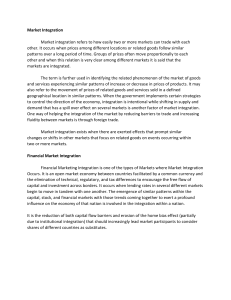

Philippine Corporation Code Comparison (Old vs. Revised)

advertisement

CORPORATION Corporation Code if the Philippines (OLD) Revised Corporation Code of the Philippines (NEW) At least 5 stockholders One Person Corporation (OPC) - natural person, trust or an estate - Single stockholder will act as the president and sole director. - Treasurer - upon submission of a bond to SEC. Ex: banks, quasi-banks, pre-need, trust, insurance, public and publicaly listed companies, and non-chartered government-owned and controlled corporations, a JURIDICAL ENTITY (e.g. corporations) Requirement to avail limited liability ● Prove to SEC that the OPC is sufficiently financed and its assets are separate from his. Otherwise, he is solidary liable with the liabilities of the OPC. Maximum of 50 years (term limit) unless extended. Perpetual existence (default rule) unless otherwise specified in Articles of Incorporation. For corporations existing before the RCC - unless the corporation, upon required votes of the stockholders, notifies the SEC for the retention of the specified term. “Lazarus” provision - revival of a corporation whose term has already expired (upon application, and subject to approval of SEC) ● same rights and privileges, duties, debts, and liabilities as before the expiration of term ● perpetual existence is still the default upon revival Minimum Capital Stock No minimum capital stock unless provided by special laws ● At least 25% of the authorized capital stock are subscribe ● At least 25% of the subscription is paid ● Minimum paid-up capital is not less than PhP 5,000 Minimum of 5 incorporators, directors, and trustees. ● natural persons ONLY Maximum of 15 ● natural and juridical persons (partnership, association, or corporation) For corporations vested with public interest ● Inbdipendent Directors - must composed at least 20% of the board ● membership of the corporations) Nor required to appoint a compliance officer Emergency Board - when vacancy in the board prevents remaining directors to constitute a quorum and emergency actions Officers and qualifications - the same as the old law, except for TREASURER (now required to be a resident of the Philippines) Remote Cimmunication and In Absentia Voting - Requires physical presence Remote Communication and In Absentia Voting - Vdeioconferencing, teleconferencing, etc. are allowed - No physical presence or proxy representatives is required in order to communicate and vote when authorized in the by-laws Non-use of corporate charter for 2 years - deemed dissolved Continuous inoperation for 5 years ground for revocation of corporate franchise Non-use of corporate charter for 5 years - deemed dissolved Continuous inoperation for 5 years - ground for revocation of corporate franchise Separate personality ● Separate assets and liabilities from its stockholders ● Stockholders do not have ownership but only interest with regards corporation’s assets ● Reagarding corporate properties or affairs ○ stockholders cannot maintain action in their own name; and ○ they have no right to recover possession of property belonging to the corporation; or to recover damages for injury thereto ● Separate income from stockholders (important for taxation purposes) Piercing the vale of corporate entitiy/fiction - Separate personality of corporation is disregarded - When it is used for wrong and unlawful actions (e.g. evading taxes or other obligations) - Liability of the corporation will attach to its stockholders Partnership vs. Corporation Similarities Partnership ● ● ● Corporatrion Juridical Personality Artifical persons (no physical existence) Composed of group of persons (except OPC) Differences Partnership Corporatrion Created by operation of law Mere consent/agreement Not greater the 15 persons 2 or more Right of succession No right of succession ● Taxed as corporation (except GPP) Power expressly authorized by law or incidental to its existence Any power authorized by the partners, provided it is not contrary to law, good customs, morals, public order, and public policy. Board of directors According to agreement for the system of managemet. If nona, all general partners are agents. Limited liability Depending if partners are general or limited Commencement Commencement - Upon issuance of - Execution of the partnership certificate of incorporation contract Transferrability of interest - No need for consent of the other stockholders or members Term of existence - Perpetual or fixed