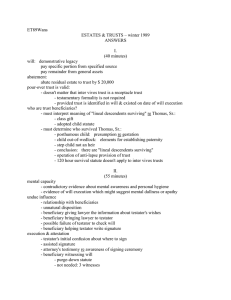

Inheritance The giver has the right to give property, as a part of their right to property, but receivers do not have a right to property. The giver is able to give their property to whoever they choose. Hodel. While the Government cannot "take sticks away" from your bundle of property rights, they can "break some off," for example, in taxing at death, etc. Forced Heirs: In the United States, surviving spouses get some protection, but children get almost none. Personality Rights: (RCW 63.60) "Every individual or personality has a property right in the use of his or her name, voice, signature, photograph, or likeness." Public Policy There's a line between a will that includes a condition that would disinherit a beneficiary if the beneficiary married outside of a religion (enforceable) and a condition that would disinherit a beneficiary if the beneficiary divorces their spouse (unenforceable) or if they were to marry someone of a specific race (unenforceable). Enforceability of provisions can be challenged on public policy basis. ● Taking: Under constitutional law, the government’s actual or effective appropriation of a person’s private property, including by substantially interfering with such person’s use and possession of the property. If the government takes private property for public use, the government must provide "just compensation" to the property owner. ● Escheat: Where required by statute, the transfer of a decedent’s property to the state or as otherwise directed by the statute, rather than by descent or devise. Often used when there's no will, no family members, etc. ● Devise: The giving of property—usually real property—by will. ● Inter Vivos: A legal term of art typically referring to a transfer of property that takes place during the grantor's lifetime, as opposed to a transfer that is effective only upon the grantor's death, such as by will or intestacy. ● Revocable Inter Vivos (Living) Trust: A document under which assets are held in trust for specified beneficiaries during the life of the settlor and the settlor reserves the right to revoke the trust during his or her lifetime. The trust also directs how the income and assets of the trust are to be distributed after the death of the settlor. Ethics Common Problems of Professional Responsibility 1. A duty of competence owed to a client's intended beneficiaries in addition to the client, and 2. Duties in joint representation of multiple persons in the same family. Privity Defense Generally, privity exists when there is a contract between parties. However, even though there is no privity between a drafting attorney and an intended beneficiary, the foreseeability of injury to the beneficiary demands an exception to the privity rule. An intended beneficiary has "third-party status," thus the drafting attorney has a duty to the intended beneficiary. (Simpson). As a result, an intended beneficiary is able to sue the lawyer for malpractice. Only several states still follow the "old rule" that a lack of privity between the drafter and an intended beneficiary bars a malpractice action by the beneficiary. Jurisdiction Generally, the validity and construction of a will is a matter for the probate court to decide. The negligence of a lawyer is a matter for a court of general jurisdiction. Engagement Letters In instances where a lawyer may be representing multiple members of the same family, it's important for the lawyer to discuss the issue of conflict of interests and the ground rules for sharing information, including the advantages and disadvantages of joint representation. And then, an engagement letter (or other form of consent) should be put into place. Bequests to Attorneys Undue Influence Many states hold that a presumption of undue influence arises when a lawyer receives a bequest under a will that the lawyer drafted, unless the lawyer is closely related to the testator. In some states, the presumption can be rebutted only by clear and convincing evidence, and in a few states the presumption is conclusive. Professional Responsibility Rule 1.8 of the Model Rules of Professional Conduct provides that a "lawyer shall not solicit any substantial gift from a client, including a testamentary gift, or prepare on behalf of a client an instrument giving the lawyer or a person related to the lawyer any substantial gift unless the lawyer or other recipient of the gift is related to the client." Even if the client is a relative of the lawyer, the lawyer needs to exercise "special care" if the proposed gift to the lawyer is disproportionately large in relation to the gift the proposes to make others who are equally related. Fiduciary Appointments A fiduciary appointment is not a gift, but the lawyer might be entitled to compensation for serving as fiduciary. To avoid any conflict of interest issues, the lawyer should explain "the role and duties of the fiduciary, the ability of a lay person to serve as fiduciary with legal and other professional assistance, and the comparative costs of appointing the lawyer or other person or institution as fiduciary. “ Safeguarding A Will Potential difficulties of locating wills have prompted some lawyers to recommend that the client's original will be left in the lawyer's care. The client should be given a copy of the will and a cover letter in which the location of the original will is noted. Keeping a client's will, however, may have the appearance of soliciting business, a potentially unethical practice. RCW 11.12.265: Filing of original will with court before death of testator. Any person who has custody or control of any original will and who has not received knowledge of the death of the testator may deliver the will for filing under seal to any court having jurisdiction. The testator may withdraw the original will so filed upon proper identification. Any other person, including an attorney-in-fact or guardian of the testator, may withdraw the original will so filed only upon court order after showing of good cause. Upon request and presentation of a certified copy of the testator's death certificate, the clerk shall unseal the file. This section does not preclude filing a will not under seal and does not alter any duty of a person having knowledge of the testator's death to file the will. Probate Process Purposes of Probate and the Process ● ● Transferring of title of decedent’s property to heirs. Settling creditor claims. There was a time when probate was the only readily available way to transfer property with clear title at a person's death. However, because the process became cumbersome, much more property today passes by nonprobate transfer via a will substitute than by probate transfer via a will or intestacy. Property that passes by will substitute outside of probate is said to be nonprobate property. Although nonprobate succession is the norm, probate administration remains important. If a decedent didn't arrange his affairs during life so that all of his property passes by nonprobabte transfer and his family cannot divide up the property in private, probate administration fills the gap. If a dispute or other difficulty arises for a nonprobate transfer, the probate system will be call to resolve the matter. Inter Vivos Trust While property held in testamentary trust created under the decedent's will passes through probate, property put in an inter vivos trust during the decedent's life passes in accordance with the terms of the trust. The benefit of this is that it avoids probate administration. Because the trustee holds legal title to the trust property, there is no need to change title by probate administration upon the death of the settlor. This is a will trust and is generally preferred over the testamentary trust. Pay-On-Death (POD) and Transfer-On-Death (TOD) Contracts The account custodian distributes the property at the decedent's death to the named beneficiary. To collect property held under a POD or TOD arrangement, all the beneficiary need do is file a death certificate with the custodian. Life Insurance The proceeds of a life insurance policy on the decedent's life are paid by the insurance company to the beneficiary named in the insurance contract. The company pays upon receipt of a death certificate of the insured. Life insurance is thus a form of POD contract that operates independently of probate administration. Joint Tenancy The decedent's interest vanishes at death. The survivor then owns the whole property free of the decedent's interest. In order for the survivor to perfect title to jointly held real estate, the survivor need only file a death certificate with the local registrar of deeds. To perfect title over a joint bank or brokerage account, the survivor need only file a death certificate with the bank or broker. Probate Terminology ● Probate Property: Property solely in the name of the decedent, owned only by the decedent, or owned with other persons but with no survivorship provisions. ● Nonprobate Property: Property with some contractual obligation directing transfer upon death of owner, such as life insurance, joint tenancy, pension assets, etc. Arrangement has been made during life, thus not governed by will. ● Personal Representative: When a person dies and probate is necessary, the first step is the appointment of a personal representative. This person is a fiduciary who collects and inventories the property of the decedent; manages and protects the property during the administration of the estate; processes the claims of creditors and files tax returns; and distributes the property to those entitled. A personal representative has the duty to settle and distribute the estate efficiently under the terms of the will and the Uniform Probate Code, and in the best interests of the estate and the decedent’s successors. ● Testate: If a decedent dies with a will, she is said to die testate. If a testate decedent in her will names the person who is to execute the will and administer the probate estate, such personal representative is usually called an executor. If the will does not name an executor, the named executor is unable or unwilling to serve, or the decedent dies intestate, the court will name a personal representative who is generally called an administrator. Under the UPC, the following classes of people will be appointed to serve as personal representative, in this order of priority: ● (1) anyone named in any probated will, ● (2) a surviving spouse of the decedent who is also slated to take under a will, ● (3) a designated taker under the will other than the surviving spouse, ● ● ● (4) a surviving spouse of the decedent who is not slated to take under the will, (5) other heirs of the decedent, and (6) a creditor of the estate, once 45 days have passed from the decedent’s death. Probate Administration Probate serves three functions: (1) it provides evidence of transfer of title to the new owners, making the property marketable again and allowing the new owner to fend off rival claimants; (2) it protects creditors by providing a procedure for payment of the decedent's debts; and (3) it distributes the decedent's property to those intended after the decedent's creditors are paid. Opening Probate and Choice of Law Generally, the law of the state where the decedent was domiciled at death governs the disposition of personal property, and the law of the state here the decedent's real property is located governs the disposition of the property. Thus, the will should first be probated in the jurisdiction where the decedent was domiciled at death. This is known as the primary or domiciliary jurisdiction. If the probate estate includes property that is located in another jurisdiction, ancillary probate in that jurisdiction is required. The main purpose of requiring ancillary probate proceeding is to prove title to property in the situs state's recording system and to protect local creditors. Because these proceedings can be costly and timely, attorney's commonly advise clients with real estate in another jurisdiction to put the property in an inter vivos trust. Will Contests (RCW 11.24): A will contest must be filed within 4 months after the probate has been opened. If there are multiple heirs, you would want to be the first one to submit the will or else you may be in the position to have to contest the will. Formal and Informal Probate UPC Sec. 3-301 sets forth the requirements for informal probate. Without giving notice to anyone, the representative petitions for appointment. The petition must contain pertinent information about the decedent and the names and addresses of the spouse, the children, or other heirs, and, if a will is involved, the devisees. If the petition is for probate of a will, the original will must accompany the petition. UPC Sec. 3-401 (formal probate) is