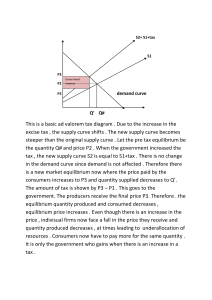

CHAPTER THREE AGGREGATE DEMAND IN CLOSED ECONOMY 3.1. Introduction In chapter two, the expenditure approach of measuring GDP gives us Y= C + I +G +NX………………….(1) where C, I, G and NX represent consumption, private investment, government purchases and net exports respectively. Equation (1) gives components of Aggregate Demand (AD). In a closed economy, NX=0 and GDP is given by the identity: Y = C + I +G………………………...(2) Consumption: Households receive income from their labour service and their ownership of capital. According to the national income identity, the income households receive equals the output of the economy (Y). Households pay taxes (T) and the left over (Y-T) is called Disposable Income. Disposable income is divided into consumption (C) and saving (S). The higher is the disposable income, the higher would be the consumption of households as described by the following Keynesian consumption function. C C C0 c1 (Y T ) 0, c1 , (0 c1 1)..............(3) Y where C0 is autonomous consumption, which is unrelated to income. The parameter c1 stands for the slope of consumption function. It measures the amount by which consumption changes when disposable income increases by one Birr. Average Propensity to Consume (APC): is the ratio of consumption expenditure of households to their disposable income. APC C c0 c1.........................( 4) (Y T ) Y T In Equation (4), c1 is constant but c0/(Y-T) declines as income or disposable income increases. Thus, APC changes with changes in income. This is one of the axioms of Keynesian consumption theory. Investment: Households purchase new houses and firms buy investment goods to add to their stock of capital, replace existing worn-out machinery and equipment or change their inventories. Households and firms consider the prevailing interest rate before making decisions. Investment function of households is given by I = (r) = (i- )……………………….(5) Nominal interest rate, i, is the market or reported interest rate that investors or borrowers pay for the lender and real interest rate, r, is the nominal interest rate adjusted for inflation. Government expenditure (G): Government expenditure is of two types: (a) Goods and services for capital investment or recurrent consumption by the federal and local government agencies and (b) transfer payments to households such as welfare for the poor and social security payments (including pension) for the elderly. Government will have a balanced budget if its purchases or spending equals net tax or tax minus transfer payments: G = (T-R)………………………………….(6) If G < (T - TR) , government runs budget surplus and if G > (T - TR), it runs budget deficit. Transfer payments increase disposable income and consumption contrary to taxes. For simplicity, for the time being, we set T to stand for taxes less government transfer payments. Taxes and government purchases are determined by government authorities, not in the model. Given the above components and assuming government spending (G G ), private investment( I I ) and taxes (T T ) ; AD is represented by E as follows. E c0 c1 (Y T ) I G................................(7) Aggregate Demand is an outcome of the interaction between product (goods) and money markets. The product market is designated by the IS curve, while money market interactions are captured through the LM curve. Where: S= Saving, I =investment. L and M stand for liquidity and money respectively. The Product/Goods Market Equilibrium Keynesian cross displays what possible actions firms take when there is disequilibrium in the product market. Disequilibrium may occur when planned expenditure and actual expenditure are not equal. Actual expenditure is the amount households, firms and government actually spend on goods and services. It is equal to GDP. Planned expenditure is the amount households, firms and government would like to spend on goods and services. The actual and the planned expenditures may not necessarily be equal. The figure shows that planned expenditure increases with an increase in income. On the supply side, for simplicity, we leave what determines the level of output and consider the total supply in the economy (Y ) The 45 degree line divides the quadrant into equal parts along which output equals actual expenditure. The product market is in equilibrium at point A, where actual expenditure equals planned expenditure. If the economy is outside of the equilibrium, how could the economy get back to the equilibrium? If the economy operates below point A towards the origin, planned expenditure ( E1) exceeds output or production in the economy (Y1) and firms will strive to draw down their inventories to satisfy the excess demand ( E1-Y1). Moreover, this move will force firms to condense their inventories and motivate them to employ more workers and expand output; a movement towards A. If the economy is operating above point A, output (Y2) exceeds the planned expenditure (E2) and firms will pileup their stock of inventories by unsold products on the amount (Y2 - E2 ) to reduce their sales to the level of AD. Government fiscal policies may affect the equilibrium condition in the economy. Before we consider changes in fiscal policy instruments, let us quantitatively indicate the equilibrium condition. Y 1 (c0 I G c1T ) E......................