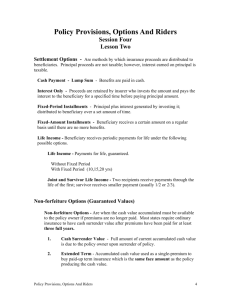

Insurance Concepts Review TRADITIONAL LIFE & VARIABLE UNIVERSAL LIFE 1 We are your Learning partners Course Content Part 1: TRADITIONAL LIFE 2 Part 2: VARIABLE UNIT-LINKED a. Insurance Commission a. Concept of Variable Universal Life b. Insurance Commission Exam (IC)/Insurance Institute for Asia and the Pacific (IIAP) Examination Process b. Financial Planning Process c. Types of Investment Assets d. Types of Funds e. Types of Variable Contract f. Definition of Terms g. How does VUL work? h. Basic Computation of Units c. Concepts of Life Insurance d. Premium, Basic Plans and Riders e. Legal Aspects of Life Insurance f. Policy Provisions g. Annuities h. Ethics We are your Learning partners Insurance Concepts Review PART 1: TRADITIONAL LIFE 3 Insurance Commission • Regulatory government agency • Executes all laws pertaining to insurance • Regulates insurance companies 4 We are your Learning partners Insurance Commission Functions of the Insurance Commission • Issues licenses to insurance companies • Reviews policy contracts and premium rates • Examines the financial condition of insurance companies to ensure solvency • Renders assistance to the public on matters pertaining to insurance 5 We are your Learning partners Insurance Commission Location of the Insurance Commission 1071 United Nations Avenue cor. Romualdez St., Ermita, Manila 6 We are your Learning partners Insurance Commission Insurance Code of the Philippines • Rendered the provisions of Presidential Decree No. 612 • Promulgated in 1978 • Also known as Presidential Decree No. 1460 • Special law to govern insurance 7 We are your Learning partners Insurance Commission Built on Trust • Between the company, the advisor and the client • Importance of upholding professionalism and proper ethics 8 We are your Learning partners IC and IIAP Examination Process INSURANCE CONCEPTS REVIEW 9 IC and IIAP Examination Process 10 ✓ IC – Offsite Special Exam (BGC) ✓ IC Online Agents’ Computerized Examinations (ONLINE ACE) System ✓ IIAP Online Exam We are your Learning partners IC – Offsite Special Exam (BGC) 11 IC-Offsite Special Exam (BGC) Procedure and Requirements 1. Survey Alchemer for IC Special Exam schedule and registration will be emailed by Licensing Team to all FMs and SSAs 2. Kindly ensure completion of requirements: o Insurance Concepts Certificates o Proof of Exam Payment ✓ Traditional: Ps. 1,010 ✓ VUL: Ps. 1,010 ✓ Both: Ps. 2,020 3. This is on a First-come-First-served basis with 330 slots per day. 4. Please note that only FULLY VACCINATED examinees are allowed take the exams. Partially vaccinated examinees may still register as long as they are scheduled to have the 2nd dose before their desired exam date Please advise to only register on one date, otherwise you must pay exam fees for all registrations made 12 We are your Learning partners IC Online Agents’ Computerized Examinations (ONLINE ACE) System (for Provincial-Based Examinees) 13 IC ONLINE ACE System Requirements 1. Completion of Insurance Concepts Training – Life and Variable 2. Payment of Exam Fees o Life: o Variable: o Both: Ps. 1,010 Ps. 1,010 Ps. 2,020 3. Transfer or deposit payment to o BPI Account Name: Sun Life of Canada (Phils.), Inc. o Account Number: 0993015679 Proof of payment must be submitted. This can be a screenshot of the online bank transfer/ payment confirmation or validated deposit slip. No need to request for original receipt 14 We are your Learning partners IC ONLINE ACE System System Requirements for the Examinee PARAMETER MINIMUM REQUIREMENTS Web Browser Latest version of Mozilla Firefox & Chrome Operating System Windows 7, MacOS 10.12 “Sierra”, Linux Processor Dual-core RAM 2GB Network bandwidth 1 Mbps Cisco Webex Meetings. Cisco Webex Meetings is available for Windows and MacOS through this link: htts://www.webex.com/downloads.html 15 We are your Learning partners IC ONLINE ACE System Procedure 1. Recruiting Manager to email COMPLETE requirements to respective Licensing Associate: o Completely filled-out IC-ACE Excel Information sheet (Please check with SSA for copy) o Proof of Payment o 2x2 ID Picture in business attire, with white background and name plate o Insurance Concepts (Life and Variable) Certificate of Completion 2. Licensing Associate will assign the online exam schedule based on the available slots in the ICACE system. Licensing Associate will advise the requesting recruiting manager, through email, the following information: exam schedule, username, and password of their examinee, two (2) working days after the receipt of the complete requirements. 16 We are your Learning partners IC ONLINE ACE System Procedure 3. Licensing Associate will remit licensing exam fees to IC three (3) days before your exam date. Refunding of exams fees is not allowed once paid to IC. “No Show” means forfeiture of payment. 4. Insurance Commission will directly email the examinee the IC- registration link. The examinee must register not later than one (1) day before the scheduled examination date. 5. Once the registration is approved, IC will send another email to the examinee with the Joint Meeting/ Meeting Link, which will be used to enter the (online) examination room. 17 We are your Learning partners IC ONLINE ACE System On the Exam Day 1. Examinees are advised to join the meeting 30 minutes before their scheduled batch. (Cisco Webex). 2. A pop-up dialog will appear once the examinee has clicked the link for the meeting. 3. The examinee must change the Display Name and Email Address with this format : Insurance Company – Type of Exam- Examinee’s Name 4. Access the Online IC-ACE through https://web.insurance.gov.ph/ace-monitoring/ 18 We are your Learning partners IC ONLINE ACE System On the Exam Day 5. The examinee does not require using any paper, pen, pencil, or calculator. 6. The exams will be proctored through the camera and microphone of the laptop/desktop device. 7. The proctor will ask examinee to present to the camera a valid government ID will full name, year of birth, country, issue date, and expiration date. 8. Examinee may send a message to the proctor using the chat box for assistance. 9. Turn-around-time for the release of the results may vary. 19 We are your Learning partners IC ONLINE ACE System Important Reminders 1. The exam shall be taken in well-lit, quiet, and private room (alone). The following should be removed from the workspace (other laptops/desktops, mobile phones, smart devices, calculators, papers, reviewers/books, any object that may contain writing ). 2. All programs, applications and websites must be closed except for WebEx application, and web browser used to access the Online ACE. 3. Once the exams start, do not refresh the browser, or navigate away from the exam as this may result in the loss of progress and will not be recoverable, even by the proctor. 4. Individuals who are not taking the examination are prohibited from entering the room. 5. The face of the examinee should be fully visible the entire duration of the examination. 6. Hats, sunglasses, headphones are prohibited during the exam. 7. If hearing aid is required, examinee must inform Licensing Associate 48 hours prior to the exam starting time. 20 We are your Learning partners IC ONLINE ACE System Important Reminders 8. Bathroom breaks are not permitted. 9. In cases where the proctor suspects that cheating or any other act of impropriety may be occurring, the proctor may request the examinee to share screen and will provide instructions for doing this. 10. The online examination room is recorded upon entry of the examinee until the submission of the last examinee of their exam. 11. If an act of impropriety has been deemed to have taken place, IC reserves the right to apply the appropriate disciplinary policy. 21 We are your Learning partners IIAP Online Exam (for Provincial-Based Examinees) 22 IIAP ONLINE EXAM Requirements 1. Completion of IIAP Online Training. Recruiting Manager to enroll the Advisor Candidate by registering thru https://survey.alchemer.com/s3/5206975/Online-CoursesEnrollment-Form. 2. After completion of training, Recruiting manager should make a separate e-mail request to Phil.ELearning@sunlife.com for: o IIAP Application Form 0930, and o IIAP Exam Undertaking 3. Payment of Online Exam Fee of PhP 1,200.00 o BPI Account Name: Sun Life of Canada (Phils.), Inc. o Account Number: 0993015679 No need to request for Original Receipt. Instead, proof of payment such as screenshot of confirmed transfer details or copy of validated deposit slip will be required for submission. 23 We are your Learning partners IIAP ONLINE EXAM Procedure 1. Advisor Candidate to complete the IIAP Online Training. . 