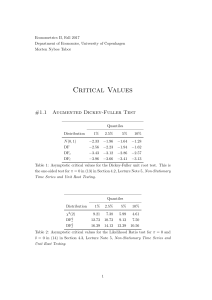

Review of International Economics, 6(4), 683–694, 1998 Exchange Rates and Oil Prices Robert A. Amano and Simon van Norden* Abstract The paper documents a robust and interesting relationship between the real domestic price of oil and real effective exchange rates for Germany, Japan and the United States. It also offers an explanation of why the real oil price captures exogenous terms-of-trade shocks, and why such shocks could be the most important factor determining real exchange rates in the long run. 1. Introduction The exchange rate is arguably the most difficult macroeconomic variable to model empirically. Surveys of exchange rate models, such as Meese (1990) and Mussa (1990), tend to agree on only one point: existing models are unsatisfactory. Monetary models that appeared to fit the data for the 1970s are rejected when the sample period is extended to the 1980s (Meese and Rogoff, 1983). Later work on the monetary approach, such as Meese and Rogoff (1988), find that even quite general predictions about the co-movements of real exchange rates and real interest rates are rejected by the data. In short, there are several reasons to doubt the ability of traditional exchange rate models to explain exchange rate movements. Quite recently, however, we have begun to see more positive (but still controversial) results emerging in three areas. First, work by researchers such as MacDonald and Taylor (1994) has shown that a long-run relationship exists among the variables in the monetary model of exchange rates, and that such models perform better than a random walk in out-of-sample forecasting. The data, however, reject most of the parameter restrictions imposed by the monetary approach, so it is uncertain whether these results are really evidence in favor of the monetary model.1 Moreover, this positive evidence of a long-run monetary model contrasts with the findings of other researchers such as Cushman et al. (1996). The second line of research has evolved around the idea of purchasing power parity (PPP). As noted by Froot and Rogoff (1994), researchers have found significant evidence in favor of PPP when they use sufficiently long spans of data. This is a particularly confusing result, since it is precisely over such long periods that we would expect gradual shifts in industrial structure, relative productivity growth and other factors to alter real equilibrium exchange rates.2 Third, structural time-series work on the determinants of real exchange rate fluctuations indicate that real shocks or permanent components play a major and significant role in explaining real exchange rate fluctuations. Univariate and multivariate Beveridge and Nelson (1981) decompositions by Huizinga (1987) and Baxter (1994) * Amano: Bank of Canada, Ottawa, Ontario, Canada, K1A 0G9. Fax: (613) 782-7163; E-mail: bamano@bankbanque-canada.ca. van Norden: Service de l’enseignement de la finance, Ecole des Haute Etudes Commerciales, Montreal, Quebec, H3T 2A7, Canada. Fax: (514) 340-5632; E-mail: svn@alum.mit.edu. We thank seminar participants at the Bank of Canada and the Federal Reserve Bank of Kansas City for their suggestions. Preliminary versions of this paper were written while the authors were with the International Department of the Bank of Canada. This paper represents the views of the authors and does not necessarily reflect those of the Bank of Canada or its staff. Any errors or omissions are ours. © Blackwell Publishers Ltd 1998, 108 Cowley Road, Oxford OX4 1JF, UK and 350 Main Street, Malden, MA 02148, USA. 684 Robert A. Amano and Simon van Norden find that, even though real exchange rates may not follow a random walk, most of their movements are due to changes in the permanent components. Evans and Lothian (1993) use the Blanchard and Quah (1989) decomposition, and find that much of the variance of both real and nominal exchange rates from a number of countries over both short and long horizons is due to real shocks. The conclusions from the structural time-series literature therefore seem to be robust to both decomposition method and currencies. This has led some to suggest that an unidentified real factor may be causing persistent shifts in real equilibrium exchange rates.3 In this paper, we try to identify this real factor by examining the ability of real domestic oil prices to account for permanent movements in the real effective exchange rate of Germany, Japan, and the United States over the post-Bretton Woods period. The potential importance of oil prices for exchange rate