a litigated judicial determination after notice to interested parties. A formal proceeding may be used to probate a will, to block an informal proceeding, or to secure a declaratory judgment of intestacy. Formal proceedings become final judgments if not appealed. Interested Persons: The UPC defines an interested person as including heirs, devisees, children, spouses, creditors, beneficiaries, and any others having a property right in or claim against a trust estate or the estate of a decedent, ward, or protected person. Supervised and Unsupervised Administration In a supervised administration (UPC Sec. 3-501), the personal representative is subject to the continuing authority of the probate court while administering the estate. The representative is empowered to act without interim court approvals, but she cannot make a distribution to the beneficiaries without approval from the court. In an unsupervised administration (UPC Sec. 3-715), after appointment, the personal representative administers the estate without going back to court. The representative has broad powers of a trustee in dealing with the estate property and may collect asserts, clear titles, sell property, invest in other assets, pay creditors, continue any business of the decedent, and distribute the estate—all without court approval. Unsupervised administration is the default under the UPC, but an interested party can petition for supervised administration at any time (UPC Sec. 3-502). Rights to Creditors Nonclaim statutes require creditors to file claims within a specified time period (Wash. is 4 months if notice given; 24 months if no notice given). Claims filed after that period are barred. These statutes come in two forms: (1) they bar claims not filed within a relatively short period after notice is given that probate proceedings have commenced, generally two to six months; or (2) they bar claims not filed within a longer period after the decedent's death, generally one to five years. ● Tulsa Prof. Collection Servs.: published notice only, without informing the creditor, violates due process. ● Washington State: The personal representative of a probate estate is not required to publish notice to creditors. If a notice is given, a creditor will have 4 months to file a claim. However, if notice is not given, then creditors will have 24 months to file a claim. Closing The Estate A personal representative of an estate can close only after several required steps, including identifying and paying creditors, clearing titles, paying taxes, and selling businesses. For a supervised administration, judicial approval is required to relieve the representative from liability. For an unsupervised administration, the estate may be closed by filing a sworn statement that the representative has published notice to creditors, administered the estate, paid all claims, and sent a statement and accounting to all known distributees. Avoiding Probate Probate can be avoided, provided that during life the client arranges to transfer all of his property by way of will substitutes (bank, etc.). In this scenario, probate serves as a backup function. Even for probate property, probate administration is not always necessary, such as where the amount of property is small. In this case, just an affidavit of the successor in a summary administration (estates of $25,000 - $100,000) is necessary. Lost Wills and Presumption of Revocation The presumption of revocation arises when a will last known to be in the testator's possession cannot be found (or is found in a mutilated condition). The law presumes that the will cannot be found because the testator destroyed or mutilated it with the intent to revoke it. There is a split of authority on how much evidence is needed to overcome the presumption of revocation. Many cases have required clear and convincing evidence, but recent cases, following the restatement, require only a preponderance. If the presumption is rebutted, the will is entitled to probate if its contents can be proved, unless the party opposing probate proves the will was actually revoked. If a lost or mutilated will was last known to have been in the possession of someone other than the testator, there is no presumption of revocation, and the will is entitled to probate unless, of course, there is proof that the testator in fact revoked the will. Death Taxes Federal Gift Tax Taxable Gifts ● ● Inadequate Consideration in Money's Worth: A transfer of property for less than adequate and full consideration in money or money's worth is a taxable gift. There is a safe harbor for transfers made pursuant to a sale or exchange in the ordinary course of business that is arm's length and free from donative intent. Completion: A transfer is not subject to gift taxation until it is complete, that is, until the donor has relinquished all "dominion and control" over the property. There is not gift tax due upon the funding of a revocable trust, for example, because the settlor retains the power to revoke or amend the trust. The Annual Exclusion The Internal Revenue Code allows a donor to exclude from gift taxation a certain amount of value given to each donee in the current year. The IRC also allows an unlimited exclusion for tuition payments and medical expenses paid directly to the provider. Federal Estate Tax The first step in calculating an estate tax is to compute the value of the decedent's gross estate, which includes lifetime gratuitous transfers over which the decedent retained a possessory interest or control of beneficial enjoyment, and also any property over which the decedent had a general power of appointment. From the gross estate certain deductions may be taken, such as for the decedent's debts and other claims against the estate, state death taxes, transfers to the decedent's spouse, and transfers to charity. The gross estate minus deductions equals the taxable estate. To compute the estate tax, adjusted taxable gifts are added to the taxable estate. The total of these two amounts is the estate tax base, against which the tax rate is applied to produce a tentative estate tax. The Gross Estate ● The Probate Estate: The IRC includes in the gross estate any property that under state law is included in the decedent's probate estate. ● Joint Tenancy: Because a decedent's interest in a joint tenancy vanishes at death, it is not included in the probate estate and is not included in the gross estate. Such an interest may be included under IRC 2040, depending on whether the interest was in a joint tenancy between persons other than spouses, or a joint tenancy between spouses. ○ Persons Not Married to Each Other. If the joint tenants are not married to each other, IRC includes in the gross estate the entire value of the property held in joint tenancy, except any part that is attributable to consideration furnished by the surviving joint tenant. ○ Spouses. If property is held by the decedent and the decedent's spouse as joint tenants with right of survivorship or as tenants by the entirety, one-half of its date-of-death value is includable in the decedent's gross estate regardless of which spouse furnished the consideration for the property's acquisition or improvement. ● Annuities and Employee Death Benefits: Survivor benefits paid under annuity contracts and retirement plans may be includible in the decedent's gross estate; such benefits are included to the extent that the decedent had a right to current or future distributions while still living, and another beneficiary will receive distributions by reason of surviving the decedent. However, survivorship benefits that are payable by statute to the decedent's spouse or children are not included because the decedent did not have the power to select the beneficiary. Social security benefits are therefore not included in the gross estate. ● Life Insurance: IRC requires inclusion in the gross estate insurance proceeds on the life of the decedent if (1) the policy proceeds were payable to the decedent's probate estate, or (2) the decedent possessed at death any incident of ownership in the policy. ● Retained Rights or Powers: Gifts with strings attached, such as a right to retain possession or enjoyment of the property, will be included in the donor's gross estate. Deductions The Marital Deduction The marital deduction has been based on the theory that donative transfers between spouses should not be subject to wealth transfer taxation between because the spouses are one economic unit. Under the IRC, unlimited amounts of property, other than certain "terminable interests," can be transferred between spouses without gift tax or estate tax liability. The Charitable Deduction IRC allows an unlimited deduction if the gift is properly structured and the organization that received the property qualifies under the Code The Generation-Skipping Transfer Tax A generation-skipping transfer is a transfer—whether lifetime or deathtime—to a skip person. A skip person is a grandchild or any other person assigned to a generation that is two or more generations below the transferor's generation. The GST tax is levied on generation-skipping transfers in the form of (1) a taxable termination, (2) a taxable distribution, or (3) a direct skip. Power of Appointment General Power A general power of appointment is one which allows the holder of the power to appoint to himself, his estate, his creditors, or the creditors of his or her estate the right to have the beneficial use and enjoyment of certain property covered by the power of appointment. Special Power A special power of appointment gives the donee power to give the decedent's assets to a select group of individuals. The objects of the power in a special power of appointment cannot be the donee herself, her estate, her creditors or creditors of her estate. Gifts An inter vivos gift is a transfer of property during the donor’s lifetime with (1) donative intent and (2) without consideration. The donor must deliver the property to the donee, who in turn must accept the gift. A transfer is made without consideration if the donor expects nothing in return. A transfer in exchange for inadequate consideration can be an inter vivos gift to the extent that the property’s value exceeds the consideration paid. Intestacy Purpose A person who dies without a will is said to die intestate. Intestacy statutes are intended to approximate what most people would want to do with their estates. Most people in the U.S. die intestate. Process Two steps: Divide the estate into categories of people (piles), then divide each pile. ● Length of marriage: Intestacy laws do not take into account length of marriage, because laws are focused on intent of marriage, and when a individual passes away, the couple was not intending on ending the marriage. 1. Sort into piles (UPC 2-102, 2-103) a. The first inquiry is whether there is a spouse. i. If there are no descendants (children, grandchildren, etc.) or parents, then the spouse will get everything. ii. If there are descendants, and those descendants are also descendants of the surviving spouse, then everything goes to the S/S. However, if a decedent dies with no surviving spouse or descendants, her parents will inherit her entire intestate estate. b. If there is a parent, or a descendent of the deceased or S/S that isn't a descendant of the other (child from different relationship), then S/S share is reduced: i. S/S gets $300k plus ¾ if D has surviving parents, with rest going to the parents (this only applies if the deceased had no descendants of his own). ii. S/S gets $225k plus ½ if S/S has separate descendants. iii. S/S gets $150k plus ½ if D leaves descendants that aren't descendants of S/S (other half is split between D’s descendants) ● Child from different relationship > descendant. If an intestate decedent has both a surviving spouse and descendants with that surviving spouse, but the surviving spouse also has other descendants that are unrelated to the decedent, then the surviving spouse’s share is reduced according to above. 