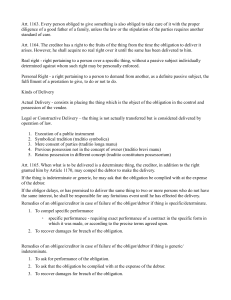

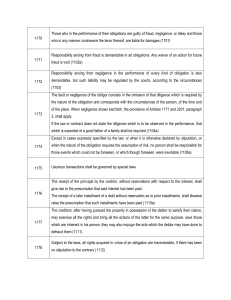

Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. Law on Obligations General Principles An obligation is a juridical necessity to give, to do or not to do. (Art. 1156) It is a juridical relation or a juridical necessity whereby a person (creditor) may demand from another (debtor) the observance of a determinative conduct (giving, doing, or not doing), and in case of breach, may demand satisfaction from the assets of the latter. It is a juridical necessity because in case of non-compliance, the courts of justice may be called upon by the aggrieved party to enforce its fulfillment or, in default thereof, the economic value that it represents. Art. 1156 refers only to civil obligations which are enforceable in court when breached. It does not cover natural obligations. GR: the law does not require any form in obligations arising from contract for their validity or binding force. (Art. 1356) XPNs: o When the form is essential to the validity of the contract as required by law (Art. 1346) o When the contract is unenforceable unless it is in a certain form, such as those under the Statute of Frauds as formulated in Art. 1403. Different Kinds of Prestation BASIS OBLIGATION OBLIGATION TO GIVE TO DO As to what the obligation consists of Consists in the delivery of a thing to the creditor Covers the rendering of works or services whether physical or mental Refraining from doing certain acts Examples Sale, Deposit, Pledge, Donation Contract for professional services (e.g., singing, modeling) Negative easement, Restraining order or Injunction 1|P age OBLIGATION NOT TO DO Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. General Principles Elements of an Obligation 1. Juridical tie 2. Active subject 3. Passive subject 4. Object or prestation To be valid; it must be: a. Licit or lawful; b. Possible, physically and judicially; c. Determinate or determinable; and d. Pecuniary value or possible equivalent in money. Sources of Obligations Law Contracts Quasi-contracts Delict Quasi-delict NOTE: the list is EXCLUSIVE Sources of Law Constitution; Legislation; Administrative or executive orders, regulations, and rulings; Judicial decisions or jurisprudence; Custom – habits and practices which through long and uninterrupted usage have become acknowledged and approved by society as binding rules of conduct. OBLIGATION EX LEGE: Obligations derived from law are not presumed. Characteristics of a legal obligation: – Does not need the consent of the obligor – Must be expressly set forth in the law creating it and not merely presumed: and – In order that the law may be a source of obligation, it should be the creator of the obligation itself OBLIGATION EX CONTRACTU Requisites of a contractual obligation o It must contain all the essential requisites of a contract o It must not be contrary to law, morals, good customs, public order, and public policy Rules governing the obligations arising from contracts o GR: these obligations arising from contracts shall be governed primarily by the stipulations, clauses, terms, and conditions of the parties’ agreements o XPN: contracts with prestations that are unconscionable or unreasonable 2|P age Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. Binding force of obligation ex contractu – obligations arising from contracts have the force of law between the parties and should be complied with in good faith (Principle of Obligatory of Contracts). OBLIGATION EX QUASI-CONTRACTU • Quasi-contract – a juridical relation arising from lawful, voluntary, and unilateral acts based in the principle that no one shall be unjustly enriched or benefited at the expense of another (NCC, Art. 2142) • Characteristics of a quasi-contract (LUV): – It must be LAWFUL – It must be UNILATERAL – It must be VOLUNTARY • Principal Forms of Quasi-Contracts – Negotiorum gestio (inofficious manager) - Arises when a person voluntarily takes charge of the management of the business or property of another without any power from the latter (NCC, Art. 2144) – Solutio indebiti (unjust enrichment) – takes place when a person received something from another without any right to demand for it, and the thing was unduly delivered to him through mistake (NCC, Art. 2154). CONTRACT QUASI-CONTRACT There is meeting of the minds or consent; the parties must have deliberately entered into a formal agreement. There is no consent, but the same is supplied by fiction of law; to prevent injustice. OBLIGATION EX DELICTO: An act or omission punishable under the law Basis – GR: Art. 100 of the RPC provides: “Every person criminally liable for a felony is also civilly liable” – XPN: crimes of treason, rebellion, espionage, contempt and others wherein no civil liability arises on the part of the offender either because there are no damages to be compensated or there is no private person injured by the crime Implied institution of the civil action in a criminal case – GR: When a criminal action is instituted, the civil action for the recovery of the civil liability arising from the offense charged shall be deemed instituted with the criminal action – XPN: when the offended party o Waives the civil action; o Reserves the right to institute it separately; and o Institutes the civil action prior to the criminal action. 