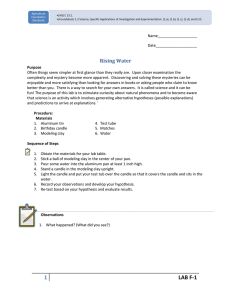

THE ART OF JAPANESE CANDLESTICK CHARTS A synchronized mentor for investments www.candletricks.com Contents Types of Charts Anatomy of candlestick charts Importance of Real Body & Shadows Logic & psychology behind Support and Resistance Power of Single Candle Lines Advanced Double Candle Pattern Trade Management Money Management 1 TYPES OF CHART 1. Line chart 2. Bar chart 3. Candlestick chart LINE CHART This type of chart is formed, taking only the Closing price of a session. Those ‘closing price points’ are linked together to form a graph. This type of chart may be used for referring to the long term trends. Since this type of chart is not formed using sufficient data, it doesn’t reveal anything about the current market condition. So, Line charts are not used for the purpose of trading. BAR CHART Unlike line charts, the Bar charts are formed using 4 key data points – Open, High, Low, Close (of a session / day). Bar charts are actually used for taking trades. But traditionally, a chartist who uses a bar chart looks for a trend, which takes weeks, if not months to form and takes trades based on that. So one major drawdown with the bar chart is it’s not ideal for short term trading (like day trading). 2 CANDLESTICK CHART Similar to bar charts Candlestick charts are formed with – Open, High, Low & Close (of a session / day). But, since these types of charts are easy to understand, they became quite popular. The degree of information given out by these charts make them quite reliable; also, they provide early reversal signals. With these types of charts it’s easy to pinpoint the potential reversal zones. One main advantage of these types of charts is that, apart from imparting the information on trend, they also provide indepth information on every session / day. Hence, these can be conveniently used for the purposes of both short & long term trading. 3 shadows high high close open Real body open close low low Bullish and bearish candle line A Candlestick has two main parts: 1. Real body 2. Shadows Both real bodies & shadows are important in understanding the market condition. BUYING NEUTRAL SELLING 4 BULLISH BODY AND TAIL COMBINATIONS Very Strong Strong Neutral Aspects Observation A candle which has only real body a and has no shadows at both ends.it is also called marubozu [Bull]. It denotes bulls are powerful. Wide bull candle with flat head and small lower tail. Bears might dominate @ the price below lower tail. Tail is twice or more lengthier than real body . tiny upper tail acceptable. It is also called hammer. It might act as a power line. Aspects Observation Wide bull candle with small upper tail and flat bottom The upper shadow denotes minor selling pressure Narrow bull candle flat head and lower tail. The tail is less the 2x the real body Shows bulls in control Wide bull candle with medium upper tail and flat bottom. Tail must not exceed 100% than real body. It is the begining of selling @ the top Aspects Observation Bull candle with towering tail.Tail stretched to 100 % of real body Evaporation of bulls control 5 Narrow bull candle with tiny tails @ both ends. It is also called as bull spinning top. Bearish Aspects Crucial moment is near. Observation Narrow candle with top tail and flat bottom.Tail length less than 2x of real body. Entry of bears. Tail more than 2x the length of the real body can have tiny bottom tail.it is also called shooting star. Beginning of powerful selling BEARISH BODY AND TAIL COMBINATIONS Very Weak Weak Aspects Observation A candle which has only real body a and has no shadows at both ends. It is also called marubozu [bear] It denotes bears are powerful. Wide candle with tiny upper tail and flat bottom. Very Weak session of market. Tail is twice or more lengthier than real body. tiny lower tail acceptable. It is also called shooting star. Bears took charge. Aspects Wide bear candle with tiny tail @ both the ends. Observation Tiny tail shows some rejection of bears 6 Neutral Bullish Narrow candle with tiny top tail and flat bottom. Tail lesser than 2x times the real body. Tiny lower tail acceptable Weak session of market. Narrow candle with medium tail.Tail upto 100 % of real body. Entry of bulls. Aspects Bear candle with long bottoming tail.Tail more than 100 % of real body Observation Bulls entry Narrow bear candle with tiny tails @ both ends. It is also called as bear spinning top. Crucial moment is near Aspects Narrow bear candle with medium tail.Tail less than 2x the length of real body. Observation Bulls entry Tail more than 2x the length of the real body .tiny top tail accepted. It is also called hammer. Bulls are getting stronger If we group the signal candles or patterns logically it will be easy to understand. 7 MESSAGES FROM SHADOWS What do these shadows reveal to a trader? These lower shadows are occurring again and again, consecutively after the price has fallen; so It indicates that the selling pressure is weakening / exhausting here, after the bears made their move. A trader who is in short here, should be cautious here, and think about trailing the Stop loss for his trade. 