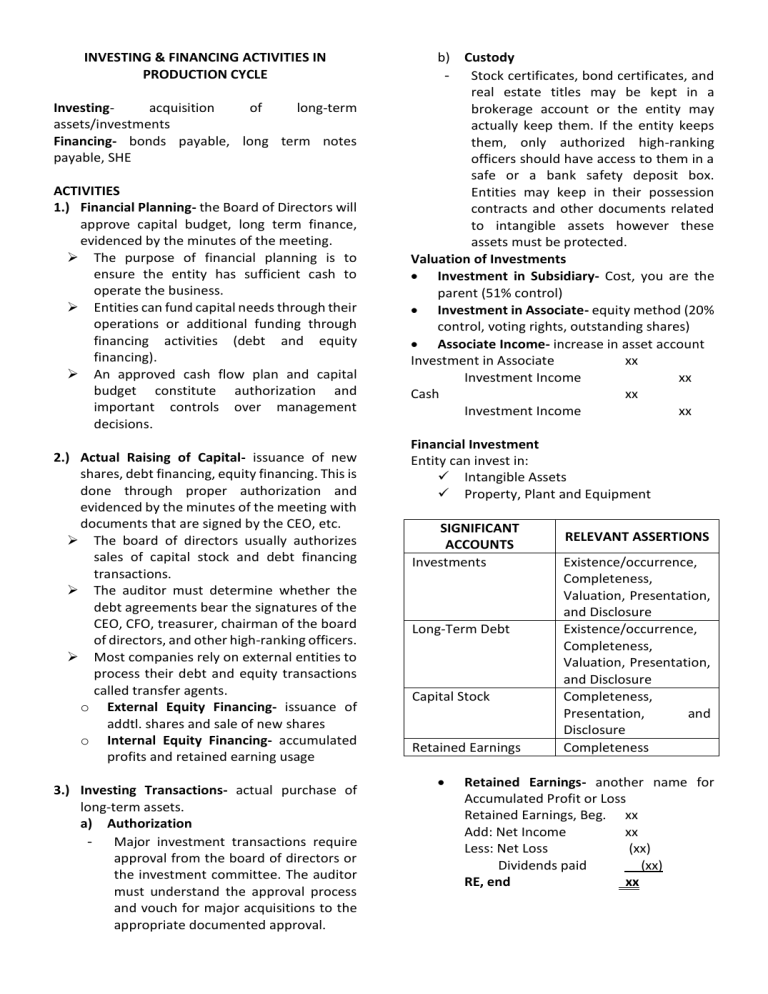

INVESTING & FINANCING ACTIVITIES IN PRODUCTION CYCLE Investingacquisition of long-term assets/investments Financing- bonds payable, long term notes payable, SHE ACTIVITIES 1.) Financial Planning- the Board of Directors will approve capital budget, long term finance, evidenced by the minutes of the meeting. The purpose of financial planning is to ensure the entity has sufficient cash to operate the business. Entities can fund capital needs through their operations or additional funding through financing activities (debt and equity financing). An approved cash flow plan and capital budget constitute authorization and important controls over management decisions. 2.) Actual Raising of Capital- issuance of new shares, debt financing, equity financing. This is done through proper authorization and evidenced by the minutes of the meeting with documents that are signed by the CEO, etc. The board of directors usually authorizes sales of capital stock and debt financing transactions. The auditor must determine whether the debt agreements bear the signatures of the CEO, CFO, treasurer, chairman of the board of directors, and other high-ranking officers. Most companies rely on external entities to process their debt and equity transactions called transfer agents. o External Equity Financing- issuance of addtl. shares and sale of new shares o Internal Equity Financing- accumulated profits and retained earning usage 3.) Investing Transactions- actual purchase of long-term assets. a) Authorization - Major investment transactions require approval from the board of directors or the investment committee. The auditor must understand the approval process and vouch for major acquisitions to the appropriate documented approval. b) Custody - Stock certificates, bond certificates, and real estate titles may be kept in a brokerage account or the entity may actually keep them. If the entity keeps them, only authorized high-ranking officers should have access to them in a safe or a bank safety deposit box. Entities may keep in their possession contracts and other documents related to intangible assets however these assets must be protected. Valuation of Investments Investment in Subsidiary- Cost, you are the parent (51% control) Investment in Associate- equity method (20% control, voting rights, outstanding shares) Associate Income- increase in asset account Investment in Associate xx Investment Income xx Cash xx Investment Income xx Financial Investment Entity can invest in: Intangible Assets Property, Plant and Equipment SIGNIFICANT ACCOUNTS Investments Long-Term Debt Capital Stock Retained Earnings RELEVANT ASSERTIONS Existence/occurrence, Completeness, Valuation, Presentation, and Disclosure Existence/occurrence, Completeness, Valuation, Presentation, and Disclosure Completeness, Presentation, and Disclosure Completeness Retained Earnings- another name for Accumulated Profit or Loss Retained Earnings, Beg. xx Add: Net Income xx Less: Net Loss (xx) Dividends paid (xx) RE, end xx Internal Control 1.) Segregation of