movements has been noted by, inter alios, Krugman (1983) and Rogoff (1991). Although these models are intuitively appealing, the empirical work in this area has several important gaps. First, while there are several studies on the link between oil prices and US macroeconomic aggregates, exchange rates are not included (Hamilton, 1983; Dotsey and Reid, 1992). Second, there is also some analysis with calibrated macromodels (Yoshikawa, 1990) which suggests that oil price fluctuations play an important role in exchange rate movements. These studies, however, tend to lack econometric rigor and consider a data sample limited either in length or number of currencies. Third, some recent papers such as Throop (1993) find evidence of a long-run relationship between exchange rates and a number of macroeconomic factors, including oil prices. The tests used in these papers, however, tend to produce false evidence of cointegration when several variables are included in the system.4 In addition, they do not examine the causal relationship between these variables, so it is not clear whether these are models of exchange rate determination or whether they simply capture the influence of exchange rates on a variety of other macroeconomic variables. We do not argue that oil prices play a unique role in exchange rate determination. Instead, we rationalize its explanatory power by noting that, for the three currencies and for the time period we consider (roughly the post-Bretton Woods period), oil prices have been the dominant source of persistent changes in the terms of trade. This follows from the fact that oil has been an important share of these nations’ imports, and that its price was extremely volatile in the 1970s and 80s as a result of three distinct and highly persistent oil price shocks.5 In other work (not reported here), we show that oil prices alone cannot explain the exchange rate movements for industrial nations like Canada or the United Kingdom whose international trade in oil is much more nearly balanced than that of the oil importers we consider in this paper.6 Of course, it would be a mistake to assume that terms of trade is an exogenous variable and to interpret its explanatory power for exchange rates as a causal relationship. We have, however, good reason to treat oil prices as an exogenous variable. If we examine the behavior of oil prices over the most recent floating exchange rate period, we see that the series is dominated by major persistent shocks around 1973–74, 1979–80, and 1985–86, with another large but transitory shock in 1990–91. The historical record offers us a very plausible explanation for these shocks; they were supplyside shocks that were themselves the result of political conflicts specific to events in the Middle East and therefore exogenous in a macroeconomic sense. Note that we are not arguing that oil prices (or even the stability of price cartels) are immune to the laws of supply and demand, or that they cannot be affected by shifts in the growth rates of the industrialized world. Instead, we feel that there is ample reason to believe that such demand-side factors have been small relative to the supply-side shocks expe© Blackwell Publishers Ltd 1998 EXCHANGE RATES AND OIL PRICES 685 rienced over the last 20 years, and that the supply shocks have been exogenous in the sense of most macroeconomic models.7 Furthermore, comparing domestic real oil prices with terms-of-trade series for each of the United States, Japan and Germany in Figure 1 shows that oil prices shocks, indeed, appear to account for most of the major movements in the terms of trade.8 In fact, the point correlation between the terms of trade and the one-period lagged price of oil is −0.57, −0.78 and −0.92 for the United States, Japan and Germany, respectively. In the empirical work we present in subsequent sections, we use the real price of oil as a proxy for exogenous changes in the terms of trade. While we do not claim that oil prices would be a useful proxy for all nations, we feel that the price of oil is a good approximation for some industrialized nations, such as the United States, Japan and Figure 1. Terms of Trade and the Price of Oil © Blackwell Publishers Ltd 1998 686 Robert A. Amano and Simon van Norden Germany. It should be noted that we also examined the relationship using terms-oftrade data rather than real oil prices. These results, available from the authors, are broadly similar to the results which we present below using oil price data. As the case for exogeneity of the terms of trade is less convincing