Feng WANG1 , Keren DONG2 , Xiaotie DENG

2

1 State Key Lab of Software Engineering, Wuhan University, Wuhan 430072, China

2 Department of Computer Science, City University of Hong Kong, Kowloon, Hong Kong, China

c

Higher Education Press and Springer-Verlag 2009

Abstract This paper provides an overview of research and

development in algorithmic trading and discusses key issues

involved in the current effort on its improvement, which

would be of great value to traders and investors. Some

current systems for algorithmic trading are introduced, together with some illustrations of their functionalities. We

then present our platform named FiSim and discuss its overall design as well as some experimental results in user strategy comparisons.

Keywords algorithmic trading, portfolio optimization,

news retrieval, decision making, system design

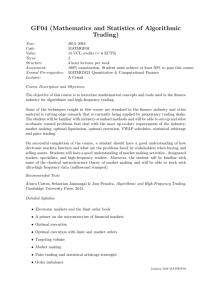

includes identification of investment opportunities (what to

trade) and execution of orders for a variety of asset classes

(when, how, and where to trade). Fig. 1 shows the main

elements in such trading processes.

As shown in Fig. 1, there are four steps in the trading strategy generation process. The first step includes analysis of

market data as well as relevant external news. The analysis

is often supported by computer tools such as spreadsheets or

charts, which is very important to generate a trading signal

and make a trading strategy. The trading model and decision

making are the kernel of AT. The last step of the process is

the execution of the trading strategy, which can be done automatically by computer.

The financial sector has been the one that embraces the advent of information and communication technology without

a minute of hesitation. Advantages in collecting information, making decisions, and executing trade strategies turn

into profits in investors’ hands as quickly as one does it faster

than the competitors. The emergence of the Internet has sped

up the trend in the financial market industry in its increased

automation of trading, now commonly referred to as algorithmic trading (AT).

In general, algorithmic trading can be described as some

elements in financial decision making and financial investment being executed by an algorithm through computers

and communication networks in an electronic way [1]. The

algorithms are involved in predefined trading strategies or

adaptive strategies generated through artificial intelligence

methodologies. Trading strategies are automated by defining a sequence of instructions executed by a computer, which

Received November 11, 2008; accepted April 2, 2009

E-mail: fengwang@whu.edu.cn, {keredong, csdeng}@cityu.edu.hk

Fig. 1

Algorithmic trading process

As the development of information technology, expansions

of financial markets in both its depth and width, structures

236

Feng WANG, et al. Algorithmic trading system: design and applications

resulting from relaxation in regulatory environment and creation of new markets, and economic landscape changes continue to speed up financial transaction, investors constantly

look into ways to reduce transaction costs, increase efficiency, enhance risk control, and utilize information and

technology to make decisions one step ahead of competitors and markets. Algorithmic trading provides traders with

the tools to achieve those objectives, through improvement

in several frontiers.

2.1 Decision-making strategies

Algorithmic trading is a computer-supported financial investment platform for active traders to actively look at the

price movement for profitable opportunities, typically of

short-term profits. Under the AT model, it is important to

evaluate the price dynamics and decide on the amount, trading time, and various parameters related to the trading process. The kernel of AT can be thought of as “package of

strategies”, individually conceived and customized to help

traders to model their financial objectives and execute transaction plans, with the flexibility to revise strategies swiftly.

The automated process allows traders to take on a greater

volume of transactions with more efficiency and less chance

of shortfall. Effectiveness is the right word to describe an

AT system since it can minimize execution shortfall, which

is the difference between the execution plan and the actual

execution results.

The choice of kernel, i.e., the decision on which trading

algorithm to use, depends on users’ specific investment objectives as well as their styles of market operations. For example, what weight should be given to factors like minimizing transaction costs, venue restrictions, risk management,

and information leakage? Would they prefer to make speedy

execution, paying no regard to the impact on price levels, or

other way around?

