Table of Contents

Chapter

Quiz 1

Introduction to Engineering Economy

Analysis for Compounding Periods Not Equal to Payments

Arithmetic Gradient Series

Bond Valuation

Bond Valuation Problem Set

Derivation of Linear Gradient Formulas

Financing Decisions

Interest and Money – Time Relationships Part I

Interest and Money – Time Relationships Part II

Selections in Present Economy

Selections in Present Economy Problem Set

Quiz 2

Depreciation

Applications of Money-Time Relationships

Applications of Money-Time Relationships for Multi-Business Project Analysis

Interest and Money-Time Relationship Problem Set

Evaluating Single Projects Problem Set

Money-Time Relationships Problem Set

Quiz 3

After Tax Cash Flow Analysis, Capital Gains (Loss) and Replacement Analysis

Inflation

Inflation Problem Set

Risk in Capital Budgeting

Risk in Capital Budgeting Problem Set

Dealing with Uncertainty

Page

1

4

6

8

10

12

14

16

20

22

25

29

33

38

42

43

46

49

52

53

55

60

61

INTRODUCTION TO ENGINEERING ECONOMY

Engineering economy

–

The science that deals with the study of how economic theories and laws

are used to solve engineering problems.

–

Discipline concerned with the economic aspects of engineering and

involves the systematic evaluation of the costs and benefits of proposed

technical and business projects and ventures.

–

To be economically acceptable (affordable), solutions to engineering

problems must demonstrate a positive balance of long term benefits over

long term costs and they must also:

Promote the well being and survival of the organization

Embody creative and innovative technology and ideas

Permit identification and scrutiny of their estimated outcomes

Translate profitability to the “bottom line” through a valid and

acceptable measure of merit.

Applications of Engineering Economy

1. Set additional objectives or uses for a particular product or multi-product

2. Discover key factors for the success/failure of the company

3. Comparison of alternatives

4. Analysis of investment of capital

Principles of Engineering Economy

1. Develop the alternatives.

The choice is among alternatives. The alternatives need to be identified and

then defined for subsequent analysis.

2. Focus on the differences

Only the differences in expected future outcomes among the alternatives are

relevant to their comparison and should be considered in the decision.

3. Use a consistent point of view

The prospective outcomes of the alternatives economic and other, should be

consistently developed from a defined viewpoint (perspective).

4. Use a common unit of measure

Using a common unit of measurement to enumerate as many of the

prospective outcomes as possible will make easier the analysis and

comparison of the alternatives.

5. Consider all relevant criteria

1

Selection of a preferred alternative (decision making) requires the use of a

criterion (or several criteria). The decision process should consider both the

outcomes enumerated in the monetary unit and those expressed in some

other unit of measurement or made explicit in a descriptive manner.

6. Make uncertainty explicit

Uncertainty is inherent in projecting (or estimating) the future outcomes of

the alternatives and should be recognized in these analysis and comparison.

7. Revisit your decisions

Improved decision making results from an adaptive process; to the extent

practicable, the initial projected outcomes of the selected alternative should

be subsequently compared with actual results achieved.

Procedure of Engineering Economic Analysis

1. Problem recognition, definition and evaluation

2. Development of feasible alternatives

3. Development of the cash flows for each alternative

4. Selection of a criterion

5. Analysis and comparison of alternatives

6. Selection of preferred alternative

7. Performance monitoring and post evaluation

Accounting and Engineering Economy Studies

General Accounting / Financial Accounting / Cost Accounting

–

Procedures that provide financial events relating to the investment to

determine financial performance.

–

These accounting data are primarily concerned with past and current

financial events even though such data are often used to make projections

about the future.

–

Controls are established and utilized to aid in guiding the operation toward

desired financial goals

General Accounting – source of much of the past financial data needed in making

estimates of future financial conditions. Accounting is also a source of data for

analysis that might be made regarding how well the results of a capital investment

turned out compared to the results that were predicted in the engineering economic

analysis.

Cost Accounting / Management Accounting – is a phase of accounting that is of

particular importance because it is concerned principally with decision making and

control in a firm

2

It is also the source of some of the cost data that are needed in engineering

economic studies.

Modern cost accounting may satisfy any or all of the following objectives:

1. Determination of the cost of products or services

2. Provision of a rational basis for pricing goods or services

3. Provision of a means for controlling expenditures

4. Provision of information on which operating decisions may be based

and the results evaluated.

ANALYSIS FOR COMPOUNDING PERIODS NOT EQUAL TO PAYMENTS

Most Common Solution:

Convert interest rate to a period equal to that of payment by using effective interest rate concept

A. Compounding More Frequent Than Payments

Suppose you make equal quarterly deposits of $1,000 into a fund that pays interest at a rate of

12% compounded monthly. Find the balance at the end of 2 years.

First solution: convert interest period to payment period

Second solution: convert payment period into interest period

B. Compounding Less Frequent Than Payments

Suppose you make P500 monthly deposits to a tax deferred retirement plan that pays interest at a

rate of 10% compounded quarterly. Compute the balance at the end of 10 years.

First solution: convert interest period to payment period

Second solution: convert payment period into interest period

Predictions and

projections

Data for projections in

the future

Engineering Economy

- gives information on

which decisions pertaining

to the FUTURE operation

of an organization can be

based

Accounting

3

- is concerned with the

past and current financial

events so that the financial

performance can be

determined.

ARITHMETIC GRADIENT SERIES (Applicable to price changes due to inflation)

2

3

n-1

C(1+g)

4

C(1+g)

2

C(1+g)

C(1+g)

C

1

n-2

Derivation of Formulas:

n-1

n

P

F

P C 1 i C 1 g 1 i ... C 1 g

1

2

C 1 g

C C 1 g

...

n

1 i

1 i

1 i

2

n 1

n 1

1

1 g

1 g

C

...

2

n

1 i 1 i

1 i

Multiply

1

by

n 1

1

1 g

1 g

4

1 i

n

g = rate of increase

2

n

1 g

C 1 g 1 g

P

...

2

n

1 g 1 i 1 i

1 i

1 4 4 4 4 4 2 4 4 4 4 43

Sum of Geometric Sequence

a

1 g

1 i

n

1 g

1 i

1 g n

1

C 1 g 1 i

1 g 1 i 1 g 1

1 i

n

n

C 1 g 1 i 1

1 i 1 g 1 i

1 i

1 g n 1 i n 1

C

if g i

g i

But if g i ;

Cn

1 g

For Future Worth Value:

P

if i g

1 g n 1 i n 1

n

F C

1 i

g i

1 g n 1 i n

C

g i

if i g

F

Cn 1 i

n

1 g

1

P

2

5

3

4

P1762.84

P1573.52

P1404.93

P1254.40

P1120

P1000

Sample Problems:

1. For the cash flow shown below, find the values of P and F if i 15% per year:

5

6

g 12% ,

i 15%

2. Eleanor makes year-end deposits of P500 the first year, P550 the second year, P605 the third

year, and so on increasing the net year’s deposit by 105 of the deposit in the preceding year

until the end of the tenth year. Ronald makes equal year-end deposits of P700 each year for

10 years. If interest on both funds is 12% compounded annually, who will be able to save

more at the end of 10 yrs. And by what amount?

Bond Valuation

Value of a Bond – simply the present value of the cash flows the asset (bond)is expected to produce.

