Production Oper Manag - 2021 - Oh - Optimal Pricing and Overbooking of Reservations

advertisement

DOI 10.1111/poms.13583

© 2021 Production and Operations Management Society

Optimal Pricing and Overbooking of Reservations

Jaelynn Oh*

David Eccles School of Business, The University of Utah, Salt Lake City, Utah 84112, USA, jaelynn.oh@eccles.utah.edu

Xuanming Su

The Wharton School, University of Pennsylvania, Philadelphia, Pennsylvania 19104, USA, xuanming@wharton.upenn.edu

e study the optimal design of reservations for a firm with limited capacity. The firm faces a random number of customers, each of whom has a random valuation for service. The reservation policy has two components: pricing and

overbooking. For the former, the firm charges a reservation fee (at the time of reservation) and a service price (at the time

of service). For the latter, the firm imposes a booking limit that caps the number of reservations it sells. Given the firm’s

reservation policy, customers make reservations in advance and later decide whether to show up. Denying service to

reservation holders is costly. We obtain the following equilibrium results. First, when demand is small relative to capacity,

the firm’s pricing structure relies on reservation fees prepaid in advance, but when demand is large relative to capacity, it

relies on payment received upon service. Second, when demand is low and/or predictable, the firm accepts all reservation

requests, but when demand is high and/or variable, the firm uses a booking limit.

W

Key words: pricing; overbooking; reservations; revenue management; advance selling; capacity

History: Received: May 2020; Accepted: August 2021 by Dan Zhang, after 2 revisions.

*Corresponding author.

deposit, and some hotels require a full and nonrefundable payment upon reservation. Second, on overbooking, firms have to decide how many excess

reservations to accept beyond the number capacity

can accommodate. Denying service to reservation

holders can be costly; for example, the Department of

Transportation mandates that up to 400% of the oneway fare must be compensated to each involuntarily

bumped passenger (DOT 2020). Yet, bumping rates

differ across US airlines, ranging from 0.02 to 6.28 per

100,000 passengers in 2018 (McCarthy 2019).

By studying the pricing and the overbooking decisions jointly, we hope to answer the following

research questions. First, how does the market condition affect the optimal overbooking policy? Second,

how can the firm choose the optimal pricing policy

among the wide range of reservation pricing policies

observed in practice dependent on the market condition? From the answers of the above research questions, we hope to provide recommendations on the

optimal overbooking and pricing policies to firms that

take reservations while facing the uncertainties on the

market size and customer valuations.

We analyze the following stylized model. First, the

firm determines its reservation policy, which comprises of two prices (a reservation fee and a service

price) and a booking limit on the maximum number

of reservations to take. Then, the market size is realized; customers decide whether to make reservations

1. Introduction

Reservations are ubiquitous for firms such as car rentals, airlines, and hotels. These firms have limited

capacity and may take reservations in advance in

order to subsequently guarantee service. Because of

the time gap between the point reservation is made

and the point service is rendered, both the firm and

the customers face uncertainty. Firms give out reservations without knowing the precise number of

patrons, and customers make reservations before

learning their precise need for service. This study

intends to study how firms can set the optimal overbooking and pricing policies to deal with the uncertainties the firm and the customers face when

reservations are made. As we study the optimal reservation policies, we provide explanations on how certain market conditions, characterized as the average

market size and the market size variability, lead to

certain equilibrium outcome.

In this study, we focus on two specific aspects of

reservation policies: pricing and overbooking. First,

on pricing, firms generally have to make two decisions: how much to charge for making the reservation

and how much to charge for exercising it; these are

analogous to the purchase price and strike price of

financial options. There is a wide variation observed

in practices. For example, some hotels give out reservations for free, others charge a nonrefundable

928

19375956, 2022, 3, Downloaded from https://onlinelibrary.wiley.com/doi/10.1111/poms.13583 by Vrije Universiteit Amsterdam, Wiley Online Library on [07/03/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

Vol. 31, No. 3, March 2022, pp. 928–940

ISSN 1059-1478|EISSN 1937-5956|22|3103|0928

Production and Operations Management 31(3), pp. 928–940, © 2021 Production and Operations Management Society

(paying the reservation fee) and if so, the firm accepts

reservations up to its booking limit. Finally, individual customer valuations are realized; customers

decide whether to show up (paying the service price)

and the firm serves customers up to its capacity limit.

This model admits a wide range of reservation policies that are chosen by firms. We summarize our

results below.

First, the optimal overbooking policy has a simple

structure and takes one of two forms. In some cases, it

may be optimal to accept all reservation requests and

impose no booking limit whatsoever. In other cases, a

booking limit is needed: this caps the number of reservations given out so that the number of customers

who are expected to show up is aligned with the units

of capacity available. Note that the booking limit may

exceed capacity, so some overbooking may be practiced. In summary, the optimal overbooking policy

may be an “accept all policy” or a “booking limit

policy.”

Second, the optimal pricing policy often involves a

combination of reservation fees and service prices.

The former dominates in small markets while the latter dominates in large markets. In extreme cases (i.e.,

when average market demand is extremely small or

extremely large, relative to capacity), it may even be

optimal to charge only the reservation fee (i.e., fully

prepaid reservations) or only the service price (i.e.,

free reservations). As the average market size

increases, the firm relies less on advance pre-payment

at the time of reservation but more on spot payment

at the time of consumption.

Third, by running numerical simulations, we map

the optimal reservation policies with market conditions characterized as a combination of the mean and

the standard deviation of the market size. We find

that accepting all reservations is an optimal overbooking policy for a market with small mean and/or small

variance. On the other hand, setting a booking limit is

optimal when the average market size is large and/or

the standard deviation of the market size is large.

From the numerical results we can also see that the

optimal prices alone can effectively regulate the customer traffic when the market size is less variable, but

booking limits become essential as the market size

variability increases to avoid customer bumping.

2. Literature Review

This study is closely related to the advance selling literature. The key feature in common is that customers

make purchase decisions while facing uncertainty

over their consumption valuations. Despite this

uncertainty, DeGraba (1995) finds that limiting supply induces customers to buy in advance, and the

threat of unavailability even allows prices to be set

929

above market-clearing levels. Gale and Holmes (1993)

show that offering a discount can also induce customers to purchase in advance; this helps shift

demand from peak to off-peak periods. Dana (1998)

finds that such advance purchase discounts can generate competitive advantages. Xie and Shugan (2001)

develop a framework for comparing advance selling

to spot selling (i.e., selling to customers after their valuation uncertainty is resolved) and also study

whether to advance sell at a discount or at a premium;

Shugan and Xie (2005) generalize the earlier framework to competitive settings. Prasad et al. (2011)

embed a classic newsvendor model into the advance

selling framework to study the firm’s decision of how

many units to advance sell; they also compare

advance selling and spot selling. Nasiry and Popescu

(2012) study how anticipated regret can affect customer decisions and firm profits in an advance selling

context. Yu et al. (2015) study the pricing and capacity

decision of an advance selling firm when customer

valuations are correlated. In this stream of work, the

focus is on pure advance selling and pure spot selling,

that is, customers make purchase decisions either

before or after resolving uncertainty over their valuations. In contrast, we offer a general framework that

integrates these two modes of operation: customers

pay a reservation fee in advance and/or pay another

spot price when they show up for their reservations.