3|P age Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. OBLIGATION EX QUASI-DELICTO: An act or omission arising from fault or negligence which causes damage to another, there being no pre-existing contractual relations between the parties (NCC, Art. 2176) Elements of a Quasi-Delict: – Negligent or wrongful act or omission; – Damage or injury caused to another; – Causal relation between such negligence or fault and damage; and – No pre-existing contractual relationship between parties (NCC, Art. 2176). Classification of Obligations Creation – Legal – imposed by law – Conventional – by agreement of parties Nature – Personal – to do, not to do – Real – to give Object – Determinate/Specific – particularly or physically designated – Generic – merely by its class or genus – Limited generic – generic objects confined to a particularly class or source Performance – Positive – to give, to do – Negative – not to do Person obliged – Unilateral – only one party is bound – Bilateral – both parties are bound. Existence of burden or condition – Pure – not burdened by any condition or term; immediately demandable – Conditional – subject to a condition which may be suspensive or resolutory. Classification of Obligations Character of responsibility or liability – Joint: each debtor is liable only for a part of the whole liability and to each creditor shall belong only a part of the correlative rights – Solidary: debtor is answerable for the whole of the obligation without prejudice to his right to collect from his co-debtors the latter’s shares in the obligation Susceptibility of partial fulfillment – Divisible – obligation is susceptible of partial performance – Indivisible - obligation is not susceptible of partial performance Right to choose and substitution – Alternative – obligor may choose to completely perform one out of several prestations 4|P age Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. – Facultative – only one prestation has been agreed upon, but the obligor may render one in substitution of the first one Imposition of penalty – Simple – there is no penalty imposed for violation of the terms thereof – Obligations with a penal clause – obligation which imposes a penalty for violation of the terms thereof Sanction – Civil – gives a right of action to compel their performance – Natural – not based on positive law but on equity and natural law; does not grant a right of action to enforce their performance Specific v. Generic Duties of debtor in obligation to give a determinate thing – Preserve the thing – Deliver the fruits of the thing – Deliver the accessions and accessories – Deliver the thing itself (e.g., particular brand) – Answer for damages in case of non-fulfillment or breach Diligence required – Depending on agreement of parties, on the nature of the obligation and corresponds with the circumstances of the person, of the time, and of the place; and – Diligence of a good father of the family. Duties of debtor in obligation to give a generic thing – To deliver a thing which is of the quality intended (no particular brand) by parties taking into consideration the purpose of the obligation and other circumstances; and – To be liable for damages in case of fraud, negligence, or delay, in the performance of his obligation, or contravention of the tenor thereof. Fruits Kinds of fruits – Natural – Industrial – Civil Right of creditor to the fruits – The creditor is entitled to the fruits of the thing to be delivered from the time the obligation to make delivery arises. When obligation to deliver fruits arises – GR: the obligation to deliver the thing due and, consequently, the fruits thereof, if any, arises from the time of the perfection of the contract – If the obligation is subject to a suspensive condition or period, it arises upon the fulfillment of the condition or arrival of the term. 5|P age Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. – In a contract of sale, the obligation arises from the perfection of the contract even if the obligation is subject to a suspensive condition or a suspensive period where the price has been paid. – In obligations to give arising from law, quasi-contract, delict, quasi-delicts, the time of performance is determined by the specific provisions of law applicable. Accessions v. Accessories Accessions – fruits of a thing or additions to or improvements upon a thing Accessories – thing joined to or included with the principal thing for the latter’s embellishment, better use, or completion. Right of creditor to accessions and accessories – GR: all accession and accessories are considered included in the obligation to deliver a determinate thing although they may not have been mentioned. (Accessory follows the principal) – XPN: if exclusion is stipulated. Breaches of Obligations Forms of breach of obligations – Voluntary – debtor is liable for damages if he is guilty of: • Default (mora) • Fraud (dolo) • Negligence (culpa) • Breach through contravention of the tenor thereof (NCC, Art. 1170) – Involuntary – debtor is unable to perform the obligation due to fortuitous event thus not liable for damages Effects of breach of obligation – If a person obliged to do something fails to do it, or if he does it in contravention of the tenor of the obligation or what has been poorly done be undone, the same shall be executed at his cost (NCC, Art. 1167) – When the obligation consists in not doing and the obligor does what has been forbidden him, it shall also be undone at his expense (NCC, Art. 1168). Delay (Mora) Those obliged to deliver or to do something incur in delay from the time the obligee (creditor) judicially or extrajudicially demands from them the fulfillment of their obligations. In reciprocal obligations, neither party incurs in delay if the other does not comply or is not ready to comply in a proper manner with what is incumbent upon him. From the moment one of the parties fulfills his obligations, delay by the other begins (NCC, Art. 1169) Kinds of delay – Ordinary delay – mere failure to perform an obligation at the stipulated time – Extraordinary or legal delay – equates to non-fulfillment of the obligation and arises after the extrajudicial or judicial demand has been made