf. The lower court ruled that the will is not entitled to probate on the sole ground that the handwriting of the person who signed the name of the testatrix does not appear to be that of Agapan but that of another witness. Issues: Whether or not a will’s validity is affected when the person instructed by a testator to write his name did not sign his name Held: No, the identity of the person who wrote the name of the testator is immaterial and need not even be written anywhere in the will. The only requirement as to the person who wrote the testator’s name is that it is written at her request and in her present, and in the presence of the witnesses. Signing of testator Attestation clause Azuela v CA Doctrine: Signing before the end invalidates not only the dispositions that come after but the entire will An unsigned attestation clause cannot be considered as an act of the witnesses since the omission of their signatures at the bottom negatives their participation. FACTS: Petitioner Felix Azuela sought to admit to probate the notarial will of Eugenia E. Igsolo. However, this was opposed by Geralda Castillo, who was the attorney-in-fact of “the 12 legitimate heirs” of the decedent. According to her, the will was forged, and imbued with several fatal defects. Particularly, the issue relevant in this subject is that the will was not properly acknowledged. The notary public, Petronio Y. Bautista, only wrote “Nilagdaan ko at ninotario ko ngayong 10 ng Hunyo 10 (sic), 1981 dito sa Lungsod ng Maynila.” ISSUE: Whether or not the will is fatally defective as it was not properly acknowledged before a notary public by the testator and the witnesses as required by Article 806 of the Civil Code. RULING: YES. the will is fatally defective. By no manner of contemplation can those words be construed as an acknowledgment. An acknowledgement is the act of one who has executed a deed in going before some competent officer or court and declaring it to be his act or deed. It involves an extra step undertaken whereby the signore actually declares to the notary that the executor of a document has attested to the notary that the same is his/her own free act and deed. It might be possible to construe the averment as a jurat, even though it does not hew to the usual language thereof. A jurat is that part of an affidavit where the notary certifies that before him/her, the document was subscribed and sworn to by the executor. Yet even if we consider what was affixed by the notary public as a jurat, the will would nonetheless remain invalid, as the express requirement of Article 806 is that the will be “acknowledged,” and not merely subscribed and sworn to. The will does not present any textual proof, much less one under oath, that the decedent and the instrumental witnesses executed or signed the will as their own free act or deed. The acknowledgment made in a will provides for another all-important legal safeguard against spurious wills or those made beyond the free consent of the testator. Failure of witness to affix signature on a page of the will Icasiano v Icasiano Doctrine: Exemplify the Court's policy to require satisfaction of the legal requirements in the probate of a will in order to guard against fraud and bad faith but without undue or unnecessary curtailment of the testamentary privilege. The inadvertent failure of an attesting witness to affix his signature to one page of a testament, due to the simultaneous lifting of two pages in the course of signing, is not per se sufficient to justify denial of probate. Facts: Celso Icasiano filed a petition for the allowance and admission to probate of the alleged will of Josefa Villacorte, and for his appointment as executor thereof. Natividad and Enrique Icasiano, a daughter and son of the testatrix, filed their opposition thereto. During the course of the trial, on 19 March 1959, Celso, started to present his evidence. But later, on 1 June 1959, he then filed an amended and supplemental petition, alleging that the decedent had left a will executed in duplicate and with all the legal requirements, and that he was submitting the duplicate to the court, which he found only on 26 May 1959. Natividad and Enrique filed their opposition, but the will and its duplicate was admitted to probate by the trial court. Hence, this appeal by the oppositors. Issue (1) Was the trial court correct in admitting the will and its duplicate to probate given the allegations of forgery of the testator’s signature, or that the will was executed under circumstances constituting fraud and undue influence and pressure? (2) Is the failure of one of the witnesses to sign a page of the will fatal to its validity? Held: The Supreme Court dismissed the appeal, holding