Furthermore, we incorporate overbooking into

advance selling by allowing the firm to sell more

reservations than its capacity can serve.

There is a series of related papers that focus on

reservations. An early study by Png (1989) finds that

optimal reservation policies should provide compensation to reservation holders who show up but are

denied service. Bertsimas and Shioda (2003) develop

a decision tool for managing restaurant reservations,

taking into account the possibility of no-shows. Chen

et al. (2017) studies long-term revenue-maximizing

admission policy when different types of customers

arrive to make reservation requests with services that

have heterogeneous duration and start time and the

sellers decide which requests to accept or deny.

Alexandrov and Lariviere (2012) point out that reservations help attract demand when customers incur a

travel cost to request service. Cil and Lariviere (2013)

study how to allocate capacity between reservation

holders and walk-in demand. Elmaghraby et al.

(2009) and Osadchiy and Vulcano (2010) study binding reservations in retail environments: customers

may reserve a unit for purchase but are obligated to

buy if there is availability at the end of the selling season. In the papers above, the firm sells reservations at

a single price. However, we consider a more general

mechanism that involves two prices: a reservation fee

and a service price.

19375956, 2022, 3, Downloaded from https://onlinelibrary.wiley.com/doi/10.1111/poms.13583 by Vrije Universiteit Amsterdam, Wiley Online Library on [07/03/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

Oh and Su: Optimal Pricing and Overbooking of Reservations

Oh and Su: Optimal Pricing and Overbooking of Reservations

Production and Operations Management 31(3), pp. 928–940, © 2021 Production and Operations Management Society

Our two-price modeling setup has alternative interpretations that have been used in some earlier papers.

For example, charging a reservation fee in advance

and a service price later is equivalent to collecting a

partially refundable payment in advance. In the economics literature, Courty and Li (2000) show that a

menu of partial refund contracts can be used to screen

multiple customer segments: customers who face

greater uncertainty are willing to pay more in

advance for more generous refunds. Similarly, Akan

et al. (2015) apply partial refund contracts to develop

a continuous time sequential screening mechanism

when selling to customers who realize their valuations at different times. The above papers focus on

price discrimination and do not consider the role of

capacity constraints, which play a critical role in our

study. In this sense, our paper is more closely related

to the following revenue management models. Gallego and Sahin (2010) study capacity options: customers pay an option price for the right to purchase a

unit of capacity and may later pay the strike price to

exercise that right; the option and strike prices here

are analogous to our reservation and service fees. The

authors focus on profit and welfare implications of

capacity options, but we are more interested in understanding the structure of optimal reservations policies

(e.g., whether reservations should be fully or partially

prepaid). More recently, Georgiadis and Tang (2014)

study reservation policies consisting of a nonrefundable deposit and a retail price. They consider four customer segments with low/high service valuations and

low/high no-show probabilities, and study the optimal subset of customers to sell reservations to. In contrast, we consider customers who endogenously

choose whether to show up for service based on their

realized valuations, which follow general distributions. This key difference allows pricing to play a

stronger role in regulating customer arrivals in our

model. With our model, we distinguish between the

following regimes: no reservations (i.e., spot selling),

fully refundable reservations, partially refundable

reservations, and nonrefundable reservations (i.e.,

advance selling). While considering advance deposits

and spot prices for reservation customers, Oh and Su

(2018) study capacity allocation between reservations

and walk-ins. This study, on the other hand, studies

how to use booking limits to discipline overbooking

practices.

Finally, our study is related to the literature on

appointment scheduling and overbooking. Cayirli

and Veral (2003) and Gupta and Denton (2008) provide a comprehensive review of the literature, most of

which is in the health care context. Kim and Giachetti

(2006) develop an overbooking model that considers

both no-shows and walk-ins to obtain the optimal

number of appointments. LaGanga and Lawrence

(2007), Zeng et al. (2010), and LaGanga and Lawrence

(2012) study overbooking models that balance the

benefit of expected revenue increase and the cost due

to increased customer waits and provider overwork.

Robinson and Chen (2010) and Liu et al. (2010) compare appointment overbooking to an open access policy where patients can come right away on the day

they want to be seen. Zacharias and Pinedo (2014)

find an optimal overbooking policy that minimizes a

weighted sum of customer wait time, provider idle

time, and provider overtime. Liu and Ziya (2014) look

for the optimal panel size (total number of patients

the provider commits to provide service for) and

study overbooking decisions. The study mentioned

above focus on appointment systems with fixed

prices. In contrast, we study joint overbooking and

pricing decisions.

3. Model

The Firm: There is a monopolist firm with a fixed

capacity. This capacity may be cars in a car rental

company or rooms in a hotel. When capacity is full,

no more customers may be served. Let μ denote the

firm’s capacity; in other words, the firm can serve no

more than μ customers. The firm sells its capacity

through reservations. The firm’s reservation policy

specifies two prices: a reservation fee ϕ and a service

price p. The reservation fee is collected when a reservation is made, and the service price is charged when

a reservation holder shows up and receives the service. In addition, the firm sets a booking limit B,

which is the maximum number of reservations the

firm takes. Note that if the firm takes too many reservations and too many of them show up, the firm will

be unable to honor all these reservations. For each

reservation holder the firm turns away, the firm

arranges a substitute service while incurring a bumping cost C > 0. The firm’s bumping cost C may

include a goodwill cost, any cost related to arrangements made to a bumped customer, and a compensation the firm may have to give to a denied customer.

There are different practices regarding the compensation in different industries. The hotel industry

requires accommodations to be provided at a neighboring hotel at an equal or complementary rate, and

they maintain partnerships with neighboring hotels

to utilize as alternative arrangements for overbooked

customers (Wikipedia 2021). Airlines, however, are

mandated to pay an involuntarily bumped customer

an amount equal to 200% of the one-way fare upon

arranging substitute transportation that is scheduled

to arrive within 2 hours after the original arrival time

(DOT 2020). The firm does not divulge overbooking

practices and the booking limit B is not observable.

However, the prices p and ϕ are observable.

19375956, 2022, 3, Downloaded from https://onlinelibrary.wiley.com/doi/10.1111/poms.13583 by Vrije Universiteit Amsterdam, Wiley Online Library on [07/03/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

930

Production and Operations Management 31(3), pp. 928–940, © 2021 Production and Operations Management Society

The Customers: The total number of customers

(i.e., market demand) is Λ ≥ 0. Here, Λ is a random

variable with density g and distribution G; let

¼ 1 G. Each customer is a strategic utility maxiG

mizer and makes two decisions sequentially: first,

whether to make a reservation (paying the reservation fee), and second, whether to exercise the reservation (paying the service price) if one has been

made. When making the former decision, customers

are uncertain about how much value they will derive

out of the firm’s service. This valuation u is independent and identically distributed across customers; it

follows distribution F and density f, and let

¼ 1 F. Based on the distribution of valuations,

F

customers choose whether to make a reservation. If a

customer chooses not to make a reservation, she

leaves the market and receives zero utility. If a customer chooses to make a reservation, she faces the

second decision, that is, whether to show up for

the reservation and pay the price for service, after

the service valuation u is realized. However, due to

overbooking, it is possible that a reservation holder

shows up for service while the firm does not have

available capacity to serve the customer Figure 1. In

this case, the customer incurs a denial cost c. We

assume that the inconvenience of being bumped

exceeds any potential compensation paid by the

firm, so our analysis excludes customers who prefer

to be bumped in hopes of earning the compensation,

that is, c ≥ 0.

