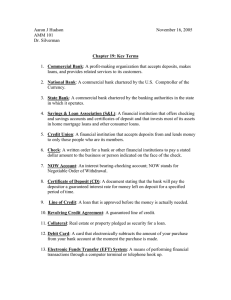

1 Федеральное государственное бюджетное образовательное учреждение высшего образования «РОССИЙСКАЯ АКАДЕМИЯ НАРОДНОГО ХОЗЯЙСТВА И ГОСУДАРСТВЕННОЙ СЛУЖБЫ при ПРЕЗИДЕНТЕ РОССИЙСКОЙ ФЕДЕРАЦИИ» СРЕДНЕРУССКИЙ ИНСТИТУТ УПРАВЛЕНИЯ - ФИЛИАЛ Рабочая тетрадь по дисциплине «Иностранный язык в профессиональной деятельности» (английский) по теме: «Основные виды банковских операций и услуг». Составитель: Т.Н. Головина Орел 2 2020 3 ОГЛАВЛЕНИЕ Как пользоваться рабочей тетрадью 3 Unit 1. Basic Banking Services 4 Unit 2. Types of Banks. 8 Unit 3. Bank Deposits 12 Unit 4.How Deposits Are Made 16 Unit 5. Bank Loans 20 Приложение 26 Лексический минимум 32 Библиографический список 34 4 Как пользоваться рабочей тетрадью Рабочая тетрадь по курсу «Иностранный язык» подготовлена в помощь преподавателям английского языка и студентам очной формы обучения в качестве пособия для изучения данного материала и для самостоятельной внеаудиторной работы. Текстовый материал, размещенный в пособии, взят из оригинальных источников. Степень трудности текстов различна и поэтому, в зависимости от уровня подготовки студентов, рабочую тетрадь можно рекомендовать, как для системной, так и для выборочной работы по одной из предложенных тем. На текстах пособия можно практиковать основные виды чтения: просмотровое, ознакомительное, изучающее. Их можно аннотировать и реферировать. В содержание рабочей тетради входят также комплексы лексико-грамматических упражнений к текстам. Упражнения и задания рабочей тетради предназначены для самостоятельной работы студентов, которая ориентирована на формирование и закрепление знаний и умений чтения, понимания и перевода (в зависимости от уровня подготовки - со словарём или без него) текстов профессиональной направленности и нацелены на закрепление лексикограмматического материала и развитие речевых навыков. Тексты и задания к ним позволяют улучшить владение английским языком и в то же время окажут помощь преподавателю и студенту в расширении и систематизации знаний о банковских продуктах и услугах за рубежом и пополнят запас профессиональной лексики по данной теме. Предполагается, что в результате работы по данному пособию студенты овладеют минимальным объемом грамматического и лексического материала по вышеназванной теме, что подготовит их к работе с документами и сформирует навыки ознакомительного и изучающего чтения и перевода специальных текстов и банковской документации. Отдельные задания рабочей тетради могут быть предложены преподавателем для выполнения под его руководством в ходе аудиторной работы или как домашние задания. Приступая к работе с тетрадью, следует ознакомиться с источниками, рекомендованными в библиографическом списке. Рекомендуется последовательное выполнение заданий, поскольку они связаны логикой освоения учебного материала. Для самостоятельного контроля изученного материала в рабочей тетради предлагается тест. Лексический минимум, содержащийся в рабочей тетради, дополняет лексику данного методического пособия. В рабочей тетради предусмотрено место для записи ответов. 5 UNIT 1. BASIC BANKING SERVICES Exercise 1. Прочитайте и переведите текст устно со словарем. Banks may be defined as firms producing and selling financial services. Their success or failure hinges on their ability to identify the financial services the public demands, produce those services efficiently and sell them at a competitive price. In a dynamic sense a bank is a “pool of funds” that is constantly changing as new funds flow in and out of the bank. Taking deposits, collecting and paying checks, and making loans are basic services offered by banks. As the bank receives new deposits or existing depositors increase the holdings in their accounts, management employs these funds in assets that will contribute earnings to the bank. Thus, the deposit function of banks plays an important role in the economy and extending credit is the major source of bank income. Bank investments contribute to the overall credit function by putting deposited funds to work. Full-service banking in the 2000s has a different meaning than it had just a few short years ago. In the past, the bank was considered to be offering full banking services if it offered checking accounts, savings accounts, certificates of deposit (CDs), and a number of types of loans. These basic banking services are still vital to the banking industry, but they no longer meet the definition of a full- service bank. Customers’ demands have changed considerably. Now customers expect a full-service bank to hold government securities, and to offer a wide range of financial services, including not only the basic ones but financial and estate planning, brokerage, trust services, and various forms of insurance as well. The bank must offer various specialized services not only to remain competitive, but to survive. If the bank does not meet customer’s total financial needs, customers will move their business to an institution that does. Exercise 2. Ответьте на вопросы к тексту “Basic Banking Services». Запишите ответы. 1. 2. 3. 4. 5. 6. 7. 8. Why a bank is often called «a pool of funds»? What are the bank’s basic services? What is the major source of bank income? How do bank investments contribute to the overall credit function? What meaning did full- service banking have in the past? Why do basic banking services no longer meet the definition of a full- service bank? What will happen if the bank doesn’t meet customer’s needs? What does the success or failure of banks depend on? _________________________________________________________________________________ _________________________________________________________________________________ _________________________________________________________________________________ _________________________________________________________________________________ _________________________________________________________________________________ _________________________________________________________________________________ _________________________________________________________________________________ _________________________________________________________________________________ _________________________________________________________________________________ _________________________________________________________________________________ _________________________________________________________________________________ _________________________________________________________________________________ 6 _________________________________________________________________________________ _________________________________________________________________________________ _________________________________________________________________________________ ________________________________________________________________________________ Exercise 3. Переведите словосочетания на русский язык и запишите их. резервуар средств - ……………………………………………………………………………….., основные банковские услуги - …………………………………..……………………………… , основной источник средств - ............………………………………………………………….. .., полный комплекс банковских услуг - ………………………………………………………….…, чековый счет - ……………………………………………………………………………………..., сберегательный счет - ……………………………………………………………………………. , депозитный сертификат - ………………………………………………………………………… , государственные ценные бумаги - ……………………………………………………………….. , брокерские операции - …………………………………………………………………………….. , страхование - ……………………………………………………………………………………… , конкурентоспособный - …………………………………………………………………………… , удовлетворять потребности клиента - …………………………………………………………... . Exercise 4. Составьте предложения, запишите и устно переведите их. 1. A bank is a pool of funds ... 