M

INT INT INT INT

Kd%

Bond’s

Value

1

N

N

Bond’s Value (VB) =

2

INT

(1 k

t 1

d

)

t

3

INT

4

M

(1 k d ) N

if coupon interest payment is annual

Annuity

Where: kd = bond’s market interest rate

N = no. of years (or periods) before the bond matures

INT= interest paid each year (or period)

= coupon rate x par value

M = the par or maturity value of the bond

6

If coupon interest payment is:

a. Semi-annual

N

INT

M

Bond’s Value (VB) =

; INT is interest received semi-annually

kd t

kd N

t 1

(1 )

(1 )

2

2

b. Quarterly

N

INT

M

Bond’s Value (VB) =

; INT is interest received quarterly

kd t

kd N

t 1

(1 )

(1 )

4

4

c. Monthly

N

INT

M

Bond’s Value (VB) =

; INT is interest received monthly

kd t

kd N

t 1

(1 )

(1 )

12

12

Example:

Allied Foods issued $1,000 par value 15 years life bonds with 10% coupon rate to be paid at the end

of each year. Compute for the value of this bond is market interest rate at the time of issue is:

a. 10%

b. 5%

c. 15%

Notes:

1. Whenever the going rate of interest, kd is equal to the coupon rate, a fixed-rate bond will sell at

its par value. Normally, the coupon rate is equal to the going rate when a bond is issued, causing

it to sell at par initially.

2. Interest rates do change over time, but the coupon rate remains fixed after the bond has been

issued. Whenever the going rate of interest rises above the coupon rate, a fixed rate bond’s price

will fall below its par value. Such a bond is called a discount bond.

3. Whenever the going rate of interest falls below the coupon rate, a fixed rate bond’s price will rise

above its par value. Such a bond is called a premium bond.

4. Increase in kd will cause the prices of outstanding bonds to fall, whereas a decrease in rates will

cause bond’s prices to rise.

5. The market value of a bond will always approach its par value as its maturity date approaches,

provided the firm will not go bankcrupt.

Bond Yields

1. YTM – Yield to Maturity (rate of interest one would earn if a bond will be held to maturity)

N

INT

M

Bond’s Value (VB) =

; if kd is unknown, it becomes the YTM.

t

(1 k d ) N

t 1 (1 k d )

(Formula assumes annual coupon payment.)

2. YTC-Yield to Call (rate of interest one would earn if a bond will be called)

N

INT

Call Pr ice

Bond’s Value (VB) =

; if kd is unknown, it becomes the YTC.

t

(1 k d ) N

t 1 (1 k d )

(Formula assumes annual coupon payment.)

7

3. Current Yield = annual interest/bond’s current price

- does not represent the return that investors should expect to receive from holding the bond.

Example:

Suppose Allied’s bonds had a provision that permitted the company if it is desired, to call the bonds

10 years after the issue date at a price of $1,100. I f you bought the bonds one year after issuance at a

price of $1,494.932, what is the YTC of the bond?

Zero Coupon Bond

Example:

Vandenburg Corporation, a shopping center developer is in need of $50M. The company does not

anticipate major cash flows from the project for about 5 years. Therefore, it decided to issue a 5-year

zero coupon bond with maturity value of $1,000. Bond-yield at issue time is 6%.

a. What should be the issue price of the bond?

b. What should be the total face value of the bonds the company must offer to raise $50M?

Problems on Bond Valuation

1. The Pennington Corporation issued a new series of bonds on January 1, 1974. The bonds

were sold at par ($1,000), have a 12 percent coupon, and mature in 30 years, on December 31,

2003. Coupon payments are made semiannually (on June 30 and December31).

a. What was the YTM of Pennington’s bonds on January 1,1974

b. What was the price of the bond on January 1, 1979, 5 years later, assuming that the level of

interest rates had fallen to 10 percent?

c. On July 1, 1997, Pennington’s bonds sold for $916.42. What was the YTM at that date?

d. Now, assume that you purchased and outstanding Pennington bond on March 1, 1997, when

the going rate of interest was 15.5 percent. How large a check must you have written to

complete the transaction?

2. Callaghan Motors’ bonds have 10 years remaining to maturity. Interest is paid annually, the

bonds have a $1,000 par value, and the coupon interest rate is 8 percent. The bonds have a yield

to maturity of 9 percent. What is the current market price of these bonds?

3. The Heymann Company’s bonds have 4 years remaining to maturity. Interest is paid

annually; the bonds have a $1,000 par value; and the coupon interest rate is 9 percent.

a. What is the yield to maturity at a current market price of (1) $829 or (2) $1,104?

b. Would you pay $829 for one of these bonds if you thought that the appropriate rate of

interest was 12 percent- that is, if kd = 12% Explain your answer.

8

4. Six years ago, The Singleton Company sold a 20-year bond issue with a 14 percent annual

coupon rate and a 9 percent call premium. Today, Singleton called the bonds. The bonds

originally were sold at their face value of $1,000. Compute the realized rate or return for

investors who purchased the bonds when they were issued and who surrender them today in

exchange for the call price.

5. A 10-year, 12 percent semiannual coupon band, with a par value of $1,000, may

be called

in 4 years at a call price of $1,060. The sells for $1,100 (Assume that the bond has been

issued.)

a. What is the bond’s yield to maturity?

b. What is the bond’s current yield?

c. What is the bond’s yield to call?

6. You just purchased a bond which matures in 5 years. The bond has a face value of $1,000,

and has an 8 percent annual coupon. The bond has a current yield of 8.21 percent. What is the

bond’s yield to maturity?

7. A bond which matures in 7 years sells for $1,020 . The bond has a face value of $ 1,000 and a

yield to maturity of 10.5883 percent. The bond pays coupons semiannually. What is the bond’s

current yield?

8. Suppose Ford Motor Company sold an issue of bonds with a 10-year maturity, a $1,000 par

value, a 10 percent coupon rate, and semiannual interest payments.

a. Two years after the bonds were issued, the going rate of interest on bonds such as

these fell to 6 percent. At what price would the bonds sell?

b. Suppose that, 2 years after the initial offering, the going interest rate had risen to12

percent. At what price would the bonds sell?

c. Suppose that the conditions in Part a existed- that is, interest rates fell to6 percent 2

years after the issue date. Suppose further that the interest rate remained at six

percent for the next 8 years. What would happen to the price of the Ford Motor

Company bond over time?

9

DERIVATION OF LINEAR GRADIENT FORMULAS

1

G

2G

3G

(n-2)G (n-1)G

2

3

4

n-1

n

P

F

P G1 i 2G1 i ... n 2G1 i

2

Multiply1

3

n 1

n 1G1 i

1

1

by 1 i :

1

n 2 n 1

2

P1 i G

...

1

2

1 i n 2 1 i n 1

1 i 1 i

Subtract

n

from

2

n 1

1

1

1

Pi G

...

n 1

n 1

1 i 1 1 i 2

1 i

1 i

1 4 4 4 4 4 2 4 4 4 4 4 3

Geometric Sequence to n-1

10

2

Sum of Geometric Sequence -

a

1

1

,r

1 i

1 i

rn 1

sum a

r 1

1

1 i n

a ar ar 2 ar 3 ... ar n

1 n

1

1

n 1

1 1 i

Pi G

1 i n 1 i n

1

1 i

1

1 i

G 1 i 1 1 n 1

i 1 1 i

1 i n

n

P

n

G 1 i 1

n

P

i

i

1 i n

G 1 1 i

P

i

i

n

F P1 i

n

G 1 1 i

i

i

n

n

G 1 i

F

n

i i

n

1 i

1 i

n

n

1 i n

n

i1 i n

A P

n

1 i 1

n

n

G 1 1 i

n i1 i

i

i

1 i n 1 i n 1

n

G 1 i 1

in

i 1 i n 1 1 i n 1

1

n

A G

n

i 1 i 1

11

Financing Decision

- determine the optimal capital structures of the firm

Capital Structures

- a mix of long-term sources of funds of the co.

Liabilities

Equity

(creditors)

(owners)

Objective: determine the mix that will maximize the market value of the firm

Types of Financing

1. Debt Financing

2. Equity Financing

Preferred Stock Financing

Common Stock Financing

Debt financing

- the firm borrows from an external source(s) to raise funds.

