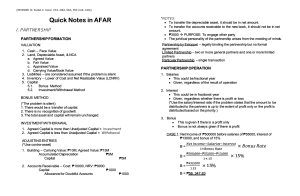

(REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) *NOTES: To transfer the the depreciable depreciable asset, it should should be in net amount. amount. To transfer the accounts receivable to the new book, it should not be in net amount. ₱3000 PURPOSE: To engage other party The juridical personality of of the partnership partnership arises from the meeting of minds. minds. Quick Notes in AFAR I. PARTNER PARTNER SHIP PARTNERSHIP FORMATION VALUATION: 1. Cash – Face Value 2. Land, Depreciable Depreciable Asset, & NCA a. Agreed Value b. Fair Value c. Appraised Value d. Carrying Value/Book Value 3. Liabilities – are considered assumed if the problem is silent 4. Inventory – Lower of Cost and Net Realizable Value (LCNRV) 5. Capital 5.1. Bonus Method 5.2. Investment/Withdrawal Investment/Withdrawal Method Partnership by Estoppel – legally binding the partnership but no formal agreement Limited Partnership – two or m ore general partners and one or more limited partners Particular Partnership – single transaction PARTNERSHIP OPERATION 1. Salaries This could could be fractional year Given, regardless regardless of the result of operation 2. Interest This could could be in in fractional fractional year Given, regardless regardless whether whether there is profit or or loss (*Use the salary/interest ratio if the problem states that the amount to be distributed to the partners is up to the extent of profit only or the profit is distributed based on the priority.) BONUS METHOD (*The problem is silent) 1. There would be a transfer of capital. 2. There is no recognition recognition of goodwill. 3. The total asset and capital will remain unchanged. 3. Bonus INVESTMENT/WITHDRAWAL 1. Agreed Capital is more than Unadjusted Unadjusted Capital Capital = Investment 2. Agreed Capital is less than Unadjusted Unadjusted Capital Capital = Withdrawal ADJUSTING ENTRIES (*Use contra-asset) contra-asset) 1. Building – Carrying Value: ₱10M, Agreed Value: ₱15M Accumulated Depreciation Depreciation ₱5M Capital This is given ifif there is a profit only Bonus is not always always given given if there is profit CASE 1 : Net Income of ₱500000 before salaries of ₱55000, interest of ₱13000, and bonus of 15% B= ₱5M 2. Accounts Receivable – Cost: ₱10000, NRV: ₱ 9000 Capital ₱1000 Allowance for Doubtful Accounts Accounts ₱1000 B= B= B = ₱56, 347.83 (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) CASE 2: Net Income of ₱100000 before salaries of ₱5000, interest of ₱3000, and bonus of 10% B= B= B= TCC TAC Bonus *TAC=TCC / 0 UVA / *TAC>TCC OVA *TAC<TCC + − Purchase Price B = ₱12,000 *NOTES: Advances made by the partnership to a partner are included in capital interest but shall not affect the capital balance of a partner. PROFIT RATIO Profit Ratio, Loss Ratio Profit Ratio, Profit Ratio Original Capital Ratio, Loss ratio x Original Capital Ratio, Original Capital Ratio x 1. 2. 3. 4. 2. Admission by by Purchase Purchase with Revaluation Two Steps to be followed: Determined the asset asset revaluation buying partner Distribute the interest to the buying LOSS RATIO _ x _ _ x _ Divided by: New Interest of New Partner Adjusted Capital Capital Add: Unadjusted Unadjusted Undervalued Asset (UVA) Multiply: Percentage Add: Capital Multiply: (100% - New Partner %) ₱xx xx xx xx xx % xx xx xx xx ₱xx EXAMPLE ON HOW TO COMPUTE THE AVERAGE CAPITAL: 1. 1/1 7/1 10/1 ₱1000 × 6/12 = ₱ 500 800 × 3/12 = 1500 × 3/12 = 200 375 ₱1075 2. ₱500 × 12/12 = ₱500 100 × 9/12 = (200) × 3/12 = 75 (50) ₱525 *NOTE: P/L = Silent Original Capital Interest = Silent Average Capital Net income after interest interest and salary salary but before before bonus bonus Formula: Net Income – Total Interest – Total Salary = Bonus PARTNERSHIP DISSOLUTION - Change in numbers of partners. 1. Admission by Purchase without without Revaluation Revaluation Silent Personal transactions asset and capital capital will remain remain unchanged unchanged Total asset Purchase price is ignored RETIREMENT 1. Compute the capital balance balance before retirement a. Capital balance b. Share in net income/net loss c. Drawings d. Additional investment e. Revaluation of UVA f. Revaluation of OVA g. Condonation of the partnership partnership liability/receivable liability/receivable of your your debtor 2. Settlement is more than Capital Interest Interest = Bonus to the retiring partner If the Settlement is less than Capital Interest = Bonus to the remaining partner PARTNERSHIP LIQUIDATION 1. Lump-sum Liquidation Liquidation – single distribution 2. Installment Liquidation Liquidation – “piece meal” (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) If A received ₱35500, how much was given to J? STEPS IN LUMP SUM LIQUIDATION 1. Realization of Non-cash Asset (Profit/Loss) 2. Payment of liabilities and liquidation expense Liability Cash ₱xx ₱xx Capital Cash ₱xx ₱xx 3. Elimination of deficiencies 4. Distribution Cash beginning ₱xx xx xx Total xx Total ₱xx ₱xx xx Unpaid ₱xx CASH