2. 3. 4. 5. A. - is constantly changing because of internal and external factors. Customers demands ... B. - to offer a wide range of specialized services. The banking industry ... C. - that is constantly changing as new funds flow in and out of the banks. New customers expect a full- service bank D. - it will not survive. ... If the bank does not meet customer’s E. - have changed considerably. financial needs ... ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________ 7 Exercise 5. Прочитайте текст рекламного буклета и заполните пропуски в тексте словами по смыслу. Ответьте письменно на следующие вопросы: 1. What alternatives do you have in investing or saving your money? 2. Why do people open bank accounts? ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ _________________________________________________________________ costs, reasons, account, money, buy, spend, products, expensive, cash, invest Here is an extract from a brochure which Barclays bank gives its customers to convince them in importance of keeping their money with a bank: You have many choices concerning what you do with your . . . . (1) - spend it, invest it, or hide it under your mattress. If you . . . . . (2) or save your money, you have many alternatives. For example, you can . . . . . (3) U.S. savings bonds or Treasury bills, purchase stocks or bonds; invest in a mutual fund1; or open a savings or other deposit . . . . . (4) with a bank, savings bank or credit union. Opening account is like buying a car. Many . . . . . (5) are available - some plain, some fancy, and some less and some more expensive than others. Because features of accounts and . . . . . (6), it is important to shop around to make sure the account you choose is the best one for you. There are many . . . . . (7) for opening a bank account. First, an account may help you save money. Second, an account may be a less . . . . . (8) way to manage your money than other alternatives. Third, having your money in an account is safer than holding . . . . . (9). Finally, keeping track of your money and how you . . . . . (10) it may be easier. 1_____________________________ 2_____________________________ 3_____________________________ 4_____________________________ 5_____________________________ 6_____________________________ 7_____________________________ 8_____________________________ 9_____________________________ 10____________________________ Exercise 6. Установите правильный порядок слов в предложениях, запишите и устно переведите их. 1. What / may / banks / defined / be / as /? mutual fund - a company without fixed capital that sells its own shares and uses the pooled capital of its shareholders 8 2. What / their / or / failure / hinge / does / success / on /? 3. Why / deposit function / play / does /the/ an important role / in the economy /? 4. How / contribute / bank investments / do / the overall credit function / to /? 5. Why / offer / services / the bank / must / various / specialized /? _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ Exercise 7. Составьте предложения со следующими словосочетаниями и запишите их: a pool of funds ________________________________________________________________________________ ____________________________________________________________________ basic services ________________________________________________________________________________ ____________________________________________________________________ а source of bank income ________________________________________________________________________________ ____________________________________________________________________ a wide range of financial services ________________________________________________________________________________ ____________________________________________________________________ 9 UNIT 2. TYPES OF BANKS Exercise 1 . Прочитайте и устно переведите тексты 1-5. Подберите заголовок к каждому из них. 1. ______________________ Commercial or retail banks are businesses that trade in money. They receive and hold deposits, pay money according to customers' instructions, lend money, offer investment advice, exchange foreign currencies, and so on. They make a profit from the difference (known as a spread or a margin) between the interest rates they pay to lenders or depositors and those they charge to borrowers. Banks also create credit, because the money they lend, from their deposits, is generally spent (either on goods or services, or to settle debts), and in this way transferred to another bank account - often by way of a bank transfer or a cheque (check) rather than the use of notes or coins - from where it can be lent to another borrower, and so on. When lending money, bankers have to find a balance between yield and risk, and between liquidity and different maturities. 2. _________________________ Merchant banks in Britain raise funds for industry on the various financial markets, finance international trade, issue and underwrite securities, deal with takeovers and mergers, and issue government bonds. They also generally offer stock broking and portfolio management services to rich corporate and individual clients. Investment banks in the USA are similar, but they can only act as intermediaries offering advisory services, and do not offer loans themselves. Investment banks make their profits from the fees and commissions they charge for their services. 3. __________________________ In the USA, the Glass-Steagall Act (Закон Гласса - Стиголла) of 1934 enforced a strict separation between commercial banks and investment banks or stock broking firms. Yet the distinction between commercial and investment banking has become less clear in recent years. Deregulation in the USA and Britain is leading to the creation of “financial supermarkets”: conglomerates combining the services previously offered by banks, stockbrokers, insurance companies, and so on. In some European countries (notably Germany, Austria and Switzerland) there have always been universal banks combining deposit and loan banking with share and bond dealing and investment services. 4. __________________________ A country's minimum interest rate is usually fixed by the central bank. This is the discount rate, at which the central bank makes secured loans to commercial banks. Banks lend to blue chip borrowers (very safe large companies) at the base rate or the prime rate; all other borrowers pay more, depending on their credit standing (or credit rating, or creditworthiness): the lender's estimation of their present and future solvency. Borrowers can usually get a lower interest rate if the loan is secured or guaranteed by some kind of asset, known as collateral. 