(8) 1 c1 1 1 c1 The parameter is called the multiplier; because it multiplies changes in exogenous variables such I or G to give resulting change in output. Digression: Saving Function The saving of households is part of the disposable income, which has not been consumed. S = Y-T-C or S= -c0+(1-c1)(Y-T)………………….(9) The income of households is allocated for (a) consumption, (b) saving and (c) taxes. Y=C+S+T………………………………(10) On the expenditure side, AD equals consumption, government expenditure and private investment spending. Y=C+I+G………………………(11) At equilibrium, we have Y=C+S+T=C+I+G S+T=I+G………………….(12) From equation (12), S=I+(G-T)…………………………………..(13) If government runs a balanced budget, G = T, this equals S = I…………………………………..(14) Equation (14) is called Saving-Investment Identity. If government runs a budget deficit or G>T, S > I………………………………………….(15) Equation (15) shows that saving exceeds investment because part of the saving is siphoned off to finance government budget deficit. It is called crowding out of private investment or because of excess government spending, private investment is constrained. If government runs a budget surplus, (G-T) < 0, then there will be private investment spending exceeding household saving. S <I……………………………………(16) Thus, private investment is finance by household saving (SH) and government saving (SG), which is equal to government budget surplus. I = SH+SG……………………………………………(17) What is the effect of saving on investment? In the shortrun, increase in saving has contractionary or negative effect on output. Based on Equation (15), lowering C0 decreases AD by the amount [C0/(1-c1)]. An increase in saving requires c1 to decline or (1- c1) to increase. A decrease in c1 reduces the multiplier and also has a stronger negative effect on AD. This is called the saving paradox; because of the inverse relationship between AD and S. However, in the long-run, as saving increases, the supply for loanable funds will increase; and causes interest rate to fall. Given equation 5, the decline in interest rate leads to an increase in I and also AD. The Effect of Fiscal Policy Changes on Output or Income Given Equation (13), what would happen if government uses one of its fiscal policy instruments, say an increase in government expenditure (G)? Increase in G, ∆G>0, brings Y 1 (G )........................................(18) 1 c1 Y 1 1 is government expenditure multiplier Where G 1 c Thus, the positive change in government spending raises planned expenditure by (1/(1-c1)∆G for any given level of income This leads to a move for the equilibrium position from A to B and income to raise from Y1 toY2 1 The Effect of Increased in Government Spending on Equilibrium Output The multiplier increases as marginal propensity to consume ( c1) increases. The second fiscal policy instrument is change in tax. If tax is reduced by ΔT, this will raise disposable income by the change in tax and increase consumption by (c1ΔT). Output increases from Y1 to Y2 by the change in tax times the multiplier for the tax rate, [-c1/(1-c1) ΔT]. To derive the IS curve, let us relax the assumption imposed on investment or I. Investment is no more exogenous. I=f(r)……………………………(19) I I br...............................................( 20) We also assume that other components of the AD constant Given this assumption, investment (I) and real interest rate (r) are inversely related. A decrease in interest rate from r1 to r2 boosts the demand for investment from I2 to I1, which causes an upward shift of planned expenditure curve from E1 to E2. This leads to a change in the equilibrium position from A to B. Because of an inverse relationship between interest rate and investment, it is also inversely related to income or output as well. Thus, IS curve slopes downward. What is the IS curve? IS curve (or schedule) shows the combinations of interest rate and output (income) such that planned spending equals income. The Effects of Fiscal Policy Change on Interest Rate and Income What will be the effect of fiscal policy changes on equilibrium level of interest rate and income? The equilibrium level of output will increase by the change in government spending (ΔG ) times government expenditure multiplier [1/(1-c1)]. This effect will also shift the IS curve upwards. Relaxing the assumptions imposed on the multiplier We assume government collects tax revenue at a rate of t per a fraction of income (Y), where 0 < t <1. C c0 c1[Y R (tY )]orC c0 c1 R c1 (1 t )Y ........