Sequence of Events: The game chronology can be

summarized as follows. First, the firm sets the

reservation fee ϕ and the service price p, which are

both publicly observable. In addition, the firm sets

its booking limit B. Next, the market size Λ is realized; the firm observes the market size, but customers only know its distribution. Then, customers

decide whether to make reservations and pay the

reservation fee. The firm then accepts reservation

requests up to the booking limit B. Finally, customers’ service valuations u are realized, and reservation holders decide whether to show up and pay

the price of service. The firm serves customers up to

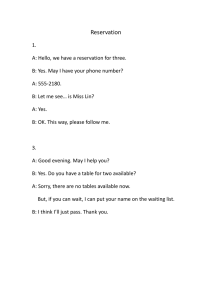

Figure 1 Customers’ Decisions and Payoffs [Color figure can be

viewed at wileyonlinelibrary.com]

931

its capacity limit μ. Figure 2 summarizes the

sequence of events described above. The figure also

labels the continuation equilibrium, which is the set

of outcomes that follow a particular set of prices ϕ

and p, and the full equilibrium, which consists of

equilibrium prices and their corresponding continuation equilibrium.

Utility Function: We now study customers’ utility

function. Using backward induction, we first examine a reservation holder’s decision of whether to

exercise the reservation (i.e., the second to last box in

Figure 2). The decision depends on two factors: first,

the customer’s valuation u, which has already been

realized, and second, the customer’s probability q of

receiving the service if she shows up. (We will derive

q later in this section.) The customer’s expected utility is

ðu pÞq cð1 qÞ ϕ,

if show up,

ϕ,

if no show:

Note that the customer pays the price of service p if

service is rendered, but she incurs the denial cost c

if capacity is unavailable despite securing the reservation; the former occurs with probability q. A reservation holder will thus show up when doing so

yields a higher expected utility than not showing up

and losing the reservation fee ϕ. In other words, to

maximize expected utility, customers with realized

1q

valuations u above the cutoff v ¼ p þ c q will

show up, while other customers will not. Therefore,

the expected utility from making a reservation is

νðqÞ ¼ ϕ þ Eu maxfðu pÞq cð1 qÞ, 0g:

When this expected utility is positive, customers

will choose to make reservations.

Profit Function: Next, we turn to the firm’s

profit function in the continuation equilibrium.

Having already chosen the prices ϕ and p, the

firm is now choosing the booking limit B. We

assume that customers make reservations; if they

do not, the firm earns nothing and the booking

limit plays no role. The firm’s expected profit as a

function of the booking limit and customers’ cutoff

valuation v is

πðB; vÞ ¼ EΛ p min RðBÞ FðvÞ,

μ

þ ϕ RðBÞ C max RðBÞ FðvÞ

μ, 0 ,

where R(B) ≡ min(B, Λ) is the number of reservations given out. There are three terms in the expectation. The first term is total revenue from service

provision since a fraction FðvÞ

of the R(B) reservation holders show up for service, and the firm may

serve up to μ of them. The second term is the total

19375956, 2022, 3, Downloaded from https://onlinelibrary.wiley.com/doi/10.1111/poms.13583 by Vrije Universiteit Amsterdam, Wiley Online Library on [07/03/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

Oh and Su: Optimal Pricing and Overbooking of Reservations

Production and Operations Management 31(3), pp. 928–940, © 2021 Production and Operations Management Society

Figure 2 Sequence of Events [Color figure can be viewed at wileyonlinelibrary.com]

revenue from reservation fees. The third term is the

total bumping cost from turning away reservation

holders. Based on this function, the firm chooses the

optimal booking limit that maximizes the expected

profit.

Continuation Equilibrium: We are now ready to

analyze the continuation equilibrium. Here, the

prices ϕ and p have already been set. Based only

on these prices, customers choose whether to make

reservations. If they do not, the game ends and

everyone earns nothing. In the more interesting

case, customers make reservations, and the continuation equilibrium outcomes are described as what

follows.

DEFINITION 1. Given (ϕ, p), a continuation equilibrium

ðBðϕ;pÞ , vðϕ;pÞ , qðϕ;pÞ Þ, in which customers make reservations, must satisfy the following conditions:

(i) Bðϕ;pÞ ∈ arg maxB πðB; vðϕ;pÞ Þ,

(ii) vðϕ;pÞ ¼ p þ c

1qðϕ;pÞ

qðϕ;pÞ

(iii) qðϕ;pÞ ¼ EΛ min

,

RðBðϕ;pÞ

μ

ÞFðv

ðϕ;pÞ

,

1

:

Þ

Condition (i) states that the booking limit Bðϕ;pÞ

maximizes the firm’s expected profit, given the

customers’ cutoff strategy vðϕ;pÞ . Condition (ii) states

that the cutoff vðϕ;pÞ maximizes customers’ expected

utility given the fill rate qðϕ;pÞ . Condition (iii) calculates

the fill rate qðϕ;pÞ based on the firm’s and customers’

decisions Bðϕ;pÞ and vðϕ;pÞ . Together, these conditions

characterize continuation equilibrium outcomes

following prices ϕ and p, when customers make

reservations.

Full equilibrium: We are now ready to describe the

full equilibrium of the game. Let π ðϕ, pÞ and

ν ðϕ, pÞ, respectively, denote the firm’s expected

profit and customers’ expected utility corresponding

to the outcomes ðBðϕ;pÞ , vðϕ;pÞ , qðϕ;pÞ Þ described above.

We have

π ðϕ, pÞ ¼ πðBðϕ;pÞ ; vðϕ;pÞ Þ,

ν ðϕ, pÞ ¼ νðqðϕ;pÞ Þ:

A customer will make a reservation if the expected

utility ν ðϕ, pÞ is greater than the outside option of

zero. Therefore, the firm solves the following profit

maximization problem:

max

ϕ, p

π ðϕ, pÞ

s:t: ν ðϕ, pÞ ≥ 0:

The full equilibrium of the game is thus defined as

follows.

DEFINITION 2. The full equilibrium ðϕ , p , B , v , q Þ

satisfies the following conditions.

(i)

(ii)

(iii)

(iv)

ðϕ , p Þ ∈ arg maxðϕ;pÞ: ν ðϕ;pÞ≥0 π ðϕ, pÞ,

B ¼ Bðϕ ; p Þ ,

v ¼ vðϕ ; p Þ ,

q ¼ qðϕ ; p Þ .

Condition (i) requires that the firm’s pricing policy

ðϕ , p Þ maximizes its expected profit in the

continuation equilibrium while ensuring that customers are willing to make reservations. Conditions (ii),

(iii), and (iv) ensure that ðB , v , q Þ is a continuation

equilibrium given the prices ðϕ , p Þ. All our results

below are based on analyses of the full equilibrium.

4. Analysis

4.1. The Overbooking Policy

We begin by showing that there are two possible

types of equilibria: the accept-all equilibrium and the

booking-limit equilibrium.

