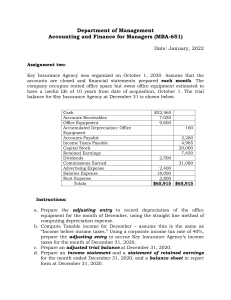

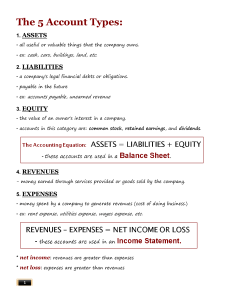

FINANCIAL ACCOUNTING Seventh Canadian Edition LIBBY, LIBBY, HODGE, KANAAN, STERLING Operating Decisions and the Accounting System Chapter 3 PowerPoint Author: Shannon Butler, CPA, CA, MEd Carleton University, Sprott School of Business © 2020 McGraw-Hill Limited 3-1 Learning Objectives LO3-1 Describe a typical business operating cycle and explain the necessity for the periodicity assumption. LO3-2 Explain how transactions arising from operating activities affect the elements of the statement of earnings. LO3-3 Explain the accrual basis of accounting and apply the revenue recognition principle and the matching process to measure net earnings. LO3-4 Apply transaction analysis to recognize, classify, and record the effects of transactions arising from operating activities on the financial statements. © 2020 McGraw-Hill Limited 3-2 Learning Objectives Continued LO3-5 Prepare a classified statement of earnings and explain the difference between net earnings and cash flow from operations. LO3-6 Compute and interpret the total asset turnover ratio and the return on assets. SUPPLEMENTARY MATERIAL LO3-S1 Explain earnings measurement and comprehensive income. © 2020 McGraw-Hill Limited 3-3 The Operating Cycle (cash-to-cash cycle) The operating (or cash-to-cash) cycle is the time it takes for a company to pay cash to suppliers, sell those goods and services to customers, and collect cash from customers. © 2020 McGraw-Hill Limited 3-4 The Periodicity Assumption To meet the needs of decision makers, we report financial information for relatively short time periods (monthly, quarterly, annually). Two types of issues arise in reporting periodic net earnings to users: Recognition issues. When should the transactions and their effects of operating activities be recognized, classified, and recorded? Measurement issues. What amounts should be recognized and recorded for the transactions? © 2020 McGraw-Hill Limited 3-5 Classified Statement of Earnings The statement of earnings includes a number of sections and subtotals to aid the user in identifying the company’s earnings from operations for the year, and to highlight the effect of other items on net earnings. Most manufacturing and merchandising companies use the following basic structure as shown on the next slide. © 2020 McGraw-Hill Limited 3-6 Classified Statement of Earnings basic structure: Net sales − Cost of sales = Gross profit − Operating expenses = Earnings from operations +/− Non-operating revenues/expenses and gains/losses = Earnings before income taxes − Income tax expense = Earnings from continuing operations +/− Earnings/loss from discontinued operations = Net earnings © 2020 McGraw-Hill Limited 3-7 Classified Statement of Earnings The statement of earnings includes three major sections: 1. Results of continuing operations 2. Results of discontinued operations 3. Earnings per share All companies report information for sections 1 and 3, while some companies report information in section 2, depending upon their particular circumstances. The bottom line, net earnings, is the sum of sections 1 and 2. © 2020 McGraw-Hill Limited 3-8 Continuing Operations This section of the statement of earnings presents the results of normal or continuing operations. Revenues are defined as increases in assets or settlements of liabilities from ongoing operations of the business. Operating revenues result from the sale of goods or services. Expenses are decreases in assets or increases in liabilities from ongoing operations, and are incurred to generate revenues during the period. © 2020 McGraw-Hill Limited 3-9 Primary Operating Expenses The following are primary operating expenses for most merchandising companies: Cost of sales is the cost of products sold to customers. In companies with a manufacturing or merchandising focus, the cost of sales (also called cost of goods sold) is usually the most significant expense. The difference between sales—net of sales discounts, returns, and allowances—and cost of sales is known as gross profit (or gross margin). Operating expenses are the usual expenses, other than cost of sales, that are incurred in operating a business during a specific accounting period. The expenses reported will depend on the nature of the company’s operations. Earnings from operations, also called operating income, equals net sales less cost of sales and operating expenses. © 2020 McGraw-Hill Limited 3-10 Primary Operating Expenses Continued © 2020 McGraw-Hill Limited 3-11 Non-Operating Items Not all activities affecting a