than that for the real price of oil, we will henceforth consider oil prices rather than the terms of trade. We are, however, comforted by the fact that broadly similar results are found using aggregate terms-of-trade data. 2. Unit-Root and Cointegration Results In this section, we present evidence of a stable long-run relationship between real exchange rates and real oil prices. The data we use are the Morgan Guaranty 15country real effective exchange rate series of Germany (mark), Japan (yen), and the United States (dollar), and the domestic price of oil, defined as the US price of West Texas intermediate crude oil converted to the domestic currency and then deflated by the domestic consumer price index. The data are observed monthly and cover the period 1973:01 to 1993:06.9 Figure 2 plots each country’s real exchange rate with its respective real price of oil. From the figure, it is readily apparent that the real exchange rate and the price of oil for each country are related over the sample period. In the remainder of this section we examine these relationships in some detail. Our first step is to examine the time-series properties of each variable using the augmented Dickey and Fuller (1979) and Phillips and Perron (1988) tests. The results, available from the authors upon request, suggest that the data are well-characterized as nonstationary processes.10,11 Our approach to testing for a long-run relationship between the real effective exchange rate and the price of oil is to look for evidence of cointegration between the two variables. This allows us to gauge the adequacy of specifying the real exchange rate simply as a function of the price of oil. If the long-run real exchange rate is determined by nonstationary factors other than those associated with the price of oil, then their omission should prevent us from finding significant evidence of cointegration (see Engle and Granger, 1987). Evidence of cointegration, on the other hand, suggests that asymptotically, the price of oil can adequately capture all the permanent innovations in the real effective exchange rate. We test for cointegration between exchange rates and oil prices using a cointegration test developed by Johansen and Juselius (1990). These results are reported in Table 1. The Johansen–Juselius (JJ) tests find evidence consistent with cointegration for all three currencies, suggesting that the price of oil captures the permanent innovations in the real exchange rate for Germany, Japan and the United States. Table 2 presents the parameter estimates using the JJ methodology as well as that using Phillips and Hansen’s (1990) fully modified least-squares (FMLS) estimator (we apply the latter method since it allows us to apply Hansen’s (1992) tests for parameter stability). According to the results, a 10% rise in oil prices causes a depreciation of the mark of 0.9%, a 1.7% depreciation of the yen, and an appreciation of the dollar of about 2.6%. While the United States is a major importer of crude oil, our results imply that higher oil prices lead to an appreciation of the US dollar in the long run.12 This “reverse” effect is not entirely counterintuitive; in fact it is consistent with explanations offered by various sources. For instance, one often-mentioned hypothesis is the relative termsof-trade effect. This effect posits that while the United States is a significant energy importer, it is less dependent on imports than most of its major trading partners (apart from Canada and Mexico).Therefore while the US dollar should depreciate in absolute © Blackwell Publishers Ltd 1998 EXCHANGE RATES AND OIL PRICES 687 Figure 2. Effective Exchange Rates and the Price of Oil Table 1. Johansen and Juselius Tests for Cointegration λ max statistic Trace statistic Equation Mark Yen Dollar Lags r≤0 r≤1 r≤0 r≤1 5 4 4 19.81* 20.60* 21.89* 3.84 2.61 4.76 15.98* 17.99* 15.123* 3.84 2.61 4.76 Note: We performed the tests under the assumption that the cointegrating vector annihilates any drift terms in the exchange rate or price of oil. Tests of this restriction are available from the authors. The critical values are taken from Johansen and Juselius (1990). Lag lengths are determined using standard likelihood ratio tests. We begin with 13 lags and use a 5% critical value. r denotes the number of cointegrating vectors. © Blackwell Publishers Ltd 1998 688 Robert A. Amano and Simon van Norden Table 2. The Estimated Effect of Oil Prices on Exchange Rates Estimation method JJ FMLS Mark Yen Dollar −0.087 (0.012) −0.086 (0.011) −0.183 (0.032) −0.170 (0.029) 0.245 (0.073) 0.276 (0.089) Note: Standard errors are in parentheses. The FMLS estimates are based on a VAR(2) prewhitening procedure of Andrews and Monahan (1992) as this gave us serially uncorrelated residuals. The JJ estimates are based on the lag structure of Table 1. Table 3. Hansen Stability Tests of the Cointegrating Vector Equation Mark Yen Dollar Lc MeanF SupF 0.380 (> 0.09) 0.111 (> 0.20) 0.260 (> 0.19) 2.493 (> 0.20) 1.334 (> 0.20) 2.421 (> 0.20) 4.447 (> 0.20) 3.087 (> 0.20) 5.451 (> 0.20) Note: We use the FMLS estimates from Table 2 to calculate these test statistics. The reported values in parentheses are p-values. terms, it should be expected to depreciate less than the currencies of its major trading partners. Put another way, proponents of this view would argue that although higher oil prices lower the US absolute terms of trade, higher oil prices will raise the US terms of trade relative to its industrialized trading partners. Since our measure of the effective exchange rate takes only those countries into consideration, it is not surprising that higher oil prices lead to an appreciation of the US dollar. To interpret these elasticities it is important that the long-run parameter estimates be structurally stable over the sample period. To test for structural stability of the parameter estimates we use a series of parameter constancy tests for I(1) processes recently proposed by Hansen (1992)—the Lc, MeanF and SupF tests. All three tests have the same null hypothesis of parameter stability, but differ in their alternative hypothesis. Specifically, the SupF is useful if we are interested in testing whether there is a sharp shift in regime, while the Lc and MeanF tests are useful for determining whether or not the specified model captures a stable relationship. The results presented in Table 3 suggest that we are unable to reject the null hypothesis for any of the tests even at the 20% level. We note that Hansen (1992) suggests that these tests may also be viewed as tests for the null of cointegration against the alternative of no cointegration. Thus, these test results also corroborate our previous conclusion of cointegration among the variables under study. Another way to assess the stability of these cointegrating relationships is to evaluate their performance in forecasting exchange rate movements out-of-sample. This allows us to compare our results with those of Meese and Rogoff (1983), who reported that structural exchange rate models failed to forecast consistently better out-ofsample than a random walk. Accordingly, we updated our data sample to March 1995 (April in the case of the United States) and used Meese and Rogoff’s methodology to assess the forecast performance of the oil-price/exchange-rate relationship.13 The forecasting equation simply fits the log exchange rate to lagged values of itself and of the © Blackwell Publishers Ltd 1998 EXCHANGE RATES AND OIL PRICES 689 Table 4. Theil’s U-Statistics for Real Exchange Rate Forecasts One lag Four lags (five for Germany) Starting period Horizon (months) USA Germany Japan USA Germany Japan 1985:01 1 2 3 6 12 18 24 0.9703 0.9647 0.9574 0.9243 0.8251 0.7204 0.6499 1.0162 0.9980 0.9570 0.8096 0.6274 0.5539 0.5827 0.9736 0.9485 0.9264 0.8388 0.6907 0.5956 0.5633 0.8773 0.9357 0.9572 0.9740 0.8948 0.7627 0.6630 0.9622 0.9812 0.9778 0.9054 0.6658 0.5624 0.5737 0.8541 0.8680 0.8463 0.7599 0.5947 0.5127 0.4606 1989:01 1 2 3 6 12 18 24 1.0331 1.0449 1.0546 1.0630 1.1093 1.3258 1.5338 1.0548 1.0527 1.0246 0.8743 0.7293 0.7631 1.2056 1.0396 1.0365 1.0322 0.9421 0.8371 0.7200 0.5864 0.9158 0.9701 0.9889 1.0188 1.0222 1.1876 1.2771 0.9330 0.9431 0.9682 0.9149 0.7315 0.7274 1.1646 0.9090 0.9461 0.9418 0.8596 0.7353 0.6319 0.5269 Note: The U-statistic is the ratio of the RMSE of a linear forecasting equation to the RMSE of a random walk forecast. The forecast equation contains the indicated number of lags of the real exchange rate and the real price of oil in domestic currency. The equation is estimated recursively by least squares and forecasts use ex post information on real oil prices only. log of the real oil price. Two alternative lag lengths were used. In constructing the cointegration tests we saw that four lags (five in the case of Germany) were required to correct for serial correlation in the residuals of the vector error-correction model. We also examine the behaviour of a system with only one lag in order to isolate the forecasting ability of the long-run error-correction mechanism from any associated shortrun dynamics. Table 4 reports Theil’s