term Dissolution - Cannot be dissolved without the consent of the State. - Requires consent of all partners - At will (could be indefinite) At a fixed term or specific undertaking - Could be dissolve by the agreement of the partners. Other causes: death of a partner, insanity, court decree etc. - Steps in Incorporation 1. Verification with the SEC of the name to be used 2. Drafting and execution of the AOI signed by the incorporators 3. Filing of the articles of AOI with SEC together with the other documents 4. Payment of the filing, publication, and other fees 5. Issuance of the certificate of incorporation by the SEC Contents of Articles of Incorporation ● Name ● Purpose ● Principal office ● Term of existence ● Names, nationalities, and residence of incorporators (NNR) ● Number, names, nationalities, and residences of directors or trustees (NNNR) ● Capital stock (par shares: authorized CS, number of shares, par value; no par shares: authorized number of shares, statement that they are no par; both are present: both rule is used) ● ● ● ● ● subscription details (Names and nationalities of subscribers, number of shares subscribed, amount subscribed, and amount paid-in) no more minimum capital Others (inconsistent with law but are necessary) Name of temporary treasurer elected (treasurer in trust) Notarial acknowledgement Treasurer's affidavit A. Definition of corporation - An artificial being - a juridical person Created by operation of law Having rights of succession Limited Capacity (power, attributes, and properties expressly authorized by law or incidental to its existence) * a partnership cannot have succession due to Delectus Personae concept * can a nonstock corporation earn profits? - yes, but it cannot distribute its profits to its corporators (members); NO DIVIDENDS Artificial being - can be sued, but not suing the owners directly Created by law - only the State through SEC can grant a business license to operate as a corporation Right of succession - it continues to exist for a period for which it has been formed regardless of changes in ownership (unlike partnership and sole proprietorship, it stops existing when owner dies) Limited Capacity (doctrine) - power, attributes, and properties expressly authorized by law or incidental to its existence; Express, Implied, and Incidental (inherent) powers - (unlke Partnerhsip and Sole Proprietorship, any power as long as not contrary to law, good moral, public order/policy, etc.) B. Classes of corporations Classifications of Corporations MAJOR CLASSES ● Stock corporation - shares; dividends ● Non-stock corporation - No concept of share; usually not for profit As to nationality (laws of incorporation) ● Domestic corporation ● Foreign corporation - operating in the Philippines but is not organized under Philippine Laws Numbers of persons composing them ● Corporation aggregate ● Corporation sole - different from OPC As to purpose ● Public corporation (Sec. 3, TCL) - For the general good and welfare ● Private corporation - private purposes (profit) ○ Government owned or controlled corporation (GOCC) - gov owns at least majority (51% and above) of outstanding capital stock ○ Quasi-public corporation - supported by the government for the performance of public duties (utilities electricity, water, transportation, etc.) Religious or not ● Ecclesiastical or religious corporation religious purposes ● Lay corporation De facto Corporations Charitable or not ● Eleemosynary corporation - for charitable purposes ● Civil corporation As to legal right (legal status) ● De jure corporation ● De facto corporation In relation to other corporation/s (control) ● Parent or holding corporation - owns shares of another corporation, with the power to elect the latter’s board of directors ● Subsidiary corporation - one whose shares are owned by a parent corporation (51% above ownership) Whether or not it may be held by the public ● Closed corporation - shares are limited to a few and restricted as to their transfer; not listed in any stock exchange. ● Open corporation - shares are open to public; listed in stock exchanges Others ● Corporation by prescription - Practiced corporate powers for a long time w/o interference of the state, by fiction of law, it is given status of a corporation - A corporation that has existed longer than the memory of man can remember and is presumed to have acquired its juridical personality from the long time ago. - Assumed that there is a law or authority that granted its formation as a