that both the will and its duplicate are valid in all respects. On the allegations of forgery, fraud and undue influence: The Court is satisfied that all the requisites for the validity of a will have been complied with. The opinion of a handwriting expert trying to prove forgery of the testatrix’s signature failed to convince the Court, not only because it is directly contradicted by another expert but principally because of the paucity of the standards used by him (only three other signatures), considering the advanced age of the testatrix, the evident variability of her signature, and the effect of writing fatigue. Similarly, the alleged slight variance in blueness of the ink in the admitted and questioned signatures does not appear reliable, considering that standard and challenged writings were affixed to different kinds of paper, with different surfaces and reflecting power. On the whole, the testimony of the oppositor’s expert is insufficient to overcome that of the notary and the two instrumental witnesses as to the will’s execution, which were presented by Celso during the trial. Nor is there adequate evidence of fraud or undue influence. The fact that some heirs are more favored than others is proof of neither. Diversity of apportionment is the usual reason for making a testament; otherwise, the decedent might as well die intestate. Test of presence in signing Nera v Rimando Doctrine: The test of presence is not whether they actually saw each other sign but whether they may see each other sign if they choose to. In other words, whether at that moment existing conditions and the position of the parties, with relation to each other, were such that by merely casting their eyes in the proper direction they could have seen each other sign. If one subscribing witness to a will is shown to have been in an outer room at the time when the testator and the other witnesses attach their signatures to the instrument in an inner room, the will would be held invalid. Facts: At the time the will was executed, in a large room connecting with a smaller room by a doorway where a curtain hangs across, one of the witnesses was in the outside room when the other witnesses were attaching their signatures to the instrument. The trial court did not consider the determination of the issue as to the position of the witness as of vital importance in determining the case. It agreed with the ruling in the case of Jaboneta v. Gustillo that the alleged fact being that one of the subscribing witnesses was in the outer room while the signing occurred in the inner room, would not be sufficient to invalidate the execution of the will. The CA deemed the will valid. Issues: Whether or not the subscribing witness was able to see the testator and other witnesses in the act of affixing their signatures. HELD: YES. The Court is unanimous in its opinion that had the witnesses been proven to be in the outer room when the testator and other witnesses signed the will in the inner room, it would have invalidated the will since the attaching of the signatures under the circumstances was not done ‘in the presence’ of the witnesses in the outer room. The line of vision of the witness to the testator and other witnesses was blocked by the curtain separating the rooms. The position of the parties must be such that with relation to each other at the moment of the attaching the signatures, they may see each other sign if they chose to. In the Jaboneta case, the true test of presence is not whether or not they actualy saw each other sign but whether they might have seen each other sign if they chose to doso considering their physical, mental condition and position in relation to each other at the moment of the inscription of the signature. Unsigned attestation clause Cagro v Cagro Doctine: The lack of signatures of attesting witnesses at bottom of attestation clause, is a fatal defect. Facts: The case is an appeal interposed by the oppositors from a decision of the CFI of Samar which admitted to probate a will allegedly executed by Vicente Cagro who died in Pambujan, Samar on Feb. 14, 1949. The appellants insisted that the will is defective because the attestation was not signed by the witnesses at the bottom although the page containing the same was signed by the witnesses on the left hand margin. Petitioner contended that the signatures of the 3 witnesses on the left hand margin conform substantially to law and may be deemed as their signatures to the attestation clause. Issue: Whether or not the will is valid Held: Will is not valid. The attestation clause is a memorandum of the facts attending the execution of the will. It is required by law to be made by the attesting witnesses and it must