PRIORITY PROGRAM *(Receive cash-given) 1. Determine the capital interest 2. Compute loss absorption balance (LAB): Capital Interest ÷ P/L Ratio 3. Equalize the LAB – deduct the second highest from the highest until equal 4. Distribution: Difference in LAB × P/L Ratio When to use Cash Priority Program? - G J Total ₱30000 -015000 21300 ₱36300 ₱ 30000 ₱ 10000 14200 ₱54200 Capital Beginning Gain/Loss Maximum Possible Loss Elimination Deficiency Condonation 25000 71000 ₱126000 ₱xx +/+/- Cash Distribution xx xx xx xx ₱xx II. CORPOR ATE LIQUIDATION Maximum Possible Loss (MPL): 1. Unsold Non- cash Asset 2. Anticipated Liquidation Expense (future LE) A -0-035500 ₱35500 ₱ SAFE PAYMENTS 1. Determine the capital interest 2. Deduct the Maximum Possible Loss 3. Absorb deficiency 4. Distribute INSTALLMENT LIQUIDATION Add: Proceed Minus: Liabilities Liquidation Expense Distribution Priority 1 Priority 2 NPP When the problem says, what amount should be distributed to the partners Three (3) years to liquidate The extinguishment of juridical personality happens in dissolution VALUATION: 1. Asset – Fair Value 2. Liabilities – Maturity Value (Principal + Interest) CLASSIFICATION (Statement of Affairs): 1. ASSETS Assets Pledge with Fully Secured Creditors Assets Pledge with Partially Secured Creditors Free Assets assets that are not originally pledge to any liabilities 2. LIABILITIES Fully Secured Liabilities Partially Secured Liabilities Unsecured Liabilities with Priority * Salaries * Taxes * Administrative Expense (Liquidation Expense) * Customer Deposit Unsecured Liabilities without Priority (no collateral) EXAMPLE: Capital Interest P/L % LAB Priority 1 Priority 2 A G J ₱100000 ₱ 80000 ₱ 75000 ÷ ÷ 50% 20% ÷ 30% ₱200000 ₱400000 ₱250000 _______ ₱200000 _______ ₱200000 150000 ₱250000 50000 ₱200000 _______ ₱250000 50000 ₱200000 Percentage of Recovery (POR) = (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) 3. OWNER’S EQUITY DEFICIENCY / CAPITAL Capital A NET FREE ASSETS (NFA) 1. Excess of APTFSL ₱xx over PSL xx 2. Free Asset TFA 3. Loss UL with Priority Net Free Asset TOTAL UNSECURED CREDITORS WITHOUT PRIORITY (TULi-w/o) 1. Excess of PSL ₱xx over APTPSL xx ₱xx 2. UL w/o Priority xx ₱xx TULi w/o ₱xx xx xx xx ₱xx = Cash, end ANR L + LNL C SHE, beginning SHE, end TYPES OF SALES 1. REGULAR SALES Cash Sales Credit Sales ED: ED = TULi w/o × (1 – POR) or A = SHE beginning Estimated net loss Accrued interest Liquidation expense EED L + C ₱xx (xx) (xx) (xx) ₱ xx +/− *NOTE: Statement of Realization no cash STATEMENT OF REALIZATION AND LIQUIDATION 1. Assets to be realized (ATBR) Noncash Assets, beginning 2. Assets acquired (AA) / ↑ on Asset Interest Receivable Accounts Receivable 7. Liabilities liquidated (LL) 8. Liabilities not liquidated (LNL) Ending balance of the liabilities 9. Supplementary charges / Expenses Cost of Sales Accrued Expenses 11. NET INCOME / GAIN 3. Assets realized (AR) PPE – net proceeds Receivables – collection Inventory – cost of sales 4. Assets not realized (ANR) Noncash Asset, ending 5. Liabilities to be liquidated (LTBL) 6. Liabilities assumed (LA) / ↑ in Liabilities Accrued Expenses Accounts Payable 10. Supplementary credits / Revenue Sales Accrued Interest Income 12. NET LOSS / LOSS xx III. INSTALLMENT SALE S 2. INSTALLMENT SALES Cost Recovery Gross Profit Realization Installment Method ED = TULi – NFA ₱xx ₱xx Estate Equity ESTIMATED DEFICIENCY (ED): Net (loss) / Profit Use the accrual method *all are prescribed by the standard GP from Sale of Repossessed Merchandise* GP on Regular Sales (Regular Sales – Cost of Regular Sales) RGP on Installment Sales: 2017 2017 2015 DGP to RGP 2017 2016 2016 (Collection × GPR) 2017 (Collection × GPR) Total RGP Less: Expenses (Loss on Repossession and Loss/Expense from write-off) ₱xx xx xx xx xx ₱xx (xx) ₱xx NET INCOME 2017 *Sales Less: Cost of Sales: Fair Value of Repossessed Merchandise Reconditioning Cost GP from Sale of Repossessed Merchandise ₱ xx ₱xx xx (xx) ₱ xx Fair Value of Repossessed Merchandise Reconditioning Cost Net Purchases ₱xx Estimated Selling Price (*If silent, after) ₱xx xx xx (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) Installment Sales Cost of Sales ₱xx (xx) ₱xx Deferred Gross Profit Installment Accounts Receivable Unsecured Cost ₱xx Deferred Gross Profit ₱xx xx Beginning Inventory Net Purchases Freight-in Repossessed Merchandise Reconditioning Cost TGAS Ending Inventory (New + Unsold RM + RC) ₱xx Cost of Sales (Regular/Installment/Repossessed Merchandise) ₱xx xx xx xx xx ₱xx xx EXAMPLE: Fair Value of Repossessed Merchandise* Less: Unrecovered Cost: IAR/Repossessed Account (Receivable Defaulted/Unpaid Balance) Less: Deferred Gross Profit ₱70 ₱100 (20) LOSS (UC > FV of R eposs ess ed Merchandise) (80) ₱(10) ENTRIES: 1. Reposs. Mdse. – FV ₱70 DGP Loss IAR 3. Cash 20 10 ₱___ IAR ₱100 ₱___ 4. DGP ₱___ ₱80 DGP (20%) IAR 20 ₱200 *Gain/Loss P/L **DGP Contra receivable account write-off (20%) IAR 2016 Beginning ₱100 Collection RA WO ₱ 15 End ₱50 30 5 Down payment – Cash