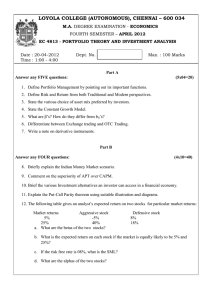

Chapter 1 An Introduction to Asset Pricing Models 3 ABSTRACT This chapter provides a brief overview of asset pricing models, with an emphasis on those models that are widely used to describe the returns of traded financial securities. Here, we focus on various models of stock returns and fixed-income returns, and discuss the reasoning and assumptions that underlie the structure of each of these models. 1.1 HISTORICAL ASSET PRICING MODELS Individuals are born with a sense of the perils of risk, and they develop mental adjustments to penalize opportunities that involve more risk.1 For example, farmers do not plant corn, which requires a great deal of rainfall (which may or may not happen), unless the expected price of corn at harvest time is sufficiently high. Currency traders will not take a long position in the Thai baht and short the U.S. dollar unless they expect the baht to appreciate sufficiently. In essence, the farmer and the currency trader are each applying a “personal discount rate” to the expected return of planting corn or investing in baht. The farmer’s discount rate depends on his assessment of the risk of rainfall (which greatly affects his total corn crop output) and the risk of a price change in the crop. The currency trader’s discount rate depends on the relative economic health of Thailand and the U.S., and any potential government intervention against currency 1 Gibson and Walk (1960) performed a famous experiment that was designed to test for depth perception possessed by infants as young as six months old. Infants were unwilling to crawl on a transparent glass plate that was placed over a several-foot drop, proving that they possessed depth perception at a very early age. Another inference which can be drawn from this experiment is that infants already perceive physical risks and exhibit risk-averse behavior at a very early age (probably before they are environmentally taught to avoid risk). Performance Evaluation and Attribution of Security Portfolios. http://dx.doi.org/10.1016/B978-0-08-092652-0.00001-7 © 2013 Elsevier Inc. All rights reserved. For End-of-chapter Questions: © 2012. CFA Institute, Reproduced and republished with permission from CFA Institute. All rights reserved. Keywords Asset Pricing Models, CAPM, Factor Models, Fama French three-factor model, Carhart four-factor model, DGTW stock characteristics model, Estimating beta, Expected return and risk. 4 CHAPTER 1 An Introduction to Asset Pricing Models speculation—both of which may carry large risks. Both economic agents” discount rates also depend on their personal aversion to risk, and, thus, may require very different compensations to take similar risks.2, 3 Markowitz Asset managers and investors also understand that some securities are less certain in their payouts than others, and make adjustments to their investment plans accordingly. Short-maturity bank certificates of deposit (CDs), while paying a very low annual interest rate, are attractive because they return the principal fairly quickly and guarantee (with insurance) a particular rate-of-return. ten Stocks, in that they will pay the next quarterly dividend, provide withone not even a promise much higher returns than CDs, on average. In general, greater levels of risk in a security or security portfolio—especially those risks that cannot be inexpensively insured—require compensation by risk-averse investors in the form of higher potential future returns. The most basic approach to an “asset pricing model” that describes the compensation to investors for risk-taking simply ranks securities by the standard deviation of their periodic (say, monthly) returns, then conjectures a particular functional relation between this risk and the expected (average future) returns of securities.4 But, should the relation be linear or non-linear between standard deviation and expected return? Should there be any credit given to securities that have counter-cyclical risk patterns (i.e., high returns during recessions)? How can we account for offsetting risk patterns between a group of securities, even .w.to within a bull market (e.g., technology vs. utility stocks)? Should risk that can be diversified by holding many different investments be rewarded? These questions are the focus of modern asset pricing theory. The foundations of modern asset pricing models attempt to combine a few very basic and simple axioms that appear to hold in society, including the following. First, that investors prefer more wealth to less wealth. Second, that investors dislike risk in the payouts from securities because they prefer smooth patterns of consumption of their wealth, and not “feast or famine” periods of time. And, third, that investors should not be rewarded with extra return for taking on risk that could be avoided through a smart and costless approach to mixing assets. Our next sections briefly describe the most widely used asset pricing models of today. In discussing these models, we focus on their application to describe the 2 The History of personal risk notion of creating a personal “price of risk”, or a required expected reward for taking on a unit of risk, has its mathematical origins at least as long ago as 1738, when Daniel Bernoulli defined the systematic process by which individuals make choices, and, in 1809, when Gauss discovered the normal distribution. For an excellent discussion of the historical origins and development of concepts of risk, see Bernstein (1996). 3 In cases where bankruptcy is possible, an economic agent may not take a risk that would otherwise be attractive—if credit is not available to forestall the bankruptcy until the expected payoff from the bet. This is the essence of Shleifer and Vishny’s (1997) “limits to arbitrage” argument (which might be better referred to as “limits to risky arbitrage”). 4 An asset pricing model estimates the future required expected return that must be offered by a security or portfolio with certain observable characteristics, such as perceived future return volatility. 1.2 The Beginning of Modern Asset Pricing Models 5 evolution of returns for liquid securities—chiefly, stocks and bonds.5 However, the usefulness of these models—with some modifications—goes far beyond stocks and bonds to other securities, such as derivatives and less liquid assets such as private equity and real estate. 1.2 THE BEGINNING OF MODERN ASSET PRICING MODELS A great deal of work has been done, over the past 60 years, to advance the ability of statistical models to explain the returns on securities. Building on Markowitz’s (1952) seminal work on efficient portfolio diversification, Sharpe published his famous paper on the capital asset pricing model (CAPM) in 1964 (Sharpe, 1964).6 These two ideas shared the 1990 Nobel Prize in Economics. The CAPM says that the expected (average) future excess return, Rt, is a linear function of the systematic (or market-related) risk of a stock or portfolio, β: excessreturn E [Rt ] = β · E [RMRF t ] , (1.1) factor model single Go'M where Rt = security or portfolio return minus riskfree rate, RMRFt = market t ,RMRFt ) return minus riskfree rate, and β = cov(R var(RMRFt ) is a measure of correlation of the ere security or portfolio with the broad market portfolio.7 This relation is extremely simple and useful for relating the reward (expected return) that is required of a stock with its level of market-based risk. For instance, if market-based risk (β) is doubled, then expected return, in excess of the riskfree rate, must be doubled for the security or portfolio to be in equilibrium with the market. If T-bills pay 2%/year and a stock with a beta of one promises an average return of 7%, then a stock with a beta of two must promise an average of 12%. Sharpe’s CAPM is simple and is an equilibrium theory, but it depends on several unrealistic assumptions about the economy, including: 1. All investors have the exact same information about possible future expected earnings and their risks at each point in time. 2. Investors are risk-averse and behave perfectly rationally, meaning they do not favor one type of security nover another unless the calculated Net Present Value of the first is higher. 