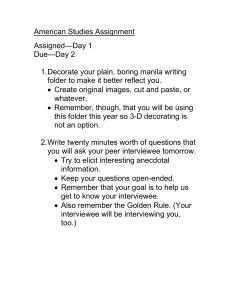

CASEBOOK 1 FIRM TYPE clubs.marshall.usc.edu/mcsc INDUSTRY MCSC 2016 Casebook 1: Table of Contents • FIRM Case # Type Name Industry Page Aviation 3 Sports 5 Automotive 7 General 9 Small Business 11 1 Market Sizing Flying High 2 Market Sizing Dry Cleaners in Philadelphia 3 Market Sizing Car Tires in the United States 4 Market Sizing What a Drag 5 Market Sizing Japanese Golf Ball Market 6 Market Entry RayQ Magazine Publishing 13 7 Profitability You’ve Got Mail! e-Commerce 15 8 Cost Reduction MarshallCare Healthcare 18 9 Profitability Ray’s Streetside Slots Entertainment 21 10 Profitability Drake’s Deposit Disaster Finance 24 11 Market Entry Trojan Airlines Aviation 27 12 Private Equity Wang’s Bistro Small Business 30 13 Market Entry Giant-Sized Chickens Vitamins 33 14 Profitability Houston Firearms Defense 36 15 New Product Missle Misser Aerospace 38 16 Market Entry Home Alone Security 41 17 New Business Olympic Trials Sports 47 18 Profitability Chris’ Clothes Fashion, Retail 50 19 Profitability Make up your mind Cosmetics 57 20 Profitability Plastics Manufacturing 60 TYPE INDUSTRY 2 Case 1: Flying High PROMPT How many Americans fly domestically each day? DESCRIPTION ADDITIONAL INFORMATION (if asked) This case is designed to test math skills as well as well as present the interviewer Commercial • Assume 3,000 domestic flights per day • An average flight has 250 seats • Average flight occupancy is 80% • Average staff consists of 2 pilots and 8 flight attendants Cargo • Assume 6,000 flights per day • An average flight has 10 crew members Key assumptions • Can ignore which day of the week/holidays • Can ignore people who are flying through other means (helicopters, hot air balloons, sky divers, etc.) • Passengers going through connecting flights, flying more than once a day, etc. can be considered unique passengers FIRM IBM / R1 TYPE Market Sizing INDUSTRY Aviation 3 Case 1: Flying High CALCULATIONS COMMERCIAL • (Flights per day) x (Number of seats) x (Occupancy) + (Flights per day) x (Crew members) • 3,000 flights x 250 seats x 80% = 600,000 • Math tip – Break down math to logical digestible fragments • 250 x 4/5 = 250/5 x 4 = 50 x 4 = 200 • 200 x 3k = 600k • 3,000 flights x 10 crew = 30,000 crew members • 600k + 30k = 630k Americans on domestic flights per day CARGO • (Flights per day) x (Crew size) • 6,000 flights x 10 crewmates = 60,000 crew members TOTAL • Commercial flights + Cargo flights = total Americans flying domestically • 630k + 60K = 690K FIRM IBM / R1 TYPE Market Sizing INDUSTRY Aviation 4 Case 2: Dry Cleaners in Philadelphia PROMPT How many dry cleaners are located in Philadelphia? DESCRIPTION ADDITIONAL INFORMATION (if asked) After the candidate has written out their framework, ask them for their approach. • The population of Philadelphia is 2MM ***After hearing their approach, ask the candidate if there is any other way to size the market (they should be able to list 2 total– top down and bottom up) Then proceed to have them size the market using the “top down” method. Make sure they drive the case. If they ask for any other information other than the population of Philly, respond with, “I don’t know, what do you think?” FIRM Accenture TYPE Market Sizing INDUSTRY Small Business 5 Case 2: Dry Cleaners in Philadelphia CALCULATIONS • • Demand: Assumption: Population is uniformly distributed from 0-80 years old. • 0-20 years: 0.5 MM • 21-40 years: 0.5 MM • 41-60 years: 0.5 MM • 61-81 years: 0.5 MM • Number of clothing items dry cleaned per week: • 0-20 years: No one dry cleans • 21-40 years: 0.5 MM people * (30% use dry cleaning) * (5 articles of clothing/week) = 750K articles/week • 41-60 years: 0.5 MM people * (40% use dry cleaning) * (5 articles of clothing/week) = 1MM articles/week • 61-81 years: 0.5 MM people * (10% use dry cleaning) * (3 articles of clothing/week) = 150K articles/week • Total: 1.9MM articles/week • • • • Supply: Assumption: The average dry cleaner has 10 washers and 10 dryers, each with a capacity of 30 articles Assumption: A wash cycle = 1 hour. Dry cycle = 1 hour. Transporting clothes is instant. Assumption: Machines are utilized 60% of the time. Dry cleaners are open 12 hours a day. 5 day weeks • FIRM 10 sets of machines * 30 articles/hour * 60% utilization * 12 hr/day * 5 days/week = 10.8K articles/week • Total Demand/Week ÷ Total Capacity per Cleaner/Week • 1.9 MM Articless / 10.8k Units per Cleaner per Week = ~175 Dry Cleaners • TOTAL = ~175 Dry Cleaners in Philadelphia Accenture TYPE Market Sizing INDUSTRY Small Business 6 Case 3: Car Tires in the United States PROMPT Please estimate the number of passenger car tires sold each year in the United States. DESCRIPTION ADDITIONAL INFORMATION (if applicable) None • Passenger car tires are defined as tires used on regular cars (no motorcycles, semi-trucks, etc.) Market Size • 10M new cars sold each year • 60M cars on the road • Cars have a 7 year life-span • Tires last 45k miles • The average driver drives 15k miles/year Considerations • Some cars might come with a spare tire – this will affect calculations Key Assumptions • People purchase new tires immediately when necessary • When people replace tires, they replace all 4 at the same time • No growth in “installed cars” FIRM Samsung / R1 TYPE Market Sizing INDUSTRY Automotive 7 Case 3: Car Tires in the United States NOTES CALCULATIONS • • • FIRM Existing Cars • 60M cars on the road • Because tires last for 45k miles and average usage is 15k, tires need to be replaced every 3 years • 60M cars/ 3 Years = 20M cars need replacement • 20M * 4 tires = 80M tires New Cars • 4 new tires: 10M * 4 = 40M tires • 4 new tires + spare: 10M * 5 = 50M tires Total tires sold each year • 80M + 40M = 120M (130M if every new car has a spare) Samsung / R1 TYPE Market Sizing This is one way to do a “bottomup” approach. There are several different ways to answer this question provided that the numbers and logic make sense Push back on any assumptions that fall outside the scope of tires meant for a standard car If interviewer entertains any uses for tires outside of typical car usage, ask them to estimate the number (with logic) and then to not include them into the final calculations INDUSTRY Automotive 8 Case 4: What a Drag PROMPT How many cigarettes are smoked in a year in the United States? DESCRIPTION ADDITIONAL INFORMATION (if requested) This is a case to explain how to approach a case from a top-down method. While we suggest breaking the population down by age groups, there are other ways to approach. • There are 320 million people in the United States Aside from the size of U.S. population, allow the interviewee to use any numbers that he/she chooses – provided that the sound logic is used. FIRM MCSC TYPE Market Sizing INDUSTRY General 9 Case 4: What a Drag INTERVIEWER INSTRUCTIONS This is a top-down approach. Allow the interviewee to approach the problem independently before suggesting that they break this down by 4 distinct age ranges. The breakdowns beyond this point is how we approached it but allow them to choose their own numbers. If the interviewee struggles with calculations – suggest that they use simpler numbers. CALCULATIONS (do not reveal this to interviewee) Age Groups Total people in this age range % Smokers Smokers in age range 0-20 80M 10% 8M 21-40 80M 25% 20M 41-60 80M 20% 16M 61+ 80M 15% 12M Assuming that each smoker smokes 5 cigarettes a day (some will smoke more than a pack a day but many will smoke less). • (Total American Smokers) x (cigarettes per day) x (number of days a year) • (8M + 20M + 16M + 12M) x 5/day x 365 days/year = 56M x 5 * 365 = 280M *365 = 300M x 350 = 105B cigarettes smoked by Americans each year • FIRM Bonus: Interviewee considers alternates/substitutes to cigarettes (ex. E-cigs & Cigars, etc) MCSC TYPE Market Sizing INDUSTRY General 10 Case 5: Japanese Golf Ball Market PROMPT You are going to visit a client who wants to sell golf balls in Japan. Having had no time for background research, you sit on the plane wondering about the size of the market for golf balls in Japan. How big is this market? DESCRIPTION