upon the debtor 6|P age Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. Kinds of Legal Delay or Default – Mora solvendi – default on the part of the debtor/obligor – Mora accipiendi – default on the part of the creditor/obligee – Compensatio morae – default on the part of both the debtor and creditor in reciprocal obligations. Mora Solvendi Requisites: – Obligation pertains to the debtor; – Obligation is determinable, due and demandable, and liquidated – Obligation has not been performed on its date; – There is judicial or extrajudicial demand by the creditor; and – Failure of the debtor to comply with such demand. GR: Demand is necessary. Thus, no demand, no delay. Exceptions: – The obligation or the law expressly so declares; or – From the nature and the circumstances of the obligation it appears that the designation of time when the thing is to be delivered or the service is to be rendered was a controlling motive for the establishment of the contract; (e.g. wedding gown has to be ready before the wedding) or – Demand would be useless, as when the obligor has rendered it beyond his power to perform. [NCC, Art. 1169 (2)] Effects of Mora Solvendi: – Debtor may be liable for damages or interests; and – When the obligation has for its object a determinate thing, the debtor may bear the risk of loss of the thing even if the loss is due to fortuitous event; – Rescission or resolution. The creditor incurs in delay when debtor tender’s payment or performance, but the creditor refuses to accept it without just cause. Mora Accipiendi Requisites: – Offer of performance by the capacitated debtor; – Offer must be to comply with the prestation as it should be performed; and – Refusal of the creditor without just cause Effects of Mora Accipiendi – Responsibility of debtor is limited to fraud and gross negligence; – Debtor is exempted from risk of loss of thing, creditor bears risk of loss; – Expenses by debtor for preservation of thing after delay is chargeable to creditor; – If the obligation bears interest, debtor does not have to pay it from time of delay; – Creditor liable for damages; and – Debtor may relieve himself of obligation by consigning the thing. 7|P age Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. Delay on both sides in reciprocal obligations, cancel each other out. Compensation Morae Requisites: – Offer of performance by the capacitated debtor; – Offer must be to comply with the prestation as it should be performed; and – Refusal of the creditor without just cause. Rules on Compensatio Morae Time of delay XPNs: Unilateral Obligations Reciprocal Obligations Default or delay begins from extrajudicial or judicial demand – mere expiration of the period fixed is not enough in order that the debtor may incur delay. Delay by the other party begins from the moment one of the parties fulfills his obligation. 1. The obligation or the law expressly so dictates; 2. Time is of the essence; 3. Demand would be useless, as debtor has rendered it beyond his power to perform; or 4. Debtor has acknowledged that he is in default. When different dates for the performance of the obligation is fixed by the parties. Fraud (Deceit or Dolo) As used in Art. 1170, it is the deliberate or intentional evasion of the normal fulfillment of an obligation. Effects of Fraud – Creditor may insist on proper substitute or specific performance – Rescission or resolution (Art. 1191) – Damages in either case. 8|P age Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. Incidental Fraud (dolo incidente) Causal Fraud (dolo causante) Art. 1170 Art. 1338 Committed in the performance of an obligation already existing because of the contract Fraud employed in the execution of a contract, which vitiates consent. S obliged himself to deliver to B 20 bottles of wine, of a particular brand. S delivered 20 bottles knowing that they contain cheaper wine. B bought the 20 bottles of wine on the false representation of S that the wine is that as represented by the labels. (without this fraud, B would not have given his consent to the contract.) Remedy: claim damages Remedy: annulment of contract Waiver of action for future fraud – A waiver of an action for future fraud is void (no effect, as if there is no waiver) as being against the law and public policy. – A contrary rule would encourage the perpetration of fraud because the obligor knows that even if he should commit fraud, he would not be liable for it, thus making the obligation illusory. Waiver of action for past fraud – A waiver of an action for past fraud is valid – A past fraud can be subject of a valid waiver because the waiver can be considered as an act of generosity and magnanimity on the part of the party who is the victim of the fraud. – Here, what is renounced is the effect of the fraud, that is, the right to indemnity of the party entitled thereto. Negligence Negligence – any voluntary act or omission, there being no malice, which prevents the normal fulfillment of an obligation; it is the absence of due diligence Like fraud, negligence results in improper performance. But unlike fraud which is characterized by malice, negligence is characterized by lack of care “Lack of care” – lack of due diligence or the care of a good father of the family under Art. 1163 9|P age Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. Effects of Negligence – Creditor may insist on proper substitute or specific performance (Art. 1233) – Rescission or resolution (Art. 1191) – Damages in either case (Art. 1170) Example: a taxi runs into an accident as a result of entering a one-way street. Responsibility arising from negligence demandable – in the performance of every kind of obligation, the debtor is also liable for damages resulting from his negligence. Kinds of negligence according