2. Advisor Candidate to accomplish/fill out, scan, and email the following to the recruiting manager. Each of the examinees must put their requirements in one/continuous PDF to ensure that the documents are readable, accessible and in uniform format. (1 pdf file= 1 examinee). o o o o o o 24 IIAP Application Form 0930 (PDF Format) IIAP Exam Undertaking (PDF Format) 1x1 recent ID photo (JPEG Format) (yellow color background) Scanned copy of any government-issued ID (PDF Format) Proof of Exam Payment PDF format (PDF Format) IIAP online Examinees Template We are your Learning partners IIAP ONLINE EXAM Procedure 3. Recruiting manager to check completion/correctness of requirements and email the same to Licensing Associate* / Recruitment Specialist concerned: Email Subject: IIAP ONLINE EXAM REQUIREMENTS XXXX NBO 4. Licensing Associate to email IIAP the list of all online examinees two (2) workings days after receipt of all the requirements. 5. Licensing to prepare and remit check payment to IIAP within two (2) working days from date the list of online examinees was submitted to IIAP. 6. IIAP will send directly to the examinee’s email address the exam verification code within 24hours upon receipt of payment from Sun Life. Please ensure correct e-mail address of examinees in all forms. 7. Verification code will only be valid for seven (7) days from the date of receipt of email. Once accessed, examinee must finish the exam within one (1) hour. *Licensing Associate may vary from time-to-time 25 We are your Learning partners IIAP ONLINE EXAM Procedure 8. IIAP to release the exam results to Sun Life five (5) working days after the exam. Licensing will email the recruiting manager of the results. 26 We are your Learning partners Concept of Life Insurance TRADITIONAL LIFE 27 Concept of Life Insurance Man at Work INCOME OLD AGE 28 We are your Learning partners DISABILITY EXPENSES DEATH SICKNESS Concept of Life Insurance Man at Work INCOME “Life Insurance is against all O.D.D.S!” 29 We are your Learning partners EXPENSES LIFE INSURANCE Concept of Life Insurance THREATS SERVICE BENEFIT Family Protection Death Benefit Retirement Income Maturity Benefit Guaranteed Savings Cash Values DEATH OLD AGE SICKNESS & DISABILITY 30 We are your Learning partners Concept of Life Insurance Human Economic Value • Human life has an economic value • The capitalized monetary worth of the earning capacity of an individual devoted to the support of his family during his working lifetime 31 We are your Learning partners Concept of Life Insurance Life Insurance A RISK–SHARING BUSINESS 32 We are your Learning partners Concept of Life Insurance Risk Sharing • A group of people places a fund together in preparation for an uncertain event. • 33 Everyone is prepared to accept a small loss to compensate the unfortunate from the effect of a larger loss. We are your Learning partners Concept of Life Insurance What is Risk? • Chance of loss. • Exists when there is uncertainty about the future. 34 We are your Learning partners Concept of Life Insurance Types of Risk 1. SPECULATIVE RISK – involves three possible outcomes: loss, gain, or no change. 2. PURE RISK – is a risk that involves no possibility of gain; there is either a loss or no loss. May be insured. 35 We are your Learning partners Concept of Life Insurance Law of Probability • A likelihood that a given event will occur in the future. • This is used in determining the number of people dying & living at a particular age within a given period. 36 We are your Learning partners Concept of Life Insurance Law of Large Numbers • 37 The more frequent a particular event is observed, the more likely that the observed results will approximate the true probability of the event happening. We are your Learning partners Concept of Life Insurance Risk Selection/Underwriter • 38 A systematic evaluation of an insurance applicant for the purpose of determining the classification of risk for possible coverage. We are your Learning partners Concept of Life Insurance Anti-Selection 39 • The high pre-disposition for those with impairments to purchase life insurance • Can be prevented through proper Risk Selection/ Underwriting. We are your Learning partners Concept of Life Insurance Factors in Risk Selection PHYSICAL OCCUPATION FINANCIAL MORAL HAZARD AVOCATION RESIDENCE/TRAVEL 40 We are your Learning partners Concept of Life Insurance Sources of Information 41 • Application Form • Medical Examination Report • Agent’s Confidential Report • Medical Information Database (MID) We are your Learning partners Concept of Life Insurance RISK CLASSIFICATION ACCEPT STANDARD 42 We are your Learning partners SUBSTANDARD DECLINE Concept of Life Insurance Basic Insurance Terms • Life Insurance Policy • Face Amount • Insurer • Premium • Insured • Death Benefit • Policyowner/ Applicant • Maturity Benefit • Beneficiary • Cash Values • Dividends 43 We are your Learning partners Concept of Life Insurance Basic Insurance Terms Life Insurance Policy as defined by the Insurance Code P.D. 1460 A contract whereby a PARTY for a CONSIDERATION agrees to pay ANOTHER a SUM OF MONEY in the event of his DEATH FROM ANY CAUSE NOT EXCEPTED IN THE CONTRACT, or upon surviving a SPECIFIED PERIOD, or otherwise on the CONTINUANCE or cessation of life. 44 We are your Learning partners Concept of Life Insurance Life Insurance Policy as defined by the Insurance Code P.D. 1460 Party – Insured & Insurer Consideration – premium payment/policy payment Another – Beneficiary Sum of Money – proceeds/face amount/face value Death from any cause not excepted in the contract – excluded risks Specified period / Continuance – Maturity period 45 We are your Learning partners Concept of Life Insurance Insurer o The insurance company Insured o The person whose life is covered under the insurance policy. Policyowner/Applicant o The person who is buying or applying for life insurance. 46 We are your Learning partners Concept of Life Insurance Beneficiary o The person who is designated to receive the insurance proceeds upon death of the insured. Face Amount o The amount stated in the policy as payable under a life insurance policy if the insured dies while the policy is in force. 47 We are your Learning partners Concept of Life Insurance Premium o A sum of money given by the insured as a consideration for the insured’s promise to indemnify or replace the loss. Death Benefit o The amount payable upon death of insured. The sum assured the beneficiary (ies) would receive in case the insured dies during the protection period. 48 We are your Learning partners Concept of Life Insurance Maturity Benefit o The amount payable if the insured outlives the protection period. Cash Values o The guaranteed amount received in case the plan is terminated prior to the death of the insured or maturity of the policy. o Legal reserves or the savings element of the policy. 49 We are your Learning partners Concept of Life Insurance Dividends o Return of excess premium paid annually to owner of insurance policy based on insurer’s performance and experience over a given year. 50 We are your Learning partners Concept of Life Insurance Cash Needs: CReFaLEER C Clean Up Fund Fund to pay hospital bills, funeral expenses, and taxes Re Readjustment Fund Fund used to cushion immediate lifestyle adjustment that family must make if the insured dies Fa Family Dependency Fund Fund to provide for the family’s needs while the children still dependent L Life Income for the Widow Lifetime fund for the widow E Educational Fund Fund that will ensure the education of children E Emergency Fund Fund that is designed to provide financial back up for unexpected R Retirement Fund Fund that gives security and peace of mind who have outlived their earning years 51 Concept of Life Insurance Life Insurance gives certainty to uncertainty Death is a certainty When, is an uncertainty To live is one’s right How long isn’t one’s choice Life insurance cannot prevent your death It prevents your plans from dying with you 52 We are your Learning partners Premiums, Basic Plans & Riders TRADITIONAL LIFE 53 Premiums, Basic Plans & Riders Concept of Premium • An ACTUARY is the /a company officer that determines the premium rates with respect to the principal elements of the life insurance. 54 We are your Learning partners Premiums, Basic Plans & Riders Factors that affect the premium: 1. Mortality 2. Interest 3. Expense 55 We are your Learning partners Premiums, Basic Plans & Riders Mortality + Interest = NET PREMIUM Expense + (Safety Margin Requirement) = LOADING Net Premium + Loading = GROSS PREMIUM 56 We are your Learning partners Premiums, Basic Plans & Riders Types of Premium 57 • Natural Premium o premiums that increase each year as the age of the insured increases. • Level Premium o premiums that remain the same from year to year throughout the premium paying period. We are your Learning partners Premiums, Basic Plans & Riders CLASSIFICATION OF BASIC PLANS According to NATURE 58 We are your Learning partners According to PARTICIPATION According to COVERAGE Premiums, Basic Plans & Riders CLASSIFICATION OF BASIC PLANS According to NATURE 59 We are your Learning partners According to PARTICIPATION According to COVERAGE Premiums, Basic Plans & Riders ACCORDING TO NATURE TEMPORARY / TERM LEVEL TERM DECREASING TERM PERMANENT ORDINARY / WHOLE LIFE Limited Pay Life 60 We are your Learning partners ENDOWMENT Regular Endowment Pure Endowment Anticipated Endowment Premiums, Basic Plans & Riders Temporary or Term Plan • Life Insurance that remains in force for a specified period or term. • Term pays the face amount only in the event of death. • There are no cash values, no profit sharing, and is the cheapest in terms of initial premium outlay. • Renewable & Convertible. 