ADDITIONAL INFORMATION (if asked) After the candidate has written out their framework, ask them for their approach. • The population of Japan is 120M ***After hearing their approach, ask the candidate if there is any other way to size the market (they should be able to list 2 total– top down and bottom up) Then proceed to have them size the market using the “top down” method. Make sure they drive the case. If they ask for any other information other than the population of Japan, respond with, “I don’t know, what do you think?” FIRM McKinsey TYPE Market Sizing INDUSTRY Sports 11 Case 5: Japanese Golf Ball Market CALCULATIONS FIRM • Assumption: Population is uniformly distributed from 0-80 years old. • 0-20 years: 30 MM • 20-40 years: 30 MM • 41-60 years: 30 MM • 61-80 years: 30 MM • % of • • • • • • Number of golf balls used • 0-20 years: 3 MM people * (playing 3 times per year) * (4 balls used each time) = 36MM balls • 20-40 years: 4.5 MM people * (playing 6 times per year) * (3 balls used each time) = 81MM balls • 41-60 years: 9 MM people * (playing 12 times per year) * (2 balls used each time) = 216MM balls • 61-80 years: 9 MM people * (playing 18 times per year) * (2 balls used each time) = 324MM balls • SIZE OF GOLF BALL MARKET IN JAPAN = 657 Million Balls Golfers per Segment 0-20 years: 30 MM * 10% = 3 MM 20-40 years: 30 MM * 15% = 4.5 MM 41-60 years: 30 MM * 30% = 9 MM 61-80 years: 30 MM * 30% = 9 MM TOTAL GOLFERS = 25.5 MM McKinsey TYPE Market Sizing INDUSTRY Sports 12 Case 6: RayQ Magazine PROMPT Your client is the CEO of a publishing company producing a line of educational magazines and a line of women's magazines. Both businesses are profitable but not growing quickly. He wants to start a third monthly magazine in the US targeted at 25- to 55-year-old men (e.g. GQ Magazine). His stated goal is $5 million in circulation revenues in the first year. Is this possible? DESCRIPTION ADDITIONAL INFORMATION (if asked) After the candidate has written out their framework, ask them for their approach. Make sure they are clear exactly how they are going to size this problem before they start. • None If they are unclear or you don’t understand their approach, clarify with them and challenge any assumption you don’t agree with. If they ask for any information, respond with, “That’s a good question, but we don’t know. Why don’t you make an assumption?” Candidate is NOT allowed to round numbers in this case. FIRM Strategos TYPE Market Entry INDUSTRY Publishing 13 Case 6: RayQ Magazine CALCULATIONS Population sizing: • Candidate is allowed to use different assumptions provided that they are logical. If you disagree with what they stated – question their logic and then ask them to use the numbers provided below • Start with a US population size of 320M people • Assumption: Population is uniformly distributed from 0-80 years old. The population that falls between 25-55 years is 120 million people (55 – 25 = 30; 30/80 * 320 = 30 * 320/80 = 30 * 4 = 120) • Assumption: Half of them are male, so 60 million males • Assumption: 25% of this demographic reads magazines of some sort = 15 million • Assumption: Given the wide range of magazines on the market, assume that only 10% of magazine readers would want to read a men's journal = 1.5 million males that would read this type of magazine • Assumption: Market penetration rate of 5% for the first year, or 75K people Revenue calculation: • 2 sources of magazine sales: newsstand sales and subscription sales • Assumption: A cover price of $4/magazine at the newsstand and $2/magazine for a subscription. • Assumption: Assume 50% subscribe (37.5K customers) and 50% buy at the newsstand (37.5K customers). • Revenue/month newsstand = $150,000, Revenue/month subscription = $75,000 • TOTAL ANNUAL REVENUE = $2.7 MM Based on $2.7M being far short of $5M, recommendation would be to not pursue this venture FIRM Strategos TYPE Market Entry INDUSTRY Publishing 14 Case 7: You’ve Got Mail! PROMPT It is 2004, and a major greeting card company is considering a proposal from Yahoo to advertise its e-commerce product, a greeting card that is sent to the recipient as an e-mail attachment. Your client will get an exclusive position on the website’s front page that will help drive traffic to its greeting card site. The Yahoo exclusivity costs $4.5 million per year for the next two years. Should your client do it? DESCRIPTION ADDITIONAL INFORMATION (if asked) This is a classic profitability problem. • • • • • The interviewee should identify revenues and costs in the framework but also not forget about other factors ****Do not mention cannibalization unless interviewee brings it up • There is no right or wrong answer to this case. The candidate should be able to justify their recommendation, whether it is a go or no go. • • • The client has two products: traditional paper cards and electronic cards 50 billion visits to Yahoo’s site (per year) Click through rate to greeting card site – 1:1000 5% sell rate (ie: .05 cards sold per visitor) Cannibalization would be 25% of traditional greeting card business (number of visitors who would have bought traditional cards, but are buying ecards instead) Total company revenues: $20 million • $10 million from electronic cards • $10 million from traditional cards All inclusive costs for e-cards (design, production, etc)= 50% of revenues All inclusive costs for traditional cards = 75% of revenues Card price to customer = $4 per electronic card Recommendations should include risks and next steps. FIRM MCSC TYPE Profitability INDUSTRY E-commerce 15 Case 7: You’ve Got Mail! ANALYSIS Customer Base from Yahoo: • 50 billion visits to Yahoo’s site (per year) • Click through rate to greeting card site – 1:1000 5% sell rate • Result: 2.5 million sales via Yahoo (interviewee calculation) Cannibalization: • 25% of traditional greeting card business = 625,000 people Profit Margins: • E-cards: Price =$4, at 50% margin, profit = $2 per card • Traditional cards: Price = $4, at 25% margin, profit = $1 per card Net Profit: • Extra profit from electronic greeting cards = 2,500,000 x $2 = $5,000,000 • Loss from Cannibalization = 625,000 x $1 = $625,000 • Less $4.5 million exclusivity cost for Yahoo • Total Net Loss from deal = $125K in profit per year FIRM MCSC TYPE Profitability INDUSTRY E-commerce 16 Case 7: You’ve Got Mail! CONCLUSION If interviewee says GO: • Yes, should acquire because even if they lose $125K per year, they gain on other fronts such as: • Branding • Possibility to introduce and cross sell products (introduce more products to customer through site) • Prevent competitors from partnering with yahoo and stealing market share • Increase in internet usage resulting in increased foot traffic • Risks: • Cannibalization is larger than expected • Foot traffic is smaller than expected • Anything else that attacks assumptions made • Next Steps: • Talk with yahoo • Pilot test with other smaller websites • Optimize landing page for this new venture • Analyze demographic that will be coming to website and optimize accordingly If interviewee says NO GO: • No, should not acquire because they are losing $125K per year • Risks: • Competitor partners with yahoo and steals market share • Company brand could deteriorate • Missing out on profits if any assumptions made are wrong • Next steps: • Find other small companies to partner with • Find out what competitors are doing • Renegotiate with Yahoo to see if they can get a better deal FIRM MCSC TYPE Profitability INDUSTRY E-commerce 17 Case 8: MarshallCare PROMPT A local hospital has been hurting. The 600 bed institution has had consistently high patient volume growth, but is seeing a rise in the number of uninsured patients. Recently, it has been under operating margin pressure from the local government, which is requiring the hospital to reduce its budget $100 million over the next three years. Also, the hospital cannot forego service in this budget cut – it must maintain its service. What do you recommend about the budget, and what implementation challenges to do you see in your recommendations? DESCRIPTION ADDITIONAL