Notes and Loans Receivable: Accounting 103 Presentation

advertisement

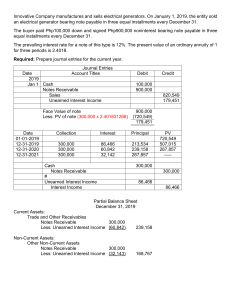

Accounting 103 MODULE 1 NOTES AND LOANS RECEIVABLES Notes Receivable Discounting of Notes Receivable Loans Receivable RECEIVABLES Review and Overview of Receivables Module 1_Notes and Loans Receivable 2 RECEIVABLES Receivables are financial assets that represent a contractual right to receive cash or another financial asset from another entity Claims arising from sale of merchandise or services in the ordinary course of business Claims arising from sources other than the sale of merchandise or services Trade Receivables Non-Trade Receivables Module 1_Notes and Loans Receivable 3 RECEIVABLES Trade Receivables Accounts Receivable Notes Receivable Open accounts or those not supported by promissory notes Those supported by formal promises to pay in the form of notes Classification : Current or Non-Current Assets • Dishonored notes shall be removed from notes receivable account and transferred to accounts receivable at an amount to include, if any, interest and other charges. Module 1_Notes and Loans Receivable 4 NOTES RECEIVABLE Notes Receivable are claims supported by formal promises to pay usually in the form of notes • A negotiable promissory note is an unconditional promise in writing made by one person to another, signed by the maker, engaging to pay on demand or at a fixed determinable future time a sum certain in money to order or to bearer • Standing alone, the term notes receivable represents only claims arising from sale of merchandise or service in the ordinary course of business. Module 1_Notes and Loans Receivable 5 VALUATION OF NOTES RECEIVABLE : INITIAL RECOGNITION Conceptually, notes receivable shall be measured initially at Present Value. Present value is the sum of all future cash flows discounted using the prevailing market rate of interest (effective interest rate) Short Term Notes Receivable Long term Notes Receivable • Short term notes receivable shall be measured at face value Module 1_Notes and Loans Receivable 6 ➢Interest Bearing Long term notes are measures at face value which is actually the present value upon issuance ➢Noninterest Bearing long-term notes are measured at present value which is the discounted value of the future cash flows using the effective interest rate. Valuation of Notes Receivable : Initial Recognition Interest Bearing NR Journal Entry An entity owned a tract of land costing P800,000 and sold the land for P1,000,000. Notes Receivable The entity received a 3-year note for P1,000,000 plus interest of 12% compounded annually. Land 800,000 Gain on Sale of Land 200,000 Accrued Interest Receivable Notes Receivable is measured initially at P1,000,000. Interest Income (12% x P1,000,000) P1,000,000 is the Face Value which is actually the present value upon issuance Module 1_Notes and Loans Receivable 7 1,000,000 120,000 120,000 Valuation of Notes Receivable : Initial Recognition Non-Interest Bearing NR : Illustration 1 An entity manufactures and sells machinery. On January 1, 2019, the entity sold machinery costing P280,000 for P400,000. Journal Entry 2019 Notes Receivable 400,000 Sales The buyer signed a noninterest bearing note for P400,000, payable in four equal installments every December 31. 350,000 Unearned Interest Income 50,000 FS Presentation The cash sales price of the machinery is P350,000. Face Value of Note 400,000 Notes Receivable 400,000 Present value – cash sales price 350,000 Less : Unearned Interest Income (50,000) Notes Receivable, Carrying Amount (PV) 350,000 Unearned interest income 50,000 Cash Sale Price 350,000 Cost of Machinery Module 1_Notes and Loans Receivable Gross Income 280,000 70,000 *The present value of NR is equal to the cash sales price of P350,000 at initial recognition. (Note : co-relate to your PPE topic, acquisition through deferred credit) 8 Valuation of Notes Receivable : Initial Recognition Non-Interest Bearing NR : Illustration 2 Computations : On January 1, 2019, an entity sold an equipment with a cost of P250,000 for P400,000. The buyer paid a down of P100,000 and signed a noninterest bearing note for P300,000 payable in equal annual installment of P100,000 every December 31. The prevailing