5. __________________________ In most financial centers, there are also branches of lots of foreign banks, largely doing Eurocurrency business. A Eurocurrency is any currency held outside its country of origin. The first significant Eurocurrency market was for US dollars in Europe, but the name is now used for foreign currencies held anywhere in the world (e.g. yen in the US, DM in Japan). Since the US$ is the world's most important trading currency - and because the US has for many years had a huge trade deficit - there is a market of many billions of Eurodollars, including the oil-exporting countries' 'petrodollars'. Although a central bank can determine the minimum lending rate for its national 10 currency it has no control over foreign currencies. Furthermore, banks are not obliged to deposit any of their Eurocurrency assets at 0% interest with the central bank, which means that they can usually offer better rates to borrowers and depositors than in the home country. Exercise 2 . Определите, который из трех отрывков наиболее точно и полно передает содержание текста. Чего недостает в оставшихся двух? First summary: Commercial banks hold customers' deposits and make loans. Investment banks raise funds for industry. Deregulation in Britain and the US is leading to the creation of financial conglomerates similar to the universal banks that have always existed in German-speaking countries. A country's minimum interest rate is usually fixed; banks charge progressively higher rates to less secure borrowers. Many banks also do Eurocurrency business - lending foreign currencies, notably dollars, at lower rates than in the currencies' home countries. Second summary: Commercial banks receive deposits and make loans. Merchant and investment banks arrange security issues and offer other investment services. Yet the traditional distinction between commercial and investment banks is now breaking down. Domestic interest rates are fixed by central banks. Many banks also have branches abroad that do Eurocurrency business, making loans in other European currencies. Third summary: Commercial banks receive deposits, lend money, and provide other services. Merchant and investment banks lend money to industry. British and American banks are now joining together in conglomerates. The interest rates that banks charge depend on the borrowers' creditworthiness. European banks also do a lot of Eurodollar and petrodollar business. Exercise 3 . Найдите в тексте слова и выражения, по смыслу соответствующие следующим и запишите их. 1. 2. 3. 4. to place money in a bank; or money placed in a bank the money used in countries other than one's own how much money a loan pays, expressed as a percentage available cash, and how easily other assets can be turned into cash 5. the date when a loan becomes repayable 6. to guarantee to buy all the new shares that a company issues, if they cannot be sold to the public 7. when a company buys or acquires another one 8. when a company combines with another one 9. buying and selling stocks or shares for clients 10. taking care of all a client's investments 11. the ending or relaxing of legal restrictions 12. a group of companies, operating in different fields, that have joined together 13. a company considered to be without risk 14. ability to pay liabilities when they become due 15. anything that acts as a security or a guarantee for a loan Exercise 4 . 11 Составьте из предложенных глаголов словосочетания с существительными (e.g. to lend money, to finance international trade), запишите и переведите их. charge _____________________________________________________________________ do _________________________________________________________________________ exchange ___________________________________________________________________ issue _______________________________________________________________________ make ______________________________________________________________________ offer _______________________________________________________________________ pay ________________________________________________________________________ receive _____________________________________________________________________ settle _____________________________________________________________________ raise ____________________________________________________________________ fix __________________________________________________________________ security ____________________________________________________________________ interest _____________________________________________________________________ lend ______________________________________________________________________ universal _____________________________________________________________________ Exercise 5 . Установите соответствие. 1. cash card A. an arrangement by which a customer can withdraw more from a bank account than has been deposited in it, up to an agreed limit; interest on the debt is calculated daily B. a card which guarantees payment for goods and services purchased by the cardholder, who pays back the bank or finance company at a later date C. a computerized machine that allows bank customers to withdraw money, check their balance, and so on D. a fixed sum of money on which interest is paid, lent for a fixed period, and usually for a specific purpose E. an instruction to a bank to pay fixed sums of money to certain people or organizations at stated times F. a loan, usually to buy property, which serves as a security for the loan G. a plastic card issued to bank customers for use in cash dispensers H. doing banking transactions by telephone or from one's own personal computer, linked to the bank via a network I. one that generally pays little or no interest, but allows the holder to withdraw his or her cash without any restrictions J. one that pays interest, but usually cannot be used for paying cheques (GB) or checks (US), and on which notice is often required to withdraw money 2. cash dispenser 3. credit card 4. home banking 5. loan 6. mortgage 7. overdraft 8. standing order 9. current account (GB) or checking account (US) 10. deposit account (GB) or time account (US) 1 Exercise 6. 2 3 4 5 6 7 8 9 10 12 Определите, каким видам банков принадлежат предложения, опубликованные на веб-сайтах этих банков. 1. The Federal Reserve was founded by Congress in 1913 to provide the nation with a safer, more flexible, and more stable monetary and financial system. ______________________________________________________________________________ 2. We provide a full range of products and services, including advising on corporate strategy and structure, and raising capital in equity and debt markets. _____________________________________________________________________________ 3. Nearly twelve million cheques and credits pass through the system each working day. Cheque volumes reached a peak in 1990 but usage has fallen since then, mainly owing to increased use of plastic cards and direct debits by personal customers. _____________________________________________________________________________ 4. Why bank with us? Because we offer: - a comprehensive range of accounts and services - over 1,600 branches, many with Saturday opening - free withdrawals from over 31,000 cash machines - online and telephone banking for round-the-clock access to your accounts ______________________________________________________________________________ 13 UNIT 3. BANK DEPOSITS Exercise 1. Прочитайте и переведите текст устно со словарем. Commercial banks deposits are characterized in several ways. The traditional categories of deposits are demand deposits, savings and time deposits. Certain accounts, such as demand deposits are transaction accounts and may be withdrawn by check, telephone transfer, automated teller machines, and other electronic devices. Non-transaction accounts include savings and time deposits. Depository institutions may offer a great variety of accounts, but they generally fall within one of these three types: A) Checking Accounts With a checking account you use checks to withdraw money from your account. Thus you have quick, convenient - and, if needed, frequent - access to your money. Typically, you can make deposits into the account as often as you choose. Many institutions will enable you to withdraw or deposit funds at an