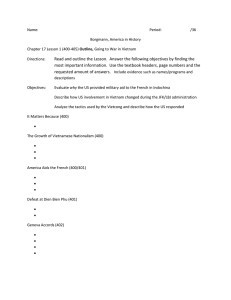

MARKETING PLAN FOR BAEMIN VIETNAM BUSINESS PRACTICE EXPLORED – FOREIGN TRADE UNIVERSITY STUDENT INFORMATION Name: Ngo Khanh Hung Student Code: 2105003035 Class: F-UON-M-3A TABLE OF CONTENT Section No. Content Page 1 EXECUTIVE SUMMARY 4 2 BUSINESS INTRODUCTION 5 2.1 General introduction about Baemin 5 2.2 Features 5 2.3 Mission 5 2.4 Resources 6 2.5 Customer 7 2.6 Current position 7 2.7 SWOT Analysis 7 ENVIRONMENTAL ANALYSIS 8 3.1 Macroeconomic Environment 8 3.1.1 Demographic environment 8 3.1.2 Economic environment 9 3.1.3 Socio-cultural environment 9 3.1.4 Legal and political environment 9 3.1.5 Technological environment 9 3.1.6 Natural environment 10 Microeconomic Environment 10 3.2.1 Industry environment 10 3.2.2 Customer 10 3.2.3 Competitive analysis 11 3 3.2 4 2 FUTURE OBJECTIVES 12 4.1 12 Business objectives Section No 4.2 5 6 7 Content Marketing objectives Page 12 MARKETING STRATEGIES 13 5.1 Target Market Analysis 13 5.2 Target Market Table 14 5.3 4Ps Marketing Mix 15 5.3.1 Product 15 5.3.2 Price 16 5.3.3 Place 16 5.3.4 Promotion 16 MARKETING IMPLEMENTATION 17 6.1 Brand Direct Marketing 17 6.2 Multi-platform marketing campaign 18 EVALUATION AND CONTROL 19 7.1 Advantages 19 7.2 Difficulties 19 8 CONCLUSION 20 9 REFERENCE 21 3 1. EXECUTIVE SUMMARY: Although the Vietnamese meal delivery sector is very new, it is extremely exciting. Because many customers' eating habits have changed significantly as a result of today's busy and active life rhythms and the emergence of the modern urban wave. As a result, the trend toward door-to-door delivery options is growing and receiving passionate support, particularly among Generation Z (born between 1995 and 2006). As a result of this shift in customer behavior, a furious online meal delivery competition has erupted. The fast-food delivery business is heating up by the day, and there is a lot of money to be made. On the other hand, smartphone application use is growing in popularity, and users can pay via Mobile Banking and e-wallets, making it highly convenient for buyers and sellers, particularly delivery personnel. Now Food is one of the most popular names among users (formerly known as Delivery Now), Grabfood, and Gojek (the parent company of the old Go Viet). Woowa Brothers Corp is the most recent to enter the Vietnamese food delivery sector by acquiring Vietnammm. Vietnammm's logo and image were officially changed to Baemin on January 1, 2019. Despite the parent company's strong backing and financial infusion at KimChi's headquarters, Baemin still lacks a strong foothold and a significant number of clients when compared to its current competitors in the same industry. In the marketplace, there is market loyalty. Recognize the necessity of growing a young organization with holes in previous strategy and operations. Baemin offered several promotions, including discount vouchers, during its debut phase in the market to raise brand awareness and draw clients. Baemin immediately drew a large number of app downloads with this and other marketing activities. Baemin, on the other hand, was only successful in a few areas. Baemin had a lot of success drawing clients in the era when there were a lot of specials. Recognizing the importance of client retention to increase the number of repeat consumers. As a result, we completed the project "Building a Baemin Marketing Strategy." This issue focuses specifically on developing a strategy for firms to "retain consumers." With a drive to design campaigns and the best solutions for businesses to encourage clients to stay with the dependable food delivery brand "Baemin". 4 2. BUSINESS INTRODUCTION: 2.1. General introduction about Baemin: - Baemin (short for Baedal Minjeok) is the leading food delivery application in the Korean market with headquarters located in Seoul, launched by startup Woowa Brothers in 2010. After Woowa Brothers bought Vietnammm, it was officially launched. launched Baemin application version in Vietnam market on May 14, 2019. - Baemin provides services in the food delivery industry operated by Vietnam MM Co., Ltd., Baemin will be primarily responsible for operations management. The application helps connect food suppliers, delivery service providers, and people who need to use food delivery services. Therefore, Baemin is an application that inherits technology from the leading food delivery application in the Korean market with more than 9 years of experience in this market, along with the number of customers and shippers available after the acquisition. Vietnammm. Baemin will contribute to ensuring the effective connection between users, partner restaurants, and food delivery partners even when transporting many orders at the same time to bring the best experience to customers. partners and customers. 