corporation (i.e. those corporations older than the law) - They are not required to file an articles of incorporation. ● Corporation by estoppel - not a real corporation (created through persons acting as a corporation to third persons) - Same powers as de jure corporations Due existence can be attacked in a quo warranto proceeding Due existence cannot be attacked colaterally or as an incident to a proceeding Requirements for a de facto corporation: ● There must be a valid law under which it is incorporated ● An attempt in good faith to incorporate ● An actual exercise of corporate powers ● Certificate of incorporation is issued despite a defect in its incorporation Defects that would create a de facto corporation: ● Most of incorporators and non-resident aliens ● Name is similar to an existing corporation or one that is protected by law ● Acknowledgement is defective No creation of any corporation in the following circumstances: ● Absence articles of incorporation ● Failure to file the articles of incorporation C. Nationality of corporations ● ● Control Test Grandfather Rule Domestic Corporation - incorporated under PH laws Foreign Corporation - incorporated under laws other than PH’s Test to determine nationality A. Incorporation Test (primary test) - based on the country under whose laws it was incorporated B. Control Test (Liberal Rule) - based on the stockholders owning the controlling interest - If at least 60% of the share are Filipino owned, then all shares (100%) are recorded as Filipino shares or a “100% domestic corporation” - Applied during wartime for the purpose of the security of the State 60:40 rule - Article 12 National Patrimony (1987 constitution) - To prevent foreigners from taking over businesses in the Philippines Nationalized or Partly-nationalized industries (FOREIGN INVESTMENT NEGATIVE LIST - list of industries) ● No foreign equity (100% Filipino) - MASS MEDIA (by mandate of 1987 Constitution) ● Up to 25% foreign equity - PRIVATE RECRUITMENT (local or overseas employment, by mandate of PD No. 42) ● Up to 40% foreign equity - ownership of private lands by mandate of the Constitution C. Grandfather Rule (Strict Rule) - still under the CONRTOL TEST, it determines the actual Filipino ownership and control in a corporation by tracing both the direct and indirect shareholdings in the corporation. ● Important in determining the nationality and voting rights (https://www.alburolaw.com/grandfather-rule-when-the-60-40-filipino-foreign-equity-is-in-doubt/#:~:tex t=Grandfather%20Rule%20%E2%80%93,control%20of%20Filipinos) “When should the Grandfather Rule be applied?” ● the corporation’s Filipino equity falls below the constitutional threshold of 60 percent or; ● there exists a “doubt” as to the Filipino to Foreign equity. (when the 60:40 Filipino-Foreign ownership application is in doubt) - Control test is first applied, then if there is “doubt”, even if the Filipino equity does not fall below the threshold, Grandfather Rule will be applied. * applying to be a corporation in certain industries (i.e. manufacture of firearms) require a minimum number of Filipino ownerships (i.e. at least 60% Filipino shares), failure to comply will not be allowed to form a corporation. ● Domiciliary Test – It is determined by the principal place of business of the corporation Can a corporation be a partner in a partnership? ● General Rule: NO ● Exceptions: ○ It is expressly conferred by the charter of (or) the articles of incorporation of the corporation and the nature to be undertaken by the partnership is in line with business of the corporation ○ If it is a foreign corporation, must obtain license to transact business in the Philippines D. Corporate Juridical Personality ● ● Doctrine of separate juridical personality ○ Liability for tort and crimes ○ Recovery of damages Doctrine of piercing the corporate veil ○ Grounds for application of doctrine ○ Test in determining applicability Doctrine of piercing the veil of corporate fiction - disregard the separate personality of the corporation Grounds for application: 1. Defeat public convenience (used for evasion of existing obligation) 2. Fraud cases or WFC (justify as wrong, protect a fraud, or defend a crime, perpetuate deception) 3. Alter ego cases - mere business conduit of a person; mere an instrumentality, agency, conduit, or adjunct of another corporation Tests: ● Fraud test ● Alter-ego or instrumentality test (or conduit cases) - i.e. to evade taxes ● ● Public convenience or objective test Equity