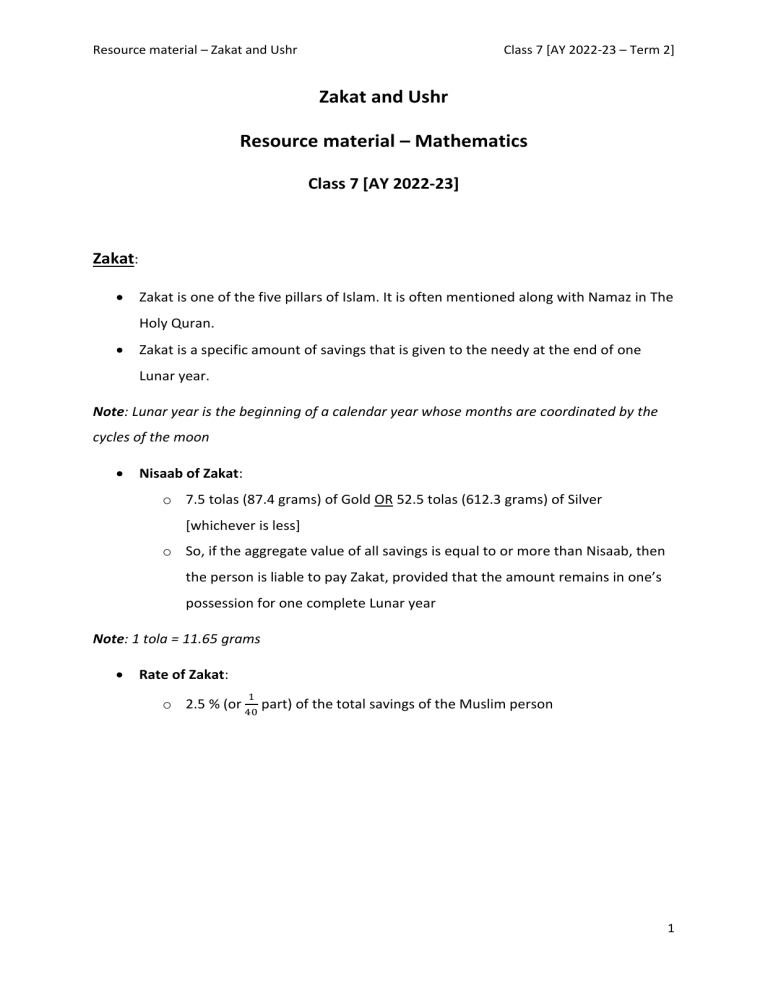

Resource material – Zakat and Ushr Class 7 [AY 2022-23 – Term 2] Zakat and Ushr Resource material – Mathematics Class 7 [AY 2022-23] Zakat: • Zakat is one of the five pillars of Islam. It is often mentioned along with Namaz in The Holy Quran. • Zakat is a specific amount of savings that is given to the needy at the end of one Lunar year. Note: Lunar year is the beginning of a calendar year whose months are coordinated by the cycles of the moon • Nisaab of Zakat: o 7.5 tolas (87.4 grams) of Gold OR 52.5 tolas (612.3 grams) of Silver [whichever is less] o So, if the aggregate value of all savings is equal to or more than Nisaab, then the person is liable to pay Zakat, provided that the amount remains in one’s possession for one complete Lunar year Note: 1 tola = 11.65 grams • Rate of Zakat: 1 o 2.5 % (or 40 part) of the total savings of the Muslim person 1 Resource material – Zakat and Ushr Class 7 [AY 2022-23 – Term 2] Questions on Zakat: 1. Yearly saving of Yousuf is Rs: 22,00,000. What is the amount of Zakat due upon him? a. Yousuf’s saving = Rs: 22,00,000 Rate of Zakat = 2.5% Amount of Zakat = 2.5% × 22,00,000 2.5 = 100 × 22,00,000 = 55,000 So, the amount of Zakat due upon Yousuf is Rs: 55,000 2. Abdullah pays Rs: 40,000 as Zakat. What is his yearly saving? a. Amount of Zakat = Rs: 40,000 Rate of Zakat = 2.5% Let the yearly Saving of Abdullah = s Amount of Zakat = rate of Zakat × s 40,000 = 2.5% × s 40,000 × 100 = 2.5s 40,00,000 = 2.5s s = 40,00,000 ÷ 2.5 s = 16,00,000 So, the yearly saving of Abdullah is Rs: 16,00,000 3. Ahmed’s yearly saving is Rs: 5,00,000. If the rate of Gold is Rs: 1,50,000 per tola and the rate of Silver is Rs: 2000, find out whether Ahmed is Sahib-e-Nisab? a. Nisab amount (in terms of Gold) = 7.5 tolas × price of 1 tola of gold = 7.5 × 1,50,000 = Rs: 11,25,000 Nisab amount (in terms of Silver) = 52.5 tolas × price of 1 tola of silver = 52.5 × 2000 = Rs: 1,05,000 2 Resource material – Zakat and Ushr Class 7 [AY 2022-23 – Term 2] Ahmed’s yearly saving is Rs: 5,00,000 – which is greater than the Nisab amount (in terms of Silver). Therefore, Ahmed is Sahib-e-Nisab and it is obligatory for Ahmed to pay Zakat. 4. Mustafa possesses Rs: 8,00,000 as savings and 4 tolas of pure Gold. Find the amount of Zakat due upon him. [Consider the rate of Gold per tola as Rs: 1,50,000] a. Mustafa’s saving = Rs: 8,00,000 Mustafa’s gold possession worth = 4 × 1,50,000 = Rs: 6,00,000 Total amount on which Zakat is due = 8,00,000 + 6,00,000 = Rs: 14,00,000 Rate of Zakat = 2.5% Amount of Zakat = 2.5% × 14,00,000 2.5 = 100 × 14,00,000 = 35,000 So, the amount of Zakat due upon Mustafa is Rs: 35,000 5. Amna paid Zakat worth Rs: 15000 on Gold. Find the value of Gold in her possession a. Amount of Zakat = Rs: 