61 We are your Learning partners Premiums, Basic Plans & Riders Renewable Example: Yearly Renewable Term Protection Period Age 30 62 Renewable for another year Age 31 We are your Learning partners Age 32 Premiums, Basic Plans & Riders Convertible Example: 5 Year Convertible Term Protection Period Age 30 Age 33 Age 35 May be converted in whole or in part 63 We are your Learning partners Premiums, Basic Plans & Riders Types of Term Plans 1. Level Term o the death benefit remains constant over the term of coverage. 2. Decreasing Term o 64 the death benefit starts at the set face amount and then decreases over the term of the coverage. We are your Learning partners Premiums, Basic Plans & Riders Types of Term Plans 1. Level Term Example: 5 Year Level Term Face Amount Php 3M Php 3M 5 Years 65 We are your Learning partners Premiums, Basic Plans & Riders Types of Term Plans 2. Decreasing Term Example: 5 Year Decreasing Term Face Amount Php 5M Php 2.5M Death Benefit 66 We are your Learning partners 5 Years Premiums, Basic Plans & Riders Whole Life Plan • Life Insurance that remains in force during the insured’s lifetime. • The face amount is paid whenever death occurs up to the age of 100 of the insured. • There are cash values as well as profit sharing and dividends. • The initial premium outlay is higher than term insurance but is lower than endowment. 67 We are your Learning partners Premiums, Basic Plans & Riders Whole Life Plan Protection Period & Premium Paying Period Age 30 68 Age 65 LB = CV+AD We are your Learning partners Age 75 (RIP) DB = FA+AD Age 100 MB = FA+AD Premiums, Basic Plans & Riders Limited Pay Life Plan • Provides lifetime protection with premiums payable for limited term of years. • Life Insurance that remains in force during the insured’s lifetime. • The face amount is paid whenever death occurs up to the age of 100 of the insured. • There are cash values as well as profit sharing and dividends. 69 We are your Learning partners Premiums, Basic Plans & Riders Limited Pay Life Plan Example: 10 Year Limited Pay Life Plan Protection Period Age 30 Age 40 Premium Paying Period 70 We are your Learning partners Age 65 LB = CV+AD Age 75 (RIP) DB = FA+AD Age 100 MB = FA+AD Premiums, Basic Plans & Riders Endowment Plan • Pays the face amount whether the life insured lives to the end of a specified period or dies during that period. • It has cash values, profit sharing or dividends. • Initial premium outlay is the highest compared to term and permanent plans. • Allows for faster accumulation of funds, making it ideal for saving for future needs. 71 We are your Learning partners Premiums, Basic Plans & Riders Endowment Plan Example: 20 Year Endowment Plan Protection & Premium Paying Period Age 40 72 We are your Learning partners Age 50 (RIP) DB = FA+AD Age 60 MB = FA+AD Premiums, Basic Plans & Riders Types of Endowment Plan 1. Regular Endowment a. Age-based b. Term-based 2. Pure Endowment 3. Anticipated Endowment 73 We are your Learning partners Premiums, Basic Plans & Riders Types of Endowment Plan 1. Regular Endowment a. Age-based - provides maturity benefit at a specified age (Ex. Endowment at 65) b. Term-based - provides maturity benefit at the end of a specified period (Ex. 20 Year Endowment) 74 We are your Learning partners Premiums, Basic Plans & Riders Types of Endowment Plan 2. Pure Endowment 75 • Promises to pay the face amount only if the insured survives up to the end of the endowment period. • Nothing will be paid if death occurs before the end of the endowment period. We are your Learning partners Premiums, Basic Plans & Riders Types of Endowment Plan 3. Anticipated Endowment • 76 Policy owner does not have to wait for the maturity date of before a portion of the face amount is given. We are your Learning partners Premiums, Basic Plans & Riders CLASSIFICATION OF BASIC PLANS According to NATURE 77 We are your Learning partners According to PARTICIPATION According to COVERAGE Premiums, Basic Plans & Riders ACCORDING TO PARTICIPATION PARTICIPATING 78 We are your Learning partners NON PARTICIPATING Premiums, Basic Plans & Riders Participating vs. Non-participating • Non-Participating o is one in which the policy owner does not share in the insurer’s dividends. • Participating o is one under which the policy owner shares in the insurance company’s dividends. 79 We are your Learning partners Premiums, Basic Plans & Riders CLASSIFICATION OF BASIC PLANS According to NATURE 80 We are your Learning partners According to PARTICIPATION According to COVERAGE Premiums, Basic Plans & Riders ACCORDING TO COVERAGE INDIVIDUAL LIFE 81 We are your Learning partners JOINT LIFE GROUP LIFE Joint Life Contributory Joint and Last Survivor NonContributory Premiums, Basic Plans & Riders Individual Life • Provide protection to one person only. There is only one Insured in this type of plan. • May be payable annually, semi-annually or quarterly basis. • Individual policies may also be paid on a monthly basis in the form of Salary Savings insurance. 82 We are your Learning partners Premiums, Basic Plans & Riders Joint Life • 83 Joint Life plans provide protection to two or more persons, allowing a single plan to have 2 or more Insureds. We are your Learning partners Premiums, Basic Plans & Riders Types of Joint Life • Joint Life o Death benefit payable at first death, after which the policy terminates. • Joint and Last Survivor o Insurance coverage is extended until the last person being covered in the policy dies. 84 We are your Learning partners Premiums, Basic Plans & Riders Group Life • Provides protection to a group of people • A single master policy under which individuals in a natural group (such as employees of a business firm) are insured 85 We are your Learning partners Premiums, Basic Plans & Riders Types of Group Life • Non-contributory o employer pays for the premium; 100% of the employees are included in the policy • Contributory o employer and the employees share in the premium payment; at least 75% should be enrolled 86 We are your Learning partners Premiums, Basic Plans & Riders Riders • Are supplementary contracts that when attached to the basic policy, will provide additional benefits at minimal cost. • It is referred to as a rider because it needs a basic policy to “ride on” to be effective. 87 We are your Learning partners Premiums, Basic Plans & Riders Types of Riders • Accidental Death Benefit 88 • Waiver of Premium Due to Disability • Payor’s Benefit • Guaranteed Insurability Option • Term Insurance Rider • Family Income Rider We are your Learning partners Premiums, Basic Plans & Riders Accidental Death Benefit (ADB) • Provides an additional amount equal to the coverage in the event of accidental death of the insured. • Limited within the period of 90 days from the date of the accident. 89 We are your Learning partners Premiums, Basic Plans & Riders Waiver of Premium due to Disability (WPD) • Provides for a waiver of premium if the insured suffers from a total and permanent disability. 90 We are your Learning partners Premiums, Basic Plans & Riders Payor’s Benefit • Provides waiver of premium during the rider term when the payor dies or becomes totally and permanently disabled. • Waives premiums until the time the insured child reaches the age where he can earn and pay for the premiums of the policy. 91 We are your Learning partners Premiums, Basic Plans & Riders Guaranteed Insurability Option (GIO) • Provides an opportunity for people to buy specific amounts of additional life insurance coverage at stated future intervals without the need to show evidence of insurability. • This means that the insured will automatically pay the standard rate since there would be minimal underwriting requirements. 92 We are your Learning partners Premiums, Basic Plans & Riders Term Insurance Rider • Provides an additional amount of coverage for a minimal cost. • The rider has its own face amount separate from the coverage of the basic policy, but cost of coverage is lesser since it is a term coverage. 