duties o Custody (transfer agent, banks) Stock certificates, bond certificates, and real estate titles may be kept in a brokerage account or the entity may actually keep them. o o If the entity keeps them, only authorized high-ranking officers should have access to them in a safe or a bank safety deposit box. Entities may keep in their possession contracts and other documents related to intangible assets however these assets must be protected. Recording Authorization (approval BOD- minutes of the meeting) Major investment transactions require approval from the board of directors or the investment committee. The auditor must understand the approval process and vouch for major acquisitions to the appropriate documented approval. Substantive Analytical Procedures and Test of Details in the Financing and Investing Cycle 1.) Fair Value Measurement 2.) Internal Expense is properly recorded - Classification of liability 3.) SHE, inspect minutes of the meeting - Trace cash proceeds to bank account - Confirmation- send confirmation letter to transfer agent 4.) Stock based compensation plan - High-ranking officers share salaries (may be through shares) - Copy of compensation plan approved by the BOD; mins. Of the meeting - Vesting Period: 3 years The auditor normally relies on substantive tests of details in the financing and investing cycle because the transactions involved are nonroutinary and involve large amounts. Investment costs should be vouched to the broker’s confirmations, monthly statements, or other documentary evidence of cost. The auditor may determine evidence about value impairment of trading securities securities available-for-sale sale INVENTORIES Measures at the lower of cost and Net Realizable Value Raw Materials, Work in Process, Finished Goods Assets sold in the ordinary course of business. Inventory varies in the nature of the business. Legal Test- to test if it is part of the entity’s inventory. Items that you own, but not in physical possession Purchases in transit; FOB Shipping Point Sales in Transit; FOB Destination Goods out on consignment o Not “on”, “to”, “for”- excluded o “with”-included Goods in the hands of the salesmen Goods left by customers for approval Inventories include: - Merchandise - Raw materials - Work in process - Finished goods inventory - Allowance for obsolescence (spoilage) Periodic- with purchases accounts, requires physical count Perpetual- merchandise, physical count at least once, if effective, can be none Trade Discount- not recorded Cash Discount- recorded TD Invoice= 700,000 Trade Discount= 10%, 15% Inventory 535,500 A/P 535,500 CD Credit Term: 1/15,n/30 A/P 535,500 Purchase Discount 5,355 Cash 530,145 Inventories 1.) Cost of Purchase - Initial acquisition price + cost of acquisition, import duties (customes will hold goods, til paid, then released) & other costs. 2.) Manufacturing Costs - Conversion cost (DM, DL, Manuf. OH), Variable and Fixed Costs Inventory Cost Flow 1.) First in, First Out (FIFO) 2.) Weighted Average Method 3.) Specific Identification 4.) Relative Sales Price Method