interest rate for a note of this type is 10%. The present value of an ordinary annuity of 1 for three periods at 10% is 2.4869. *The present value of the note is computed by multiplying the annual installment of P100,000 by the present value factor of 2.4869 or P248,690. Journal Entry : Sale of Equipment Cash 100,000 Notes Receivable 300,000 Equipment Gain on sale of equipment Module 1_Notes and Loans Receivable Unearned Interest Income Face Value of Note Present Value of Note (100,000 x 2.4869) Unearned interest Income 300,000 (248,690) 51,310 Present Value of Note 248.690 Cash Received – Down Payment 100,000 Sale Price 348,690 Cost of Equipment 250,000 Gain on Sale of Equipment 98,690 Financial Statement Presentation : Initial Recognition 250,000 98,690 51,310 9 Face Value of Note 300,000 Less : Unearned interest income (51,310) Notes Receivable, Carrying Amount (PV) 248,690 Valuation of Notes Receivable : Initial Recognition Non-Interest Bearing NR : Illustration 3 On January 1, 2019, an entity sold an equipment costing P600,000 with accumulated depreciation of P250,000. The entity received as consideration P100,000 cash and a P400,000 noninterest bearing note due on January 1, 2022. The prevailing rate of interest for a note of this type is 10%. The present value of 1 at 10% for 3 years is 0.7513. Note : Note is collectible on a lump sum basis after 3 years. Journal Entry : Sale of Equipment Cash 100,000 Notes Receivable 400,000 Accumulated Depreciation 250,000 Equipment Gain on Sale of Equipment Unearned Interest Income Module 1_Notes and Loans Receivable *The Unearned Interest Income is sometimes described as 600,000 “Discount on 50,520 Note 10 99,480 Receivable” Computations : Face Value of Note Present Value of Note (400,000 x .7513) Unearned interest Income* 400,000 (300,520) 99.480 Present Value of Note 300,520 Cash Received – Down Payment 100,000 Sale Price 400,520 Carrying Amount of Equipment (600k-250k) Gain on Sale of Equipment (350,000) 50,520 Financial Statement Presentation : Initial Recognition Face Value of Note 400,000 Less : Unearned interest income (99,480) Notes Receivable, Carrying Amount (PV) 300,520 VALUATION OF NOTES RECEIVABLE : SUBSEQUENT RECOGNITION Subsequent to initial recognition, long term notes receivable shall be measured at “amortized cost”. • “Amortized cost” = the amount at which the receivable is measured initially – principal repayment+ or – the cumulative amortization of any difference between the initial carrying amount and the principal maturity amount - reduction for impairment or uncollectibility. Module 1_Notes and Loans Receivable 11 Valuation of Notes Receivable : Subsequent Recognition Non-Interest Bearing NR : Illustration 1 An entity manufactures and sells machinery. On January 1, 2019, the entity sold machinery costing P280,000 for P400,000. The buyer signed a noninterest bearing note for P400,000, payable in four equal installments every December 31. The cash sales price of the machinery is P350,000. To recognize the unearned interest income over the term of the note: Unearned interest income Interest Income FS Presentation :Subsequent Measurement (Current Portion) 400,000 Sales 350,000 Unearned Interest Income 50,000 Notes Receivable Module 1_Notes and Loans Receivable Notes Receivable 100,000 Less : Unearned Interest Income (15,000) Carrying Amount or Amortized cost To record the first installment collection Cash 20,000 The recognition of the unearned interest income is based on the outstanding NR method Journal Entry 2019 Notes Receivable 20,000 85,000 FS Presentation:Subsequent Measurement (Non-Current Portion) 100,000 100,000 12 Notes Receivable – non current portion 200,000 Less : Unearned Interest Income (15,000) Carrying Amount or Amortized cost 185,000 Valuation of Notes Receivable: Subsequent Recognition Non-Interest Bearing NR : Illustration 2 Computations : On January 1, 2019, an entity sold an equipment with a cost of P250,000 for P400,000. The buyer paid a down of P100,000 and signed a noninterest bearing note for P300,000 payable in equal annual installment of P100,000 every December 31. The prevailing interest rate for a note of this type is 10%. The present value of an ordinary annuity of 1 for three periods at 