19375956, 2022, 3, Downloaded from https://onlinelibrary.wiley.com/doi/10.1111/poms.13583 by Vrije Universiteit Amsterdam, Wiley Online Library on [07/03/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

Oh and Su: Optimal Pricing and Overbooking of Reservations

932

Production and Operations Management 31(3), pp. 928–940, © 2021 Production and Operations Management Society

PROPOSITION 1. In the full equilibrium, ðB , v , q Þ

must take one of the following two forms.

(i) (Accept-all equilibrium) B ¼ ∞, v ¼ p þ c

n

o

μ

q ¼ EΛ min ΛFðv

,

1

.

Þ

(ii) (Booking-limit

q ¼ 1.

equilibrium)

μ

B ¼ Fðp

Þ,

1 q

q ,

v ¼ p ,

In the first type of equilibrium shown in Proposition 1(i), the firm effectively accepts all reservation

requests because the booking limit is B ¼ ∞. However, when market demand is too high, the firm does

not have enough capacity to honor all the reservations

it gives out. In other words, the probability that a

reservation holder will be served is only q < 1. Customers anticipate this, so their cutoff valuation,

1 q

v ¼ p þ c q , is strictly greater than the service

price p to account for the risk of being bumped. We

call this the accept-all equilibrium.

In the second type of equilibrium shown in Propoμ

sition 1(ii), the firm uses a booking limit B ¼ Fðp

Þ.

Specifically, the firm accepts up to B reservations, at

which point it stops accepting any more that might be

requested. The booking limit is chosen so that when it

is reached, the expected number of reservation holders who show up for service is aligned with the units

of capacity available. (Customers who realize that

their valuation is below the price will not find it

worthwhile to show up for service, so only a fraction

Þ of reservation holders will show up.) Using the

Fðp

booking limit B , the firm ensures that all reservation

holders who show up will be served in expectation

(i.e., q ¼ 1). Consequently, the corresponding cutoff

valuation v equals the service price p . We call this

the booking-limit equilibrium.

The two candidate equilibria reflect different priorities in reservation management. To explain this point,

we present the following proposition.

PROPOSITION 2. Consider some fixed (ϕ, p) with two

continuation equilibria, one satisfying the conditions of

the accept-all equilibrium and the other satisfying the

conditions of the booking-limit equilibrium. Then, we

have the following.

(i) The accept-all equilibrium is more profitable if p is

sufficiently small, but the booking-limit equilibrium

is more profitable if p is sufficiently large.

(ii) The accept-all equilibrium is more profitable if ϕ is

sufficiently large, but the booking-limit equilibrium

is more profitable if ϕ is sufficiently small.

With two continuation equilibria following the

same set of prices, a meaningful comparison between

933

the accept-all and the booking-limit reservation formats is possible. Note that the full equilibrium is

uniquely determined since the firm chooses the format of continuation equilibrium that brings a higher

expected profit. Even though these continuation equilibria may not occur in the full equilibrium, comparing them is instructive nonetheless. According to

Proposition 2 above, if the firm relies heavily on reservation fees (i.e., high ϕ but low p), then the accept-all

equilibrium is more profitable. This is reasonable

since the accept-all equilibrium gives out more reservations and thus collects more reservation fees. On

the other hand, if the firm relies more on the revenue

collected from service, then the booking-limit equilibrium is more profitable. In this case, the booking

limit helps to maintain high service levels, which supports higher service prices that contribute to higher

revenue. Therefore, the two candidate equilibria

reflect different priorities in reservation management:

the accept-all equilibrium focuses on volume, while

the booking-limit equilibrium focuses on service.

We now study the market condition under which

one equilibrium overbooking format outperforms the

other. We focus on how market variability influences

the optimal overbooking policy. In the following proposition, we assume that the market size Λ follows a

normal distribution and study the effect of the standard deviation parameter, holding the mean fixed.

PROPOSITION 3. Let market demand Λ follow a normal

distribution Nðλ, σ 2 Þ truncated at zero.

(i) If σ is sufficiently small, the equilibrium must be an

accept-all equilibrium.

(ii) If σ is sufficiently large, the equilibrium must be a

booking-limit equilibrium.

The result above shows that when the market variability is low, the firm accepts all reservation requests.

The intuition is as follows. When market demand is

relatively predictable, customers are in a good position to regulate their own arrival patterns and ensure

that just the right amount of demand shows up for

service. In the extreme case where demand is deterministic, customers can even ensure 100% service

level by independently choosing whether to show up

for service (cf. Lariviere and Van Mieghem 2004). For

example, if everyone knows that there are 500 customers in the market and the firm has ample capacity

to serve 400, an equilibrium will emerge whereby the

400 customers with the highest valuations will show

up for service and all of them will be served. This outcome is possible because customers respond strategically to prices, that is, only customers with realized

valuations above the service price will show up. Ultimately, it is the firm’s responsibility to set the right

19375956, 2022, 3, Downloaded from https://onlinelibrary.wiley.com/doi/10.1111/poms.13583 by Vrije Universiteit Amsterdam, Wiley Online Library on [07/03/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

Oh and Su: Optimal Pricing and Overbooking of Reservations

Production and Operations Management 31(3), pp. 928–940, © 2021 Production and Operations Management Society

service price so that just the right amount of demand

shows up to fully utilize capacity. If the price is too

high, too few customers show up and capacity is

wasted; if the price is too low, too many show up and

some of them are “bumped.” With the right prices,

the accept-all equilibrium can indeed be optimal in

predictable markets.

On the other hand, when market variability is high, a

booking limit must be used in equilibrium. This is

because customers are no longer sufficiently wellinformed to regulate their own arrivals. Since customers are not privy to demand realizations, they

decide whether to show up based only on their valuations. In equilibrium, the same proportion of reservation holders will show up for service, regardless of

whether demand is high or low. To avoid having too

many customers show up for service, a booking limit is

needed. When demand is low, reservations can be

given out without any restriction because the firm has

ample capacity to honor them. However, when

demand is high, the firm must limit the number of

reservations in order to maintain reasonably high service levels. This role is served by the booking limit,

which is necessary when the market variability is high.

4.2. The Pricing Policy

In the previous section, we studied how booking limits can help firms hedge against the risk of bumping

customers when the market size is uncertain. We now

study how the firm can deal with customer valuation

uncertainties using the reservation pricing policy. We

begin by stating the following proposition, which

shows the equilibrium pricing policies and their

dependence on the average market size. To solicit the

effect of the average market demand while keeping

the analysis simple, we first study the case where the

market size Λ is deterministic.

PROPOSITION 4. When the market size Λ is deterministic,

the equilibrium price ðϕ , p Þ satisfies the following.

R∞

(i) If Λ ≤ μ: p ¼ 0 and ϕ ¼ 0 ufðuÞdu.

R

1 ð μ Þ and ϕ ¼ ∞ ðu p ÞfðuÞdu.

(ii) If Λ > μ: p ¼ F

Λ

p

Therefore, the service price p increases as the market size

Λ increases, and the reservation fee ϕ decreases and converges to zero as the market size Λ increases.

Proposition 4(i) shows that when the market size is

smaller than the capacity, the service price p becomes

zero, so the firm’s revenue comes primarily from

reservation fees. Since the bulk of the payment is

received upfront, this scheme protects the firm

against no-shows. In addition, this scheme leads to

efficient consumption: since the firm essentially does

not charge for service, all reservation holders with

positive valuations will receive the service. In contrast, if the firm charges p > 0 for service, some customers with positive valuations below p will not

show up, leading to lost surplus and hence lost profits

(since the firm extracts full surplus). Therefore, the

firm adopts a full prepayment scheme when average

demand is sufficiently small.