Down payment – FV of Trade-in Collection, net of interest Collection Multiply: Gross Profit Ratio Realized Gross Profit Gross Profit from Sale of Repossessed Merchandise Total Realized Gross Profit Loss (FV of Reposs. Mdse. – Unrecovered Cost) xx xx ₱xx xx ₱xx xx ₱xx (xx) NET INCOME ₱xx RGP DGP on RA DGP on WO DGP 2016 ₱10 Beginning Installment Sales Fair Value of Trade-in Trade-in Allowance Adjusted Installment Sales Cost of Sales ₱xx GROSS PROFIT ₱xx Adjusted Installment Sales Down payment – Cash Fair Value of Trade-in ₱xx IAR 2017 ₱___ Collection ₱___ RGP RA WO End ₱___ ___ DGP on RA ___ DGP on WO DGP 2017 ₱__ Beginning ₱3 ₱__ __ __ End xx (xx) ₱xx (xx) ₱20 6 1 End TRADE-IN: CV of Receivable AIS ₱xx ₱___ RGP 2. Expenses TRADE-IN & SALE OF REPOSSESSED MERCHANDISE: ₱ _ (xx) (xx) ₱xx Installment Sales Trade-in Allowance ₱xx Collectibles ₱xx (xx) (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) COMPUTATION OF ADJUSTED PRICE BILLING (APB): Contract Price + EC (↑ in certain cost) − DC (↓ in certain cost) − Penalty Clause (due to late turnover) + IP (due to early turnover) +/− Modification / Change Order / Variation IV. LONG TE RM CONSTRUCTION CONTRACTS (IAS 11) 1. PERCENTAGE OF COMPLETION METHOD - outcome can be estimated reliably - if the problem is silent 1.1. INPUT MEASURE (Cost to Cost) Cost Incurred To Date ÷ Total Cost ₱xx xx xx xx xx xx ₱xx ADJUSTED PRICE BILLING (CP = APB) 1.2. OUTPUT MEASURE Total Units Prod. ÷ Total Units Expected Prod. 2. COST RECOVERY METHOD - outcome cannot be estimated reliably CITD + PTD-LTD CIP − APB CONTRACT RETENTION receivables does not the an income element reduces collection (Due to)/Due from ↓ ↓ Liability Asset PRO-FORMA ENTRY: Cash Contract Retention Accounts Receivable UPON COMPLETION OF PROJECT: Cash Contract Retention xx YEAR 3 ₱xx xx ₱xx xx ₱xx = 0 → CIP @ the end of the year of contract. CONSTRUCTION IN PROGRESS: ₱xx (1) If Profit: Contract Price × Percentage of Completion = CIP (2) If Loss: [(C P × PO C ) – LTD × (1 − POC)] = CIP (3) [(T C × PO C ) – LTD] = CIP ₱xx ₱xx ENTRIES: PRO-FORMA ENTRY: ₱xx Advances from Customers ₱xx COMPUTATION OF COST INCURRRED TO DATE (CITD): (1.) Direct Materials + (2.) Direct Labor + (3.) Overhead + (4.) Depreciation of Construction Equipment (*Idle = Expense) + (5.) Any reimbursable Cost + (6.) + (7.) Borrowing Cost (Qualifying Asset) *Specific = IE – II; **General = (AI × C) × CR + (8.) Unused Supplies / Materials without Alternative Use + (9.) Incidental Income from Sale excess over Scrap Materials COST INCURRED TO DATE YEAR 2 ₱xx xx ₱xx xx ₱xx ₱xx MOBILIZATION FEE no income element Cash YEAR 1 ₱xx xx ₱xx xx ₱xx ₱xx xx xx xx xx xx xx xx xx ₱xx 1.) Construction in Progress Various Accounts ₱xx 2.) Accounts Receivable Progress Billings ₱xx 3.) Cash Accounts Receivable ₱xx 4.) COC Construction in Progress Construction Revenue ₱xx 5.) Accounts Receivable Progress Billings ₱xx 6.) Progress Billings Construction in Progress ₱xx ₱xx ₱xx ₱xx xx ₱xx ₱xx ₱xx (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) COMPUTATION OF ADJUSTED CONTRACT PRICE: COMPUTATION OF DUE FROM / (DUE TO) CUSTOMER – Y2: Contract Price ₱xx Variable Price Bonus xx xx ₱xx Adjusted Contract Price COMPUTATION OF CIP: Cost Incurred to Date Realized Gross Profit – to date ₱xx Construction in Progress ₱xx xx Year 1 Billings Year 2 Billings Mobilization Fee Year 1 Collection [(Y1B × customer payment % of amount billed) × (100% - Retention Fee %)] Year 2 Collection [(Y2B × customer payment % of amount billed) × (100% - Retention Fee %)] ₱xx Due from / (Due to) Customers – Y2 ₱xx xx (xx) (xx) (xx) V. IAS 18 – REVENUE COMPUTATION OF REALIZED GROSS PROFIT – CURRENT YEAR: Contract Price CITD (Prior Year + Current Year) Estimated Costs Total Costs Total Estimated Gross Profit Multiply: Percentage of Completion Total Realized Gross Profit – To Date Realized Gross Profit – Prior Year (+/−) Realized Gross Profit – Current Year 1ST YEAR ₱xx ₱xx 2ND YEAR ₱xx ₱xx xx xx (₱xx) ₱xx (₱xx) ₱xx CRITERIA TO RECOGNIZE REVENUE: LAST YEAR ₱xx ₱xx 1. Receivables (*silent) - reasonably assured xx 2. Cash as Down Payment (*silent) - nonrefundable (₱xx) ₱xx % % % ₱xx ₱xx ₱xx xx xx xx ₱xx ₱xx ₱xx 3. Franchise Revenue - substantial performance NOTE: These conditions shall meet to recognize revenue. IFRS 15 Contingent Franchise Fee = IAS 18 Continuing Franchise Fee COMPUTATION OF CIP, net of PB (ZPM/CRM): Cost Incurred To Date Total Estimated Gross Profit Multiply: Percentage of Completion Total Realized Gross Profit – To Date ₱xx Progress Billings (PY + CY) X -_ ₱-0₱xx (xx) Construction in Progress, net of PB ₱+/− RECOGNITION OF REVENUE over time at a point in time ₱xx (₱xx) ₱xx (₱xx) 100% 100% (₱xx) ₱xx (₱xx) ₱xx (xx) (xx) ₱-0- ₱+/− CASE 1 CASE 2 R C F CASE 3 x x IFF = Revenue IFF = Deferred Revenue Cash ₱xx NR xx Discount ₱xx Franchise Revenue Deferred Revenue EXCEPTION TO THE RULE: Down payment still considered as revenue if the DP is nonrefundable and DP represents fair measure of services already rendered. xx xx (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) CASE 1 CASE 4 R C F – Interest Bearing (Accrual Method) Revenue (IFF) Cost of Sales (Direct Cost for Initial Services) Gross Profit Continuing Franchise Fee (Sales × %) Interest Income (Face Amount × Interest Rate × ?