2.2. Features: - The main feature of Baemin application is to order food online using a mobile application similar to GrabFood, Now, Go-Food services. Baemin will link up with restaurant partners so that sellers can upload products, food, and drinks on the application so that customers can choose food and order to have it delivered to their place. - Baemin also has his team of food delivery shippers, not using intermediary delivery services. Baemin officially operated in Vietnam market from May 14, 2019, with service coverage in Ho Chi Minh City, after more than a month of testing this application on some central areas in the same area. 2.3. Mission: - Baemin's mission when coming to Vietnam is "Helping people eat delicious food anytime, anywhere" with just a few simple steps on the application such as: Choose food, choose the nearest store and order, and then The food will be delivered quickly at an extremely reasonable price. Whether it's a daily meal or a high-end culinary need, an afternoon cup of milk tea, or a morning cup of coffee; all are met in the 5 most "hot and crispy" way by Baemin through a series of restaurants and eateries from popular to high-class. 2.4. Resources: - Beamin is owned by Woowa Brothers Corp (valued at $4 billion in 2019). Baemin's total assets are 534 billion VND, charter capital is about 1 billion VND. - Currently in Vietnam, Baemin is present in Hanoi, Ho Chi Minh City, and Da Nang - Baemin's revenue in 2020 is 1.09 trillion won (equivalent to 960 million USD), up 94.4% from a year earlier (loss amounted to 569 billion VND, on revenue of 76 billion VND). Despite the skyrocketing revenue, Baemin recorded an operating loss of 11.2 billion won in 2020 and was the second consecutive year of losses. However, the loss fell by 69.2% year on year. Food delivery orders placed through Baemin in 2020 reached 15.7 trillion won, up 78.4% from the previous year. (Business results of Woowa Brothers Vietnam (Baemin) for the period 2016 – 2019) 6 2.5. Customer: - Baemin's main customers are also young customers who often use smartphones as well as online ordering and online payment services. 2.6. Current position: According to the Vietnam Online Food Delivery Service Market Report 2020, which has just been analyzed by Reputa- Social Listening Platform, GrabFood is the leading brand in the market, accounting for 33.38% of the discussion market share, followed by GrabFood. is Now with 23.16% of the discussion on social, the third is Baemin with 21.95%. Loship and GoFood accounted for 15.14% and 6.37% of the discussion market share, respectively. - In May 2020, Baemin achieved the same amount of discussion as GrabFood at the same time when the brand started promoting communication activities. In terms of discussion participation rate, Beamin is most popular with young people in Ho Chi Minh City; while Grab Food, Go Food and Loship are more popular with younger people, from 36-45 years old. Now is more interested and preferred by women with the highest proportion of women accounting for 78%. GrabFood is the only brand that receives more attention from Men (54%) than women (46%). 2.7. SWOT Analysis: Strengths - Friendly, beautiful images, sympathetic words to consumers. - Vivid, clear, easy-to-operate interface. Weaknesses - The illustrations for the food have not been fully updated, especially the restaurants in Hanoi. - Many promotions and discounts every day (up to 60%). - The closed shop and the open shop are not separated, making it easy for users to confuse - Many dishes and currently being updated continuously. - The list of food shops and restaurants is still not diverse. - Maintenance shipping fee, no increase in freight, much surcharge. - Shipper is friendly, cheerful, polite. - There is no chatbot for quick handling when the restaurant is closed or cannot order. - Convenient features such as saving items in the basket, saving orders for - Reviews of restaurants and dishes are not clear. 7 each purchase, or suggesting dishes are all effective. - There are many different collections easily many different objects to choose from - The payment solution integrates many solutions for maximum flexibility. Opportunities - BAEMIN Is the best growth app in the online food delivery market in Vietnam. - BAEMIN is the top 3 application in the Vietnam market thanks to the popularity and love of young people. - Discussion market share in food delivery brands in the top 3. - The situation of the Covid epidemic led to an increase in the number of orders. Threats - In the future, there will be many new food delivery applications with many strengths and attractive promotions, making it easy for brands to lose customers. - The problem of traffic congestion and environmental pollution affecting the quality of food and delivery time makes it easy for customers to abandon the brand. - The rapid urbanization in Vietnam combined with technology factors makes the target market larger and larger. 3. ENVIRONMENTAL ANALYSIS: 3.1. Macroeconomic Environment: 3.1.1. Demographic environment: The number of Vietnamese people aged 16-33 is about 30% of the population. At this age, most of the students, students, and working people have high dietary needs. 