INFORMATION (if asked) The difficult part of this case lies in collecting data effectively and understanding how to re-do the budget. Product • Hospital known for decent quality -- relative to competitors it is middle-ofthe-road • Provides a range of service, from simple examinations to high-end procedures (ankle sprains to brain surgery) • There is a growing demand for higher-margin services such as emergency room procedures A key component to doing well in this case will be having a MECE framework. At the very least, the candidate must consider operations, revenues, costs, and dive into each of these during the case. The recommendation should be clear, concise, and address issues talked about during the case. Relevant risks and next steps should also be mentioned FIRM Deloitte S&O TYPE Capacity • They have noticed unused capacity – high quality doctors are spending time doing routine examinations. • Also noticed doctors are working outside of their profession in an effort to speed-up the process Costs • Major variable costs • Personnel - Doctors forced to take care of administrative tasks • Supplies - Supply use has been high (medication, waste) • Ask interviewee how they would evaluate this (answer: benchmark with comparable hospitals) • In this case, the volume of disposable waste has been growing • Major fixed costs: utilities, SG&A, sales and marketing, and capital expenditures (equipment upgrades) Cost Reduction INDUSTRY Healthcare 18 Case 8: MarshallCare ANALYSIS Capacity Issues • Re-align doctors: have them stay within their own practice to ensure they are working on what they are best at • Hire (lower salaried) generalists to deal with routine, low margin procedures Cost Issues • Personnel cost • Supplies cost • Volume: encourage lower use of disposables (be environmentally friendly) • Price: re-negotiate cost of supplies with vendors, or even look for new, cheaper vendors • Equipment upgrade cost: • Focus on equipment maintenance to reduce frequency of repair • Consider lowering the quality of non essential equipment – ie: perhaps use lower quality beds Data (ASK INTERVIEWEE) – What data would you want to collect in order to assess if the issues identified were indeed issues? How would you validate this information? • Would want to collect info about usage rates, hours worked • Compare to: internal metrics over time, and to other comparable hospitals • Patient turnover • Possible solutions: • Can make beds more compact • Encourage home-care when possible to lower turnover FIRM Deloitte S&O TYPE Cost Reduction INDUSTRY Healthcare 19 Case 8: MarshallCare RECOMMENDATION • Improve efficiency: • Change talent pool to reflect service needs: hire generalists, re-align doctors, re-shift work focus • Capacity: put beds closer together, encourage home care to reduce turnover • Costs: • Reduce volume (work with nurses & doctors) and price of supplies (work with suppliers) • Cut unnecessary equipment costs, reduce quality RISKS • • • • • Economic Legal: ramifications with local government? Internal: unions / bureaucracy that make change difficult? Competitive response: how will other hospitals react? Community: PR issues with cutting quality in some areas NEXT STEPS • • • FIRM Patient surveys Workflow analysis and begin realigning doctors Talk with suppliers and begin renegotiating Deloitte S&O TYPE Cost Reduction INDUSTRY Healthcare 20 Case 9: Ray’s Streetside Slots PROMPT Your friend owns a gas station on I-15 right outside of Las Vegas. He is thinking about installing a slot machine in the gas station. He asked you if he should do it. DESCRIPTION ADDITIONAL INFORMATION (if asked) This is a classic profitability problem. The interviewee should identify revenues and costs in the framework but also not forget about other factors Candidate should be very clear and easy to follow on paper. Recommendation, risks, and next steps should be coherent and concise. FIRM Analysis Group TYPE • He is looking to install 1 slot machine • Costs • Fixed Cost • Machine Install-$5,000 (one time cost) • There is an annual licensing fee of $1,000 • Variable Cost • It has to have a minimum pay out rate of 80%. You are able to set the payout rate yourself. • Variable costs – electricity – $1/day • Revenue • Benchmark - The average Vegas hotel casino slot machine brings in $200/day in revenue. • Additional information: • Since the slot will not be located in a hotel, assume it would bring in 50% of a hotel slot machine • The gas station is open every day • Taxes are 30% Profitability INDUSTRY Entertainment 21 Case 9: Ray’s Streetside Slots CALCULATIONS • Revenue: • Annual revenue = $100/day x 365 = $36,500 • Revenue after payout rate: (1-0.80) x $36,500 = $7,300 (will vary based on chosen %) • Cost: • Fixed costs = $5,000 one time investment + $1,000 annual licensing fee • Variable costs = $1/day = $365 • Profit = $7,300 – $5,000 - $1,000 - $365 = $935 • Profit after taxes = (1-0.70) x $935 = $654.50 FIRM Analysis Group TYPE Profitability INDUSTRY Entertainment 22 Case 9: Ray’s Streetside Slots RECOMMENDATIONS Yes, he should install it because there is a profit and because he will not need to incur the $5,000 purchase cost for several years • Extra points if candidate points out that machines have lifespans and because a machine is likely to last longer than a year, the investment looks even more attractive • Additional items candidate could mention • Could place it near the bathrooms to let people play while they are waiting in line. • Assuming the gas station sell snacks, it may increase food purchases by drawing people inside. • You can adjust the payout rate, so the friend can play around with the optimal payout. • IE: he needs to consider the “price” of the slot – $0.05, $0.25, $1, etc. A $0.25 may encourage more people to play. People could use the change from their recent snack purchase to play. • RISKS • Short term variance if customer wins a jackpot • Other legal considerations NEXT STEPS • Pick a machine, purchase, and install • Consider adding more machines if space allows FIRM Analysis Group TYPE Profitability INDUSTRY Entertainment 23 Case 10: Drake’s Deposit Disaster PROMPT Your client manufactures and sells deposit slips to banks at a price of $1/slip. They are the leading firm in this $100Mn industry with 60% market share. There is only one other competitor. Federal regulations will decrease the industry size by 10% next year. Our client wants to maintain its profit to fund other projects. What options does it have and are any of these appealing? DESCRIPTION ADDITIONAL INFORMATION (if asked) The candidate’s framework should highlight revenues and costs, but should also consider competition, industry, and other external factors • Total Cost for client is $0.70 per slip. • Competitor out-sources manufacturing for a total cost of $0.90 per slip. ***A successful candidate will consider competitive response. If this is not brought up, DO NOT provide candidate with this information. FIRM Bain TYPE Profitability INDUSTRY Finance 24 Case 10: Drake’s Deposit Disaster ANALYSIS Candidate should calculate current profitability • Q = 60% x 100M = 60M • Total Revenue = Q x $1/slip = $60M • Total Cost = Q x $0.70/slip = $42M • Profit = TR – TC = $18M Candidate should determine who would win a price war… • Client cost of $.70/slip is lower than competitor cost of $0.90/slip, so client should win the war if they change their price to $.90/slip. Rational competitor should not price below cost. …and whether client will maintain current profits after price war. • The price war will end at P = $.90/slip. (Competitor would be selling at cost, they might leave the market) • Q = 90M (client has 100% of market now, but market has shrunk by 10% due to federal regulation) • Total Rev = Q x $0.90/slip = 81M Total Cost = Q x $0.70/slip = 63M • Profit = $18M → Profits are maintained → Go ahead with price war. A • • • solid interview will address other potential risks Capacity constraints: Q is increasing by significant amount (50%), so plant expansion may be necessary. Federal regulation may be a sign of future trends and lower industry