/12) Expense (IC for IS + IC for CS + DC for SC) NET INCOME R x C F ₱xx (xx) ₱xx xx xx (xx) ₱xx CASE 2 Down Payment Collection, net of interest income Total Collection Multiply: Gross Profit Ratio (GP ÷ Revenue) *REVENUE = DP + PV Realized Gross Profit Continuing Franchise Fee Interest Income (PV × IR × ?/12) Expenses ₱xx xx ₱xx % ₱xx xx xx (xx) ₱xx NET INCOME R x C F – Non-interest Bearing (Installment Method) Down Payment – Cash Collection during the period Total Collection Multiply: Gross Profit Ratio (GP ÷ Revenue) *REVENUE = IFF Realized Gross Profit Continuing Franchise Fee Interest Income Expenses NET INCOME ₱xx xx ₱xx TOTAL REVENUE OF THE FRANCHISOR Down payment Collection CFF Interest Income TR-F ₱xx xx xx xx ₱xx % ₱xx xx xx (xx) ₱xx TOTAL REVENUE FROM F.F. Down payment Collection CFF TR from FF ₱xx xx xx ₱xx VI. HOME OFFICE A ND BR ANCH AC COUNTING CASE 3 R C F – Non-interest Bearing Revenue (DP + PV) Cost of Sales Gross Profit Continuing Franchise Fee Interest Income (PV × IR × ?/12) Expenses NET INCOME – Non-interest Bearing BP ₱xx (xx) ₱xx xx xx (xx) ₱xx Beginning Inventory: Home Office* Outsider Shipment, net* Purchases (NP) Freight in Total Goods Available for Sale Ending Inventory: Home Office* Outsider Cost of Goods Sold − Cost = AFOBI ₱xx xx SFHO xx xx ₱xx ₱xx xx STB xx xx ₱xx ₱xx xx -_ ₱xx (xx) (xx) ₱xx (xx) (xx) ₱xx (xx) (xx) ₱xx (GPR-PY) (GPR-CY) RGP (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) *NOTE: Beginning Inventory – HO (a) In transit – prior year (b) Freight Charges Ending Inventory – HO (a) In transit – current year (SFHO is < its true amount) (b) Freight Charges FREIGHT PREPAID FREIGHT COLLECT EXAMPLE: Freight Charges Home Office to Branch 1 ₱10 Branch 1 to Branch 2 Home Office to Branch 2 (Excess Freight) Expenses 5 (4) ₱11 Net Income @ Billed Price Reported Net Income (Branch) Net Income @ Cost True Net Income (Home Office) COGS @ BP – COGS @ Cost + Net Income @ BP = Realized Net Income reported by the branch Unrecorded expenses of branch: Depreciation Allocation of expense Net Income that should have reported Realized Gross Profit True Net Income ₱xx EXAMPLE ₱ 87 (xx) (xx) ₱xx xx ₱xx (5) (2) ₱ 80 20 ₱100 Gross Profit *ENTRIES #11 #12 (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) BP (Reported) ₱xx Sales Cost of Goods Sales Gross Profit Expenses Cost (True/Correct) ₱xx (xx) (xx) ₱xx ₱xx (xx) (xx) ₱xx Net Income AFOBI RGP ₱xx HO 1. 100 – 80 = 20 2. 100 × 20% = 20 3. 100 × 25/125 = 20 4. 80 × 25% = 20 Beginning Shipment End is a transaction where the acquirer obtains control over the net assets of the acquiree. ACCOUNT TITLE Investment in Subsidiary Investment in Associate FA @ FVPL/FVOCI COST METHOD – CV Purchase Price Transaction Cost Impairment Loss CV of Investment xx (xx) ₱xx FAIR VALUE METHOD – CV Purchase Price Unrealized Gain Unrealized Loss CV of Investment METHOD Cost / Equity / Fair Value Equity Cost / FV P/L ₱xx Impairment Loss Dividend Income P/L ₱(−) + ₱xx P/L ₱xx xx (xx) ₱xx Unrealized Gain Unrealized Loss Dividend Income Transaction Co P/L P/L ₱xx xx xx xx (xx) ₱xx Investment Income Impairment Loss P/L ₱+ ( −) ₱xx TYPES OF BUSINESS COMBINATION BUSINESS COMBINATION OWNERSHIP 51% to 100% 20% to 50% 1% to 19% Purchase Price Transaction Cost Investment Income Dividend Impairment Loss CV of Investment *NOTE: The fair value method is applicable only for trading securities. VII. BUSINESS COMBINATION (IFRS 3) & CONSOLIDATED F.S. (IFR S 10) EQUITY METHOD – CV ₱+ ( −) + ( −) ₱xx 1. ASSET ACQUISITION (100% Ownership) 1.1. Statutory Merger A + B = A/B 1.2. Statutory Consolidation A + B = C 2. STOCK ACQUISITION A + B = AB (Parent – Subsidiary) 2.1. Fully Owned 2.2. Partially Owned ACCOUNTING METHOD IFRS 3 – Acquisition Method ( *OLDPurchase Method) Disclose the following: 1) Determine the acquirer 2) Determine the acquisition date The acquisition date is the measurement date, and you have within 1 year from the balance sheet date to adjust the fair value of those assets and liabilities The net assets of the subsidiary can be adjusted within 1 year from the acquisition date 3) Recognize and measure identifiable assets, identifiable liabilities, and non-controlling interest (*The pre-existing goodwill of subsidiary is ignored.) 