U-statistic (which is the ratio of the root-mean-squared error (RMSE) of the model’s forecast to the RMSE of a random-walk forecast) for a variety of forecast periods and forecast horizons. Values less than 1.0 indicate that the oil-price relationship forecasts better than a random walk over the period examined, while values greater than 1.0 imply the opposite. For the forecast period beginning in 1985, we see that the forecasts based on oil prices perform better than a random walk for nearly every currency, forecast horizon and lag length considered. The improvement tends to increase with the forecast horizon, with the oil price model showing little advantage at the shortest horizons, but at horizons of 12–24 months its forecast has a RMSE that is roughly one-third less than that of the random walk. The results for the four- and five-lag models are usually quite similar to those for the one-lag model, implying that most of the forecasting power is coming from the cointegrating relationship as opposed to any additional short-run dynamics. For the forecast period beginning in 1989, the forecasting equation does noticeably worse. Roughly half the U-statistics are now greater than 1.0, there is no clear tendency for them to improve as the forecast horizon lengthens (except for Japan), and the equation with several lags now tends to forecast better than the single-lag equation. The reasons for this deterioration in forecast performance can be easily understood if we © Blackwell Publishers Ltd 1998 690 Robert A. Amano and Simon van Norden consider the behaviour of real oil prices over this period (see Figure 1 or 2). Oil prices experienced a major persistent drop at the end of 1985 and, with the exception of a sharp and very short-lived rise during the Gulf War in 1990–91, have been relatively stable thereafter. Obviously, in the absence of large persistent movements in oil prices, a forecasting equation based on long-run movements in oil prices will have difficulty forecasting better than a random walk. This is precisely what we find in Table 4. Some may argue that because our measure of domestic oil prices uses the bilateral exchange rate with the United States to convert US dollar oil prices into a domestic price, any evidence of cointegration is simply a result of a common trend between the effective and bilateral exchange rates. However, this is unlikely to be the case. Specifically, we investigated this possibility by using the bilateral rate as the explanatory variable in the place of the real domestic price of oil. With this change, we find no evidence of cointegration even at the 10% significance level. Moreover, such an explanation cannot explain the evidence of cointegration found between real US dollar oil prices and the US real exchange rate. Finally, if we are simply capturing a relationship between bilateral and effective exchange rates we should not find unidirectional causality in our systems. We address this point in the next section. 3. Causality and Exogeneity From Engle and Granger (1987) we know that cointegration in a two-variable system implies that at least one of the variables must Granger-cause the other. However, the results presented above do not indicate whether the long-run relationship we have found reflects the endogeneity of the domestic price of oil, or the determination of the exchange rate, or both. While understanding the causal links between these variables may be interesting in its own right, we note that causality from the price of oil to the exchange rate would also imply that exchange rate changes are forecastable, and therefore implies a rejection of semi-strong market efficiency. Our first step in testing for causality is to test for “long-run causality”, or more accurately, whether any of our variables are weakly exogeneous in the sense of Engle et al. (1983). This can be tested using the likelihood-ratio test described in Johansen and Juselius (1990). The results shown in Table 5 imply that the price of oil is weakly exogeneous, while the real exchange rates are not. This implies that deviations from the long-run relationship between oil prices and exchange rates significantly influence exchange rates, but do not significantly affect domestic oil prices. Next we test for more general Granger-causality using standard tests on the vector autoregression level representation of our system. As demonstrated in Sims et al. (1990), standard inference procedures are valid in this case under the maintained Table 5. Johansen Weak Exogeneity Tests Equation Mark Yen Dollar