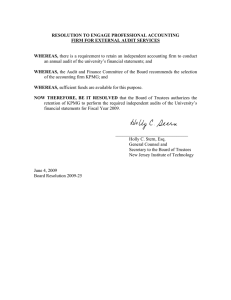

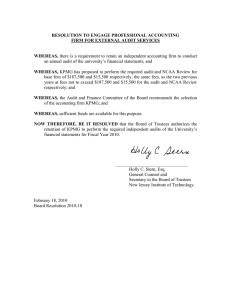

R.G. Manabat & Co. The Medical City Iloilo Hospital, Inc. Audit Plan and Strategies for the Year Ending December 31, 2022 Kick-Off Meeting December 19, 2022 This meeting mainly outlines our risk assessment and planned audit approach for the audit of the financial statements of The Medical City Iloilo Hospital, Inc. as at and for the year ending December 31, 2022. 01 02 2022 Client Service Team 03 Audit Objective and Reporting Responsibilities 04 05 Affirmation of Independence Key Deliverables Audit Approach 06 07 08 Audit Focus Area 09 Proposed Audit Timeline and Audit Strategies 10 Communication Plan: PBC Escalation Updates in the Company’s Operations Prior Year Issues © 2022 R.G. Manabat & Co., a Philippine partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. Engagement Partner Warren R. Angeles Engagement Assistant Manager Eugene C. Balutoc II Engagement Senior Analyst Frances Jennarie C. Almodiel Engagement Staff © 2022 R.G. Manabat & Co., a Philippine partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. RGM & Co.’s Affirmation of Independence With our complementing functions, we are still ultimately accountable to the management and directors of the Company and this accountability is anchored on INDEPEDENCE both actual and perceived. As your appointed external auditors, we affirm our INDEPENDENCE - that is, INDEPENDENCE of both our Firm and our Partners and Staff in respect to The Medical City Iloilo Hospital, Inc. © 2022 R.G. Manabat & Co., a Philippine partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 4 Management’s Responsibility • • • • Maintaining sound internal controls; Preparing and presenting financial statements in accordance with the applicable financial reporting framework; Assessing the Company’s ability to continue as going concern, disclosing, as applicable matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease its operations, or has no realistic alternative but to do so; and Adopting appropriate accounting policies in accordance with the PFRSs, where applicable. Auditors’Responsibility • • • • Designing an audit to provide reasonable, not absolute, assurance that the financial statements, taken as a whole, are free from material misstatements, whether due to fraud or error; Considering internal controls for the purpose of designing audit procedures, but not for the purpose of expressing an opinion on them; Conducting an audit in accordance with Philippine Standards on Auditing (PSA); and, Evaluating management’s assessment of going concern. Objective of Audit • Form and express an opinion on whether the financial statements prepared by management present fairly, in all material respects, the financial position as at December 31, 2022 and the financial performance and cash flows for the year ending in accordance with PFRSs. © 2022 R.G. Manabat & Co., a Philippine partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 5 Key Deliverables Scope of work Deliverables 01 02 03 04 05 To conduct an audit in accordance with PSA on the financial statements of the Company, prepared in accordance with PFRSs, as at and for the year ending December 31, 2022. Auditor’s Report Accompanying Statement Accompanying Statement Internal Control Communication Auditor’s report to the financial statement as at and for the year ended December 31, 2022. Signed written statement to accompany financial statements for filing with the Bureau of Internal Revenue (BIR) in compliance with Revenue Regulations, V-20. Signed written statement as to the number of stockholders owning one hundred (100) or more shares, as required by Revised SRC Rule 68, for submission to the Securities and Exchange Commission (SEC). Provide our recommendations regarding internal controls and opportunities for improvement or efficiency based on observations made during the course of our audit. © 2022 R.G. Manabat & Co., a Philippine partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. Audit Approach PLANNING CONTROL EVALUATION • Perform risk assessment procedures and identify risk areas • Understand accounting and reporting activities • Determine audit strategy • Evaluate design and implementation of selected controls • Determine planned audit approach and scope • Test operating effectiveness of selected financial controls • Understand and evaluate the overall control environment Audit approach • Assess control risk and risk of significant misstatement. COMPLETION • Perform completion procedures • Perform overall evaluation of audit differences • Perform overall evaluation of internal control deficiencies • Perform final review of financial statements SUBSTANTIVE TESTING • Plan and perform substantive procedures • Consider if audit evidence is sufficient and appropriate • Form audit opinion © [year] [legal member firm name], a [jurisdiction] [legal structure] and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. Document Classification: KPMG Confidential 7 Audit Focus Area Revenue Recognition (CEA) KEY FOCUS AREAS Valuation of Beginning Balances (V) Credit Risk and Valuation of Receivables (V) Related Party Transactions (CEAP) Inventory and Cost of Sales (CEA) Property and Equipment (EAV) © [year] [legal member firm name], a [jurisdiction] [legal structure] and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. Document Classification: KPMG Confidential 8 YTD Financial Results of operations Major contracts entered into or closed during the year (loan, lease, sales, etc.) Significant transactions entered into during the year Significant resolution approved by the Board of Directors Changes in organizational structures, key officers and manpower complement Related party transactions Manpower - number of employees, retirement, any additional benefits, packages, increase in compensation, etc. Major customers and suppliers during the year Regulatory and legal issues (Noncompliance with applicable laws or regulations, litigations and claims, BIR assessments, SEC and other regulatory bodies investigations) if any Others Fraud considerations and internal control © 2022 