2. Subdivide any remaining. a. All to descendants, if any. b. If no descendants, to parents c. If no parent, to descendants of parents (siblings, nieces, nephews, etc.) d. If no one under (c), half to paternal grandparent or issue if gparent dead, and half to maternal grandparent or issue if gparent dead. ● Washington Intestacy ○ S/S gets all of community property, and a portion of SP: ½ if surviving descendants, ¾ if surviving parent. ○ Rest of Estate: ■ All to descendants; ■ If no descendants, then all to surviving parent(s); ■ If no surviving parents, then all to issue of parents (brothers, sisters, etc.); ■ If no issues, then all to grandparents; ■ If no grandparents, then to all issue of grandparents (uncles, aunts, cousins, etc.); ■ If no issue of grandparents, escheats to state. Does not go up to Great Grandparents and beyond. See pg. 85 for chart. Simultaneous Death / Survivorship To take by intestacy, an heir must survive the decedent. If the heir is deemed to have died before the decedent, then she cannot take by intestacy. Under the UPC, it must be established by clear and convincing evidence that the heir survived the decedent by 120 hours. Choice of Law Generally, the law of the state where real property is located governs intestate succession of real property. That state typically has the strongest interest in deciding matters concerning real property located within its borders. On the other hand, the law of the state where the decedent was domiciled at death typically governs intestate succession to personal property—all types of property except real property. That state typically has the strongest interest in the these matters. Shares of Descendants Always stop when you hit a live person — the live person takes to exclusion of their descendants. Pure Per Stirpes: Difference between pure and modern is that under modern, you don't start divvying up until you hit a generation with a live person in it. Under this system, the descendants' share of the intestate estate is divided into one equal share for each (1) surviving child of the decedent, and (2) deceased child of the descendant who has at least one living descendant. The portion allocated to any deceased child is further divided and allocated in exactly the same manner, repeating until the descendants' entire intestate share is fully allocated. Modern Per Stirpes: Difference between pure and modern is that under modern, you don't start divvying up until you hit a generation with a live person in it. Under this system, the descendants' share of the intestate estate is divided into one equal share for each (1) surviving child of the decedent, and (2) deceased child of the descendant who has at least one living descendant. The portion allocated to any deceased child is further divided and allocated in exactly the same manner, repeating until the descendants' entire intestate share is fully allocated. Example: A man died with $200,000 in his intestate estate. He was survived by three children and two grandchildren who were descendants of a deceased child. Under a per stirpes distribution, each of the three living children inherited $50,000. The deceased child's $50,000 share was divided between that deceased child's descendants, which meant that each of the two grandchildren inherited $25,000. Per Capita at Each Generation: The default method. Allocating on the basis of representation involves a threestep process. First alive descendants split between total amount of descendants in that generation. 1. Starting at the first generation of descendants with at least one surviving member (prime generation), divide the intestate estate into one equal share for each (1) surviving descendant in the prime generation, and (2) deceased descendant in the prime generation who has at least one surviving descendant. 2. Each surviving descendant in the prime generation gets one equal share. 3. Combine the shares of all deceased descendants in the prime generation into one share and then allocate that share among more remote descendants in like manner, repeating until the intestate share is fully allocated. Example: A man died with $200,000 in his intestate estate. He was survived by three living children, three grandchildren who were descendants of one deceased child, and one grandchild who was a descendant of another deceased child. The representation scheme was per capita at each generation. Accordingly, the estate was divided into five equal shares of $40,000, one for each of the decedent's three surviving and two deceased children. Each of the three surviving children inherited a $40,000 share. The two $40,000 shares for the deceased children were combined into one $80,000 share, which was distributed equally among the four grandchildren. Each of the four grandchildren thus inherited $20,000. Shares of Ancestors and “Collaterals” Ancestors are individuals of whom the decedent is a descendant, including the decedent's parents and grandparents. A collateral is a relative who is neither an ancestor nor a descendant—sisters, brothers, aunts, uncles, nieces, and nephews. If the decedent has no surviving descendants, then ancestors and collaterals may take whatever share of the intestate estate does not go to a surviving spouse. No collateral relative may inherit if the decedent has any surviving descendants. Half-Bloods A half blood generally inherits on equal terms with other collaterals. Step-Children and In-Laws Step-children and in-laws are generally not included on the chart. Defining “Descendants” Adopted Children Formal Adoption Generally, an adopted child is generally considered a descendant (issue) of the adoptive parents, not the genetic parents. Adopted by Stepparent: (UPC Exception) A stepchild adopted by a stepparent may inherit an intestate share from both the genetic and stepparent. If a stepparent adopts a stepchild, then the stepchild: (1) is considered a descendant of both genetic parents and the stepparent and (2) may inherit from all three parents. See Uniform Probate Code § 2-119(b) (2010). If the child dies before the parents, then the stepparent and the genetic parent who is the stepparent’s spouse are both considered the adopted child’s parents and may inherit from the child. Adopted by Relative: A child adopted by a relative, or after the death of both genetic parents, may inherit from or through genetic relatives. This exception also include an orphan adoption. In any case, this problem can be solved with an express will. Under the revised UPC, the key determination is whether there is a parent-child relationship. If such relationship exists, the parent is a parent of the child and the child is a child of the parent for the purpose of intestate succession by, "from and through" the parent of the child. Hall. In Washington, if you are adopted, you can no longer inherit from your birth parents. Adult Adoption Most intestacy statutes draw no distinction between the adoption of a minor and the adoption of an adult. Stranger-to-the-Adoption Rule: An adopted child is presumptively barred if the donor was not the adoptive parent (T makes a gift to children of A before A adopted B). An adoption might be permitted to take if adopted before, but not after, the donor's death, on the theory that the donor knew of this child and must have contemplated the child's inclusion. Adopt for Purpose of Making Heir An adult adopted for the purpose of making that person an heir under a preexisting testamentary will not be entitled to inherit as a natural heir, if there was no proof of intent to include such person as an heir. (Minary) Equitable Adoption A legal principle that allows a person to be considered the adopted child of his or her foster parent or step-parent, in the absence of a legal, court-sanctioned adoption. For a person to inherit under the equitable adoption doctrine, there must be evidence of a close family relationship between the child and foster or step-parent, and that the foster or step-parent intended to adopt the child. There is no equitable adoption in Washington state. Posthumous Children Posthumous children are children conceived before, but born after, a decedent's death, and may inherit an intestate share from the estate. In general, a posthumous child must be in gestation at the time of the decedent's death and survive 120 hours after birth. Without clear and convincing evidence of the posthumous child's survival, the child is considered to have predeceased the decedent. UPC 2-705. Posthumously Conceived Children (Assisted Reproductive Technology). Unlike a posthumous child, who is born after a parent's death but conceived while the parent is still alive, a posthumously conceived child is both born and conceived after the death of one or both of the child's genetic parents (sperm stored in vials). The child must not be in utero later in 36 months, and not be born after 45 months from the deceased parent's death. (Woodward) First, the genetic relationship with the parent must be clearly established. Second, the deceased parent must have consented to both the posthumous conception and the posthumous support of the children. Some states put a "clock" on how long a child has to be born (I.e. within 36 months of decedent's death). Nonmarital Children A child born out of wedlock may generally inherit an intestate share from the genetic mother assuming it is uncontested that she gave birth to the child and was not a gestational carrier under a gestational or surrogacy agreement. Wills and Trusts. If T gifts to the "children" of A, and a A has a nonmarital child, that child is still entitled to a share in the gift as long as A "functioned as a parent of the child before the child reached 18." Surrogacy You have to look to the laws of the state regarding who is considered the parent, and to see what would happen at death. Advancement Doctrine Under this doctrine, an heirs intestate share may be reduced by the value of property that the decedent transferred to the heir before the decedent's death. Generally, a gift from the decedent to an heir will be presumed to be only a gift unless (1) the decedent declares, in a writing contemporaneous with the transfer, that the transfer is intended to operate as an advancement, or (2) the heir acknowledges the transfer as an advancement at any time. RCW 11.04.041. Oral declarations and acknowledgements are always insufficient. RCW 11.04.041. Advancements. If a person dies intestate, property which he or she gave in his or her lifetime as an advancement to any person shall be counted toward the advancee's intestate share, and to the extent that it does not exceed such intestate share shall be taken into account in computing the estate to be distributed. Every gratuitous inter vivos transfer is deemed to be an absolute gift and not an advancement unless shown to be an advancement. The advancement shall be considered as of its value at the time when the advancee came into possession or enjoyment or at the time of the death of the intestate, whichever first occurs. If the advancee dies before the intestate, the advancement shall be taken into account in the same manner as if it had been made directly to such heir. If such heir is entitled to a lesser share in the estate than the advancee would have been entitled had he or she survived the intestate, then the heir shall only be charged with such proportion of the advancement as the amount he or she would have inherited, had there been no advancement, bears to the amount which the advancee would have inherited, had there been no advancement. Hotchpot If an heir receives an advancement, her reduced share may be calculated using the hotchpot method. Under this method, the value of the lifetime gift is added to the value of the intestate estate. Each heir is then assigned an equal fraction share of the resulting value. Finally, the value of the advancement is deduced from the recipient's share. First, look at the statute to see where the burden lies. If an heir’s advancement exceeds the share amount, then the heir’s share is eliminated, and the total is recalculated without that advancement included. Example: Testator has estate worth $50,000. Child A received $10,000 during testator's life. Hotchpot method would add the $10,000 to the total estate— $50,000, for a total of $60,000. The $60,000 would be divided by the amount of children—here, 3. Thus, each child would be allocated $20,000. Child A would then subtract the $10,000 that she received from the testator during his life, so Child A would receive $10,000 from the testator's estate, and Child B and Child C would receive $20,000. Common Law to Modern At common law, any lifetime gift was presumed to be an advancement. Largely because of the difficulty of proving the donor's intent, many states have reversed the common law presumption of advancement. In these states, a lifetime gift is presumed not to be an advancement unless it is shown to have been intended as such. Guardianship and Conservatorship of Minors Because a minor lacks legal capacity to manage property and to decide how and where to live, a client with a minor child should be advised to provide for the possibility of the child becoming orphaned. Guardian of the Person If both parents die while a child is a minor, the court will appoint a guardian of the person, usually from among the nearest relatives. For a parent with a minor child, an important reason to make a will is to designate a guardian of the person for the child. In most states, a parent's testamentary appointment of a guardian, although not formally binding, is nonetheless