In a recent report published by AMD, five categories of

the current trading models in AT were presented [2]. They

are price algorithm, time algorithm, implementation shortfall algorithm, volume participation algorithm, and smart order routing algorithm. It was reported that the most popular algorithmic strategies are volume-weighted average price

(VWAP), time-weighted average price (TWAP), stock index

future arbitrage, and statistical arbitrage.

(1) VWAP

VWAP is defined as the ratio of the dollar transaction volume to share volume over the trading horizon. It is common to evaluate the performance of traders by their ability

to execute orders at prices better than the volume-weighted

average price (VWAP) over the trading horizon. Berkowitz,

Logue, and Noser [3] regard the VWAP benchmark as a good

approximation of the price for a passive trader. Its computational simplicity is a major advantage, especially in markets

where detailed trade level data are difficult or expensive to

obtain.

(2) TWAP

TWAP is the average price of contracts or shares over

a specified time, which attempts to execute an order and

achieve the time-weighted average price or better. Highvolume traders use TWAP to execute their orders over a

specific time, so they trade to keep the price close to that

which reflects the true market price. TWAP is different from

VWAP in that orders are a strategy of executing trades evenly

over a specified time period.

(3) Stock index future arbitrage

Actually, arbitrage is one of the most important actions in

AT. In stock index future market, it employs the mis-pricing

between the future market and the spot market and makes

strategies, such as short sells, to make risk-free profits [4].

(4) Statistical arbitrage

Statistical arbitrage is based on the mis-pricing of one

or more assets in their expected values. Arbitrage can be

viewed as a special type of statistical arbitrage. One major

distinction is that a statistical arbitrage is not always riskless.

Hogan et al. have proposed a yield curve method to determine whether there exists a statistical arbitrage opportunity

in the market [5, 6]. A yield curve is a graphic representation of market value (yield) for a security plotted against

the maturity of the security. They applied a trading strategy

to valuate the profits generated based on the standard yield

curves.

Some other trading strategies, such as iceberging, guerrilla, benchmarking, sniper, and sniffer are also widely used

in the real market. However, it has been observed that few

strategies outperform the benchmark indices in the long run.

Data mining has to be applied to constantly seek profitable

insights in active investment strategies.

2.2 Real-time and historical data feed

A powerful data source is a very important component for

an AT system [7]. The data usually consist of market trading data and the news data. Historical data are used to train

the trading models, while the current data are used to preanalyze the trade strategies. Data capture and retrieval have

been the key problem in the data feed package.

News data retrieval is a challenge issue in AT. First, the

news information captured from the Internet must be analyzed in a very short time. It involves in many methodolo-

Front. Comput. Sci. China 2009, 3(2): 235–246

gies from natural language processing, pattern recognition,

and machine learning, such as neural network, SVM, and

evolutionary algorithms.

On another hand, Bloomberg and Reuters provide and

promote the use of organized financial data and financially

related news data for financial decision analyses. They are

becoming more and more important for AT practice.

2.3 Order management

In general, there are two types of orders: limit orders and

market orders. A limit order specifies the side of the transactions, i.e., whether it’s a buy or a sell, the quantity, and the

price. It constitutes a firm commitment to take the specified

side in a trade. Limit orders can be canceled at any time,

as long as they have not been matched by an order of the

opposite side. Market orders do not specify a price but just

state the side and the quantity. They are filled immediately

from the limit order book at the price most favorable for the

market order submitting party. Gradually, more and more

firms use order management systems (OMSs) in their trading. The automated software systems for this purpose make

the desired transactions executed in a timely fashion.

2.4 Risk management

With AT tools, traders can improve their risk management

by monitoring market changes and make speedy transitions

in their market positions. At the same time, they may also

reduce their market exposure caused by market impact and

timing delay of their investment decisions. Their automated

strategies result in better management of execution shortfall

with liquid and easier-to-trade orders. The AT system also

allows risk analysis methodologies to be applied to study

market trends and news alerts, so that a quick response can

automatically execute transactions to reduce the risk that an

investor may be exposed in any emergence event.