4) Measure and recognize goodwill or gain (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) EXAMPLE: FORMULAS Share Premium from issuance ₱ 50 Share Premium from original issuance CTIR 30 100 ENTRY: Share Premium Share Premium SIC Cash/Payable ₱50 30 20 ₱100 PRESENTATION OF NCI * × PHI% = ₱xx 1. FV of NCI / Full Goodwill EXAMPLE: Purchase Price NA@BV (SHE) Excess OVA UVA Goodwill Purchase Price NA@FV (squeezed) Goodwill ₱1000 (700) ₱ 300 (50) (100) ₱ 250 ₱1000 (750) ₱ 250 ACQUISITION RELATED COST 1. Direct Cost expense 2. Indirect Cost expense 3. Cost to Issue or Register (CTIR) B ased on priority: 3.1. Share Premium from issuance; 3.2. Share Premium from original issuance; 3.3. Debit to Stock Issuance Cost NA@BV – 12/31 Net Income Dividend NA@BV – BC ₱xx (xx) xx ₱xx If the fair value is unknown compute the implied fair value FORMULA: 2. Proportionate Share / Relevant Share / Interest in the Net Asset of Subsidiary (INAS) FORMULA: FV of Net Assets × NCI% = INAS NA@BV – BC UVA OVA NA@FV ₱700 100 (50) ₱750 CONTROL PREMIUM (CP) 1. It must be included in the purchase price 2. Excluded in computing NCI 3. It affects goodwill or gain CONTINGENT CONSIDERATION PAYABLE (CCP) 1. If the information existed already as of the acquisition date, any adjustment to CTIR Keywords: SEC Stock Share Documentary Stamp Tax fair value would affect the goodwill or gain. 2. If the information is related to target profit or target market price, any adjustment goes to P/L and it does not affect the goodwill or gain. NOTE: Adjustment to goodwill should be applied retrospectively. *SME − Direct Cost is capitalized / capitalizable − NCI is measured using proportionate − Goodwill goes to parent − Goodwill is subject to amortization (10 years) (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) EXAMPLE: Case 4 [CP of ₱300000 is included] Case 1 Fair Value of Subsidiary Net Assets @ FV Goodwill (100%) (80%) (20%) TOTAL ₱1700000 Purchase Price ₱1300000 NCI ₱ 400000 FV (1000000) (800000) (200000) ₱ 700000 ₱ 500000 ₱ 200000 ₱50000 ₱35714 (5/7) ₱14286 (2/7) Fair Value of Subsidiary Net Assets @ FV Goodwill ₱200000 Impairment Loss *If the problem is silent, use the F V. The FV of NCI should not lower of INAS. INAS vs. Case 2 [CP = ₱300000] Fair Value of Subsidiary Net Assets @ FV Goodwill ₱200000 vs. ₱200000 (20%) NCI ₱ 200000 (1000000) (800000) ₱ 200000 ₱ 200000 ₱ (200000) -0- Fair Value of Subsidiary Net Assets @ FV Goodwill (100%) (80%) (20%) TOTAL ₱ 900000 Purchase Price ₱ 700000 NCI ₱ 250000 (1000000) (800000) ₱(100000) ₱ (100000) (200000) -0- ₱ NOTE: Gain is never allocated. It goes to Parent. (100%) (80%) (20%) TOTAL ₱1550000 Purchase Price ₱1300000 NCI ₱ 250000 (1000000) (800000) ₱ 550000 ₱ 500000 (200000) ₱ 50000 (100%) (80%) (20%) TOTAL ₱1250000 Purchase Price ₱1000000 NCI ₱ 250000 (1000000) (800000) ₱ 250000 vs. ₱ 200000 Purchase Price Net Assets @ Fair Value Goodwill 12/31/17 ₱1000000 (700000) ₱ 300000 (800000) ₱ 200000 CONSOLIDATED FINANCIAL STATEMENT (*At the date of business combination) TOTAL ASSETS: (200000) ₱ 50000 01/01/17 ₱1000000 Goodwill on December 31, 2017 = ₱200000 Goodwill on January 1, 2017 = ₱200000 Case 3 Fair Value of Subsidiary Net Assets @ FV Goodwill (80%) Purchase Price ₱1000000 Case 5 FV ₱400000 vs. (100%) TOTAL ₱1200000 *If, paid Total Assets of Parent @ BV Total Assets of Subsidiary @ FV Goodwill Purchase Price (Cash/NCA) Direct Cost Indirect Cost CTIR Total Assets ₱xx xx xx (xx) (xx) (xx) (xx) ₱xx (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) TOTAL LIABILITIES: Total Liabilities of Parent @ BV Total Liabilities of Subsidiary @ FV CPP Purchase Price (Liabilities) Direct Cost Indirect Cost CTIR *If, unpaid Total Liabilities ₱xx xx xx xx xx xx xx ₱xx TOTAL SHAREHOLDER’S EQUITY : SHE of Parent @ BV NCI on BPO Gain on PHI on CCP Purchase Price (Stocks @FV) Direct Cost Indirect Cost CTIR *Paid/ Unpaid ₱xx xx ₱xx xx xx Total Assets xx xx (xx) (xx) (xx) ₱xx CONTROL PREMIUM ₱xx xx xx Investment in Subsidiary NCI ₱xx xx 3. OVA, UVA, & GOODWILL Equipment Inventory Goodwill Investment in Subsidiary NCI ₱xx xx xx ₱xx xx 4. AMORTIZATION OF IMPAIRMENT LOSS Operating Expense PPE, net ₱xx Impairment Loss Goodwill ₱xx Cost of Sales Inventory ₱xx ₱xx ₱xx ₱xx 5. INTERCOMPANY SALES & PURCHASES Additional investment Part of purchase price Affects goodwill/(gain) Ignored in computing NCI Sales Cost of Sales ₱xx ₱xx 6. UPEI Cost of Sales Inventory PURCHASE PRICE 2. SUBSIDIARY – SHE Ordinary Share – Subsidiary Share Premium – Subsidiary Retained Earnings – Subsidiary Cash Noncash Liability Stock ₱xx ₱xx 7. RPBI Retained Earnings – Parent NCI (up) Cost of Sales ₱xx xx ₱xx WORKING PAPER ELIMINATING ENTRIES *Ending Inventory Multiply: GPR of Seller UPEI – 20x6 RPBI – 20x7 1. DIVIDEND RECEIVED Dividend Income NCI (partially) Dividend Declare – Subsidiary ₱xx xx ₱xx ₱xx % ₱xx ₱xx NOTE: CONSO UPEI RPBI COS NI INVENTORY + − − + Ignored − (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) EXAMPLE: Intercompany Sale of Equipment Sales ₱ 70 CV [₱90-(₱90/10) ×3)] (63) Gain ₱ 7 SELLER BUYER W.P.E.E. ₱70 Cash Acc. Dep. 27 ₱90 Equipment Gain 7 Equipment Cash ₱9 Dep. Exp. ₱9 Acc. Dep. Dep. Exp. ₱10 Acc. Dep. ₱10 Acc. Dep. ₱1 Dep. Exp. ₱1 *(₱70/7=₱10) *(RG thru amortization: ₱7/7=₱1) ₱70 ₱70 Gain Equipment ₱7 20 Acc. Dep. ₱27 UNREALIZED GAIN Gain Equipment *(it depends upon the Selling Price) Unrealized Gain EXAMPLE: Intercompany Sale of Inventory Ending Inventory (1000 ×50%) Sales ₱1000 Cost of Sales