8 Opposite of what we saw in the previous example: The higher shadows after big, long moves indicate the exhaustion of buying pressure. A trader who is long should be able to trail his stop when these types of candles occur consecutively for 2 or 3 days. SUPPORT & RESISTANCE Break out 9 In general, the above example just speaks about the break out of trend line. But in fact, it is not the trend line breakage or something. Only for technical analysis it is applicable. In fact, it is purely based on the candle. The price and the price action played a vital role @ the right place for this break out to take place. The arrowed line is the base line or the SUPPORT LINE in this place. The bullish harami swing point acts as support and when price reaches this support level price action tends to lead this break out which we will discuss only about this in upcoming portions. Break out 10 The consolidation breakout occurred after the price reached the support zone. The below triangle break also implies same in case of resistance followed by the ladder breakout by support. Thus, support & resistance plays vital role. LOGICAL SUPPORT & RESISTANCE: The arrows that are shown in the below example indicates swing highs & lows. It seems that when price reaches that point some sort of reaction takes place in the price movement. These points act as support and resistance. 11 Major Support HAMMER (POWER LINE) – NORMS 1. Small real body 2. Color may be red or green 3. No or very less upper shadow 4. Lower tail - minimum twice the real body 12 Hammer In the above image, the arrow shows the occurrence of hammer. That marked hammer we will name it as point 1. That hammer low is the support. In the next few hours, the price reaches that point 1. Now wait for any price action. Again, the price action hammer has occurred, now wait for next bull candle to confirm that hammer. The next bar after hammer is a bullish candle and confirmed for a bullish movement now. If the risk & reward ratio satisfies as in the image, the bullish candle is the right place to take a drive. Note: it is important to place stops loss order for each and every trade for capital protection. 13 Hammer Hammer @ Support 14 Hammer Power Line with Confirmation 15 The above image, there are two similar hammers. Both the hammers occurred after down trend only. Both the hammers are in support only. Both the hammers are suitable for entry also. But what makes difference in the entry. The confirmation candle plays a vital role in both the condition and shows its importance here clearly. So, the entry should not be placed directly over the head of hammer which will become a headache entry. Hammer Hammer 16 In the above image, the hammer has occurred at various place. But every price action is not an entry point. It depends on the trend, confirmation candle and the risk, reward ratio. In the rounded portion, we got couple of hammers with confirmation bar, so it’s the right place to drive a trade. Halt The above image clearly shows the down trend, and then a small halt, finally the uptrend move occurs with a hammer and the confirmation candle. 17 Power line Above pictures show similar examples of the hammer occurrence and the upward movement of the price. 18 INVERTED HAMMER – NORMS Basic criteria 1. Small real body 2. Green or Red real body 3. Lengthy upper shadow (>2x of Real body) 4. Small lower shadow acceptable Strong Criteria: No lower shadow Inverted Hammer The above example shows other form of price action (i.e) INVERTED HAMMER. the curved arrow shows the hammer which acts as a support @this place. When the price reached the support the inverted hammer formation is occurred. the next candle is strong bullish candle to confirm long move. So, the price rocked to next resistance level as a target. 19 The next example also clearly reveals the importance of inverted hammer formation and the confirmation bar near to support level. But later the support level was also reached and formed a power line as a double confirmation. So, the price reversal has happened with a rocket move. Inverted hammer Power line 20 Both the images shown above resembles the price movement after the formation of inverted hammer and also shows strong up movement. 21 SHOOTING STAR – NORMS Basic criteria 1. Uptrend if favorable 2. Green or Red real body 3. Lengthy upper shadow (>2x of Real body) 4. Small lower shadow acceptable Strict criteria: Red real body without lower shadow 2 3 1 The above examples show’s that after an uptrend, in the resistance a green shooting star has been formed and next is the strong bearish candle which confirms that shooting star. Where 1 is uptrend, 2nd is resistance level and 3rd is shooting star followed by a confirmation candle. The 22 target level could be the next support level. Risk reward ratio must be satisfied before entering a trade as shown in the example. Note: The stop loss must be compulsorily placed and trailed @ proper intervals for capital protection. T This example shows the shooting star formation in the resistance level and price tends to fall down till the support level marked as T which is nothing but the target. Below is the shooting star in the resistance level after an uptrend. The bulls got stuck @ one end and price tends to fall down. The marked lines A, B, and C are support levels. It is advisable to quit @ first support level or to trail stop@ correct intervals based on candle formation. 