cases test - Elements of piercing the veil of corporate fiction 1. Control - control of the corporation by the stockholder or corporation (alter ego theory) 2. Commit fraud or fundamental unfairness to the plaintiff (WFC) 3. Harm or damage caused to the plaintiff by the fraudulent or unfair act of the corporation Is a corporation liable for TORTS? - YES, whenever a tortuous act is committed by an officer or agent under the express direction or authority of the stockholders or members acting as a body, or, generally, from the directors as the governing body. Is a corporation liable for CRIMES? - General Rule: NO, sine a corporation is a mere legal fiction, it cannot be held liable fior a crime comitted by its officers, since it does not have the essential element of malice; in such case the responsible officers would be criminally liable. (hindi pwedeng makulong ang isang corporation) - Exception: if the penalty of the crime is only fine or forfeiture of license or franchise/death of a corporation. (cases na hindi kulong ang penalty) Can a corporation recover damages? - YES - Exception: moral damages ● Exception to the Exception: ○ The corporation may recover moral damages under item of Artcile 2219 of the New Civil Code because said provision expressly authorizes the recovery of moral damages in cases of libel, slander, or any other for of defamation. Article 2219(7) does not qualify whether the injure party is a natural or juridical person. Therefore, a corporation, as a juridical person, can validly complain for libel or any other form of defamation and claim moral damages. ○ When the corporation has a reputation that is debased, resulting in its humiliation in the business realm E. Capital structure ● ● ● ● Number and qualifications of incorporators Subscription requirements Corporate term Classification of shares i. Preferred shares versus common shares ii. Scope of voting rights subject to classification iii. Founder's shares iv. Redeemable shares v. Treasury shares Pre-incoporation Activities ● Determination if the Capital Structure ● ● ● ○ Incorporators ○ Subscription requirements ○ Corporate Term ○ Classes of Shares Pre-incorporation subscription (usually done by Promoters) Preparations of the AOI - submitted to SEC (required) Preparation of the By-Laws (not required) Number and Qualifications of Incorporators ● Natural or Artificial Person ● Not more than 15 (non-stock corporations may exceed to 15 members) ● Cannot organize corporations for practice of profession (only GPPs can have that purpose) ● Legal Age (if natural person) ● Holder or subscriber if at least 1 stock (subsequent to incorporation, an incorporator will remain as an incorporator even if he/she sold his/her stock to others) Subscription Requirements ● No more minimum capital stock in the RCC except if required by special laws ○ Certain industries requiring a minimum capital stock Corporate Term ● Default: Perpetual Existence ● Except: Fixed term in AOI → Those existed before the RCC and are continuing - perpetual existence, unless majority of stockholders opt to retain the corporate term through notifying the SEC Extending or shortening of Term - Through amendments of AOI - Cannot extend earlier than 3 years prior to the original or subsequent expiry date, UNLESS there is justibfiable reasons, - For early extension, such extension shall only take effect the day after the original or subsequent expiry date(s). Expiry of Corporate Term - Corporation is not automatically dissolved - Lazarus provision - It can still apply for revival of corporate existence (same rights and privileges, and duties, debts, and liabilities prior to revival) - Upon approval, a Certificate of Revival of Corporate Existence will be issued (perpetual existence or otherwise provided) - Mnemonics - BBQ-PIN-PCF Classification of Shares For Stock Corpoations ● Par ● No Par Common Shares Preferred Shares - May be deprived of voting rights (can be voting or non-voting, but generally voting) - Preference in dividend distribution - Preference in distribution of assets upon liquidation - P/S can only be issued with PAR (cannot be “no par” share) Voting Shares Non-voting Shares Mnemonics: AASIIMID AOI, bylaws, corporate property, bonds, capital, merger and con, funudd of others, dissolution Par Value Shares No Par Value Shares - Deemed fully paid and non-assessible (so the stockholder shall not be liable anymore unless contrary is proven) - normally binabayaran na lahat agad Cannot be issued for less than