- Principal amt. loaned and interests to be paid are stipulated in a debt contract

(including when and how much will be paid)

- Company is obligated to pay principal and interests regardless of its earnings

12

-

-

Lenders (creditors) do not/cannot exercise direct control over the company but can

place certain restrictions on the company w/c when violated gives them the right to

exert some influences on the company’s direction

Claim of lenders (creditors) are prioritized over that of equity holders in case of

liquidation

Interest paid to creditors are tax-deductible (as seen in income statement of the

borrowing company)

Bonds – a contract or agreement that a borrower has to pay interest and principal at specific

dates. (actually, a certificate of indebtedness)

4 Main types of Bonds:

1. Treasury Bonds – referred to as government bonds, these are issued by the government.

2. Corporate Bonds – bonds issued by corporations and are exposed to default risk (inability

to make promised principal and interest payments)

3. Municipal Bonds – or “munis”, these are issued by state and local governments and are

exposed to default risk. (main advantage: interest earned by holders are exempted from

taxes)

4. Foreign Bonds – bonds issued by foreign governments or corporations. Main risk:

currency exchange movement. (happen if bonds are denominated in a currency other than

of that of the investor’s home currency)

Key Characteristics of bonds:

- all bonds have some common characteristics, they usually differ only on some

contractual features.

Bond Terminology:

1. Par Value – face value of a stock or bond

2. Coupon Payment – specified amt. of dollars/pesos that are to be paid each period on a

per par value basis

3. Coupon Interest Rate – stated “annual” rate of interest on a bond.

coupon payment

par value

4. Floating Rate Bond – bond whose interest rate fluctuates with shifted in the general level

at interest rates (maybe tied to T-bonds’ rate)

- coupon rate is set for initial period after which it can be adjusted

from time to time

- can include upper and lower limits (“cups” and “flours”) or how

high or low the yield (interest rate) can go.

- Can cause market value of bonds to stabilize in times of varying

market rates.

5. Zero Coupon Bond – bond paying no periodic interest but is sold at a discount below par,

thus providing corporation Co investors on the form of capital appreciation

6. Maturity date – a specified date on which the par value of a bond must be repaid.

13

Continued in PowerPoint slides

INTEREST AND MONEY-TIME RELATIONSHIPS ( I )

Capital:

- refers to wealth in the form of money or property that can be used to produce more wealth.

Two Types of Capital:

a. Equity Capital – those owned by individuals who have invested their money or property in a

business project or venture in the hope of receiving a profit.

b. Debt Capital / Borrowed Capital – obtained from lenders for investment. Lenders in turn

receive interest payment from the borrowers.

The General Concepts of Interest:

“ What may be unfamiliar to us is the idea that, in the financial world, money itself is a

commodity, and like other goods that are bought and sold, money costs money. “

- C.S. Park -

Interest - the cost of money often expressed as a percentage that is periodically applied

and added to an amount ( or varying amounts ) of money over a specified length

of time.

- the return obtainable from the productive investment and efficient use of

money resources during a specific time period.

- the compensation ( return ) for the administrative expenses of making the loan,

for the risk that the loan will not be repaid, and for the earnings forgone had the

money been placed in other investments.

- it is the profit from lending money, or the earning power of money.

14

- the amount paid for the use of borrowed money, the cost of borrowing money.

The Time Value of Money:

- the economic value of a sum of money depends on when it is received, because money has

earning power over time ( a dollar received today has a greater value than a dollar received

at some future time ).

- the changing worth of money through time can be because of its earning potential over time,

or to its decrease in value due to inflation over time , or to both.

Ways of Calculating Interest:

a. Simple Interest

- when total interest earned or charged is linearly proportional to the initial

amount of the loan ( principal, or the amount of money borrowed ).

- General Formula :

I=(P)(N)(i)

Where : P = principal amount lent or borrowed

N = number of interest period ( e.g. years )

i = interest rate per interest period

- interest period is that time period for which the interest is calculated; usually, it is

annually, semi-annually, quarterly or monthly but it can be any desired time interval.

Illustrative Problems:

1. Php 400 is loaned for 5 quarters at a simple interest rate of 3% per quarter.

a. What is the total amount of interest to be paid?

b. What is the total amount owed after 5 quarters ( that is if principal and interest amount

are to be paid only at the end of 5 quarters ) ?

2. Find the total interest earned by a principal loan of Php 1000 given a simple interest rate of

12% per month if the loan is for 3 weeks, if the interest is 3.5% per quarter for 4 months, and

if the interest rate is 12.55% per annum for 27 months.

b. Compound Interest

- it is based on the total amount owed at the end of the previous period which consists of

the original principal loaned plus the accumulated interests which had not been paid when due.

- when the interest charge for any interest period is based on the remaining principal

amount plus any accumulated interest charges up to the beginning of that period ( compounding

).

Illustrative Problem:

1. If Php 400 is loaned for 5 quarters at a compound interest of 3% per quarter compounded

quarterly, find the total amount owed at the end of the last quarter.

Notations and Cash Flow Diagrams:

The following notations are commonly utililized in formulas for compound interest calculations

and other engineering economy problems :

i = effective interest rate per period

15

N = number of compounding periods

P = present sum of money; the equivalent value of one or more cash flows at a

reference point in time called the present

F = future sum of money; the equivalent value of one or more cash flows at a

reference point in time called the future

A = end-of- period cash flows ( or any other equivalent end-of- period values ) in

A uniform series continuing for a specified number of periods, starting at the

end of the first period and continuing through the last period

With the use of cash flow diagrams, the timing occurrence of flows become more apparent and

therefore reducing careless errors.

Some concepts in constructing a cash flow diagram ( c.f.d ):

1. Define first the time frame over which the cash flows occur. This establishes the horizontal

scale divided into time periods. Time period progresses as one move from left to right of the

horizontal scale.

2. Cash receipts ( incoming ) and disbursements ( outgoing ) are then located on the time scale

according to data projected by the investment. Cash receipts are represented by upward

arrows, and cash disbursements are represented by downward arrows.

3. Direction of arrows depend on whose point of view is the cash flow diagram drawn for.

Illustrative Example :

Mrs. Green has just purchased a new car for $12,000. She makes a down payment of 30% of the

negotiated price and then makes payments for $303.68 per month thereafter for 36 months.

Furthermore, she believes the car can be sold for $3,500 at the end of three years. Draw a cash

flow diagram of this situation from Mrs. Green’s viewpoint.

Nominal Interest Versus Effective Interest Rate

Nominal Rate of Interest ( r ) :

- for compounded interest, the rate of interest usually quoted is the nominal rate of

interest which is the specific rate of interest and the number of interest period per year. This is

because it has become customary to quote interest rates on an annual basis, followed by the

compounding period if different from one year in length.

Ex: a nominal rate of 8% compounded quarterly

i = 8% / 4 = 2%

Effective Rate of Interest :

- the actual or exact rate of interest earned on the principal during one year .

- this is usually expressed on annual basis unless specifically stated otherwise.

Converting Nominal Interest to Effective Interest Rate:

ieff = ( 1+ r/N )N – 1

where : ieff is the effective interest rate

r is the nominal rate of interest

N is the number of compounding period per year

16

Note: effective interest rate is only equal to nominal rate of interest when compounding is on

annual basis. When N>1, i>r.

Sample Problem:

1. Find the nominal rate which if converted quarterly could be used instead of 12%

compounded monthly. What is the corresponding effective rate?

Interest Formulas Relating Present and Future Equivalent Values of Single Cash Flows

Future Worth:

If any amount P is invested at a point in time and i% is the interest rateper period, the amount

will grow to a future amount of P+Pi = P(1+i) by the end of one period; by the end of two

periods, the amount will grow to P(1+i)(1+i)=P(1+i)2; by the end of three periods, the amount

will grow to P(1+i)2(1+i)=P(1+i)3; and by the end of N periods, the amount will grow to:

F = P(1+i)N

Where : F = future worth of money

N = number of interest period

The quantity (1+i)N is commonly called the single payment compound amount factor. It is also

symbolize by ( F/P, i%, N ).