15,000 Rate of Zakat = 2.5% Let the value of gold = g Amount of Zakat = rate of Zakat × g 15,000 = 2.5% × g 15,000 × 100 = 2.5g 15,00,000 = 2.5g g = 15,00,000 ÷ 2.5 g = 6,00,000 So, the value of Gold in Amna’s possession is Rs: 6,00,000 3 Resource material – Zakat and Ushr Class 7 [AY 2022-23 – Term 2] Ushr: • Ushr is the Zakat paid on Agricultural produce (grains, fruits, vegetables) • Ushr means “one-tenth” • It is to be paid at the time of harvest • Rate of Ushr: o If the land is irrigated by natural resources of water, then one-tenth (10%) of the harvest (or money equal to harvest’s value) needs to be paid. Natural resources mean rain water, natural water canals, natural streams or rivers, etc. o If the land is irrigated by artificial resources of water, then one-fifth (5%) of the harvest (or money equal to harvest’s value) needs to be paid. Artificial resources mean tube-well, artificial water canals, etc. Questions on Ushr: 1. Abdul-Rehman harvests 15000 kg of sugar cane. Find the amount of Ushr (in Rupees) that he has to pay. His land was irrigated by natural resources of water. The rate of sugar-cane is Rs: 500 per kg a. Value of sugar-cane harvest = 15000 × 500 = Rs:75,00,000 Rate of Ushr = 10% (Because land was irrigated by natural resources of water) Amount of Ushr = 10% × 75,00,000 10 = 100 × 75,00,000 = 7,50,000 So, the amount of Ushr due upon Abdul-Rehman is Rs: 7,50,000 4 Resource material – Zakat and Ushr Class 7 [AY 2022-23 – Term 2] 2. Usman harvests and then exports oranges of his garden for Rs: 5,00,000. Find the amount of Ushr (in Rupees) that he has to pay. His land was irrigated by artificial resources of water a. Value of oranges harvested = Rs: 5,00,000 Rate of Ushr = 5% (Because land was irrigated by artificial resources of water) Amount of Ushr = 5% × 5,00,000 5 = 100 × 5,00,000 = 25,000 So, the amount of Ushr due upon Usman is Rs: 25,000 3. Shahid pays Rs: 10,000 as Ushr. Find the value of the crop he harvested. His crop was irrigated by artificial resources of water a. Amount of Ushr = Rs: 10,000 Rate of Ushr = 5% (Because land was irrigated by artificial resources of water) Let the value of crop = c Amount of Ushr = rate of Ushr × c 10,000 = 5% × c 10,000 × 100 = 5c 10,00,000 = 5c c = 10,00,000 ÷ 5 c = 2,00,000 So, the value of crop Shahid harvested is Rs: 2,00,000 5 Resource material – Zakat and Ushr Class 7 [AY 2022-23 – Term 2] 4. Suleman harvests 20000 kg of cotton. Find the amount of Ushr (in kilograms of cotton) that he has to pay. His land was irrigated by artificial resources of water. a. Amount of cotton harvest = 20000 kg Rate of Ushr = 5% (Because land was irrigated by artificial resources of water) Amount of Ushr = 5% × 20000 5 = 100 × 20000 = 1000 So, the amount of Ushr due upon Suleman is 1000 kg 6