10% is 2.4869. *The present value of the note is computed by multiplying the annual installment of P100,000 by the present value factor of 2.4869 or P248,690. Journal Entry : Sale of Equipment Cash 100,000 Notes Receivable 300,000 Equipment Gain on sale of equipment Module 1_Notes and Loans Receivable Unearned Interest Income Face Value of Note Present Value of Note (100,000 x 2.4869) Unearned interest Income 300,000 (248,690) 51,310 Present Value of Note 248.690 Cash Received – Down Payment 100,000 Sale Price 348,690 Cost of Equipment 250,000 Gain on Sale of Equipment 98,690 Financial Statement Presentation : Initial Recognition 250,000 98,690 51,310 13 Face Value of Note 300,000 Less : Unearned interest income (51,310) Notes Receivable, Carrying Amount (PV) 248,690 Valuation of Notes Receivable : Subsequent Recognition Non-Interest Bearing NR : Illustration 2 Journal Entry : Sale of Equipment Cash 100,000 Notes Receivable 300,000 Equipment *In this case, the computation of interest income is made using the effective interest method 250,000 Gain on sale of equipment 98,690 Unearned Interest Income 51,310 To record the first installment collection Cash 100,000 Notes Receivable 100,000 Date Jan. 1, 2019 Dec. 31, 2019 Dec. 31, 2020 Dec. 31, 2021 TOTALS Annual C ollection 100,000 100,000 100,000 3 0 0 ,0 0 0 Interest Incom e 24,869 17,356 9,085 5 1 ,3 1 0 Face Value of Note Unearned interest income Less : First Installment Collection Interest Income Module 1_Notes and Loans Receivable 24,869 75,131 82,644 90,915 2 4 8 ,6 9 0 Present Value 248,690 173,559 90,915 - Financial Statement Presentation : Subsequent Recognition (end of 2019) To record the interest income for 2019 24,869 Principal 300,000 (100,000) Less : Unearned Interest Income (26,441) Carrying Amount of NR (PV) 14 173,559 Valuation of Notes Receivable : Subsequent Recognition Non-Interest Bearing NR : Illustration 3 On January 1, 2019, an entity sold an equipment costing P600,000 with accumulated depreciation of P250,000. The entity received as consideration P100,000 cash and a P400,000 noninterest bearing note due on January 1, 2022. The prevailing rate of interest for a note of this type is 10%. The present value of 1 at 10% for 3 years is 0.7513. Note : Note is collectible on a lump sum basis after 3 years. Journal Entry : Sale of Equipment in 2019 (Jan) Cash 100,000 Notes Receivable 400,000 Accumulated Depreciation 250,000 Equipment Gain on Sale of Equipment Unearned Interest Income Module 1_Notes and Loans Receivable Journal Entry : Recognition of Interest Income for 2019 Dec. 31 Unearned Interest Income 30,052 Interest Income Da te Jan. 1, 2019 Dec. 31, 2019 Dec. 31, 2020 Dec. 31, 2021 TOTALS Inte re st Inco m e 30,052 33,057 36,371 9 9 ,4 8 0 30,052 U ne a rne d Int. Inco m e 99,480 69,428 36,371 - Pre se nt Va lue 300,520 330,572 363,629 400,000 Financial Statement Presentation : Subsequent Recognition (End of 2019) 600,000 50,520 99,480 15 Face Value of Note 400,000 Less : Unearned interest income (69,428) Notes Receivable, Carrying Amount (PV) 330,572 SAMPLE EXERCISES Problem 6-1 (Feasible Company) Problem 6-2 (Bygone Company) Problem 6-3 (Innovative Company) Problem 6-11 (Persevere Company) Try solving the problems prior to viewing the answers ASSIGNMENT Problem 6-4 (Gullible Company) Problem 6-5 (Enigma Company) Problem 6-12 (Precious Company) LOAN RECEIVABLE Module 1_Notes and Loans Receivable 18 LOAN RECEIVABLE A loan receivable is a financial asset arising from a loan granted by a bank or other financial institution to a borrower of client. • The term of the loan may be short-term but in most cases, the repayment periods cover several years. Module 1_Notes and Loans Receivable 19 MEASUREMENT OF LOAN RECEIVABLE INITIAL RECOGNITION SUBSEQUENT MEASUREMENT • At initial recognition, an entity shall measure a loan receivable at fair value plus transaction costs that are directly attributable to the acquisition of the financial asset. • A Loan Receivable is measured subsequently at Amortized Cost using the effective interest method. • Fair value = Transaction price (amount of loan granted) • Amortized cost is the amount at which the loan receivable is measured initially minus principal repayment, plus or minus