Present Worth:

To find the present worth of a certain amount of money given it’s future value.

P = F(1+i)-N

The quantity ( 1+i)-N is called the single payment present worth factor. It is symbolize by ( P/F,

i%, N ).

Illustrative Problem:

1. A chemical engineer wished to accumulate a total of Php 10,000 in a savings account at the

end of 10 years. If the bank pays only 4% compounded quarterly, what should be the initial

deposit?

2. What amount can be withdrawn two years from now from a bank offering a nominal rate of

40% compounded quarterly if Php 1,000 is deposited now?

3. Solve problem 2 by using the effective rate of interest.

4. By the conditions of a will, the sum of Php 25,000 is left to a girl to be held in trust by her

guardian until it amounts to Php 45,000. When will the girl receive the money if the fund is

invested at 8% compounded quarterly?

5. If Php 1,000 becomes Php 5,743 after 15 years, when invested at an unknown rate of interest

compounded semi-annually, determine the unknown nominal rate and the corresponding

effective rate.

17

INTEREST AND MONEY-TIME RELATIONSHIPS (II)

The Five Types of Cash Flows:

1. Single Cash Flow

- the simplest case, involves equivalence of a single present amount and its future worth.

2. Equal ( Uniform ) Series

- probably the most familiar category which includes transactions arranged as a series of

equal cash flows at regular intervals.

3. Linear Gradient Series

- cash flow when common pattern of variation occurs in terms of cash flow in a series

increases ( or decrease ) by a fixed amount.

4. Geometric Gradient Series

- another kind of gradient series that is formed when the cash flow is determined not by

some fixed amount but by some fixed rate, expressed as percentage.

5. Irregular Series

- a series of cash flow in that it does not exhibit a regular overall pattern.

Annuities

- is a series of equal payments occurring at equal periods of time.

P

1

2

3

n

0

18

N

A

Formulas Relating Annuity , Present Worth and Future Worth Amounts:

Finding P given A:

Finding F given A:

n

(1 i ) 1

(1 i) n 1

PA

FA

[i]

i(1 i) n

Illustrative Problems:

1. What are the present worth and the accumulated amount of a 10 year annuity paying Php

10,000 at the end of each year, with interest at 15% compounded annually?

2. A plastic manufacturing company is intending to expand its production facilities starting

1988. The program requires the following estimated expenditures:

Php 1,000,000 at the end of 1988

Php 1,200,000 at the end of 1990

Php 1,500,000 at the end of 1993

To accumulate the required funds, it established a sinking fund consisting of 15 uniform

annual deposits, the first deposit having been made at the end of 1979. The interest rate of the

fund is 12% per annum. Calculate the annual deposit. What will be the balance in the fund on

January 1, 1990?

3. The officers and board of directors of the institute of Integrated Electrical Engineers desire to

award a Php 3,600 scholarship annually to deserving electrical engineering students for as

long as its scholarship fund shall last. The fund was started July 1, 1987 by a donor in the

amount of Php 18,000. The IIEE invested this amount at that time at 8% per annum and plans

on adding Php 600 each year to the fund from its dues starting July 1, 1988 for as long as

awards are made.

a. For how many years starting July 1, 1988 can scholarship be awarded?

b. What will be the balance in the fund after the last award is made?

4. A chemical engineer wishes to set up a special fund by making uniform semi-annual end-ofperiod deposits for 20 years. The fund is to provide Php 100,000 at the end of each of the last

five years of the 20 year period. If interest is 8% compounded semi-annually, what is the

required semi-annual deposit to be made?

Deferred Annuity:

Ordinary Annuity - involves the first cash flow being made at the end of the first period.

Deferred Annuity - if cash flow does not begin until some later date; one where the first payment

is made several periods after the beginning of the annuity.

P

m periods

1

2

3

0

n periods

0

m

1

2

A

A

A ( P/A,i%,n)(P/F,i%,m)

19

3

4

A

A

A ( P/A, i%, n )

n-1 n

A

A

P = A (P/A,i%,n)(P/F,i%,m)

P = A { [ 1-(1+i)-n ] / i } (1+i)-m

Sample Problems:

1. On the day his grandson was born, a man deposited to a trust company a sufficient amount of

money so that the boy could receive five annual payments of Php 10,000 each for his college

fees, starting with his 18th birthday. Interest at the rate of 12% per annum was to be paid on all

amounts on deposit. There was also a provision that the grandson could elect to withdraw no

annual payments and receive a single lump amount on his 25th birthday. The grandson chose this

option.

a. How much did the boy receive as single payment?

b. How much did the grandfather deposit?

2. If Php 10,000 is deposited each year for 9 years, how much annuity can a person get annually

from the bank every 8 years starting 1 year after the 9th deposit is made. Cost of money is 14%.

Perpetuity:

- an annuity in which payments continue indefinitely.

P

1

2

3

n to

4

0

P = A { [ 1- (1+i)-n]/i} = A { [1-(1+i)-]/i}

P = A/i

Sample Problem:

1. What amount of money invested today at 15% interest can provide the following scholarships:

Php 30,000 at the end of each yearfor 6 years; Php 40,000 for the next 6 years and Php 50,000

thereafter?

Linear Gradient Series:

- involves receipts and expenses that are projected to increase or decrease by a uniform

amount each period, thus constituting an arithmetic sequence of cash flows.

- ex: maintenance and repair expenses on specific equipment may increase by a relatively

constant amount each period; suppose that the maintenance expense on a certain machine is Php

2,00020

1,500

1,000

2,500

3,000

1000 at the end of the first year and increasing at a constant rate of

four years :

Php 500 each for the next

This cash flow may be resolved into two components:

2G

3G

(n-1)G

G

A

A

A

A

A

0

+

1

2

3

4

A = Php 1,000 n = 5

0

5

G PisA known as the uniform gradient amount:

Finding P when given G:

P = PA + P G

PA = A {( [ 1+i]n - 1 ) / i(1+i)n }

PG = G/i { [ (1+i)n - 1]/i - (n) } { 1/(1+i)n }

1

PG

2

3

4

5

G = Php 500 n = 5

Finding F when given G:

F = G/i { [(1+i)n - 1]/i } - nG/i

Finding A when given G:

A = G { 1/i - n/[(1+i)n - 1] }

Sample Problem:

1. A loan was to be amortized by a group of four end of year payments forming an ascending

arithmetic progression. The initial payment was to Php 5,000 and the difference between

successive payments was to be Php 400. But the loan was renegotiated to provide for the

payment of equal rather than uniformly varying sums. If the interest rate of the loan was 15%

what was the annual payment?

2. Find the equivalent annual payment of the following obligations at 20% interest rate.

End of year

Payment

1

Php 8,000

2

7,000

3

6,000

4

5,000

Additional Problem:

21

1. A man bought a lot worth Php 1,000,000 if paid in cash. On the installment basis, he paid a

down payment of Php 200,000; Php 300,00 at the end of one year, Php 400,000 at the end of

three years and a final payment at the end of five years. What was the final payment if interest

was 20%.

Selections in Present Economy : Problem Set

Method:

1. In a mining site in Mindoro, the ore contains, on the average, one ounce of gold per ton. One

method of processing “A” costs Php 1,500 per ton and recovers 90% of the gold. Another

method “B” costs only Php 1,200 per ton and recovers 80% of the gold. If the gold can be

sold at Php 4,000 per ounce, which method is better and by how much?

2. The making of rivet holes in structural steel members can be done by two methods. The first

method consists of laying out the position of the holes in the members and using a drill press

costing Php 30,000. The machinist is paid Php 20 per hour and he can drill 30 holes per hour.

The second method makes use of a multiple-punch machine costing Php 27,500. The punch

operator is paid Php 18 an hour and he can punch out 4 holes every minute. This method also

requires an expense of Php 0.70 per hole to set the machine.

a. If all other costs are assumed equal, what is the total cost for each machine for 6,000

holes, assuming that the total cost of each machine is charged to these holes?

b. For how many holes will the costs be equal?

