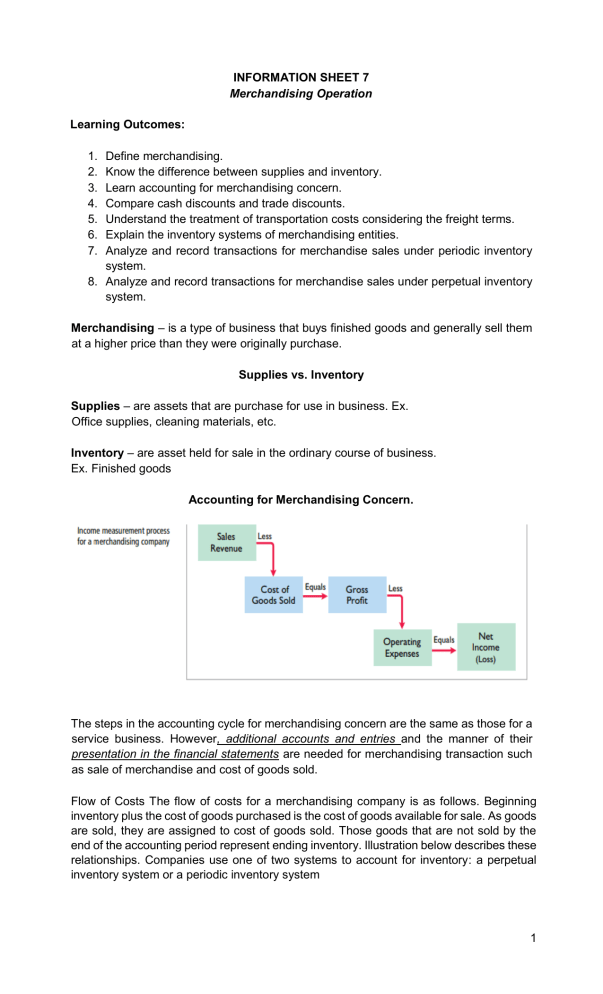

INFORMATION SHEET 7 Merchandising Operation Learning Outcomes: 1. 2. 3. 4. 5. 6. 7. Define merchandising. Know the difference between supplies and inventory. Learn accounting for merchandising concern. Compare cash discounts and trade discounts. Understand the treatment of transportation costs considering the freight terms. Explain the inventory systems of merchandising entities. Analyze and record transactions for merchandise sales under periodic inventory system. 8. Analyze and record transactions for merchandise sales under perpetual inventory system. Merchandising – is a type of business that buys finished goods and generally sell them at a higher price than they were originally purchase. Supplies vs. Inventory Supplies – are assets that are purchase for use in business. Ex. Office supplies, cleaning materials, etc. Inventory – are asset held for sale in the ordinary course of business. Ex. Finished goods Accounting for Merchandising Concern. The steps in the accounting cycle for merchandising concern are the same as those for a service business. However, additional accounts and entries and the manner of their presentation in the financial statements are needed for merchandising transaction such as sale of merchandise and cost of goods sold. Flow of Costs The flow of costs for a merchandising company is as follows. Beginning inventory plus the cost of goods purchased is the cost of goods available for sale. As goods are sold, they are assigned to cost of goods sold. Those goods that are not sold by the end of the accounting period represent ending inventory. Illustration below describes these relationships. Companies use one of two systems to account for inventory: a perpetual inventory system or a periodic inventory system 1 Additional Accounts and Entries I. Sales and related accounts 1. Sales – used to record the sales of merchandise. It could be on cash or on account. However, sales should be recognized when merchandise is sold, whether payment has been received or not, following accrual basis of accounting. 2. Sales returns and allowances – a customer may physically return merchandise received due to excess delivery, damages or inferior quality. This is known as sales return. Sometimes, a customer may be willing to keep the merchandise even if there are minor defects or damages as long as he is granted a price reduction. This is called sales allowance. Although there is a difference between sales return and allowances, they are often combined under one account called Sales Return and Allowances. This is a contra revenue account and evidence by a credit memorandum issued by the seller. 3. Sales discount – when goods are sold on credit, both parties should have an understanding as to the amount and time of payment. To encourage customers to pay their accounts promptly, a cash discounts is usually given if payment are received within a number of days from the date of sale. From the seller’s point of view, cash discount is called sales discount. II. Purchase and related accounts 1. Purchases - under periodic inventory system, when a merchandising business buys goods for resale, the purchase account is debited for the cost of goods purchase. 2. Purchase return and allowances – the buyer may return merchandising due to excess delivery, damages or inferior quality. This is known as purchase return. Or the buyer may be willing to accept the goods despite certain defects but a reduction in price will be granted. This is known as purchase allowances. Purchase return and allowances reduces purchases account and evidenced by a debit memorandum issued by the buyer. 3. Purchase discount – to encourage the buyers to pay their accounts promptly, a cash discount is usually given if payments are made within a 2 certain number of days from the date of sale. From the buyer’s point of view, cash discount is called Purchase Discount. 2 TYPES OF DISCOUNTS Credit terms specify the amount of the cash discount and time period in which it is offered. They also indicate the time period in which the purchaser is expected to pay the full invoice price. Credit terms are 2/10, n/30, which is read “two-ten, net thirty.” This means that the buyer may take a 2% cash discount on the invoice price, less (“net of”) any returns or allowances, if payment is made within 10 days of the invoice date (the discount period). Otherwise, the invoice price, less any returns or allowances, is due 30 days from the invoice date. Alternatively, the discount period may extend to a specified number of days following the month in which the sale occurs. For example, 1/10 EOM (end of month) means that a 1% discount is available if the invoice is paid within the first 10 days of the next month. III. Shipping charges on Merchandise sold. 1. FOB Shipping point – FOB means free on board. The purchases agreed to shoulder all the transportation costs from the point of shipment up to point of destination. The buyer receives title to the goods at shipping point. 2. FOB destination – the seller agreed to shoulder all the transportation costs from the point of shipment up to the point of destination. The buyer receives the title to the goods at the point of destination. Who paid the shipping point? • • If the seller paid the freight cost at the shipping point, this refer to “Freight Prepaid”. If the buyer paid the freight cost at the destination point, this refer to Freight Collect. 