Lags H0: Price of oil is weakly exogeneous H0: Exchange rate is weakly exogeneous 5 4 4 0.414 0.158 0.901 < 0.000 < 0.000 0.001 Note: Reported numbers are p-values (the lowest significance level at which we can reject the null hypothesis). © Blackwell Publishers Ltd 1998 EXCHANGE RATES AND OIL PRICES 691 hypothesis of one cointegrating vector and provided that we test the exclusion restrictions on one variable at a time. These results are reported in Table 6.14 They indicate strong evidence that the price of oil Granger-causes the real exchange rate, whereas there is no evidence of the reverse. If we accept the conclusion that exchange rates do not Granger-cause oil prices as our empirical evidence suggests, what other interpretation can we offer for the apparent long-run relationship between these two variables? An important possibility to consider is that oil prices and exchange rates are jointly determined by some third (omitted) macroeconomic variable. This would imply that we have a reduced-form relationship, but not one that should be thought of as a structural or causal link. Without a specific alternative, this is not a criticism that we can test. Nonetheless we feel that this is unlikely to be the case. As we argued in the introduction, the behavior of oil prices over our sample period is dominated by major persistent supply shocks that have been exogenous in the sense of most macroeconomic models. Accordingly, few macroeconomic insights are likely to be gained from a search for a codeterminant of exchange rates and oil prices. Previous formal analysis of this question for the United States would seem to support our view. In particular, Hamilton’s (1983) claim that major oil price increases preceded almost all post World War II recessions in the United States is accompanied by an extensive search for variables that were Granger-causally-prior to domestic US oil prices. After exploring a wide range of variables including aggregate prices, wages, real output, monetary aggregates, bond yields, and a stock-price index, Hamilton finds that almost none seemed to cause oil prices and none could explain its effect on output.15 As for the monetary and fiscal variables that have been the mainstay of modern exchange rate modeling, we have already cited studies which show that the explanatory power of these variables for exchange rates is limited. Furthermore, even supposedly “exogenous” measures of monetary policy such as that recently proposed by Romer and Romer (1989) for the United States may capture a considerable amount of endogenous policy reaction to exogenous external oil prices. Indeed, Dotsey and Reid (1992) show that Romer and Romer’s measure of monetary policy is coincident with several major oil price shocks, and that its explanatory power for output variables vanishes when oil prices are included in the system. We therefore think it is unlikely that oil prices are simply acting as a proxy for some other macroeconomic determinant of long-run exchange rates. 4. Concluding Remarks We have documented what we think is a robust and interesting relationship between the real domestic price of oil and real effective exchange rates for Germany, Japan and Table 6. Granger-Causality Tests Equation Mark Yen Dollar Lags H0: Price of oil does not cause exchange rates H0: Exchange rates do not cause oil prices 5 4 4 0.002 0.012 0.017 0.239 0.422 0.857 Note: Reported numbers are p-values. © Blackwell Publishers Ltd 1998 692 Robert A. Amano and Simon van Norden the United States. We have also explained why we think the real oil price captures exogenous terms-of-trade shocks, and why such shocks could be the most important factor determining real exchange rates in the long run. Given the ongoing debate over the determination of exchange rates and the other work we have cited examining relationships between exchange rates and the term of trade for other industrialized countries, we think that this is an area that deserves further research. This research could be usefully extended in several directions. Obviously, more evidence could be gathered, perhaps for additional currencies, for additional measures of the terms of trade, or from additional testing methods. More structural work on the relationship between oil prices and exchange rates would also be useful. There are several terms-of-trade models that predict oil prices will have important effects on industrialized-country exchange rates. As such, more detailed testing and comparison of these competing models may be warranted. References Adelman, Morris A., The