Managerial Accounting Test Bank: Budgetary Control & Responsibility

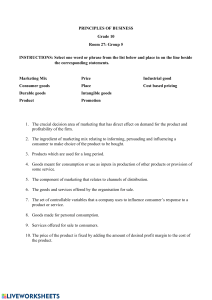

advertisement