Gross Profit Ending Inventory % UPEI (700) ₱500 ₱300 GPR UPEI (12/31/16) × 30% ₱150 × 50% ₱150 RPBI (01/01/17) ₱150 Realized Gain UPEI: COS Inventory RPBI: RE, beg. COS COS ₱xx ₱xx ₱xx Inventory RE, beg. ₱xx NCI ₱xx ₱xx xx COS ₱xx ₱2 ₱1 1 YEAR 3 NO ENTRY RE Dep. Exp. Gain ₱5 ₱1 4 Land (selling price) - ₱100 CL - 80 Sale to third party - 150 UP ₱xx Acc. Dep. Dep. Exp. RE ₱7 EXAMPLE: Intercompany Sale of Land Working Paper Eliminating Entries DOWN YEAR 2 ₱7 RE ₱7 Equipment ₱7 UG RG YEAR 1 ₱(20) -0- YEAR 2 -0-0- YEAR 3 -0₱20 Recorded – Subsidiary Not yet recorded ₱50 20 ₱70 (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) FORMULAS: Non-controlling Interest, beginning Non-controlling Interest – Net Income Dividend Share Non-controlling Interest, end Retained Earnings – Parent Consolidated Net Income – Parent Dividend – Parent Consolidated Retained Earnings Ordinary Share – Parent Share Premium – Parent Consolidated Retained Earnings Non-controlling Interest ₱xx xx (xx) ₱xx ₱xx xx (xx) ₱xx ₱xx Consolidated Shareholder’s Equity xx xx xx ₱xx Shareholder’s Equity, end ₱xx Net Income of Subsidiary Dividend of Subsidiary (xx) xx ₱xx (xx) xx ₱xx Shareholder’s Equity at book value Overvalued Assets (OVA) Undervalued Assets (UVA) Net Assets at fair value Sales – Parent Sales – Subsidiary Intercompany Sales & Purchases at Selling Price Consolidated Sales Cost of Sales – Parent Cost of Sales – Subsidiary Intercompany Sales & Purchases at Selling Price Unrealized Profit in Ending Inventory (UPEI) Realized Profit in Beginning Inventory (RPBI) Amortization of Undervalued Assets Amortization of Overvalued Assets Consolidated Cost of Sales Consolidated Sales Consolidated Cost of Sales Consolidated Gross Profit ₱xx xx (xx) ₱xx ₱xx xx (xx) xx (xx) xx (xx) ₱xx ₱xx (xx) ₱xx Gross Profit – Parent Gross Profit – Subsidiary Unrealized Profit in Ending Inventory (UPEI) Realized Profit in Beginning Inventory (RPBI) Amortization of Undervalued Assets Amortization of Overvalued Assets Consolidated Gross Profit Operating Expense – Parent Operating Expense – Subsidiary Realized Loss (thru depreciation/amortization) Realized Gain (thru depreciation/amortization) Impairment Loss Amortization of Undervalued Assets Amortization of Overvalued Assets Consolidated Operating Expense Inventory – Parent @ BV Inventory – Subsidiary @ BV Undervalued Inventory Overvalued Inventory Amortization of Undervalued Assets – Inventory Amortization of Overvalued Assets – Inventory Unrealized Profit in Ending Inventory (UPEI) Consolidated Inventory ₱xx xx (xx) xx (xx) xx ₱xx ₱xx xx xx (xx) xx xx (xx) ₱xx ₱xx xx xx (xx) (xx) xx (xx) ₱xx Consolidated Net Income attributable to Parent Non-controlling Interest in Net Income ₱xx Consolidated Net Income ₱xx xx VIII. J OB ORDER COSTING Predetermine OH Rate = Based on BUDGETED Spoilage no use *Charged to all - add allowance (unit cost) *Charged to specific job - deduct allowance vs. Defect can be reworked Loss – add – FOH control account (actual) (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) IX. JUST IN TIME ALLOCATION OF COST DIRECT METHOD Service Provided to Machining Assembly 262500 120000 382500 87500 80000 167500 by Quality Control Maintenance GOALS: 1. Eliminating any production process that does not add value STEP-DOWN 2. *Benefit provided ranking table (Company Policy) *Based on the service department which has the highest cost QC Maintenance JOURNAL ENTRIES: QC Maintenance Machining Assembly 350000 (350000) ___-___ -0- 200000 70000 (270000) -0- 400000 210000 162000 772000 300000 70000 108000 478000 *Once the OH cost of the service department becomes exhausted, do not allocate other cost to the service department TRIGGER POINTS: Purchase Production Completion Sale Purchase Quality Control Maintenance Maintenance Machining Assembly 25% 20% - 60% 45% 20% 30% Quality Control = 350000 + 0.25M Substitute Maintenance = 200000 + 0.20QC QC = 350000 + 71053 = 421053 M = 200000 + 0.20(421053) = 284211 ₱xx Conversion Cost Various Accounts ₱xx Finished Goods Raw and In Process Conversion Cost Sales Cost of Sales Finished Goods Cost of Sales Raw and In Process Conversion Cost QC Maintenance Machining Assembly 350000 (421053) 71053 -0- 200000 84211 (284211) -0- 400000 252632 127894 780527 300000 84211 85263 469474 ₱xx ₱xx Completion RECIPROCAL METHOD QC Raw and In Process Accounts Payable 75% ₱xx ₱xx xx ₱xx ₱xx ₱xx ₱xx xx were sold Cost of Sales Finished Goods Conversion Cost Raw and In Process ₱xx xx ₱xx xx (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) X. J OINT C OS TING DL AHAR Joint Cost Less: NRV of By-product Remaining Joint Cost Rate ₱xx (xx) ₱xx DLRV AHSR if, inventoriable/ material AHSR Efficiency TREATMENT OF BY-PRODUCT DLEV SHSR 1. Upon sale or realization - recorded as other income, if the by-product is immaterial. 