PhP5 per share (stated value) All consideration received for no par share are treated a capital and shall not be available for distribution as dividends Legal Capital - Portion of capital that cannot leave the business (cannot be declared as dividends; doing such is a violation of the Trust Fund Doctrine) - If par, the aggregated par value issued and subscribed - If no par, total consideration including premium - Contributed Capital minus share premium of the shares with PAR VALUE, and include the premium of the NO PAR shares. Contributed Capital (CC) - Total SHE minus Retained Earnings ● Shares Issued ● Subscribed Shares ● Share Premium (Additional Pai-In Capital) → The share or series of shares may or may not have a par value, except for (par value shares only): ● Banks ● Trust ● Insurance ● Preneed Companies ● Public Utilities ● Building ands loan associations ● Corporations authorized to obtain or access funds from the public whether publicly listed or not MNEMONICS: BTI-PP-BC Others: Founders’ Shares Redeemable Shares Treasury Shares Section 6 paragraph 2 ● Only preferred and redeemable share may be deprived of voting rights ● There shall be a class or series of shares with complete voting rights (at least one class/series) Founders’ Shares - Usually given to incorporators - May give rights and privileges not enjoyed by owners of other stocks ● Exclusive right to vote and be voted for the Board of Directors - Limited within 5 years after incorporation - Not allowed if it will violated the: ● Commonwealth Act No. 108 → Anti-Dummy Law - created to penalize those who violate foreign equity restrictions and evade nationalization laws of the Philippines ● Republic Act No. 7042 → Foreign Investments Act of 1991 - foreign investors are allowed to invest 100% equity in companies engaged in almost all types of business activities subject to certain restrictions as prescribed in the Foreign Investments Negative List (FINL). Redeemable Share - Must be expressly provided in the AOI (as initially created, or as amended) - Share with redemption date and price (they are set and are beyond the control of corporation) - They can be redeemed (bought back) upon the expiration of a fixed period, regardless of the existence of unrestricted retained earnings (unlike in treasury shares) - Essentially not an equity but a liability of the corporation Treasury Shares - Formerly issued and fully paid for - Subsequently reacquired through PRDL (purchase, redemption, donation, or some other lawful means) - May again be reasonably diusposed for a reasonable price fixed by the Board of Birectors - A corporation can only buy treasury shares to the extent of their unrestricted retained earnings F. Incorporation and organization A. Promoter B. Subscription contract C. Pre-incorporation subscription agreements D. Consideration for stocks E. Articles of Incorporation F. Contents G. Non-amendable items H. Corporate name; limitations on use of corporate name I. Registration, incorporation and commencement of corporate existence J. Election of directors or trustees K. Adoption of by-laws a. Contents of by-laws b. Binding effects c. Amendments L. Effects of non-use of corporate charter Different Components of a Corporation A. Corporator - those who compose the corporation, whether as stockholders or members B. Incorporator - they are those mentioned in the AOI as originally forming and composing the corporation and who are signatories thereof C. Directors and Trustees - the board of directors is the governing body in a stock corporation while the board of trustees is teh governing body of a non-stock corporation D. Corporate Officers - officers identified by the Corporation Code (president, treasurer, secretary), AOI, or the By-laws (used in adding officers aside from those set by the Corp Code) of the corporation E. Stockholders - owners of shares in a stock corporation F. Members - corporators of a non-stock corporation; do not own stock ; membership depends on terms in the AOI or by-laws G. Promoter - a person who, acting alone or with others, takes the initiative in founding and organizing the business or enterprise of the issuer and receives consideration therefor H. Subscriber - those who agreed to taka and pay for original, unissued shares of a corporation formed or to be formed I. Underwriter (guanrantor) - a person who guarantees on a firm commitment and/or declared best effort basis the distribution and sale of securities of any kind by another ● ● All incorporators are