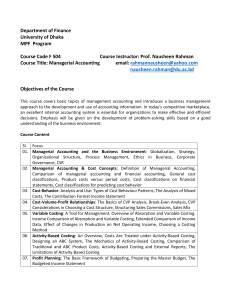

Activity-Based Costing Managerial Accounting, ADA Instructor Mehriban Ahmadova Introduction • Activity-based costing (ABC) is a costing method that is designed to provide managers with cost information. • It is a process that assigns overhead to products based on the various activities that drive overhead costs. • It is used as a supplement to, not as a replacement for usual costing system. • Official costing system used for external reporting and ABC for internal reporting. Managerial Accounting, ADA, Mehriban Ahmadova 2 Outline 1. 2. 3. 4. Review P.O.R. under traditional allocation method. Cost drivers. Activity-based costing calculation. Traditional vs ABC systems. Managerial Accounting, ADA, Mehriban Ahmadova 3 Review P.O.R. under traditional allocation method Managerial Accounting, ADA, Mehriban Ahmadova 4 1/4 Review P.O.R. under traditional allocation method Calculate P.O.R. and total cost #1 • Component categories under traditional allocation • Product or job cost = direct materials + direct labor + manufacturing overhead • Estimated total manufacturing overhead costs • Overhead application rate based on estimated overhead costs and a estimated level of activity (see formula (3.1)) 𝐸𝑠𝑡𝑖𝑚𝑎𝑡𝑒𝑑 𝑡𝑜𝑡𝑎𝑙 𝑚𝑎𝑛𝑢𝑓𝑎𝑐𝑡𝑢𝑟𝑖𝑛𝑔 𝑜𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝑐𝑜𝑠𝑡 𝑃. 𝑂. 𝑅. = 𝐸𝑠𝑡𝑖𝑚𝑎𝑡𝑒𝑑 𝑡𝑜𝑡𝑎𝑙 𝑎𝑙𝑙𝑜𝑐𝑎𝑡𝑖𝑜𝑛 𝑏𝑎𝑠𝑒 Managerial Accounting, ADA, Mehriban Ahmadova 5 1/4 Review P.O.R. under traditional allocation method Calculate P.O.R. and total cost #2 • The materials and labor costs per unit for three different recorders produced by Musicality Manufacturing: • Musicality determines the overhead rate based on direct labor hours. At the beginning of the year, the company estimates total overhead costs to be $2,500,000 and total direct labor hours to be 1,250,000. 1. What is the predetermined overhead rate? Managerial Accounting, ADA, Mehriban Ahmadova 6 1/4 Review P.O.R. under traditional allocation method Calculate P.O.R. and total cost #3 1. What is the predetermined overhead rate? Estimated Annual Overhead Costs Estimated Annual Activity $2,500,000 1,250,000 direct labor hours $2,500,000 Estimated Overhead_______ = $2.00 per direct labor hour 1,250,000 Estimated Direct Labor Hours Managerial Accounting, ADA, Mehriban Ahmadova 7 1/4 Review P.O.R. under traditional allocation method Calculate P.O.R. and total cost #4 The total direct labor hours estimated for the solo product is 350,000 direct labor hours; for the band product is 400,000 direct labor hours: for the orchestra product is 500,000 direct labor hours. Number of units produced are solo – 140,000, band – 100,000, orchestra – 250,000 2. Calculate overhead cost per unit for all of the products. Managerial Accounting, ADA, Mehriban Ahmadova 8 1/4 Review P.O.R. under traditional allocation method Calculate P.O.R. and total cost #5 3. Combine overhead cost per unit with direct materials per unit and direct labor cost per unit. Managerial Accounting, ADA, Mehriban Ahmadova 9 1/4 Review P.O.R. under traditional allocation method Calculate P.O.R. and total cost #6 Sale price was set as follows: solo - $20, band - $25, orchestra - $30. Number of units sold are: solo – 150,000 units, band – 110,000 units, orchestra – 200,000 units. 4. Calculate gross profit per unit for each product. Managerial Accounting, ADA, Mehriban Ahmadova 10 1/4 Review P.O.R. under traditional allocation method Calculate P.O.R. and total cost #7 Sale price was set as follows: solo - $20, band - $25, orchestra - $30. Number of units sold are: solo – 150,000 units, band – 110,000 units, orchestra – 200,000 units. 4. Calculate gross profit for each product. Managerial Accounting, ADA, Mehriban Ahmadova 11 Cost Drivers & Cost Pools Managerial Accounting, ADA, Mehriban Ahmadova 12 2/4 Cost Drivers Identify Cost Drivers • Cost driver: the reason a cost occurs • In a labor-intensive environment, direct labor hours or dollars are a driver of cost. In a machine intensive environment, machine hours are a cost driver. • Identify cost drivers: Managerial Accounting, ADA, Mehriban Ahmadova 13 Activity-based costing calculation Managerial Accounting, ADA, Mehriban Ahmadova 14 3/4 Activity-based costing MOH Allocation: History • Historical perspective on determination of manufacturing overhead allocation • Much of production historically was labor based, making labor hours or labor dollars a good match for overhead allocation. • Increased used of machines makes machine hours an appropriate cost driver. • Both labor hours and machine hours are easily measured. • Establishing an activity-based costing system • Technology has allowed for more detailed measurement of the many costs that make up overhead in many industries. Managerial Accounting, ADA, Mehriban Ahmadova 15 3/4 Activity-based costing 5-step ABC process 1. 