When the market size is larger than the capacity, on

the other hand, Proposition 4(ii) shows that the firm

charges service price so that customers can selfregulate to avoid being bumped. The fraction of customers having realized valuation greater than the

price of service is set equal to the fraction of capacity

over the market size. Hence, as the market size

increases, the firm charges a higher service price p,

but needs to correspondingly decrease the reservation

fee ϕ to make reservations attractive ex ante. When

the market size becomes significantly large, reservation fee ϕ becomes negligibly small, and reservations

are offered for free.

The results of Proposition 4 follow from the fact

that the reservation price is paid before customers

know their valuations, whereas the service price is

paid after customers’ valuations are realized. When

the firm is charging a price to customers who are unaware of their valuations, the firm can only set the

price that is attractive to the customers in expectation.

Therefore, the reservation deposit is set based on the

customers’ expected valuation. In contrast, the service

price that is charged after customers learn their valuations can actively depend on the market size. To illustrate, consider the case where a firm has 20 units of

capacity to sell to the customers, and customers’ service valuations follow Uniform distribution with the

support of [$0, $100]. If the firm sells the capacities to

customers who have not yet seen their realized valuations, the only price the customers are willing to pay

is less than or equal to their expected valuation of $50.

However, if the firm sells the capacities to customers

who already know their valuations, it can sell them to

20 customers who have the highest realized valuations. For example, if there are 100 customers in the

potential market, the firm can sell its capacities to the

top 20% of the population by setting the service price

equal to $80. If there are 1000 customers in the potential market, the firm can now sell its capacities to top

2% of the population with the price of $98. As it can

be seen in the above exercise, the market size does not

have a direct effect on the prepaid reservation

deposit, whereas the service price increases as the

market size increases. When the firm charges both the

reservation deposit and the service price as in our

model, the firm increases the service price as the

potential market size increases, and the prepayment

needs to be lowered so that customers are willing to

pay the deposit based on their expected utility.

19375956, 2022, 3, Downloaded from https://onlinelibrary.wiley.com/doi/10.1111/poms.13583 by Vrije Universiteit Amsterdam, Wiley Online Library on [07/03/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

Oh and Su: Optimal Pricing and Overbooking of Reservations

934

Production and Operations Management 31(3), pp. 928–940, © 2021 Production and Operations Management Society

Proposition 4 also implies that the firm’s optimal

pricing strategy for reservations diverges from the

common belief that reservations are more useful

when capacity is scarce. When the market size is

large, this is when customers would value reservations more. However, our results show that the firm

should give out reservations for free when the market

size becomes significantly large. This is because customers view reservations as a means to secure capacity. However, to the firm reservations can be a tool to

change the point of payment to maximize revenue.

When the market size is small, the firm is better off

charging the reservation deposit in advance while

customers are still uncertain about their valuations.

On the other hand, when there are more potential customers, the firm can sell its capacities at a higher price

when the price is charged after customers find out

their realized valuations.

A key question in the advance selling literature is

when one pricing scheme dominates the other

between advance sales and spot sales. It is generally

recognized that as the market size increases, the optimal policy switches from advance to spot sales (Xie

and Shugan 2001). In comparison, with a generalization of advance selling in the form of reservations, we

find that pure advance selling and pure spot selling

are optimal only in extreme cases. In all other cases, it

is important to consider a “hybrid” reservation system with two prices, ϕ and p. With two prices

charged, we see that the market size has implications

on pricing.

Proposition 5 extends the results of Proposition 4 to

the case where Λ is uncertain.

PROPOSITION 5.

Let λ = EΛ.

(i) Suppose λ is sufficiently small such that the market

demand Λ is smaller than μ with probability 1 − ɛ,

for some small ɛ > 0. Then, p < ɛ.

(ii) Suppose λ is sufficiently large such that the market

demand Λ is greater than 1ɛ with probability 1 − ɛ,

for some small ɛ > 0. Then, ϕ < ɛ.

(iii) There is an increasing function p(λ) and a decreasing function ϕ(λ) such that for any λ, p ≥ pðλÞ and

ϕ ≤ ϕðλÞ.

Proposition 5 shows that (i) the service price p

becomes negligible when the average market size is

small, (ii) the reservation fee ϕ becomes negligibly

small with a large enough market size, and (iii) the

firm depends more heavily on the price of service and

less so on the price of reservation as the market size

increases.

Our results are opposite from the findings of Georgiadis and Tang (2014), who find that prepayment

plays a more important role in large rather than small

935

markets. The reason is as follows. In their model, the

no-show probability is exogenous, so the number of

reservation holders willing to show up cannot be

manipulated using the service price. As market size

increases, the opportunity cost of wasted capacity

increases. Hence, it becomes more important to use

prepayment to combat no-shows. In contrast, our

model endogenizes customers’ decisions to show up

for service. As market size increases, a greater number of reservation holders are willing to show up at

each given price, so we can increase service price

while fully utilizing capacity; the reservation fee correspondingly decreases. Consequently, there is less

reliance on prepayment in larger markets.

4.3. The Overbooking and the Pricing Policies

So far, we have seen how booking limits can be useful

to deal with the market size uncertainty, while the

pricing policy uses customer valuation uncertainty to

maximize firm profit. As we studied the overbooking

policy and the pricing policy separately, we showed

how the format of the optimal overbooking policy

depends on the standard deviation of the market size

and how the pricing policy changes with the average

market size. Now, to study how the mean and the

standard deviation of the market size conjointly determine the optimal overbooking and the pricing policies, we run a numerical study using simulation

method. While keeping the distribution of customer

valuation as normal distribution with mean 200 and

standard deviation 10, we vary the customers’ denial

cost c and the firm’s bumping cost C where c =

[50, 75, 100, . . ., 300] and C = [50, 75, 100, . . ., 300].

For each pair of c and C values, we vary the average

market size/capacity ratio from 0.8 to 2 and the standard deviation of the market size from 0 to 100. We

then compute the optimal pricing and the overbooking policy for each combination of mean market size/

capacity ratio and the standard deviation of market

size.

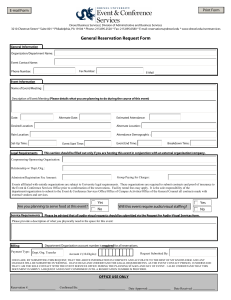

We first discuss the simulation results that show

the market conditions that result in the accept-all

equilibrium over the booking-limit equilibrium as

shown in Figure 3. In Figure 3, the x-axis represents

the values of average demand over capacity ranging

from 0.8 to 2, whereas the y-axis shows the standard

deviation of the market size ranging from 0 to 100.