cumulative amortization of any differences between the initial carrying amount and the principal maturity amount minus reduction for impairment or uncollectibility. • Direct origination costs should be included in the transaction cost that is part of the initial measurement of the Loan Receivable • Indirect origination costs should be treated as outright expense Module 1_Notes and Loans Receivable 20 ORIGINATION FEES • Includes compensation for the following activities: ✓ Evaluating the borrower’s financial condition ✓ Evaluating guarantees, collateral, and other security ✓ Negotiating the terms of the loan ✓ Preparing and processing the documents related to the loan ✓ Closing and approving the loan transaction The fees charged by the bank against the borrower for the creation of the loan are known as origination fees. Module 1_Notes and Loans Receivable 21 ACCOUNTING FOR ORIGINATION FEES • The origination fees received from borrower are recognized as unearned interest income and amortized over the term of the loan. • If the origination fees are not chargeable against the borrower, the fees are known as “direct origination costs” • Preferably, the direct origination costs are offset directly against any unearned origination fees received. • The origination fees received and the direct origination costs are included in the measurement of the loan receivable. Illustration : Global Bank granted a loan to a borrower on January 1, 2019. The interest on the loan is 12% payable annually starting December 31, 2019. The loan matures in three years on December 31, 2021. Initial Carrying Amount of the Loan Principal amount Direct Origination costs incurred 5,000,000 Origination fees received from borrower 331,800 Direct origination costs incurred 100,000 Module 1_Notes and Loans Receivable Principal Amount 5,000,000 Origination fees received (331,800) Initial Carrying Amount of Loan 22 100,000 4,768,200 ACCOUNTING FOR ORIGINATION FEES Illustration : Journal Entries on January 1, 2019: Global Bank granted a loan to a borrower on January 1, 2019. The interest on the loan is 12% payable annually starting December 31, 2019. The loan matures in three years on December 31, 2021. Principal amount To record the loan Loan Receivable Cash 5,000,000 Origination fees received from borrower 331,800 Direct origination costs incurred 100,000 5,000,000 Origination fees received (331,800) Direct Origination costs incurred Initial Carrying Amount of Loan Module 1_Notes and Loans Receivable 5,000,000 To record the origination fees received from the borrower: Cash 331,800 Unearned interest income Initial Carrying Amount of the Loan Principal Amount 5,000,000 331,800 To record the direct origination costs incurred by the bank: Unearned interest income Cash 100,000 100,000 100,000 Because of the origination fees received and the direct origination costs, a new effective interest rate must be computed 4,768,200 23 ACCOUNTING FOR ORIGINATION FEES Illustration : Global Bank granted a loan to a borrower on January 1, 2019. The interest on the loan is 12% payable annually starting December 31, 2019. The loan matures in three years on December 31, 2021. Principal amount 5,000,000 Origination fees received from borrower 331,800 Direct origination costs incurred 100,000 Initial Carrying Amount of the Loan Principal Amount Origination fees received Direct Origination costs incurred Initial Carrying Amount of Loan Am ortiz ation Table - Effective Interest M ethod Interest Interest Date Am ortiz ation Received Incom e Jan. 1, 2019 Dec. 31, 2019 600,000 667,548 67,548 Dec. 31, 2020 600,000 677,005 77,005 Dec. 31, 2021 600,000 687,247 87,247 TOTALS 1 ,8 0 0 ,0 0 0 2 ,0 3 1 ,8 0 0 2 3 1 ,8 0 0 C arrying Am ount 4,768,200 4,835,748 4,912,753 5,000,000 Interest Received = Principal times nominal rate Interest income = Carrying Amount times effective rate Carrying Amount = Previous’ years CA plus amortization 5,000,000 (331,800) Journal Entries on December 31, 2019 100,000 Cash 4,768,200 Since the initial carrying amount of the loan receivable of P4,768,200 is lower than the principal amount, it means there is a discount and therefore the effective rate must be higher than the nominal rate of 12%. After consideration of the origination fee and the direct origination cost, the effective interest rate is determined to be 14%. 