3. The monthly demand for ice cans being manufactured by Mr. Cool is 3,200 pieces. With a

manually operated guillotine, the unit cutting cost is Php 25. An electrically operated

hydraulic guillotine was offered to Mr. Cool at a price of Php 275,000 and which will cut by

30% the unit cutting cost. Disregarding the cost of money, how many months will Mr. Cool

be able to recover the cost of the machine if he decides to buy now?

22

Material:

1. GMA will be visiting an automobile plant. It was decided by the plant management that they

must paint the plant.

Boysen paint costs Php 70 per gallon and covers 350 sq. ft. per gallon. The manufacturer

claims that it will last 5 years and can be applied at a rate of 100 sq. ft. per hour.

General paint costs Php 100 per gallon and covers 500 sq. ft. per gallon. It will last for 4

years and can be applied at a rate of 125 sq. ft. per hour. If the painter is Paid Php 15 per

hour, which paint should be used?

2. The volume of raw material required for a certain product is 2.02 cu. cm. The finished

product volume is 1.05 cu. cm. The time for machining each piece of the product is 45

seconds for steel and 30 seconds for brass. The cost of steel is Php 26.50 per kg. and the

value of steel scrap is negligible. The cost of brass is Php 51.25 per kg. and the value of brass

scrap is Php 16 per kg. The wage of the operator is Php 25 per hour and the overhead cost of

the machine is Php 15 per hour. The weight of steel and brass are 0.0081 and 0.0088 kg. per

cu cm., respectively. Which material will you recommend?

3. High carbon steel or alloy steel can be used for the set of tools on a lathe. The tools must be

sharpened periodically. Data for each are as follows:

High Carbon Steel

Alloy Steel

Output per hour

60 pcs.

70 pcs.

Time between tool grinds

4 hours

6 hours

Time required to change tools

1 hour

1 hour

The wage of the lathe operator is Php 24 per hour, based on the actual working hours. The tool

changer costs Php 30 per hour. Overhead costs for the lathe are Php 14 per hour, including toolchange time. A set of unsharpened high carbon steel costs Php 500 and can be ground ten times;

a set of unsharpened alloy steel costs Php 650 and can be ground five times. Which type of steel

should be used?

Design:

1. A company manufactures 1,000,000 units of a product yearly. A new design of the product

will reduce materials cost by 12%, but will increase processing cost by 2%. If materials cost

is Php 1.20 per unit and processing will cost Php 0.40 per unit, how much can the company

afford to pay for the preparation of making the new design and making changes in

equipment?

Site Selection:

1. A certain masonry dam requires 200,000 cu. M. Of gravel for its construction. The contractor

found two possible sources for the gravel with the following data:

Source A

Source B

Average distance, gravel pit

3.0 km.

1.2 km.

to dam site

Gravel cost / cu. m. At pit

NA

PHP 10.00

23

Purchase price of pit

Road construction

necessary

Overburdened to be

removed

@ Php 4.20 / cu. m.

Hauling cost per cu. m. per

km.

Php 800,000

Php 450,000

NA

NA

NA

90,000 cu. m.

Php 4.00

Php 4.00

Which of the two sites will give lesser cost?

Equipment Maintenance:

1. A machine used for cutting materials in a factory has the following outputs per hour at

various speeds and requires periodic tool regrinding at the intervals cited.

Speed

Output per Hour

Tool Regrinding

A

200 pieces

Every 8 hours

B

280 pieces

Every 5 hours

A set of tools costs Php 1,260 and can be ground twenty times. Each regrinding costs Php 54

and the time needed to regrind and change tool is 1 hour. The machine operator is paid Php 19.20

per hour, including the time the tool is changed. The tool grinder who also sets the tools to the

machine is paid Php 21 per hour. The hourly rate chargeable against the machine (based on

machine operating time) is Php 38, regardless of machine speed. Which speed is the most

economical?

Economy and Proficiency of Labor / Workers:

1. An electrical contractor has a job which should be completed in 100 days. At present, he has

80 men on the job and it is estimated that they will finish the work in 130 days. If of the 80

men, 50 are paid Php 62 a day, 25 at Php 68 a day, and 5 at Php 75 a day and if for each day

beyond the original 100 days, the contractor has to pay Php 250 liquidated damages:

a. How many more men should the contractor add so he can complete the work on time?

b. Of the additional men, 5 are paid Php 68 a day and the rest at Php 62 a day. Would the

contractor save money by employing more men and not paying the fine?

2. A certain product is being made by hand in a small factory. The workers were paid Php 0.20

per acceptable piece produced. It was found that if a worker produced 80 pieces per day, 5%

would be rejected. If 90 pieces were produced per day, 10% would be rejected, and at the rate

of 100 pieces, 20% would be rejected. The cost of materials was Php 0.50 per piece, and the

24

materials in any rejected piece had to be thrown away. There was a fixed overhead expense

of Php 10.00 per day per worker, regardless of considerable change in output.

a. At which of the three outputs did the worker make the highest wage?

b. At what output did the factory achieve the lowest unit cost?

3. An executive receives an annual salary of Php 240,000 and his secretary a salary of Php

60,000 a year. A certain task can be performed by the executive working alone in 4 hours. If

he delegates the task to his secretary it will require him 30 minutes to explain the work and

another 45 minutes to check the finished work. Due to the unfamiliarity of the secretary to do

task, it takes her an additional time of 6 hours after being instructed. Considering salary cost

only, determine the cost of performing the task by each method if secretary works 2,400

hours a year and the executive 3,000 hours a year.

IEMECON

Selections in the Present Economy

Problem Set

1. A building contractor can source door frames from either a nearby shop or a far-off forest area.

The cost details are summarized in the table below. The total requirement of wood for the

construction work is 75 tons. Find the best alternative for buying the wooden frames. Also find

the economic advantage of the best alternative.

Items

Nearby Shop Far-off Forest Area

Distance to site

Negligible

900 km

Transportation cost per ton per km Negligible

$ 100

Material cost per ton

$ 2,000

$ 1,250

2. A company is considering the possibility of buying part No.010 from an outside supplier instead

of manufacturing the part as it is now. The annual requirement for part No. 010 is 50,000 units.

The cost to manufacture this part is:

Direct Material

Php 4

Direct Labor

Php 2

Manufacturing Overhead

Variable

Php 2

25

Fixed

Total Unit Cost

Php 4

Php 15

An offer was received from a supplier to supply the part at Php 13 per unit. Should the company

make or buy the part?

3. In the design of a jet engine part, the designer has a choice of specifying either an aluminum alloy

casting or steel casting. Either material will provide equal service, but the aluminum casting will

weigh 1.2 kg compared with 1.35 kg for the steel casting.

The aluminum can be cast for $ 80.00 per kg and the steel one for $ 35.00 per kg. The cost

of machining per unit is $ 150.00 for aluminum and $ 170.00 for steel. Every kilogram of excess

weight is associated with a penalty of $ 1,300 due to increased fuel consumption. Which material

should be specified and what is the economic advantage of the selection per unit?

4.

The Pampanga Corporation manufactures a single product called “Mangyanan” Under normal

operating conditions; the company manufactures and sells 90,000 units of this product in a 6

month period. The contribution to fixed costs and profits of each unit of product is P 8. The fixed

overhead costs for six months amount to P 320,000.

Other companies buying this product are currently encountering labor difficulties and this resulted

to a reduction in sales to only 4,000 units per month. A sales volume of only 4,000 units monthly

will definitely result to a loss. Therefore, the management of the firm plans to close the plant for

six months, anticipating that market will be back to normal after six months.

Studies indicated that the 6-month fixed overhead costs of P 320,000 can be cut down to

P225,000 if the plant is closed. However, additional costs to protect the facilities and start up

costs have been estimated at P 31,000.

Should the company close the plant for six months or continue its operation?