statement of earnings are central to continuing operations. Any revenues, expenses, gains, or losses that result from these other activities are not included as part of earnings from operations but instead categorized as other income or expenses. These typically include: Interest income, financing costs, gains or losses on disposal of assets. The non-operating items that are subject to income taxes are added to or subtracted from earnings from operations to obtain the earnings before income taxes (or pretax earnings). © 2020 McGraw-Hill Limited 3-12 Income Tax Expense Income tax expense is the last expense listed on the statement of earnings. All for-profit corporations are required to compute income taxes owed to federal, provincial, and foreign governments. Income tax expense is calculated as a percentage of earnings before income taxes, reflecting the difference between income, which includes revenues and gains, and expenses and losses. It is determined by using applicable tax rates. © 2020 McGraw-Hill Limited 3-13 Discontinued Operations Companies may dispose of a major line of business or a geographical area of operations during the accounting period, or decide to discontinue a specific operation in the near future. The net earnings or loss from that component, as well as any gain or loss on subsequent disposal, are disclosed separately on the statement of earnings as discontinued operations. Because of their non-recurring nature, the financial results of discontinued operations are not useful in predicting future recurring net earnings. © 2020 McGraw-Hill Limited 3-14 Earnings per Share Corporations are required to disclose earnings per share on the statement of earnings or in the notes to the financial statements. This ratio is widely used in evaluating the operating performance and profitability of a company. Simple earnings per share can be calculated as net earnings divided by the average number of shares outstanding during the period. The calculation of the ratio is actually more complex and beyond the scope of this course. © 2020 McGraw-Hill Limited 3-15 How Are Transactions from Operating Activities Recognized and Measured? Many local retailers and other small businesses use cash basis accounting, in which revenues are recorded when cash is received and expenses are recorded when cash is paid, regardless of when and revenues are earned or the expenses are incurred. A cash basis is often quite adequate for these small businesses, which usually do not have to report to external users. © 2020 McGraw-Hill Limited 3-16 Cash Basis Accounting Financial statements created under cash basis accounting normally postpone or accelerate recognition of revenues and expenses long after or before goods and services are produced and delivered (when cash is received or paid). The cash basis also does not necessarily reflect all assets and liabilities of a company on a particular date. Cash basis financial statements are not very useful to external decision makers. IFRS therefore require accrual basis accounting for financial reporting purposes. © 2020 McGraw-Hill Limited 3-17 Accrual Accounting In accrual basis accounting, revenues and expenses are recognized when the transaction that causes them occurs, not necessarily when cash is received or paid. Revenues are recognized when they are earned and expenses when they are incurred. The revenue recognition principle and the matching process determine when revenues and expenses are to be recorded under accrual basis accounting. © 2020 McGraw-Hill Limited 3-18 The Revenue Recognition Principle The revenue recognition principle specifies both the timing and amount of revenue to be recognized during an accounting period. It requires that a company recognize revenue when goods and services are transferred to customers in an amount it expects to receive. Revenue is earned when the business delivers goods or services, although cash can be received from customers (1) in a period before delivery, (2) in the same period as delivery, or (3) in a period after delivery. © 2020 McGraw-Hill Limited 3-19 Recording Revenues versus Cash Receipts © 2020 McGraw-Hill Limited 3-20 Revenue Recognition – Example 1 Cash is received before the goods or services are delivered. On receipt of a $1,000 cash deposit Debit Cash (+A) 1,000 Deferred revenue (+L) Credit 1,000 On delivery of ordered goods Deferred revenue (−L) Sales revenue (+R, +SE) © 2020 McGraw-Hill Limited 1,000 1,000 3-21 Revenue Recognition – Example 2 Cash is received in the same period as the goods or services are delivered. On delivery of purchased goods for $300 cash