to source of obligation – Contractual negligence (culpa contractual) – negligence arising from contracts resulting in their breach. This kind of negligence is not a source of obligation. It merely makes the debtor liable for damages in view of his negligence in the fulfillment of a pre-existing obligation. (Passenger vs. Operator/owner only) – Civil negligence (culpa aquiliana) – negligence which by itself is the source of an obligation between the parties not so related before by any pre-existing contract. It is also called tort or quasi-delict. (Passenger vs. Driver and Operator). – Criminal negligence (culpa criminal) – negligence resulting in the commission of a crime. The same negligent act causing damages may produce civil liability arising from a crime under Art. 100 of the RPC, or create an action for quasi-delict under Art. 2176. (Passenger vs. Driver only). Contravention of the terms of obligation: This is the violation of the terms and conditions stipulated in the obligation. The contravention must not be due to a fortuitous event or force majeure. Fortuitous event Fortuitous event – any event which cannot be foreseen, or which, though forseen, is inevitable. Kinds of fortuitous events: – Ordinary fortuitous events – those events which are common and which the contracting parties could reasonably foresee (e.g. rain) – Extra-ordinary fortuitous events – those events which are uncommon and which the contracting parties could not have reasonably foreseen (e.g. earthquake, fire, war) Requisites of a fortuitous event: – The event must be independent of the human will or at least of the debtor’s will – The event could not be foreseen, or if foreseen, is inevitable – The event must be of such a character as to render it impossible for the debtor to comply with his obligation in a normal manner – The debtor must be free from any participation in, or the aggravation of, the injury to the creditor, that is, there is no concurrent negligence on his part. 10 | P a g e Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. Fortuitous events GR: a person is NOT responsible for loss or danage caused to another resulting from fortuitous events. His obligation is EXTINGUISHED. Exceptions: – When expressly specified by law o The debtor is guilty of fraud, negligence, or delay, or contravention of the tenor of the obligation. (e.g. S is obliged to deliver a horse to B on August 10. S did not deliver the horse on said date. If, on August 11, the horse died because it was hit by lightning, S is not liable IF NO DEMAND was made by B. his obligation is extinguished. If the horse died AFTER A DEMAND WAS MADE by B, S is liable for damages because he is guilty of delay) o The debtor has promised to deliver the same (specific) thing to two or more persons who do not have the same interest. (e.g. If S promised to deliver the same car to B and C separately, S is liable even for a fortuitous event.) o The obligation to deliver a specific thing arises from a crime. (e.g. S stole a carabao of B. S has the obligation, arising from the crime, to return the carabao. Even if the carabao dies or is lost through a fortuitous event, S is still liable for damages unless B is in mora accipiendi) o The thing to be delivered is generic. (e.g. loss of the thing such as rice or corn does not extinguish an obligation). Exceptions: – When declared by stipulation (basis: freedom of contract) – When the nature of the obligation requires assumption of risk (e.g. B insured his house against fire for P100,000 with C, an insurance company. Later, the house was destroyed by accidental fire. Although the cause of the loss is fortuitous event, B may recover the amount of the policy). Kinds of Obligations Pure and Conditional Obligations Pure obligation – not subject to any condition and no specific date is mentioned for its fulfillment and is, therefore, immediately demandable Conditional obligation – one whose consequences are subject in one way or another to the fulfillment of a condition CONDITION – future and uncertain event, upon the happening of which, the effectivity or extinguishment of an obligation (or right) subject to it depends. Two principal kinds of condition: – Suspensive condition – one the fulfillment of which will GIVE RISE to an obligation; the demandability of the obligation is suspended until the happening of the uncertain event which constitutes the condition; (e.g. I will give you my car if you pass the board exam.) 11 | P a g e Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. – Resolutory condition – one the fulfillment of which will EXTINGUISH an obligation (e.g. I will let you use my car until you pass the board exam.) Conditional Obligation Classification of conditions: As to effect: – Suspensive – the happening of which gives rise to the obligation; the demandability of the obligation is suspended until the happening of the condition. – Resolutory –the happening of which extinguishes the obligation; the obligation is demandable at once but it shall be extinguished upon the happening As to possibility: – Possible – condition is capable of fulfillment, legally and physically – Impossible – condition is not capable of fulfillment, legally or physically o Physically impossible conditions – when they, in the nature of things, cannot exist or cannot be done – “I will pay you P1,000.00 if it will not rain for one year in the Philippines” – “I will pay you P1,000.00 if you can carry twenty cavans of palay in your shoulders” o Legally impossible conditions – when they are contrary to law, morals, good customs, public order, or public policy – “I will give you P1,000,000.00 if you kill X” (against the law) – “I will give you P1,000,000.00 if you will be my common-law wife” (against morals) – “I will give you P1,000,000.00 