5. A cement kiln with production capacity of 130 tons per day (24 hours) of clinker has at its

burning zone about 45 tons of magnesite chrome bricks being replaced periodically, depending on

some operational factors and the life of the bricks.

If locally produced bricks cost P 25,000 per ton and have a life of 4 months, while certain

imported bricks costing P 30,000 per ton and have a life of 6 months, determine the more

economical bricks and by how much. (ME Board Problem- Oct.1987)

6.

An equipment installation job in the completion stage can be completed in 40 days of 8 hour day

work, with 40 men working. With the contract expiring in 30 days, the mechanical engineer

contractor decided to add 10 men on the job, overtime not being permitted.

26

If the liquidated damage is P 2,000 per day of delay, and the men are paid P 80 per day, will the

engineer be able to complete the jobe on time? Would he save money with the addition of

workers?(ME Board Problem- April 1988)

7. The chief engineer of refinery operations is not satisfied with the preliminary design for storage

tanks to be used as part of a plant expansion programme. The engineer who submitted the design

was called in and asked to reconsidfer the overall dimensions in the light of an article in the

Chemical Engineer, entitled “How to size future process vessels?”

The original design submitted called for 4 tanks 5.2 m in diameter and 7m in height. From a graph

of the article, the engineer found that the present ratio of height to diameter of 1.35 is 111% of the

minimum cost and that the minimum cost for a tank was when the ratio of height to diameter was

4:1. The cost for the tank design as originally submitted was estimated to be $ 9,000,000. What

are the optimum task dimensions if the volume remains the same as for the original design? What

total savings may be expected through the redesign?

8. Suarez Corporation manufactures a certain product XYZ. This product can be sold at the end of a

particular stage of production or can be further processed and sold as a completely processed

product.

A partially processed product sells for P 45 per unit and the manufacturing costs amount to P 30

per unit. If the product is further processed, variable cost of P 15 will be spent and the product can

be sold at P 55 per unit. The estimate annual sales for this product is 30,000 units.

9. Two alternatives are under consideration for a tapered fastening pin. Either design will serve the

purpose and will involve the same material and manufacturing cost except for the lathe and

grinder operations.

Design A will require 16 hours of lathe time and 4.5 hours of grinder time per 1,000 units. Design

B will require 7 hours of lathe time and 12 hours of grinder time per 1,000 units. The operating

cost of the lathe including labour is $200 per hour. The operating cost of the grinder including

labour is 150 per hour. Which design should be adopted if 1,000 units are required per year and

what is the economic advantage of the best alternative?

10. A company manufactures dining tables which mainly consist of a wooden frame and a table top.

The different materials used to manufactire the tables and their costs are given in Table 2.1

Table 2.1

Description of Item

Quantity

Wood for frame and legs

0.1 m3

Table top with sunmica finish 1

Leg bushes

4

Nails

100 g

Total labour

15 hr

27

Cost ($)

12,000/m3

3,000

10/bush

300/kg

50/hr

In view of the growing awareness towards deforestation and environmental conservation, the

company feels that the use of wood should be minimal. The wooden top therefore could be

replaced with a granite top. This would require additional wood for the frame and legs to take the

extra weight of the granite top. The materials and labour requirements along with cost details to

manufacture a table with granite top are given in Table 2.2

Table 2.2

Description of Item Quantity

Wood for frame and legs 0.15 m3

Granite Table top

1.62 m2

Leg bushes

4

Nails

50 g

Total labour

8 hr

Cost ($)

12,000/m3

800/m2

25/bush

300/kg

50/hr

If the cost of the dining table with a granite top works out to be lesser than that of the table with

wooden top, the company is willing to manufacture dining tales with granite tops. Compute the

cost of manufacture of the table under each of the alternatives described above and suggest the

best alernative. Also, find the economic advantage of the best alternative.

11. In the design of buidlings to be constructed in Alpha State, the designer is considering the type of

window frame to satisfy. Either steel or aluminum windrow frames will satisfy the design criteria.

Because of the remote location of the building site and lack of building materials in Alpha state,

the window frames will be purchased in Beta State and transported for a distance of 2,500 km to

the site. The price of window frames of the type required is $ 1,000 each for steel frames and $

1,500 each for aluminum frames. The weight of steel window frames is 75 kg each and that of

aluminim window frame is 28 kg each. The shipping rate is $ 1 per kg per 100 km. Which design

should be specified and what is the economic advantage of the selection?

12. The process planning engineer of a firm listed the sequences of operations as shown in the table

2.3 to produce a component.

Table 2.3

Sequence

Process Sequence

1

Turning-Milling-Shaping-Drilling

2

Turning-Milling-Drilling

3

All operations are performed with CNC machines

The details of processing times of the component for various operations and their machine hour

rates are summarized in Table 2.4.

Table 2.4

Machine Hour Rates and Processing Times (minutes)

Machine

Operation

Process Sequence

Hour Rate

1

2

Turning

200

5

5

Milling

400

8

14

28

3

-

Shaping

Drilling

CNC

350

300

1,000

10

3

-

3

-

8

Find the most economical sequence of operations to manufacture the component.

13. A paint manufacturing company uses a sand mill for fine grinding of paint with an output of 100

liters per hour using glass beads as grinding media. Media load in the mill is 25 kg, costing P 200

per kg, and is fully replenished in 2 months time, at 8 hours per day operation, 25 days per month.

A ceramics grinding media is offered to this paint company costing P400 per kg, and needs 30 kg

in the sand mill, but guarantees an output of 120 liters per hour and full replenishment of media in

3 months.

If profits on paint production is P 15 liter, would you recommend the change in media? Show by

calculations comparative cost to justify your answer. (ME Board Problem- Oct.1987).

DEPRECIATION

Depreciation---is the decrease in value of physical properties with the passage

of time and use. More specifically, depreciation is an accounting concept that

establishes an annual deduction against a before-tax income such that the

effect of time and use on an asset’s value can be reflected in a firm’s financial

statements. Annual depreciation deductions are intended to “match” yearly

fraction of value used by an asset in the production of income over the asset’s

actual economic life.

The actual amount of depreciation can never be

established until the asset is retired from service.

Types of Depreciation

1. Normal Depreciation

(a) Physical depreciation---due to the lessening of a property’s physical ability

to produce results.

(b) Functional depreciation or obsolescence---due to the lessening in the

demand for the function that the property was designed to render.

29

2. Depreciation due to change in price levels, when price levels rise during

inflationary periods. Even if original purchase price was recovered through

proper depreciation procedure. Identical replacement can not be attained,

capital depreciated.

3. Depletion---used to indicate the value of the resource base when natural

resources are being consumed in producing products or services.

Symbols Used

P-original installed cost of the depreciable property

N-depreciable life of the asset

F-salvage value of the asset after its useful life of N years

dn-depreciation charge for year n and is dependent on the method used

Dn-accumulated depreciation charges from the acquisition time to the end of

year n

BVn-book value of the asset at the end of year n

Depreciation Methods

1. Straight Line Method (SL)---is the simplest and most widely used

depreciation method. It assumes that a constant amount is depreciated

each year over the depreciable life of the asset. To solve using the SLM, the

following formula applies:

PF

N

D n nd n

dn

BVn P D n

2. Declining Balance Method (DB)---sometimes called the Matheson Formula,

assumes that the annual cost of depreciation is a fixed percentage of the BV

at the beginning of the year. The ratio of the depreciation in any one year to

the BV at the beginning of the year is constant throughout the life of the

asset and is designated by R (0 to 1). In this method, R=2/N when 200%

declining balance is used and R=1.5/N when 150% declining balance is

used.

F

P

BVn P(1 k ) n

k 1 N

d n kBVn 1 kP(1 k ) n 1

D n P BVn

30

3. Sum-of-the-Years Digit Method (SYD)---to compute the depreciation

deduction by the SYD method, the digits corresponding to the number of

each permissible year of life are first listed in reversed order. The sum of

these digits is then determined. The depreciation factor for any year is the

number from the reverse-ordered listing for that year divided by the sum of

the digits.