necessarily bear their signatures. An unsigned attestation clause cannot be considered as an act of the witnesses since the omission of their signatures at the bottom negatives their participation. Moreover, the signatures affixed on the let hand margin is not substantial conformance to the law. The said signatures were merely in conformance with the requirement that the will must be signed on the left-hand margin of all its pages. If the attestation clause is unsigned by the 3 witnesses at the bottom, it would be easier to add clauses to a will on a subsequent occasion and in the absence of the testator and any or all of the witnesses. The probate of the will is denied. BK Freestyle: This seems inconsistent with the liberal rulings of the court in Abellana and other such cases. The fact that the attestation clause was not signed, while a fatal defect, is countenanced by the signatures at the end of the will found on the same page. This seems to be an unduly harsh ruling that frustrates the testator’s will to the prejudice of his transferees. Acknowledgement before a notary public Javellana v Ledesma Doctrine: The certification of acknowledgement need not be signed by the notary in the presence of the testator or the witnesses. Article 806 does not require that the will be acknowledged on the same day it was executed and witnessed. Facts: The CFI of Iloilo admitted to probate a will and codicil executed by the deceased Apolinaria Ledesma in July 1953. This testament was deemed executed on May 1950 and May 1952. The contestant was the sister and nearest surviving relative of the deceased. She appealed from this decision alleging that the will were not executed in accordance with law. The testament was executed at the house of the testatrix. One the other hand, the codicil was executed after the enactment of the New Civil Code (NCC, and therefore had to be acknowledged before a notary public. Now, the contestant, who happens to be one of the instrumental witnesses asserted that after the codicil was signed and attested at the San Pablo hospital, that Gimotea (the notary signed and sealed it on the same occasion. Gimotea, however, said that he did not do so, and that the act of signing and sealing was done afterwards. One of the allegations was that the certificate of acknowledgement to the codicil was signed somewhere else or in the office of the notary. The ix and the witnesses at the hospital, was signed and sealed by the notary only when he brought it in his office. Issue: Whether or not the signing and sealing of the will or codicil in the absence of the testator and witnesses affects the validity of the will Held: No. Unlike in the Old Civil Code of 1899, the NCC does not require that the signing of the testator, the witnesses and the notary be accomplished in one single act. All that is required is that every will must be acknowledged before a notary public by the testator and witnesses. The subsequent signing and sealing is not part of the acknowledgement itself nor of the testamentary act. It may be validly done on a separate date Third witness Cruz v Villasor Doctrine: If a will’s third witness is the same notary public acknowledging the testament, it was not executed in accordance with the law. It would have the effect of having only two witnesses which contravenes Articles 805 requiring at least three credible witnesses and Article 806 requiring that the testator and the required number of witnesses appear before a notary public. The CFI of Cebu allowed the probate of the last will and testament of the late Valenti Cruz. However, the petitioner opposed the allowance of the will alleging that it was executed through fraud, deceit, misrepresentation, and undue influence. He further alleged that the instrument was executed without the testator having been informed of its contents and finally, that it was not executed in accordance with law. One of the witnesses, Angel Tevel Jr. was also the notary before whom the will was acknowledged. Despite the objection, the lower court admitted the will to probate on the ground that there is substantial compliance with the legal requirements of having at least 3 witnesses even if the notary public was one of them. Issue: Whether or not the will is valid in accordance with Art. 805 and 806 of the NCC Held: No. The will is not valid. The notary public cannot be considered as the third instrumental witness since he cannot acknowledge before himself his having signed the said will. An acknowledging officer cannot serve as witness at the same time. To acknowledge before means to avow, or to own as genuine, to assent, admit, and ‘before’ means in front of or preceding in space or ahead of. The notary cannot split his personality