3 Example: June 10, Lady Company buys merchandise from Lord Company on account., P1,000, terms FOB Shipping point and pays the transportation cost P150. What if the terms: FOB Shipping Point, Freight Prepaid June 15, Feb Company sells merchandise to Mary Joy Company on account. P1,100, terms FOB Destination. The cost of merchandise sold is P800. Feb pays the transportation cost P200. 4 What if terms is: FOB Destination, Freight Collect Inventory systems There are two methods of accounting for cost of goods sold and merchandise inventory namely: 1. Perpetual Inventory Systems Under this method, the cost of item acquired is debited to the Merchandising Inventory account. As the items are sold, the merchandise inventory account is credited and the cost of goods sold is debited for the cost of items sold. Hence, under this method, the amount of merchandise inventory and cost of goods sold are always updated in the accounting records. This system of accounting is applicable for merchandising firms that sell high-unit value and in small quantities such as automobiles and industrial machineries. For example, a Ford dealership has separate inventory records for each automobile, truck, and van on its lot and showroom floor. Similarly, a Kroger grocery store uses bar codes and optical scanners to keep a daily running record of every box of cereal and every jar of jelly that it buys and sells. Under a perpetual inventory system, a company determines the cost of goods sold each time a sale occurs. 5 Helpful Hint: For control purposes, companies take a physical inventory count under the perpetual system, even though it is not needed to determine cost of goods sold. 2. Periodic Inventory Systems Under this method, the count of physical inventory takes place periodically, usually at the end of the accounting period and no detailed records of the physical inventory on hand are maintained during the period. The Purchase account is used to record the cost of merchandise bought by the business. When merchandise is sold, revenue account (sales) is recorded but not the cost of merchandise sold. When the financial statements are prepared, the company takes a physical count of the ending merchandising which is then used in computing the cost of goods sold. This system of accounting is applicable for merchandising firm with low value and large quantities. To determine the cost of goods sold under a periodic inventory system, the following steps are necessary: 1. Determine the cost of goods on hand at the beginning of the accounting period. 2. Add to it the cost of goods purchased. 3. Subtract the cost of goods on hand at the end of the accounting period. RECORDING OF TRANSACTIONS Book of the buyer: Date Transaction May-04 Purchase of merchandise on credit 6 Freight costs on purchases. 8 Purchase returns and allowances. 14 Payment on account with a discount Perpetual Inventory System Merchandise Inventory 3,800 Purchases Accounts Payable Merchandise Inventory Cash Accounts Payable Merchandise Inventory Accounts Payable Cash Merchandise Inventory Periodic Inventory System 3,800 3,800 Accounts Payable 150 150 300 300 3, 500 3,430 70 Freight-In Cash Accounts Payable Purchase Returns and Allowances Accounts Payable Cash Purchase Discounts 3,800 150 150 300 300 3, 500 3,430 70 6 Book of the seller: CLOSING ENTRIES PERPETUAL PERIODIC Sales xxx Sales xxx Sales Return and Allowances xxx Sales Return and Allowances xxx Sales Discount xxx Sales Discount xxx Income Summary xxx Income Summary xxx To close sales and its related accounts To close sales and its related accounts Income Summary xxx Cost of Goods Sold xxx Operating expenses xxx To close cost of goods sold and other expenses Merchandise Inventory, end xxx Purchase Discount xxx Purchase Return xxx Income Summary xxx Merchandise Inventory, beg. Purchases Income Summary xxx Freight-in Adrianne, Capital xxxx To close the related accounts To close the income summary account in cost of goods sold Adrianne, Capital xxx Adrianne, Drawing To close the drawing account xxx Income Summary xxx Operating Expense To close all operating expenses xxx xxx xxx xxx Income Summary xxx Adrianne, Capital xxxx To close the income summary account Adrianne, Capital xxx Adrianne, Drawing To close the drawing account xxx 7 Sample of Statement of Cost of Goods Sold PW AUDIO SUPPLY, INC. STATEMENT OF COST OF GOODS SOLD FOR THE YEAR ENDED DEC. 31, 1998 Beginning Inventory Purchases Less: Purchase Returns and Allowances P 40,000.00 Purchase Discount 60,000.00 Net puchases Total Freight In Total Goods Available for Sale Less: Ending Inventory Cost of Goods Sold P P 250,000.00 250,000.00 100,000.00 P P P 150,000.00 400,000.00 50,000.00 450,000.00 134,000.00 316,000.00 Sample of Income Statement 8 Required: Record the transactions What do you think are the missing controls? 9 References Ballada, Win, “Basic Accounting Made Easy.” Lopez, Rafael M., “Fundamentals of Accounting.” Valix, Condrado T., “Theory of Accounts.” https://legacy.senate.gov.ph/publications/AG%202012-03%20-%20MSME.pd Weygandt, J. et.al 2015. “Accounting Principles”, Illinois, Courier Kendallville “If you are not willing to learn, no one can help you. If you are determined to learn, no one can stop you” By: Zig Ziglar 10