23 A B C 24 The previous example shows the market in one side for few hours, the price reversal takes place with a fine shooting star entry. There are two shooting star formation which are rounded. The first one is also a fine shooting star, but what about the confirmation candle for that shooting star. The second rounded shooting star is fine with confirmation bar and signals the price fall @ this level and trend breakout. This example is a double top formation in which shooting star plays vital role with strong bearish confirmation. 25 HANGING MAN - NORMS 1. Red or Green real body 2. No or very less upper shadow 3. Small real body 4. Lower tail - minimum twice the real body 1 2 3 26 The previous example is about the hanging man price action. 1 is the bearish harami which acts as resistance level 2 is the hanging man with the strong bearish candle as confirmation bar. 3 is the support level or the target level for that entry. When the price reaches, the resistance level the hanging man has occurred and the bulls try to move higher level but couldn’t withstand the bears entry. So, price tends to fall down quickly. The arrows after uptrend show couple of hanging man @ resistance with strong bearish candle to confirm short move. 27 Hanging man makes bulls fall into well This shows the market is in consolidation. A hanging man has appeared @ resistance level followed by couple of shooting star for price breakout. Break out 28 Hanging Man When the swing has broken the bulls, end was shown by neutral, later the hanging man showed bears entry with strong bear candle and price fell down. NEUTRALIZERS Norms: 1. Single candle price action 2. small size real body. 3. Very powerful in triggering the future movements. 4. Confirmation is must. 29 TREND STOP OR PAUSE OR REVERSE Trend may stop, pause or reverse after a neutral. Hence a neutral ALWAYS needs a confirmation. Neutral The above picture shows the formation of other single price action is neutral. The uptrend movement is clearly stopped due to this neutral formation. in this condition, it is a reversal neutral. The neutral is a state of neutral formation in which the bulls and bears are equally balanced. 30 The next move could be continuation or reversal which we have to find. So, wait for the formation of next candle and check whether bulls dominate or bears dominate. In this picture, the next is a strong bearish candle and indicates bears dominate. So, it’s the time for bulls to quit and bears to enter and ignition of down movement. R Neutral The example above shows, after an uptrend and the swing point occurrence, the neutral candle as formed, followed by a neutral which denotes the end of up movement. The strong bearish candle confirms the ignition of downward movement, and free fall of price occurred. Note: risk reward ratio must also satisfy for the entry as in the image. 31 Neutral Neutra l 32 R The above picture shows the neutral which is round marked. After the uptrend, a couple of shooting star has formed a swing point and act as resistance. The neutral has formed in that resistance point followed by a strong bearish candle to confirm it. So, the price fall is more likely to happen in that point. The target will be the nearest support level. 33 Break out The above image shows the CONSOLIDATION BREAKOUT, it has started its Movement with neutral and strong bullish candle to confirm the rocket move. The following example reveals the down movement after the formation of neutral. 1 is indicates the up movement. Second is resistance level. Third is price action with proper confirmation bar. So, short is possible shortly. 2 3 1 34 Series of Neutral 35 The example above reveals same down movement after a series of neutral and a confirmation candle at the resistance point. The other form of neutral which the image resembles the name itself. The example below indicates the neutral in the support point. It has occurred in the support zone with the strong bull candle. A price has flawed up to resistance level. Neutral 36 3 2 1 This is opposite to nuetral formation in visual, and neutral resembles the bulls are @ the risk of grave yard. 1st is uptrend, 2nd is the resistance level, 3rd is the neutral followed by a strong bear candle. So, when the entry triggered after confirmation candle, the bulls have fallen down. 37 This example clearly shows the power of neutral @ resistance level after an uptrend where there is very strong confirmation bar, the price tends to move down quickly. 38 The arrow mark indicates the neutral, which means neutral [i.e.] bulls and bears are in the equal force. Since it is in support to take long is favorable. As expected the next candle was a bullish one. So, the bulls dominate here and price moved upwards. The next example shows two entries based on the neutral candle. the neutral @ resistance shows short and neutral @support shows long move respectively. After the formation of neutral the movement started after confirmation bar in both cases. 