600,000 Interest Income 24 Unearned interest income Interest Income 600,000 67,548 67.548 ACCOUNTING FOR ORIGINATION FEES • FINANCIAL STATEMENT PRESENTATION If a statement of Financial Position is prepared on December 31, 2019, the loan receivable is presented as follows: Loan Receivable 5,000,000 Unearned Interest Income (231,800-67,548) (164,252) Carrying Amount, December 31, 2019 4,835,748 Module 1_Notes and Loans Receivable 25 Impairment of Loan PFRS 9, paragraph 5.5.1, provides that an entity shall recognize a loss allowance for expected credit losses on financial asset measured at amortized cost. • Credit losses are the present value of all cash shortfalls. • Expected credit losses are an estimate of credit losses over the life of the financial instrument. Measurement of Impairment ❑The probability – weighted outcome ❑The time value of money ❑Reasonable and supportable information Module 1_Notes and Loans Receivable 26 IMPAIRMENT OF LOAN Illustration : International Bank loaned P5,000,000 to Bankard Company on January 1, 2017. The terms of the loan require principal payment of P1,000,000 each year for 5 years plus interest at 10%. The first principal and interest payment is due on December 31, 2017. Bankard Company made the required payment s on Dec. 31, 2017 and Dec. 31, 2018. Using the original effective rate of 10%, the present value of 1 is .9091 for one period, .8264 for two periods and .7513 for three periods. Present Value of the Cash Flows December 31, 2020 (500,000 x .9091) 454,550 However, during 2019, Bankard Company began to experience financial difficulties and was unable to make the required principal and interest payment on Dec 31, 2019. December 31, 2021 (1,000,000 x .8264) 826,400 December 31, 2022 (1,500,000 x .7513) 1,126,950 On Dec. 31 2019, International Bank assessed the collectability of the loan and has determined that the remaining principal payments will be collected but the collection of the interest is unlikely. Total Present Value of Cash Flows 2,407,900 The loan receivable has a carrying amount of P3,300,000 including the accrued interst of P300,000 on December 31, 2019. International Bank projected the cash flows from the loan on December 31, 2019. Date of Cash Flow Amount Projected December 31, 2020 500,000 December 31, 2021 1,000,000 December 31, 2022 1,500,000 27 IMPAIRMENT OF LOAN Using the original effective rate of 10%, the present value of 1 is .9091 for one period, .8264 for two periods and .7513 for three periods. Journal Entries on December 31, 2019 Loan Impairment Loss Present Value of the Cash Flows December 31, 2020 (500,000 x .9091) 454,550 December 31, 2021 (1,000,000 x .8264) 826,400 December 31, 2022 (1,500,000 x .7513) 1,126,950 Total Present Value of Cash Flows 2,407,900 COMPUTATION OF IMPAIRMENT LOSS Accrued Interest Receivable 300,000 Allowance for Loan Impairment 592,100 Statement Presentation on December 31, 2020 Loan Receivable 3,000,000 Allowance for Loan Impairment (592,100) Carrying Amount 2,407,900 Journal Entries on December 31, 2020 The impairment loss is the difference between the carrying amount of the loan and the present value of the cash flows. Carrying Amount of Loan 3,300,000 Present value of Cash Flows 2,407,900 Impairment Loss 892,100 892,100 Cash 500,000 Loan Receivable Allowance for Loan Impairment 28 Interest Income (2,407,900 x 10%) 500,000 240,790 240,790 SAMPLE EXERCISES Problem 7-1 (Nasty Bank) Problem 7-3 (Pauper Bank) Problem 7-5 (Solvent Bank) Problem 7-9 (Moderate Bank) Try solving the problems prior to viewing the answers ASSIGNMENT Problem 7-2 (Awesome Bank) Problem 7-6 (Solvent Bank) Problem 7-10 (Solid Bank) DISCOUNTING OF NOTES RECEIVABLE Receivable Financing Module 1_Notes and Loans Receivable 31 CONCEPT OF DISCOUNTING As a form of receivable financing, discounting specifically pertains to note receivable Maker → the one liable Payee → the one entitled to payment on the date of maturity ❖ To discount the note, the payee must endorse it. Thus, payee becomes endorser and the bank becomes endorsee. ❖ Endorsement is the transfer of right to a negotiable instrument by simply signing at the back of the