3. The cost of trading securities is zero. 4. Investors are mean-variance optimizers (it is sufficient, but not necessary, for this requirement that security returns are normally distributed). nnha d 5 For r.sn a general review of asset pricing theories and empirical tests of the theories, see, for example, Cochrane (2001) and Campbell et al. (1997). 6 Apparently, Bill Sharpe, a Ph.D. student in Economics at UCLA, visited Harry Markowitz at the Rand Institute in Santa Monica, California during the early 1960s to discuss Markowitz’s paper and Bill’s thoughts about an asset-pricing model. This led to Bill’s dissertation on the CAPM. 7 Note that the correlation coefficient between the excess return on a security or portfolio and the excess return on the broad market is defined as ρ = √ cov(Rt ,RMRFt ) , which is close to the definivar(Rt )·var(RMRFt ) tion of β. correlation coefficient ptyiji 6 CHAPTER 1 An Introduction to Asset Pricing Models 5Y M Unusable 5. All investors are myopic, and care only about one-period returns. 6. Investors are “price-takers”, meaning that their actions cannot influence prices of securities. 7. There are no taxes on holding or trading securities. 8. Investors can trade any amount of an asset, no matter how small or large. Several of these assumptions may not fit real-world markets, and many papers have attempted, with some—but far from complete—success in extending the CAPM to situations which eliminate one or more of these assumptions. Among these papers are Merton’s (1973) intertemporal CAPM (ICAPM), which extends the CAPM to a multiperiod model (to address #5). A good discussion of these extended CAPMs can be found in several investments textbooks, such as Elton et al. (2009). While there are many extensions of the CAPM that deal with dropping one assumption at a time, it is not at all clear that dropping several assumptions simultaneously still results in the CAPM being a good model that describes the relation of returns to risk in real financial markets. Because of this, recent work has focused on building practical models that “work” with data, even if they are not based on a particular theoretical derivation. Although many attempts have been made, with some success, at creating a new model of asset pricing, no theory has become as universally accepted as the CAPM once was. Hopefully, some future financial economist will create such a new model that reflects real financial markets well. In the meantime, we must rely on either empirical applications of the CAPM, or on other models that have no particular equilibrium theory supporting them. 1.2.1 Estimating the CAPM Model In reality, we do not know the true values of E [Rt ] , E [RMRFt ], and β, so we must estimate them somehow from data. This is where a time-series version of the CAPM (also called the Jensen model (Jensen, 1968)) can be used on return data for a security or a portfolio of securities. The time-series version of the CAPM can be written as i Rt = α + β · RMRFt + et , (1.2) while its application to real-world data can be similarly written as:8 rt = α + β · rmrft + #t , (1.3) where we estimate the parameters α (the model intercept) and β (the model slope) using historical values of Rt and RMRFt . (This model is more generally called the “single-factor model”, as it does not require that the CAPM is exactly correct to be implemented on real-world data.) A widely used method for doing this is ordinary least squares (OLS), which fits the data with estimated 8 Note that, in probability and statistics, we use upper case to denote random variables and lower case to denote realizations (outcomes) of these random variables. We will relax this in later chapters, but will use this convention in this chapter to clarify the concepts. 1.2 The Beginning of Modern Asset Pricing Models !, such that the sum of the α and β values of α and β, which are denoted as ! squared residuals from the “fitted OLS regression line” is minimized. Note that Equation (1.1) implies that α = 0. We can either impose that restricα, tion before estimating the model, or we can allow the model to estimate ! depending on our assumption about how strictly the CAPM model holds in the real world. For instance, if we believe that the CAPM model is mostly correct, but that there are temporary deviations of stocks away from the model, α , to be estimated using real data. Even if the we would allow the intercept, ! CAPM holds exactly at the beginning of each period for, say, Apple, it is easy to understand why there can be several unexpected positive surprises for Apple over a several-month period (such as the unexpected introduction of several innovative products). Such unexpected “shocks” can be captured by ! α estimate, which prevents them from affecting the precision of the β the ! estimate. In this discussion, we’ll stick with the model including an intercept 三 to accommodate such issues. After we estimate the model, we write the resulting “fitted model” as ! · E [RMRFt ] , ! α+β E [Rt ] = ! (1.4) ! · E [RMRFt+1 ] , ! E [Rt+1 ] = β (1.5) α is just a temporary deviation, and we expect it to be zero where we realize that ! in the future. Using this expectation, we can use this model to forecast future returns with: where all we need to do is to estimate one value—the expected excess return of the market portfolio of stocks, E [RMRFt+1 ]. One simple, but not very precise, method of estimating this parameter is to use the average historical values over the past T periods:9 !