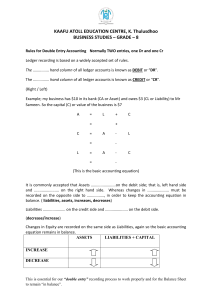

Financial Accounting Chapter-1 Introduction Q.1 What is accounting? Accounting is an information system that identifies records and communities the economic events of an organization to interested users. Let’s take a closer look at these three activities --1. Identifying economic events involve selecting the economic activities relevant to a particular organization. Sale of goods, purchase of assets, expenses and revenues received etc are example of economic events. 2. Once identified economic events are recorded to provide a history of the organization’s financial activities. Recording consists of keeping a systematic, chronological diary of events, measured in Dollars and Cents/Taka and Paisa. In recording, economic events are also classified and summarized. 3. The identifying and recording activities are of little use unless the information is communicated to interested users. Financial information is communicated through accounting reports, the most common of which also called Financial Statements. A vital element in communicating economic events is the accountant’s ability to analyze and interpret the reported information. Analysis involves the use of use of ratios, percentage, graphs, and charts to highlight significant financial trend and relationship. Interpretation involves explanting the uses, meaning and limitations of reported data. Q.2 Who are the users of accounting data? Because it communicates financial information, accounting is often called ‘’the language if Business’’. There are two broad groups of users of accounting information: 1. Internal Users and 2. External Users. 1. Internal Users: Internal Users of accounting information are managers who plan, organize and run a business. These include marketing managers, production supervisors, financial directors and company officers. For internal users, accounting provides internal reports. Example: cost information, production data and projections of income from new sales campaigns and forecasts of cash needs for the next year. 1 2. External Users: There are several type of external users of accounting information. Investors (owners) use accounting data to make decisions to buy, hold or sell stock. Creditors such as suppliers and bankers use accounting data to evaluate the risks of granting credit or lending money. The information need of other external users very considerably Taxing authorities, such as NBR want to know whether the company complies with the tax laws. Regulatory agencies, such as SEC want to know whether the company is operating with in prescribed rules. Customers are interested in whether a company will continue to product warranties and support its product lines. Labour Unions want to know whether the owners can pay increased wages and benefits. Economic planners use accounting information to forecast economic activity. C. The Origin of Accounting: The origin of accounting is generally attributed to the work Luca Pacioli, an Italian Renaissance mathematician. Pacioli was a close friend and tutor to Leonardo da Vinchi and a contemporary of Christopher Columbus. In his 1494 text ‘’Summa de Arithmetica, Geometria, Proportione et Proportionalite’’, Pacioli described a system to ensure that financial information was recorded efficiently and accurately. D. Book-keeping and Accounting: Book-keeping usually involves only the recording of economic events. It is therefore just one part of the accounting process. In total, accounting involves the entire process of identifying, recording and communicating economic events. E. Generally Accepted Accounting Principles: The accounting profession has developed standards that are generally accepted and universally practiced. This common set of standards is called generally accepted accounting principles (GAAP).These standards indicate how to report economic events. FASB, SEC: Two organizations are primarily responsible for establishing generally accepted accounting principles. The first is the Financial Accounting Standards Board (FASB) and the second one is the Securities and Exchange Commission (SEC). Cost Principles: One important principles is the cost principle, which states that assets should be recorded at their cost. Cost is the value exchanged at the time something is acquired. 2 F. Assumptions: In developing GAAP, certain basic assumptions are made. These assumptions provide a foundation for the accounting process. Two main assumptions are the monetary unit assumption and the economic entity assumption. i) Monetary Unit assumption requires that only transaction data that can be expressed in terms of money and/or money’s worth be included in the accounting records. This assumption enables accounting to quantify (measure) economic events. ii) Economics Entity Assumption: An economic entity can be any organization or unit in society. It may be a business enterprise, a governmental unit, a municipality, a school or a church/mosque. The economic entity assumption requires that the activities of its owner and all other economic entities. Proprietorship, Partnership, Corporation are examples of economic entity. G. Basic Accounting Equation: The two basic