profitability in future years. ****Competitor may act irrationally and continue in market despite running a loss (Do not give this to the candidate unless they mention competitive response) BONUS: Give only if the candidate asks about reasons the competitor may act irrationally • The competitor has another division. Does this change anything? • The competitor’s other division comprises 75% of its revenues. • This division manufactures a specialty chemical that is sold to banks to check for fraud. (e.g. ink pen that changes color when used on counterfeit money). • This division is highly dependent on bank relationships built through the deposit slip business. FIRM Bain TYPE Profitability INDUSTRY Finance 25 Case 10: Drake’s Deposit Disaster CONCLUSION 2 Different Recommendations: If candidate does NOT ask about competitor acting irrationally and selling at a loss: • Client should engage in a pricing war to steal market share from the competitor. Even with the decline in market size, the client will maintain current dollar profits. If • • • FIRM candidate does ask about competitor acting irrationally and selling at a loss: The competitor is more likely to sell deposit slips below cost because its other division is so dependent on it. Price war may not be a good idea. Client should pursue other means of increasing profits and revenues, such as diversifying into other products, selling to other customers, etc Bain TYPE Profitability INDUSTRY Finance 26 Case 11: Trojan Airlines PROMPT Our client is a budget airline considering entering a new market for business class flights. They are considering running an all business-class service within Europe. They want your advice on whether this is a good idea, and if so, how they should do it. DESCRIPTION ADDITIONAL INFORMATION (if asked) The candidate’s framework should highlight revenues and costs, but should also consider competition, industry, and other external factors Product • Current flights are cheap, short haul flights from the UK to various European destinations • Company does not offer business class flights at the moment • Various upgrades such as speedy boarding and greater legroom are available for purchase • Brand perception is that this airline is extremely cheap, but also has very low quality service Math should be organized, quick, and easy to comprehend The difficult part about this case are staying organized and staying composed under pressure. Candidate will frequently be pushed until they run out of ideas. Make sure recommendation is succinct (under 1:30) and logical. Make sure Risks and Next Steps are present. FIRM Strategy& TYPE Competition • The going rate for similar type business seats are $1k/customer Entry Method • Company does not want to acquire a competitor • Partnerships are possible, but we have no data on any potential candidates Market Entry INDUSTRY Aviation 27 Case 11: Trojan Airlines ANALYSIS Do not move on to next section unless candidate has considered all of the following: competitors, method of entry, company, and product. Ask the candidate “What else do you want to consider?” before moving on. FIRM • Ask the following: Our first destination will be Vienna. How much would we have to charge to break even with 25/32 seats filled? • Costs when • • • • • • • • • Breakeven Revenue: • 25 passengers • $27,500 costs / 25 passengers = $1,100 / passenger • Then • • • (Ask the candidates to list as many cost items as possible. Keep pushing until they run out of ideas, and they do so, provide them with the following list): Fuel: 6,000 gallons @ $3.00/gallon = $18,000 Aircraft dry lease: $2,500/flight Aircraft Servicing: $600 / flight Aircrew Costs: 2 pilots @ $700 & 3 crew @ $400 = $2,600 Other Overhead: $1,500 / flight Airport Charges (landing, passenger use of facilities): $900 / flight Catering Costs: $1,400 / flight TOTAL COSTS: $27,500 / flight ask the following: What challenges do you think the client will face?: Issues exist around the brand of a low cost airline, meaning the rebranding might be necessary Landing slots at hub airports are critical to business travel, and will be very hard to acquire They do not have the full set of capabilities required to deliver a business class service, so choice of partners is critical Strategy& TYPE Market Entry INDUSTRY Aviation 28 Case 11: Trojan Airlines CONCLUSION Then ask the following: If offering business class flights is not attractive, what are some innovative ways for our client to get into the luxury tourism market? (Push them until they run out of ideas) Possible Answers (chance to be creative… these are simply some ideas): • Fly a scheduled service to high end holiday resorts • Partner with luxury hotel chains and travel companies to offer packages • Fly from regional airports and include a chauffeur to get passengers there • Charter to luxury cruise lines to offer passengers flights to the ships • Do not fly scheduled flights, but focus on one of flights to key European social events – Monaco Grand Prix, Paris • Fashion Week, etc. • Offer packages including entry to these events • Run on board events like wine tasting • Offer experience flights ie. Over north pole Conclusion • Recommendation can be either a “go” or a “no go”, but make sure candidate has appropriate Risks and Next Steps mentioned • Ie: If it is a go, make sure candidate mentions the challenges as risks and possible next steps moving forward • If it is a no go, make sure candidate mentions risks company could face if not entering the business class market as well as next steps to further assess the situation FIRM Strategy& TYPE Market Entry INDUSTRY Aviation 29 Case 12: Wang’s Bistro PROMPT Your friend has been approached by a restaurant owner with an offer. The restaurant owner runs a restaurant in Los Angeles with his wife. They are reaching retirement age and would like to pass on the business to someone else. The restaurant has always been a family-owned business and is part of a strip mall near the freeway. This strip mall also have four other restaurants and it sits across the street from two tall business centers. In the past four years, the restaurant has been losing money and the owners don’t know why. What is going on with their profits, what do you recommend to turn around profits (if possible), and do you recommend your friend acquire the business? DESCRIPTION ADDITIONAL INFORMATION (if asked) The candidate’s framework should highlight revenues and costs, but should also consider market share and size, competition, and customers Market Share and Size • Business is based almost entirely on adjacent business centers. • Is a function mainly of lunch customers each day. • Each business center has 20 floors and sits 100 people per floor on average (all of whom eat lunch). • On any given day, 5% of the people didn’t show up for work, 50% of the remaining go out to lunch, and 90% of them go to the adjacent restaurants for food. • Our restaurant currently has 10% market share (relative to its 4 competitors). • No growth. • 4 other restaurants are all fast-food. Math should be organized, quick, and easy to comprehend Make sure recommendation is succinct (under 1:30) and logical. Make sure Risks and Next Steps are present. FIRM Capgemini Restaurant • When business declined 4 years ago, the owners had to fire 2 assistants, which put a strain on manager / employee relations. • Sell all kinds of food – mostly a broad ‘American’ food place. • Restaurant is like a sit-down diner, but also package food to go. • Average wait time at our restaurant is 5 minutes, average time at the others is 3 minutes. TYPE Private Equity INDUSTRY Small Business 30 Case 12: Wang’s Bistro ANALYSIS Market Size Estimation • 2 buildings * 20 floors * 100 person capacity per floor = 4,000 people • 4,000 * 95% present = 3,800 in buildings • 3,800 present * 50% out to lunch * 90% who go to adjacent restaurants = 1,710 total market opportunity. • 1,710 market opportunity * 10% market share = 171 customers each day Customer If interviewee asks about customer characteristics, ask them the following: • Given that our client only has 10% of the