Figure 3 shows the results for the case where both the

customers’ denial cost c and the firm’s bumping cost

C are 100. The yellow squares represent the (average

demand/capacity, standard deviation of market size)

pairs that result in the accept-all equilibrium format,

whereas the blue/green squares represent those pairs

that result in the booking-limit equilibrium as the

optimal overbooking policy. Among the squares that

are of the booking-limit equilibrium, darker blue

19375956, 2022, 3, Downloaded from https://onlinelibrary.wiley.com/doi/10.1111/poms.13583 by Vrije Universiteit Amsterdam, Wiley Online Library on [07/03/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

Oh and Su: Optimal Pricing and Overbooking of Reservations

Oh and Su: Optimal Pricing and Overbooking of Reservations

Production and Operations Management 31(3), pp. 928–940, © 2021 Production and Operations Management Society

Figure 3 Accept-all Equilibrium vs. Booking-limit Equilibrium. The Yellow Squares Represent the (average demand/capacity, standard deviation of market size) Pairs that Result in the

Accept-all Equilibrium, Whereas the blue/green Squares Represent the Pairs that Result in the Booking-limit Equilibrium.

Darker Blue Squares Represent Less Capacities being Overbooked; Squares that are Closer to Yellow in Color Represent Market Conditions Resulting in Larger Capacities being

Overbooked

[Color

figure

can

be

viewed

at

wileyonlinelibrary.com]

squares represent the cases with less fraction of capacity being overbooked, whereas the squares that are

closer to yellow in color represent booking limits that

allow more capacity to be overbooked.

From Figure 3 we confirm that the theoretical

results of Proposition 3 hold: for a fixed value of average market size, the accept-all equilibrium is optimal

when the standard deviation of the market size is

small and the booking-limit equilibrium is optimal

when the standard deviation of the market size is

large. Figure 3 also shows that for a fixed value of

market size standard deviation, the accept-all equilibrium is more profitable for smaller average market

size values and the booking-limit equilibrium is more

profitable for larger average market size values. From

the above two facts, one can see that the threshold

standard deviation of the market size below which

the accept-all equilibrium is optimal decreases as the

average market size increases. In other words, when

the demand is low and/or predictable, the firm

accepts all reservation requests, but when the demand

is high and/or variable, the firm uses a booking limit.

By the colors of Figure 3, one can also see that the fraction of capacity that is overbooked increases with

average demand but decreases with the standard

deviation of demand.

From the simulation results, we can also see how

the (average market size/capacity, standard deviation of the market size) pair affects the optimal

reservation pricing policy as shown in Figure 4.

Figure 4 shows how the fraction of the total payϕ

ment paid as the reservation deposit, ϕ þ

p, changes

as the market condition changes for the case where

both the customers’ denial cost c and the firm’s

bumping cost C are 100. In Figure 4, the x-axes represent the values of average demand over capacity

ranging from 0.8 to 2, and the y-axes represent the

standard deviation of the market size ranging from

0 to 100. In Figure 4a, the height of each bar repreϕ

sents the value of ϕ þ

p for each pair of (average

market size/capacity, standard deviation of market

size). The yellow bars represent the cases where the

firm only charges the reservation deposit with the

service price of zero; the shorter the bars are, the

smaller the fraction of the reservation deposit is in

the total payment. Figure 4b shows the same information as Figure 4a but color codes the proportion

of ϕ over the total payment on the two-dimensional

market condition space. Each square represents an

(average market size/capacity, standard deviation of

market size) pair. The yellow squares show the

market condition pairs that result in full prepayment as the optimal pricing policy. The darker blue

squares represent the market conditions where the

reservation deposits take smaller proportion of the

total payment; the fraction of the prepayment

becomes larger as the squares become closer to yellow in color. From Figure 4, we can confirm the

results of Propositions 4 and 5. For a fixed value of

market size standard deviation, the service price p

equals zero for small markets so that the payment

is purely made through the reservation deposit. As

the average market size grows, the firm charges

higher service price p, and the corresponding reservation deposit ϕ decreases. When the market size

becomes significantly large, reservation deposit

becomes negligible.

By looking at Figures 3 and 4b together, we can

infer how the overbooking policy and the reservation pricing policy interact as the market conditions

change. As it was discussed following Propositions

3 and 4, when the market size is deterministic, the

prices that maximize the profit can also regulate

customer traffic perfectly and ensure 100% service

level. However, as the market size variability

increases, finding the profit-maximizing prices

become a nontrivial task. In this case, optimal pricing policy alone becomes less competent in regulating customer traffic, and the firm needs a booking

limit to avoid customer bumping. When the market

size is highly variable, the actual market size can

turn out to be quite different from the expected

market size. Therefore, the firm should charge a

non-negligible service price even in the case with

small average market size keeping in mind that the

market realization can be large. Likewise, the firm

also has to charge a fair amount as the prepaid

19375956, 2022, 3, Downloaded from https://onlinelibrary.wiley.com/doi/10.1111/poms.13583 by Vrije Universiteit Amsterdam, Wiley Online Library on [07/03/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

936

Production and Operations Management 31(3), pp. 928–940, © 2021 Production and Operations Management Society

937

Figure 4 Fraction of ϕ over ϕ + p [Color figure can be viewed at wileyonlinelibrary.com]

ϕ

Notes: (a) The height of each bar represents the value of ϕ þ

p for each (average demand/capacity, standard deviation of market size) pair. (b) The yellow

squares represent the (mean demand/capacity, standard deviation of market size) pairs that result in fully prepaid reservations; the green/blue squares

represent the market condition pairs that result in partially prepaid reservations. The fraction of the prepayment becomes smaller as the squares become

darker blue in color.

19375956, 2022, 3, Downloaded from https://onlinelibrary.wiley.com/doi/10.1111/poms.13583 by Vrije Universiteit Amsterdam, Wiley Online Library on [07/03/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

Oh and Su: Optimal Pricing and Overbooking of Reservations

Oh and Su: Optimal Pricing and Overbooking of Reservations

Production and Operations Management 31(3), pp. 928–940, © 2021 Production and Operations Management Society

deposit even when the average market size is large

knowing that the market can turn out to be smaller

than expected. This can be seen from Figure 4b as

the area of green squares become wider when the

standard deviation of the market size grows. Note

also that the (mean market size/capacity, standard

deviation of market size) pairs that are lighter

green in Figure 4b are in darker blue in Figure 3.

This means that as it becomes a more challenging

task to set the profit-maximizing prices, the firm

tends to set more stringent booking limits to avoid

the risk of bumping the customers.

5. Extension: Free Cancelation

So far, we have studied how firms can set the optimal overbooking and pricing policies to deal with

the uncertainties the firm and the customers face

when reservations are made. We have studied how

a firm can deal with the market size uncertainty by

jointly utilizing the overbooking and the pricing

policies. We have also looked at how the firm can

resort to the pricing policies to manipulate the level

of customer valuation uncertainty at the point payment takes place. In this section, we consider an

extension of the base model where customers’ valuation uncertainties are resolved gradually over time.

Through this extension, we intend to better understand how the firm’s pricing decision and its profitability depend on the point of sales as the

customers’ level of knowledge on valuation changes

over time. This extension also serves as a robustness

check when richer customer choice dynamics are

introduced. In our basic model, once customers

book their reservations, their next decision was at

the time of service when they either show up or

not. However, during this interval, customers may

learn more about their valuations and some may

choose to cancel their reservations. This is a common occurrence, and it is useful to check the basic

results in this scenario.

The model is as what follows. In period 0, reservations are offered for free. In period 1, customers

realize their types i ∈ {h, l}, where h represents the

high type and l represents the low type. We assume

that there are αΛ high type customers in the market, whereas the remaining (1− α)Λ are low type.