93 We are your Learning partners Premiums, Basic Plans & Riders Family Income Rider • 94 A form of decreasing term rider that provides the family of the insured monthly income from the insured’s date of death until the duration of the rider. We are your Learning partners Legal Aspects of Life Insurance TRADITIONAL LIFE 95 Legal Aspects of Life Insurance Types of Contracts 96 • Valued Contracts and Contracts of Indemnity • Informal and Formal Contracts • Unilateral and Bilateral Contracts • Aleatory and Commutative Contracts • Contracts of Adhesion and Bargaining Contracts We are your Learning partners Legal Aspects of Life Insurance Valued Contract vs. Contract of Indemnity LIFE INSURANCE NOT LIFE INSURANCE ✓VALUED CONTRACT CONTRACT OF INDEMNITY Specifies the amount of benefit that will be payable when a covered loss occurs, regardless of the actual amount that was incurred. 97 We are your Learning partners The amount of policy benefit payable for a covered loss is based on the actual amount of financial loss, as determined at the time of loss. Legal Aspects of Life Insurance Informal Contract vs. Formal Contract LIFE INSURANCE NOT LIFE INSURANCE ✓INFORMAL CONTRACT FORMALCONTRACT o Parties met requirement o 98 concerning the substance of the agreement. It may be expressed in a verbal or written fashion. Life insurance contracts are typically written. We are your Learning partners o Parties met certain formalities o concerning the form of the agreement. Contract should be written and should have a seal to be enforceable. Legal Aspects of Life Insurance Unilateral Contract vs. Bilateral Contract LIFE INSURANCE NOT LIFE INSURANCE ✓UNILATERAL CONTRACT BILATERAL CONTRACT Only one of the parties (insurer) to the contract has legally enforceable promises. 99 We are your Learning partners Both parties to the contract have legally enforceable promises. Legal Aspects of Life Insurance Aleatory Contract vs. Commutative Contract LIFE INSURANCE NOT LIFE INSURANCE ✓ALEATORY CONTRACT COMMUTATIVE CONTRACT o One party provides o 100 something of value to another party in exchange for a conditional promise One party may receive something of greater value than that party gave. We are your Learning partners o an agreement which the o parties specify in advance the values that they will exchange parties exchange items or services of relatively equal value. Legal Aspects of Life Insurance Contract of Adhesion vs. Bargaining Contract LIFE INSURANCE NOT LIFE INSURANCE ✓CONTRACT OF ADHESION BARGAINING CONTRACT One party prepares the contract and the other may accept or reject as a whole, without any bargaining between the parties to the agreement. 101 We are your Learning partners Both parties, as equals, set the terms and conditions of the contract. Legal Aspects of Life Insurance Offer and Acceptance • For a contract to be valid there must be: An OFFER and ACCEPTANCE 102 We are your Learning partners Legal Aspects of Life Insurance Conditional Receipt • In most cases when an advisor receives the premium payment from the client, he/she issues a conditional receipt to acknowledge payment. 103 We are your Learning partners Legal Aspects of Life Insurance Legal Capacity • Policyowner o Must be of legal age o Must have sound mind and body • Insurance Company o Registration and Regulation o Capitalization 104 We are your Learning partners Legal Aspects of Life Insurance • Insurable Interest o Insurable Interest exists when a policyowner has reasonable chance of suffering financial loss if the person who is insured dies. o It should also exist between the insured and the named beneficiaries. o Its existence during inception of the policy is required. 105 We are your Learning partners Legal Aspects of Life Insurance Every person has an insurable interest in the life and health: 1. Of himself, of his spouse and of his children; 2. Of any person on whom he depends wholly or in part for education or support, or in whom he has a pecuniary interest; 3. Of any person under a legal obligation to him for the payment of money, or respecting property or services, of which death or illness might delay or prevent the performance; and 4. Of any person upon whose life any estate or interest vested in him depends. 106 We are your Learning partners Policy Provisions TRADITIONAL LIFE 107 Policy Provisions While the insured lives and the policy is active.. o Entire Contract Clause o Assignment o Ownership o Dividend Options o Premium Payment o Grace Period o Policy Loan 108 We are your Learning partners Policy Provisions Entire Contract Clause o Made up of the policy and the attached application form o Includes other reports, amendments material to the policy o Cannot be affected by later changes 109 We are your Learning partners Policy Provisions Ownership o Right to assign, transfer or have policies amended. o Change beneficiaries and exercise privileges in the contract. o Right to cash values and dividends. 110 We are your Learning partners Policy Provisions Premium Payment o Can be done annually, semi-annually, quarterly and monthly. o Payment of the first premium makes the contract binding. o Subsequent payments are entirely dependent on the policyowner. 111 We are your Learning partners Policy Provisions Grace Period o Protects the policy from lapsing o Generally, 30 days from due date o Right to cash values and dividends 112 We are your Learning partners Policy Provisions Policy Loan o Right to loan against the cash value o Loan within prescribed limits; not exceed the cash value o Treated as a loan, has interest 113 We are your Learning partners Policy Provisions Incontestability o 2 years after the policy has been in force, the company cannot contest its validity. o If the company has no objection during the period, there can be no question about the payment of proceeds. 114 We are your Learning partners Policy Provisions Dividends o For participating policyholders o Dependent on mortality experience, investment earnings and expenses o 115 NOT GUARANTEED We are your Learning partners Policy Provisions Dividend Options 1. Cash 2. Reduced Premium 3. Interest 4. Paid-Up Addition 5. Yearly Renewable Term 116 We are your Learning partners Policy Provisions When the insured dies… o Misstatement of age o Incontestability o Suicide o Beneficiary o Settlement 117 We are your Learning partners Policy Provisions Misstatement of Age o Misrepresentation on the matter of age o Age is increased or decreased o Amount of proceeds will be adjusted upon death 118 We are your Learning partners Policy Provisions Assignment o Right of the policyowner to transfer or assign the policy o Two types: Absolute and Collateral o Must notify the company of any assignment o Company will accept without question 119 We are your Learning partners Policy Provisions Suicide o To discourage financially desperate people from purchasing policies with suicide in mind. o If committed within 2 years of the policy, the company will refund the premiums. 120 We are your Learning partners Policy Provisions Beneficiary o Designated to receive the proceeds of the policy o Must be identified clearly o Types of Beneficiary: ✓ Primary or Secondary (Contingent) ✓ Revocable or Irrevocable 121 We are your Learning partners Policy Provisions Beneficiary Primary vs. Secondary (Contingent) ✓ PRIMARY- first person in line to receive the death proceeds ✓ SECONDARY (CONTINGENT) - person next in line to receive the proceeds in case of death of the primary beneficiary 122 We are your Learning partners Policy Provisions Beneficiary Revocable vs. Irrevocable ✓ REVOCABLE – changes/amendments to the contract may take effect without consent. Subject to Estate Tax. ✓ IRREVOCABLE - changes/amendments to the contract require written consent. Not subject to Estate Tax. 123 We are your Learning partners Policy Provisions Beneficiary Revocable vs. Irrevocable Minors are not recommended to be named as irrevocable beneficiaries. 124 We are your Learning partners Policy Provisions Settlement o Lump Sum o Interest Option o Fixed Period Option o Fixed Income Option o Life Income Option 125 We are your Learning partners Policy Provisions Settlement • Lump Sum o Single sum payment of the proceeds. • Interest Option o The company will hold the proceeds to earn interest. o Interest earnings will be paid out regularly. 126 We are your Learning partners Policy Provisions Settlement • Fixed Period Option o Pays the beneficiary equal amounts at regular intervals over a specified period of years. • Fixed Income Option o Pays the beneficiary a specified amount until proceeds are depleted. 127 We are your Learning partners Policy Provisions Settlement • Life Income Option o Pays the beneficiary regular income for his lifetime, no matter how long he lives. 128 We are your Learning partners Policy Provisions When the insured quits paying his premiums.. o Non-Forfeiture Options o Reinstatement 129 We are your Learning partners Policy Provisions Non-Forfeiture Options o Cash Surrender Value (CSV) o Reduced Paid-Up (RPU) o Extended Term Insurance (ETI) o Automatic Premium Loan (APL) 130 We are your Learning partners Policy Provisions Non-Forfeiture Options • Cash Surrender Value o Policyowner claims an immediate cash pay-out for his policy. o Once elected, policy is terminated. 