( 21) We incorporate the new consumption and investment function to get the new planned expenditure or AD as: Y c0 c1 R c1 (1 t )Y I br G..................(22) By collecting autonomous spending together, we would get; Y A br g [ A br ].....................( 23) 1 c1 (1 t ) Where A c0 c1 R I G Equation (22) and (23) are called the IS equations. g Changes in the IS curve What happens if government exercises its fiscal policy by increasing public spending by ΔG, other things remaining constant? The effect of change in government spending on output is: Y g G......................................(24) The effect of change in autonomous investment on income is: Y g I .........................................(25) The effect of change in government transfer on aggregate output or income? Y c1 R c1 (1 t )Y Y c1 R................(26) 1 c1 (1 t ) The effect of change in G on income Y G The effect of change in G on tax revenue is: T tY t g G Thus, the effect of change in G on government budget balance is: g GBB T G (t g G G ) (t g 1) G The Money Market and the LM Curve Assets of an economy could be broadly divided into two categories, financial assets and tangible assets. Real assets or tangible assets are (a) properties owned by firms or corporations such as machines, land, and structures or buildings (b) consumer durables (such as cars, washing machines, stereos, etc.) and (c) residences owned by households. Financial assets are money, bonds or credit market instruments (and other interest-bearing assets and equities or stocks). Bonds: A bond is a promise by a borrower to pay the lender a certain amount (the principal) at a specified date (the maturity date of the bond) and to pay a given amount of interest per year in the meantime. Money: money is the stock of assets that can be readily used to make transactions and can be immediately used for payments. Money Functions as medium of exchange, store of value and unit of account. Types of money: fiat money and commodity money Based on composition, we have different components and deposits. Currency in Circulation: The fiat money and commodity money that we see circulating in the market. Demand Deposit: Demand deposit is non-interest bearing deposit; it can be transferred easily to bearer of the check. Saving Deposit: It is the common kind of deposits that we know, a deposit that bears interest but can be drawn at any time. Time Deposit: It is interest bearing deposit It cannot be withdrawn from banks before the agreement set between the bank and the client. Following these components, we have three types of money i. Narrow Money: M1 = C+DD ii. Quasi money: SD + TD, Where:SD= saving and TD= time deposit iii. Broad money (M2): M2 = M1 + SD+TD The Demand for Money i. Precautionary Demand for Money: It is a demand for money kept aside for precautionary (for fear of risks) and it is affected by transaction and speculative demand for money. ii. Speculative Demand for Money: demand for money for speculative purposes is a negative function of interest rate. Ls =f(r), (dLs/dr) < 0. Where Ls = speculative demand for money, I = liquidity preference, r = interest rate. As income increases, the speculative demand for money increases for any given level of interest rate. iii. Transaction Demand for Money: It is the motive for holding money to bridge the time gap between receipt of income and payments that have to be made for transaction purpose. It increases with an increase in income The demand for money also called the demand for real balances (sum of the two functions) is given by: L=L(r) +k(Y) Specific demand for real money balances is a decreasing function of interest rate L = kY-hr, k, h>0 Real money balances (real balances) are the quantity of nominal money divided by the price level. Money Supply: It is to be exogenously determined by the central bank regardless of the interest rate (assumption). M/P = l(Y)-h(r) Where M/p is real money supply. The specific functional form could become: 1 M / P kY hr r [ M / P kY ] h This is LM – equation representing equilibrium in the money market. The LM curve represents the pairs of interest and income that keep the money market in equilibrium with the given level of money supply, M, and a given price level P. LM is positively sloped because an increase in Y raises the transaction demand for money and so of the total money demand. At (r=r1), the supply of real balances (M/P) is fixed. There is now excess demand