· ! E [Rt+1 ] = β t 1 " ! · rmrf . rmrfj = β T j=t−T Other methods of estimating E [RMRFt+1 ] include using the average return forecast from professionals, such as security analysts, or deriving forecasts from index futures or options markets. We can also estimate the risk of holding a stock or portfolio—as well as decomposing this risk into market-based and idiosyncratic risk—with this one-factor model by applying the rules of variances to Equation (1.2): V [Rt ] = β 2 · V [RMRFt ] + "# $ ! Systematic Risk 9 This V [et ] ! "# $ . Idiosyncratic(stock! or portfolio!specific) risk estimator is not precise because of the high variance of monthly values of rmrft. (1.6) 7 8 CHAPTER 1 An Introduction to Asset Pricing Models Here, we can again use the fitted regression, in conjunction with past values of RMRF and the regression residuals, !t to estimate the future total risk: o ! !2 · V [Rt+1 ] = β 1 T −1 t " $2 # rmrfj − rmrf + j=t−T t 1 " 2 "ˆj . T −1 (1.7) j=t−T Figure 1.1 and Tables 1.1 and 1.2 show an example of a fitted model using Chevron-Texaco (CVX) over the 2007–2008 period. Two approaches to fitting the model of Equation (1.3) using OLS are presented in the graph and in the tables: (1) the unrestricted model, and (2) the restricted model (where α is forced to equal zero): CVX Monthly Return, Jan 2007-Dec 2008 0.15 0.10 0.05 -0.20 -0.15 -0.10 -0.05 -0.05 Unrestricted Model Restricted Model 0.00 0.05 RMRF 0.10 ii -0.10 -0.15 IT zlnwould -0.20 FIGURE 1.1 CAPM Regression Graph for Chevron-Texaco. Table 1.1 Unrestricted Ordinary Least Squares CAPM Regression Output for Chevron-Texaco Regression Output (Unrestricted Model) Broke Intercept (α) RMRF Table 1.2 Coefficients Standard Error t Stat P-value 0.012 0.58 0.012 0.22 1.0 2.58 0.32 0.01 Restricted Ordinary Least Squares CAPM Regression Output for Chevron-Texaco Regression Output (Restricted Model, α = 0 ) Intercept (α) RMRF Coefficients Standard Error t Stat P-value 0 0.51 0.21 2.38 0.02 1.2 The Beginning of Modern Asset Pricing Models Note that, if we restrict the intercept to equal zero, we get a lower estimate of !, since we force the fitted regression line to the slope coefficient on RMRF, β pass through zero, as shown in the figure above. In most cases, it is better to allow the intercept to be estimated, since it can be non-zero by the randomness in stock returns, as illustrated by the Apple example discussed previously. Next, let’s model CVX over the following two years, 2009–2010, shown in Table 1.3. Table 1.3 Unrestricted Ordinary Least Squares CAPM Regression Output for Chevron-Texaco, 2009–2010 Regression Output (Unrestricted Model) Intercept (α) RMRF Coefficients Standard Error t Stat P-value −0.0024 0.81 0.01 0.16 −0.23 5.03 0.32 0.00005 ! have changed from their values during 2007–2008. α and β Note that both ! Does this mean that these parameters actually change quickly for individual stocks? In most cases, no—these changes are the result of “estimation error”, rne which happens when we have a very “noisy” (volatile) y-variable, such as CVX monthly returns,10 due again to randomness. Besides using the above regression output in the context of Equation (1.5) to estimate the expected (going-forward) return of CVX, we can also use the regression output to estimate risk for CVX going forward, using Equation (1.6). The results from the above two regression windows point out an important lesson to remember: individual stock betas are extremely difficult to estimate precisely, which makes the CAPM very difficult to use in modeling individual stocks. There are several ways to attempt to correct these estimated betas while still using the CAPM. One important example is a correction for stocks that respond slowly to broad stock market forces, and might have a lag in their reaction due to their illiquidity. Scholes and Williams (1977) describe an approach to correct for the betas of these stocks by adding a lagged market factor to the CAPM regression, rt = α + β̂1 · rmrft−1 + β̂2 · rmrft + #t . on 10 lag in (1.8) reaction One example of a case where these parameters could actually change quickly is when a company’s capital structure shifts dramatically, which might happen with an extreme stock return, a stock repurchase, or a large issuance of equity or bonds. Theory predicts a change in the CAPM regression slope, β, in all of these cases. 9 10 CHAPTER 1 An Introduction to Asset Pricing Models !SW ), An improved estimate of the beta of a stock, the Scholes-Williams beta (β is then computed by adding together the estimates of β1 and β2 (assuming rmrft has trivial serial correlation): !SW = β !1 + β !2 β (1.9) There are many other potential problems with estimated betas, and numerous approaches to dealing with them. However, none of these methods, many of which can be complicated to implement, fully correct for the problem of large estimation errors for individual securities, such as stocks.11 As a result, one should always be very careful about modeling an individual security. When possible, form portfolios of securities, then apply regression models. 1.3 EFFICIENT MARKETS CAPM X pricing The notion of market prices efficiently reflecting all available (public) information is likely as old as the notion of capitalism itself. Indeed, if prices swing wildly in a way that is not consistent with the (unknown) expected intrinsic value of assets, then a case can be made for government intervention. Examples of this are the two rounds of “quantitative easing” (QE1 and QE2) that were implemented during 2009 and 2010, during and shortly after the financial crisis of 2008 and 2009.12 However, there are many shades of market efficiency, from completely informationally efficient markets to markets that are only “somewhat” informationally efficient.13 In the world around us, we can easily see that many forms of information are fairly cheap to collect (such as announcements from the Federal Reserve), while many other forms are expensive (such as buying a Bloomberg terminal with all of its models). In their seminal paper, Grossman and Stiglitz (1980) argued that, in a world of costly information, informed traders must earn an excess return, or else they would have no incentive to gather and analyze information to make prices more efficient (i.e., reflective of information). That is, markets need to be “mostly but not completely efficient”, or else investors would not make the effort to assess whether prices are “fair”. If that were to happen, prices would no longer properly reflect all available and relevant information, and markets would lose their ability to allocate capital efficiently. Thus, Grossman and Stiglitz advocate that markets are likely “Grossman-Stiglitz efficient”, which mn.in nhnEnn n.nnnnnnn 11 Bayesian models can be very useful for controlling estimation error. A Bayesian prior can be based on the CAPM, or another asset pricing model that is believed to be correct. However, they depend on the researcher having some strong belief in the functional form of one of several possible asset pricing models. 12 QE1 and QE2 involved the Federal Reserve purchasing long-term government bonds from the marketplace, which is, in essence, placing more money into circulation (i.e., the Fed “printed money”). 13 Informationally efficient markets are those that instantaneously reflect new information that affects market prices, whether this information is freely available to the market or must be purchased or processed using costly means. Such markets may not perfectly know the true value of a security, which would require perfect information on the distribution of cashflows and the proper discount rate, but they use current information properly to estimate these parameters in an unbiased way. 