131 We are your Learning partners Policy Provisions Cash Surrender Value Protection Period 30 No more protection 40 100 Quits paying: ✓ Receive Cash Surrender Value and Accumulated Dividends ✓ Policy terminates 132 We are your Learning partners Maturity Benefit = 0.00 Policy Provisions Non-Forfeiture Options • Reduced Paid-Up o Protection continues for life but for a lower face amount. 133 We are your Learning partners Policy Provisions Reduced Paid-Up Protection Period Protection Period FA = REDUCED FA = 1,000,000 30 40 Quits paying: 100 ✓ Same Protection Period ✓ Reduced Face Amount 134 We are your Learning partners Maturity Benefit = REDUCED Policy Provisions Non-Forfeiture Options • Extended Term Insurance o Protection continues for the same face amount but only until a certain period of years and days. o Automatic non-forfeiture option. 135 We are your Learning partners Policy Provisions Extended Term Insurance Protection Period Protection Period FA = 1,000,000 FA = 1,000,000 30 Until a certain period of Years and Days Reduced Protection Period 40 Quits paying: ✓ Same Face Amount ✓ New Protection Period 136 We are your Learning partners Maturity Benefit = 0.00 Policy Provisions Non-Forfeiture Options • Automatic Premium Loan o The company lends to the insured an amount from the cash value to pay for the overdue premiums. o Policy has to have a sufficient amount of cash value. 137 We are your Learning partners Policy Provisions Automatic Premium Loan • if cash value is sufficient, automatic payment will be applied on the premium due • it will be considered as policy loan Cash Vaue 30 40 41 missed the 30-day grace period: • SAME protection period • COVERAGE : Face Amount less loan (unpaid due) 138 We are your Learning partners 100 Maturity Benefit = less any unpaid dues with interest Policy Provisions Reinstatement o Pure Reinstatement o Redating 139 We are your Learning partners Policy Provisions Reinstatement • Pure Reinstatement o Pays back all past due premiums plus o proof of insurability is necessary 140 We are your Learning partners interest Policy Provisions Reinstatement • Redating o New premium would be charged o Based on new attained age o New policy effectivity date 141 We are your Learning partners Annuities TRADITIONAL LIFE 142 Annuities Annuities o Purchase of income o Primarily used as an income stream 143 We are your Learning partners Annuities Types of Annuities • Fixed o Single Premium Immediate o Single Premium Deferred o Installment Deferred • Variable o Conventional Variable o Deferred Variable 144 We are your Learning partners Annuities So how are annuities different from life insurance contracts? 145 We are your Learning partners Annuities LIFE INSURANCE Estate Creation Premiums mostly in installments Beneficiary or Insured Death of the Insured or at the Maturity of the Policy 146 We are your Learning partners ANNUITY NATURE Estate Distribution PAYMENT Purchase price mostly paid in lump sum RECIPIENT Annuitant or Successor PAYMENT OF PROCEEDS While the annuitant is still alive or until a specified period Ethics TRADITIONAL LIFE 147 Ethics Unethical Practices o Twisting o Knocking o Overloading o Rebating o Misrepresentation 148 We are your Learning partners Ethics Unethical Practices • Twisting o persuading the person to lapse or surrender a policy in order to purchase a new one. o Also called Replacement 149 We are your Learning partners Ethics Unethical Practices • Knocking o Making derogatory remarks about competing policies, advisors or companies. 150 We are your Learning partners Ethics Unethical Practices • Overloading o Selling a person insurance more than warranted by his resources. 151 We are your Learning partners what is Ethics Unethical Practices • Rebating o Offering part of your commission to your client. o Accepting a smaller premium than the one stipulated in the policy. o Premium discrimination against 152 We are your Learning partners policyholders. Ethics Unethical Practices • Misrepresentation o Misstatement of material facts for insurance 153 We are your Learning partners Insurance Concepts Review PART 2: VARIABLE UNIVERSAL LIFE 154 Course Content Part 1: TRADITIONAL LIFE Part 2: VARIABLE UNIVERSAL LIFE a. Insurance Commission a. Concept of Variable Universal Life b. Insurance Commission Exam (IC)/Insurance Institute for Asia and the Pacific (IIAP) Examination Process b. Financial Planning Process c. Types of Investment Assets d. Types of Funds e. Types of Variable Contract f. Definition of Terms g. How does VUL work? h. Basic Computation of Units c. Concepts of Life Insurance d. Premium, Basic Plans and Riders e. Legal Aspects of Life Insurance f. Policy Provisions g. Annuities h. Ethics 155 We are your Learning partners Concept of VUL Non-Traditional Policies Traditional Policies 1. 2. 3. Premiums, cash values and death benefits are predetermined. Policyholders do not have investment options Implicit charges 1. 2. 3. 4. Examples: Term, Whole Life, and Endowment 156 We are your Learning partners Cash Values/Fund Values are not pre-determined Additional premiums may be allowed (on top of regular premiums) Policyholders may have investment options Explicit charges Examples: Universal Life, Variable Life, and Variable Universal Life Concept of VUL Variable Life (VL) Universal Life (UL) 1. 2. 3. 4. 5. 157 Unbundled Flexible Premiums, Death Benefit Seen as savings account plus term insurance Interest credited to account value, usually subject to minimum interest rate Policyowner does not have a choice of the investment funds We are your Learning partners 1. 2. 3. Fixed premium, minimum death benefit Cash value depends on investment performance Policyowner has a choice of investment funds Concept of VUL Variable Investment Control 158 We are your Learning partners Universal Premium Flexibility Life Death Benefit Concept of VUL POT OF GOLD ILLUSTRATION Top-Ups/Excess Premiums Single Premium or Regular Premium Initial/Premium Charge Initial/Premium Charge Purchase Units in Select Funds Insurance Charge 159 Periodic Charge We are your Learning partners VUL Advantages 160 Diversification Professional Management Flexibility Administration Transparent Charges Investment Risk We are your Learning partners Access Client is Involved Peso Cost-Averaging Peso cost averaging is an investing technique intended to reduce exposure to risk associated with making a single large purchase. The idea is simple: spend a fixed peso amount at regular intervals (e.g., monthly) on a particular investment or portfolio, regardless of the unit price 161 We are your Learning partners Peso Cost-Averaging Example: If you invest Ps. 10,000 today, and the unit price is Ps. 1/unit, you will receive 10,000 units. If you invest the same amount next month, and the unit price is 90 centavos/unit, you will have purchased 11,111 units then. By adding your investment (Ps. 10,000 + 10,000) and dividing the by the total number of units (10,000 + 11,111), you would end up having an average purchase price of 95 centavos per unit. Ps. 20,000 investment = 21,111 units 162 We are your Learning partners Peso Cost-Averaging How can we maximize the returns of the fund? Regular Top-Ups Habit of Saving Buy low, sell high! * It complements peso-cost averaging 163 We are your Learning partners Financial Planning VARIABLE UNIVERSAL LIFE 164 Financial Planning GOALS FINANCIAL RESOURCES o o 165 RISK TOLERANCE PERSONAL CIRCUMSTANCES Managing one’s financial resources in order to achieve specific goals Necessary to develop a financial plan that is suited to client’s unique requirements We are your Learning partners Financial Planning Process Set Goals Analyze Resources Evaluate the Plan Implement the Plan 166 We are your Learning partners Evaluate Investment Options Financial Planning Process To enhance or provide a comfortable standard of living; to provide for dependents To improve one’s financial situation To supplement retirement income SET GOALS To provide funds for the education and bringing up of children To provide a fund for paying necessary costs and taxes when a person dies To save for the down payment/major purchase or event (house/car/debut or wedding) 167 We are your Learning partners Financial Planning Process Keep stock of what you already have (cash/ To enhance or provide a comfortable time deposits, dollar deposits, real estate) standard of living; to provide for The investment decision is greatly affected dependents by the level or amount of funds available To improve one’s financial situation For the investor: the more funds, the greater/wider is the choice of investment available To supplement retirement income ANALYZE RESOURCES To provide funds for the education and Set aside the less liquid assets from those you could bringing up of children use for investment purposes & include a contingency To provide a fund for paying necessary fund costs and taxes when a person dies Review monthly expenses by separating the essential To save for the down payment/major or living expenses from the non-essential or purchase or event (house/car/debut or wedding) discretionary expenses. 