Type-i customers have valuation for service ui ,

which is independent and identically distributed

across the type-i customers; the valuation follows

i ¼ 1 Fi . We

distribution Fi and density f i with F

assume that the high type customers’ valuation for

service uh has first-order stochastic dominance over

the low-type customers’ valuation ul so that for any

l ðxÞ. Upon observing their types in

h ðxÞ ≥ F

given x, F

period 1, customers decide whether they should

keep their reservations or not. Customers who cancel their reservations need not pay anything,

whereas those who decide to keep their reservations

pay the price of reservation ϕ as was the case in the

base model. In period 2, customers who have kept

their reservations decide if they show up or not. A

customer who shows up for her reservation and

receives the service pays a price p; a customer who

shows up but is denied a service incurs a cost c of

being bumped.

The firm then has two pricing strategies: (i) set

(ϕ, p) so that both high type and low type customers keep their reservations in period 1,

(ii) set (ϕ, p) so that only high type customers keep

their reservations. Note that a strategy where only

low type customers keeping their reservations is not

feasible. We now state the equilibrium outcome as

the following.

PROPOSITION 6.

In equilibrium, the followings are true.

1. When both types of customers keep reservations in

period 1, ðB , v , q Þ must take one of the following

two forms.

(i) (Accept-all equilibrium) B ¼ ∞, v ¼ p þ

1 q

μ

c q , q ¼ EΛ min

,

1

.

l h αΛF ðv Þþð1αÞΛF ðv Þ

(ii) (Booking-limit

μ

,

h ðp Þ þ ð1 αÞF

l ðp Þ

αF

equilibrium)

v ¼ p , q ¼ 1.

B ¼

2. When only high type customers keep reservations in

Step 1, ðB , v , q Þ must take one of the following

two forms.

(i) (Accept-all equilibrium) B ¼ ∞, v ¼ p þ

μ

c 1 q q , q ¼ EΛ min

,

1

.

h αΛF ðv Þ

(ii) (Booking-limit equilibrium) B ¼

q ¼ 1.

μ

,

h ðp Þ

αF

v ¼ p ,

From the above proposition, we show that there still

exist two types of equilibria regarding the overbooking policy when customers are granted an option to

cancel their reservations for free in advance.

A natural question that follows then is when it is

more profitable for the firm to set the prices (ϕ, p) so

that low type customers take advantage of free cancelation. To simplify the analyses and focus on interesting findings, we assume that the market size Λ is

deterministic for the rest of this section.

PROPOSITION 7.

such that

~ðΛÞ

For a fixed constant Λ, there exists α

~ðΛÞ, both types of customers keep their

1. when α < α

reservations in period 1, and

19375956, 2022, 3, Downloaded from https://onlinelibrary.wiley.com/doi/10.1111/poms.13583 by Vrije Universiteit Amsterdam, Wiley Online Library on [07/03/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

938

Production and Operations Management 31(3), pp. 928–940, © 2021 Production and Operations Management Society

1

R ¼ Λ, p ≥ ðFÞ

v ¼ p , q ¼ 1.

μ

Λ

, ϕ ¼

R∞

p

ðu p Þ f l ðuÞdu,

~ðΛÞ, only high type customers keep

2. when α ≥ α

their reservations in period 1, and

1 h Þ μ ,

If αΛ ≥ μ, then R ¼ αΛ, p ¼ ðF

Λ

R∞

ϕ ¼ p ðu p Þ f h ðuÞdu, v ¼ p , q ¼ 1.

R∞

If αΛ < μ, then R ¼ αΛ, p ¼ 0, ϕ ¼ p u f h ðuÞdu,

v ¼ 0, q ¼ 1.

Proposition 7(1) states that when the population of

high type customers is not large enough, the firm

should set the prices (ϕ, p) so that both types of customers keep their reservations. In this case, the prices

are set to extract the surplus of low type customers

while leaving positive surplus to high type customers.

Proposition 7(2) states that when there are enough

high type customers in the market, the firm should

just have high type customers keep their reservations

and low type customers cancel for free in period 1. By

forgoing the profit from low type customers, the firm

is able to charge prices (ϕ, p) so as to extract surplus

from the high type customers. Note that in both cases

of Proposition 7 we observe the pattern where the

firm depends less on prepayment ϕ and more on the

spot price p as the targeted market size grows.

Another question of interest is if granting customers free cancelation is good for the firm, which is

answered by the following proposition.

PROPOSITION 8. For a fixed market size Λ, the following

statements hold in equilibrium.

~ðΛÞ, offering free cancelation to customers

1. If α < α

decreases the firm’s profit.

~ðΛÞ, offering free cancelation to customers

2. If α ≥ α

increases the firm’s profit.

Proposition 8(1) states that when there are not

enough high type customers in the market and thus

the firm sets the price so that both high type and low

type customers keep their reservations in period 1,

then the firm is better off not giving the option of free

cancelation to the customers. This is because offering

free cancelation allows low type customers to pay the

price of reservation ϕ after they realize their types,

whereas not offering free cancelation forces low type

customers to pay the upfront reservation price when

they are uncertain of their types. When customers are

unsure of their types, they are willing to pay the reservation price based on their expected types; this price

charged based on expectation is higher than the reservation price that can be charged to low type customers

who are aware of their types. This shows that the result

of Shugan and Xie (2005) where selling goods in

939

advance while customers are uncertain of their valuation bring higher profit to the seller extends to our case

of two prices and two-stage realization of valuation.

Proposition 8(2) conversely shows that when there

are enough high type customers in the market and

thus the firm sets the prices so that only high type

customers keep their reservations, then the firm is

better off by offering free cancelation to customers.

This is because the firm now targets to sell reservations only to the high type customers with its

increased price.

Note that in Proposition 8(1) when offering free

cancelation decreases firm’s profit, nobody exercises

the option of free cancelation. On the other hand,

when some customers indeed cancel their reservations

for free, that is when offering free cancelation is more

profitable to the firm as shown in Proposition 8(2).

6. Conclusion

In this study, we study the optimal design of reservations. Our results provide two guiding principles for

optimal reservation policies.

• Principle 1: Reservations require a nonrefundable fee when booked and/or a service charge

when used; the former dominates in small

markets and the latter dominates in large markets.

• Principle 2: All reservation requests can be

accepted when demand is relatively low and/or

predictable, but a booking limit is required to

ensure that all reservations can be honored

when demand is large and/or highly variable.

These two principles characterize the optimal design

of reservation dependent on market condition defined

as a pair of mean and the standard deviation of market size.

The reasoning behind our principles can be outlined as follows. The first principle holds because

reservation holders consider prices when choosing

whether to show up for service. Firms facing low

demand should charge low service prices and high

reservation deposit since they can sell their capacities

at a higher price when customers make the payments

in advance without knowing their valuations for service. On the other hand, firms facing high demand do

not rely on the nonrefundable deposit because they

can charge high service prices: even when the service

price is high, there is sufficient demand to fully utilize

capacity. This logic brings us to the second principle.

