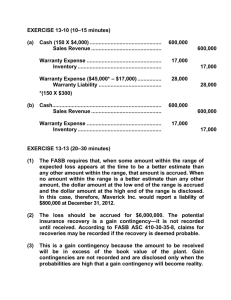

Provisions & Contingencies Quizzer - Financial Accounting

advertisement