168 We are your Learning partners Financial Planning Process You will realize that you can’t afford to set To enhance or provide a comfortable aside funds for all your goals at the same time. standard of living; to provide for dependents Categorized goals: short-term (less than 5 years) To improve one’s financial situation medium term (5-10 years) long term (over 10 years) To supplement retirement income EVALUATE INVESTMENT OPTIONS 169 To provide the education and Tip #1 –funds Don’tfor invest in something you don’t bringing up of children understand To provide a fund for paying necessary • Educate yourself costs and taxes when a person dies • Understand the investment product • Go yourpayment/major way to see what investments are To save for out theof down available in the market purchase or event (house/car/debut or wedding) We are your Learning partners Financial Planning Process Evaluate … or provide a comfortable To enhance standard of living; provide foryou reasonably expect to earn by 1. Potential Return to – How much can investing in the product? Historical return on investment or yield on the dependents investment. To improve one’s financial situation To EVALUATE INVESTMENT OPTIONS 2. Safety – What are the risk involved? Can you lose all or part of your supplement investment? retirement income To provide funds for the education and 3. Liquidity & Marketability (Accessibility of Funds) - If the requires the fund in a short time. Can you readily bringing upindividual of children convert your instrument into cash? To provide a fund for paying necessary - Consider the cost or penalty of realizing the investment before its costs and taxes when a person dies maturity period. Are there any penalties for pre-termination? To save for the down payment/major - Is there a ready buyer or a market for your investment? How purchase event or into the muchor is the initial(house/car/debut cost in setting up or buying investment? Minimum investment amount? wedding) 170 We are your Learning partners Financial Planning Process Evaluate … or provide a comfortable To enhance standard of living; toinvestment provide for 4. Performance of the dependents - country’s economic factors To - competencies/capabilities of the management team improve one’scompany’s financial situation - the invested level of costs To supplement retirement income 5. Taxation Treatment – Different types of investment vehicle/s enjoy (or burden) a wide range of tax treatment. What are the tax implications? What provide funds for the education are the subsequent taxation liabilities of theand investor? EVALUATE INVESTMENT OPTIONS To bringing up of children To provide a fund for paying necessary costs and taxes when a person dies To save for the down payment/major purchase or event (house/car/debut or wedding) 171 We are your Learning partners Financial Planning Process Tip#2 - No Risk , No Gain To enhance or provide a comfortable Tolerance for thetomagnitude standard of living; provide and for variability of future return loss. dependents - The higher the risk, the higher must be the potential returnone’s in order to attractsituation people into investing in it. To improve financial To supplement retirement income 2 Types of Investors 1. EVALUATE INVESTMENT OPTIONS Some investors may be tempted to PLAY it To provide for the education safefunds – CONSERVATIVE instrumentsand (people bringingwith up of lesschildren financial resources – less tolerance for Risk). To provide a fund for paying necessary 2. High net worth individuals are the ones who costs and when person diesmoney to aretaxes less averse to a risk – they have for losses. (people with more money – To save cover for the down payment/major high tolerance for RISK). purchase or event (house/car/debut or wedding) 172 We are your Learning partners Financial Planning Process To enhance or provide a comfortable Types of Risk Investment: standard of living; to provide for dependents 1. Low Risk investment - Bank deposits/short-term government securities (locked-in at interest) To improve one’s financial situation EVALUATE INVESTMENT OPTIONS To supplement retirement income 2. High Risk investment – investment in shares To provide funds for the education and Investor’s of risk averseness depends on… bringing up of level children To provide a fund for paying necessary 1. Age costs2.andInvestment taxes when a person dies Objectives 3. for Financial Condition To save the down payment/major 4. Personality purchase or event (house/car/debut or wedding) 173 We are your Learning partners Financial Planning Process Tip#3 - Match the investment product with your To enhance time or provide horizona comfortable standard of living; to provide for dependents - A match between the investment horizon and the maturity of an investment asset is very important To improve one’s financial situation EVALUATE INVESTMENT OPTIONS 174 1. Short –retirement Term Goalsincome To supplement - Consider investments that are not risky or To providehighly fundsspeculative for the education and (ex. Government securities, bringing uptime of children deposits, high-grade commercial paper, mutual funds & money market funds) To providebond a fund for paying necessary costs and taxes when a person dies 2. Medium – Term Goals To save for the down“medium payment/major - Objective: risk-medium return” purchase- Less or event (house/car/debut or speculative investment returns such as wedding) blue-chip stocks & balanced mutual funds We are your Learning partners Financial Planning Process 3. Medium – Long Term Goals To enhance or provide a comfortable - Objective: to MAXIMIZE investment return standard ofrather living;than to provide forinvestment risk MINIMIZE dependents - take some risks since you have more time to make-up for possible losses To improve one’s financial situation - establish a portfolio that is heavy on “high-riskhigh return” (ex: stocks) To supplement retirement income EVALUATE INVESTMENT OPTIONS To provide funds for the education and bringing up of children To provide a fund for paying necessary costs and taxes when a person dies To save for the down payment/major purchase or event (house/car/debut or wedding) 175 We are your Learning partners Financial Planning Process Tip#4 - Diversification To enhance or provide a comfortable standard of living; to provide for - Risk are inherent in all types of investments dependents To improve one’s financial situation • Process of investing across different asset classes and To supplement retirement income across different market environments EVALUATE INVESTMENT OPTIONS 176 To provide funds for theineducation and • Proven effective reducing risk without sacrificing bringingreturns up of children To provide a fund for paying necessary • “Don’t put all your eggs in one basket.” Spreading of risk costs and taxes when a person dies by putting the money under management into several of investments such as stocks, bonds and To savecategories for the down payment/major purchase or event (house/car/debut or money market instruments. wedding) We are your Learning partners Financial Planning Process To enhance or provide a comfortable standard of living; to provide for dependents Avoid procrastination To improve one’s financial situation Achievingretirement one’s financial goal is financial discipline To supplement income IMPLEMENT THE PLAN To provide funds and Stick to planforif the youeducation haven’t changed your goals bringing up of children or personal circumstances To provide a fund for paying necessary costs and taxes when a person dies To save for the down payment/major purchase or event (house/car/debut or wedding) 177 We are your Learning partners Financial Planning Process EVALUATE THE PLAN 178 A continuing process because the plan has To enhance or provide a comfortable to be evaluated regularly standard of living; to provide for dependents The plan may have to be revised from time to time one’s due tofinancial changes in the market To improve situation conditions & the investor’s needs & wants To supplement retirement income Changes…… To provide funds for the education and -- in the Market Conditions: bringing up of children - new investment products - revisions taxpaying laws necessary To provide a fundoffor - prolonged period of economic costs and taxes when a person dies growth or difficulties To save for the down payment/major -- in the personal requirements: purchase orInvestor’s event (house/car/debut or - being promoted/getting married/ getting older wedding) We are your Learning partners Types of Investment Assets VARIABLE UNIVERSAL LIFE 179 Types of Investments 1. Fixed Income Securities Investments with a fixed principal amount, a fixed period of time (term) and a specific rate of interest (coupon). 