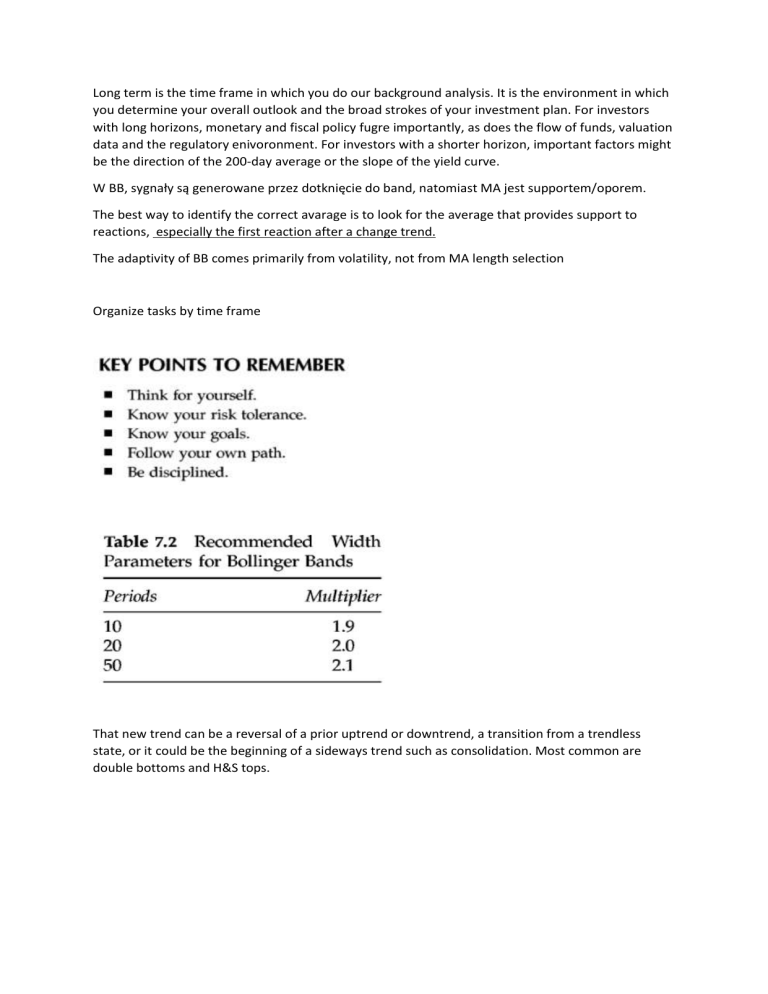

Long term is the time frame in which you do our background analysis. It is the environment in which you determine your overall outlook and the broad strokes of your investment plan. For investors with long horizons, monetary and fiscal policy fugre importantly, as does the flow of funds, valuation data and the regulatory enivoronment. For investors with a shorter horizon, important factors might be the direction of the 200-day average or the slope of the yield curve. W BB, sygnały są generowane przez dotknięcie do band, natomiast MA jest supportem/oporem. The best way to identify the correct avarage is to look for the average that provides support to reactions, especially the first reaction after a change trend. The adaptivity of BB comes primarily from volatility, not from MA length selection Organize tasks by time frame That new trend can be a reversal of a prior uptrend or downtrend, a transition from a trendless state, or it could be the beginning of a sideways trend such as consolidation. Most common are double bottoms and H&S tops. W-TYPE BOTTOMS Difference in psychology – bottoms are created in an environment of fear and pain, quite different from the environment of euphoria and hope in which tops are formed. Thus we expect bottoms to be sharper and more tightly focused to take less time and be more dramatic. Ws can be formed in any number of ways, each with their own emotional color. The right-hand side of the formation can be higher, equal to or lower than the left side. Where the right side of the W is higher, frustration is the main emotion when investors waiting for a “proper retest” are left standing at the door as the stock rallies away from them. When the lows are equal, satisfaction is the main emotion as investors buy into the restest without much trouble and are rewarded quickly. When low on the right-hand formation is a lower low, fear and discomfort characterize the crowd. Investors who bought at the prior low are shaken out, and few have the courage necessary to get back in. BOLLINGER BANDS AND INDICATORS VOLUME INDICATORS STRATEGIA: FOLLOW TRENDU Strategia: Reversale INVESTING IS A TOUGH TASK, TAKE CARE OUT THERE