有 if itmed太多 1.4 Studies That Attack the not educate or move themarket 11 CAPM ⼝ means that costly information is not immediately and freely reflected in prices 此 available to all investors. Indeed, the idea of Grossman-Stiglitz efficient markets is a very useful way for students to view real-world financial markets. l still rational Behavioral finance academics, such as John Campbell and Robert Shiller, have found evidence that markets do not behave “as if” investors are perfectly rational in some Adam Smith “invisible hand” sense—in fact, they believe the evidence makes the potential for efficient markets—Grossman-Stiglitz or other notions of efficiency—very improbable in many areas of financial markets. This evidence is somewhat controversial among academics, although investment practitioners worn seem to have accepted the idea of behavioral finance more completely than academics. While the field of behavioral finance has become immense, a full discussion of the literature is beyond the scope of this book.14 However, in the next section, we will discuss some research that documents return anomalies— potentially driven by investor “misbehaviors”—that are directly related to the models used to describe stock and bond returns today—so that the reader will have a better understanding of the origin of these models.15 ī 6 Greatreturn less risk 1.4 STUDIES THAT ATTACK THE CAPM Many financial economists during the 1970s attempted, with some success, to criticize the CAPM as a model that doesn’t reflect the real world of stock returns and risk. The reader should note that no one doubted that the mathematics of the CAPM were correct, given its many assumptions. Instead, the model was attacked because it did not work well in the real world of stock, bond, and other security and asset pricing, which means its assumptions were not realistic. critize CAPMdecent A few of the many famous papers are described here. Most CAPM criticisms have focused on the stock market, mostly because stock price and return data have been studied extensively by academic researchers and such data are of high-quality (i.e., from the Center for Research in Security Prices–CRSP—at the University of Chicago). First, Banz (1981) studied the returns of small capitalization stocks using the CAPM model. Banz found that a size factor (one that reflects the return difference between stocks with low equity capitalization—price times shares outstanding—and stocks with high equity capitalization) adds explanatory power for the cross-section of future stock returns above the explanatory power of market betas. He finds that average returns on small stocks are too high, even controlling for their higher betas, and that average returns on large stocks are too low, relative to the predictions of the CAPM. 14 Many contributions can be found in the articles and books of Kahneman and Tversky, Shiller, Thaler, Campbell, Barber and Odean, Lo, and several others. 15 Studies that document anomalies in other markets are much more sparse, such as anomalies in bond or futures markets. To some extent, this is due to the fact that academic researchers have devoted the majority of their time to studying stock prices (due to the high-quality data and transparent markets for stocks, as well as the broad participation of individual investors in stock markets). iii iii A i smallcap risky higher betalsyshis SML PetaandExpected Slope EIRMD.FI retu 12 CHAPTER 1 An Introduction to Asset Pricing Models Bhandari (1988) found a positive relation between financial leverage (debt to equity ratio) and the cross-section of future stock returns, even after controlling for both size and beta. Basu (1983) finds that the earnings-to-price ratio (E/P) predicts cross-sectional differences in future stock returns in models that include size and beta as explanatory variables. High E/P stocks outperform low E/P stocks. lets 吴培 cnn.me Keim (1983) finds that about 50% of the size factor return, during 1963–1979, occurs in January. Further, over 50% of the January return occurs during the first week of trading, in particular, the first trading day. And, Reinganum (1983) finds similar results, and also finds that this “January effect” does not appear to be completely explained by investor tax-loss selling in December and repurchasing in January. 1.5 DOES PROVING THE CAPM WRONG = MARKET INEFFICIENCY? OR, DO EFFICIENT MARKETS = THE CAPM IS CORRECT? Emphatically, no! This is often termed the “joint hypothesis problem”, since any empirical test of the CAPM, such as the above-cited studies, is jointly testing the validity of the model and whether violations to the model can be found. Often, students of finance believe in the CAPM so thoroughly (probably through the fault of their professors) that they equate the CAPM’s validity to the validity of efficient markets. However, there is no such tie. Markets can be perfectly efficient, and the CAPM model can simply be wrong—it’s just that it does not describe the proper risk factors in the economy. For instance, if two risk factors drive the economy, then the CAPM will not work. ThejointhypEE c.AM validity EMT validity factors o risk egyz CAPM is wrong use an expanded notion of the CAPM that has two versions: one version that is visible to everyone, and another that is visible only to the “informed investors”. if CAPM iscorrect The CAPM modeled by Sharpe, however, has no such duality—there is one marIf the CAPM is exactly correct, however, markets must be efficient—unless we Marketsmusttent ket portfolio and one beta for each security in the economy. In Sharpe’s CAPM ifCAPMis tv EMT is v Fanaand Fend world, markets are perfectly efficient, and everyone has the same information.16 1.6 SMALL CAPITALIZATION AND VALUE STOCKS In the early 1990s, Fama and French tried to settle the question of the usefulness of the CAPM in the face of all these apparent stock “anomalies”. In doing so, Fama and French (FF; 1992) declared that “beta is dead”, meaning that the CAPM was a somewhat useless model, at least for the stock market. Instead, FF promoted the use of two new factors to model the difference in returns of different stocks: the market capitalization of the stock (also called “size”) and the book-to-market ratio (BTM) of the stock—that is, the accounting book value of ⼝ equity divided by the market’s value of the equity (using the traded market price). cut 器叶 16 Dybvig and Ross (1985), Mayers and Rice (1979), and Keim and Stambaugh (1986) were among the first to expand the notion of the CAPM to one involving two types of investors, informed and uninformed. 1.6 Small Capitalization and Value Stocks FF used a clever approach to demonstate this argument. Most prior studies of the CAPM first estimate individual stock or stock portfolio betas from the one-factor regression of Equation (1.4), as we did for CVX above, then test whether these betas forecast future stock returns. FF argued that small capitalization stocks tend to have much higher betas than large capitalization stocks, so it might be that small stocks simply have higher returns than large stocks, regardless of their betas. size分成10但 1 咀 rankbyp First, FF estimated each stock’s beta with five years (60 months) of past returns, using the one-factor regression model of Equation (1.3). Then, they ranked all stocks by their market capitalization (size), from largest to smallest, then cut these ranked stocks into 10 groups. The top decile group was the group of largest stocks, while the bottom decile was the small stock group. Next, FF ranked stocks—within each of these decile groups—by the betas of the stocks that they had already computed. Then, FF took the highest 1/10th of stocks, according to their betas, from each of the 10 size deciles (that 1/10th was 1/100 of all stocks)—then, recombined these 10 “high beta” subportfolios into a high beta, mixed size portfolio. This was repeated for the 2nd highest 1/10th of stocks in each portfolio to form the “2nd highest beta” subportfolio with mixed size. And, so on, to the lowest beta 1/10th of stocks to form the “low beta” subportfolio with mixed size. Finally, FF measured the equal-weighted returns of each of these newly constructed 10 portfolios—each