2( N n 1)

d n ( P f )

N( N 1)

( 2N n 1)n

D n ( P F )

N( N 1)

BVn P D n

4. Sinking Fund Formula---it is assumed that a sinking fund is established in

which funds will accumulate for replacement purposes and will bear

interest.

i

d n ( P F )

N

(1 i ) 1

(1 i ) n 1

Dn d n

i

BVn I D n

5. Service Output or Units-of-Production Method---the decrease in value for

(P F)

d

N

BVn I D n

this type of depreciation method is due to the number of hours that the

asset can be used before its end life. In this case, the life of the asset is in

terms of time that it can produce before replacement.

6. Double Declining Balance --- same as Declining Balance only:

k

2

N

Illustrative Problems:

31

(1) A company purchased a machine for $15,000. It paid sales tax and

shipping costs of $1,000 and nonrecurring installation costs amounting to

$1,200. At the end of five years, the company had no further use for the

machine, it was sold for $1,000.

Required:

(a) What is the depreciation each year using SL, DB, DDB, and SYD?

(b)What is the book value at the end of the second year using the different

methods mentioned above.

(2) An asset for drilling was purchased and placed in service by a petroleum

production company. Its cost basis is $60,000 and it has an estimated

salvage value of $12,000 at the end of 14 years. The interest for the

sinking fund is 10%.

Required:

(a) What is the depreciation each year using the sinking fund formula?

(b) What is the book value at the end of 10 years?

(3) A piece of equipment used in a business has a cost basis of $50,000 and is

expected to have a $10,000 salvage value when replaced after 20,000 hours

of use. Find its depreciation rate per hour of use, and find its book value

after 10,000 hours of operation.

(4) In 1992, Silicon Chemical Company purchased a special purpose machine

that had a fair price of $120,000. This new machine is expected to produce

100,000 units throughout its estimated useful life of 10 years. Up to the

end of the third year it had produced 45,000 units and during the fourth

year it produced 15,000 units. If the estimated market value is $12,000 at

the end of 10 years, compute for the depreciation amount in the third year

and the book value at the end of the fourth year by each of these methods:

(a) straight-line method

(b) sum-of-the-years digit method

(c) 200% declining balance method

(d) sinking fund method (i=10%)

(e) service output or units-of-production method

[5] Show in tabular form [depreciation schedule] the computation for the

annual depreciation expenses for a machine worth P1,000,000 with a salvage

value of 10% the original cost and a depreciable life of 5 years, using.

[a] straight line method

[b] sum of year’s digits

[c] declining balance

[d] double declining balance

[6] A contractor imported a bulldozer for his job, paying P250,000 to the

manufacturer. Freight and insurance charges amounted to P18,000; custom’s

32

broker’s fees, P8,500; taxes, permits, and other initial expenses, P25,000. If

the contractor estimates life of the bulldozer to be 10 years, with a salvage

value of P20,000, determine the book value at the end of six years, using the:

[a] straight line formula

[b] sinking fund formula at 8%

[c] declining balance method

[d] SYD method

[7] A machine that cost P68,000 was depreciated on a straight line basis for

five years under the assumption that it would have an eight year life and a

P4,000 trade-in value. At the point, it was recognized that the machine had

five years of remaining useful lie, after which it would have an estimated

P3,000 scrap value. Using the straight line method.

[a] Determine the machine’s book value at the end of its fifth year.

[b] Determine the amount of depreciation to be charged against the machine

during each of the remaining years of its life.

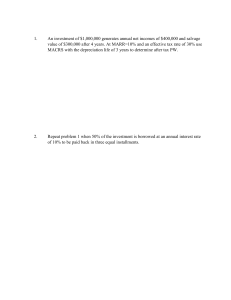

APPLICATIONS OF MONEY-TIME RELATIONSHIPS

All engineering economy studies of capital projects should consider the return that a given project will or

should produce. By using several methods of making engineering economy studies to evaluate the economic

profitability of a proposed problem solution.

The Present Worth (PW), Annual Worth (AW) and the Future Worth (FW) methods convert cash flows

resulting from a proposed solution into their equivalent worth at some point (or points) in time by using an interest

rate known as the Minimum Attractive Rate of Return (MARR). The Internal Rate of Return (IRR), Explicit

Reinvestment Rate of Return (ERRR) and the External Rate of Return (ERR) methods produce annual rates of

profit, or returns, resulting from an investment, and are then compared against the MARR. The last method, the

payback period, is a measure of speed with which an investment is recovered by the inflows it produces.

DETERMINING THE MINIMUM ATTRACTIVE RATE OF RETURN

The MARR is usually a policy issue resolved by the top management of an organization in view of

numerous considerations. Among these are:

33

1.

2.

3.

4.

The amount of money available for investment, and the source and cost of this funds (i.e., equity funds or

borrowed funds).

The number of good projects available for investment and their purpose.

The amount of perceived risk associated with investment opportunities available to the firm and the estimated

cost of administering projects over short planning horizons versus long planning horizons.

The type of organization involved (i.e., government, public utility, or competitive industry)

Illustrative Problem.

1. A firm has the following capital structure:

Source of Fund

Common Stock

Preferred Stock

Debt

Retained Earnings

Determine the MARR.

Capital

20M

6M

45M

19M

Cost of Capital

15%

8%

9%

15%

BASIC METHODS IN MAKING ENGINEERING ECONOMY STUDIES

Present Worth (PW) – is based on the concept of equivalent worth of all cash flows relative to some base or

beginning point in time called the present. The PW is a measure of how much money an individual or firm

could afford to pay for the investment in excess of its cost. Or, stated differently, a positive PW for an

investment project is a dollar amount of profit over the minimum amount required by investors. Therefore, a

positive PW would accept the proposed solution.

To find PW, it is necessary to discount future amounts to the present by using the formula:

1.

N

PW Fk 1 i

k

k 0

Where: i = effective interest rate, or MARR, per compounding period

k = index for each compounding period (0 k N)

Fk = future cash flow at the end of period k

N = number of compounding periods in the planning horizon (i.e., study

period)

I = investment

S = salvage value

Illustrative Problem.

1. A special purpose machine is to be acquired by paying a P15,000 initial cash payment plus a debt

assumption of P135,000. The machine will generate additional net annual cash inflow of P40,000 for the

firm throughout the 10 years of useful life of the asset. At the end of its life, a salvage value of 10% of its

initial cost will be realized. Assuming that the MARR is 13.2% per annum, is the project justified using

the PW method?

2.

Annual Worth (AW) – is an equal annual series of dollar amounts, for a stated study period, that is equivalent to

the cash inflows and outflows at an interest rate that is generally the MARR. As long as the AW is greater than

or equal to zero, the project is economically attractive; otherwise, it is not. An AW of zero means that an

annual return exactly equal to the MARR has been earned.

N

N

k i 1 i

AW Fk 1 i

N

k 0

1 i 1

Where: i = effective interest rate, or MARR, per compounding period

k = index for each compounding period (0 k N)

34

Fk = future cash flow at the end of period k

N = number of compounding periods in the planning horizon (i.e., study

period)

I = investment

S = salvage value

Illustrative Problem.

1. A manufacturing process can be carried out by using a machine which can be acquired for P20,000. The

annual receipts generated by the investment is P150,000 and the annual disbursement is P138,000. The

asset will have a life of 10 years in which it will have a salvage value of P2,000 at the end of its life.

MARR = 20% Is the project acceptable using the AW method?

3.

Future Worth (FW) – is based on the equivalent worth of all cash inflows and outflows at the end of the

planning horizon at an interest rate that is generally the MARR. A positive FW would result to acceptance of

the problem solution

N

FW Fk 1 i

N k

k 0

Where: i = effective interest rate, or MARR, per compounding period

k = index for each compounding period (0 k N)

Fk = future cash flow at the end of period k

N = number of compounding periods in the planning horizon (i.e., study

period)

I = investment

S = salvage value

Illustrative Problem.