if you slap your father” (against good customs) – “I will give you P1,000,000.00 if you advocate to overthrow the government” (against public order) – “I will give you P1,000,000.00 if you will not appear as witness in a criminal case against me” (against public policy). As to form: – Express – condition is clearly stated – Implied – condition is merely inferred As to mode: – Positive – condition consists in the performance of an act – Negative – condition consists in the omission of an act As to numbers: – Conjunctive– there are several conditions and all must be fulfilled; – Disjunctive –there are several conditions and only one or some of them must be fulfilled 12 | P a g e Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. As to divisibility: – Divisible – condition is susceptible of partial performance o “I will give you a car if you finish your law course and P1,000,000.000 if you top the Bar” – Indivisible – condition is not susceptible of partial performance o “I will give you a car if you finish your law course and top the Bar” (Both conditions must be complied) As to cause or origin: – Potestative – condition depends upon the will of one of the contracting parties o Potestative on the part of the debtor: ✓ If suspensive – the obligation is VOID; “D is to give C a car if D goes to Baguio” ✓ If resolutory – the obligation is VALID; “D is to allow the use of his car by C until D returns from Baguio” o Potestative on the part of the creditor: ✓ The obligation is VALID whether the condition is suspensive or resolutory. “D is to give C a car if D goes to Baguio”, “D is to allow the use of his car by C until D returns from Baguio” – Casual – condition depends upon chance or upon the will of a third person; “D is to give C P1,000,000.00 if D wins the lotto”, “D is to give C P1,000,000.00 if X goes to Baguio” – Mixed - condition depends partly upon chance and partly upon the will of a third person; “D is to give C P1,000,000.00 if C will marry X”. Rules in case of loss, deterioration or improvement of determinate thing before the fulfillment of the suspensive condition Loss of the thing – Without debtor’s fault – obligation is extinguished – With debtor’s fault – debtor is obliged to pay damages Example: D is to give C his only ring if C passes the CPA Board examination. If the ring is lost without the fault of D beofre C passes the Board, the obligation is extinguished even if C thereafter passes the Board. However, if the ring is lost through D’s fault, he is to pay damages should C pass the Board. • Deterioration of the thing – Without debtor’s fault – impairment shall be borne by the creditor; no liability on the part of the debtor to pay damages – With debtor’s fault – creditor may choose between (a) rescission plus damages or (b) fulfillment plus damages Example: D is to give C a specific car if C passes the CPA Board examination. If the car deteriorated due to wear and tear before C passes the Board, the deterioration will be borne 13 | P a g e Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. by C when he later passes the Board. However, if the car is damaged due to D’s fault and C later passes the Board, C may choose to rescind the contract and ask for damages, or ask D to still deliver the car in its deteriorated condition plus damages. • Impprovement of the thing – By nature or by time – the improvement shall inure to the benefit of the creditor – At the expense of the debtor – the debtor will have the rights granted to a usufructuary; he can have the enjoyment of the use of the improved thing and its fruits; he may remove the improvement if no damage is caused to the principal thing. If the improvement cannot be removed without causing damage to the principal, the thing and the improvement shall be delivered to the creditor without any right on the part of the debtor to indemnity. He may, however, set off the improvements against any damage. Obligations with a Period One whose demandability or extinguishment is subjected to the expiration of the term which must necessarily come. In other words, there is a day certain when the obligation will arise or cease. A future and certain event upon the arrival of which the obligation subject to it either arises or is extinguished Kinds of period o Ex die – a period with suspended effect. The obligation becomes demandable upon the lapse of the period. “D is to give C his car on May 1, 2021” o In diem – a period with a resolutory effect. The obligation is demandable at once but is extinguished upon the lapse of the period. “D allowed C to use his car until May 1, 2021” o Legal – a period that is fixed by law o Voluntary – fixed by the parties o Judicial – fixed by the court Alternative Obligations v. Facultative Obligations Alternative Obligations Facultative Obligations Several prestations are due, but the performance of one is sufficient to extinguish the debt. Only one prestation, the principal obligation, is due. Example: D is obliged to give a specific ring, a specific watch, or a specific bracelet to C. the delivery of any of the three articles will extinguish the obligation. Example: D is obliged to give a specific ring to C with the agreement that D may deliver a specific watch as a substitute. 