market, how would you find out why customers aren’t coming? • Stand outside business center and survey • Ask customers who do come • Ask business center management • Customers are workers looking for a quick lunch. (Candidate should deduce that our wait time is too long) • Most customers take food back to business center and eat at desk (don’t sit and eat at restaurant). Profits • Ask interviewee: what if breakeven for restaurant every day is 200 customers? Do you think buying would be a good idea or not? • There is no right or wrong here • Interviewee should begin brainstorming of ways to increase profits (increasing revenue or decreasing costs) and explain how to do so • Drill down revenues and costs and figure out how to improve the restaurant on both fronts. Push the candidate until they run out of ideas, after which they should be asked to give a recommendation • Some sample ways to increase profits • Brand more as quicker food option, advertise in business centers, offer delivery, offer more fastfood items on menu, identify restaurant bottleneck and provide more resources FIRM Capgemini TYPE Private Equity INDUSTRY Small Business 31 Case 12: Wang’s Bistro CONCLUSION Recommendation: • Acquire? No correct answer, many things to consider: • If yes: optimistic that can improve operations to reduce customer turnaround time; may be able to bring down breakeven level of customers. • If no: market is not growing, strong competition, challenges in picking up family-owned business. FIRM Capgemini TYPE Private Equity INDUSTRY Small Business 32 Case 13: Giant-Sized Chickens PROMPT Your client is a chicken vitamin manufacturer. The vitamin helps increase the size of chicken breast and reduce fat content. Should they enter China? DESCRIPTION ADDITIONAL INFORMATION (if asked) The candidate’s framework should include entry method, company, industry, product, customers, and external factors Chicken Industry in China • Chinese chicken industry is twice as large as US in terms of amount of chicken consumed • Growth trends are similar to those of the US Customers • The customers in the US consist primarily of large corporate farmers e.g. Tyson, Purdue • The customers in China can be segmented into 3 categories: • Family Poultry Farms – 80% Market Size, 1% Growth Rate • Village Farms – 10% Market Size, 19% Growth Rate • Corporate Farms – 10%, 80% Growth Rate Competition • There is no direct competitor at the moment in China. There is one substitute product which sells for $0.47/lb. • The client’s product is superior in performance and has no side effects compared to the substitute product Manufacturing Costs • Magnesium is an important ingredient used to manufacture the vitamins • The firm has one mine in Florida which is operating at max capacity • There are mines in other parts of the world, which have a cost structure as follows (includes transportation to China.) • 2 in Europe - $0.39/lb • 1 in India - $0.37/lb • 1 in Africa - $0.35/lb • 1 in China - $0.38/lb Candidate should thoroughly explore each avenue listed in Additional Information. Pros, cons, and risks, should proactively be brought up by the candidate. Make sure recommendation is succinct (under 1:30) and logical. Make sure Risks and Next Steps are present. • • FIRM PwC TYPE NOTE: These are prices if the client were to acquire the mines The additional cost beyond the raw material is $0.10/lb Market Entry INDUSTRY Vitamins 33 Case 13: Giant-Sized Chickens ANALYSIS • Before the recommendation, candidate should have covered the following: • Which customer segment is most appealing and why • Which mine to expand to and why • The competition, what the substitute product looks like, and how big competitors are • Any risks including government regulations, shipping, fixed costs of establishing a new mine, competitors entering the market, competitive response Recommendation • The client should enter China • It should target the corporate market since it is growing rapidly (80% growth in 5 years) • Supplying this segment is also much cheaper since corporations tend to have their supply chains in place, while family farms would require that the client develop their own infrastructure • The client should acquire the mine in Africa due to lower cost, although candidate can also argue that distance creates a bigger risk and opt for the mine in China • Risks • • • • • Next • • • FIRM Competitive response Government issues New entrants Large investment in expanding Steps Establish relationships with corporate farms Do due diligence on business environment in China Look into getting patent protection on product PwC TYPE Market Entry INDUSTRY Vitamins 34 Case 13: Giant-Sized Chickens RECOMMENDATIONS The client should enter China • It should target the corporate market since it is growing rapidly (80% growth in 5 years) • Supplying this segment is also much cheaper since corporations tend to have their supply chains in place, while family farms would require that the client develop their own infrastructure • The client should acquire the mine in Africa due to lower cost, although candidate can also argue that distance creates a bigger risk and opt for the mine in China RISKS • • • • Competitive response Government issues New entrants Large investment in expanding NEXT STEPS • • • FIRM Establish relationships with corporate farms Do due diligence on business environment in China Look into getting patent protection on product PwC TYPE Market Entry INDUSTRY Vitamins 35 Case 14: Houston Firearms PROMPT Our customer, Houston Firearms, is a 150-year old national market leader of firearm manufacturing and sales. Recently, they have seen a decrease in sales. They want to know why they’ve seen this drop and how to increase sales FIRM DESCRIPTION ADDITIONAL INFORMATION (if asked) This decrease in sales is due to a new market entrant: “Bullseye”. This case presents a typical problem of competitive reactions to a market entrant and driving sales. A good framework should help pinpoint the problem quickly. Then a clear framework for driving sales, along with creative solutions, wrap up the case well. Houston Firearms • Market share in 2015 was 45%, in 2014 it was 55% • Firearms industry has grown by 3% annually in the past 5 years IBM / R1 TYPE Product • Most popular product “Houston Rocket” constitutes 75% of Houston Firearm’s sales. Remaining sales come from firearm suppliers • Cost of production, distribution, and marketing have not changed • Prices have increased only at the rate of inflation Competition • Dallas based firearms manufacturer “Bullseye” was established in 2005 and has been growing rapidly. • Outsource production and offer a cheaper alternative “the Cowboy” • There is no other major competition in this industry Profitability INDUSTRY Defense 36 Case 14: Houston Firearms ANALYSIS Step I: Realizing the Issue • Decrease in sales is due to recent competitor “Bullseye” Step II: Frame Solutions • Need to find competitive responses to respond to new entrant • Frame the solution: ex. Divide growth strategies into 4 categories (New/existing customers and New/existing products) Step III: Brainstorm and Present Solutions • If Bullseye is producing cheaper firearms, Houston Firearms must either compete on price or focus on competitive advantage (quality, manufacturing, premium market position) • Engaging in a price war would likely decrease profitability as well as damage brand • Rocket’s competitive advantages are • Quality, safety, superior security • History of U.S. tradition and domestic production – esp. given that many firearm users are patriotic • Additional suggestions may include the following: • Creating a cheaper firearm product to compete with the Cowboy (using a different name) • Move into different points of the value chain (gun cleaning equipment, bullets, etc) • Investing more heavily in underserved regions (be weary of international expansion) FIRM IBM / R1 TYPE Profitability INDUSTRY Defense 37 Case 15: Missile Misser PROMPT Our client is a major defense contractor for the United States government. There has been a growing threat from terrorists who are shooting