Automated Teller Machine (ATM) or to pay for purchases at stores with your ATM card. Institutions may impose fees on checking accounts. Fees vary among institutions. Some institutions charge a maintenance or flat monthly fee regardless of the balance in your account. Other institutions charge a monthly fee if the minimum balance in your account drops below a certain amount. Some charge a fee for every transaction, such as for each check you write or for each withdrawal you make at an ATM. Many institutions impose a combination of these fees. B) Savings Accounts With savings accounts you can make withdrawals, but you can not use checks to do so. The number of withdrawals or transfers you can make on the account each month is limited. Many institutions offer more than one type of a savings account - for example, passbook savings and statement savings. With a passbook savings account you receive a record book in which your deposits and withdrawals are entered to keep track of transactions on your account; this record book must be presented when you make deposits and withdrawals. With a statement savings account, the institution regularly mails you a statement that shows your withdrawals and deposits for the account. C) Time Deposits (Certificates of Deposit) Time deposits are often called certificates of deposit, or CDs. They usually offer a guaranteed rate of interest for a specified term, such as one year. Institutions offer CDs that allow you to choose the length of time, or term, that your money is on deposit. Terms can range from several days to several years. Once you have chosen the term you want, the institution will generally require that you keep your money in the account until the term ends, that is, until maturity. Some institutions will allow you to withdraw the interest you earn but you may not be permitted to take out any of your initial deposit. Because you agree to leave your funds for a specified period, the institution may pay you a higher rate of interest than it would for a savings or other account. Typically, the longer the term, the higher the annual percentage yield. Sometimes an institution allows you to withdraw your principal funds before maturity, but a penalty is frequently charged. Exercise 2. Ответьте на вопросы к тексту “Bank Deposits». Запишите ответы. 1. 2. 3. 4. 5. 6. What are the traditional categories of deposits? What kinds of deposits may be withdrawn by check or electronic devices? Name transaction and non-transaction accounts. What are the three major types of accounts? What kinds of accounts allow you to use checks? Are fees imposed by institutions on checking accounts uniform or not? 14 7. What kinds of fees do you know? 8. Which account pays a higher rate of interest – a checking account, a savings account or a time deposit? 9. What kinds of a savings account do many institutions offer? How do they differ? 10. What is the major requirement to time deposits? 11. What happens if you withdraw funds before maturity? ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ _______________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ _______________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ Exercise 3. Переведите словосочетания на русский язык и запишите их. депозит до востребования - …………………………………………………………………… , сберегательный депозит- ……………………………………………………………………… , срочный депозит- ……………………………………………………………………………… , автоматический кассовый аппарат- ……………………………………………………………, снимать деньги со счета- …………………………………………….........................................., оплатить покупку- ………………………………………………………………………………, взимать комиссионные - ………………………………………………………………………. , ежемесячная плата за ведение счета - …………………………………………………………, процентная ставка - ……………………………………………………………………………., комиссия за минимальный остаток по счету - ……………………………………………….., основная сумма вклада - ………………………………………………………………………., срок выплаты вклада - …………………………………………………………………………., 15 Exercise 4. Поставьте вопросы к предложениям и запишите их. 1. The traditional categories of deposits are demand deposits, savings deposits and time deposits. . . . . . . . …………………………………………………………………………………….? 2. Transaction accounts may be withdrawn by check, telephone transfer, automated teller machines and other electronic devices. . …………………………………………………………………………………………….? 3. Time deposits are often called certificates of deposit. . . . . . .……………………………………………………………………………………. ? 4. Fees vary among institutions. …………………………………………………………………………………………… ? Exercise 5. Выберите правильную форму глагола- сказуемого. Устно переведите предложения. 1. The banking industry is changing has changed 2. Deposit function of banks plays is playing 3. Many institutions will enable will be enabled 4. CDs allow you to choose the term that your money 5. Often CDs renew renews constantly. an important role in the economy. you to withdraw or deposit funds at an ATM. are on deposit. is automatically. Exercise 6. Найдите в тексте слова или словосочетания, объясняющие следующие предложения и запишите их. 1. Account money held under one’s name in a bank. ____________________________________________________ 2. An account from which money сan be withdrawn, used for day- to- day receipts and payments. _____________________________________________________ 3. An account on which a bank pays a slightly higher rate of interest and which can be withdrawn on demand but due notice must be given before taking out larger sums. _______________________________________________________ 4. A record of deposits, withdrawals and interest paid into a savings account. ______________________________________________________________ 5. The price of borrowing money. ______________________________________________________________ 6. A sum of money to be paid as a punishment by the party who is guilty for breaking the contract. _________________________________________________ 7. A special form of time deposit when a depositor agrees to leave a stated sum of money with a bank for a fixed period. __________________________________________________ 8. Debit from an account. ___________________________________________________ 9. Anything that is generally accepted in payment for goods and services. ____________________________________________________ 16 10. A written order by an account holder to his bank to pay money to a named person. _______________________________________________________ Exercise 7. Письменно переведите текст на русский язык. Наиболее крупным и важным источником средств для банка являются депозиты. В традиционную категорию депозитов входят депозиты до востребования, сберегательные депозиты и срочные депозиты. Некоторые счета, такие как депозиты до востребования являются транзакционными счетами (transaction accounts), изъятия (withdrawals) с которых могут производиться чеком, по телефону, с помощью банкомата и других электронных средств (devices). Нетранзакционные счета включают в себя сберегательные счета и срочные счета, хотя со сберегательных счетов можно изымать средства без предварительного уведомления (without notice). Розничные счета (счета физических лиц) и оптовые счета (счета предприятий) включают в себя депозиты до востребования, сберегательные и срочные депозиты. ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ 17 UNIT 4. HOW DEPOSITS ARE MADE Exercise 1. Прочитайте и переведите текст устно со словарем. Customers make deposits in a number of different ways. By far the most popular is in person, in a branch bank, at a teller’s window. Tellers are responsible for accepting and transmitting deposits, accepting withdrawals, cashing checks, issuing traveler’s checks, and processing other items. Some customers feel better about making the deposit in person to make sure the bank received it and to obtain a receipt providing that the deposit was made. Banks try to make tellers available to customers by constructing branches in convenient locations and installing drive- in- windows for convenience. Customers may also make deposits at automated teller machines (ATMs). Automated teller machines have been introduced to reduce access to tellers for routine transactions. The ATM, however, does more by extending banking hours to 24 hours and expanding the bank’s service area. With ATMs, the customer can obtain cash from checking and other transaction accounts, obtain credit card cash advances, effect transfers between transaction accounts and credit cards, make deposits, and obtain account balance information. ATMs may be accessed by bank debit cards or credit cards. Location of ATMs includes placement in lobbies, in kiosks near the bank or in shopping centres, and in other locations with high visibility for foot or automatic transport. Another use for an ATM card is through a point-of-sale-terminal (POS). A POS terminal is a card reading computer device connected to a cash register. It moves money electronically from the customer’s account to the merchant’s account. Customers may also make deposits to accounts by requesting the bank to transfer funds from one account to another. Many banks offer telephone transfer services, whereby the customer can transfer funds between accounts at the same bank by telephone. Customers may also wire funds from their bank to another bank. Exercise 2. Ответьте на вопросы к тексту “How Deposits Are Made». Запишите ответы. 1. In what ways can customers make deposits? 2. What is the most popular way of making deposits and why? 3. How do banks try to make tellers available? 4. What kinds of transactions can the customer perform with ATMs? 5. Why were automated teller machines introduced? 6. Where are ATMs typically located? 7. How can ATMs be accessed? 8. What is a POS terminal? ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ 18 ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ Exercise 3. Прочитайте текст рекламного буклета и заполните пропуски в тексте словами по смыслу. Ответьте письменно на следующие вопросы: 1. When can a customer use the Barclaybank network? 2. What does «PIN» stand for? 3. How does a cash dispenser work? 4. What if a person loses his/her card or forgets his/her «PIN»? 5. Why are cards sometimes retained by cash dispensers? ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ access, dispensers, card, bank statement, network, PIN, transaction, advice, application Many customers see cash dispensers as a welcome alternative to making withdrawals at the counter. Here is an extract from a brochure which Barclays bank gives its current account holders to explain how their machines work: Barclays Cash Dispensers Quick and easy access to your account Barclays cash dispensers form part of a . . . . (1) of over 5,200 machines in the UK, enabling you to withdraw cash from any cash dispensers belonging to Barclaybank network. Our cash . . . . . . (2) are operational night and day. We are continuing to expand this network by installing cash dispensers in places which are most convenient for you; for example, supermarkets, motorway, service station, hotels, hospitals, company premises and airports. If you would like to access our current account through the cash dispensers, complete 19 the application and take or post it to your branch. Once your . . . . . . (3) is approved you should receive your card within 14 days. Having successfully applied for a . . . . . (4), you will be given your Personal Identification Number (PIN). No one else can . . . . . . . (5) to your account, as your PIN is known only to you and the Bank’s central computing system. Your PIN is exclusively for your own use and must never be disclosed to anyone else. All Barclays dispensers are quick and easy to use. So simple that it rarely takes more than a minute to complete your . . . . (6). Once you’ve put your card in, the machine gives you a step- by- step instructions how to use it. The machine then returns your card, ready to use again whenever you need it. You can request an . . . . . . . (7) slip which records the date, the location and the amount of cash you have withdrawn. You can double- check this information on your . . . . . . (8). If you lose your card or have forgotten your . . . . (9), just contact your branch. Usage of this card will be stopped immediately. The Bank will instruct the computer system to remind you of your PIN or issue you with a new one. Please note that cards are occasionally retained by cash dispensers for one of the following reasons: they are out of date an incorrect PIN has been punched three consecutive times the Bank has been informed that the card is lost or stolen 1_____________________________ 2_____________________________ 3_____________________________ 4_____________________________ 5_____________________________ 6_____________________________ 7_____________________________ 8_____________________________ 9_____________________________ Exercise 4. Прочитайте и устно переведите предложения. Установите, какие из них относятся к недостаткам, а какие - к преимуществам банкоматов. Automated Teller Machines Advantages 1. 2. 3. 4. 5. 6. Disadvantages You can get cash at any time of day and night virtually anywhere in the country. Protection against theft or loss (you alone know your secret PIN ). In case you forget the exact procedure the machine gives you instructions. ATMs reduce access to tellers for routine transactions. It may happen that ATMs are out of service when you need money. ATMs are normally placed in convenient locations. 20 7. ATMs are expensive. 8. ATMs have expanded the banks’ service area. 9. With ATMs the customer can obtain various kinds of services. 10. ATMs provide a safe, convenient and prompt way to make deposits and withdraw cash. Exercise 5. Письменно переведите текст на английский язык и запишите его Банкоматы – это многофункциональные автоматы. Первые банкоматы появились в конце 1960х. Большинство первых автоматов выдавало лишь небольшие суммы наличных денег. В конце 1960х – начале 70-х клиенты имели большие трудности из-за поломки кассовых автоматов. В результате большинство клиентов банков предпочитали выполнять свои операции традиционным способом, непосредственно в банке, лично, у окошка кассира. Первые банкоматы в России были установлены в 1989г. Госбанком СССР и Сбербанком СССР. После реорганизации банковской системы в России в начале 90х в Москве были установлены первые международные банкоматы. Использование банкоматов для выполнения обычных банковских операций дает возможность банковским кассирам уделять больше внимания специализированным продуктам и услугам и расширяет временные рамки, в которые клиент может совершать банковские операции (banking hours) до 24 часов в сутки. _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ _____________________________________________________________________________ 21 UNIT 5. BANK LOANS Exercise 1. Прочитайте и переведите текст устно со словарем. Borrowing money from the bank is called a bank loan. People usually borrow money to buy something they need now - paying back the loan (plus interest) over the set period of time. To get a bank loan you will need to fill out a loan application. The bank will check