14 | P a g e Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. If there are void prestations, the other may still be valid, hence, the obligation remains. If the principal obligation is void, the debtor is not required to give the substitute. The right of choice is with the debtor, unless expressly given to the creditor. The right of choice belongs to the debtor only. If all prestations are impossible except one, that which is possible must still be given. If the principal obligation is impossible, the debtor is not required to give the substitute. Joint Obligations v. Solidary Obligations. Joint Obligations Solidary Obligations Each debtor is liable only for a proportionate part of the credit, and each creditor is entitled only to a proportionate part of the credit. Each debtor is liable for the whole obligation, and each creditor is entitled to demand payment of the whole obligation. Example: A and B are indebted to X for P10,000.00. A is liable only for P5,000.00; B is liable only for P5,000.00. Example: A and B are solidary debtors, are indebted to X for P10,000.00. X can demand payment of P10,000.00 from either A or B. if A pays X P10,000.00, the obligation is extinguished. A can demand reimbursement of P5,000.00 from B representing the latter’s share in the debt. Other terms: Proprtionately, Pro rata, Mancomunada, Mancomunada simple Other terms: Jointly and severally, Individually and collectively, In solidum, Macomunada solidaria, Juntos o separadamente Rule: if there is a concurrence of two or more debtors and/or two or more creditors in one and the same obligation GR: the obligation is presumed to be joint XPNs: – When the obligation expressly so states – When the law requires solidarity (Example: where the instrument containing the word “I promise to pay” is signed by two or more persons, they are deemed to be jointly and severally liable thereon.) – When the nature of the obligation requires solidarity (Example: AA, a security guard of BC Partnership, was killed in line of duty. The heirs of AA demanded compensation under Workmen’s Compensation Law for the whole amount from B. B claimed that he should only be liable for one-half thereof, and the other half to be shouldered by C, the other partner. The court ruled that the 15 | P a g e Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. partners’ liability is solidary since the nature of the obligation requires solidarity. The evident intention of WCL is to give full protection to workers.) Extinguishment of Obligations Payment – means not only the delivery of money but also the performance, in any other manner, of an obligation How must the payment be made 1. There must be delivery of the thing or rendition of the service that was contemplated a. The debtor of a thing cannot compel the creditor to accept a different one although the latter may be of the same value as, or more valuable than that which is due. b. In obligation to do or not to do, an act or forbearance cannot be substituted by another act or forbearance against the obligee’s will. c. In obligations to give a generic thing whose quality and circumstances have not been stated, the creditor cannot demand a thing of superior quality. Neither can the debtor deliver a thing of inferior quality. d. If the obligation is monetary obligation, the payment must be in legal tender. 2. The payment or performance must be complete. Exceptions: a. If the obligation has been substantially performed in good faith, the obligor may recover as though there had been strict and complete fulfillment, less damages suffered by the obligee; b. When the obligee accepts the performance knowing its incompleteness or irregularity, and without expressing any protest or objection, the obligation is deemed fully complied with. Who must make the payment? Payment must be made by the debtor who must possess the following: 1. Free disposal of the thing due (property delivered should not be subject to any claim by encumbrances in favor of third persons) 2. Capacity to alienate the thing (debtor must be capable of giving consent) Payment by a third person – creditor is not bound to accept payment or performance by a third person except: 1. When there is a stipulation to that effect 2. When the third person has an interest in the fulfillment of the obligation such as a guarantor or a co-debtor Rights of a third person who makes the payment 1. Payment with knowledge and consent of the debtor a. Right to reimbursement b. Right to subrogation 2. Payment without the knowledge or against the will of the debtor a. He can recover only insofar as the payment has been beneficial to the debtor. He is not entitled to subrogation. 16 | P a g e Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. To whom shall payment be made 1. To the creditor 2. To the creditor’s successors in interest Payment to an incapacitated person – NOT valid, except: 1. If he kept the thing delivered (e.g. Debt of P10,000.00 was paid to C who became insane. C kept P4,000.00 and threw away the rest. The payment is valid only up to P4,000.00) 2. Insofar as the payment has been beneficial to him (e.g. C used only P3,000.00 to buy his food and lost the remaining balance. The payment is valid only up to P3,000.00, the amount beneficial to him) Payment to unauthorized person – NOT valid, except 1. If the payment has redounded to the benefit of the creditor 2. If the payment is made in good faith to a third person in possession of the credit Where payment must be made 1. Place stipulated 2. If there is no stipulation a. If the obligation is to give a determinate thing, wherever the thing might be at the time the obligation was constituted b. If the obligation is to give a generic thing or an obligation to do, then at the domicile of the debtor. Special forms of payment 1. Dacion in payment (Dacion en pago) 2. Payment by cession 3. Application of payment 4. Tender of payment and consignation Dacion in payment Payment by cession Ownership of property is transferred to his creditor to pay a debt in money (property is given as payment in lieu of money) Abandonment or assignment by the debtor of all his property in favor of his creditors so that the latter may sell them and recover their claims out of the proceeds Plurality of creditors in not required There must be two or more creditors The debtor may not be insolvent The debtor is insolvent Does not affect all the debtor’s properties Affects all the debtor’s properties, except those exempts from execution. 