2.5 Agent-based computational models

An agent-based model is a model comprising autonomous

agents placed in an interactive environment (society) or social network which is widely used in the AT modeling [8–

10]. Simulating the model via computers is probably the

most practical way to visualize economic dynamics.

Agent-based model is very popular in AT system design

and is easy to be understood to simulate the market behaviors. Blake LeBaron gave a review of early research of using computer program to simulate finance market (simple

agent, zero intelligence traders, foreign exchange markets

and experiments, costly information and learning, and neu1

2

237

ral network- based agents) [11]. Aki-Hiro Sato proposed a

simple agent-based model in which N market participants

exchange M currency pairs and analyze the frequency of tick

quotes of foreign exchange market [12].

In recent years, more and more researchers began to

employ soft computing methodologies into the agent-based

trading modeling, such as Genetic Programming and Genetic

Algorithms [13–15]. Chen et al. used genetic programming

to simulate the human behaviors of the traders in the market

and studied four fundamental issues of GP in agent-based

economic modeling: primitives, grammar, genetic operators,

and architecture [16]. Christopher and his collaborators also

used GP to forecast out-of-sample daily volatility in the foreign exchange market [17].

2.6 System design and integration

The biggest changes of equity market have occurred in alternative trading systems during the last decade. Alternative trading systems (ATSs) are nontraditional, computerized trading systems that compete with or supplement

dealer markets and traditional exchanges. These trading systems facilitate the exchange of millions of shares every day

through electronic means. The most well-known ATSs are

the electronic communication networks (ECNs) and the electronic crossing systems (ECSs). Both have heavily relied on

electricity technology for information and communication

[18, 19].

Reuters also provides the low latency and reference information, high performance technology, and community support that helps the buy-side or sell-side make more competitive algorithms for investment decisions1 . The news data information feed package offered by Reuters Market Data System capture, store, and analyze ever-increasing volumes of

market data. Through the powerful data feed package (real

time and not only market data but news data), enhanced with

algorithmic analytic tools, it can help to access the market

with efficient order execution and operate the models close

to the trading venue.

Bloomberg has proposed a trading platform that targets

an average execution benchmarked to the VWAP throughout

the day or for a defined time period2. The execution module

employs statistical theoretical values, which maximize the

probability of spread capture within the given constraints.

The orders, during the execution period, can be updated or

canceled by the traders.

MetaTrader, which is developed by MetaQuotes Software

Corp and designed to provide broker services to customers

at forex, futures, and CFD markets, is an online trading com-

http://about.reuters.com/productinfo/algorithmic trading/

http://www.bloomberg.com/apps/news?pid=20601109&refer=home&sid=amK25dKbMrhQ

238

Feng WANG, et al. Algorithmic trading system: design and applications

Fig. 2 Interface of the algorithmic trading via Bloomberg

plex. It defines a language designed specially for describing trading strategies, called MetaQuotes Language (MQL)3 .

MetaTrader has the advantage of being well admitted in industry: most forex brokers employ it as the main client application. Strategies written in MQL can be shared in different

broker applications without modifications. It also has an online community3 that provides documentation of MQL and

sample codes. Users are encouraged to upload their own

code and share with each other, so it is possible to learn

strategies from others in the community. Strategies written

using MQL can be tested on history data by MetaTrader, and

detailed reports will be generated after testing. Logging utility is also provided to help in debugging the strategies. Like

Great Wisdom, MetaTrader lacks the ability to generate new

strategies automatically; it is designed only for executing existing strategies.

Artificial Stock Market, developed by the Santa Fe Institute in New Mexico, is another well-known system for

AT [20, 21]. It consists of a central computational market

Fig. 3

3

http://www.mql4.com, MQL 4 Community

and a number of artificially intelligent agents. The agents

choose between investing in a stock and leaving their money

in the bank, which pays a fixed interest rate. The stock pays a

stochastic dividend and has a price that fluctuates according

to agent demand. The agents make their investment decisions by attempting to forecast future returns on the stock,

using genetic algorithms to generate, test, and evolve predictive rules. The artificial market exhibits two distinct regimens of behavior, depending on parameter settings and initial conditions. These behaviors can help to analyze the market trend and help traders to make corresponding strategies.