corporators, but not all coprorators are incorporator. An incorporator who sells his share subsequent to incorporation is still an incorporator but not a corporator. Promoter ● Discovers a prospective business and brings together people who wants invest in it by forming a corporation ● Procures subscription and capital for the corporation ● Setting the motion in the machinery which leads to the incorporation of the corporation itself ● Promoters are agent of the incorporators and not the corporation (still inexistent during its formation) Liability - personably liable to any contract entered for the proposed corporation ○ If incorporation does not materialize → all promoters remains jointly personally liable for damages ○ If incorporation materializes → promoter is still liable until corporation ratifies or adopts such contract, or releases him from liability. The third must also agree to absolve him. ■ BOD must pass a resolution ratifying all contracts entered into by the inorporators with the promoter. Then promoters become agent of the corporation - liability becomes limited since they clearly become agents of a principal which is the corporation ● Corporation’s liability for pre-incorporation contracts entered into by promoter - not automatic, unless through adoption, ratification, or novation of such contracts. Subscription Contract - A contract for the acquisition of unissued stock in an existing corporation or a corporation still to be formed. It is considered as such notwithstanding the fact that the parties refer to it as purchase or some other contract. (SEC. 59) Kinds of Subscriptiuon contracts: 1. Pre-incorporation subscription contract (Included in the AOI) (SEC. 60) - Irrevocable for 6 months from date of subscription Exception (early revocation/cancellation): a. all of the other subscribers agree to the revocation; b. or the corporation fails to incorporate within 6 months or within a longer period stipulated in the subscription contract. - No pre-incorporation subscription may be revoked after AOI is submitted to the Commission. 2. Post-incorporation subscription contract Rule: ● Upon perfection of subscription corntract, subscriber is a stockholder already regardless if unpaid ● Unless shares are delinquent (past due), stockholders retain the rights Considerations for stocks (SEC 61) Invalid Consdierations ● Promissory Notes ● Future Services Other than cash or if intangibles: ● Valuation → SH or BOD, to be approved by SEC Articles of Incorporation (Contents) 1. Name of corporation 2. Purpose(s) - primary and secondary… 3. Place of principal office (must be within Philippines) 4. Corporate term (if no fixed term, default is perpetual) 5. NNR of incorporators (name, nationalities, residence addresses) 6. Numbers and NNR of directors (not more than 15 in stock, may be more than 15 in non-stock) 7. NNR of acting directors or trustees until first regular directors/trustees are elected and qualified in this Code 8. (stock) a. Amount of authorized capital stock, number of shares, par (par shares); b. NNR of original subscribers and their amount subscribed and amount paid; (for no par) statement that some share have no par value 9. (non-stock) amount of capital; NNR of contributors and amount contributed 10. Other matter consistent with law and deemed necessary and convenient by stockholders Additional Contents: ● Name of temporary treasurer elected (treasurer in trust) ● Notarial acknowledgement ● Treasurer's affidavit Non-ammendable items of the AOI ● Names of incorporators ● First set of directors and subscriber ● Initial treasurer ● Original subscription ● Place and date of execution of the AOI Corporate Name: ● Must be distinguishable from: ○ those already reserved or registered ○ those protected by law ○ those contrary to law, rules, and regulations Does not constitute distinguishment: ● Words: company, corporation, incorporated, limited, limited liability, or their abbreviation ● Punctuations, articles, conjunctions, contractions, prepositions, abbreviations, different tenses, spacing, or number of the same word or phrase Pag nakalusot yung name na bawal ● Cease and desist fromusinf such name ● Register a new one → the Commission will: ○ order the removal of all signages, marks, ads, label prints, and other bearing such name ○ Issue a COI under the amended name Failure of the corporation to comply: ● Corporation and its directors/officers will be held administratively, civilly, or criminally liable; OR ● Revoke the registration