down commercial aircrafts with rocket launchers. There is a potential solution to the problem; equipping planes with anti-missile defense systems called IRCMs (Infrared Counter Measures). These devices defend against ground-to-air attacks. Congress has approached your client requesting that these systems be installed on commercial planes. Do you recommend that they take the deal? DESCRIPTION ADDITIONAL INFORMATION (if asked) This case focuses on the profitability of the new system. Selling to congress means losing money but there are huge opportunities overseas. That opportunity may make the deal worth taking. There is also a major strategic threat: the major competitor will have 50% of the market. What would happen if the competitor doesn’t accept the job (would our client be able to gain the entire market?) What if the competitor also moves overseas? Market • 6,000 commercial airplanes (3,000 eligible for installation) • Client can capture a maximum of 50% of the market – government law requires a competitive market Product • System is installed beneath planes. Small device that does not affect performance of aircraft. Installation is not an issue • Uses infrared lasers to redirect missiles away from plane, missile will still detonate in a different location • Government will pay $2M per installation • Variable cost per system is $1.7M • System needs reinstallation every 10 years Company • Current total revenue of $15B • Fixed costs: $250M for factory, $250 for management/employees, $250 for R&D FIRM Bain / R1 TYPE New Product INDUSTRY Aerospace 38 Case 15: Missile Misser ANALYSIS Market Opportunities • 3,000 eligible for installation * 50% market share = 1,500 planes • $2M in installation • 1.5k * 2M = $3B Market opportunity Profitability • Profit = Rev – (FC + TC) • Revenue = $3000M • Variable Costs = 1,500 x 1.5 = $2,625M • Gross Margin = $375M • Total fixed costs = $750M • Profits = $3000M – ($750M + $3,000M) = ($750M) Opportunities Expand geographically: what governments would be interested? (Fixed costs stay the same if expand internationally, so marginal profit is positive.) • Ones with many commercial flights over terrorist areas • Middle East and southern Asia What are criteria in selecting governments to sell to? Any governments NOT willing to sell to? • If they can pay (afford it) • Type of government (democratic?) • Level of corruption • Competitors in new market • PR issues FIRM Bain / R1 TYPE New Product INDUSTRY Aerospace 39 Case 15: Missile Misser RECOMMENDATIONS • Develop the domestic (U.S.) market before considering international expansion RISKS • • • • • What if competitor does the same? What if we don’t sell in U.S., how will appear to other areas of the business? Political: what if government changes its mind? Internal: do have capacity for immediate production and installation of 1,500 systems? Who takes responsibility for the missile after it is diverted from the plane? What if people on the ground are killed? (ethical and PR issue.) NEXT STEPS • • FIRM Develop contracts with the United States ensuring a certain volume or exclusivity Continue R&D that disarms or detonates missile to limit collateral damage Bain / R1 TYPE New Product INDUSTRY Aerospace 40 Case 16: Home Alone PROMPT Your client is a financial investor interested in investing in a start-up national security company. The security company sells and installs alarm systems and then provides monitoring service, patrolling the neighborhood and following up if the alarm goes off. The client has hired you to size the market and recommend if this is a good investment or not. FIRM DESRIPTION ADDITIONAL INFORMATION (if asked) Interviewee should identify first how he or she would tackle the problem by allocating resources and deciding how the timeframe of the project will work. As for the project itself, it is a good idea to enter the Scottsdale market because doing so is profitable. It is only profitable with 2 planes, however. There are significant risks to entering, and the interviewee should consider how these might affect the outcome Only provide each support slide after being asked for the information by the candidate • Slides: • Target company’s current situation • Demographics and growth by income • Competitive landscape • Competitive estimated revenues and earnings • 10M suburban households • 1M new suburban households each year • System is priced ‘at-cost’ • 1-2 large local players per market • Large local players are entering national market and competing with large national player Bain / R1 TYPE Market Entry INDUSTRY Security 41 Case 16: Home Alone Exhibit 1 Client Market Situation FIRM Number of homes in market 10 Million Home growth last year 1 Million Competitors Largest national player appears to have financial difficulties System Price $1,000 installed Service Price $30 per month Bain / R1 TYPE Market Entry INDUSTRY Security 42 Case 16: Home Alone Exhibit 2 2015: US Homes by Value 100% 90% 1% Growth 80% <$100k 70% $100K to $200K 60% $200K to $500K 50% $500k to $1M 1% Growth 40% >$1M 30% 2% Growth 20% 4% Growth 10% 4% Growth 0% US FIRM Bain / R1 Own a security system TYPE Market Entry INDUSTRY Security 43 Case 16: Home Alone Exhibit 3 Competitive Landscape 100% National Player 5 National Player 4 90% Local Local Local Local National Player 3 80% Player Player Player Player 1 2 3 4 National Player 2 70% 60% 50% 40% National Player 1 Other Players (5,000+) National Market Local Market 30% 20% 10% 0% FIRM Bain / R1 TYPE Market Entry INDUSTRY Security 44 Case 16: Home Alone Exhibit 4 Competitive Estimated Revenues and Earnings EBIT (%) 30% 25% 20% 15% 10% 5% 0% National Player 1 National Player 2 National Player 3 Local Player 1 Revenues ($M) FIRM $1,500 Bain / R1 TYPE $270 $100 Market Entry $30 INDUSTRY Local Player 2 $20 Security 45 Case 16: Home Alone ANALYSIS Market Sizing/Opportunity • Expected Annual revenue = New Systems + Existing Systems • New Systems • $1000 New System * 1M New Homes = $1B • Existing Systems • $30/Month Service * 12 Months *10M Existing Homes = $3.6B • Annual revenue = $4.6B Market Growth • 70% of alarm buying market is growing at 1% per year, with the overall alarm buying market growing at or less than population growth • This makes market growth unattractive Competitive Reach • The national market is dominated by one player with several other strong players making entry very difficult • The local market is highly fragmented with apparently 1-2 major players in each market, making entry in this space equally difficult with local de-facto monopolies Competitive Environment • Large national players appear to be operating with rather low EBIT numbers – this may be due to spread out infrastructure and inefficient utilization of resources • Smaller local players have stronger EBITs, however this leaves them in a strong position to compete, and entry will be difficult The market does not appear attractive at this time. FIRM Bain / R1 TYPE Market Entry INDUSTRY Security 46 Case 17: Olympic Trials PROMPT Los Angeles is considering placing a bid to host the upcoming Summer Olympic Games. Our client, the bidding committee, approached us to ask for our opinion of what the major considerations should be. Of major concern is how to convince the state and federal governments that this would be beneficial for the city. How would you recommend they go about doing this? FIRM DESCRIPTION ADDITIONAL INFORMATION (if asked) This case is designed to test the interviewee’s ability to generate a framework outside of what they might be accustomed to; there is no market, no competition, a very unusual product. The case is designed to initially revolve around profitability, which will show a great deficit. At this point, the interviewer should ask If hosting the games is a bad idea. If the interviewee says that it is, then the case can turn into a brainstorming session on how the committee might convince the government that it is a good idea after all. Let the interviewee float around with some questions, before hinting that we should be looking at this from a profitability angle. • • Strategy& TYPE • The Olympics