Genie Out of the Bottle: World Oil Since 1970, Cambridge, MA: MIT Press, 1995. Amano, Robert A. and Simon van Norden, “Terms of Trade and Real Exchange Rates: The Canadian Evidence,” Journal of International Money and Finance 14 (1995):83–104. Andrews, Donald W. K. and J. Christopher Monahan, “An Improved Heteroskedasticity and Autocorrelation Consistent Covariance Matrix Estimator,” Econometrica 60 (1992):953–66. Baxter, Marianne, “Real Exchange Rates, Real Interest Differentials, and Government Policy: Theory and Evidence,” Journal of Monetary Economics 33 (1994):5–37. Beveridge, Stephen and Charles Nelson,“A New Approach to Decomposition of Economic Time Series into Permanent and Transitory Components with Particular Attention to Measurement of Business Cycles,” Journal of Monetary Economics 7 (1981):151–74. Blanchard, Olivier J. and Danny Quah, “The Dynamic Effect of Aggregate Demand and Supply Disturbance,” American Economic Review 79 (1989):655–73. Cushman, David O., S. L. Sang and Thorsteinn Thorgeirsson, “Maximum Likelihood Estimates of Cointegration in Exchange Rate Models for Seven Inflationary OECD Countries,” Journal of International Money and Finance 15 (1996):337–68. Dickey, David A. and Wayne A. Fuller, “Distribution of the Estimator for Autoregressive Time Series with a Unit Root,” Journal of the American Statistical Association 74 (1979):427–31. Dotsey, Michael and Max Reid, “Oil Shocks, Monetary Policy and Economic Activity,” Federal Reserve Bank of Richmond Economic Review 78 (1992):14–27. Engle, Robert F. and Clive W. J. Granger, “Cointegration and Error Correction: Representation, Estimation and Testing,” Econometrica 55 (1987):251–76. Engle, Robert F., David F. Hendry and Jean-Francois Richard, “Exogeneity,” Econometrica 51 (1983):277–304. Evans, Martin D. D. and James R. Lothian, “The Response of Exchange Rates to Permanent and Transitory Shocks Under Floating Exchange Rates,” Journal of International Money and Finance 12 (1993):563–86. Froot, Kenneth A. and Kenneth Rogoff, “Perspectives on PPP and Long-Run Real Exchange Rates,” in Gene M. Grossman and Kenneth Rogoff (eds.), Handbook of International Economics, vol. 3, New York: Elsevier, 1994. Godbout, Marie-Josée and Simon van Norden, “Reconsidering Cointegration in Exchange Rates: Case Studies of Size Distortion in Finite Samples,” Working Paper 97-1, Bank of Canada, 1997. Hamilton, James D., “Oil and the Macroeconomy since World War II,” Journal of Political Economy 91 (1983):228–48. Hansen, Bruce E., “Tests for Parameter Instability in Regressions with I(1) Processes,” Journal of Business & Economic Statistics 10 (1992):321–35. © Blackwell Publishers Ltd 1998 EXCHANGE RATES AND OIL PRICES 693 Huizinga, John, “An Empirical investigation of the Long-Run Behavior of Real Exchange Rates,” Carnegie-Rochester Series on Public Policy, 27 (1987):149–215. Johansen, Soren and Katarina Juselius, “The Full Information Maximum Likelihood Procedure for Inference on Cointegration,” Oxford Bulletin of Economics and Statistic 52 (1990):169– 210. Krugman, Paul, “Oil and the Dollar,” in Jagdeep S. Bahandari and Bulford H. Putnam (eds.) Economic Interdependence and Flexible Exchange Rates, Cambridge, MA: MIT Press, 1983. MacDonald, Ronald and Mark P. Taylor, “The Monetary Model of the Exchange Rate: LongRun Relationships, Short-Run Dynamics and How to Beat a Random Walk,” Journal of International Money and Finance 13 (1994):276–90. Meese, Richard A., “Currency Fluctuations in the Post-Bretton Woods Era,” Journal of Economic Perspectives 4 (1990):117–34. Meese, Richard A. and Kenneth Rogoff, “Empirical Exchange Rate Models of the Seventies: Do They Fit Out of Sample?” Journal of International Economics 14 (1983):3–24. ———, “Was it Real? The Exchange Rate-Interest Differential Relation Over the Modern Floating-Rate Period,” Journal of Finance 43 (1988):933–48. Mussa, Michael L., “Exchange Rates in Theory and in Reality,” Essays in International Finance, No. 179, Princeton University, 1990. Phillips, Peter C. B. and Bruce E. Hansen, “Statistical Inference in Instrumental Variables Regression with I(1) Processes,” Review of Economic Studies 57 (1990):99–125. Phillips, Peter C. B. and Pierre Perron, “Testing for a Unit Root in Time Series Regressions,” Biometrika 75 (1988):335–46. Rogoff, Kenneth, “Oil, Productivity, Government Spending and the Real Yen–Dollar Exchange Rate,” Working Paper 91-06, Federal Reserve Bank of San Francisco, 1991. Romer, Christine D. and David H. Romer, “Does Monetary Policy Matter? A New Test in the Spirit of Friedman and