of the corporation Steps in Incorporation 1. Verification with the SEC of the name to be used 2. Drafting and execution of the AOI signed by the incorporators 3. Filing of the articles of AOI with SEC together with the other documents 4. Payment of the filing, publication, and other fees 5. Issuance of the certificate of incorporation by the SEC * by-laws can be submitted alongside with the AOI or after incorporation. AOI is need for incorporation. * issuance of the COI under official seal of SEC marks the commencement of the corporation having a separate juridical personality Election of Board of Director/Trustees - Done after incorporation, so there will be people to manage the corporation. - Each SH has the right to vote for BOD, unless if there are founders’ shares. ● Majority of corporators must be present ○ in person ○ representative through written proxy ○ remote communication (in absentia) if authoruzed by: ■ by-laws; or ■ majority of directors ● ● Stocks - the amount of rights is based of stockholdings Non-stocks - each member has equal rights Note: - Voting in absentia need not be provided in the bylaws for corporations vested with public interest - Election may be in ballots upon request of any SH. Votes of A = 5000 x 12 = 60,000 votes ● A can distribute his votes to different nominees or dedicate it all to a single candidate. * A has 5 thousand shares so it means his votes are enough to guarantee the win of his favored candidates. Adoption of By-Laws (SEC. 45) - Used for providing additional rules not mentioned in the AOI or the RCC. - Becomes effective upon the SEC’s issuance of a certificate that the by-laws are in accordance with RCC. Requirements: → Post-incorporation ● Vote of the majority ○ Stock - SHs owning majority of the share ○ Non-stock - majority of the members ● Signature of the corporators voting for them ● Kept in the principal office of the business (subject to inspection of corporators during office hours) ● A copy of the By-laws ○ qcertified by majority of directors/trustees, ○ countersigned by their secretary, ○ filed to the SEC ○ attached to the AOI → Pre-incorporation ● Must be approved and signed by the incorporators ● Submitted to the SEC together with the AOI Contents of By-laws Note: Notice to third person must be proven and not presumed in order to be binding. How to amend/repeal by-laws, and adopt new bylaws? ● A meeting, for such purpose, composing the majority of BOD and majority of SH (stock) or members (non-stock) ● Delegation of such power: Majority (2/3) of the corporators could delegate such power ot the board of directors/trustees, unless revoked by the majority of the corporators (by voting in a regular or special meeting). Amended and/or newly adopted bylaws shall be submitted to the SEC, together with (if applicable) a resolution authorizing the delegation of power for such, duly certified under oath by corporate secretary and majority of the board. Amendments and addition to bylaws shall be effective upon issuance of certification by the SEC. Non-use of corporate charter for 5 years - COI shall be deemed revoked on the day following the end of the 5 year period (SEC. 21) Continuous inoperation for 5 consecutive years - ground for revocation of corporate franchise; the Commission may place it under delinquent status after a due notice and hearing. Delinquent Corporation - May resume operations within 2 years and comply with all requirements prescribe by the SEC. ● Compliance: SEC shall issue and order lifting delinquent status ● Failure to comply: revocation of the Certificate of Incorporation (COI) ○ SEC shall notify and coordinate appropriate regulatory agency before suspending and revoking COI of companies under their special regulatory jurisdiction. (e.g. CHED for Tertiary Educational Institutions) A corporation’s liability is not the liability of the owners, unless the corporation veil is pierced. Liability for torts - master-servant relationship → liability of servant is imputed to the master. - Respondenteat and superior 2180 - torts definition 2176 Damages - article 2197 MENTAL - moral, exemplary, nominal, terminate?, Article 2217 of the Civil Code recognizes that moral damages which include physical suffering, mental anguish, fright, serious anxiety, besmirched reputation, wounded feelings, moral shock, social humiliation and similar injury, are incapable of pecuniary estimation. General rule: corps cannot claim moral damages since it has no emotion Exception: libel, slander, defamation,