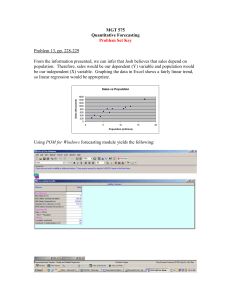

Manufacturing Systems CA01 Q1 i. Compute the Simple Moving Average for three and five periods, and then compute MAD and MSE for each. Period Demand Sum SMA (3) et |et| |et-ebar| |et-ebar|2 1 2 3 4 5 6 7 8 9 10 11 20 18 25 15 18 22 26 28 25 23 15 63.00 58.00 58.00 55.00 66.00 76.00 79.00 76.00 21.00 19.33 19.33 18.33 22.00 25.33 26.33 25.33 AVG (ebar) SUM -6.00 -1.33 2.67 7.67 6.00 -0.33 -3.33 -10.33 6.00 1.33 2.67 7.67 6.00 0.33 3.33 10.33 4.71 1.29 3.38 2.04 2.96 1.29 4.38 1.38 5.63 1.67 11.39 4.17 8.75 1.67 19.14 1.89 31.64 22.33 80.32 Period 1 2 3 4 5 6 7 8 9 10 11 Demand 20 18 25 15 18 22 26 28 25 23 15 MAD (3) MSE (3) 3.19 11.47 Sum SMA (5) et |et| |et-ebar| |et-ebar|2 96.00 98.00 106.00 109.00 119.00 124.00 19.20 19.60 21.20 21.80 23.80 24.80 AVG (ebar) SUM 2.80 6.40 6.80 3.20 -0.80 -9.80 2.80 6.40 6.80 3.20 0.80 9.80 4.97 2.17 1.43 1.83 1.77 4.17 4.83 4.69 2.05 3.36 3.12 17.36 23.36 16.20 53.95 MAD (5) MSE (5) 3.24 10.79 ii. Show a simple chart of the actual and forecast demands of SMA (3) and SMA (5). 30 No. of vaccines (in millions) 25 20 15 10 5 0 0 2 4 6 8 10 12 Period Demand SMA (3) SMA (5) iii. Conclude from the results of your computations. Generally, lower deviation or error is preferred for forecasting. For this example however, SMA(3) has a smaller MAD but a higher MSE. It might be due to one of the values deviated too far away. Furthermore, the average error is relatively small in SMA(3), squaring the difference of the large error and small average error would result in a very large number. There isn’t a clear indication of which Simple Moving Average is better in this case, as both MAD and MSE can be justified. However in general, when more time period is taken into consideration, the error would be more diluted. Q2. Forecast the number of engine failures over periods 1 through 7 using Holt’s Method, assuming α=β=0.1 and compute the corresponding MAD and MSE. What can you infer from the results of your computation? Period 0 1 2 3 4 5 6 7 Demand It St Forecast 200.00 10.00 250 214.00 10.40 210.00 175 219.46 9.91 224.40 186 225.03 9.47 229.37 225 233.55 9.38 234.50 285 247.14 9.80 242.93 305 261.74 10.28 256.93 190 263.82 9.46 272.02 AVG (ebar) SUM MAD MSE et 40.00 -49.40 -43.37 -9.50 42.07 48.07 -82.02 |et| 40.00 49.40 43.37 9.50 42.07 48.07 82.02 44.92 |etebar| |et-ebar|2 4.92 4.48 1.55 35.42 2.85 3.15 37.10 24.18 20.09 2.41 1254.29 8.10 9.91 1376.53 89.46 2695.52 14.91 449.25 The high MAD and MSE values indicate that forecast was not very accurate with regards to the demand. For certain periods, the forecast was not responsive to the trends hence a suggestion would be to adjust the alpha-α and beta-β values for greater precision. Q3. Compute the sample correlation coefficient, r, and deduce the correlation. Is this inference expected? SUM AVG GDP(x) 5.5 6.1 6.6 7.4 7.3 6.8 7.9 7.0 6.9 7.6 69.1 6.91 Job(y) 115 130 130 142 139 133 145 155 139 142 1370 137 xy 632.5 793.0 858.0 1050.8 1014.7 904.4 1145.5 1085.0 959.1 1079.2 9522.2 x2 30.25 37.21 43.56 54.76 53.29 46.24 62.41 49.00 47.61 57.76 482.09 y2 13225 16900 16900 20164 19321 17689 21025 24025 19321 20164 188734 n Sxy Sxx Syy r 10 55.5 4.609 1044 0.800 The r value is positive, hence the GPD and number of jobs is positively correlated. As the GPD increase, the number of jobs will increase, and vice versa as well. Quite logically, the better developing countries with higher GDP would tend to have more number of jobs.