elements of a business are what it owns and what it owes. Assets are the resources owned by a business. Liabilities and owners equity are the rights or claims against these resources. Claims of those to whom money is owned (creditors) are called liabilities . Claims of owners are called owner’s equity. This relationship of assets, liabilities and owner’s equity can be expressed as an equation as follows: Assets = Liabilities + Owner’s Equity This relationship is referred to as the Basic Accounting Equation. Assets must equal the sum of liabilities and owner’s equality. Assets are resources owned by a business. Liabilities are claims against assets. That is, liabilities are existing debts and obligations. Owner’s Equity- The ownership claim on total assets is known as owner’s equity. Owner’s equity is increased by owner’s investments and by revenues from business operations. In contrast, owner’s equity is decreased by an owner’s withdrawals of assets and by expenses. Net income results when revenues exceed expenses. A net loss occurs when expenses exceed revenues. 3 H. Transaction Analysis: Transaction (often referred to as business transactions) is the economic events of an enterprise that are recorded. Transactions may be identified as external or internal. External transactions involve economic events between the company and some outside enterprise. Internal transactions are economic events that occur entirely within one company. Example : Use of supplies, depreciation and an assets, etc., A company may carry on many activities that do not in themselves represent business transactions. Hiring employees, answering the telephone, talking with customers, and placing orders for merchandise are not transactions. Some of these activities however may lead to business transactions: employees will earn wages, and merchandise will be delivered by suppliers. If an event has an effect on the components of the basic accounting equation, it will be recorded in the accounting process as business transaction. The equality of the basic equation must be preserved. Therefore, each transaction must have a dual effect on the equation. I. Financial Statements: After transactions are identified, recorded and summarized, four financial statements are prepared from the summarized accounting data: 1) Income Statement- for a specific period of time. 2) Owner’s Equity Statement- for a specific period of time. 3) Balance Sheet- reports the assets, liabilities and owner’s equity at a specific date. 4) Statement of cash flows- summarizes information about the cash inflows (receipts) and outflows (payments) for a specific period of time. Each statement provides management, owners, and other interested parties with relevant financial data. Also, every set of financial statements is accompanied by explanatory notes and supporting schedules that are an integral part of the statement. 4 J. Branches of Accounting: With the development of trade and commerce, industry and economy the use of accounting information increased and the new branches of accounting originated. The main branches of accounting are as follows: 1) Financial Accounting : Deals with financial transactions of an enterprise. It records all economic events. 2) Cost Accounting : To ascertain cost of production & control costs. 3) Management Accounting : Techniques used to take day to day decisions of business. 4) Tax Accounting : That determines the income tax, sales tax, VAT, wealth tax, etc. 5) Integrated Accounting : Combination of cost & financial accounting. 6) National Income Accounting : That counts the national income, GDP, NNP, per capita income and standard of living of people of the country. 7) Government Accounting : Accounts maintained in public sector or in different departments of the government Cash system of Accounting. 8) Human Resources Accounting : Keeping accounting of expenses for development of human resources, collecting data about human resources, identifying the human resources and supplying the information about the human resources to the users of the same is the subject matter of HR accounting. 9) Budgetary Accounting : Preparation of different budgets like cash budget, production budget, sales budget, master budget and use of accounting information for preparing those budgetary accounting., 10) Inflationary Accounting : Inflationary accounting refers to the process of adjusting the financial statements of a company to show the real financial position of the company during inflationary period. Assets are recorded at cost price of historical value but due to inflation, the depreciation on these assets is charged at cost which is less than the current market value resulting in inflation of profit., To adjust it, inflation accounting is originated and depreciation and profit as per inflation accounting is shown in financial statements in developed countries. 