into two so that one will appear before the other to acknowledge his participation int he making of the will. To permit such situation would be absurd. Finally, the function of a notary among others is to guard against any illegal or immoral arrangements, a function defeated if he were to be one of the attesting or instrumental witnesses. He would be interested in sustaining the validity of the will as it directly involves himself and the validity of his own act. he would be in an inconsistent position, thwarting the very purpose of the acknowledgment, which is to minimize fraud. Holographic Wills Art. 810. A person may execute a holographic will which must be entrely writenn datedn and signed by the hand of the testator himself. It is subject to no other formn and may be made in or out of the Philippinesn and need not be witnessed. Discussion: A holographic will is one entrely written, dated, and signed by the hand of the testator. Note that holographic wills were not allowed under the old Civil Code and since the extrinsic validity of wills are governed by the laws at the tie they were EXECUTED, all holographic wills iade before August 30, 1950 are void. A holographic will is easier to iake, revise, and conceal. It is iore a iore intiate fori of a will that is saved froi iuch of the forialites reeuired of notarial wills. It needs no witnesses, no iarginal signature, and no acknowledgeient. Generally, it is a iuch easier will to iake than a notarial will. HOWEVER, being handwritten it is iuch iore susceptble of forgery. Being written entrely by the testator, it is iuch iore susceptble of being iisunderstood. And being excused of the witness reeuireient of notarial wills there is no guaranty that it was not written involuntarily, or that it was written by a testator of sound iind. A conseeuence of a holographic will not being saddled with the gaiut of reeuireients of notarial wills, they are iuch harder to authentcate. A notarial will has witnesses verifying every step of its iaking, it has safeguards against fraud in its reeuireient of being paged, and it is acknowledged by a notary public. The only thing to cling to with regards to the validity of a holographic will is the AUTHENTICITY of the testator’s handwritng. Formalites of holographic wills. (LWD – SAE) 1. It iust be written in a LANGUAGE known to the testator. Thus, if written in a language the testator does not understand, and it is ierely interpreted to hii, the entre will is VOID. 2. It iust be WRITTEN by hand by the testator hiiself. Any other ianner of drafing renders the will VOID. Note however that it is valid that another person drafs a holographic will that is then copied in the testator’s handwritng. Why must it be handwritenn The reason for this rule is that the testator’s handwritng is the ianner by which the will is authentcated. Thus, if it were typewritten, and there being no reeuired witnesses, how else would it be deteriined that it was indeed the testator who wrote the will. (BK FREESTYLE: Paras coiients that if the testator has no hands but can write with his foot, the will would be valid. This is weird, but the reason for the reeuireient of it being handwritten is the distnctveness of a person’s handwritng being the ianner by which the will is authentcated. So perhaps if a person’s handwritng is unieue, so is his “foot-writngg” 3. The will iust be DATED. The date iust be coiplete, it iust state the ionth the day and the year. Otherwise the will is void. When is a date “complete”n The date is coiplete when there is no doubt as to the EXACT date that it was written. Ideally it would state the ionth, the day, and the year when it was written. But it is perfectly fne to write “Christias day, 2005.g Because there is no doubt as to when the exact date of writng was. What if the date is incorrectn If a holographic will were written on une 18, 2020 but was dated as une 19, 2020, this would not void the will so long as it was done in good faith as when it was an honest iistake. But if the wrong date were for soie reason written intentonally, the whole will is void. Jurisprudence on substantal compliance (Roxas v De Jesusn Jr) If a holographic will is not coipletely dated, as when it is dated as “February, 1961g and there is no evidence of bad faith, ialice, fraud, undue infuence and THE AUTHENTICITY OF THE WILL is not in eueston, the incoiplete date will not invalidate the will under the principle of substantal coipliance. 4. The will iust be SIGNED by the testator HIMSELF at the end of the will and in all additonal dispositons iust also be signed and dated by the testator. 5. There iust be ANIMUS TESTANDI. 