180 We are your Learning partners Types of Investments 1. Fixed Income Securities A. Money Market Securities • Commonly referred to as “cash and deposits” • Any deposit instruments with a maturity of 1 year or less e.g. Treasury Bills and Bank Deposits 181 We are your Learning partners Types of Investments 1. Fixed Income Securities B. Bonds Loan that pays interest over a fixed term or period of time 3 general types of bonds Government Bonds Corporate Bonds Convertible Bonds 182 We are your Learning partners Types of Investments 2. Equity Securities (Stocks) • • Pieces of a corporation pie The ownership interest of shareholders in a corporation Preferred Stocks Common Stocks 183 We are your Learning partners Types of Investments 3. Common Trust Fund • • • 184 A form of pooled investment maintained by a bank Sells and buys back units of participation at net asset value Monitored by Banko Sentral ng Pilipinas (BSP) We are your Learning partners Types of Investments 4. Mutual Funds • • • 185 Open-end investment company A regulated investment company with a pool of assets that regularly sells and redeems its shares Monitored by Securities & Exchange Commission (SEC) We are your Learning partners Types of Investments 5. Property • Something owned; any tangible or intangible possession that is owned by someone 3 Types of Properties: ✓ Agricultural Property ✓ Domestic Property & ✓ Commercial/Industrial Property 186 We are your Learning partners Types of Investments 6. Insurance A promise of compensation for specific potential future losses in exchange for a periodic payment 187 We are your Learning partners Types of Funds VARIABLE UNIVERSAL LIFE 188 Types of Funds Stocks or Equity Funds Bond Funds Balanced Funds Money Market Funds Cash Funds Specialized Funds 189 189 Types of Funds Stocks or Equity Funds 190 We are your Learning partners - invests in shares of stocks- prices may be volatile. - mainly to generate long-term for capital appreciation through investment in high-quality equities diversified across sectors. 190 Types of Funds Bond Funds - invests mainly in long-term debt instruments and high-quality fixed income instruments that are classified as below average risk. - aims to generate fixed regular income. 191 We are your Learning partners 191 Types of Funds Balanced Funds 192 We are your Learning partners - invests in both shares of stock and debt instruments. - the allocation my be fixed or may vary at the portfolio manager’s discretion. 192 Types of Funds Balanced Funds - 193 We are your Learning partners it combines the current income from bonds and capital appreciation prospects from stocks. For example, 60% of the funds are in bonds & 40% in equities. 193 Types of Funds Money Market Funds 194 We are your Learning partners - invests purely in short-term (one year or less) debt instruments. - may be diversified or specialized type of money market instrument (prime commercial paper/shortterm government securities). 194 Types of Funds Cash Fund 195 We are your Learning partners - Invests in cash and other forms of bank deposits. - Low risk and relatively safe. 195 Types of Funds Specialized Funds 196 We are your Learning partners - Restrict investments to a particular country or region Income securities. - Offers exposure to different markets in different industry/regions. 196 Types of Variable Contracts VARIABLE UNIVERSAL LIFE 197 Key Features of VUL Payment Period • Single • Regular (Annual) Pay For Regular Premium: • Premiums are paid regularly • Have flexibility of varying the level of regular premium payments, making single premium top-ups or taking premium holidays • If funds are sufficient, the policyowner may stop paying for premiums • The policyowner may vary the sum of his policy without changing the level of his regular premiums 198 We are your Learning partners Key Features of VUL Currency Types of Pricing Method Types of Charges • Philippine Peso • US Dollar • Single Pricing Method • Dual Pricing Method • • • • • Policy Fee Mortality/Assurance Charges Unallocated Premiums Full Withdrawal Charges Investment Management Charges (Bid Offer Spread & Fund Management Fee) 199 We are your Learning partners Type of VUL Contracts Type of Life Insurance LINKED to Investment Funds SINGLE PREMIUM INVESTMENT LINKED WHOLE LIFE PLAN 1. The amount of insurance protection is a percentage (usually 125%) of the single premium paid 2. For long-term savings and investment; offers nominal life protection 3. Top-ups are allowed 4. Right to withdraw full or partial units 200 We are your Learning partners REGULAR PREMIUMS INVESTMENT WHOLE LIFE PLAN 1. Paid on regular intervals for investments & life protection. 2. Life protection is the priority. 3. Premium holiday or top-ups are allowed. 4. Partial & full withdrawal are allowed. Type of VUL Contracts Type of Life Insurance LINKED to Investment Funds INVESTMENT - LINKED INDIVIDUAL PENSION PLAN 1. Usually involves a high allocation of the premium contributions to investments through simply accumulating the fund to retirement. 2. No life insurance cover other than a return of investment funds. 3. There are tax advantages for employees. 201 We are your Learning partners Type of VUL Contracts Type of Life Insurance LINKED to Investment Funds INVESTMENT - LINKED PERMANENT HEALTH INSURANCE 1. Provides health coverage such as disability income. 2. Contains cash value unlike the traditional health plans. 202 We are your Learning partners INVESTMENT-LINKED DREAD DISEASE INSURANCE 1. A policy which advances the whole sum assured in the event of the diagnosis of a critical illness. Definition of Terms VARIABLE UNIVERSAL LIFE 203 Definition of Terms Unit Pricing is the process whereby the unit price of units is set. Offer price or Selling Price the price which the insurer uses to allocate units to a policy when premiums are paid. Bid price or Buying Price the price which the insurer will give for the units if the policyholder wishes to cash in or claim under the policy. Top –ups 204 are single premium injections which can be used to buy additional units. Premium Holiday refers to the cessation of premium payments on a variable life insurance contract for a period, with a view to continue it later on. Forward Pricing is a pricing structure wherein the buying and selling prices of units are determined at the next valuation date. Allocation of premiums means the periodic distribution of premiums to insurance and units. 15-day cooling-off period the contract may be returned within 15 days of receipt by the policyholder. Grace Period 30 days grace period. We are your Learning partners Definition of Terms Policy Fee it covers setting up and administrative expenses Mortality Charges it covers mortality cost (dependent on age) Unallocated Premiums a part of the premium being deposited for marketing & setting-up expenses of the policy Full Withdrawal Charges deducted when the policy is fully withdrawn Bid-Offer Spread difference between bid and offer prices Fund Management Fee it is imposed on each investment fund (.5% - 2% per annum) - used to cover investment expenses Fund Switching Charge What is Switching? - Facility for transferring from one fund to another - Limited number of switches are usually not charged - Useful in retirement and education fees planning Fund Allocation Charge 205 changes in fund allocation in the policy We are your Learning partners How does VUL work? VARIABLE UNIVERSAL LIFE 206 How does VUL Work? Single Premium Ps. 100,000 Total Charges Policy Fee • 207 Is usually imposed once as a flat fee at the start of the policy We are your Learning partners Admin & Mortality Charge • Covers the cost of providing life protection for the insured • Varies according to the age of the insured • May be paid once at the start of the policy or on a recurrent manner How does VUL Work? Single Premium Ps. 100,000 Total Charges Policy Fee Administrative & Mortality Charge Ps. 200 Ps. 3% of the Premium Ps. 100,000 x 3% = Ps. 3,000.00 Ps. 3,200.00 Ps 96,800 : Net Available for Investments 208 We are your Learning partners How does VUL Work? Ps 96,800 : Net Available for Investments Units Purchased & Remaining Offer Price Is the price used to allocate/create units @ Ps. 1.50 Purchased Units Ps. 96,800/Ps. 1.50 64,533.33 units created Bid Price Is the price used for cash-in or claims @ Ps. 1.40 Note: OFFER PRICE or SELLING PRICE is the price which the insurer uses to allocate units to a policy when premiums are paid. BID PRICE or BUYING PRICE is the price which the insurer will give for the units if the policyholder wishes to cash in or claim under the policy. BID -OFFER SPREAD is the difference between the bid price and the offer price. 