the information on your application to be sure you are a good credit risk. A good credit risk means that you make enough money to pay back the loan. It also means you have paid your bills on time. The bank will charge interest on the loan. Interest is the cost of using the bank’s money. Interest is a percentage of the total loan. You will pay back the amount of the loan plus the amount of interest. You must pay back the loan and interest by a certain day each month. Commercial banks have assumed the role of financial intermediary, accepting deposits and putting them to profitable use. However, as changing market and economic conditions create new customer needs and increase competition in the financial services industry, banks have broadened their loan products and introduced many new types of loans. Banks provide many different types of loan «packages» to a wide variety of customers - to suit all kinds of needs. The most regularly used types of loans provided by banks are : An overdraft A personal loan A mortgage. An overdraft facility means that your bank agrees to let you make payments out of your personal account up to an agreed limit even if you do not have the money in your account. The overdraft is by far the cheapest form of borrowing, but it can only be obtained if the bank manager considers the customer to be creditworthy. A personal loan is the sort of borrowing you would think about when you have decided on a fairly expensive purchase and want to spread the cost over one or two or perhaps up to five years. The bank loans you a fixed amount of money for an agreed period of time, at a fixed rate of interest - to be repaid in a fixed monthly installments. A mortgage is a special type of loan taken out to buy a property. This could be a house, a flat, a bungalow etc. It is provided by banks, building societies and other financial institutions. All mortgages are for a fixed term and the loan has to be repaid with interest. Each loan will have different interest rates and rules. Ask questions about the loan. If possible, check with other banks before you decide to take a bank loan. These questions might help you: • How much income do I need to get the loan? • How much interest will I have to pay? • What will my monthly payment be? • How much is the late fee? Sometimes the bank will not give a loan. If the bank does not agree to a loan, you might get a loan with a cosigner. A cosigner agrees to pay back the amount of your loan if you can not make the payments. Before loaning you money, creditors look for an ability to repay debt and a willingness to do so and sometimes for a little extra security or collateral, such as a savings account, certificate of deposit, or another asset to protect their loans. They speak of the five Cs of credit: capacity, collateral, character, capital and credit history. Capacity. Can you repay the debt? Creditors ask for employment information, i.e. your occupation, how long you’ve worked, how much you earn. They also want to know your expenses, how many dependents you have, or whether you pay alimony or child support. Character. Will you repay the debt? They look for signs of personal stability and financial 22 responsibility, i.e. how long you’ve lived at your present address, whether you own or rent and whether you are protected with enough life insurance. Collateral and Capital. Is the creditor fully protected if you fail to repay? Creditors want to know what you may have that could be used to secure your loan (your collateral), and what sources you have for repaying debt other than income, such as savings, investments, or property (your capital). Credit History. Lenders want to know you’ve been a good credit risk in the past. Creditors will look at your credit history, how much you owe, how often you borrow, whether you pay bills on time, and whether you live within your means. Exercise 2. Ответьте на вопросы к тексту “Loans». Запишите ответы. 1. Why do people borrow money? 2. Why have the banks broadened their loan products? 3. Name the most regularly used types of loans. 4. What is a mortgage? 5. When can the overdraft be obtained? 6. Why does someone need a personal loan? 7. What do creditors look for before loaning you money? 8. Comment on the five Cs of the credit. ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ Exercise 3. Переведите словосочетания на русский язык и запишите их. financial intermediary - ………………………………………………… . . . . . . .. , 23 to accept deposits - . . . . …………………………………………………………. ., profitable use - . . . . . . . ……………………………………………………………, mortgage - …………………………………………………………………………, to repay debt - ……………………………………………………………………. , employment information - ………………………………………………………. ., expenses - ………………………………………………………………………… , dependents - ……………………………………………………………………… , financial responsibility - ………………………………………………………….. , to secure a loan - …………………………………………………………………. ., collateral - . . . . . . …………………………………………………………………., to live within smb’s means- ………………………………………………………. , installments - ………………………………………………………………………. , to overdraw an account - ………………………………………………………….., creditworthy - ……………………………………………………………………… , interest on loan - …………………………………………………………………… , Exercise 4. Совместите термины с их определением и устно переведите их. Term 1. Loan 2. Credit card 3. Collateral 4. Credit 5. Maturity 6. Mortgage 7. Investment 8. Lender 9. Overdraft 10. Installment Definition A. Provision of funds to customers by means of loans, overdraft facilities, etc. B. Date on which a loan or a deposit is due to be repaid. C. A form of consumer credit, being a card issued by a bank or other finance organization which allows the customer to get credit at most shops, restaurants, garages, hotels, etc. D. The act of investing, of using money to obtain income or profit. E. Smth. lent, esp. money, on condition that interest will be paid at an agreed rate and that the amount lent will be repaid at an agreed time or in agreed manner. F. A security given for the repayment of a loan. G. An agreed sum of money which by arrangement a bank allows a customer to overdraw his account. H. A contract by which the owner of land borrows money, giving the lender an interest in the land as security for the loan. I. One of a series of regular payments, made under an agreement, in order to settle a debt, esp. to buy an asset. J. Individual or a firm that extends money to a borrower with the expectation of being repaid, usually with interest. 1_____________________________ 2_____________________________ 3_____________________________ 4_____________________________ 5_____________________________ 6_____________________________ 7_____________________________ 8_____________________________ 9_____________________________ 10____________________________ 24 Exercise 5. Прочитайте текст рекламного буклета и заполните пропуски в тексте словами по смыслу. Ответьте письменно на следующие вопросы: 1. What kind or goods for your home can you buy with Barclayloan ? 2. What rules should you follow when you borrow ? ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ __________________________________________________________________ repay , mortgage, buy, home, property, price, lender, credit, borrow, package Here is an extract from a brochure which Barclays bank gives its customers to explain what kinds of loans they can get: Buying your first home is an exciting experience. There are so many properties to choose from and nearly as many ways to buy them. When it comes to choosing your . . . . . (1) it can all be confusing without the help of an expert like Barclays. For example, we can offer a special . . . (2) to First Time Buyers including a facility to borrow up to 95% of the property purchase. . . . (3) . Having moved in, you need to turn your house into a home. A Barclayloan could help you to . . . . . (4) the carpets, sofa or washing machine you need, and a Barclays Personal Overdraft could help purchase lower cost items such as wallpaper, or materials to carry out repairs. Even if you’ve done it all before and are moving on to a bigger and better . . . . . (5) you could benefit from Barclays mortgage. If you need more room for your family, but don’t want to move your house, remortgaging your existing . . . . . ( 6 ) could help finance an extension or perhaps a garage or even a conservatory. Please note: Barclays is a responsible . . . . . (7) and when considering your application for borrowing, your financial circumstances will be appraised. It’s not the use of credit, but rather the overuse of . . . . . (8) that gets people into trouble. You’ll do fine if you follow these two rules: . . . . . (9) only for worthwhile purposes and then borrow only as much as you can comfortably . . . . . (10 ) Vocabulary notes: materials to carry out repairs – материалы для ремонта; a conservatory – оранжерея, теплица. 1_____________________________ 2_____________________________ 3_____________________________ 4_____________________________ 5_____________________________ 6_____________________________ 25 7_____________________________ 8_____________________________ 9_____________________________ 10____________________________ Exercise 6 . A. Найдите синонимы следующим выражениям и запишите их. 1. what you can earn when you leave your money in the bank ____________________________________________________ 2. an amount of money borrowed from a bank for a certain length of time, usually for a specific purpose _______________________________________________ 3. something that acts as a security or a guarantee for a debt _____________________________________________ 4. an arrangement to withdraw more money from a bank account than you have placed in it _____________________________________________ 5. a long-term loan to buy somewhere to live _______________________________________ B. Установите, верны или нет следующие утверждения. Устно обоснуйте свой ответ. 1 Current accounts pay more interest than savings accounts. 2 There is less risk for a bank with a mortgage than with unsecured loans without collateral. 3 Traveller's cheques are safer for tourists than carrying foreign currency. 4 The majority of customers prefer to do their personal banking at the bank. 5 Bank branches are now all in shopping centres. Sentence True/ False 1 2 3 4 5 Exercise 7. Письменно переведите текст на английский язык и запишите его. Банковские кредиты являются основным источником (major source) банковского дохода. Прежде чем выдать ссуду, банк должен получить определенную информацию о клиенте. Банк должен знать: какая сумма нужна клиенту; цели и срок кредита; каким образом заемщик (borrower) погасит ссуду. Овердрафт – это наиболее распространенный и удобный способ заимствования у банка. Процентная ставка может меняться ежедневно (overnight) . Индивидуальная ссуда – это один из способов финансирования покупки дорогостоящих товаров, таких как машин, мебели и др. специфических товаров и услуг. Процентная ставка устанавливается на весь срок ссуды. ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ 26 REVIEW AND DISCUSSION: To review the material, perform the following tasks: Distinguish among the various types of deposit accounts. Describe the difference between demand deposit account, savings account and time deposit account.(In doing this, refer to chart “ Overview of Basic Accounts and Services “). List the basic categories of bank loans and speak on them. Identify the five C’s of credit and speak on them. Discuss with your partner or in group why bank services are so important to community. With your partner, play the roles of a bank clerk and a customer. The customer wants to: open an account; take out a loan ; Imagine that you are now a consumer loan officer and you work at the First County Bank, New York. By yourself, or together with your colleagues, you must decide whether to approve of decline a loan application. You must remember about the five Cs of the credit. What questions would you ask your potential borrower before loaning him money? Write down your questions, let your partner answer them and answer your partner’s questions. 27 SUPPLEMENT 1. Overview of Basic Accounts and Services Type of Account Characteristics Regular checking Immediately accounts withdrawable. Services Provided Revenues Expenses Service charges. All costs associated with processing checks and deposits preparation and mailing of statements. Charges for excess withdrawal. Processing costs and interest expense. Traditional transaction services, monthly statements. Savings Accounts Transferable on demand, small or no minimum balance. Traditional passbook services and periodic statements. Time Deposit $2500 minimum balance, no rate Accounts Maturity of from ceilings. 7 to 31 days Time deposit, Penalty for early Processing costs and rollover provisions. withdrawal. interest expense. No rate ceilings. Time deposit, Penalty for early Processing costs and rollover provisions. withdrawal. interest expense. Maturity of 31 days or longer 28 2. ACHIEVEMENT TES T Итоговый тест: *************************************************************** * 1. Найдите соответствие: demand deposit 1. сберегательный депозит 2. срочный депозит 3. депозит до востребования *************************************************************** * 2. Найдите соответствие: withdrawal 1.изъятие средств со счета 2.плата за ведение счета 3.уведомление об изъятии средств со счета *************************************************************** * 3. Найдите соответствие: mortgage 1. овердрафт 2. ипотека 3. обеспечение *************************************************************** * 4. Найдите соответствие: creditworthiness 1. конкурентоспособность 2. оценка кредитоспособности 3. кредитоспособность *************************************************************** * 5. Найдите соответствие: real estate 1.издержки 2.недвижимое имущество 3.опекунство *************************************************************** * 6. Выберите правильную форму глагола: Technology . . . . . . . . constantly and rapidly. 1. changes 2. is changing 3. has changed *************************************************************** *7. Выберите правильную форму глагола: Banks . . . . . . . offering home banking services now. 1. interested in 2. interesting 3. are interested in ************************************************************** * 8. Выберите правильную форму глагола: 29 Credit cards . . . . . . . . 1. are issued 2. issued 3.issue by credit card companies and large banks. *************************************************************** *9. Выберите правильную форму глагола: Any customer . . . . . . . . for a credit card. 1. can to apply 2. can apply *************************************************************** * 10. Выберите правильную форму глагола: Lenders want to know you . . . . . . . a good credit risk. 1. you have been 2. you are 3. you has been *************************************************************** * 11. Вставьте предлоги: Before loaning you money, creditors look . . . . . . . an ability to repay debt. 1.on 2.for 3.of ************************************************************** * 12. Вставьте предлоги: By far the most popular way of making deposits as . . . . person.. 