11) Social Accounting: Social accounting measures the environmental and social impact of an organization. Business is a socio-economic activity and it draws its inputs from the society, hence its objective should be the welfare of the society. When the technique of double aspect of transactions is applied in socio-economic sectors, then it is called social accounting. Counting national & foreign income, etc. 5 12) Responsibility Accounting: In govt. private & autonomous organization, functions are delegated to different executives. To ascertain whether they have performed their functions duly, Responsibility accounting originated. K. The Account and Types of Account An account is an individual record of increases and decreases in a specific asset, liability or owner’s equity items. For example, cash a/c, accounts receivable, salaries expenses, service revenue a/c and so on. In its simplest form an account consists of three parts: (i) The title of the a/c; (ii) A left or debits side and (iii) A right or credit side. It is called T account as the parts of an account resemble the title-T. Types of accounts: Traditionally, Luca Pacioli classified the accounts into three –a) Personal a/c, b) Real a/c, and c) Nominal a/c. According to modern concept, the accounts are classified into five (5) types- i)Assets a/c, ii) Liabilities a/c, iii) Owner’s equity/capital a/c, iv) Expenses a/c, and v) Revenues a/c. Debits and Credits- Rules for ascertaining debit & credit: A) Traditional Method: Personal A/C - Receiver of the Benefit- Debit Giver of the benefit- Credit Real A/C - What comes in- Debit What goes out- Credit Nominal A/C - All expenses and losses- Debit All incomes, revenues, gains & profits-Credit B) Modern Concept: a) Assets A/C- Increase in assets- Debit Decrease in assets- Credit b) Liabilities A/C- Decrease in liabilities- Debit Increase in liabilities- Credit c) Owner’s equity A/C- Decrease in capital/ Owner’s equity-Debit Increase in capital/ Owner’s equity- Credit 6 d) Expenses A/C- Increase in expenses- Debit Decreases in expenses- Credit e) Revenue A/C- Decreases in revenue/incomes- Debit Increases in revenue/incomes- Credit L. The Double Entry System of Book-keeping; Definition: A system that records in appropriate accounts the dual aspect/effect of each transaction. Debits must equal credits for each transactions. Other systems of Book – keeping are – (a) Single Entry System and (b) Cash system. M. The Accounting Cycle – Basic Steps: Accounting cycle is the procedure/process of recording business transactions step by step in books of accounts under the double entry system of accounting. The basic steps of accounting cycle are – Identifying the transactions, accounts, evidences. Recording the transactions – in Journal. Classifying the transactions – in Ledger. Summarizing the accounts – preparation of trial balance. Preparation of financial statements. Analysis and interpretation – reporting to users. Opening entry Other steps of accounting cycle are – Adjusting entries Adjusted trial balance Closing entries Reversing entries 7 N. The journal: The book in which transactions are initially recorded in chronological order, is called a Journal. It is the book of original entry. For each transaction the journal shows the debit and credit effects on specific accounts.(In computerized system, ‘Journals’ are now kept as files, and accounts are recorded in computer databases). Companies may use various kinds of journals, but every company has the most basic form of journal, a General Journal. Other journals are – cash book, purchases book, sales book, A/R book, Returns book etc. Journalizing: Entering transaction data in the journal is called Journalizing. Separate journal entries are made for each transaction. The form of a General Journal is as below: Date Account title & Explanation 2006 Ref. Cash A/c Jan 1 Debit Taka 1000000 Karim’s Capital A/c Credit Taka 1000000 (Being Capital in cash invested in business) Types of entry - a) Simple Entry and b) Compound Entry O. The Ledger: The entire group of accounts maintained by a company is called the Ledger. The ledger keeps in one place all the information about changes in specific account balances. Companies may use various types of ledgers, but every company has a General Ledger. A general ledger contains all the assets, liabilities and owner’s equity accounts. Other ledgers are Customer’s ledger and Supplier’s ledger. Form of ledger - a) T-account from (British System & Traditional form) b) Three-column form of ledger account Date Explanation Ref. Debit Credit Balance Dr 8 Cr P. The Trial Balance: A trial balance is a list of accounts and their balances at a given time. Customarily, a trial balance is prepared at the end of an accounting period. The primary purpose of a trial balance is to prove (check) that the debits equal the credits after posting. In addition, it is useful in the preparation of financial statements. Limitations of Trial Balance: A trial balance does not guarantee freedom from recording errors; however, some errors could not be detected by the trial balance like – Errors of omission Errors of commission Errors of principle and Off-setting errors/compensating errors. Form of Trial Balance: ... … … Co. Ltd. Trial Balance For the month of January, 2006 Sl. Account title Ledger No Debit Credit Folio *But the ledger folio column is omitted. Book Reference: 1. Weygandt, Kieso, Kimmel, Accounting Principles,(12th Edition), John Wiley and Sons,USA. 9