Schwartz,” National Bureau of Economic Research Macroeconomic Annual 4 (1989):122–70. Sims, Christopher A., James H. Stock, and Mark W. Watson, “Inference in Linear Time Series Models With Some Unit Roots,” Econometrica 58 (1990):113–44. Throop, Adrian W., “A Generalized Uncovered Interest Parity Model of Exchange Rates,” Federal Reserve Bank of San Francisco Economic Review 2 (1993):3–16. Yoshikawa, Hiroshi, “On the Equilibrium Yen–Dollar Rate,” American Economic Review 80 (1990):576–83. Notes 1. Recent Monte Carlo studies (Godbout and van Norden, 1997) have found that the systems approach to cointegration, an approach often used in this literature, will tend to find evidence of cointegration where none exists in systems with many variables (as is the case with the monetary model of exchange rate determination). 2. For example, see the discussion on Balassa–Samuelson effects in Froot and Rogoff (1994). 3. Those investigating the failure of real interest rate parity relationships have already tried to identify this factor, without much success (Meese and Rogoff, 1988; Baxter, 1994). Their research has focused on the explanatory power of fiscal policy and external indebtedness. Other studies have used a broader range of explanatory variables. 4. For reference, see note 1. 5. The macroeconomic importance of oil prices may also in part be due to the fact that other important forms of energy (coal, gas, and to a lesser extent electricity) are substitutes for oil, so that their prices tend to reflect variations in oil prices. 6. Amano and van Norden (1995) document the Canadian evidence. 7. See Adelman (1995) for a full discussion of the determination of oil prices over this period. 8. The terms-of-trade variables are calculated as the ratio between the unit value of exports and the unit value of imports. These data are taken from the International Financial Statistics (International Monetary Fund). © Blackwell Publishers Ltd 1998 694 Robert A. Amano and Simon van Norden 9. Although other measures of the real exchange rate are available, we chose the Morgan Guaranty 15-country measure simply because it gave us the longest span of data. We should note that the results appear robust to different price deflators and measures of the real effective exchange rate. The latter is not surprising as the different measures are very highly correlated (> 0.98). 10. In additional work not reported here, we also found that real interest rate differentials alone cannot explain the failure of PPP, and structural decompositions suggest that real shocks are an important source of persistent real exchange rate movements. These results are available from the authors. 11. We emphasize that the nonstationarity assumption is not crucial to our conclusions concerning the stability, causality or out-of-sample forecasting ability of the relationship we uncover between the price of oil and real exchange rates. 12. We note that the United States is not the only nation for which there is evidence of such a “reverse” effect. Amano and van Norden (1995) present evidence of a similar effect for Canada, where higher energy prices lead to a weaker Canadian dollar despite the fact that Canada is a substantial exporter of energy. 13. Specifically, we used least-squares to estimate the level of the exchange rate as a linear function of past exchange rates and oil prices, and then forecast the exchange rate a number of periods ahead using ex post realizations of oil prices and (if needed) previously calculated forecasts of the exchange rate at shorter horizons. The least-squares estimates were updated each period while ensuring that no data from the forecast sample were used to estimate the forecasting equation. No attempt was made to optimize the number of lags used, this being fixed at the length used for the cointegration tests. See Meese and Rogoff (1983) for further details. 14. Since all results are based on asymptotic approximations, we use the limiting chi-squared critical values instead of their more common F-distributed counterparts. 15. Apparently, causally-prior variables were import prices (weak evidence that is sensitive to the lag-length used), coal prices, and the ratio of person-days idle due to strike to total employment. The first two variables could simply reflect the same external energy supply shocks, but might respond to these shocks more quickly than domestic energy prices. The latter variable may simply reflect the influence of strikes by US coal miners on domestic energy prices in the 1950s. © Blackwell Publishers Ltd 1998