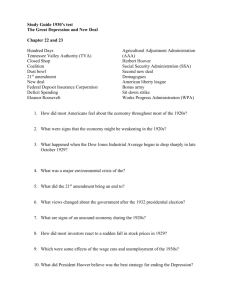

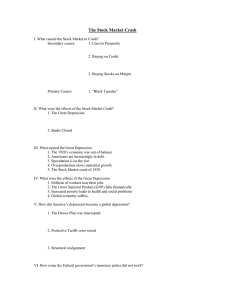

How did consumers weaken the economy in the late 1920s? Consumers did not necessarily weaken the economy in the late 1920s, but rather falling consumer spending was one of the indicators of a faltering economy during the Great Depression that started in 1929. The stock market crash of 1929 marked the beginning of a deep economic slump that lasted for over a decade in the United States. One of the causes of the depression was the overproduction of goods and a lack of demand for those goods, which ultimately led to a decline in consumer spending. The overproduction of goods was a result of a boom period in the 1920s when manufacturers increased production to meet rising consumer demand. However, when demand started to fall, manufacturers had to cut prices to sell their products. As prices fell, companies' profits declined, which, in turn, led to wage cuts and layoffs. Unemployment and falling wages reduced the amount of money consumers had to spend, ultimately leading to a vicious cycle of reduced demand for products and further cutbacks in production and employment. Moreover, many consumers had purchased goods on credit that they could not afford to pay back, leading to an increase in defaulted loans, and ultimately, the collapse of banks. The decreased availability of credit made it more difficult for businesses to finance their operations or for consumers to buy homes or other durable goods, which added to the decline in consumer spending. References: - "The Great Depression." Economic History Association, 2008, eh.net/encyclopedia/thegreat-depression/ . - "The Stock Market Crash and the Great Depression." Federal Reserve History, 2020, federalreservehistory.org/essays/stock-market-crash-and-great-depression . - "Falling Consumer Demand Amplified the Great Depression." The Balance, 2021, thebalance.com/causes-of-the-great-depression-3305689 .