39 The following example shows the formation of neutral candle. The curved arrow shows the formation of neutral. The neutral here acts as resistance, when the price reached the resistance the neutral has formed with gap up open, which shows the price is in neutral state. The next 40 candle opens with gap down and forms a strong bearish candle. It is a confirmation candle for price fall to next support level. The same for the next example too which shows long movement after a neutral followed by neutral price action. 41 ADVANCED DOUBLE CANDLES: [BULLS] PIERCING PATTERN - NORMS Two session pattern and prior trend is downwards. Open of second session below the prior close and green body should close above 50% of red body. The rectangular box is the piercing line which normally occurs in down trend as shown. this pattern serves as an indicator to either buy a stock or close short entries because the price may soon trend upwards. In this the bears forces the price to open below previous close but, however bulls step in after the open and push the price higher and it closes above midpoint of previous candle. 42 halt 2 1 43 The above shown [1] also resembles a piercing line pattern in the support zone, but yet price has not moved upward. Although the piercing pattern covered midpoint of previous bear candle It is a failure entry since [2] indicates a selling pressure in that candle by its shadow. The previous two sessions are also a strong selling pressure candles. So, it is advisable to avoid entries @ these situations. Piercing line – green real body open below previous red candle’s close, and covers more than 50% of the red real body. This two-candle pattern indicates a strong buy signal. Confirmation candle is not mandatory for this pattern. 44 In the above example, you could see that the green candle, although opened below the prior close, did not close more than 50% into the prior red candle. So, it’s not a valid piercing line pattern. BULL ENGULF - NORMS: Two session pattern and market must be in downtrend. Green real body covers the red real body completely. 45 In the above example the bullish harami low acting as support level, and when price again reached this support level it formed a neutral followed by hammer and an engulf leads to price reversal in the above picture. 46 halt 47 This trend breakout is due to the formation of bullish engulf at support levels. BULL SASH – NORMS Trend is not important. A red bar followed by the green bar, which opens inside the body of red candle and closes above it. 48 The above picture bullish inside bar & below image bull engulf low acts as a support. When price reached that level, the bears tried to push the price down to create lower lows, but the bull force dominates with a gap up open and formed a bull sash pattern. The bulls are ignited and the price moved upwards. Bulls ignited 49 neutral Strong bull Bear force Bull ignition 50 BULL INSIDE BAR / BULL HARAMI NORMS: Two session pattern It is better if market in down trend First candle long red bar and second a narrow green bar Green bar must be within the real body of red bar 51 These two charts resemble a rocket move of price after small ups and downs in the previous hours. This happened due to the formation of bullish inner body in the support zone. The child candle fulfils the need of neutral state followed by a strong bullish bar to confirm the price reversal. 52 The bullish inner body here is a gap up power line indicates price reversal Bull Bull 53 ADVANCED DOUBLE CANDLE LINES: [BEARS] DARK CLOUD COVER NORMS: It’s two session pattern The second session gaps up and closes below 50 % of the previous candle In an uptrend market. Dark cloud cover can also act as a resistance level, as shown above. 54 Dark cloud cover – opposite to piercing line pattern. The second red candle opens above prior close and closes more than 50% into the prior green candle. In the above example, you could see how the piercing line pattern at a resistance had reversed an uptrend. DCC @ Resistance 55 DCC @ Resistance BEARISH ENGULF NORMS: Market is in uptrend. It’s two session pattern and the red real body envelops around the green real body. 56 1 2 3 The above example shows about the formation of bear engulf pattern. The price after some up movement reached the arrow marked with 1 which is the resistance. 2 shows the neutral formation after a strong bullish candle. 3 is the candle which engulfs the neutral and shows bears dominate. So, the price reached to next support level. R The image shows that after an uptrend towards a resistance zone a neutral candle has been formed. It speaks about the state of neutral condition. The strength of bulls comes to a climax. 57 The next candle is a bearish candle which engulfed that neutral state and implies the strong bearish entry and trend reversal. So, the price fell down to immediate support level. 