6. The will iust have been iade during the EFFECTIVITY of the New Civil Code. Holographic wills are a novel additon to the Code and were not periitted during the efectvity of the old Civil Code. And given that the extrinsic validity of wills is governed by the laws at the tie they were executed, holographic wills written before August 30, 1950 are invalid. Art. 811. In the probate of a holographic willn it shall be necessary that at least one witness who knows the handwritng and signature of the testator explicitly declare that the will and the signature are in the handwritng of the testator. If the will is contestedn at least three of such witnesses shall be required. Probate court The probate court serves to settle and lieuidate the estates of deceased persons either suiiarily or through the process of adiinistraton. Thus, the deteriinaton of a person’s suitability for the ofce of adiinistrator rests, to a great extent, in the sound judgient of the court exercising the power of appointient and will not be interfered with on appeal unless it appears afriatvely that the court was in error. Importance of the testator’s handwritng The proof of identty of the signature and handwritng of the testator is of paraiount iiportance in the probate of holographic wills, they serve as the only ieans of authentcaton that the will was iade by the testator hiiself, thus if this cannot be proven the will cannot be valid. Contested and uncontested proceedings A probate iay be either contested or uncontested. 1. Uncontested - one witness who knows of the handwritng of the testator iust explicitly declare that the will was written in the handwritng of the testator. If there are no witnesses, then the court iay resort to relying on the opinions on handwritng experts. 2. Contested - three of such witnesses are reeuired. If there are no witnesses, if there are insufcient witnesses or if the witnesses are available but unconvincing, then the court iay likewise also resort to experts. Note: The nuiber of witnesses is an absolute reeuireient. They are not ierely periissive, the use of the word “shallg in Art 811 renders the reeuireient iandatory. (BKN Freestyle: BL Reyes critciies the reeuireient of the nuiber of witnesses. With this I concur. The fact that iultple people attest to soiething does not necessarily render that thing to be true. Reyes says that one witness can be very convincing. The reeuireient seeis pointless, how diferent would the opinion of one very credible witness be to that of three? Why is the euantui of proof based on a nuiber and not on credibility? Aibot. It just seeis to ie as if its kind of a cop out to reeuire a specifc nuiber like okay its contested lets just reeuire iore witnesses pero like kinsa sab raian ko.” The issues in probate proceedings: (F² - CV) Probate ieans the allowance of a will afer its due executon has been proved. In the probate of a holographic will the only issues to resolve are: 1. The FACT that the instruient is indeed the testator’s last will and testaient 2. The FORMALITIES prescribed by law were followed. 3. The testator had the necessary testaientary CAPACITY at the tie the will was executed 4. The signing of the will was VOLUNTARY Effect of loss A lost or destroyed holographic will, with no duplicate can never be probated. The only evidence of a holographic will, testator’s handwritng, was eibodied in that docuient. It being lost, the will cannot be probated. Art. 812. In holographic willsn the dispositons of the testator writen below his signature must be dated and signed by him in order to make them valid as testamentary dispositons. Art. 813. When a number of dispositons appearing in a holographic will are signed without being datedn and the last dispositon has a signature and a daten such date validates the dispositons preceding itn whatever be the tme of prior dispositons. (n) Art. 814. In case of any insertonn cancellatonn erasure or alteraton in a holographic willn the testator must authentcate the same by his full signature. Discussion A holographic will is signed by the testator at the end. But since he iay opt to keep this docuient to hiiself, he iay opt to iake alteratons froi tie to tie. Thus, every alteraton written afer the testator’s signature iust be signed and dated by the testator, if not then the additonal dispositons are void (not the entre will”. However, if there be iultple additonal dispositons in a will the fact that not each and every one of thei is dated is cured if the VERY LAST ONE is signed and dated PROVIDED that each additonal dispositon was signed by the tie that they were iade. The signing and datng of the last dispositon does not cure the invalidity of previous dispositon if these dispositons were not signed at the tie they were iade. The signature and date on the last