persuasive in the court's reckoning of the best interests of the child. Property Management Options A guardian of the person has no authority to deal with the child's property. Thus, its important for a parent of a minor child to have a will that deals with the management of the child's property. Several alternatives for surrogate fiduciary property management are available: Guardianship Origin in feudal practice in which a guardian took possession of the ward's lands; still subject to extensive judicial supervision. Conservatorship A guardian of property with investment powers similar to those of trustees, more flexible than guardianship. Custodianship A person who is given property to hold for the benefit of a minor under the UTMA or UGMA. Trusteeship A trust is the most flexible of all property arrangements. The donor is able to tailor the trust specifically to family circumstances, and while the child must receive the property at 18 under a guardianship or custodianship, a trust can postpone possession until the donor thinks the child is competent to manage the property, which is an advantage. Bars to Succession The Slayer Rule A slayer statute bars inheritance by an heir who feloniously and intentionally killed the decedent. Typically, a slayer statute requires either (1) a conviction or (2) a finding of criminal accountability based on a preponderance of the evidence. Even without a slayer statute, courts generally apply equitable principles to prevent unjust enrichment by an heir who feloniously and intentionally killed the decedent. The UPC bars the slayer from succeeding to probate and nonprobate property. The UPC provides that a final criminal conviction of a felonious and intentional killing is conclusive. An acquittal, however, is not dispositive of the acquitted individual's status as a slayer, and a court will determine whether under a preponderance of the evidence rather than the criminal standard of beyond a reasonable doubt that the individual would be found criminally accountable. If so, the individual is barred. RCW 11.84.020. Slayer or abuser not to benefit from death. No slayer or abuser shall in any way acquire any property or receive any benefit as the result of the death of the decedent, but such property shall pass as provided in the sections following. ● Applications: These statutes invalidate a broad range of at death transfers, not limited to intestate inheritance or gifts under will. This can include life insurance and other gifts. ● Forfeiture of Property: A killer does not forfeit property that he already owned, prior to the killing. ● Three Approaches: There are three approaches that courts take when a person responsible for the death of a decedent stands to inherit from that decedent under the laws of descent. Mahoney. a. First, acknowledging that only the statutes of descent govern the distribution of intestate estates, the killer may inherit despite the killing. b. Second, employing the equitable principle that a person should not profit from their own wrongdoing, the estate does not pass to the killer, but instead to the decedent's relatives. c. Third, if a defendant is unjustly enriched by the acquisition of title to identifiable property at the expense of the claimant, the defendant may be declared a constructive trustee. The estate must pass as statutorily required but equity imposes a constructive trust requiring the killer to hold the assets in trust for the decedent’s next of kin. This was the approach recognized in Mahoney. ● Opt-Out of Slayer Rules: In most states, the decedent may not opt-out of slayer rules by making it explicit in their will that the estate should still pass down for the benefit of the individual even if that individual kills them. ● Alternate Taker: Under the UPC, the slayer is treated as having predeceased the victim. Under the RCW, the slayer is deemed to have predeceased the property. Alternate Statutory Disinheritance Schemes ● ● ● ● Chinese System: Disinherited for not caring for your family/parents. Elder Abuse: Can be disinherited for subjecting parents to financial abuse. Adultery Disposition of Remains: Gives priority to family members that have priority in deciding what to do with remains of deceased. Disclaimer An heir may disclaim, or renounce, an interest in the decedent's intestate estate. The disclaiming heir will be considered to have predeceased the decedent, meaning the heir will not inherit the disclaimed portion of the intestate share. Instead, the gift lapses and will pass into residue or intestacy (next in line) of the deceased. Some common reasons for disclaiming an inheritance include reduction of estate taxes, protecting the disclaimed property from outstanding judgment or liens, or preserving eligibility for student financial aid. A disclaimer usually must be made within 9-months after the interest is created. ● Avoiding Taxes: Under the IRC, only a "qualified disclaimer" will avoid the gift tax liability that would have resulted if a disclaimant inherited property and then gave it away. To qualify as a "qualified disclaimer," the disclaimer must be made (1) within nine months after the interest is created or (2) after the donee reaches 21, whichever is later. ● Avoiding Creditors: ○ Ordinary Creditors. Ordinary creditors (not the IRS) cannot reach the disclaimed property. Because the disclaimer relates back to the date of the decedent's death, the property is treated as passing directly to others, bypassing the disclaimant. Moreover, so long as the disclaimer was made prior to the filing of a bankruptcy petition, courts will respect the state law relation-back doctrine for claims against a bankrupt debtor. If however, a bankruptcy petition is filed before the debtor disclaims, courts almost always hold that the disclaimer is ineffective under bankruptcy law. ● ● Federal Tax Liens. Because a disclaimant had the unqualified right to receive the value of the decedent's estate, the control that the person has renders the inheritance property belonging to him within the meaning of the IRC, and hence subject to federal tax liens. Disclaimers to Qualify for Medicaid: A person who would lose Medicaid benefits because of the inheritance of property cannot disclaim that inheritance in order to remain qualified for the Medicaid benefits. Wills FORMALITIES & FORMS Execution The Probate Code of every state includes a provision known as the Wills Act, which prescribes rules for making a valid will. By making a will in compliance with the Wills Act, a testator ensures that her probate property will be distributed in accordance with her actual intent rather than the presumed intent of intestacy. The statute should be looked at first, and can include various statutory requirements. All wills must include writing, and be signed in the presence of witnesses, but the technicalities can differ state-by-state. Variations can include: ● Placement of testator's signature; ● Number of witnesses; ● Presence of witnesses; or ● Timing of witnesses' signature. Attested Wills In order for a testator to execute a valid will he must have the intent to execute a will and he must comply with the formalities required for the execution of a will: 1. writing; 2. signed by the testator or in the testator's name by an individual in the testator's presence and at the testator's discretion; and , 3. attestation (witnessed) by the statutorily required number of people who sign the will within a reasonable time after witnessing the signature on behalf of the testator or witnessing the testator's acknowledgement of the signature as his own. The witness must be in the presence of the testator for it to be valid. The "Signature" Requirement The law in all states requires the testator to sign the will. The purpose of the signature requirement is to provide evidence of finality, distinguishing the will from mere drafts or notes, and to provide evidence of genuineness. Handwritten text of the testator containing the testator's full name located at the end of the document will almost always satisfy the signature requirement. Although a full name is preferable, a mark, cross, abbreviation, initials, or nickname can be sufficient. Order of Signing. In general, the testator must sign or acknowledge the will before the witness attest. However, if they all sign as part of a single (or continuous) transaction, the exact order of signing is not critical. Delayed Attestation. If a witness sees the testator make or acknowledge his signature, but the witness does not immediately sign the will, the UPC provides that the witnesses must sign "within a reasonable time." The comment to the UPC takes the position that a "reasonable time" could extend until after the testator's death. States may have different rules, such as New York requiring the witnesses to attest within 30 days, or California, where the witness must sign during the testator's lifetime. Interested Witnesses and Purging Statutes In most states, an interested witness may validly attest a will and in turn the will stay valid. However, most of these states have enacted so-called purging statutes that divest an interest witness of any benefit under the will. Thus, an interested witness may attest a will, but if she does, she takes nothing under the will. Some states make a partial exception if the interested witness is an heir at law. In that case, the witness's gift under the will is purged only to the extent as the gift exceeds what the witness would receive in intestacy. Similarly, other states make a partial exception if the witness was slated to take under a prior will. The witness's gift under the current will is purged to the extent as it exceeds the gift the witness was to receive under the prior will. ● If the interested witness is not an heir (would not have received anything under intestate), then they are entitled to nothing under a will. Thus, anything given to them in a will is considered excess off of the bat. There is a trend away from purging. ● Most states purge only excess benefit. ● A substantial minority of states, and the UPC, permit interested witnesses to validly attest a will, and not have their interest purged. This is considered bad practice, but not categorically invalid. Washington follows this but puts the burden of proof on witnesses to prove that there wasn't undue influence. Self-Proving Affidavit. A self-proven affidavit is where the witness makes an affidavit swearing as to the will's due execution. Almost all states recognize such a self-proving affidavit. What differentiates a self-proving affidavit from an attestation clause is that the affidavit is a sworn declaration under oath. ● This creates a rebuttable presumption that the will was duly executed. ● The affidavit must be signed by the testator and witnesses in front of a notary after the testator and witnesses have signed the will. Comity (UPC) Under the Uniform Probate Code (UPC), a will is valid everywhere if it is valid under the law, as it existed at the time of execution, of either the forum state or the place where: (1) the will was executed, (2) the testator was domiciled at death or the will was executed, (3) the testator had a place of abode at death or the will was executed, or (4) the testator was a national at death or the will was executed. RCW 11.02.005 (8) "Issue" means all the lineal descendants of an individual. An adopted individual is a lineal descendant of each of his or her adoptive parents and of all individuals with regard to which each adoptive parent is a lineal descendant. A child conceived prior to the death of a parent but born after the death of the deceased parent is considered to be the surviving issue of the deceased parent for purposes of this title. (9) "Net estate" refers to the real and personal property of a decedent exclusive of homestead rights, exempt property, the family allowance and enforceable claims against, and debts of, the deceased or the estate. RCW 11.12.020. Requisites of wills. (Comity Statute) (1) Every will shall be in writing signed by the testator or by some other person under the testator's direction in the testator's presence, and shall be attested by two or more competent witnesses … while in the presence of the testator and at the testator's direction or request: PROVIDED, That will executed in the mode prescribed by the law of the place where executed or of the testator's domicile (First State) shall be deemed to be legally executed, and shall be of the same force and effect as if executed in the mode prescribed by the laws of this state (Second State). ● Summary: Under Washington law, the witnesses have to sign as a witness in the presence of the testator, but the witnesses do not have to be together. ● Summary: Under Washington law, if a testator executes a will in compliance with another state’s