8 3.1.2. Economic environment: Income per capita: 2,750 USD/person/year. According to Picodi's calculations in 2020, basic food cost/minimum wage in Vietnam stands at 50.2%. According to Deloitte's survey on Vietnamese consumers published in February 2021, people tend to give more priority to items in the list of necessities in the family's monthly spending budget. Compared to 2019, spending on food (including prepared, fresh, and canned food) increased from 34% to 42%, housing & utility costs also increased from 7% to 12%. 3.1.3. Socio-cultural environment: Vietnamese people attach great importance to the culinary culture of their homeland but are also very willing to discover and experience new dishes. Young people's eating trends also change with new lifestyles, such as eating clean, healthy, etc. Besides, they also like to experience the food and drink of famous brands. However, the serious Covid-19 epidemic has limited people's going out. This also significantly affects people's daily life habits and is a premise for the development of online food delivery services. 3.1.4. Legal and political environment: Stable politics with many State policies on economic development facilitated the wide development of a network of eateries throughout the country that is no longer restricted to the region. In terms of law, because of the strong outbreak of the Covid-19 epidemic, restaurants, and bars in many districts and cities across the country have to stop providing on-site food services that can only be bought and taken away. This affects people's habits; at the same time, promotes the development and use of many online food delivery services. 3.1.5. Technological environment: The era of technology revolution 4.0 creates a strong development of new services and technologies. Besides, the percentage of Vietnamese people using smart mobile phones and the Internet is increasing, making online applications and services more accessible to consumers. This includes online food delivery services. With advantages 9 in technology, convenience, and ease of use, this industry is fully capable of developing more in the future. 3.1.6. Natural environment: The increasingly polluted environment makes Vietnamese users increasingly change their views, habits and love a green lifestyle with environmentally friendly products, try to use plastic bags, and use less plastic wrap. as much as possible. This also significantly affects the products and services serving consumers of businesses, including the food delivery industry. 3.2. Microeconomic environment: 3.2.1. Industry environment: According to Reputa, in 2020, Vietnam recorded strong growth in online food delivery due to COVID-19 (1,140,397 discussions). According to market research company Euromonitor International, the online food delivery market in Vietnam will reach 195 million USD in 2020, an increase of 33% compared to 2019. In which, delivery via the app is expected to reach a scale of about approx. $38 million, double that of last year, and will grow 11% on average over the next 5 years. Market research company Kantar TNS estimates, the revenue of the online food delivery market can reach 449 million USD by 2023. 3.2.2. Customer: Habits of using food delivery services: According to the report "Trends to use food delivery apps in Vietnam 2020" published by Q&Me in mid-December 2020, 80% of survey respondents ordered food. online at least once a week, mostly at lunch and dinner. According to the survey, 57% of app users often look for restaurant discount codes when ordering food online. On the other hand, 73% of users often choose food with free delivery. The results of market research in 2020 conducted by Gojek-Kantar on culinary consumption behavior of Vietnamese people show that lunch and dinner are the two most important meals, Vietnamese people rarely eat alone and give priority. Food quality and variety rather than convenience. More than 60% of people have a habit of eating at restaurants, cash payment prevails and the average spend on ordering food online is twice as much as eating on the spot. According to an analysis from Reputa, the main reason for customer satisfaction with the service is "preferential programs and promotions" (accounting for 84%). Speed is 10 not always the dominant point, what customers care about is which service has the most promo codes, rather than the speed of delivery (which is only 2%). In addition, the time of dinner is when customers use the service the most, many brands have made good use of this point to attract orders. 3.2.3. Competitive Analysis: Baemin's direct competitor analyze table: No Firm Advantage 1 ShopeeFood - Customers can refer to comments, reviews, photos before ordering. - The most abundant restaurant data of all apps (nearly 37,000 shops in Ho Chi Minh City) and available in 15 other provinces. - Intuitive app interface, users can take notes, or add topping according to each dish. - There are many payment methods such as AirPay ewallet, card payment. Disadvantage - Time to confirm the application is still slow - Surcharge for shops located in commercial centers, shops that do not sign contracts (3,000-6,000 VND) - AirPay wallet is multi-step and complicated, you need to install Now payment tap and card link. - Faced with allegations of forcing drivers to match orders and cutting too much revenue percentage. - 24/7 operation 2 GrabFood - Developed from an online ride-hailing platform - Built-in Moca e-wallet link right in the app - There are many promotions for each member, different levels. 