2. 3. 4. 5. Identify activities performed, activity cost pools and activity measures Assign overhead costs to cost pools Calculate activity rates for each cost Allocate activity rates to cost objects (products, services) Calculate unit product costs/prepare management reports Managerial Accounting, ADA, Mehriban Ahmadova 16 3/4 Activity-based costing Illustration: Classic Brass Managerial Accounting, ADA, Mehriban Ahmadova 17 3/4 Activity-based costing Illustration: Classic Brass: step 1 • At Classic Brass, the ABC team, in consultation with top managers, selected the following activity cost pools and activity measures Managerial Accounting, ADA, Mehriban Ahmadova 18 3/4 Activity-based costing Illustration: Classic Brass: step 2 • The first-stage allocation in an ABC system is the process of assigning functionally organized overhead costs derived from a company’s general ledger to the activity cost pools. Managerial Accounting, ADA, Mehriban Ahmadova 19 3/4 Activity-based costing Illustration: Classic Brass: step 2 • First-stage allocations are usually based on the results of interviews with employees who have first-hand knowledge of the activities. Managerial Accounting, ADA, Mehriban Ahmadova 20 3/4 Activity-based costing Illustration: Classic Brass: step 2 Managerial Accounting, ADA, Mehriban Ahmadova 21 3/4 Activity-based costing Illustration: Classic Brass: step 3 • Activity rates = $𝑎𝑠𝑠𝑖𝑔𝑛𝑒𝑑 𝑡𝑜 𝑎𝑐𝑡𝑖𝑣𝑖𝑡𝑦 𝑐𝑜𝑠𝑡 𝑝𝑜𝑜𝑙 𝑒𝑠𝑡𝑖𝑚𝑎𝑡𝑒 𝑎𝑐𝑡𝑖𝑣𝑖𝑡𝑦 𝑙𝑒𝑣𝑒𝑙 Managerial Accounting, ADA, Mehriban Ahmadova 22 3/4 Activity-based costing Illustration: Classic Brass: ABC Managerial Accounting, ADA, Mehriban Ahmadova 23 3/4 Activity-based costing Illustration: Classic Brass: step 4 • In the second-stage allocation, activity rates are used to apply overhead costs to products and customers. Managerial Accounting, ADA, Mehriban Ahmadova 24 3/4 Activity-based costing Illustration: Classic Brass: step 4 Managerial Accounting, ADA, Mehriban Ahmadova 25 3/4 Activity-based costing Illustration: Classic Brass: step 4 Managerial Accounting, ADA, Mehriban Ahmadova 26 3/4 Activity-based costing Illustration: Classic Brass: step 5 • Given information: Managerial Accounting, ADA, Mehriban Ahmadova 27 3/4 Activity-based costing Illustration: Classic Brass: step 5 Managerial Accounting, ADA, Mehriban Ahmadova 28 3/4 Activity-based costing Illustration: Classic Brass: step 5 Managerial Accounting, ADA, Mehriban Ahmadova 29 Traditional vs ABC systems Managerial Accounting, ADA, Mehriban Ahmadova 30 4/4 Traditional vs ABC systems Overhead in Traditional vs ABC Costing Managerial Accounting, ADA, Mehriban Ahmadova 31 4/4 Traditional vs ABC systems Traditional vs ABC Systems Traditional Costing Activity-Based Costing Advantages Advantages All manufacturing costs are classified as material, labor, or overhead and assigned to products. There are multiple overhead cost pools, and each has an individual measure of activity. All manufacturing costs are considered to be part of the product cost. The allocation bases, or measures of activity, are often different from those used in traditional allocation. There is only one overhead cost pool and a single measure of activity. Both nonmanufacturing costs and manufacturing costs may be assigned to products. Disadvantages Disadvantages The use of the single cost driver does not allocate overhead as Some manufacturing costs may be excluded from product accurately as using multiple cost drivers. costs. The use of the single cost driver may overallocate overhead to one product and underallocate overhead to another product. It is more expensive. By allocating product costs to inventory, this method is acceptable for generally accepted accounting principles (GAAP). An ABC system takes much more to implement and operate. Managerial Accounting, ADA, Mehriban Ahmadova 32