law, the will is deemed legally executed and enforced the same as if executed in Washington. ● If a person has a will in one state, but executes it in another, the Will will be valid if the first state's Comity Statute provides that a will is valid as long as it abides by the state's laws in which it was executed. RCW 11.12.030. Signature of testator at his or her direction—Signature by mark. Every person who shall sign the testator's or testatrix's name to any will by his or her direction shall subscribe his or her own name to such will and state that he or she subscribed the testator's name at his or her request: PROVIDED, That such signing and statement shall not be required if the testator shall evidence the approval of the signature so made at his or her request by making his or her mark on the will. The main functions of the Wills Act formalities is to enable a court to decide, without the benefit of live testimony from the testator, whether a purported will is authentic. ● Evidentiary Function: Provides a court with reliable evidence of testamentary intent and of the terms of the will. ● Channeling Function: Compliance with the formalities for executing witnessed wills results in considerable uniformity in the organization, language, and content of most wills. ● Cautionary Function: Formalities impress the testator with the seriousness of the treatment, and thereby assure the court that the statements of the transferor were deliberately intended to effectuate a transfer. They caution the testator, and they show the court that he was cautioned. ● Protective Function: The Wills Act protects the testator against imposition at the time of execution. The requirement that attestation be made in the presence of the testator is meant to prevent the substitution of a surreptitious will. Curative Doctrines Washington State does not have Substantial Compliance or Harmless Error; one must comply with the relevant statute. The Strict Compliance Rule Under traditional law, a will must be executed in strict compliance with all the formal requirements of the applicable Wills Act. Attestation Clause. An attestation clause is a clause that states that the formal requirements for a valid attested will are satisfied. No state requires an attestation clause, but such a clause gives rise to a rebuttable presumption that the formal requirements of valid execution are met. Present at the Same Time. If a will is not properly witnessed according to statutory requirements, the will may be probated despite the statutory non-compliance if the witnesses acknowledge their signatures in the presence of each other and the testator. However, if this narrow exception is not met, the will is invalid. Stevens. Presence Line of Sight. In some states, the requirement that the witnesses sign in the presence of the testator is satisfied only if the testator is capable of seeing the witnesses in the act of signing. Under this test, the testator does not actually have to see the witnesses sign but must be able to see them were the testator to look. Conscious Presence. In other states, a witness is in the (physical) presence of the testator if the testator, through sight, hearing, or general consciousness of events, comprehends that the witness is in the act of signing. The test is one of mental apprehension. Uniform Probate Code. The UPC prescribes to conscious presence, requiring the witness be in the physical presence of the testator for it to be valid. Technicalities to Invalidate Will. The court in Groffman invalidated the will because the requirements regarding the witnesses were not satisfied. However, the will was not favorable to the individual's spouse at all, and in light that the signing by the witnesses was very close (a tough call), it could be reasonably seen that the Court used a technicality to invalidate the will in order to ensure that the spouse received the benefits at issue. Substantial Compliance (Abandoned) The court may deem a defectively executed will as being in accord with statutory formalities if there is clear and convincing evidence that the purposes of those formalities were served. Washington State still abides by Strict Compliance. Harmless Error Doctrine (UPC Sec. 2-503) The court may excuse noncompliance if there is clear and convincing evidence that the decedent intended the document to be his will. The key is not how close the parties came, but whether there is evidence that the decedent intended the document to be his will. Hall. This is not widely adopted, and Washington state still abides by the Strict Compliance rule. However, a will that the decedent did not review and give final assent to cannot be admitted to probate. Macool. Defective Execution and Reformation Ad Hoc Relief. Because the strict compliance can be a little too harsh at times, courts have occasionally excused or corrected or another innocuous defect in execution. Snide. Switched Wills. There are two distinct solutions for a switched wills error. One is to probate the instrument that the decedent intended to sign but did not. The other solution for a switched wills error is to probate the will that the decedent actually signed but then to reform its terms to make sense. Notarized and Holographic Wills Notarized Wills The UPC provides that a will is valid if it is signed by two witnesses or if it is notarized. This provision, however, has only been adopted by two states. A notarized will is seen as serving all of the functions of the will-execution formalities. Holographic Wills A holographic will is handwritten by the testator, and does not have to be witnessed. In most states, a will may be admitted to probate if it qualifies as a holographic will under the relevant state's law, even if it does not meet the requirements for an attested will. Traditionally, a holographic will had to be entirely in the testator's handwriting. Under the UPC, a holographic will is valid if the signature and the material portions of the will are in the testator's handwriting. Washington state does not accept holographic wills. A holographic will must be: ● Handwritten by the testator; and ● Signed by the testator. Signature. In almost all states that permit holographs, the testator may sign the will at the end, at the beginning, of anywhere else on the face of the document. But, if the holograph is not signed at the end, there may be doubt whether the testator intended his name to be a signature. Extent of the Testator's Handwriting. The first generation of holographic will statutes required the entire will to be written, signed, and dated in the testator's handwriting. The second generation required the material provisions to be in handwriting. The third generation of these statutes required just that material portions be in the testator's handwriting, and allowed extrinsic evidence to establish testamentary intent. Discerning Testamentary Intent If an informal document contains evidence of the decedent’s intent to make a posthumous gift, that document is enforceable as a will even though the document also contains language that is not testamentary in nature. Kimmel. Preprinted Will Forms Where a holographic will is partially handwritten and partially preprinted, the preprinted text may be read in conjunction with the handwritten portions if the evidence as a whole demonstrates the decedent’s testamentary intent. Gonzalez. Extrinsic Evidence A letter that conveys a decedent’s testamentary intent to make a specific bequest is enforceable as a holographic codicil to the decedent’s formal will. Kuralt. Digital Wills There is scant authority on the validity of an electronic will. It has been held that a will written and signed on a tablet computer can constitute a valid signed writing. Castro. A DocuSign however, for example, would not work; Courts seem to imply a physical aspect to the signing of the will. Electronic Wills Act ● Required execution elements. ○ A record readable as text; ○ Signed electronically with testamentary intent; and ○ Either signed electronically by two witnesses in actual (or electronic) presence of testator or notarized by an electronic notary public (in states that permit "notarial" wills). ● Witness presence provisions. Actual (or electronic) presence. ● Choice of law. An electronic will is validly executed if executed in compliance with the law of the place where: ○ At the time of execution, the testator is physically located; or ○ At the time of execution or at the time of death the testator is domiciled or resides. ● Self-proving electronic wills. An electronic will with all attesting witnesses physically present in the same location as the testator may be made self-proving by acknowledgement of the testator and affidavits of the witnesses. ● Revocation. An electronic will or part is revoked by: ○ A subsequent will that revokes the previous electronic will or part expressly or by inconsistency; or ○ A physical act by the testator or at the testator's direction and in the testator's presence ○ Proof of intent to revoke is shown by a preponderance of the evidence. Electronic will may revoke a will that is not electronic. Revocation To revoke a will means to annul it. To the extent that a will is revoked, it is ineffective to dispose of property in the estate, unless the will is revived, or the revocation proves legally ineffective. A codicil may be revoked on the same basis as a will. In general, a will may be revoked by later testamentary instrument or by physical act. Revocation by Writing or by Physical Act (UPC Sec. 2-507) A will can be revoked (1) by a subsequent writing executed with Wills Act formalities, and (2) by a physical act such as destroying, obliterating, or burning the (original) will— destroyed either by the testator, or another person in the conscious presence of the testator. ● “Conscious Presence”: Includes an act that is done within one of the senses of the testator. Thus it need not be within the testator’s line of sight if it is close enough for the testator to hear what is going on. However, a call by a person after tearing up the will does not work. An oral declaration that a will is revoked, without more, is not enough to revoke the will. If a duly executed will is not revoked in accordance with the applicable revocation statute, the will must be admitted to probate. Express and Implied Revocatory Writings ● Express. A writing executed with Wills Act formalities may revoke an earlier will by express revocation, or may revoke by inconsistency. Most well-drafted wills open with an express revocation clause. ● Inconsistency. A writing executed with Wills Act formalities may also revoke a prior will by inconsistency. The issue arises when a testator executes a subsequent will that does not include an express revocation clause. The question is whether the testator intended the subsequent will to replace a prior will in or in part, or if instead he intended the subsequent will to supplement the prior will without disturbing its provisions. Complete or Partial Disposition: The modern view (UPC 2-507(c)) is to treat a subsequent will that does not expressly revoke a prior will, but makes a complete disposition of the testator's estate, as presumptively revoking the prior will by inconsistency. If the subsequent will does not make a complete disposition of the testator's estate, it is instead viewed as a codicil, and any property not disposed of under the codicil is disposed of in accordance with the prior will. Presumption of Revocation If a will was last in the testator's possession but cannot be found after her death, a rebuttable presumption arises that the testator destroyed the will with intent to revoke it. This, in turn, means court will treat the will as revoked. The presumption can be rebutted by sufficient evidence to the contrary. If the presumption is rebutted, the will may be admitted to probate, but only if the proponent can then prove its contents and due execution. Lost Wills If a will is traced to the testator's possession and cannot be found after death, there are three plausible explanations for its absence. The testator destroyed it with the intent to revoke, the will was accidentally destroyed or lost, or the will was wrongfully destroyed or suppressed by someone dissatisfied with its terms. The law presumes that the testator destroyed the will with intent to revoke it. If the presumption of revocation is rebutted, the will is entitled to probate if its contents can be proved, unless the party opposing probate proves the will was actually revoked. If a lost or mutilated will was last known to have been in the possession of someone other than the testator, there is no presumption of revocation, and the will is entitled to probate unless, of course, there is proof that the testator in fact revoked the will. Copy of the Will. A