11 - Offers are uneven across devices and users depending on customer segments - The shop data is not much, most of the shops available on the application are the shops that sign a discount contract. - Handle and solve, take good care of customers when having problems. - Grab's delivery fee is cheaper than the market. - Because the shipper flexibly chooses a Food or Bike menu, most drivers are not equipped with a thermos container. - Accumulate points after each service use and use points to exchange gifts or vouchers. - Hours of operation 24/7 3 GoFood - The number of restaurants is large, with flexible suggestions to help users choose easily. - There are many promotions. - Fast delivery speed. - Only support cash payment - Only operating in Hanoi and Ho Chi Minh. - Does not support viewing the driver's route. -> Other indirect competitors of Baemin: private delivery apps of food, drinks brands or ordering through brand call centers (The Coffee House, KFC, Popeyes, McDonald's, Burger King, Pizza Hut, etc.) 4. FUTURE OBJECTIVES: 4.1 Business objectives: - 15% revenue growth. - Cut losses by 20% (equivalent to 114 billion). - Market share rose to 2nd 4.2 Marketing objectives: - Increase brand awareness - App downloads reached 2 million - Increase the number of people using the app from 46% to 60%. 12 - Increase the frequency of frequent orders by 25% (previously 16%); while increasing the value per order. - Generate positive discussion about the brand. - Increasing satisfaction level from 93% to 95% helps increase brand love and gain market share of customers. => From there, improving customer loyalty to Baemin; retaining customers, and protecting the market share that Baemin is holding. This is the most important and main goal that this marketing strategy aims at. 5. MARKETING STRATEGIES: 5.1. Target Market Analysis: Based on the SWOT analysis as well as the dominant factors on the current position, development orientation, and market context. Baemin should choose to segment the market according to two main criteria: Age and Geographical location. Baemin segmented the market according to the following criteria: - Age: Under 16 years old 16 - 35 years old (current customer file and using Baemin the most) 35 - 55 years old Over 55 years old - Geographical location: Large cities and economic centers of the country such as Hanoi, Ho Chi Minh City, Da Nang, Hai Phong. Large provinces’ cities: Vinh, Hai Duong, Hung Yen, - Rural areas and other areas - To make the goals and orientations given above become possible, we choose a target customer group from 16-35 and live in big cities such as Hanoi, Ho Chi Minh City, and Da Nang. Nang, Hai Phong. Reason: 13 - The market segment is large enough to be able to achieve the goals of the business. - The business can outperform current and potential competitors. - In accordance with the responsiveness and performance of the enterprise. 5.2. Target Market Table: Age 16 – 35 Job Students, office workers. Geographical location Mainly urban areas, concentrated in big cities such as Hanoi, Ho Chi Minh City, Da Nang, Hai Phong. Customer psychology Users have many goals and ambitions. They tend to build a personal image on the social network. Love food that is both convenient, convenient, and affordable. Prefer e-commerce sites or simply help yourself have a variety of choices in shopping. Customer behavior More than 60% of people don't use food ordering apps because they prefer to cook for themselves. 72% use it because it saves time when traveling. 58% use because of popularity. 55% use because lazy to go out and special. 49% choose because this is a safe form for the COVID-19 epidemic. 14 80% order food and drinks at least once a week. More than 50% order food at noon, followed by orders at dinner and breaks. More than 80% of users are satisfied with the apps because of the fast delivery. Lifestyle Customers are busy and focused on their jobs, so they are comfortable with the surrounding factors, not too fussy about the quality of a meal, just need to meet the basic requirements and variety when it comes to food options. Most are single, so their lifestyle is focused on work, they focus on important things in life instead of everything, they want to have time to rest after stressful working hours. 5.3. 