Cash (+A) Sales revenue (+R, +SE) © 2020 McGraw-Hill Limited Debit Credit 300 300 3-22 Revenue Recognition – Example 3 Cash is received after the goods or services are delivered. On delivery of purchased goods for $500 on account Accounts receivable (+A) Debit Credit 500 Sales revenue (+R, +SE) 500 On receipt of cash after delivery Cash (+A) Accounts receivable (−A) © 2020 McGraw-Hill Limited 500 500 3-23 The Matching Process The matching process requires that expenses be recorded when incurred in earning revenue; all of the resources consumed in earning revenues during a specific period must be recognized in that same period. A matching of costs with benefits. © 2020 McGraw-Hill Limited 3-24 The Matching Process Continued The costs of generating revenue include expenses incurred, such as: Salaries to employees who worked during the period (wages expense) Utilities for the electricity used during the period (utilities expense) Inventory items (e.g., T-shirts, legwear, pants and shorts) that are sold during the period (cost of sales) Facilities rented during the period (rent expense) Use of buildings and equipment for production purposes during the period (depreciation expense) © 2020 McGraw-Hill Limited 3-25 Recording Expenses versus Cash Payments As with revenues and cash receipts, expenses are recorded as incurred, regardless of when cash is paid. Cash may be paid before, during, or after an expense is incurred. An entry is made on the date the expense is incurred and another one on the date of the cash payment, if at different times. © 2020 McGraw-Hill Limited 3-26 The Matching Process – Example 1 Cash is paid before the expense is incurred to generate revenue. Companies purchase many assets that are used to generate revenues in future periods. Examples include buying insurance for future coverage, paying rent for future use of space, and acquiring supplies and equipment for future use. When revenues are generated in the future, the company records an expense for the portion of the cost of the assets used—costs are matched with the benefits. © 2020 McGraw-Hill Limited 3-27 The Matching Process – Example 1 Continued Cash is paid before the expense is incurred to generate revenue. On payment of $200 cash for office supplies Debit Office supplies (+A) 2,000 Cash (−A) Credit 2,000 On subsequent use of half of the supplies Supplies expense (+E, −SE) Office supplies (−A) © 2020 McGraw-Hill Limited 1,000 1,000 3-28 The Matching Process – Example 2 Cash is paid in the same period as the expense is incurred to generate revenue. Expenses are sometimes incurred and paid for in the period in which they arise. An example is paying for repairs on sewing machines the day of the service. On payment of $500 cash for using a repair service Repairs expense (+E, −SE) Cash (−A) © 2020 McGraw-Hill Limited 500 500 3-29 The Matching Process – Example 3 Cash is paid after the cost is incurred to generate revenue. Although rent and supplies are typically purchased before they are used, many costs are paid after goods or services have been received and used. Examples include using electric and gas utilities in the current period that are not paid for until the following period, using borrowed funds and incurring interest expense to be paid in the future, and owing wages to employees who worked in the current period. © 2020 McGraw-Hill Limited 3-30 The Matching Process – Example 3 Continued Cash is paid after the cost is incurred to generate revenue. On the use of $4,000 employees’ services during the period Debit Salaries expense (+E, −SE) 4,000 Salaries payable (+L) Credit 4,000 On payment of cash after using employees’ services Salaries payable (−L) Cash (−A) © 2020 McGraw-Hill Limited 4,000 4,000 3-31 Transaction Analysis Rules © 2020 McGraw-Hill Limited 3-32 The Expanded Transaction Analysis Model Part 1 All accounts can increase or decrease, although revenues and expenses tend to increase throughout a period as transactions occur. For accounts on the left side of the accounting equation, the increase symbol, +, is written on the left side of the Taccount. For accounts on the right side of the accounting equation, the increase symbol, +, is written on the right side of the T-account, except for expenses, which increase on the left side of the T-account. © 2020 McGraw-Hill Limited 3-33 The Expanded Transaction Analysis Model Part 2 Debits (dr) are written on the left side of each T-account and credits (cr) are written on the right. Total debits equal total credits when changes arising from each transaction are recognized, classified, and recorded in the proper