copy of an original will can only be treated as the decedent's actual will with clear and convincing evidence that the decedent intended the copy itself to be his will. Partial Revocation by Physical Act The UPC allows partial revocation by physical act. If the will was last in the testator's possession, it is presumed that the testator performed the act on the will with intent to revoke. Allowed in Washington, but only to the extent it does not significantly alter testamentary scheme (as long as it's more like costume jewelry instead of a house). This means that the value of the asset being "crossed out" is considered to see whether it would constitute a significant alteration. In states where there is no partial revocation by physical act, then the assets which are the subject of revocation do not fall into the "residue." They stay with the original recipient. Codicil A codicil is an amendment to a will. If a will connected to a codicil is torn up, the codicil goes with it. If instead a codicil is torn up, the underlying will is still in place. Dependent Relative Revocation Under the doctrine of DDR, if a later will is ineffective because of mistake, and the prior revoked will was closer to what the testator would have wanted than intestacy, then court invalidates the revocation of the prior will. The court will compare the prior will to intestacy to see which was closer to the testator's intent. A prior will becomes effective despite an otherwise effective attempt by the testator to revoke it if: ● The testator revoked the prior will as a means to effectuate an alternative dispute scheme and the alternative scheme fails for some reason; or ● The testator revoked the prior will based on a false assumption that the first will is in fact revoked (of law or a false belief about objective fact) shown by clear and convincing evidence. ○ Ex: Because holographic wills are not valid in Washington State, if a testator crosses out a giving to a recipient and writes in a new amount, it would be considered a holographic will (not valid) and DRR would apply; the "new" will is conditioned on it being valid, thus, because it's not valid, the original will would be effective again. Revival Revival is the process of reinstating or revalidating a will that was previously revoked. A will that has been revoked by a destructive act, however, cannot be revived in any manner. Revival by Later Testamentary Instrument A testator may revive a revoked will by re-executing it with proper testamentary formalities after the revocation, regardless of how the prior will was revoked. Revival by Physical Act A testator may revive a revoked will by performing a subsequent physical act on the will, provided that the act demonstrates, by clear and convincing evidence, the testator's intent to revive the will. Revival by Revocation (UPC Sec. 2-509) If a later will revokes an earlier will, a testator may revive the earlier will by simply revoking the later will. Washington state follows the majority UPC rules. The minority rules disregards the testator's intent, and revocation of a later will never revives the earlier will. Under the UPC, if Will #2 wholly revokes Will #1, and the testator later revokes Will #2 by physical act, the presumption is that Will #1 is still revoked, unless it can be shown that the decedent intended the revocation of Will #2 to revive Will #1. UPC Sec. 2-509(a). If Will #2 only partially revokes Will #1, and the testator revokes Will #2 by physical act, then the revoked portion of Will #1 is revived. UPC Sec. 2-509(b). If Will #2 is revoked by Will #3, Will #3 does not revive Will #1 unless the text of the will indicates such a result is what the testator intended. UPC Sec. 2-509(c). Revocation by Operation of Law Divorce (UPC Sec. 2-804) A divorce presumptively revokes any provision in a decedent's will for the decedent's divorced spouse. This presumption may be rebutted, if, for example, the will's express terms, a court order, or an agreement between the testator and the former spouse provides otherwise. Subsequent Marriage (UPC Sec. 2-301) A premarital will remains valid in spite of a subsequent marriage, but a surviving spouse may take an intestate share of the deceased spouse's estate, unless the will indicates that the omission was intentional or the spouse is provided for in the will or by a will substitute. Birth of Children (UPC Sec. 2-302) Almost all states have pretermitted child statutes, which give a child born after the execution of a parent's will, and not mentioned in the will, a share in the parent's estate. These statutes result in a revocation of the parent's will to the extent of the share given to the child under the statute. RCW 11.12.040. Revocation of will. (1) A will, or any part thereof, can be revoked: (a) By a subsequent will that revokes, or partially revokes, the prior will expressly or by inconsistency; or (b) By being burnt, torn, canceled, obliterated, or destroyed, with the intent and for the purpose of revoking the same, by the testator or by another person in the presence and by the direction of the testator. If such act is done by any person other than the testator, the direction of the testator and the facts of such injury or destruction must be proved by two witnesses. (2) Revocation of a will in its entirety revokes its codicils, unless revocation of a codicil would be contrary to the testator's intent. RCW 11.12.080. Revocation of later will or codicil. (1) If, after making any will, the testator shall execute a later will that wholly revokes the former will, the destruction, cancellation, or revocation of the later will shall not revive the former will, unless it was the testator's intention to revive it. (2) Revocation of a codicil shall revive a prior will or part of a prior will that the codicil would have revoked had it remained in effect at the death of the testator, unless it was the testator's intention not to revive the prior will or part. (3) Evidence that revival was or was not intended includes, in addition to a writing by which the later will or codicil is revoked, the circumstances of the revocation or contemporary or subsequent declarations of the testator. RCW 11.12.051. Dissolution, invalidation, or termination of marriage or domestic partnership. (1) If, after making a will, the testator's marriage or domestic partnership is dissolved, invalidated, or terminated, all provisions in the will in favor of or granting any interest or power to the testator's former spouse or former domestic partner are revoked, unless the will expressly provides otherwise. Provisions revoked by this section are revived by the testator's remarriage to the former spouse or reregistration of the domestic partnership with the former domestic partner. (2) This section is remedial in nature and applies to decrees of dissolution and declarations of invalidity entered before, on, or after January 1, 1995. RCW 11.07.010. Nonprobate assets. Components Integration All papers that are present at the time of execution and are intended to be part of the will are treated as part of the will. Complications can be avoided by ensuring that the pages of the will are numbered and are fastened together before the testator signs, and by having the testator sign or initial each page of the will for identification. To be considered a part of a will: ● ● (1) a page or writing must be present at the time of the will's execution, and (2) the testator must intend for the page or writing to be part of the will. Rigsby: Where a purported will contains more than one page, it must be made clearly apparent that the testator intended that all of the pages together should constitute his last will and testament. Republication by Codicil A codicil is a testamentary document meeting the same requirements as a will that amends or supplements a prior valid will. A validly executed will is treated as reexecuted as of the date of the codicil. The requirements for a codicil are identical to those of an original will. The codicil need not be the same type as the original will. Incorporation by Reference A document that has not been executed with the formalities for the execution of a will, can be given testamentary effect. It may also incorporate the contents of a separate writing by reference, even if the requirements for integration are unsatisfied, if: ● The will manifests the testator's intent to make the document a part of the will, ● The will describes the document sufficiently to permit its identification, and ● The document existed when the will executed. ○ But see Tangible Personal Property below. RCW 11.12.255. Incorporation by Reference. A will may incorporate by reference any writing in existence when the will is executed if the will itself manifests the testator's intent to incorporate the writing and describes the writing sufficiently to permit its identification. In the case of any inconsistency between the writing and the will, the will controls. Existing Writings Incorporation by reference allows for a writing that was in existence but not present at the time of execution and that was not itself executed with testamentary formalities to be absorbed into the testator's will. Subsequent Writings and Tangible Personal Property The UPC allows a testator to dispose of tangible personal property (not real property or money) by a separate writing, even if prepared after the execution of the testator's will, provided that the will makes reference to the separate writing. Only a slim majority of states have adopted this approach. RCW 11.12.260. Separate writing may direct disposition of tangible personal property. ○ (1) A will or a trust … may refer to a writing that directs disposition of tangible personal property not otherwise specifically disposed of by the will or trust other than property used primarily in trade or business. Such a writing shall not be effective unless: ■ (a) An unrevoked will or trust refers to the writing, ■ (b) the writing is either in the handwriting of, or signed by, the testator or grantor, and ■ (c) the writing describes the items and the recipients of the property with reasonable certainty. ○ (2) The writing may be written or signed before or after the execution of the will or trust and need not have significance apart from its effect upon the dispositions of property made by the will or trust. A writing that meets the requirements of this section shall be given effect as if it were actually contained in the will or trust itself, except that if any person designated to receive property in the writing dies before the testator or grantor, the property shall pass as further directed in the writing and in the absence of any further directions, the disposition shall lapse and, in the case of a will, RCW 11.12.110 shall not apply to such lapse. ○ (3) The testator or grantor may make subsequent handwritten or signed changes to any writing. If there is an inconsistent disposition of tangible personal property as between writings, the most recent writing controls. ○ (4) As used in this section "tangible personal property" means articles of personal or household use or ornament... The term includes articles even if held for investment purposes and encompasses tangible property that is not real property. The term does not include mobile homes or intangible property, for example, money that is normal currency or normal legal tender, evidences of indebtedness, bank accounts or other monetary deposits, documents of title, or securities. Acts of Independence Significance If the beneficiary or property designations are identified by reference to acts or events that have a lifetime motive and significance apart from their effect on the will, the gift will be upheld. This is true even if the terms will enable the testator to alter the beneficiaries or the property by a subsequent nontestamentary act. Ex: “To my staff” is to whomever the staff is at the time testator passes away. Contracts During life, a person may bind herself to a particular exercise of her freedom of disposition at death by way of a contract to make a will or not to revoke a will. Contract law, not the law of wills, applies. To enforce the contract, the contract beneficiary must sue under the law of contracts and prove a valid contract. Factors to prove existence of a contract: ● Attempted by invalid disposition. ● Consistent but later revoked will. ● Other reasons for rendering services. Remedies If a party to a valid will contract dies leaving a will that does not comply with the terms of the contract, the will is probated in accordance with the Wills Act, but the contract beneficiary is entitled to a remedy for the breach. In some states, the remedy is damages. In others, courts impose a constructive trust in favor of the contract beneficiary to prevent the unjust