of which had stocks with similar betas, but mixed size—during the following 7 years. The objective was to separate the influence of size from beta by “mixing” the size of stocks with similar betas. This procedure is depicted in Figure 1.2. No Significant diff O ⼼⼼ higherreturns When FF regressed this 7-year future return, cross-sectionally, on the prior equalweighted betas of these 10 portfolios, they found no significant relation, where the CAPM’s central prediction is a strong and positive relation between betas and returns. Thus, according to FF, “beta was dead”.17 Then, FF presented evidence that not only does size work well, but so does BTM ratio; together, they both worked 17 皉 lowerreturns FIGURE 1.2 Fama-French’s “Beta is Dead” Slicing Test. In fact, to provide a more statistically powerful test, they repeated this similar beta mixed size portfolio construction at the end of each month during 1964 to 1989 to conclude that the evidence of beta being important (or “priced”) was, at best, weak. 13 啊 14 CHAPTER 1 An Introduction to Asset Pricing Models Result I well, so they appear to be measuring different risks. Finally, FF looked at the returnon-equity (ROE) of small stocks and stocks with a high BTM ratio, and found that the ROE of these stocks was quite low—indicating, perhaps, that they are under financial distress and are at risk of bankruptcy. While not proving anything, FF suggest that size and BTM may be a proxy for financial distress—small stocks with high BTM, for instance, are highly stressed—and this may underlie the usefulness of size and BTM. Simply put, investors demand higher returns for financially distressed stocks, as they are more likely to fail together during a recession. The reception of the Fama French paper was one of controversy, which still exists today. Most reseachers have admitted that Fama and French are right about what works better in the real world of stocks, but they disagree about why. FF represent one camp with their rational investor, financial distress risk economic story. Another camp believes that investors exhibit behavioral tendencies that color their choice of stocks. Underlying this economic story is the fact that individuals tend to overreact to longer-term trends in the economic fortunes of a corporation, and that they believe that the fortunes of stocks that have become less profitable over the past several years will continue to become worse—thus, they put sell pressure on small stocks and value stocks (high BTM stocks). A third camp believes that small stocks and value stocks have simply gone through a “lucky streak”, and that we should not place too much importance on the experience of U.S. stocks in the past few decades. In an attempt to further test the FF findings, Griffin (2002) studied size and book-to-market as stock return predictors in the U.S., Japan, the U.K., and p Canada. He found evidence in all four countries that size and BTM forecast stock returns, consistent with FF’s findings in U.S. stocks. However, he also found that returns correlate poorly for size and BTM across these countries, which could be evidence that they are risk-based or that they are due to irrational investor behavior—and country stock markets are segmented, preventing investors from arbitraging across differences in these factor returns across countries. 1.6.1 Momentum Stocks Notably, Fama and French did not quite find all the important factors that drive stock returns. Jegadeesh and Titman (JT; 1993) found that momentum, measured as the one year past return of a stock is an important predictive variable for the following year’s return. In fact, a simple sorting of stocks on their one-year past return, followed by an equal-weighted long position in the top 10% “winners” and a short position in the bottom 10% “losers” of last year provides an “arbitrage” profit of almost 1% per month (i.e., about 10% during the following year).18 18 It turns out that momentum, while known for decades by some practitioners and academics (e.g., Levy, 1964), was “discovered” by academics by accident. In conducting research for Grinblatt and Titman’s (1993) study of mutual fund performance, a PhD student accidently measured the return of mutual fund positions in stocks held today over the past year (rather than over the next year). The result was that most U.S. domestic equity mutual fund managers were, to some extent, holding larger share positions in last-years winners than in other stocks. Building on this finding, Grinblatt et al. (1995) found that such “momentum-investing funds’ also outperformed market indexes in the future—indicating that the stocks that they were buying also outperformed—thus, stock momentum was discovered! 1.6 Small Capitalization and Value Stocks 15 Figure 1.3 illustrates the profitability over numerous portfolios formed over the period 1965–1989. The monthly (not annualized) returns of the long-short portfolio over the 36 event months following the portfolio formation are shown first, followed by the cumulated monthly returns over the same 36 months.19 Further evidence supporting momentum in U.S. stocks was found during 1941– 1964, although not quite as strong—shown in Figure 1.4. However, JT found that the depression era did not support their “momentum theory”, and, instead, momentum stocks lost considerable money (see Figure 1.5). JT explained that momentum likely did not work during the depression era because of inconsistent monetary policy that artificially created reversals of stock returns during that time. Specifically, when the stock market dropped, the Fed eased monetary policy, and when it boomed, the Fed strongly tightened. Nevertheless, Daniel (2011) has shown, more recently, that momentum stocks outperformed during 1989–2007, but underperformed (badly) during the financial crisis of 2008–2009. long ĪTÉTÉÉ Re lative Stre ngth Portfolios in Event Time 34 31 28 25 22 19 16 13 10 7 4 0.000 months -0.005 t Re lative Stre ngth Portfolios in Event Time 34 31 28 25 t 22 19 16 13 10 7 4 o 1 0.100 0.090 0.080 0.070 0.060 0.050 0.040 0.030 0.020 0.010 0.000 -0.010 FIGURE 1.3 Monthly and Cumulative Momentum Long/Short Portfolio Returns, 1965–1989. 19 This Niort bottom lot Hedgefund 0.005 -0.010 Cumulative Return Top10 0.010 1 Monthly Return 0.015 ⼼的 ⼼ 知 ranking and formation strategy is repeated using (overlapping) windows. Specifically, a new portfolio is formed every month, giving (at any point in time) 36 simultaneous (overlapping) portfolio strategies. if they have similar CHAPTER 1 An Introduction to Asset Pricing Models Relative Strength Portfolios in Event Time 0.010 34 31 28 25 22 -0.005 -0.010 same pattern t Relative Strength Portfolios in Event Time 0.060 0.050 0.040 0.030 0.020 34 31 28 25 22 19 16 13 10 7 0.000 -0.010 4 0.010 1 Cumulative Return 19 16 13 7 4 0.000 10 0.005 1 Monthly Return 0.015 t 34 31 28 25 22 19 16 13 10 7 4 t 34 31 28 25 22 19 16 13 10 7 Relative Strength Portfolios in Event Time 4 0.000 -0.050 -0.100 -0.150 -0.200 -0.250 -0.300 -0.350 -0.400 -0.450 Relative Strength Portfolios in Event Time 1 0.010 0.005 0.000 -0.005 -0.010 -0.015 -0.020 -0.025 -0.030 -0.035 -0.040 -0.045 -0.050 1 Monthly Return FIGURE 1.4 Monthly and Cumulative Momentum Long/Short Portfolio Returns, 1941–1964. Cumulative Return 16 t FIGURE 1.5 Monthly and Cumulative Momentum Long/Short Portfolio Returns, 1927–1940. 