2. Upon production or inventoriable - the NRV of by-product is deducted from the total joint cost ALLOCATION OF REMAINING 1. PHYSICAL 1.1. Physical measure such as gallon/kilogram 1.2. Units produce 1.3. Weighted average units produce 2. MONETARY 2.1. Sales value at split-off also known as relative market value 2.2. Net realizable value at split-off 2.3. Hypothetical/approximated/estimated at split-off also known as adjusted market value XI. S TA ND AR D C OS TING DM DMPV AQSP EXCHANGE RATE – This is the ratio of exchange between two currencies. SPOT RATE – Rate for immediate delivery. CLOSING RATE – This is the spot rate at Balance Sheet date. FUNCTIONAL CURRENCY – Currency of primary economic environment in which the entity operates. What is the primary driver of functional currency? – SALES Closing Rate Historical Rate Average [Computation: (B+E)/2 ] Spot Rate (Theory) BUYING OF INVENTORY 1. ER↑ = Forex Loss [100] 2. ER↓ = Forex Gain (Hedging Instrument) BUYING OF F.C. [80] = [20] 3. FR↑ = Forex Gain 4. FR↓ = Forex Loss FOREX TRANSACTION: Exportation AQSP DMUV SQSP FOREX TRANSACTION: Importation (Hedge Item) AQAP Used 1. Foreign Currency Transaction 2. Foreign Exchange Translation 3. Hedging of FOREX Risk Assets & Liabilities Shareholder’s Equity Revenue & Expenses TWO TYPES OF COST FOR THE JOINT PRODUCT 1. Joint Cost Share or Allocated Joint Cost 2. Traceable Cost or Additional Processing Cost Purchased XII. F OR E IG N E XC HA NG E (I AS ) SELLER OF MERCHANDISE 5. ER↑ = Forex Gain 6. ER↓ = Forex Loss SELLER OF F.C. 7. FR↑ = Forex Loss 8. FR↓ = Forex Gain (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) A $ 10M ENTRIES: BUYING OF INVENTORY Purchases ₱xx Accounts Payable ₱xx BUYING OF F.C. FCR ₱xx FCP (fixed) ₱xx Forex Loss Accounts Payable ₱xx FCR Forex Gain ₱xx ₱xx ₱xx Accounts Payable Forex Gain ₱xx Forex Loss FCR ₱xx ₱xx Accounts Payable Cash ₱xx FCP (fixed) Cash FCR ₱xx ₱xx ₱xx xx ₱xx SELLER OF MERCHANDISE Accounts Receivable ₱xx Sales ₱xx FCR (fixed) FCR ₱xx Accounts Receivable Forex Gain Forex Loss FCP ₱xx FCP Cash FCR (fixed) ₱xx ₱xx ₱xx Forex Loss Accounts Receivable ₱xx ₱xx SELLER OF F.C. ₱xx ₱xx xx ₱xx FOREX TRANSLATION only reflected in consolidated FS an Other Comprehensive Income component OCI: 1. 2. 3. 4. 5. 6. Forex Translation (IAS 21) Effective Portion of Cash Flow Hedge (IFRS 7/9) Revaluation Surplus (IAS 16) Remeasurement G/L related to employee benefit (IAS 19R) Estimated Unrealized G/L on FA at FVTOCI (IFRS 7/9) Risk G/L on credit risk for financial liability designated to P/L RECLASSIFIED TO P/L: 1. Forex Translation 2. Effective portion of Cash Flow Hedge × ₱1 ₱ 10M = L $ 8M = × ₱1 ₱ 8M $ 10M × ₱1 ₱ 10M = + C $ 2M + × ₱0.5 ₱ 1M $ 8M $ 2M × ₱1 ₱ 8M + × ₱2 ₱ 4M + ₱ 1M Translation Adjustment Credit + ₱ 2M Translation Adjustment Debit NA, ending @ CR > NA, ending @ RF = Translation Adjustment Credit NA, ending @ CR < NA, ending @ RF = Translation Adjustment Debit NA, beg. OS × HR RE, beg. Net Income @ Average Dividend @ SR NA, end @ RF ₱xx xx xx (xx) ₱xx (translated amount) QUOTATION: 1. DIRECT – Foreign Currency to Philippine Peso 2. INDIRECT – Philippine Peso to Foreign Currency SPOT RATE: 1. BUYER – Selling Spot Rate / Offer Rate / Asking 2. SELLER – Buying Spot Rate / Bid Rate FIRM COMMITMENT (1) The hedge is perfect when the company acquired a forward contract for the same amount of the same currency in which the firm commitment is (2) Under perfect hedging, the amount of forex gain from hedging instrument is equal to firm commitment as liability (3) The amount of forex loss from hedging instrument is equal to firm commitment as asset (4) TYPES OF FIRM COMMITMENT 4.1. Sales Commitment 4.2. Purchase Commitment (5) The asset sold or purchased is recorded at the date of settlement based on the forward rate on the date of commitment (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) THREE HEDGE RELATIONSHIP (1) Fair Value Hedge - Hedges of exposure to the changes in value of a recognized asset/liability or unrecognized firm commitment - If the problem is silent, use the FVH XIII. ACCOUNTING OF N PO (A IC PA) COMPUTATION: Gross Patient Service Revenue Charity Care Amount Charge / Billed to Customers Contractual Adjustment (PHILHEALTH, MEDICARE) Discount to Hospital Employees (2) Cash Flow Hedge - Hedges of probable forecasted transactions or the variability in the cash flow of a recognized asset or liability OPTIONS Contracts that are right and not obligation to buy or sell commodities at a certain price This is always favorable on the part of the holder If it is gain or in the money, exercise the option If it is out of the money, do not exercise the option Call option is on the part of the buyer Put option is on the part of the seller AT THE MONEY IN THE MONEY (UG) OUT OF THE MONEY PUT OPTION: Market Price = Strike Price Market Price > Strike Price Market Price < Strike Price AT THE MONEY IN THE MONEY OUT OF THE MONEY FVH (xx) (xx) ₱xx STATEMENT OF ACTIVITIES Shows contractual adjustment This is collectible at third party payor (contra-revenue account) (1) For Hospitals ₱xx Contractual Adjustment ₱xx Accounts Receivable (2) For Schools Expenditure for student Accounts Receivable (contra-revenue account) ₱xx ₱xx CONTRIBUTED MATERIALS, SERVICES, & FACILITIES − Unrestricted funds SPLIT ACCOUNTING CFH (xx) ₱xx Net Patient Service Revenue (3) Net Investment Hedge - Hedges of the net investment in a foreign operation CALL OPTION: Market Price = Strike Price Market Price > Strike Price Market Price < Strike Price ₱xx (1) Inventory Contribution Revenue ₱xx (2) Salaries Contribution Revenue ₱xx ₱xx Intrinsic Value – Unrealized Gain Time Value – Gain/Loss OCI P/L (3) Rent Expense Contribution Revenue Intrinsic Value – Unrealized Gain Time Value – Gain/Loss P/L P/L OTHER OPERATING REVENUE − Unrestricted funds Cash NON-SPLIT ACCOUNTING Other Operating Revenue* CFH Intrinsic Value – Unrealized Gain OCI FVH Intrinsic Value – Unrealized Gain P/L *EXAMPLE OF OTHER OPERATING REVENUE Proceeds from cafeteria Proceeds from parking lots ₱xx ₱xx ₱xx ₱xx ₱xx (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) FINANCIAL STATEMENTS (1) STATEMENT OF ACTIVITIES Amount of changes in each of the three classes of net assets (a) Changes in Unrestricted Net Assets (b) Changes in Temporary Restricted Net Assets (c) Changes in Permanently Restricted Net Assets (2) BALANCE SHEET Assets, Liabilities, Net Assets Three types of Net Assets: (a) Unrestricted Net Assets (b) Temporary Restricted Net Assets (c) Permanently Restricted Net Assets The restricted cash and investment are prescribed separately All securities are valued at fair value (3) STATEMENT OF CASH FLOW Restricted whether temporary/permanent (FINANCING) Quasi-endowment unrestricted (OPERATING) Receipts of donation to purchase PPE (Inflow: INVESTING) Cash outflow to purchase PPE (FINANCING) Term endowment Temporary (FINANCING) Pure endowment Permanent (FINANCING) (4) STATEMENT OF FUNCTIONAL EXPENDITURE Specifically for Voluntary Health and Welfare Organization (NGOs) GOVERNMENT ACCOUNTING MANUAL (GAM) Under GAM, entity shall not maintain regular agency book and national government book GAM supersedes NGAS effective January 1, 2016 implemented in 2002 Commission on Audit has exclusive authority to define the scope of audit COMPONENTS OF GENERAL PURPOSE FINANCIAL STATEMENTS (1) Statement of Financial Position (2) Statement of Financial Performance (3) Statement of Changes in Net Assets / Equity (4) Statement of Cash Flow (5) Statement of Comparison of Budget and Actual Amounts (6) Notes to the financial statements, comprising a summary of significant accounting policies and other explanatory notes BOOKS OF ACCOUNTS & REGISTRIES 1. JOURNALS a. General Journal b. Cash Receipts Journal c. Cash Disbursement Journal d. Check Disbursement Journal 2. LEDGERS a. General Ledgers b. Subsidiary Ledgers XIV. G OVE R NME NT A CCOUNTING PHASES OF BUDGETARY PROCEDURE 1. PREPARATION AND PRESENTATION − Submission of budget of the expenditure 2. BUDGET AUTHORIZATION − Enactment by the congress of the General Appropriation Act 3. BUDGET EXECUTION AND OPERATION − Release of revenue allotment 4. BUDGET ACCOUNTABILITY − Liquidation of expenditure and audit conducted by Commission on Audit REGISTRIES (1) RROR – Registries of Revenue and Other Receipts (2) RAPAL – Registry of Appropriation and Allotments (3) RAOD – Registries of Allotments, Obligation and Disbursements (4) RBUD – Registries of Budget, Utilization and Disbursements CLASSIFICATION OF RAOD & RBUD PS – Personnel Services MOE – Maintenance and Other Operating Expenses FE – Financial Expenses CO – Capital Outlay (REVIEWER: Dr. Rodiel C. Ferrer, CPA, MBA, DBA, PhD CAR, CMA) NOTICE OF CASH ALLOCATION (NCA) Issued by Department of Budget and Management (DBM) to an agency authorizing the latter to disburse by checks (1) RECEIPT OF NCA Cash – MDS, Regular Subsidy from National Government ₱xx ₱xx *Net of 5% final VAT and 1% creditable income tax (2) UNUSED NCA Subsidy from National Government Cash – MDS, Regular ₱xx ₱xx ACCOUNTING FOR DISBURSEMENTS 1. Net Payroll Advances to Disbursing Officer Advances for Payroll Cash – MDS, Regular ₱xx ₱xx 2. Payable to Officers and Employees and to set up salary deductions Salaries and Wages – Regular PERA Due to BIR Due to GSIS Due to Pag-IBIG Due to PhilHealth Due to Officers and Employees ₱xx xx ₱xx xx xx xx xx 3. Remittance of Salary Deductions Due to GSIS Due to Pag-IBIG Due to PhilHealth Cash – MDS, Regular Magandang buhay sa inyo mga ka-reviewee! Ang notes na ito ay hango sa m ga itinuro ni Sir Ferrer (*one of my fave reviewer). Kung sakaling may mapansin man kayo na kulang o mali ay kayo na lang ang magkusang magtama nito. Hindi naman perpekto ang pagkakatype nito, tulad ko (*ansabe!?). Nawa ay makatulong ito sa inyong pag-aaral. Fighting! Ipaglaban natin ang ating pangarap. May the odds be in our favor. God bless us a ll! ^_^ Sincerely, LFA ₱xx xx xx ₱xx 4. Liquidation of Advances for Payroll Due to Officer and Employees Advances for Payroll MESSAGE TO THE READERS ₱xx ₱xx “For whatever is born of God overcomes the world. And this is the victory that has overcome the world – our FAITH.” 1 JOHN 5:4