Fig. 4 and Fig. 5 show the wealth of the 30 agents and their

relative positions in the whole market after 2000 evolving

generations.

In China, there are also some AT components that have

been developed and employed widely by the broker-dealers

and hedge funds. The trading system called New Generation

Trading System (NGTS) is developed by the Shanghai Stock

Exchange; it is a kind of ECN [22, 23]. Its protocol used

Interface of the algorithmic trading via MetaTrader

Front. Comput. Sci. China 2009, 3(2): 235–246

Fig. 4 Relative wealth of agents after 2000 evolving generations

Fig. 6

239

Fig. 5 The position of each agent in the population

Interface of the algorithmic trading via Great Wisdom

to exchange trading data, which is named STEP, is national

standard and is compatible with the most popular international financial data exchange protocol, FIX 4.4. As a result

of using standard data exchange protocol, it is possible to

develop our own client to collect data and test trading strategies. In fact, most of the analysis software provided for brokers in China is based on a third-party platform named Great

Wisdom. Fig. 6 shows the algorithmic trading interface

of Great Wisdom. Great Wisdom is an integrated system

that provides much practical functionality. The basic functionalities include showing real-time stock data, displaying

technical indicators, and providing related financial information. Most common technical indicators are provided by

Great Wisdom by default, such as MACD, DMI, DMA, etc.

Great Wisdom presents a workable demonstration for executing and testing the strategies like other equity platforms

but still lacks the ability to generate new strategies automatically, which will be the most important feature of our project.

ate sophisticated algorithms, we need more granular information such as tick level data including actual market sizes.

Due to the lack of data provided by the trading venues, banks

as well as external algorithmic traders will have to invest in

collecting a comprehensive data set and learn from experience by employing new models in the real market at an early

stage.

3.2 Order processing

The most granular CLOB design dedicates a single system

process to a single, individual security or series. A recent

study at a major U.S. futures exchange found that 60% of

all trading for the exchange was done in the near-month of

a single financial futures contract. A similar measurement

of the market opening at a U.S. regional equities exchange

pointed out that 70% of all trades were in the three most active stocks. Thus, the system processing power and software

efficiencies need to focus on the busiest instrument.

3.3 Slippage measurement

3.1 Lack of data

Many researchers are concerned about the lack of data from

some trading venues. However, even if sufficient historical

data are currently available and strong enough, they might

not build diversified order execution and algorithms. To cre-

Slippage occurs for stop orders when prices move before

the broker-dealer is able to fill the order at the stop price.

The costs of slippage are difficult to measure. First, different

equities have different slippage for different broker-dealers.

Second, the slippage is correlated with the trade volume of

the equity. When an order is placed, it is unusual to find any

record of what the target execution price was relative to the

execution received.

240

Feng WANG, et al. Algorithmic trading system: design and applications

4.1 FiSim overview

FiSim is designed to be a financial simulation platform that

is flexible and extensible enough to support analyzing strategies against various kinds of equities, currencies, futures,

and other financial products. The system is composed of two

sub-parts: one is used to collect data from either history or

real time and run a market simulator using the data; another

monitors financial news and performs automatic ranking using specified algorithms. This FiSim platform is expected to

implement the following features.

(1) Automation of simulation configuration

The simulator can load the simulation parameters from a

file automated and then start a simulation. It can also save

the parameters to a file for the next usage. The parameters

include the start date, end date, and so on.

(2) Automation of data package

The simulator can load and parse the data source from a

file automated.

(3) Simulation of the work of an investor and its assistants

The work includes the analysis of the data, the choice of

stock and the decision of whether to sell or buy, the decision of the quantity to trade, the submission of order, and the

updates and statistic of its wealth.