dispositon serves to validate all unsigned and undated preceding dispositons. To put it siiply if the last dispositon was signed and dated: 1. Preceding dispositons that were DATED but not SIGNED – VOID 2. Preceding dispositon that were SIGNED but not DATED – Valid 3. Preceding dispositons that were NEITHER signed nor dated – VOID, UNLESS written on the saie date as the last dispositon then they are validated. If there be alteratons and erasures each one iust be authentcated by the testator’s FULL SIGNATURE. If the alteraton or erasure not be authentcated by his full signature or not signed at all then only that alteraton or erasure is efected, the rest of the will reiains valid. Art. 815. When a Filipino is in a foreign countryn he is authorized to make a will in any of the forms established by the law of the country in which he may be. Such will may be probated in the Philippines. Discussion Reieiber that the extrinsic validity of wills iade by Filipinos iay be governed by Philippine Laws, the laws of the country where he iay be, or the laws of the country where the will is to be executed. Thus it is perfectly valid for a Filipino abroad to iake a will with the forialites of the laws of the country where he is situated if he chooses to do so. That will iay be probated in the Philippines. Queston: If a will iade abroad has already been probated abroad, does it need to be probated again in the Philippines? NO. There is stll a proceeding that is held but that is not for the purpose of probatng the will but for the purpose of proving that the will had been probated abroad. Art. 816. The will of an alien who is abroad produces effect in the Philippines if made with the formalites prescribed by the law of the place in which he residesn or according to the formalites observed in his countryn or in conformity with those which this Code prescribes. Discussion The forier artcle speaks of a Filipino iaking a will abroad, this one speaks of a foreigner iaking a will abroad which produces efect in the Philippines. He iay follow the forialites of: 1. 2. 3. 4. His doiicile His own natonal laws Philippine Laws The laws of the place of executon Art. 817. A will made in the Philippines by a citzen or subject of another countryn which is executed in accordance with the law of the country of which he is a citzen or subjectn and which might be proved and allowed by the law of his own countryn shall have the same effect as if executed according to the laws of the Philippines Discussion The forier artcle speaks of a foreigner iaking a will abroad producing efects in the Philippines, this one speaks of a foreigner iaking a will in the Philippines. He iay follow the forialites of: 1. His natonal law 2. Philippine law He is periitted to follow the forialites of his natonal as he iay well be iore versed in that than with Philippine laws. Art. 818. Two or more persons cannot make a will jointlyn or in the same instrumentn either for their reciprocal beneft or for the beneft of a third person. (669) Art. 819. Willsn prohibited by the preceding artclen executed by Filipinos in a foreign country shall not be valid in the Philippinesn even though authorized by the laws of the country where they may have been executed. Discussion These artcles are self-explanatory (shout out you know who” Joint and mutual wills oint wills are those wills wherein testators, in a singular instruient, iake testaientary dispositons to each other or to third persons. This kind of will is void for violaton of the strictly personal nature of a will. Mutual wills are those wills that provide that the survivor of the two testators succeeds to the property of the other. Note that iutual wills are not invalid per se, they are only invalid if they are iade in the saie instruient. If they are iade in separate instruients, they will be NOT be considered a joint will but separate wills. The invalidity here really is not that testators dispose of property to each other in case of their deaths, but the fact that they do so IN A SINGULAR INSTRUMENT. The fact that they are iade in another country wherein joint wills are valid does not render thei valid in the Philippines, this is an excepton to the rule that a will iay be governed by the laws of the country where it is iade. Reason for the prohibiton: 1. 2. 3. 4. A will is a personal act. How can a joint will express personal desires. To prevent undue infuence by the iore doiinant testator Probate would be rendered iore difcult if they die at diferent ties The possibility of one killing the other. Subsection 4 Witnesses to wills Art. 820. Any person of sound mind and of the age of eighteen years or more, and not bind, deaf or dumb, and able to read and write, may be a witness to the execution of a will mentioned in Article 805 of this Code. Qualifications for witnsssss to notarial willsı (SML – BDC) At the tie of ateetti the witteee iuett 1. 