enrichment of the will beneficiary. If there's a breach, claim is made as a creditor of the estate. Creditors get paid off of the top, then the remainder is distributed to beneficiaries. If there's no breach, creditors get paid off of the top, but then the parties to the contract, as a will beneficiary, gets paid from there. Contracts to Make a Will A contract to make a will typically arises in the context of a premarital or divorce agreement or as part of an agreement to take care of a sick or older person. Many states subject contracts to make a will to a Statute of Frauds provision, requiring a signed writing for the contract to be enforced. In the absence of a signed writing, the contract beneficiary may be entitled to restitution of the value of services rendered to the decedent. The beneficiary still must prove the existence of the agreement, however. States that do not require a writing for a contract to make a will typically require clear and convincing evidence of the contracts and its terms. Remedies and Priorities If breach of contract to make will, claim is made as a creditor of the estate. Creditors get paid off of the top. So, the creditor’s get their share, and then the remainder is to be distributed to the beneficiaries. Contracts Not to Revoke a Will Cases involving a contract not to revoke a will typically involve a married couple that has executed a joint will or mutual wills. A joint will is one instrument executed by two persons as the will of both. When one of them dies, the instrument is probated as the decedent's will. Then, when the other dies, the instrument is again probated, this time as the will of the second decedent. The majority view (reflected in Keith) is that the execution of a joint will or mirror-image will does not, by itself, give rise to a presumption of contract. The contract must be proved by clear and convincing evidence. Deadman Statute A Dead Man's Statute states that a party with an interest in the litigation may not testify against a dead party about communications with the dead party. A law forbidding the presentation of certain evidence adverse to a decedent’s estate where such evidence relates to matters that occurred during the decedent’s lifetime. CAPACITY & CONTESTS Mental Capacity General requirements include: ● Must be 18 years old or older. ● Know the objects of your bounty. ● Know the general nature and extent of your property. ● Understand what you're signing The testator must be capable of knowing and understanding in a general way (1) the nature and extent of his or property, (2) the natural objects of his or her bounty, and (3) the disposition that he or she is making of that property, and must also be capable of (4) relating these elements to one another and forming an orderly desire regarding the disposition of the property. The test for testamentary capacity is one of capability, and not actual knowledge. To prove lack of testamentary capacity, the party challenging the will (contestant) must present proof showing that the testator’s condition prevented her from having a decided and rational desire as to the disposition of her property. Wilson. Capacity Standards In most states, capacity to make a will requires less mental ability than to make a contract or to complete an irrevocable lifetime gift. A marriage is the lowest standard. ● Lowest: Marriage ● Will ● Highest: Lifetime Gift, Contract Due Execution Proof of due execution ordinarily gives rise to a presumption of testamentary capacity. In a majority of states, once the proponent shows due execution, the contestant bears the ultimate burden of persuasion to show a lack of capacity. Unethical Practice: Competence To draft a will for someone who doesn't have the mental capacity is violating the ethical rule of "competence"; it's not competent to write down a will that is not representing the testator's intention, because the testator does not have the mental capacity to properly convey her intent. Insane Delusion A person may satisfy the test for testamentary capacity but nonetheless be suffering from an insane delusion that causes the entire will to fail for lack of capacity. An insane delusion is a defect in capacity. Under an insane delusion, the testator, against all rational evidence, adheres to a false belief that materially affects or influences a disposition in the will. Only the part affected by the insane delusion will be invalidated. Elements: ● A mistaken belief, ● Not reasonably held (unreasonable), ● Causing a particular disposition. A mistake alone is not enough to invalidate a will provision. A belief to which the testator adheres based on reasoning from existing facts is not an insane delusion, even if the belief is incorrect or illogical, because the belief is supported by evidence. Undue Influence Undue influence is a defect in capacity under which a testator is improperly influenced by another person at the time of the will's execution, such that the other person's intent is substituted for the testator's intent. Typically, the testator must also be susceptible to undue influence. A person may exert undue influence over a testator by exercising control over the testator's mind and overcoming the testator's free agency and free will, causing the testator to excuse a will that she would not have executed but for the control. ● Weakened conditions may not be enough to establish testamentary capacity, but may show susceptibility to undue influence. Inference: The trier of fact may infer undue influence from circumstantial evidence that shows that: ● The donor was susceptible to undue influence, ● The alleged wrongdoer had an opportunity to exert undue influence, ● The alleged wrongdoer had a disposition to exert undue influence, and ● There was a result appearing to be the effect of the undue influence. Presumptions and Burden Shifting The contestant typically has the burden of proving that a will was procured by undue influence. In most jurisdiction, a contestant is entitled to a presumption of undue influence if the contestant shows the existence of a confidential relationship between the alleged influencer and the testator and one or more suspicious circumstances are present. Consequently, the burden may shift to the person who was allegedly in a confidential relationship with the testator. Confidential Relationship + Suspicious Circumstances = Presumption of Undue Influence Confidential Relationship The three general types of confidential relationships are (1) fiduciary, (2) reliant, and (3) dominant-subservient. Fiduciary: One in which the confidential relationship arises from a settled category of fiduciary obligation. Reliant: Whether a reliant relationship exists is a question of fact. The contestant must establish that there was a relationship based on special trust and confidence. Dominant-Subservient: Whether a dominant-subservient relationship exists is a question of fact. The contestant must establish that the donor was subservient to the alleged wrongdoer's dominant influence. Suspicious Circumstances For purposes of undue influence, suspicious circumstances surrounding the preparation, execution, or formulation of the will are circumstances indicating that the alleged wrongdoer has abused a confidential relationship with the testator. Factors include: ● ● ● ● ● The testator was susceptible to undue influence due to weakened physical or mental condition; The alleged wrongdoer participated in procuring the will; The testator received competent, independent advice; The will was prepared secretly or hastily; The testator's attitude toward other changed due to the relationship with the alleged wrongdoer; etc. Burden Shifting In most states, if a presumption of undue influence is triggered, the burden shifts to the proponent to come forward with rebuttable evidence—for example, that the presumed influencer acted in good faith throughout the transaction. In the absence of such evidence, the contestant is entitled to judgment as a matter of law based on the inference of undue influence arising from the circumstances. Bequests to Lawyers & Fiduciary Appointments Undue Influence Many states hold that a presumption of undue influence arises when a lawyer receives a bequest under a will that the lawyer drafted, unless the lawyer is closely related to the testator. In some states the presumption can be rebutted only by clear and convincing evidence, and in a few states the presumption is conclusive. Fiduciary Appointments A fiduciary appointment is not a gift, but the lawyer might be entitled to compensation for serving as fiduciary. To avoid any conflict, the lawyer should explain the role and duties of the fiduciary, the ability of a lay person to serve as a fiduciary with legal and other professional assistance, and the comparative costs of appointing the lawyer or another person or institution as fiduciary. No Contest Clause A will provision that purports to rescind a gift to, or fiduciary appointment of, anyone who contests the will. In most states and under the UPC, the provision is enforceable, unless the person contesting the will had probable cause to do so. Fraud & Duress Remedies A constructive trust is a remedy imposed in order to prevent unjust enrichment, particularly in cases of fraud, duress, or undue influence. Duress Duress occurs if a wrongdoer threatens or performs a wrongful act that coerces the testator into making a testamentary disposition the testator would not otherwise have made. In most cases, the threat is one of conduct that would constitute a crime of tort, such as assault or battery. An act is not wrongful if the alleged wrongdoer has the legal right to do it. If the duress is by threat, the testator must have no reasonable alternative but to comply. The threat must be one that a reasonable person of ordinary firmness could not resist. Fraud A will is invalid to the extent that it was procured by fraud. To invalidate a will on fraud grounds, the party challenging the will must generally show that: 1. The wrongdoer knowingly or recklessly made, to the testator, a false representation of material fact, and 2. The representation was intended to, and did, lead the testator to make a testamentary disposition she would not otherwise have made. Fraud in the Execution Fraud in the execution occurs when a person intentionally misrepresents the character or contents of the instrument signed by the testator, which does not in fact carry out the testator's intent. This is very fact-specific and more rare. Fraud in the Inducement Fraud in the inducement occurs when a misrepresentation causes the testator to execute or revoke a will, to refrain from executing or revoking a will, or to include particular provisions in the wrongdoer's favor. This differs from undue influence in that the testator retains her free agency, and freely makes a new estate plan, but does so as a result of having been misled. Tortious Interference With An Expectancy The Restatement recognizes intentional interference with an expected inheritance or gift as a valid cause of action. Under this theory, the plaintiff must prove that the interference involved tortious conduct, which under the cases include undue influence, duress, or fraud. This tort claim is not a will contest and thus damages are not sought from the estate itself, but rather seeks to recover damages from the Defendant for wrongful interference with the Plaintiff's expectation of an inheritance. One has three years instead of four months (will contest) to bring a claim. Establishing a claim for intentional interference with an expectancy of inheritance requires: 1. A showing that there was an expectancy, 2. Interference with that expectancy by tortious conduct, 3. Causation, and 4. Damages. Probate Exception: An exception applies where the probate process is already complete when the injured party discovers the tortious conduct since no adequate remedy in probate would actually be available. CONSTRUCTION OF WILLS Mistaken/Ambiguous Wills Plain Meaning and No Reformation Under the Plain Meaning rule no extrinsic evidence is allowed to contradict the plain meaning of the Will itself. Under the No Reformation rule courts may not reform a will to correct a mistaken term to reflect what the testator intended the will to say. Patent Ambiguity A patent ambiguity is evident from the face of a will, due to inconsistent or unclear language. Under traditional law, extrinsic evidence is not admissible to clarify a patent ambiguity. The court is confined to the four corners of the will even if as a result the ambiguous devise fails and the property passes by intestacy. Increasingly, however, courts are inclined to admit extrinsic to resolve a patent ambiguity. Latent Ambiguity A latent ambiguity manifests itself only when the terms of a will are applied to the