4Ps Marketing Mix: 5.3.1. Product: - Baemin's core value: "Food delivery specialist". Currently, Baemin is facing two product problems. - Firstly, customers cannot order because the driver does not accept orders from far away. For this case, there are two solutions. First, for drivers who have already received orders but canceled due to customers being far away, Baemin will take action to penalize drivers who cannot receive orders within 30 minutes. At the same time, for drivers who receive orders from far away, Baemin will reward the driver according to the increasing level of distance, order value, and number of orders/day. - Second, for the problem of the app being virtual distance, making it inconvenient for customers and drivers. Baemin will adjust the distance calculation function on the app to ensure the interests of customers as well as drivers. 15 5.3.2. Price: - In the field of food delivery, price is a competitive factor in business. After researching competitors and market acceptance, Baemin needs to come up with a reasonable delivery price (lower or equal to competitors). - To achieve the goal of "retaining customers", Baemin can use the following 2 pricing strategies: - Combo pricing strategy: Some businesses can combine products/services to sell in combo form (package), at a price lower than the total listed price of the products in the combo. - Promotion pricing strategy: many businesses strongly reduce prices on some items for a short period on a certain occasion (events, holidays, Tet…) to boost sales. These sale times are often referred to as “flash sales”. - Combo price strategy - service provision: Membership card provides a monthly shipping service package to customers for all shops, all order values , and exclusive special vouchers from partner brands. 5.3.3. Place: - Service distribution channel: Restaurant -> Driver -> Customer includes three forms of distribution as follows: - Customers come to the point of sale (restaurant). - The driver arrives at the customer's address. - Customers interact with remote service providers (Baemin) 5.3.4. Promotion: - Give promotional codes to customers. - Discount codes when paying with electronic payment wallets: Momo, Zalopay - Give birthday gifts to members who register for cards in their birthday month, send birthday messages to customers on their birthdays. 16 6. MARKETING IMPLEMENTATION: 6.1. Brand Direct Marketing: - Customer retention strategy. - Increase and protect Baemin's market share. - Currently, Baemin is the 3rd most popular app (after Grabfood and Now) and has the fastest growth rate in the market. Therefore, the current market is mainly located in Hanoi and Ho Chi Minh City. , for Baemin to achieve his Marketing and business goals as well as to dominate and increase market share in the current food delivery app market, we propose to choose a targeted market access strategy. The target is: - "Customer Retention" strategy - Orientation strategy to penetrate and develop the market Main objective: In addition to the 2 main markets of Hanoi and Ho Chi Minh City, in the upcoming strategy, Baemin will set foot in new markets which are 2 other big cities Da Nang and Hai Phong so the main goal is to increase and protect market share. - Some programs to help the strategy: + Advertise, encourage more people in the current market to choose the product + Launch loyalty program + Launch promotions, discounts + Launch interactive programs with customers such as organizing events, giving gifts,... + Create essay topics, trends on social networks to build a friendly, easy-to-use image on social media, newspapers,... + Expand the list of partners and organize programs with brands in other related fields such as e-wallets, Shopee,... + With a service industry like Baemin, we need to orient more values on products and prices for customers. + Baemin needs to build a process from supply to product to the customer quickly and conveniently to get this, the delivery staff is very important. 17 6.2. Multi-platform marketing campaign: Introduce - share - spread campaign Stage Introduce Share Spread Target Educate customers about the driver's difficulty and hardship and the value of the shipping fee Introducing Baemin's membership card Increase the number of membership card registrations Schedule 1 month 3 months 6 months (1 month after stage 2 “share”) Main activities Discussion on Social TVC Baemin x Media Amee Tiktok Challenge TVC Main contents Create a discussion on Social Media about the value of service fees Animated TVC "Journey of food" Support activities Budget 18 PR Articles, KOLs, Facebook Ads, Youtube Ads 5 billion VND Introducing the features and special offers of exclusive membership cards Join TikTok challenge to enjoy discounts when becoming a member of Baemin Introducing incentives when inviting new members to Baemin Social Media, Pr Articles, Facebook Ads, Youtube Ads 8 billion VND Social Media, Pr Articles, KOLs, Ads 2 billion VND - In addition, in the process, two new collections were launched: "Korean Restaurant" (Collection of Korean restaurants recognized by Baemin himself), "Mother's Dishes" (Collection of restaurants that provide simple, familiar, and delicious dishes like homemade). 