instrument ❖ Endorsement may be with recourse (endorser shall pay the endorsee if the maker dishonors the note), or without recourse (the endorser avoids future liability even if the maker refuses to pay the endorsee on the date of maturity). TERMS RELATED TO DISCOUNTING OF NOTE Net Proceeds The discounted value of the note received by the endorser from the endorsee (Maturity Value minus Discount) Maturity Value Amount due on the note at the date of maturity. (Principal plus interest) Maturity Date Date on which the note should be paid Principal Amount appearing on the face of the note. Also referred to as face value Interest Amount of interest for the full term of the note (Principal x rate x time) Interest Rate Rate appearing on the face of the note Time Period within which interest shall accrue. For discounting purposes, it is the period from date of note to maturity date Discount Amount of interest deducted by the bank in advance. (Maturity value x discount rate x discount period) Discount Rate Rate sed by the bank in computing the discount. If no discount rate is given, the interest rate is safely assumed as the discount rate. Discount Period Period of time from date of discounting to maturity date Equals to the term of the note minus the expired portion up to the date of discounting. Unexpired term of the note Discounting : Illustration 1 The following formula are useful to solve the required in the problem: Sample Data of a Notes Receivable ✓ Date of Note : January 1, 2015 ✓ Face Value : P500,000 ✓ Interest Rate : 12% ✓ Time : 6 months ✓ Discounted to Bank on March 1, 2015 ✓ Discount Rate : MV = 500,000 + (500,000 x 12% x 6/12) MV = 500,000 + 30,000 = 530,000 15% Discount = 530,000 x 15% x 4/12 Discount = 26,500 Compute for the following : ❑ Net Proceeds ❑ Gain or Loss on Discounting Net Proceeds = 530,000 - 26,500 Net Proceeds = 503,500 Carrying Amount = 500,000 + (500,000 x 12% x 2/12) Carrying Amount = 500,000 + 10,000 = 510,000 34 Gain or Loss on Discounting = 503,500 - 510,000 Loss = 6,500 DISCOUNTING OF NOTES RECEIVABLE • Endorser avoids future liability even if the maker refuses to pay the endorsee on the date of maturity • Sale is absolute, no contingent liability recognize • Recognize contingent liability – Notes Receivable Discounted • Notes Receivable derecognized • Derecognize the asset (NR) • • • Recognize gain or loss on discounting Notes Receivable Discounted is presented as a deduction from Total Notes Receivable with disclosure of the contingent liability Liability is recognized - equal to face amount of note receivable discounted • No gain instead expense • Loss on discounting is recognized is not or loss recognized, recognize interest DISCOUNTING OF NOTES RECEIVABLE Discounting Without Recourse ❑ Endorser avoids future liability even if the maker refuses to pay the endorsee on the date of maturity Discounting With Recourse – Conditional Sale ❑ Recognize contingent liability – Notes Receivable Discounted ❑ Derecognize the asset (NR) ❑ Notes Receivable Discounted is presented as a deduction from Total Notes Receivable with disclosure of the contingent liability ❑ Recognize gain or loss on discounting ❑ Loss on discounting is recognized ❑ Sale is absolute, no contingent liability recognize Module 1_Notes and Loans Receivable 36 Discounting With Recourse – Secured Borrowing ❑ Notes Receivable is not derecognized ❑ Liability is recognized equal to face amount of note receivable discounted ❑ No gain or loss recognized, instead recognize interest expense Illustration : Discounting Without Recourse Tender Company accepted from a customer a P4,000,000, three-month, 12% note dated August 31, 2015. On September 30, 2015, the entity discounted without recourse the note at 15%. C. Net Proceeds Net Proceeds = MV - Discount Net Proceeds = 4,120,000 - 103,000 Net Proceeds =4,017,000 D. Carrying Amount of Note Receivable CA = Principal Bal + Accrued Interest CA = 4,000,000 + (4,000,000 x 12% x 1/12) CA = 4,040,000 Compute for the following : a. Maturity Value of the note b. Discount c. Net Proceeds d. Carrying Amount of Note Receivable at time of discounting e. Gain / Loss on Discounting E. Gain / Loss on Discounting Gain / Loss = Net Proceeds - Carrying Amount Gain / Loss = 