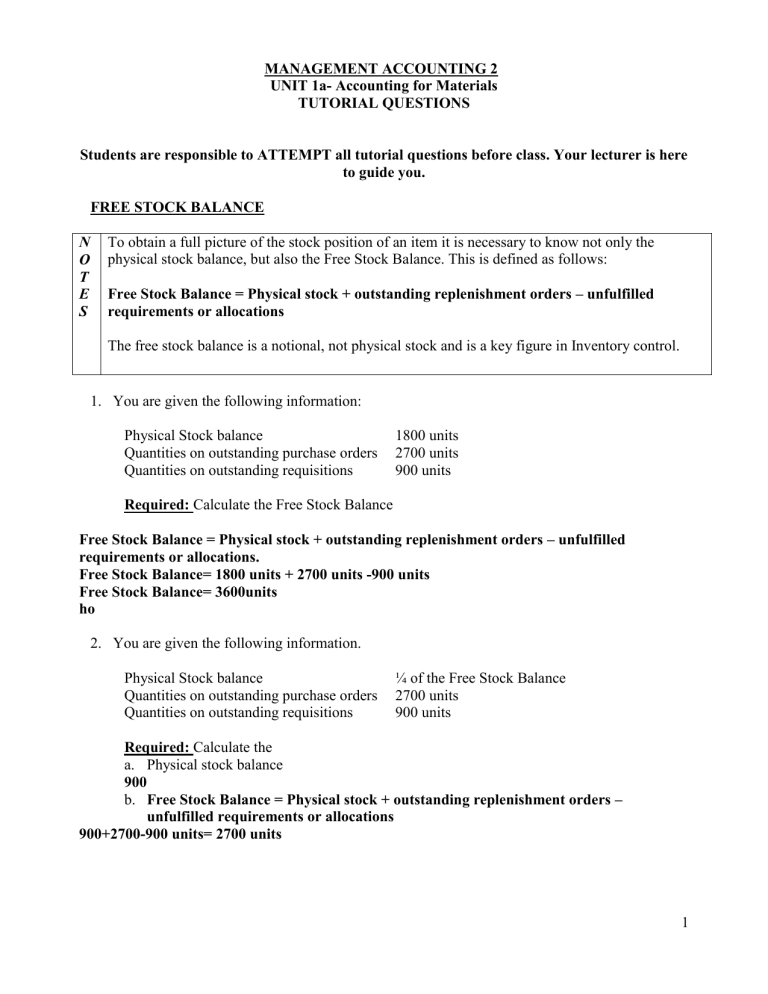

MANAGEMENT ACCOUNTING 2 UNIT 1a- Accounting for Materials TUTORIAL QUESTIONS Students are responsible to ATTEMPT all tutorial questions before class. Your lecturer is here to guide you. FREE STOCK BALANCE N O T E S To obtain a full picture of the stock position of an item it is necessary to know not only the physical stock balance, but also the Free Stock Balance. This is defined as follows: Free Stock Balance = Physical stock + outstanding replenishment orders – unfulfilled requirements or allocations The free stock balance is a notional, not physical stock and is a key figure in Inventory control. 1. You are given the following information: Physical Stock balance Quantities on outstanding purchase orders Quantities on outstanding requisitions 1800 units 2700 units 900 units Required: Calculate the Free Stock Balance Free Stock Balance = Physical stock + outstanding replenishment orders – unfulfilled requirements or allocations. Free Stock Balance= 1800 units + 2700 units -900 units Free Stock Balance= 3600units ho 2. You are given the following information. Physical Stock balance Quantities on outstanding purchase orders Quantities on outstanding requisitions ¼ of the Free Stock Balance 2700 units 900 units Required: Calculate the a. Physical stock balance 900 b. Free Stock Balance = Physical stock + outstanding replenishment orders – unfulfilled requirements or allocations 900+2700-900 units= 2700 units 1 3. You are given the following information. Physical Stock balance Quantities on outstanding purchase orders Quantities on outstanding requisitions 1/5 of the Free Stock Balance 40,000 units 5,000 units Required: Calculate the physical stock balance and the free stock balance. The physical stock balance is 720 units. Free Stock Balance = Physical stock + outstanding replenishment orders – unfulfilled requirements or allocations 720+40,000-5000 units= 35,720 units INVENTORY CONTROL LEVELS 4. The following data relates to an item of raw material. Value of Raw Material Consumption per day Minimum lead time Maximum lead time Order cost for material Carrying costs $20 200 units 20 days 30 days $450 per order 10% p.a. Assume that each year has 360 days. Required: Calculate EOQ, Re-order level, Minimum level, Maximum level Calculate EOQ: Re-order level:( Maximum usage X Maximum lead time) Minimum level: ROL- (Average usage X Average Lead) Maximum level: ROL+ EOQ- (Minimum Usage X Minimum Lead) 5. The BOF Company has in the past ordered raw material “X” in quantities of 3,250 units, which is 26 weeks’ supply. Management has decided to change over to an ordering system based on economic order quantities. Assume the following information pertaining to the company’s purchasing and production activity: Inventory usage rate: 120 – 130 units per week Lead time: 2 – 4 weeks Unit price: $1.50 2 Order cost: Carrying cost: $7.50 per order $0.30 per unit per year Required: Calculate the a. Economic Order Quantity (EOQ) using the formula. b. re-order level: Maximum usage X Maximum lead time c. maximum level: ROL+ EOQ- (Minimum Usage X Minimum Lead) d. minimum level: ROL- (Average usage X Average Lead) e. total annual order cost and carrying cost at the EOQ? f. amount the company save by adopting the EOQ model? 