7. EVALUATION AND CONTROL: - In the process of implementing the strategy to retain customers with the "Baemin" brand, we have identified some advantages and disadvantages as follows: 7.1 Advantages: - With the advantage of being young and the parent company in Korea, Baemin knows how to take advantage of close KOLs with high coverage for young people, so Baemin's next promotion process is also easier. When continuing to collaborate with singer Amee, the name has become associated with Baemin and is loved by the majority of young people. - Easily shape the portrait of the target customer because the target audience is young people with similar views and psychological trends. In addition, we can also be potential customers of the business. Make it easier for us to analyze. - Easy to find information about services, brands, and markets due to previous experience and many articles that give a lot of information. - Easily get customer data through the phone number, date of birth of the app registration. 7.2 Difficulties: - Difficulty in communication campaign in the re-education of customers. Because part of the target customer is a large number of students who do not have much income, the attraction of immediate benefits to them is still quite high. - Difficulty because at present due to the pandemic, it is difficult to organize events for communication or sponsorship. 19 8. CONCLUSION: The food delivery business in Vietnam is particularly fascinating, as evidenced by the analysis on the issue "Building a marketing strategy for Baemin." Because the market will be welcoming more new brand faces in the near future, the brand must have early orientations and tactics. We feel that adopting this issue for a company like Baemin, which is still young but has an extraordinarily high growth rate and satisfaction level, would provide a new and youthful path for the trade market. Baemin in particular, and food in general. Baemin currently has significant advantages and opportunities to dominate this fertile market, but the Korean brand must also consider its environmental weaknesses and challenges, particularly in light of the COVID-19 epidemic to develop guidelines and policies that are appropriate for business resources and the current situation. We researched and studied Baemin's competitors as well as their target clients. Our study and assessment are still limited due to a lack of resources; however, these are valuable competitor analyses that Baemin should consider and target customers in the near future. Upcoming. The aforementioned research will be helpful to people who are interested in this market, as well as to Baemin. We choose the aim for the topic of both corporate goals and objectives based on the aforementioned considerations. Marketing goals and development techniques to achieve the aforementioned goals (Strategy to retain customers - Increase and protect market share). We have also concretized the strategic orientation using the 4P's methods. Other departments and departments will benefit from the orientations on the program of the elements in the 4P's because they will have a more detailed and clear vision of the strategy, allowing the strategy to be executed more easily and successfully. Certainly, the execution will have benefits and drawbacks, but with the ability of businesses and marketers, the plan will be realized in the market and Baemin will achieve favorable results in the future. ------------------------------------------------------------------------------------------------------------------------------ 20 REFERENCE -Picodi.com Vietnam. 2021. Basic food cost/minimum wage in Vietnam. [online] Available at: <https://www.picodi.com/vn/> [Accessed 21 December 2021]. -Www2.deloitte.com. 2021. [online] Available at: <https://www2.deloitte.com/content/dam/Deloitte/vn/Documents/consumer-business/vn-cb-consumersurvey-2021-vn-version.pdf> [Accessed 21 December 2021]. -Euromonitor. 2021. Food and Drink E-Commerce in Vietnam. [online] Available at: <https://www.euromonitor.com/food-and-drink-e-commerce-in-vietnam/report> [Accessed 21 December 2021]. -Reputa.vn. 2021. Báo cáo thị trường Dịch vụ Giao thức ăn trực tuyến Việt Nam 2020. [online] Available at: <https://www.reputa.vn/blog-detail/download-bao-cao-thi-truong-dich-vu-giao-thuc-an-truc-tuyen-viet-nam2020> [Accessed 21 December 2021]. -Kantarworldpanel.com. 2021. Kantar | Consumer panel research | Consumer behavior insights | Consumer panels - Kantar Worldpanel. [online] Available at: <https://www.kantarworldpanel.com/vn> [Accessed 21 December 2021]. -Inc., A., 2021. Xu hướng sử dụng Ứng dụng giao hàng thức ăn tại Việt Nam 2020 - Báo cáo nghiên cứu thị trường | Q&Me. [online] Qandme.net. Available at: <https://qandme.net/vi/baibaocao/xu-huong-su-dung-ungdung-giao-hang-thuc-an-tai-vietnam-2020.html> [Accessed 21 December 2021]. -Gojek.com. 2021. [TCBC] GoViet công bố kết quả khảo sát xu hướng hành vi tiêu dùng ẩm thực | Gojek. [online] Available at: <https://www.gojek.com/vn/blog/goviet-cong-bo-ket-qua-khao-sat-xu-huong-hanh-vi-tieu-dungam-thuc/> [Accessed 21 December 2021]. -2021. [online] Available at: <https://www.thegioididong.com/game-app/baemin-la-gi-nhung-dieu-can-biet-veung-dung-dat-do-an-truc-1395799> [Accessed 21 December 2021]. 21