When aggregate demand is publicly known, all reservations can be accepted because the fixed market of

customers respond to prices and show up in the

appropriate numbers. However, in unpredictable

markets, customers do not know the realized number

19375956, 2022, 3, Downloaded from https://onlinelibrary.wiley.com/doi/10.1111/poms.13583 by Vrije Universiteit Amsterdam, Wiley Online Library on [07/03/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

Oh and Su: Optimal Pricing and Overbooking of Reservations

Oh and Su: Optimal Pricing and Overbooking of Reservations

Production and Operations Management 31(3), pp. 928–940, © 2021 Production and Operations Management Society

of reservation requests and too many may show up;

in such cases, a booking limit helps ensure that not

too many reservations are given out so they can all be

fulfilled.

The current work can be extended in three broad

directions. First, we have not examined the role of

competition. When there are multiple firms, price

competition becomes an issue, and moreover, the possibility that customers may take reservations from

multiple firms complicates overbooking decisions.

Second, there may be information asymmetry in the

quality of firms (e.g., good vs. bad restaurants) and

the structure of reservation policies may be an important signaling device. Some progress in this direction

has been made by Yu et al. (2014) in the advance selling literature. Third, when reservations are transferrable, there is the issue of resale and speculation.

For example, restaurant reservations bought for $50

have been resold for up to $600 (McKinley 2011). It

would be interesting to understand the impact of secondary markets on reservations.

improve profits. IEEE Trans. Syst. Man. Cybern. Syst. Hum.

36(6): 1211–1219.

LaGanga, L. R., S. R. Lawrence. 2007. Clinic overbooking to

improve patient access and increase provider productivity.

Decis. Sci. 38(2): 251–276.

LaGanga, L. R., S. R. Lawrence. 2012. Appointment overbooking

in health care clinics to improve patient service and clinic

performance. Prod. Oper. Manag. 21(5): 874–888.

Lariviere, M. A., J. A. Van Mieghem. 2004. Strategically seeking

service: How competition can generate poisson arrivals.

Manuf. Serv. Oper. Manag. 6(1): 23–40.

Liu, N., S. Ziya. 2014. Panel size and overbooking decisions for

appointment-based services under patient no-shows. Prod.

Oper. Manag. 23(12): 2209–2223.

Liu, N., S. Ziya, V. G. Kulkarni. 2010. Dynamic scheduling of outpatient appointments under patient no-shows and cancellations. Manuf. Serv. Oper. Manag. 12(2): 347–364.

McCarthy, N. 2019. The U.S. Airlines Most Likely to Bump Passengers. New Jersey, Forbes, November 21.

McKinley, J. 2011. Bidding Frenzy for Tickets to Eat at Next in Chicago. New York, The New York Times, April 9.

Nasiry, J., I. Popescu. 2012. Advance selling when consumers

regret. Management Sci. 58(6): 1160–1177.

Akan, M., B. Ata, J. D. Dana. 2015. Revenue management by

sequential screening. J. Econ. Theory. 159: 728–774.

Oh, J., X. Su. 2018. Reservation policies in queues: Advance

deposits, spot prices, and capacity allocation. Prod. Oper.

Manag. 27(4): 680–695.

Osadchiy, N., G. Vulcano. 2010. Selling with binding reservations

in the presence of strategic consumers. Management Sci.

56(12): 2173–2190.

Alexandrov, A., M. A. Lariviere. 2012. Are reservations recommended? Manuf. Serv. Oper. Manag. 14(2): 218–230.

Png, I. P. 1989. Reservations: Customer insurance in the marketing of capacity. Market. Sci. 8(3): 248–264.

Bertsimas, D., R. Shioda. 2003. Restaurant revenue management.

Oper. Res. 51(3): 472–486.

Prasad, A., K. W. Stecke, X. Zhao. 2011. Advance selling by a

newsvendor retailer. Prod. Oper. Manag. 20(1): 129–142.

Cayirli, T., E. Veral. 2003. Outpatient scheduling in health care: A

review of literature. Prod. Oper. Manag. 12(4): 519–549.

Robinson, L. W., R. R. Chen. 2010. A comparison of traditional

and open-access policies for appointment scheduling. Manuf.

Serv. Oper. Manag. 12(2): 330–346.

References

Chen, Y., R. Levi, C. Shi. 2017. Revenue management of reusable

resources with advanced reservations. Prod. Oper. Manag.

26(5): 836–859.

Cil, E. B., M. A. Lariviere. 2013. Saving seats for strategic customers. Oper. Res. 61(6): 1321–1332.

Courty, P., H. Li. 2000. Sequential screening. Rev. Econ. Stud.

67(4): 697–717.

Dana, J. D. 1998. Advance-purchase discounts and price discrimination in competitive markets. J. Polit. Econ. 106(2): 395–422.

Shugan, S. M., J. Xie. 2005. Advance-selling as a competitive marketing tool. Int. J. Res. Market. 22(3): 351–373.

Wikipedia. 2021. Overselling. Available at https://en.wikipedia.

org/wiki/Overselling#Hotels (accessed date April 4, 2021).

Xie, J., S. M. Shugan. 2001. Electronic tickets, smart cards, and

online prepayments: When and how to advance sell. Market.

Sci. 20(3): 219–243.

DeGraba, P. 1995. Buying frenzies and seller-induced excess

demand. Rand J. Econ. 331–342.

Yu, M., H. S. Ahn, R. Kapuscinski. 2014. Rationing capacity in

advance selling to signal quality. Management Sci. 61: 560–

577.

DOT. 2020. Bumping & Oversales. Available at https://www.

transportation.gov/individuals/aviation-consumer-protection/

bumping-oversales (accessed date May 23, 2020).

Yu, M., R. Kapuscinski, H. S. Ahn. 2015. Advance selling: Effects

of interdependent consumer valuations and seller’s capacity.

Management Sci. 61: 2100–2117.

Elmaghraby, W., S. A. Lippman, C. S. Tang, R. Yin. 2009. Will

more purchasing options benefit customers? Prod. Oper.

Manag. 18(4): 381–401.

Zacharias, C., M. Pinedo. 2014. Appointment scheduling with noshows and overbooking. Prod. Oper. Manag. 23(5): 788–801.

Zeng, B., A. Turkcan, J. Lin, M. Lawley. 2010. Clinic scheduling

models with overbooking for patients with heterogeneous noshow probabilities. Ann. Oper. Res. 178(1): 121–144.

Gale, I. L., T. J. Holmes. 1993. Advance-purchase discounts and

monopoly allocation of capacity. Am. Econ. Rev. 135–146.

Gallego, G., Ö. Sahin. 2010. Revenue management with partially

refundable fares. Oper. Res. 58(4-part-1): 817–833.

Georgiadis, G., C. S. Tang. 2014. Optimal reservation policies and

market segmentation. Int. J. Prod. Econ. 154: 81–99.

Gupta, D., B. Denton. 2008. Appointment scheduling in health

care: Challenges and opportunities. IIE Trans. 40(9): 800–819.

Kim, S., R. E. Giachetti. 2006. A stochastic mathematical appointment overbooking model for healthcare providers to

Supporting Information

Additional supporting information may be found online

in the Supporting Information section at the end of the

article.

Appendix S1: Appendix.

19375956, 2022, 3, Downloaded from https://onlinelibrary.wiley.com/doi/10.1111/poms.13583 by Vrije Universiteit Amsterdam, Wiley Online Library on [07/03/2023]. See the Terms and Conditions (https://onlinelibrary.wiley.com/terms-and-conditions) on Wiley Online Library for rules of use; OA articles are governed by the applicable Creative Commons License

940