4,017,000 - 4,040,000 Loss = 23,000 A. Maturity Value of the Note MV = Principal + Interest MV = 4,000,000 + (4,000,000 x 12% x 3/12) MV = 4,120,000 B. Discount Discount = MV x Disc Rate x Disc Period Discount = 4,120,000 x 15% x 2/12 Discount = 103,000 Journal Entry Cash Loss on NR Discounting 37 4,017,000 23,000 Note Receivable 4,000,000 Interest Income 40,000 Illustration : Discounting With Recourse – Conditional Sale A P2,400,000, 6 month, 12% note dated February 1 is received from a customer by an entity and discounted by First Bank on March 1 at 15%. C. Net Proceeds Net Proceeds = MV - Discount Net Proceeds =2,544,000 - 159,000 Net Proceeds = 2,385,000 If the discounting is treated as a conditional sale, Compute for the following : a. Maturity Value of the note b. Discount c. Net Proceeds d. Carrying Amount of Note Receivable at time of discounting e. Gain / Loss on Discounting D. Carrying Amount of Note Receivable CA = Principal Bal + Accrued Interest CA = 2,400,000 + (2,400,000 x 12% x 1/12) CA = 2,424,000 E. Gain / Loss on Discounting Gain / Loss = Net Proceeds - Carrying Amount Gain / Loss = 2,385,000 - 2,424,000 Loss = 39,000 Journal Entry A. Maturity Value of the Note MV = Principal + Interest MV = 2,400,000 + (2,400,000 x 12% x 6/12) MV = 2,544,000 B. Discount Discount = MV x Disc Rate x Disc Period Discount =2,544,000 x 15% x 5/12 Discount = 159,000 Cash Loss on NR Discounting Note Receivable Discounted 38 2,385,000 39,000 2,400,0000 Interest Income 24,000 The Note Receivable Discounted account is deducted from the total notes receivable when preparing the statement of financial position with disclosure of the contingent liability Illustration : Discounting With Recourse – Conditional Sale A P2,400,000, 6 month, 12% note dated February 1 is received from a customer by an entity and discounted by First Bank on March 1 at 15%. If the discounting is treated as a conditional sale, Total payment is charged to accounts receivable Journal Entry Cash Loss on NR Discounting Journal Entry : Payment to First Bank 2,385,000 Accounts Receivable 39,000 Note Receivable Discounted 2,400,0000 Interest Income Journal Entry Notes Receivable 2,550,000 Cash 2,550,000 24,000 NOTE IS PAID BY MAKER ON MATURITY On August 1, date of maturity, the note is paid by the maker to the First Bank. Note Receivable Discounted NOTE IS DISHONORED BY MAKER The note is dishonored by the maker on August 1, and the entity pays the First Bank the Maturity value of the note, P2,544,000, plus protest fee and other bank charges of P6,000. 2,400,000 2,400,000 39 Journal Entry : Cancel the Contingent Liability Notes Receivable Discounted Notes Receivable 2,400,000 2,400,000 Illustration : Discounting With Recourse – Secured Borrowing If the discounting is treated as a secured borrowing, the note receivable is not derecognized but instead an accounting liability is recorded at an amount equal to the face amount of the note receivable discounted. NOTE IS PAID BY MAKER ON MATURITY A P2,400,000, 6 month, 12% note dated February 1 is received from a customer by an entity and discounted by First Bank on March 1 at 15%. Journal Entry Liability for NR Discounted If the discounting is treated as a Secured Borrowing: Cash 2,385,000 Interest Expense Liability for NR Discounted 39,000 2,400,0000 Interest Income 24,000 ❖ The Interest Expense can be netted against the interest income (net interest expense of P15,000) because the discounting transaction is a borrowing. ❖ There is no Gain or Loss on Discounting. 2,400,000 NOTE IS DISHONORED BY MAKER The note is dishonored by the maker on August 1, and the entity pays the First Bank the Maturity value of the note, P2,544,000, plus protest fee and other bank charges of P6,000. Journal Entry Cash 2,400,000 40 Journal Entry : Payment to First Bank Accounts Receivable 2,550,000 Cash 2,550,000 Journal Entry : Derecognized the Liability for NR Discounted & NR Liability for NR Discounted Notes Receivable 2,400,000 2,400,000 SAMPLE EXERCISES Problem 9-1 (Walleye Company) Problem 9-2 (Morale Company) Problem 9-5 (Stable Company) Try solving the problems prior to viewing the answers ASSIGNMENT Problem 9-6 (Machete Company) Problem 9-8 (Foremost Company) Problem 9-9 (Jolly Company) THANK YOU!