accounts. Every transaction affects at least two accounts. © 2020 McGraw-Hill Limited 3-34 The Expanded Transaction Analysis Model Part 3 When a revenue or expense is recorded, either an asset or a liability will be affected as well: Revenues increase net earnings, retained earnings, and shareholders’ equity. Revenues have credit balances; that is, to increase a revenue account, you credit it, which increases net earnings and retained earnings. Recording revenue results in either increasing an asset (such as cash or accounts receivable) or decreasing a liability (such as deferred subscriptions revenue). © 2020 McGraw-Hill Limited 3-35 The Expanded Transaction Analysis Model Part 4 Expenses decrease net earnings, thus decreasing retained earnings and shareholders’ equity. Expenses have debit balances (opposite of the balance in retained earnings); that is, to increase an expense, you debit it, which decreases net earnings and retained earnings. Recording an expense results in either decreasing an asset (such as supplies when used) or increasing a liability (such as wages payable when money is owed to employees). © 2020 McGraw-Hill Limited 3-36 Summary REVENUES EXPENSES •Increase net earnings and shareholders’ equity •Decrease net earnings and shareholders’ equity •↑ with credits •↑ with debits •Accounts have credit balances •Accounts have debit balances © 2020 McGraw-Hill Limited 3-37 Transaction Analysis Steps: Step 1: Ask → Was a revenue earned by delivering goods or services? • If so, credit the revenue account and debit the account for what was received to recognize the sales transaction. • or Ask → Was an expense incurred to generate a revenue in the current period? • If so, recognize the transaction, debit the expense account, and credit the appropriate accounts for what was given. • or Ask → If the transaction resulted in no revenue earned or expense incurred, what was received and given? • • • Identify the accounts affected by title (e.g., cash, deferred revenue). Make sure that at least two accounts change. Classify the accounts by type. Was each account an asset (A), a liability (L), shareholders’ equity (SE), a revenue/gain (R), or an expense/loss (E)? Determine the direction of the effect. Did the account increase [+] or decrease [−]? Step 2: Verify → Is the accounting equation in balance? (A = L + SE) © 2020 McGraw-Hill Limited 3-38 How is the Statement of Earnings Prepared and Analyzed? First determine that the debits equal credits after all of the transactions from the period by generating a trial balance. Accounts are listed in a specific order: assets, liabilities, and shareholders’ equity accounts are reported on the statement of financial position, followed by revenues/gains, and expenses/losses that are reported on the statement of earnings. The ending account balances that did not change as a result of the transactions are taken from the beginning trial balance from the period. © 2020 McGraw-Hill Limited 3-39 How is the Statement of Earnings Prepared and Analyzed Continued? The accounts that did change due to transactions, their ending balances are taken from the T-accounts. There may also be new accounts that are added from the previous list of accounts. End-of-period adjustments have to be made to reflect all revenues earned and expenses incurred during the period. Chapter 4 will describe the adjustment process to update the accounting records. After the adjustments are made, the amount of income tax expense and net earnings will be determined and reported in the statement of earnings. © 2020 McGraw-Hill Limited 3-40 Focus on Cash Flows – Direct Approach to Preparing Operating Cash Flows Operating activities Cash received: Customers Interest and div idends on investments Cash paid: Suppliers Employees Interest on debt obligations Income taxes Cash Flows from Operating Activities Investing Activities Purchase of property, plant or equipment Purchase of other long-term assets Sale of property, plant or equipment Sale of other long-term assets Cash Flows from Investing Activities Financing Activities Issuance of long-term debt Issuance of contributed capital Dividends paid Repurchase of long-term debt Repurchase of contributed capital Cash Flows from Financing Activities Net increase or (decrease) in cash Beginning balance in cash account Ending balance in cash account © 2020 McGraw-Hill Limited Effect on Cash Flows + + Total + + Total + + Total 3-41 Key Ratio Analysis TOTAL ASSET TURNOVER RATIO ANALYTICAL QUESTION → How effective is management at generating sales from assets (resources)? RATIO AND COMPARISONS → The total asset turnover