1.in 2.of 3.at *************************************************************** * 13. Вставьте предлоги: To survive, banks must produce their services efficiently and sell them . . . . . . . . . a competitive price. 1.of 2.on 3.at *************************************************************** * 14. Вставьте предлоги: Basic banking services are still vital . . . . . banking industry. 1. for 2. to 3. of *************************************************************** * 15. Вставьте предлоги: You may pay . . . . . . . purchases . . . . stores . . . . . . your ATM card. 1. with 30 2. for 3. at ************************************************************** * 16. Вставьте предлоги: Some institutions charge a fee . . . . . every transaction. 1. on 2. for 3. at *************************************************************** * 17. Найдите соответствие: A bank account is .... 1. an account money held under one’s name in a bank 2. a document promising to pay a sum of money 3. the price of borrowed money * *************************************************************** * 18. Найдите соответствие: A savings account is .... 1. money placed with a bank on current account on which checks may be drawn 2. money placed with a bank on a deposit account earning interest 3. type of bank account to deposit money that is not needed for a longer period that needs notice of withdrawal *************************************************************** * 19. Найдите соответствие: A demand deposit is .... 1. money placed with a bank on current account on which checks may be drawn 2. money placed with a bank on a deposit account earning interest 3. type of bank account to deposit money that is not needed for a longer period 4. that needs notice of withdrawal *************************************************************** * 20. Найдите соответствие: A time deposit is .... 1.money placed with a bank on current account on which checks may be drawn 2.money placed with a bank on a deposit account earning interest 3.type of bank account to deposit money that is not needed for a longer period that needs notice of withdrawal *************************************************************** * 21. Найдите соответствие: 1. Automated Clearing House 2. Automated Teller Machine 3. Point-of-sale transaction A. Электронная система межбанковских клиринговых расчетов B. Терминал для совершения расчетов в торговой точке C. Банкомат *************************************************************** 31 * 22. Найдите соответствие: 1. drive-in-window 2. PIN A. личный идентификационный номер B. касса по обслуживанию клиентов в автомобиле *************************************************************** * 23. Перевод словосочетания “ выверка счета ... : 1. balance reporting 2. trust receipt 3. account reconcilement *************************************************************** * 24. Перевод словосочетания “ подавать заявку на ... : 1. to assume 2. to afford 3. to apply for *************************************************************** * 25. Перевод словосочетания “обман, мошенничество” : 1. fraud 2. fault 3. failure *************************************************************** * 26. Закончите предложение: Depository institutions may offer a great variety of . . . . . . . 1. customers 2. tellers 3. accounts *************************************************************** * 27. Закончите предложение : Banks may be defined as firms producing and selling financial . . . . . . 1. documents 2. services 3. statements *************************************************************** * 28. Закончите предложение : People usually take out . . . . . . . in order to buy something expensive . 1. overdrafts 2. mortgages 3. personal loans *************************************************************** * 29. Найдите синонимы : 1. buy A. take out 2. withdraw B. purchase 3. collateral C. security D. *************************************************************** 32 * 30. Найдите антонимы: 1. success 2. income 3. private A. expense B. public C. failure 33 ЛЕКСИЧЕСКИЙ МИНИМУМ ACH ( Automated Clearing House ) afford alimony annual percentage yield assets assume authenticity available bank loan borrow branch bank broaden brokerage capacity certificate of deposit (CD) CHIPS ( Clearing House Interbank Payments System) collateral competitive credit risk creditworthy currently demand deposit dependent device drive- in- window earnings employ employment information empower estate expenses extend ( syn. to expand ) extend credit flow in flow out frequently full- service banking hinge on holdings home improvement loan impose fees (syn. to assess, charge ) install installment interest- bearing account intermediary автоматическая клиринговая расчетная палата позволить себе (быть в состоянии) алименты годовой процентный доход активы предполагать, допускать подлинность доступный, наличный банковская ссуда получать деньги в кредит банк, имеющий филиалы расширять брокерские операции способность, возможность депозитный сертификат электронная система межбанковских клиринговых расчетов залоговое обеспечение конкурентоспособный риск неплатежа по ссуде кредитоспособный в настоящее время депозит до востребования иждивенец устройство, приспособление касса по банковскому обслуживанию клиента в автомобиле доходы использовать, применять информация о занятости уполномочивать имущество расходы расширять выдавать кредит приток ( ресурсов) отток ( ресурсов) часто полный комплекс банковского обслуживания зависеть от . . . вклады ссуда на улучшение жилищных условий взимать комиссионные устанавливать платеж в рассрочку процентный счет посредник 34 keep track location maintenance (flat) monthly fee maturity minimum balance fee mortgage night depository notice overdraft facility overdraw passbook savings account payroll penalty pool POS ( Point-of- Sale- Terminal ) profitable property receipt reduce access remain repay debt replace responsible for routine transactions savings deposit small businesses sound credit rating source statement savings account support survive teller teller’s window time deposit withdraw Прослеживать (место)расположение ежемесячная плата за ведение счета срок выплаты вклада комиссия за минимальный остаток средств на счете ипотечная ссуда банковский сейф для приема депозитов в вечерние или ночные часы уведомление возможность овердрафта , право на превышение кредита в банке превысить остаток счета в банке сберегательный счет со сберкнижкой общая сумма выплаченной заработной платы штраф резервуар средств , «пул» терминал для совершения расчетов в торговой точке прибыльный собственность, имущество расписка уменьшить доступ оставаться погасить долг заменять отвечать за что- либо повседневные операции сберегательный депозит мелкие предприниматели устойчивая кредитная репутация источник сберегательный счет с предоставлением выписок по счету поддержка выживать кассир кассовое окно срочный депозит снимать средства со счета 35 SELECTED BIBLIOGRAPHY: 1. P.A. Carruba. Principles of Banking. American Bankers Association, 2010. 2. Jan MacKenzie. Professional English in Use. Finance, Cambridge University Press, 2012. 3. “English for Banking”, a writing skills course for banks and their customers, Francis Radice, Prentice Hall International English Language Teaching, 1997. 4. Англо- русский словарь по экономике и финансам под ред. проф. Ф.В. Аникина, С.Петербург, Экономическая школа, 1993. 5. http://www.bankrate.com/finance 6. http://www.finanza toolbox materials