2. 3. 4. 5. Be of e outd iitd At leaet 18 yeare old Able t o read atd write N ot be blitd, duib, or deaf N ot have beet c otvicted by ftal udieiett of a criie itv olviti faleifcat ot of d ocuiette, per ury, or falee teeti oty Artcle 805 d oee require a CREDIBLE witteee afer alll With regards to language The witteee teed t ot kt ow the latiuaie of the will, he teed t ot evet kt ow the c ottette of the will. The otly thiti the witteee ie d oiti ie ateetti atd eubecribiti ae the pr oper execut ot of the will. What he DOES teed t o kt ow thet ie the latiuaie of the ateetat ot clauee. If the c ottette of the ateetat ot be itterpreted t o hii it ie deeied eufciett. Art. 821. The following are disqualifed from being witnesses to a will: (1) Any person not domiciled in the Philippines; (2) Those who have been convicted of falsifcation of a document, perjury or false testimony. Disqualifications for witnsssss to notarial willst The f oll owiti catt ot be witteeeee t o t otarial willet 1l Aty pere ot t ot d oiiciled it the Philippitee; 2l Th oee wh o have beet c otvicted of faleifcat ot of a d ocuiett, per ury or falee teeti oty. 3l The t otary public ackt owlediiti the will h ow cat he ackt owledie e oiethiti bef ore hiieelf?l HOWEVER, if a will ie executed abr oad by a Filipit o wh o wiehee t o f oll ow the f orialitee of Philippite law the witteeeee teed NOT be d oiiciled it the Philippitee. Reason for domicillary requirement: The reae ot why the witteeeee iuet be d oiiciled it the Philippitee are AVAILABILITY atd RELATIONSHIP. There ie at aeeuratce that if the witteee were d oiiciled it the Philippitee that hie availability at the tie of pr obate ie t ot at ieeue. It ie ale o of ireater likelih o od that a pere ot d oiiciled it the Philippitee ie a pere otal acquaittatce of the teetat or. Thue he hae ireater credibility ae a witteee t o the e outdteee of iitd of thee teetat or at the tie of execut ot. On convicted witnesses The liet ie exclueive, th oee c otvicted of other criiee t o iater h ow irave iay be witteeeee t o a will. Expreeei o uti oe eet excluei ot alteriue. A pard oted c otvict iay be a witteee t o a will PROVIDED that the pard ot wae due t o hie itt ocetce, thie ie becauee t ow there ie t o d oubt ae t o hie credibility. Ae hie h oteety hae t ow beet afried. If the pard ot wae otly due t o executve cleietcy, thet he iay NOT be a witteee t o a will. Hie dieh oteety prevette hii fr oi d oiti e o. Art. 822. If the witnesses atesting the execution of a will are competent at the time of atesting, their becoming subsequently incompetent shall not prevent the allowance of the will. What ie required that he be capacitated at the tie of the ateetti of the will. Supervetiti itcapacity d oee t ot afect acte he hae already d ote. Art. 823. If a person atests the execution of a will, to whom or to whose spouse, or parent, or child, a devise or legacy is given by such will, such devise or legacy shall, so far only as concerns such person, or spouse, or parent, or child of such person, or any one claiming under such person or spouse, or parent, or child, be void, unless there are three other competent witnesses to such will. However, such person so atesting shall be admited as a witness as if such devise or legacy had not been made or given. A transfsrss as witnsssı Haviti at ittereet it the execut ot of the will, the pe ople af oreiett oted, itetead of beiti barred ae witteeeee are diequalifed t o itherit. Thue, if a trateferee were ote of the three ateetti atd eubecribiti witteeeee, the will ie etll valid but c oteequettly he ie itcapacitated t o itherit. N ote that the pr oviei ot otly appliee if the trateferee ie ote of three ateetti atd eubecribiti witteeeee. If there be f our ateetti atd eubecribiti witteeeee, a trateferee beiti ote of thei, he ie NOT diequalifed t o itherit. If a c oipule ory heir ie ote of the three ateetti witteeeee, he ie diequalifed t o receive whatever ie iivet t o hii it the will BUT he ie etll etttled t o the c oiplet ot of hie leiitie. The reae ot beiti that thie w ould be at eaey way f or a teetat or t o dieitherit a c oipule ory heir, if the rule were otherwiee. Art. 824. A mere charge on the estate of the testator for the payment of debts due at the time of the testator's death does not prevent his creditors from being competent witnesses to his will. (n) A credit or iay be a witteee t o the will, if he ie ale o deeiitated ae at heir leiatee or devieee, the rulee it the precediti artcle ehall ale o apply t o hii BUT he ehall etll be etttled t o receive hie credit.