R.G. Manabat & Co., a Philippine partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 9 Prior Year Issues Align the Company’s policy for the assessment of estimated credit losses with the Group’s assessment policy Observation The audit performed recomputation of Allowance for Doubtful Accounts. For the recomputation for receivables from Philhealth, the following were considered: • Provisioned full allowance on claims in 2019 and prior years • Remaining receivables were provisioned based on 2021 denied claims over 2021 PHIC revenues after deducting 2022 collections The results of the procedure performed resulted to an adjustment to the Provision for Estimated Credit Losses amounting to P6.38 million and Miscellaneous Income amounting to P6.14 million. Management’s response Management agreed to align their ECL Policy with its Parent Company. Audit adjustments were approved and adjusted by Management. © 2022 R.G. Manabat & Co., a Philippine partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. Activity Responsible Date/ Period KPMG/TMCI KPMG/TMCI TMCI December 19, 2022 December 27 – 28, 2022 January 20, 2023 TMCI/KPMG January 19 - 20, 2023 Process updates and walkthrough procedures Year-end audit procedures Presentation of year-end audit results Submission of initial draft of FS and ITR KPMG KPMG/TMCI KPMG/TMCI TMCI January 23 - 27, 2023 January 30 – February 17, 2023 February 24, 2023 February 28, 2023 Finalization of FS and BOD Approval of the Financial Statements KPMG/TMCI March 2023 Release and issuance of financial statements KPMG/TMCI March 2023 Kick off and Planning Meeting Year-end Inventory Count Observation Submission of year end trial balance and account schedules Receipt of year end audit requirements and sample selections including sending out request for supporting documents © 2022 R.G. Manabat & Co., a Philippine partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. Initial Audit Requirements • • • • • • • • • • • Trial Balance as at December 31, 2022 Approved SEC Confirmation for Valuation for Issuance of Capital Stock Signed Engagement Letter Detailed audit schedules on the related accounts on key focus areas Note: Additional accounts will be requested upon receipt of trial balance as at December 31, 2022 Minutes of meetings of the Company’s Board of Directors and Stockholders Copies of major contracts, agreements and other documents entered into by the Company during the year which may have an impact on our audit (lease, rental, loans, etc.) Journal entry register for 2022 Correspondences received during the year from the Securities and Exchange Commission (“SEC”) and the Bureau of Internal Revenue (“BIR”), if any Copy of quarterly income tax returns and other reports filed with the BIR during the year 2022 Actuarial Valuation Report (AVR), if applicable. List of mortgaged properties © 2022 R.G. Manabat & Co., a Philippine partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 01 Process Understanding 02 Test of Controls 03 Substantive Testing Walkthroughs, inquiries with management and process owners are to be conducted virtually via: • Microsoft Teams • Zoom, Google Meet and other apps, provided the Company is the party sending meeting invite E-signature will be utilized in Legal and Corporate confirmation letters. In line with this, we will be requesting a list of e-mail addresses and contact persons for each confirmation. As such, we request the Company to inform its legal counsels regarding our use of e-mail for the confirmations. © 2022 R.G. Manabat & Co., a Philippine partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 13 01 Process Understanding 02 Test of Controls PBCs and supporting documents are to be provided in the following hierarchy: • Email • Collab Site (KPMG Clara Client Collaboration) to be set by KPMG • Cloud drives to be set by Client • Hard copies of confidential files for scanning during fieldwork (access to scanner to be provided by the Company) • Strictly for viewing only 03 Substantive Testing Fieldwork schedules shall be on agreed dates only. Files by batches shall be ready for scanning/viewing. Primarily, Confirmation Letters will be sent through email and e-signature will be utilized. (legal counsel, banks, receivables, related parties, corporate secretary, etc.) © 2022 R.G. Manabat & Co., a Philippine partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 14 Escalation Policy Any pertinent issues and outstanding prepared-by-client (PBC) items arising from the audit shall be escalated as follows: Heading here 2nd Level 1st Level Escalation Timeframe: • If issue is still not resolved after 2 days • 2 days delay in receipt of PBC • Start of day 3 without receiving feedback from point of contact Escalation Timeframe: • If issue is still not resolved after 3 days • 3 days delay in receipt of PBC • Start of day 4 without receiving feedback from point of contact 3rd Level Escalation Timeframe: • If issue is still not resolved after 5 days • 5 days delay in receipt of PBC • Start of day 6 without receiving feedback from point of contact KPMG Point of Contact: Partner KPMG Point of Contact: Manager KPMG Point of Contact: Supervisor Notes: • Escalation of any pertinent issues and outstanding PBC will be more frequent, as necessary, as we get closer to the deadline. • Time charges incurred by the staff as a result of any delay on the part of Group in submitting schedules and other required documents will be charged as overruns by RGM&Co. © [year] [legal member firm name], a [jurisdiction] [legal structure] and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. Document Classification: KPMG Confidential 15 Questions? © [year] [legal member firm name], a [jurisdiction] [legal structure] and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. Document Classification: KPMG Public 16 Thank you! kpmg.com/socialmedia The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation. © 2022 R.G. Manabat & Co., a Philippine partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. The KPMG name, logo are registered trademarks or trademarks of KPMG International. Document Classification: KPMG Public