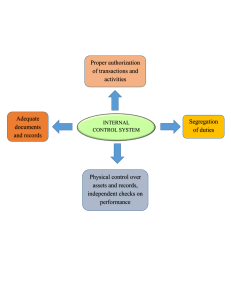

1. Accuracy of Accounting Records: The internal control system helps to ensure that financial statements accurately reflect the cash balance of an organization. This includes proper recording of cash transactions, reconciling bank statements and maintaining proper documentation of all cash transactions. 2. Effectiveness and Efficiency of Operation: Internal controls help to improve the efficiency of cash management operations by streamlining processes, reducing errors, and minimizing the risk of fraud or theft. The system helps to ensure that cash management procedures are followed consistently and efficiently, reducing the risk of errors and increasing productivity. 3. Safeguarding of Cash Assets: one of the primary objectives of internal controls over cash management is to protect an organization's cash assets from theft, fraud, or misappropriation. This is achieved through proper segregation of duties, restricted access to cash, and the establishment of authorization and approval procedures for cash disbursements. By protecting cash assets, internal controls help to maintain the stability and integrity of the organization.