1.7 The Asset Pricing Models of Today Further research by Rouwenhorst (1998) found that momentum exists in stocks in Europe, but not in Asia. More recent research seems to find momentum even in Japan (see Asness(2011)). Today, although the evidence is, at times, inconsistent, momentum is strong enough that most academic researchers appear to accept that it is a reality of markets. One economic explanation of momentum is that investors underreact to short-term news about companies, such as improving earnings or cashflows. Thus, a stock that rises this year has a bright future next year—again, not always, but on average.20 Finally, Griffin et al. (GMJ; 2003) examined momentum in the U.S. and 39 other countries, and found evidence that these factors work well in these markets, but that momentum across different countries is only weakly correlated. Therefore, country-level momentum factors work better in capturing momentum, rather than a global momentum factor across all countries. This finding suggests that whatever economics are at play in the risk of stocks, they work a little differently in different countries, but with the same overall result: small stocks outperform large stocks, value stocks outperform growth stocks, and momentum stocks outperform contrarian stocks (all of this is for an average year, but the reverse can occur for any single year or subset of years—such as the superior growth stock returns of the technology boom during the 1990s). Finally, GMJ found that momentum profits tend to reverse in the countries over the following one to four years. Next, we will describe models that attempt to capture the multiple sources of stock returns noted above. While academics and practitioners do not agree on whether these sources of additional return represent systematic risks or simply return “anomalies”, these models have been developed to better describe the drivers of stock returns, regardless of the source of the factors” power.21 1.7 THE ASSET PRICING MODELS OF TODAY The above studies have inspired researchers to add factors to the single-factor model of Equation (1.2) that is, itself, inspired by the CAPM theory. As opposed to this “theory-inspired” single-factor model, almost all recent models are “empirically inspired”, which means that they are chosen because they explain the cross-section and/or time-series of security returns while still making economic sense. This means that we don’t simply try lots of factors until we find some that work, as this can always be done (and often leads to a breakdown of the model when we try to use it with other data). We carefully examine past 20 Momentum might also be interpreted as a risk factor. See, for example, Chordia et al. (2002). reader should note that there are many more recent papers documenting other anomalies in stock returns. For instance, Sloan (1996) finds that stocks with high accruals—earnings minus cashflows—earn lower future returns than stocks with low accruals. Lee and Swaminathan (2000) find that stocks with lower trading volume (less liquidity) have higher future returns than high trading volume stocks. However, these anomalies are not yet accepted by academics to the point of revising the models that we are about to present in the next section. Or, more accurately, there is not strong agreement that these anomalies are strong enough and are independent of the existing factors to warrant a more complicated model with additional factors. 21 The 17 18 CHAPTER 1 An Introduction to Asset Pricing Models research for both economic and econometric guidance on the factors that might be used in a model. Fortunately, many researchers have already done this work for us. Almost all models are “multifactor” models, meaning that more than one x-variable (“risk factors”) is used to predict the y-variable (security or portfolio excess returns). 1.7.1 Introduction to Multifactor Models Icould skip A multifactor model can be visualized as a simple extension of a single factor model, such as the CAPM. However, by using multiple risk factors, we are implicitly rejecting the CAPM and its many assumptions about investors and markets. The simplest multifactor model is a two-factor model. Let’s suppose that we believe that, in addition to the broad stock market, the risk-premium to investing in small stocks drives security returns. Then, the time-series model would be: (1.10) Rt = α + β · RMRFt + s · SMBt + #t , where s is the exposure of a security, or portfolio, to the “small-capitalization risk-factor”. This regression for Chevron-Texaco, implemented using Excel during the 24-month period January 2009 to December 2010, results in the following output Table 1.4. Table 1.4 Two-Factor Regression for CVX Regression Output (Unrestricted Model) Intercept RMRF SMB Coefficients Standard Error t Stat P-value 0.00031 0.92 −0.56 0.01 0.17 0.38 0.03 5.32 −1.47 0.98 0.56 −1.35 The adjusted R2 from this regression is 0.54 (54%), while the adjusted R2 from the single-factor regression of CVX excess returns on RMRF (from a prior section) is 0.51.22 Therefore, in this case, the addition of a small-cap factor—to which Chevron-Texaco is negatively correlated—does not matter much. However, since we have estimated the two-factor model, and since its t-statistic is relatively close to −1.645 (the two-tailed critical value for 10% significance), we’ll use it. 22 Note that these R2 values are very high for an individual stock—likely because CVX is very large cap and had no big surprises during the period, thus, it roughly matched the stock market as a whole. A regression of an individual stock return on the four-factor model usually gives an R2 of only about 10–20%. As we will see in later chapters, a regression of a managed (long-only) portfolio, such as a mutual fund, using either the one-factor or four-factor models, usually gives an R2 in excess of 90%. Thus, if you are applying your regression model correctly, you should generally (but not always, as with CVX) see these levels of R2 values. This is a good diagnostic check of your data work. 1.7 The Asset Pricing Models of Today Once the model is fitted, the next-period estimated expected return is: ! · E [RMRFt+1 ] +! ! s · E [SMBt+1 ] , E [Rt+1 ] = β or, using the fitted regression from above, ! E [Rt+1 ] = 0. 92 · E [RMRFt+1 ] − 0. 56 · E [SMBt+1 ] . (1.11) (1.12) Note that this is an equation of a plane in three-dimensional space, where ! E [Rt+1 ] is the vertical axis. The residuals, !t, are the vertical distance from this plane of the actual month-by-month outcomes, rt, from the model-predicted values of Equation (1.12). The next-period estimated total risk, which contains a term for the covariance between RMRF and SMB, is ! V [Rt+1 ] " #$ % Total Risk (Variance)= ! ·! !2 · V [RMRFt+1 ] +! s · C [RMRFt+1 , SMBt+1 ] s 2 · V [SMBt+1 ] + 2β =β #$ % " Systematic Risk + V ["t+1 ] " #$ % Idiosyncratic Risk , (1.13) and the next-period estimated systematic (risk-factor related) risk is: !2 · V [RMRFt+1 ] +! ! ·! ! s 2 · V [SMBt+1 ] + 2β s · C [RMRFt+1 , SMBt+1 ] . VS [Rt+1 ] = β (1.14) Again, following the simple approach of using historical sample data to estimate the above expected returns and variances, the equations for expected return, total, and systematic-only risk become ! · rmrf +! ! s · smb, E [Rt+1 ] = β and 2 2 !2 · ! ! ·! ! σRMRF +! s2 ·! σSMB + 2β s ·! σRMRF, SMB + ! σ#2 , V [Rt+1 ] = β 2 2 !2 · ! ! ·! ! σRMRF +! s2 ·! σSMB + 2β s ·! σRMRF, SMB , VS [Rt+1 ] = β ! where rmrf = T1 Tt=1 rmrft, 1 !T smbt , smb = t=1 T $2 1 !T # 2 " σRMRF = rmrft − rmrf , t=1 T −1 $2 # ! T 1 2 " σSMB = smbt − smb , t=1 T −1 $# $ # 1 "T and ! .23 σRMRF,SMB = T−1 rmrf smb − smb rmrf − t t t=1 (1.15) (1.16) (1.17) 23 These sampling statistics are easy to compute in Excel, using the sample mean, variance, and covari- ance functions applied over the time-series of historical data. 19 20 CHAPTER 1 An Introduction to Asset Pricing Models 1.7.2 Models of Stock Returns why Peta ti Regression-Based Models Fama and French (1993) designed a widely used multifactor model which adds both the small-capitalization factor (SMB) and a “value stock factor” (HML) to the single-factor model of Equation (1.2).24 LNalue M BH rfs Rt = α + β · RMRF t + s · SMBt + h · HMLt + et. (1.18) However, the most widely used returns-based model for analyzing equities is the four-factor model of Carhart (1997), growt C Rt = α + β · RMRFt + s · SMBt + h · HMLt + u · UMDt + #t , (1.19) who added a momentum factor (UMDt ) to the three-factor model of Fama and French.25 Let’s estimate the “Carhart model” for CVX, during 2009–2010 in Table 1.5. Table 1.5 potsit.ve relation momentu Four-Factor Regression for CVX Regression Output (Unrestricted Model) Intercept RMRF SMB HML UMD Coefficients Standard Error t Stat P-value 0.0046 1.1 −0.61 0.00028 0 0.31 0.0097 0.20 0.34 0.31 0.11 0.64 5.5 −1.8 0.00090 2.8 0.98 .000026 0.086 0.99 X 0.012 0 How did the addition of HML and UMD affect the estimated coefficients on ! and ! ! from 0.92 to 1.1, and decreased s )? They increased β RMRF and SMB (β ! s from −0.56 to −0.61. Why did these changes occur with the addition of HML and UMD? The answer is that these two new regressors must be correlated, to o o o negative exposure 24 One might wonder why Fama and French added back the RMRF factor, when their 1992 paper found that beta did not affect stock returns. The reason is that their tests were cross-sectional, meaning that one can assume that the betas of all stocks are unity without much error. In the crosssection, RMRF then washes out of differences in stock returns. However, in the time-series, RMRF matters for each individual stock or portfolio return. Why don’t we force beta to equal one in the time-series regression? For practical reasons, among them, managed funds often carry cashholdings, while others leverage their portfolios, which even Fama and French would admit moves the portfolio beta away from one. 25 A more detailed description: Rt is the month-t excess return on the stock (net return minus T-bill return), RMRFt is the month-t excess return on a value-weighted aggregate market proxy portfolio, and SMBt, HMLt, and UMDt are the month-t returns on value-weighted, zero-investment factormimicking portfolios for size, book-to-market equity, and one-year momentum in stock returns, respectively. This model is based on empirical research by Fama and French (1992, 1993, 1996) and Jegadeesh and Titman (1993) that finds these factors closely capture the cross-sectional and timeseries variation in stock returns. 1.7 The Asset Pricing Models of Today 21 some extent, with RMRF and SMB, thus “stealing” some (pretty small) explanatory power from them, and changing their relation with the predicted variable, Rt. Also, the four-factor model shows that RMRF and UMD are the most statistically significant explanatory variables, with SMB close behind. HML has no significance, since its p-value is equal to 99% (meaning that the chances of observing a coefficient of |0.00028| or larger by pure randomness, when its actual value is zero, is 99%). So, we conclude that CVX, during 2009–2010, has a beta close to 1 (typical for a stock), is a very large capitalization stock (since its “loading” on SMB is very negative and statistically significant), and it has significant momentum (meaning the prior-year return is high over the period 2009–2010—consistent with increasing oil prices!). Note that, in general, coefficients in this model that are close to (or slightly exceed) one have a large exposure to that risk factor. However, even coefficients at the level of 0.2 or 0.3 indicate a substantial exposure to a certain risk factor. coeff close1 么 些 exposure A Stock Characteristic-Based Model Another approach to modeling stocks that is based on the findings noted above (i.e., that market capitalization, value, and momentum drive stock returns) uses the characteristics (observable features) of stocks to assemble them into groups or portfolios of stocks with similar characteristics. Daniel and Titman (1997) found empirical evidence that suggests that characteristics provide better ex-ante forecasts than regression models of the cross-sectional patterns of future stock returns. This evidence indicates that stock factors like equity book-to-market ratio at least partially relate to future stock returns due to investors having behavioral biases against certain types of stocks (e.g., those stocks with recent bad news, which pushes the BTM ratio up “too much”). Following Daniel and Titman, in the characteristic benchmarking approach, the average return of the similar characteristic portfolio is used as a more precise proxy for the expected return of the stock during the same time period. Any deviation of a single stock from this expected return is the stock’s “residual”, or Leniency unexpected return. Daniel et al. (1997) developed such an approach for U.S. three equities, and many other researchers have replicated their approach in other stock markets. First, all stocks (listed on NYSE, AMEX, or Nasdaq) having at least two years of book value of equity information available in the Compustat database, and stock return and market capitalization of equity data in the CRSP database, are ranked, at the end of each June, by their market capitalization. Quintile portfolios are formed (using NYSE size quintile breakpoints), and each quintile portfolio is further subdivided into book-to-market quintiles, based on their most recently available fiscal year-end book-to-market data as of the end of June of the ranking year.26 Here, we “industry-normalize” the book-to-market ratio, since we would like to classify 26 This usually involves allowing a 30 to 60-day delay in disclosure of fiscal results by corporations. 嚚7125 22 CHAPTER 1 An Introduction to Asset Pricing Models stocks by how much they deviate from their “industry norms”.27,28 Finally, each of the resulting 25 fractile portfolios are further subdivided into quintiles based on the 12-month past return of stocks through the end of May of the ranking year. This three-way ranking procedure results in 125 fractile portfolios, each having a distinct combination of size, book-to-market, and momentum characteristics.29 The three-way ranking procedure is repeated at the end of June of each year, and the 125 portfolios are reconstituted at that date. Figure 1.6 illustrates this process. A modification of this procedure is to reconstitute these portfolios at the end of each calendar quarter, rather than only once per year on June 30, using updated size, BTM, and momentum data. While the annual sort is closer to an implementable strategy that is an alternative to holding a particular stock, the quarterly sort allows us to more accurately control for the changing characteristics of the stock. For example, the momentum, defined as the prior 12-month return of a stock, can change quickly. Value-weighted