(4) Simulation of the work of a broker to carry out the

transaction. Fig. 7 shows the architecture of FiSim

Fig. 8

Fig. 7

Architecture of the simulation platform FiSim

4.2 Detailed design of FiSim

4.2.1 Market simulator

We use 7 classes to model the market simulator. An abstract

data model is defined for simulating the financial market in

the real world, and the structure is shown in Fig. 8:

The usages of the classes are:

(1) Platform – This class assembles the underlying components and provides external APIs for the end user. It loads

concrete financial data and translates it to an internal model;

in this way, it is extensible to different data formats. After

initialization, it will start the simulated market.

The data model of market simulator

Front. Comput. Sci. China 2009, 3(2): 235–246

(2) Market – This interface defines the contract for simulated markets. A simulated market is supposed to be able to

provide financial data like equities, currencies, futures, etc.

for brokers registered in the market. Provision of data is

continuous during the market’s lifetime. Matching orders is

done by concrete brokers in this platform; the market does

not do this job.

(3) Broker – This interface defines the contract for brokers. The broker is supposed to consume the financial data

quoted by the market. It keeps an internal list of orders; if an

order is matched at the price of the coming data, it executes

the order. When financial data are quoted, it also notifies the

registered traders, which are identical to trading strategies in

this platform.

(4) Financial data – This class is the abstract model for

financial data in the real world; the data could be equities,

currencies, futures, etc.

(5) Order – This class is the abstract model for market orders; it is generated by trader implementations and executed

by broker implementations.

(6) Market listener – This interface defines the contract

for listeners that are interested in quoting financial data. Its

implementations are registered to market instances and will

be notified when new financial data are quoted.

(7) Market event – This is the event object that wraps information for the event of quoting financial data.

Fig. 9

241

4.2.2 The implementation of market simulator

The business logic of the simulator is defined in concrete

implementations of market and broker; the structure of these

classes is shown in Fig. 9:

There are two concrete classes and two new interfaces introduced:

(1) Simple market – This class is a straightforward imple mentation of market interface; it simply keeps all data

in memory and uses a single thread to run the simulation.

It is not proper to be used with huge history data, but it is

sufficient for simple test tasks.

(2) Simple broker – This class implements the broker interface. It keeps all orders and trader instances in memory.

The orders are matched by prices of history data when simulating, since currently, we have only rough history data for

testing. If in the future, more detailed data such as tick-bytick data could be used, this class may be updated to support

that data.

(3) Data provider – This interface defines the contract for

data providers of the market. The market instance will use

its implementations to get financial data. This plug-in mechanism provides extensibility for different kinds of data.

(4) Trader – This interface defines the contract for trading

strategy. The user could provide its own implementations to

be tested on this platform. The implementations will be easily added to the platform as a plug-in; thus, no re-compile

Market implementation diagram

242

Feng WANG, et al. Algorithmic trading system: design and applications

is needed when testing new strategies.

The market simulator is still rough, but it models a simple

market in real world. The trading mechanism is very similar

to the actual market, and the data used to test is real history

data. The working process of the simulator is explained by

Fig. 10.

4.2.3 Information analysis

The platform also integrates the ability of analyzing financial

information and ranks it in real time. The architecture of this

functionality is shown in Fig. 11.

mentation of the information ranker interface. It is designed

to grab news from Yahoo and rank the news based on a predefined verb table.

(4) Crawler – This interface defines the contract for

crawlers used to grab information from sources like web

sites or databases.

(5) Web Crawler – This class is an implementation of the

crawler that targets grabbing news from web sites like finance.yahoo.com.

The working process is shown in Fig. 12.

(1) Information ranker – This interface defines the contract for the information analyzer. The implementations will

grab information from a specified source and use a concrete

algorithm to rank the information. The result will be sent to

trader instances and help in making the trading decision.