209 We are your Learning partners How does VUL Work? Offer and Bid Prices REMEMBER Offer Price is always greater than the Bid Price Bid Offer spread is expressed in percentages, e.g. 5% or 0.05 Prices (and computation) are rounded down to 4 decimal places 210 We are your Learning partners How does VUL Work? OFFER Price is the price used to allocate units Ps 96,800 : Net Available for Investments Bid Offer Spread is the difference between Offer and Bid Price Offer Price or Selling Price Ps.1.50 6.67% Policy amount Ps. 90,346.66 Units bought 64,533.33 Bid Price (buying price) Ps. 1.40 BID Price is the price for cash-in or claims 211 We are your Learning partners How does VUL Work? PARTIAL AND FULL WITHDRAWAL Ps 96,800 : Net Available for Investments 64,533.33 Units Purchased & Remaining Partial Withdrawal BID PRICE Is the price used for Cash-in or Claims @ Ps. 1.40 Ps. 20,000 • Full of Partial Withdrawal of Units is Allowed Units to be CANCELLED Ps. 20,000/ Ps. 1.40 14,285.7143 units Units Remaining after Withdrawal 64,533.33 -14,285.7143 212 = 50,247.6157 units How does VUL Work? Computation of Units Single Pricing Method ➢ There is only one price quoted whether the policyowner is buying or selling his units. Dual Pricing Method ➢ The policyowner buys the units at the offer price and sells the units at the bid price. EXAMPLE: 213 We are your Learning partners How does VUL Work? Computation of Units Important Formulas No. of Units = Single Premium/Unit Price rounded down to 4 decimal places Bid Price = Offer Price (1-Spread%) or BO1S Offer Price = Bid Price / (1-Spread%) or OB/1S Yield/Interest = (Full Withdrawal Value / Single Premium) 1/n - 1 Accumulation of Fund = x (1 + i) n 214 We are your Learning partners How does VUL Work? Single Pricing Method No. of Units (bought) = Allocated Premium/Unit Price No. of Units (cancelled) = Amount/Unit Price Fund Value = No. of Units x Unit Price 215 We are your Learning partners How does VUL Work? Basic Computation Single Pricing Method Example: A policyowner pays a single premium of Php 50,000 and the unit price at that time is Php 1.50. The insurance company deducts an initial charge of 5% and a mortality charge of 1.6%, both as a percentage of single premium. The initial charge is deducted before the premium is allocated while the mortality charge is deducted by canceling the units. 216 We are your Learning partners How does VUL Work? Basic Computation 1. The following outlines the steps in the calculating the number of units bought after all the charges We calculate the charges first. Initial Charge (5% Single Premium) Mortality Charge (1.6% x Single Premium) Php 2,500.00 800.00 Because the initial charge is deducted before the single premium is used to buy units, we calculate the remaining single premium. Single premium Less: Initial Charge Single Premium (Net of Initial Charge) 217 We are your Learning partners - Php 50,000.00 2,500.00 47,500.00 How does VUL Work? Basic Computation 2. The Single Premium (Net of Initial Charge) will then be used to buy units No. of Units Bought = Single Premium (Net of Initial Charge) /Unit Price = Php. 47,500.00/ 1.50 = 31,666.6667 Units 3. The Mortality Charge is deducted by canceling units. The No. of units to cancel (Mortality Charges) is: (Mortality Charges) = Mortality Charge/ Unit Price = 800.00/1.50 = 533.3333 Units 31,666.6667 - 533.3333 218 We are your Learning partners = 31,133.3334 units How does VUL Work? Basic Computation Withdrawal Benefit Partial or full withdrawal of units can be made by the policyholders at anytime while their policy is in force. Withdrawals are made by selling (or “canceling”) some or all of the units using the unit price at the time of withdrawal. When full withdrawal of units is made, the insurance policy is terminated. All policy benefits like the sum assured guarantee and other supplementary benefits will cease. Example: Suppose that the policyowner has 10,000 units and the unit price is Php1.97. He wishes to withdraw (partially) Php 10,000 from his policy. The following steps show how the withdrawal is made and the remaining no. of units after the withdrawal. 219 We are your Learning partners How does VUL Work? Basic Computation Withdrawal Benefit Because the withdrawals are made by selling units, the no. of units that needs to be sold to fund the withdrawal is calculated. No. of Units to sell = Withdrawal Amount Unit Price = Ps10,000.00 1.97 = 5,076.1421 units The remaining no. of units after Withdrawal is therefore: = 10,000 - 5,076.1421 = 4,923.8579 units 220 We are your Learning partners How does VUL Work? Dual Pricing Method No. of Units (bought) = Allocated Premium/Offer Price No. of Units (cancelled) = Amount/Bid Price Fund Value = No. of Units x Bid Price Bid Price = Offer Price (1- Spread) or BO1S Offer Price = Bid Price/ (1-Spread %) or OB/1S 221 We are your Learning partners How does VUL Work? Basic Computation Dual Pricing Method Under the dual pricing method, there are two prices quoted : - The price used to create/allocate units (offer price) is higher than the price used to cancel/cash-in/claim units (bid price). - One price can be worked out from the other if the bid offer spread (Spread %) is known using the formulas: Bid Price = Offer Price x (1-Spread%) or BO1S Offer Price = Bid Price/(1- Spread%) or OB/1S 222 We are your Learning partners How does VUL Work? Basic Computation Dual Pricing Method Example: If the offer price is 1.50 and the bid offer spread is 5%, the bid price can be worked out as: Bid price = Offer Price (1-spread%) and = 1.50 (1-5%) = 1.4250 223 We are your Learning partners How does VUL Work? Basic Computation Dual Pricing Method A policyowner pays a single premium of Php 50,000 and the offer price at that time is Php 1.50. The company’s bid-offer spread is 4% The insurance co. deducts an initial charge of 5% and a mortality charge of 1.6%, both as a percentage of single premium. The charges and fees are deducted by canceling units after the whole single premium is used to buy units. 1. We calculate first the number of units allocated without charges: No. of units allocated 224 = Single Premium Offer Price No. of units allocated = No . Of units allocated w/o charges = We are your Learning partners 50,000 1.50 33,333.3333 units How does VUL Work? Basic Computation Dual Pricing Method 2. Because the initial charge and mortality charge are deducted by canceling units after the single premium is invested, we add the charges then convert into units using the bid price (bec. the policyholder, in effect, buying units to pay for the initial and mortality charges. In the example, only the offer price is given. Thus, we have to compute for the bid price using the given bid- offer spread. Bid price = Offer price (1-Spread%) = 1.50 (1-4%) = 1.44 225 We are your Learning partners How does VUL Work? Basic Computation Cancellation of Units 3. We now calculate for the number of units to cancel: Initial Charge (5%Single Premium) Mortality Charge (1.6% x Single Premium) 2,500 800 ------------ Total Charges in peso 3,300 Total charges in units = Total charges = Total charges in units 226 We are your Learning partners = 2,291.6667 units Bid price 3,300 1.44 How does VUL Work? Basic Computation Cancellation of Units Now subtract the total charges in units from the no. of units allocated for investment. No. of units bought Total charges 227 We are your Learning partners 33,333.3333 - 2, 291.6667 31,041.6663 units (after all charges) How does VUL Work? Basic Computation Accumulation of Fund Over a Period of Time To compute for the accumulation of fund over a period of time Where the amount is X after n years and it increases by i (interest rate), we will you use this formula X (1+i) n Example A: What is PhP 20.00 after 10 years if it increases by 5% annually? Using the formula, X (1+i) n 20 (1+ 0.05) 10 = PhP 32.58 228 We are your Learning partners How does VUL Work? Basic Computation Accumulation of Fund Over a Period of Time Example B: Over the next 6 years, the offer price is projected to constantly increase by 7% annually. Compute for the bid price and offer price after 6 years if the bid price now is PhP1.20 and the bid offer spread is 5%. 229 Offer Price (present) = P1.20/unit (1-0.05) = 1.26 Offer Price (after 6yrs) = x (1+i) n = 1.26 (1+0.07) 6 = P1.89 Bid price after 6yrs = 1.89 (1-0.05) = P1.80 We are your Learning partners Test Taking Tips INSURANCE CONCEPTS 230 Test Taking Strategies Before the Exam 1. Be prepared, Read and Review. 2. Before the test, list everything you will need for it that is allowed. 3. Review your Traditional Life and VUL Simulated Exams and Reviewers. 231 We are your Learning partners Test Taking Strategies During the Exam 1. Read the directions carefully. 2. Get the big picture. 3. Answer easy questions first. 4. Eliminate answers to difficult questions 5. Review your test to make sure that you have answered all questions. 232 We are your Learning partners THANK YOU! & GOOD LUCK! 233 We are your Learning partners