are to be held over 15 days. Costs: (give all at once) • $2.8 billion for the operation of the games (opening ceremony, security, athlete support, transportation, etc.) • $2.6 billion for freeway upgrades • $6.0 billion for new and upgrading venues • $2.5 billion for new airport terminal • $1.1 billion for athlete facilities Revenues (ask what interviewees think revenue streams could be, and give out one at a time) • International Olympic committee support: $1.1 billion • Sponsorship: $75 per seat (occupied*) (Math Answer = $0.9B) • TV rights: combined with the preceding winter Olympic games, TV stations pay $15 billion, and the summer games is expected to take 80% of this. Of this total, 25% will go to the organizing committee. (Math Answer = $3B) • Tickets: Give Exhibit 1 but do not say occupied seat unless the interviewee asks if this is the case. If this comes after the Ticketing section, then tell the interviewee that he / she has omitted thinking about occupancy, and ask how this would affect the numbers. New Business INDUSTRY Sports 47 Case 17: Olympic Trials ANALYSIS • Profitability answer: revenue ($7B) – costs ($15B) = $(8) billion This combines the chart below and the numbers provided on the previous page. • Ask the interviewee if this makes the bid a bad idea. Regardless of the answer, ask how that gap could be closed (eg: official merchandise, tolls on new freeways, changing seating price, changing capacity through marketing, utilizing semi-temporary venues and facilities). After debating, concede that the gap might be narrowed to a $6 billion deficit. Ask if bidding for the Olympics is still a bad idea. • Explain that historically, an Olympic games rarely shows a direct profit for the host city, however, indirectly it has been shown the games can be hugely beneficial for a host city. Ask how this could be the case. • Arguments that could be made to the government that hosting the Olympics could be a good thing: • Tourism during and after the games would increase, reducing, and perhaps offsetting, the profitability deficit. • Upgrading city infrastructure (ex airports, surface roads, sports stadiums, etc) is beneficial • Sense of pride throughout the city – good for everyone living there • The chart below shows Exhibit 1 plus the ensuing calculations. Interviewee sheet Additional Info (if asked) Math Answers Seating Type Price per Ticket Total Number of Seats per day Expected Capacity* Total Occupied Seating (for entire 15 days) Total Revenue (for entire 15 days) A $200 420,000 95% 5,985,000 $1.197 B B $120 700,000 60% 6,300,000 $0.756 B 12,285,000 (~12 M) $1.953 B (~$2 B) Exact totals: (allow these when moving forward with further calculations) *Provide if asked, but allow interviewee to complete workings without this first, and then ask what assumptions have been made. If the interviewee doesn’t think of this, provide the numbers FIRM Strategy& TYPE New Business INDUSTRY Sports 48 Case 17: Olympic Trials EXHIBIT 1: Seating FIRM Seating Type Price Per Ticket Total Number of Seats per Day A $200 420,000 B $120 700,000 Strategy& TYPE New Business INDUSTRY Sports 49 Case 18: Chris’ Clothes PROMPT Your client, Chris’ Clothes, is a clothing retailer that sells casual clothes such as t-shirts and jeans through several channels, including department stores, its own retail stores, and its website. Although Chris’ has been a popular brand for most of the past two decades, it has seen declining margins in the last few years. Its CEO has asked you to help her understand why profitability has declined, and determine what Chris’ should do moving forward. FIRM DESCRIPTION ADDITIONAL INFORMATION (if asked) This case primarily tests an interviewee’s ability in two ways: 1. Analytical: Whether the interviewee can conclude that the client’s profitability issue is due the recent opening of unprofitable stores in less desirable locations. 2. Quantitative • • • • • BCG Round 1 TYPE Areas served: United States Products sold: Casual clothes such as T-shirts and jeans. Think H&M. Number of stores: 100 Customer profile: Think H&M. No data available. Competitors: Think H&M. No data available. Profitability INDUSTRY Fashion, Retail 50 Case 18: Chris’ Clothes EXHIBIT 1 Chris' Clothes Sales Chris' Clothes Costs 700M 400M 600M 350M 300M 500M 400M 300M 250M Retail Wholesale 200M Wholesale Website 200M Website 150M 100M 100M 50M M M 2011 FIRM Retail 2012 2013 BCG Round 1 2014 TYPE 2015 2011 Profitability 2012 2013 INDUSTRY 2014 2015 Fashion, Retail 51 Case 18: Chris’ Clothes EXHIBIT 2 J&H Store Data Sales ($M) Rent ($K) 2,000 15 Sales 1.500 10 Stores opened >10 years ago Stores opened 5-10 years ago Stories opened 0-5 years ago 5 1.000 0 500 0 FIRM 10 20 30 BCG Round 1 40 TYPE 50 60 70 80 Profitability 90 Rent 100 INDUSTRY Fashion, Retail 52 Case 18: Chris’ Clothes INTERVIEWER GUIDE The interviewee should begin by developing a framework that includes the following, at a minimum: • Profitability: The interviewee identify that first and foremost, we need to examine revenues (price * volume) and costs (fixed costs and variable costs) to determine the cause of declining margins. This can include a consideration of Chris’ product line, changes in customer tastes, revenues and costs by channel, and its value chain. • Competitors: The interviewee should indicate that we need to benchmark against the client’s competitors to understand where it may have fallen behind the curve. Part 1: Identifying the need to examine profitability • If the interviewee does not bring up revenues and costs after 1-2 minutes, guide him/her to ask about them. Once the interviewee does, provide Exhibit 1 and ask what he/she sees. Part 2: Exhibit 1 walk-through | Identifying that costs are the issue • Encourage the interviewee to walk you through the graphs. If asked, clarify that these are annual figures. • If the interviewee focuses on: • The website or wholesale business: Dismiss the notion by asking whether those are significant portions of the business (they are not). • Sales: Dismiss the notion by asking why he/she is focusing on sales since they’re increasing. • Key Insight: If the interviewee is unable to identify that retail costs have grown twice as quickly as retail sales in the last five years, guide the interviewee to compare growth in sales and growth in costs. Retail costs have grown by 20% (($300M - $250M) / $250 = 20%) while retail sales have only grown by 10% (($550M - $500M) / $500M = 10%). • Once the key insight is reached, ask the interviewee what the causes of this could be. Push the interviewee several times to think of different possible reasons (to test the interviewee’s ability to think under pressure). • Ask the interviewee what data he/she would want in order to dig deeper into the retail cost issue. • If the interviewee does not ask for revenue and cost data for the retail stores, guide him/her to do so. Once the interviewee does, provide Exhibit 2. FIRM BCG Round 1 TYPE Profitability INDUSTRY Fashion, Retail 53 Case 18: Chris’ Clothes INTERVIEWER GUIDE (Continued) Part 3: Exhibit 2 walk-through | Identifying that recently-opened stores are the issue • Encourage the interviewee to walk you through the graph. If asked, clarify that this data is for Chris’ 100 stores and that the figures are annual. • Key Insight: If the interviewee is unable to identify that recently-opened stores (those opened within the last 5 years) are the cause of declining profits, ask what kind of stores seem to have the lowest margins. The interviewee should realize that the stores opened within the last 5 years have the lowest margins. • Once the key insight is reached, ask the interviewee what the causes of this could be. Push the interviewee several times to think of different possible reasons. • Ask the interviewee if he/she has any ideas on what the client can do to solve the profitability issue. Push the interviewee to think of as many ideas as he/she can (keep asking “what else?”). If the interviewee does not include a suggestion to close less profitable stores, guide the interviewee to do so after several attempts. Then, ask what considerations