4.3 Order mechanism

(2) Information – This class models the financial information. Basic attributes are included, like name, time, and

content.

(1) The broker collects bids of orders that are the same

type (buy or sell) of an equity in a short time and calculate

a price that is between the lowest bid and the highest bid,

then fill all the buy orders that have a bidding price higher

than the calculated price or fill all the sell orders that have a

(3) Simple information ranker – This is a simple imple

Fig. 10

The real-world brokers use sophisticated mechanisms to

manage orders. Roughly speaking, when a new order is

placed, there are two ways to achieve it:

Market run sequence diagram

Front. Comput. Sci. China 2009, 3(2): 235–246

Fig. 11

Fig. 12

243

Information ranker class diagram

Information ranking sequence diagram

bidding price lower than the calculated price. All orders that

are not filled will be rejected.

(2) The broker collects orders and records them in a pool

if it cannot be filled. Every time a new order arrives, the

broker will check the orders pool and use the ones that match

the new one to fill each other. If the requested quantities

of the orders do not match, the lesser one would be filled

partially and kept in the pool.

One serious issue of the real-world models is that they

can not eliminate slippage. If the broker receives an order

delayed by some reasons like network issues, it may fill the

order at a price higher/lower than the trader expects. Note

that the broker did not intend to produce slippage, but slippage would always be possible because of physical issues.

It is not easy to produce the same slippage phenomenon

considering the essence of this issue. However, considering

the slippage cost, it would be meaningful to implement this

244

Feng WANG, et al. Algorithmic trading system: design and applications

feature in the simulator.

FiSim uses the following methods to handle orders:

(1) The basic order mechanism does not permit slippage.

All orders are executed according to history prices – if the

order’s bidding price equals or is higher than the requested

equity’s history price, it will be filled. Otherwise, the order

would be rejected.

(2) A configuration parameter “slippage” enables the slippage feature. If it is set to true, FiSim will generate a stochastic slippage for each order. Currently, we use a normal distribution whose mean is 0 and variance is 1 to generate the

stochastic slippage.

4.4 Experimental results

To the best of our knowledge, Reuters has done some studies on the news information aggregation to make sentimental

signals in stock market forecasting. They use the historical data (news) from their own web servers and compute the

market index for the market prediction. Our FiSim platform

is built for an efficient information aggregation and consulting system providing not only a comprehensive organized

information source but also an indicator of its impact to the

different industries/markets.

Figure 13 shows the snapshot of the working simulator.

We create three simple strategies to test the usability of the

platform, as shown in Fig. 14. The strategies are loaded

through a configuration file and added to the platform automatically. It is easy to add other new and complex strategies

to this function. The time used by the test progress is linear

with the data size. The data used to test in this project has

764 stocks and is about 150 MB. It needs about 1 minute for

a full test. Fig. 15 shows the snapshot of the simulator in

testing progress. If we are interested only in some particular stocks, the time would be reduced to several seconds or

less. Fig. 16 shows the final testing results of the generated

strategies with the detailed outcome.

The platform represents a flexible framework that could

Fig. 13

FiSim demo

Fig. 14

Strategies list

Front. Comput. Sci. China 2009, 3(2): 235–246

Fig. 15

Fig. 16

be used in financial projects like selecting or generating trading strategies. It still has many rough edges that could be

improved as future tasks, and our next job would be mostly

on using the platform in practical financial research.

! "

AT is a global trend in the international financial markets.

Early performance of exchange-based AT systems and floor

trading has shown that AT has made a great impact on market

functioning. In particular, it is likely to improve transparency

and liquidity of the markets.

As with anything, the market eventually becomes more efficient, and the model becomes less and less viable, as does

the performance of the AT platforms. AT in the exchange

market is and will continue to be a process of evolution, and

people will continue to play key roles in expanding the viability of its use. It might not be the final goal to find the

perfect trading model for the AT, and what is most important is the seamless human/machine interface that is efficient

enough for the traders to make smart trading strategies and

make deals at the first time. Since the stock index futures

plan has been proposed in the China Stock market, which

will be executed in a few months, AT will become more and

more important and popular in the China Exchange Market.