17 | P a g e Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. The creditor becomes the owner of the properties given as payment The creditors are authorized to sell only the debtor’s properties The debtor is released as a rule The debtor is not released as a rule Application of Payment – the designation of the debt to which payment shall be applied when the debtor owes several debts in favor or the same creditor Requisites of application of payment 1. There must be two or more debts 2. The debts must be of the same kind 3. The debts are owned by the same debtor to the same creditor 4. All debts are due, except: a. When the parties have stipulated that payment may be applied to a debt not yet due, or b. When the application is made by the party for whose benefit the term has been constituted How application is made 1. The debtor who is given the preferential right to apply the payment designates the debt to be paid 2. If the debtor does not make the designation, the creditor makes it by indicating the debt being paid in his credit 3. If neither the debtor nor creditor makes the designation, or application cannot be inferred from the circumstances, payment shall be applied by operation of law as follows: a. Payment shall be applied to the debt, among those due, which is the most onerous to the debtor b. If the debts are of the same nature and burden, payment shall be applied to all due debts proportionately. Tender of payment and consignation Tender of payment – the act of the debtor of offerering to his creditor what is due him. Consignation – the act of depositing the sum or thing due with the judicial authorities whenever the creditor refuses without just cause to accept the same, or in cases when the creditor cannot accept it. Requisites for tender of payment and consignation to extinguish the obligation a. There must be a valid tender of payment (the payment being tendered must be the thing contemplated, in legal tender, complete, among other requisites for a valid payment); b. The creditor refuses without just cause to receive the payment; c. The persons interested in the fulfillment of the obligation must be notified by the debtor of his intention to deposit the sum or thing due with the judicial authorities; 18 | P a g e Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. d. The sum or thing due is deposited with judicial authorites; and e. The persons interested in the fulfillment of the obligation must again be notified by the debtor that the consignation has been made (without this subsequent notice, the consignation is void). Effect of consignation duly made – if the consignation has been duly made, the debtor may ask the judge to order the cancellation of the obligation When consignation, without a previous tender of payment, will produce the same effect 1. When the creditor is absent or unknown or does not appear at the place of payment 2. When he is uncapacitated to receive the payment at the time is due 3. When, without just cause, he refuses to give a receipt 4. When two or more persons claim the same right to collect 5. When the title of the obligation has been lost Loss of the thing due Loss, concept – a thing is considered lost when it perishes, or goes out commerce, or diappears in such a way that its existence is unknown or cannot be reccovered (Art. 1189, par. 2). It includes physical or legal impossibility of the service in which the obligation consists. Effect of loss on the obligation Loss of a determinate thing GR: Obligation is extinguished XPNs: 1. When loss is due to the fault of the debtor; 2. When the debtor has incurred in delay; 3. When so provided by law (e.g. when the debtor has promised to deliver the same thing to two or more persons who do not have the same interest) 4. When it is stipulated by parties; 5. When the nature of the obligation requires assumption of risk; 6. When the debt proceeds from a criminal offense. Loss of a generic thing GR: Obligation is NOT extinguished XPN: In the case of a “delimited generic thing”, such as “100 cavans of rice from my harvest this year” when such harvest is completely destroyed Loss in personal obligations 1. When the prestation becomes legally or physically impossible without the fault of the debtor, the obligation is EXTINGUISHED. 2. When the service has become so difficult as to be manifestly beyond the contemplation of the parties, the obligor may also be released in whole or in part. 19 | P a g e Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. Condonation Condonation or remission, concept – the gratuitous abandonment by the creditor of his right; the forgiveness of an indebtedness; to extinguish the obligation, it requires the debtor’s consent Remission involving immovable property – remission and acceptance must be in a public instrument; Remission involving movable property 1. If the value of the property exceeds P5,000.00, the remission and acceptance must be in writing (public or private) 2. If the value of the property is P5,000.00 and below, the remission and the acceptance may be in any form (e.g. oral or in writing, public or private); the remission however, if made orally, requires simultaneous delivery of the thing or document representing the right remitted. Effect of Remission of Principal Obligation on the Accessory Obligation and vice-versa 1. The remission of the principal debt extinguishes the accessory obligation (accessory follows the principal rule) 2. The remission of the accessory obligation does not carry with it that of the principal debt. Confusion or Merger Confusion or Merger, concept – the meeting in