in the money market at the initial interest rate (r=r1). Interest rate must rise to restore equilibrium in the money market at r=r2. LM curve is drawn by changing the income level for a given supply of real money balances. If National Bank (NB) changes the real money balances, the LM curve shifts. Suppose NB reduces nominal money supply from M1 to M2 and real income remain constant asY-bar. Real money balance falls from M1/P to M2/P, which shifts LM curve upward. Panel (a): money Market equilibrium Panel (b): shifts in the LM curve in response to MP changes What determines the slope of the LM curve? The slope of the LM curve is given by dr/dy = k / h. The greater the responsiveness of the demand for money to income as measured by k and/or the lower the responsiveness of the demand for money to the interest rate, h, the steeper or (the higher the slope of) the LM curve will be. What causes the LM curve to shift? A change in the real money supply will shift the LM curve. If the real money supply increases, which is represent by a rightward shift of the money supply schedule, the interest rate has to decline in order to restore money market equilibrium. This will lead to a rightward/downward shift in the LM curve. The money market is in equilibrium at point E1.Assume an increase in the level of income to Y2. This will raise the demand for real balances and shift the transaction demand curve for money to the right. On all points below and to the right of the LM curve, there is an excess demand for real balances. Conversely, points above and to the left of the LM schedule correspond to excess supply of real balances. Short-Run Equilibrium in the Economy Goods Market IS: Y = C(Y+R-T)+I(r)+G Money Market LM: M/P = L(r, Y) This figure represents a simultaneous equilibrium in both the product/goods market and the money market. Monetary and Fiscal Policy Analysis Using the IS-LM Framework 1. Effect of Fiscal Policy Changes a. Changes in Government Spending Change in government spending shifts the IS curve to point B at r1. However, a shift in the IS curve with increased in the level of income will cause changes in the operation of the money market as well. As income increases, the quantity of money demanded given interest rate increases. The supply of real money has not changed. This will create in balance in the money market, and increases interest rate to r2. On the IS side, as interest rate rises, firms cut back their planned investment; thus reduce the total planned expenditure in the Keynesian cross and equilibrium level of income. The final equilibrium point in the IS-LM model becomes at point C. Thus, the fall in investment partially offsets the expansionary effect of the increase in government purchases. b. Changes in tax rate 2. Monetary Policy Effect Suppose there is an increase in nominal money (M), which leads to an increase in real money balances M/P. • For any given level of income, an increase in real money balances leads people to have more money than they want to hold at the prevailing interest rate. • Interest rate falls until all the excess money vanishes. • This leads to a downward shift in the LM curve from LM1 to LM2. • The change in money market equilibrium also brings a change in the product market equilibrium. • Lower interest rate stimulates planned investment, total planned expenditure and income Y. • This brings a new equilibrium point from point A to point C at lower interest rate and higher level of income. Aggregate Demand To derive the aggregate demand curve, we relax the fixed price assumption and examine how IS and LM models shift to price changes. AD curve shows the set of equilibrium points of income on the IS–LM model as the price level varies. It also shows the negative relationship between price and income. Suppose the money market equilibrium and overall equilibrium was at point A Suppose price increases from P1 to p2 , where p1 > p2. For any given money supply M, a higher price level P2 reduces the supply of real money balances from M/P1 to M/P 2. A lower supply of real money balances shifts the LM curve upward or to the left. This move raises the equilibrium interest rate from r1 to r2 and lowers the equilibrium level of income from Y1 to Y2. This implicit negative relationship between income and price level enables to draw aggregate demand (AD) curve and price. What shifts the AD Curve? A change in income due to fiscal and monetary policy changes in the IS–LM model for a fixed price level shifts the AD curve. Any expansionary policy (increase in government spending, increase in money supply and a decline in tax) brings an increase in income given price level and shifts the AD curve to the right and leads to higher level of income for given price level.