2 1 The above example reveals about the two-fake bearish engulfing pattern. The first arrow mark bearish engulfing pattern is fake since it is not in the major resistance point. The 2 nd arrow mark bearish engulfing pattern is fake since it ends in the support zone. The bear engulf pattern entry reveals a highway like candle and implies that this is a fake pattern. The risk reward ratio of the bearish candle must also be noticed. These are the hints to pin out the fake patterns and have safe entries. The image above is also same as discussed in the previous example. The price moved upwards and showed a neutral state. It is then engulfed by bears, but it is not in the resistance zone. The next session when the price touched the resistance level it formed a shooting star followed by strong bearish candle to overcome bulls. The bulls became weak and there was a free fall of price movement. 58 After bull trend formed neutral, then reached resistance level, then formed shooting star followed by strong bears engulf and finally fell down. 59 60 this trend breakouts are due to the formation of bear engulf @ resistance zone with proper confirmation. BEAR SASH PATTERN NORMS: Trend is not an important. A bull bar followed by a bear bar, which opens within green real body and closes under prior open. 61 After Small pullback Bears entry Neutral state 62 What about this candle? Wide range candle What this indicates? result The following image shows the momentum move of the candles after taking the bear sash pattern as support. Here 1 is the high of the sash pattern and 2 is the bear sash in which the price overcomes the pattern. 3 is the bull engulf @ support zone which will remain as the entry point for long move. 4 is the neutral candle and its low is the exit. 63 4 1 3 2 On entering short @ rounded bear sash pattern Obviously, the arrowed hammer low will be the next support level in this stage, so check the risk reward ratio before entering the trade 64 BEAR INSIDE BAR / BEAR HARAMI NORMS: Two sessions pattern, that occurs after an up-trend market. First is a long bullish candle and the second may be green or red candle. Second candle must be within the green real body. The above image shows the trend breakout. But the breakout could not simply be specified by just drawing a trendline and breaking out of it. The concept that lies behind is the formation of price action @ resistance level with proper confirmation. The price action here is the bear harami. The mother candle however shows high wave, whereas child candle is the climax of the uptrend since it is similar to that of neutral like formation. The next candle is strong bear which confirms the trend reversal. 65 There are two example below that shows a wide range bullish candle at the resistance level. In the next arrowed session price tends to move higher level but couldn’t withstand the bull force. So, it created a neutral state with harami formation. The next timeframe a strong bearish candle appeared to confirm downside move. 66 These two chart formations appeared in two different scripts, although the scripts are different, the message conveyed by candles are similar in both the cases. The bearish harami high is the highest high as well as resistance level. The price with wide range bullish candle tends to move upper level @ resistance zone. But its movement is stopped by formation of shooting star along with neutral and showed a neutral state. The next session with strong bear entry implies the domination of bears for down move. 67 TRADING DISCIPLINE ✓ Create a trading plan and follow it strictly. ✓ Take trades only after a proper candlestick signal. ✓ Enter a trade only if it has more than one confirmation. ✓ Never enter a trade without a stop-loss. ✓ Do not second guess the trade after entering. ✓ If the price moves against your expectation wait for the stop to be taken out. ✓ Before taking a trade decide all the entry, stop loss and target levels. ✓ Do not chase the trade. ✓ Do not enter a trade due to an emotional push. ✓ Always wait for the candle to close, before you decide based on it. ✓ Do not take others’ opinion to enter/exit a trade. ✓ Control your emotions! 68 MONEY MANAGEMENT 1. Minimize the risk: Place stops for every trade you take. Do not risk more than 2% of your capital. 2. Diversify: Do not invest all your capital into a single trade, no matter how strong the trade looks. 3. Calculated risk: Always calculate the risk and reward before taking a trade. If the risk is greater than the potential reward, skip the trade. 4. Let the profits grow: Once the price reaches the first target level, loosen up 50% of your position and hold on to the remaining to enjoy more profits. 5. Trail the stop: When you want to enjoy, more profits give the price some space to move around, but trail your stop without fail. 6. Use technical stops: Do not decide the stop loss level based on emotions/biases. Stop loss should, strictly, be technical. 7. Protect the profits: Sometimes, the price might reverse even before the target level is reached. In that case, it’s better to protect the profits. DISCLAIMER: - These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit & Loss. We are not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. All Judicial You are advised to take your position with your sense and judgment. We are trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations. If any other company also giving same script and recommendation, then we are not responsible for that. We have not any position in our given scripts. Visiting our web one should by agree to our terms and condition and disclaimer also. 69