6. AB Associates is reviewing its stock policy and has the following alternatives available for the evaluation of stock number 12789: Purchase stock twice monthly – 100 units Purchase stock monthly – 200 units Purchase stock quarterly – 600 units Purchase stock biannually – 1,200 units Purchase stock annually – 2,400 units It is ascertained that the purchase price per unit is $0.80 for deliveries up to 500 units. A 5% discount is offered by the supplier on the whole order where deliveries are 501 and up to 1,000 units, and 10% reduction on the total order for deliveries in excess of 1,000. Each purchase order incurs administration costs of $5.00 Storage, interest on capital and other are $0.25 per unit of average stock quantity held. Required: Advise management on the optimum order size. 7. Reed Juices Limited purchases 25,000 litres of a material each year from a single supplier. At the moment, the company obtains the material in batch sizes of 800 litres. The material costs $16 per litre, the cost of ordering a new batch from the supplier is $32 and the cost of holding one litre in stock, due to certain technical difficulties, is $4 per annum plus an interest cost equal to 15% of the purchase price of the material. 3 The supplier has agreed to offer a discount on orders above a certain size. He has offered the following price structure: Order size (litres) 0 - 499 500 - 999 1,000 plus Unit cost ($) 16.00 15.20 14.80 Required: a. Prior to considering discounts: calculate the economic order quantity and the annual savings that will be obtained if the EOQ replaced the current lot size. b. The supplier has offered quantity discounts based on the price structure indicated above, after considering discounts, how does this affect the optimal order quantity, and what would be the annual savings compared to the inventory costs with the EOQ you calculated in (a)? c. At a recent meeting, Michael Wong, one of Reed’s Ltd senior managers stated that the company should not use the EOQ model because it is based on unrealistic assumptions and no one in the company really understands how the model works. Draft a memo addressed to the company’s managing director to respond to Mr. Wong’s concerns. VALUATION OF MATERIALS ISSUES AND STOCK- FIFO/AVCO 8. On January 1, Mr. Muir started a small business buying and selling thread. She invested her redundancy money of $400,000 in the business, and, during the next six months, the following transactions occurred. Date of Receipt January 13 February 8 March 11 April 12 June 15 Thread purchases quantity (boxes) 200 400 600 400 500 Total cost ($) Date of dispatch Thread sales boxes Total value 7,200 15,000 24,000 14,000 14,000 Feb 10 500 25,000 April 20 600 27,000 June 25 400 15,200 4 The thread is stored in an office Mr. Muir has rented, and the closing stock of thread, which was counted on June 30, was 500 boxes. Other expenses incurred, and paid for in cash, during the period amounted to $3,100. Required: (a) Calculate the value of the material issues during the six-month period, and the value of the closing stock at the end of June, using the following methods of pricing. (i) first-in, first-out, (ii) weighted average (calculations to two decimal places only) (b) Calculate and discuss the effect each of the three methods of material pricing will have on the reported profit of the business and examine the performance of the business during the first six-month period. 5