1. Given: I = 150,000; N = 5 years; S = 15,000; MARR = 25%

Year

Cash flow

1

-25,000

2

-10,000

3

50,000

4

70,000

5

90,000

Is the project justified using the FW method?

Internal Rate of Return (IRR) – is the most widely used rate of return method for performing engineering

economic analyses.

This method solves for the interest rate that equates the equivalent worth of an

alternative’s cash inflows (receipts or savings) to the equivalent worth of cash outflows (expenditures, including

investment costs). The IRR must consequently be compared with the MARR, an IRR that is greater than the

MARR would result to acceptance of the problem solution.

To compute for the IRR, equate the PW to zero, then solve for the i by either “trial and error” or “interpolation”.

4.

N

PW Fk 1 i*

k

0

k 0

Where: i* = internal rate of return

k = index for each compounding period (0 k N)

Fk = future cash flow at the end of period k

N = number of compounding periods in the planning horizon (i.e., study

period)

Illustrative Problem.

1. Given: MARR = 15%

35

EOY

Cash flow

0

-100,000

1

30,000

2

40,000

3

70,000

4

50,000

5

20,000

Determine the IRR?

5.

Explicit Reinvestment Rate of Return (ERRR) – solves for the ratio of earning power. It takes into account

the interest rate that equates the annual receipts and disbursements to the amount of investment. An ERRR that

is greater than the MARR would result to acceptance of the problem solution.

R D I S

i

1 i

ERRR

N

I

1 Net Income

Investment

Where: i = effective interest rate, or MARR, per compounding period

R = annual receipts

D = annual disbursements

I = investment

S = salvage value

Illustrative Problem.

1. On land worth P800,000, an investor constructs a building worth P3,000,000, containing a theater, a bank,

stores and offices. The owner estimates that the annual receipts from rental will be P720,000 and the

annual disbursements to cover taxes, insurance and maintenance of the building will be P80,000. He also

estimates that the land can be sold for P1,200,000, the building for P2,000,000 at the end of 20 years. If

his money is now earning 15% before taxes, will this property earn enough for the investment to be

justified?

External Rate of Return (ERR) – it directly takes into account the interest rate external to a project at which net

cash flows generated (or required) by the project over its life can be reinvested (or borrowed). If this external

reinvestment rate, which is usually the firm’s MARR, happens to equal the project’s IRR, then the ERR method

produces results identical to those of the IRR method.

To compute, convert cash inflows and outflows to their future equivalent using the reinvestment rate which is

usually the MARR, equate this to the future equivalent of the investment, and then solve for the ERR.

6.

N

I 1 ERR Rk Dk 1 i

N

N k

S

k 0

Where: i = effective interest rate, or MARR, per compounding period

R = annual receipts

D = annual disbursements

I = investment

Illustrative Problem.

1. Given: I = 150,000; N = 5 years; S = 15,000; MARR = 25%

Year

Cash flow

Is the project justified?

1

-25,000

2

-10,000

36

3

50,000

4

70,000

5

90,000

7.

Payback (Payout) Period – used as a measure of a project’s riskiness, since liquidity deals with how fast an

investment can be recovered. Quite simply, the payback method calculates the number of years required for

cash inflows to just equal cash outflows.

Simple Payback Period – the length of time required to recover the first cost of an investment from the net cash

flow produced by that investment for an interest rate of zero. This method fails to consider the time value of

money. It fails to consider the consequences of the investment following the payback period, including the

magnitude and timing of the cash flows and expected life of the investment. It is more desirable to have a shorter

payback period, this means that the investment provides revenues early in its life, enough to cover initial outlay.

This quick return in capital also shortens the time span over which the investment is susceptible to losses.

R

k 1

k

Dk I 0

Where: R = annual receipts

D = annual disbursements

I = investment

= payback period

Discounted Payback Period –considers the time value of money. This method determines the length of time

required until the investments equivalent receipt exceeds the equivalent capital outlay.

R

k 1

Dk 1 i I 0

k

k

Where: i = effective interest rate, or MARR, per compounding period

R = annual receipts

D = annual disbursements

I = investment

Illustrative Problem.

1. A piece of new equipment has been proposed by engineers to increase the productivity of a certain manual

welding operation. The initial investment is P25,000 and the equipment will have a salvage value of

P5,000. Increased productivity attributable to the equipment will amount to P8,000 per year after extra

operating costs have been subtracted from the value of the additional production. MARR = 20%. In view

of the minimum acceptable payback period of 5 years, is this alternative attractive?

Exercise.

1.

A distillation column can be purchased and installed for P 2,000,000. It will incur P35,000 in operations

and maintenance expenses and yet can start generating revenues of P125,000 each month as soon as it is installed.

The distillation column could be sold at the end of its useful life of 4 years at an estimated price of P150,000.

The cost of capital is 15% per annum. The reinvestment rate is 12 %. Evaluate the project using:

a. Present worth method

e. ERR method

b. Annual worth method

f. ERRR method

c. Future worth method

g. Simple payback

d. IRR method

h. Discounted payback

For methods (a) to (f) recommend whether the column is acceptable or not.

For methods (g) and (h), Should the column be accepted if the acceptable payback period is 2.5 years?

37

APPLICATIONS OF MONEY-TIME RELATIONSHIPS FOR

MULTI-BUSINESS PROJECT ANALYSIS

Definition of Terms :

Mutually Exclusive Projects - engineering and business projects that can be accomplished by

more than one feasible alternative wherein the selection of one of these alternatives excludes the

choice and implementation of the others.

“ Do-Nothing Alternative “ - means no alternative is selected because none is economically

justifiable therefore leading to the point where no project is implemented or to continued

reliance in a current system.

Analysis Period / Study Period / Planning Horizon - the time span over which the economic

effects of an investment or project will be evaluated.

Types of Projects / Alternatives:

a. Service Projects / Cost Alternative - those whose revenue do not depend on the choice of the

project or those with all negative cashflows except for a possible positive cashflow element from

disposal of asstes at the end of the project’s useful life. This situation occurs when the

organization must take some action and the decision involves the most economical way of doing

it.

b. Revenue Projects / Investment Alternative - those whose revenue depend on the choice of the

alternative or those with initial capital investment(s) that produce positive cashflows from

increased revenue, savings through reduced costs, or both.

Main Principle in Multi-Business Project Analysis :

- Business or engineering projects must be compared over equal time span or over the same

study period; therefore projects must have equal lives before analysis is initiated. Two Cases for Multi-Project Analysis :

1. Useful lives are the same for all alternatives and equal to study period.

2. Useful lives are different among the alternatives and at least one does not match the

study period.

CASE 1 : USEFUL LIVES ARE EQUAL TO STUDY PERIOD

- USE OF EQUIVALENT WORTH METHODS:

1. For investment alternatives or revenue projects, choose the project that gives the highest

equivalent worth value.

2. For cost alternative or service projects, choose the project that gives the least or lowest

negative equivalent worth value ( meaning the project that requires the lowest cost ).

- USE OF RATE OF RETURN METHODS:

38

In this category, the incremental investment analysis technique is utilized.

4 basic steps for incremental analysis:

1. Arrange the feasible alternatives based on increasing capital investment.

2. Determine the base alternative. For cost alternatives, the base alternative is the one that

requires the least capital investment. For investment alternative, the base alternative is the project

which requires the lowest possible investment and which justifies itself ( i.e. IRR MARR ).

3. Determine the incremental cashflows from the lower to the next higher-investment project and

compare the incremental rate of return value with the MARR. A higher investment alternative

will be chosen if and only if , the additional funds required will have a rate of return that satisfies

the minimum amount.

Incremental Cash Flow = Cash Flow of B - Cash Flow of A

where : A is the base alternative

B is the next higher investment alternative