one person of the qualities or the cahracteristics of creditor and debtor Effect of merger when there is a guarantor 1. Merger which takes place in the principal debtor or creditor benefits the guarantors. Here, both the principal obligation and the guaranty are extingusihed 2. Merger which takes place in the person of the guarantor does NOT extinguish the obligation. Here, only the guaranty is extinguished. Merger in a joint obligation – extinguishes only the share of the joint debtor or creditor in whom the characters of debtor or creditor concur Merger in a solidary obligation – extinguishes the whole obligation. Compensation/Novation Compensation, concept – two or more persons, in their own right, are debtors and creditors of each other. Novation, concept – the modification or extinguishment of an obligation by another, either by changing the object or principal condition (e.g. D owes C P10,000.00. Later they agree that D should give instead a ring to C), substituting the person of the debtor, (parties agree that T shll take the place of D as debtor) or subrogating a third person in the rights of the creditor (parties later agree that X shall take the place of C as the new creditor. Novation serves two functions – to extinguish an existing obligation, to substitute a new one in its place 20 | P a g e Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. Requisites of Novation 1. There must be a previous valid obligation; 2. There must be an agreement between the parties to modify or extinguish the obligation; 3. There must be the extinguishment of the old obligation; 4. There must be validity of the new obligation. Effect if new obligation is void – novation is void. In such a case, the original one shall subsist, unless the parties intended that the former relation will be extinguished in any event. Effect if original obligation is void – novation is void. If the original obligation is void, there is no obligation to extinguish since it is non-existent. Effect if original obligation is voidable – novation is valid provided that annulment may be claimed only by the debtor or when ratification extinguishes acts which are voidable. The novation here cures whatever defects present in the original obligation. Effect if original obligation is subject to a suspensive or resolutory condition – the new obligation shall be subject to the same condition unless otherwise stipulated by the parties (Art. 1299). Kinds of Novation 1. According to object or purpose A. Real or objective – novation by changing the object or principal condition (Art. 1291) B. Personal or subjective – novation by change of the parties (debtor or creditor) I. Substituting the person of the DEBTOR (always with the creditor’s consent) a. Expromission – here, third person initiates the substitution and assumes the obligation even without knowledge or against the will of the debtor i. Rights of the new debtor if he makes payment – if the substitution was without the knowledge or against the will of the original debtor, the new debtor can only recover insofar as the payment has been beneficial to the debtor. ii. Effect if new debtor is insolvent or does not fulfill obligation – the new debtor’s insolvency or nonfulfillment of the obligation shall not give rise to any liability on the part of the original debtor. (Art. 1294) The original debtor is released from liability. b. Delegacion – here, it is the debtor who initiates the substitution, which requires the consent of all parties (original debtor, creditor, new debtor) 21 | P a g e Notes in Regulatory Framework in Business Transactions (RFBT) Prepared by: Dominador B. Billones III, BS Accountancy Disclaimer: The whole contents of this material were grasp from the excerpt of the books. This is limited to, in so far as for educational purposes. Moreover, the contents of this material are protected by the Fair Use guidelines mentioned in the R.A. 8293, otherwise known as Intellectual Property Code of the Philippines. All rights reserved to the copyright owners. i. ii. Rights of the new debtor if he makes payment – he can recover what he has paid and is entitled to subrogation. (Arts. 1236, 1237, and 1293) Effect if new debtor is insolvent or does not fulfill obligation – the creditor’s right right to proceed against the original debtor is not revived, except: 1) When the insolvency of the new debtor was already existing and of public knowledge when the original debtor delegated his debt; 2) When the insolvency of the new debtor was already existing and known to the original debtor at the time he delegated his debt II. Subrogating a third person in the rights of the creditor. Subrogation transfers to the person subrogated the credit with all the rights appertaining thereto, either against the debtor or against third persons, be they guarantors or possessors of mortgages, subject to stipulation in conventional subrogation. Kinds of subrogation a. Conventional subrogation – change of creditor by the agreement of the parties (the original parties and the new creditor) b. Legal subrogation – subrogation by operation of law. It is presumed that there is legal subrogation in the following cases: i. When a creditor pays another creditor who is preferred, even without the debtor’s knowledge. ii. When a third person, not interested in the obligation, pays with the express or tacit approval of the debtor. iii. When, even without the knowledge of the debtor, a person interested in the fulfillment of the obligation pays, without prejudice to the effects of confusion as to the latter’s share. B. Mixed – change of object and parties to the obligation. (e.g. D owes C P50,000.00. Later, the aprties agree that a ring will be used to pay the debt with X making the payment. ◼ To be continued… 22 | P a g e