ratio is useful in answering this question. It is computed as follows: Total Asset Turnover Ratio = Sales (or Operating) Revenues Average Total Assets* *Average total assets = (Beginning total assets + Ending total assets) ÷ 2. © 2020 McGraw-Hill Limited 3-42 Key Ratio Analysis Interpretation TOTAL ASSET TURNOVER RATIO INTERPRETATION The total asset turnover ratio measures the sales generated per dollar of assets. A high total asset turnover ratio signifies efficient management of assets; a low total asset turnover ratio signifies less-efficient management. Stronger operating performance improves the total asset turnover ratio. Creditors and security analysts use this ratio to assess a company’s effectiveness at controlling current and noncurrent assets. © 2020 McGraw-Hill Limited 3-43 Key Ratio Analysis Part 2 RETURN ON ASSETS (ROA) ANALYTICAL QUESTION → How well has management used the total invested capital provided by debt holders and shareholders during the period? RATIO AND COMPARISONS → Analysts refer to the rate of return on assets (ROA) as a useful measure in addressing this issue. It is computed as follows: Return on Assets (ROA) Ratio = Net Earnings* + Interest Expense (net of tax) Average Total Assets *In complex calculations, interest expense (net of tax) and minority interest are added back to net earnings. © 2020 McGraw-Hill Limited 3-44 Key Ratio Analysis Interpretation Part 2 RETURN ON ASSETS INTERPRETATION ROA measures how much the firm earned from the use of its assets. It is the broadest measure of profitability and management effectiveness, independent of financing strategy. ROA allows investors to compare management’s investment performance against alternative investment options. Firms with higher ROA are doing a better job of selecting new investments, all other things being equal. © 2020 McGraw-Hill Limited 3-45 Appendix 3A: Earnings Measurement The following table summarizes the valuation bases that are currently permitted by IFRS for the reporting of asset and liability values on the statement of financial position: Asset or Liability Group Valuation Basis Financial assets (e.g., investment in shares of other corporations, trade receivables, notes receivable) Amortized cost or fair value Inventories Lower of cost and net realizable value Property, plant, and equipment Depreciated cost or recoverable amount Investment properties (e.g., commercial real estate properties) Depreciated cost or fair value Intangible assets Amortized cost or fair value Financial liabilities Amortized cost or fair value The concepts of amortized cost, net realizable value, and recoverable amount are discussed in later chapters. © 2020 McGraw-Hill Limited 3-46 Appendix 3A: Statement of Comprehensive Income The statement of earnings includes the results of operations for a specific accounting period as well as the effects of discontinued operations. Publicly accountable enterprises are now required to disclose additional information in a statement of comprehensive income. The additional components of income reflect the financial effect of events that cause changes in shareholders’ equity, other than investments by shareholders or distributions to shareholders. © 2020 McGraw-Hill Limited 3-47 Appendix 3A: Statement of Comprehensive Income Continued The additional components of income, or other comprehensive income, include unrealized gains and losses on certain financial instruments, as well as other items discussed in advanced accounting courses. The net earnings and other comprehensive income totals are then combined to create a final total called comprehensive income (the bottom line for this statement). © 2020 McGraw-Hill Limited 3-48 End of Chapter Summary Elements on the classified statement of earnings are as follows: a. b. c. d. Revenues are increases in assets or settlements of liabilities from ongoing operations. Expenses are decreases in assets or increases in liabilities from ongoing operations. Gains are increases in assets or settlements of liabilities from peripheral activities. Losses are decreases in assets or increases in liabilities from peripheral activities. © 2020 McGraw-Hill Limited 3-49 End of Chapter Summary Continued When applying accrual accounting concepts, revenues are recognized (recorded) when earned and expenses are recognized when incurred. Based on the revenue recognition principle, we recognize revenues when goods and services are transferred to customers in an amount they expect to receive. Based on the matching process, we recognize expenses when incurred in generating revenue. © 2020 McGraw-Hill Limited 3-50