In the future work, there will be an urgent need to study how

245

Testing progress

Final report

to choose an appropriate trading model and make effective

strategies.

# 1. Eriksson S, Roding C. Algorithmic trading uncovered – impacts on an

electronic exchange of increasing automation in futures trading. Royal

Institute of Technology, Stockholm, 2007

2. Market Risk and Algorithmic Trading. AMD White Paper

3. Berkowitz S, Logue D, Noser E. The Total Cost of Transactions on the

NYSE. Journal of Finance, 1988, 41: 97–112

4. MacKinlay A C, Ramaswamy K. Index-Futures Arbitrage and the Behavior of Stock Index Futures Prices. The Review of Financial Studies,

1988, 1(2): 137–158

5. Hogan S, Jarrow R, Warachka M. Statistical arbitrage and tests of market efficiency. Working paper, 2002

6. Hogan S, Jarrow R, Teo M. Testing market efficiency using statistical

arbitrage with application to momentum and value strategies. Journal

of Financial Economics, 2004, 73: 525–565

7. Gordon Baker, Shashi Tiwari. Algorithmic Trading: Perceptions and

Challenges. Working Paper, 2004

8. Leigh Tesfatsion. Introduction to the special issue on agent-based

computational economics. Journal of Economic Dynamics and Control, 2001

9. Leigh Tesfatsion. Agent-based computational economics: modeling

economies as complex adaptive systems. Information Sciences, 2003,

149(4): 263–269

10. Shu-Heng Chen. Computational Intelligence in Agent-Based Computational Economics. Computational Intelligence: A Compendium,

246

Feng WANG, et al. Algorithmic trading system: design and applications

2008, 517–594

11. Blake LeBaron. Agent-based computational finance: Suggested readings and early research. Journal of Economic Dynamics and Control,

1998, 24: 679–702

12. Aki-Hiro Sato. Frequency analysis of tick quotes on the foreign exchange market and agent-based modeling: A spectral distance approach. Physica A: Statistical Mechanics and Its Applications, 2007,

382: 258–270

13. Dempster M A H, Romahi Y S. Intraday FX Trading: An Evolutionary

Reinforcement Learning Approach, 2002

14. Christopher Neely, Paul Weller, and Rob Dittmar. Is technical analysis

in the foreign exchange market profitable? A genetic programming

approach. Journal of Financial and Quantitative Analysis, 1997, 32(4):

405–426

15. Shu-Heng Chen and Chia-Hsuan Yeh, Genetic Programming in the

Agent-Based Artificial Stock Market. In: Proceedings of the 1999

Congress on Evolutionary Computation-CEC99, 1999, 2: 834–841

16. Shu-Heng Chen. Trends in Agnet-Based Computational Modeling of

Macroeconomics. New Generation Comput, 2004, 23(1)

17. Christopher J, Neely, Paul A, Weller. Predicting Exchange Rate

Volatility: Genetic Programming vs. GARCH and RiskMetrics.

Working paper of The Federal Reserve Bank of ST. Louis, 2001

18. Hendershott T. Electronic Trading in Financial Markets. IT Professional, 2003, 5(4): 10–14

19. Michael J. Kearns, Luis E. Ortiz. The Penn-Lehman Automated Trading Project. IEEE Intelligent Systems, 2003, 18(6): 22–31

20. Holland J and Miller J. Artificial adaptive agents in economic theory.

American Economic Review: Papers and Proceedings, 1991, 81(2):

365–370

21. Palmer G, Arthur B, Holland J, LeBaron B, and Tayler P. Artificial

economic life: A simple model of the stock market. Physica D, 1994,

75: 264–274

22. Shanghai Stock Exchange. NGTS Part Tech Guide SSE D0602, 5–6

23. Shanghai Stock Exchange. NGTS Report Trading Model, 6–10