returns are computed for each of the 125 fractile portfolios, and the benchmark for each stock during a given quarter is the buy-and-hold return of the fractile portfolio of which that stock is a member during that quarter. Therefore, the benchmark-adjusted return for a given stock is computed as the buy-and-hold stock return minus the buy-and-hold value-weighted benchmark return during the same quarter. i 1.7.3 Models of Bond Returns Fama and French (1993) found a set of five risk factors that worked well in modeling both stock and bond returns. This includes three stock market factors and two bond market factors: 1. stock market return (RMRF), 2. size factor (small cap return minus large cap return) (SMB), 3. value factor (high book-to-market stock return minus low BTM stock return) (HML), 27 Specifically, j j we compute the book-to-market characteristic as !ln(BTMi,t )−ln(BTMt ) ", where j j σj ln(BTMi,t )−ln(BTMt ) j BTMi,t is the book-to-market ratio of stock i, which belongs to industry j on June 30th of year t, and j ln(BTMt ) is the log book-to-market ratio ! of industry j at year "t (the aggregate book-value divided by j j the aggregate market value). Also, σj ln(BTMi,t ) − ln(BTMt ) is the cross-sectional standard devia- tion of the adjusted book-to-market ratio across industry. This approach was suggested by Cohen and Polk (1998), as well as by discussions with Christopher Polk. 28 We could industry-normalize the size and momentum of a stock as well, and some researchers have followed this approach. However, the most common approach is to industry-normalize only the book-to-market. 29 Thus, a stock belonging to size portfolio one, book-to-market portfolio one, and prior return portfolio one is a small, low book-to-market stock having a low prior-year return. 1.7 The Asset Pricing Models of Today 1 4. bond market maturity premium (10-year Treasury yield minus 30-day T-bill yield) (TERM), and 5. default risk premium (Moody’s Baa-rated bond yield minus 10-year Treasury yield) (DEFAULT). Panel A ! Rank all NYSE stocks by Mkt. Cap. - Divide into 5 Quintiles ! Rank Quintiles = Book Value/Market Value (BTM) Subdivide into 5 more quintiles ! Rank the 25 fractiles by past year stock return Subdivide into 5 more quintile A rank of: Size=5, Large Cap BTM=5, High BTM PR1YR=5 High Past Return Panel B Panel C FIGURE 1.6 Daniel, Grinblatt, Titman, and Wermers stock benchmarking procedure. 23 24 CHAPTER 1 An Introduction to Asset Pricing Models It is very important to note that Fama and French (1993) modeled the time-series of returns on stocks and bonds, where Fama and French (1992) modeled the crosssectional (across-stock) differences in returns on stocks—which is why the stock market return is included in the above group, but not in the 1992 paper’s factors. In essence, the 1992 paper says that we can assume that beta=1 for all stocks (without a huge amount of error), and, therefore, beta only affects stock returns over time. There is no difference in different stock returns at the same period of time, since they all have assumed betas of one, according to Fama and French (1992). 0 Fama and French (1993) also find that stock and bond returns are linked together through the correlation of the stock market return with the return on the two bond factors. Interestingly, a large body of other research since then, including Kandel and Stambaugh (1996) has found that broad macroeconomic factors, including the two bond factors noted above, help to forecast the stock market return. Gruber, Elton, Agrawal, and Mann (2001) find that the three stock risk factors above (1–3) are also useful in modeling corporate bonds—in addition to exposure to potential default and taxation of bond income. Finally, Cornell and Green (1991) find that stock market returns are even more important than government bond market yields in modeling high-yield (junk) bonds. 1 The above research on bond markets suggest that a five-factor model should be used to model bonds: Rt = α + β · RMRFt + s · SMBt + h · HMLt + m · TERMt + d · DEFAULTt + #t . (1.20) Note that there is no momentum factor for bond markets, although some recent papers have also challenged this. 1.8 CHAPTER-END PROBLEMS 1. Download the monthly returns for Exxon-Mobil (XOM) during 2009 and 2010 from CRSP, Yahoo Finance, or another source. Also, download the 30-day Treasury Bill return and the monthly factor returns for RMRF, SMB, HML, and UMD from Ken French’s website, http://mba.tuck.dartmouth. edu/pages/faculty/ken.french/. A. Using Excel or a statistics package, run a single-factor linear regression (ordinary least squares) for XOM (the y-variable is the excess return of XOM, which is the XOM return minus T-Bill return, while the x-variable is the monthly return on RMRF). How does your regression output compare with that of CVX shown in this chapter—what are the differences in the two stocks according to this output? B. Repeat, using a two-factor model that includes RMRF and SMB. How does your regression output compare with that of CVX shown in this chapter—what are the differences in the two stocks according to this output? References1.8 Chapter-End Problems C. Repeat, using the Carhart four-factor model. How does your regression output compare with that of CVX shown in this chapter—what are the differences in the two stocks according to this output? 2. Download monthly returns for Apple (AAPL) during 2009 and 2010, and run a single-factor regression on the S&P 500 as the “market factor”. What are the resulting alpha and beta? 3. Using the AAPL data from problem #2, run a four-factor model. What are the coefficients on each factor, and what do they tell you about Apple’s stock? 4. Starting with the model of Equation (1.2), derive the risk model shown by Equation (1.6). 5. Starting with the model of Equation (1.10), derive the risk model shown by Equation (1.13). 6. Describe the empirical tests that find violations of the CAPM in stock returns. 7. Describe the empirical approach that Fama and French (1992) used to find that “beta is dead”. 8. Discuss each of the assumptions of the CAPM. For each assumption, provide some brief evidence from financial markets that indicates that the assumption may not be correct. 9. Suppose that an institution holds Portfolio K. The institution wants to use Portfolio L to hedge its exposure to inflation. Specifically, it wants to combine K and L to reduce its inflation exposure to zero. Portfolios K and L are well diversified, so the manager can ignore the risk of individual assets and assume that the only source of uncertainty in the portfolio is the surprises in the two factors. The returns to the two portfolios are: RK = 0.12 + 0.5FINFL + 1.0FGDP RL = 0.11 + 1.5FINFL + 2.5FGDP Calculate the weights that a manager should have on K and L to achieve this goal. 10. Portfolio A has an expected return of 10.25 percent and a factor sensitivity of 0.5. Portfolio B has an expected return of 16.2 percent and a factor sensitivity of 1.2. The risk-free rate is 6 percent, and there is one factor. Determine the factor’s price of risk (see Tables 1.4 and 1.5). REFERENCES Bernstein, Peter, 1996. Against the Gods: The Remarkable Story of Risk. John Wiley & Sons, Inc. Campbell, John, Lo, Andrew, MacKinlay, Craig, 1997. The Econometrics of Financial Markets and Craig MacKinlay. Princeton University Press. Cochrane, John, 2001. Asset Pricing. Princeton University Press. 25