the client should take into account when going through the process of closing stores. FIRM BCG Round 1 TYPE Profitability INDUSTRY Fashion, Retail 54 Case 18: Chris’ Clothes INTERVIEWER GUIDE (Continued) Part 4: Quantitative Test • Tell the interviewee that Chris’ has three main types of stores that appeal to different customer segments. Type A stores have the highest quality products and prices, followed by Types B and C. There are also a few flagship stores. Provide the following information all at once: • Annual sales per store: Type A: $9M; Type B: $5M; Type C: $2M • Annual COGS per store: Type A: $5M; Type B: $3M; Type C: $1.5M • Annual cost of rent per store: Type A: $800K; Type B: $700K; Type C: $600K • Tell the interviewee that the client has identified 40 less profitable (or unprofitable) Type C stores that can be closed without incurring significant one-time closing costs. Ask the interviewee to calculate the impact of the closures on the client’s annual profits. Also indicate that the client expects that 60% of the annual sales of each closed store are expected to continue to be made at a nearby store (basically, 60% of sales will continue to be bought each year by customers that travel to another location to make their purchase). • If needed, guide the interviewer through the calculations: • Cost Savings: $600K/store in annual rent * 40 stores = $24M • Loss of 40% of Purchases (since 60% of purchases will continue to be made at other stores): • $2M annual sales - $1.5M annual COGS = $500K annual profits, then • $500K * 40% lost = $200K in lost profits, then • $200K * 40 stores = $8M • Total Impact: $24M in savings – $8M in lost profits = $16M • After the interviewee completes the calculation, ask if closing the stores seems like a good idea. A good interviewee will observe that the $16M in savings is about 6% of the client’s annual profits (a quick glance at Exhibit 1 reveals a profit of $250M ($550M in revenues - $300M in costs)). • Then, tell the interviewee that the CEO has just walked into the room and ask him/her to provide a quick executive summary with recommendations. FIRM BCG Round 1 TYPE Profitability INDUSTRY Fashion, Retail 55 Case 18: Chris’ Clothes RECOMMENDATION • Close 40 Type C stores RISKS • • Closing 40 out of the client’s 100 retail stores would significantly reduce its brick & mortar presence. J&H could suffer from decreased exposure to potential customers This strategy only increases total profits by 6% NEXT STEPS • • FIRM Perform a more detailed analysis of both the short- and long-term impacts of closing the 40 stores Perform an analysis of why the recently-opened stores are not doing well, and explore ways to make them profitable (i.e. management changes, adjustment to product mix to better align to customers in those stores’ locales) BCG Round 1 TYPE Profitability INDUSTRY Fashion, Retail 56 Case 19: Make up your mind PROMPT BeautyAsia (BA) is a health and beauty consumer products company headquartered in Malaysia. It manufactures and sells a line of cosmetic products ideally suited for the Malaysian marketplace. Although it has been a successful company for over twenty years, it has been losing money for the past two years and its market share has declined. The CEO has asked you to assist in diagnosing the problem and generating a few possible solutions. FIRM DESCRIPTION ADDITIONAL INFORMATION (if asked) This is a classic profitability case Company • Market share declined from 90% to 60% in the past two years. • Manufacturing is excellent • Inventory management systems are unsophisticated and ineffective, resulting in excess inventory and order fulfillment problems • Brands are widely recognized throughout Malaysia • No new products have been launched in the past eight years • BA sells its health and beauty products primarily through local mom and pop shops (i.e., convenience stores) • Management considered selling its current products outside Malaysia, but has been distracted by problems in its home country EY Round 2 TYPE Profitability INDUSTRY Cosmetics 57 Case 19: Make up your mind ADDITIONAL INFORMATION (if asked) Competitors • Several large multinational manufacturers have entered the market • Competitors have flooded the market with new products • Multinational competitors sell their products through supermarkets Consumers • As a result of multinational competitors entering the market, consumers have been exposed to new types of products and their health and beauty product tastes have become broadened and become more sophisticated Products • BA has multiple product lines ranging from lipstick to skin creams • BA’s products appeal to price-conscious consumers • The health and beauty products industry is growing approximately 15% per year Channels • BA products are currently sold through small proprietary shops • Supermarkets are becoming increasingly popular in Malaysia • Supermarkets have high order fulfillment and stocking requirements FIRM EY Round 2 TYPE Profitability INDUSTRY Cosmetics 58 Case 19: Make up your mind RECOMMENDATION Good Conclusions • Multinational competitors are creating a new distribution channel for health and beauty products. The channel shift is causing BA to lose market share. BA needs to update its inventory systems to compete in the new channel and reduce its costs. • Competitors are driving changes in consumer tastes toward greater product variety and quality. BA has not kept pace with new product introductions. BA needs to improve its marketing/market research. Excellent Conclusions • BA’s manufacturing expertise gives it an opportunity to sell high quality private label products at a discount to current prices in the supermarkets. • There is danger in challenging multinational competitors by offering a wider assortment of products in the supermarket channel. Alternatives for BA include: strengthening its position in the local shop channel; focusing on profitable customer niches (premium, low price, etc.); targeting only certain product categories like lipstick and blush for distribution through supermarkets. • The cost to BA of regaining its lost market share is extremely high. BA may be better off preventing further loss in market share and focusing on improving its current profitability instead of regaining share. FIRM EY Round 2 TYPE Profitability INDUSTRY Cosmetics 59 Case 20: Plastics PROMPT The CEO of the world’s largest plastic injection molding company has approached your consulting company to help grow profits. The Company receives a prototype from its clients and has the competency to produce as many as required. For example, a cell phone designer provides a design for a cell phone, and the company is responsible for producing millions. The company makes its products faster, better and cheaper than all its competitors. It has a 5% cost advantage, commands a sustained 5% price premium, ships internationally, and has twice the market share than the number two player. Currently, the company has a 10% profit margin. The CEO wants your help in growing the profit margin to 20% within the next two years. What do you recommend? DESCRIPTION ADDITIONAL INFORMATION (if asked) This case tests two things: an interviewee’s ability to stay cool under pressure, and the foresight to question assumptions. Doubling the profit margin isn’t possible – the company is already the best in the world! As the interviewee suggests ideas and works through a framework, the interviewer should aggressively shut down various ideas. Market • No significant threat from competitors • Too difficult to capture more share from competitors Keep pushing until the interviewee finally asks whether the growth is possible. At that point, press for more suggestions. Finally when the interviewee is out of ideas, ask for a recommendation. See if the interviewee suggests plan that try to grow profitability, or if the interviewee addresses the fact that the goal isn’t feasible. FIRM Bain / R1 TYPE Product • Sells worldwide • Other products are much lower quality • Cell phone customers: are the trendy, up-andcoming players Profitability INDUSTRY Manufacturing 60