facts; that the will's provisions are susceptible to more than one reasonable interpretation. Equivocation. When two or more persons or things fit the description exactly. Personal Usage. If extrinsic evidence shows that a testator habitually used a term in an idiosyncratic manner, the evidence is admissible to show that the testator used that term in accordance with his personal usage rather than its ordinary meaning. No Exact Fit. A description in a will does not exactly fit any person or thing. Ad Hoc Relief for Mistaken Terms While the no reformation rules guards against a spurious finding of mistake, it comes at a cost of denying relief even if there is overwhelming evidence of mistake and the testator's actual intent. To avoid this harsh result, courts have sometimes corrected a mistake under the guise of using extrinsic evidence to construe a supposedly ambiguous term. Arnheiter: If a will describes property or a beneficiary by several characteristics, and nothing or no one matching all of those characteristics exists, then the less essential characteristics of the description may be disregarded as long as the remaining characteristics match an existing person or property. Gibbs: If mistaken identification of property or a beneficiary seems to frustrate the testator’s intent, extrinsic evidence is permitted to show whether there was a mistake, and if a mistake is shown to be the cause, the mistaken details will be disregarded. Openly Reforming Wills for Mistake In general, courts are highly reluctant to consider extrinsic evidence inconsistent with a will's unambiguous terms. However, sometimes, a will's unambiguous terms do not reflect the testator's true intent due to a mistake of fact or law that affected the will's terms. In that event, some states and the UPC permit a court to reform the will, based on extrinsic evidence, so that it reflects the testator's true intent, provided that two things are proven by clear and convincing evidence: 1. That a mistake of fact or law in expression or inducement affected specific terms in the will; and 2. What the testator's true intent was at the time the will was executed, as opposed to a later change of mind. Inter Vivos Trusts and the Uniform Trust Code The UTC, adopted by a majority of states, authorizes reformation for mistake in a trust, including testamentary trusts. Death of Beneficiary Lapse: General Rules ● A beneficiary must survive the testator in order to take under the Will (unless the will provides otherwise). If a devisee does not survive the testator, the devise fails and is said to have lapsed. Will does not have to specifically require survival; it's the common law rule. ● Lapsed gift falls into residue, unless otherwise specified in the WIll. ● No Residue of a Residue Rule: If Rule is in place, the residue of a residuary gift would go into intestacy. If it's been abolished/superseded by State statute, as in most states, it's assumed that the testator would want the residue of residue to go to the class, and not to intestacy, so it would be shared among the class. General or Specific Devise: A general devise is a testamentary gift, usually a specific sum of money or quantity of property, payable from the estate's general assets and not from a named source within the estate. A specific devise is a testamentary gift of an asset that is specifically identified. The devise could refer to a singular asset or to a fractional share of an asset. Pecuniary Gift: Sum of money gifted. Residuary Devise: A residuary devise is the residue—the sum total of property not disposed of by specific, general, or demonstrative devise. The residue is whatever is left in the testate after satisfying all claims, allowances, specific devises, general devises, and demonstrative devises. If there is no residue specifically gifted, then it "continues to fall" into intestacy, for the intestacy heir in line. Class Gift: A gift to beneficiaries taking as members of a group. This means that (1) the beneficiaries each take a fraction of the whole, and (2) the identities and shares of the beneficiaries are subject to change over time, usually by the addition of new class members or the subtraction of existing class members. By contract, a gift to multiple beneficiaries whose identities and shares are fixed is not a class gift. A deceased beneficiaries' share in a class gift becomes absorbed by other members of the class under most state statutes, if it’s a specific gift. Void Devise: If a devisee is already dead at the time the will is executed, or the devisee is a dog or cat (considered property) or some other ineligible taker, the devise is void. Void gifts are treated the same as lapsed. RCW 11.12.120. Lapsed gift—Procedure and proof. ■ (1) If a will makes a gift to a person on the condition that the person survive the testator and the person does not survive the testator, then, unless otherwise provided, the gift lapses and falls into the residue of the estate to be distributed under the residuary clause of the will, if any, but otherwise according to the laws of descent and distribution. ■ (2) If the will gives the residue to two or more persons, the share of a person who does not survive the testator passes, unless otherwise provided, and subject to RCW 11.12.110, to the other person or persons receiving the residue, in proportion to the interest of each in the remaining part of the residue. ■ (3) The personal representative of the testator, a person who would be affected by the lapse or distribution of a gift under this section, or a guardian ad litem or other representative appointed to represent the interests of a person so affected may petition the court for a determination under this section, and the petition must be heard under the procedures of chapter 11.96A RCW. Antilapse Statutes Antilapse Statutes do not prevent a lapse; rather, they substitute other beneficiaries, usually the dead beneficiary's descendants, if certain requirements are met. A typical antilapse statute provides that (1) if a predeceased devisee is related to the testator in a prescribed way and (2) is survived by one or more descendants who also survive the testator, those descendants are substituted for the predeceased devisee. A will can be drafted to avoid this, but it must be specific. When words of survival ("to those who survive me") are included, it typically means do not apply statute. Requirements 1. There must be some family relationship between testator and the deceased beneficiary, and 2. The deceased beneficiary must have descendants. Nonprobate Assets: Antilapse Statutes do not apply to nonprobate assets. Presumed Intent The theory behind the antilapse statutes is one of presumed intent; the idea is that, for certain predeceasing devisees, the testator would prefer a substitute gift to the devisee's descendants rather than for the gift to pass in accordance with the common law of lapse. Scope An antilapse statute applies to a lapsed devise only if the devisee bears the particular relationship to the testator specified in the statute, could be narrow (just descendants or siblings of testator) or more broad (issue of grandparents). Default Rules Because the antilapse statutes are designed to implement presumed intent, they prescribe default rules that yield to an expression of the testator's actual intent that is contrary to the statute. UPC Sec. 2-605. Antilapse; Deceased Devisee; Class Gifts If a devisee who is a grandparent or a lineal descendant of a grandparent of the testator is dead at the time of the execution of the will, fails to survive the testator, or is treated as if he predeceased the testator, the issue of the deceased devisee who survive the testator by 120 hours take in place of the deceased devisee… ● Under the UPC, the beneficiary must be a grandparent, a descendant of a grandparent, or a stepchild. RCW 11.12.110. Death of grandparent's issue before grantor. Unless otherwise provided, when any property shall be given under a will, or under a trust of which the decedent is a grantor and which by its terms becomes irrevocable upon or before the grantor's death, to any issue of a grandparent of the decedent (includes testator's children, parents, siblings, aunts and uncles, and cousins, but not grandparents) that issue dies before the decedent, or dies before that issue's interest is no longer subject to a contingency, leaving descendants who survive the decedent, those descendants shall take that property as the predeceased issue would have done if the predeceased issue had survived the decedent. If those descendants are all in the same degree of kinship to the predeceased issue they shall take equally or, if of unequal degree, then those of more remote degree shall take by representation with respect to the predeceased issue. Washington Requirements: ● A beneficiary predeceases the testator, and ● The deceased beneficiary is an issue of grandparent. Class Gifts Under the lapse rules, a class gift is treated differently from a gift to individuals. If a class member predeceases the testator, the surviving members of the class divide the total gift, including the deceased member's share, unless an antilapse statute applies. In that case, the gift would pass on to the next in line, in compliance with the statute itself. What is a class? A class gift arises if the testator was group minded. A testator is said to be group minded if he uses a class label in describing the beneficiaries, such as "to A's children," or "to my nephews or nieces." A gift to named beneficiaries who form a natural class may be construed as a class gift if the court decides that the testator would have wanted the survivors to divide the share of a predeceasing beneficiary rather than for it to lapse. Application of Antilapse Statutes to Class Gifts Almost all states apply their antilapse statutes to a single-generation class gift, such as "to children" or "siblings." Changes in Property Ademption by Extinction Ademption by extinction means that a specific devise of a specifically identified asset is extinguished, or fails, because the gifted asset is not in the estate at the testator's death. Most commonly, this occurs because the testator transferred the asset, or the asset was lost or destroyed. Washington follows this general rule. Ademption by Extinction only applies to specific devises of specifically identified assets. If the specific devise is couched in generic language, ademption by extinction does not apply as long as something fitting the description is in the estate. However if a specifically identified asset is not in the estate, then the gift is adeemed by extinction. ● ● Applies only to specific gifts. Only if assets are disposed of before death. Classification of Gifts ○ ○ ○ ○ Specific: "I give my house at 1200 25th Ave., Seattle, WA, to the UW." A specific gift is a gift of a particular thing that can be identified as part of the estate. General: "I give $10,000 to the UW." A general gift is a gift of a certain quantity or type of property, but it does not refer only to, and is not payable only out of property found in the estate at T’s death. Demonstrative: "I give $10,000 from my Wells Fargo Money Market Account to the UW." A demonstrative gift is a quantity or type (but not a specific item) of property to be satisfied out of a specific asset if available, otherwise from general assets of the estate. Residuary: “All of my estate…” A residuary gift is a gift of whatever remains in the estate after the payment of all specific, general and demonstrative gifts. The Identity Theory In states following the identity theory, courts have developed several exceptions to avoid ademption in cases where the property is not in the estate because of an accident or action of someone other than the testator, or in which the facts otherwise indicate a high likelihood that the testator did not intend for ademption. Involuntary Transfer of Asset. The devisee is generally entitled to receive a monetary gift equal to the asset's value on the testator's death, or, if applicable, net sale price minus liens. A similar rule applies to any recovery, condemnation award, or insurance process the representative might collect for loss or damage to the asset. Substitute Gift. If a testamentary gift is adeemed by extinction, the intended devisee generally receives no substitute gift. Ademption means the gift fails entirely. However, in some states and under the UPC, the intended devisee may receive: ● The unpaid/outstanding proceeds of any sale, condemnation award, or insurance payout or similar payment for loss or damage to the asset; ● Any replacement property that is in the estate (of the same form); ● A monetary gift equal to the value of the asset as of the date of its disposition or the testator's death; or ● A gift equal to the value of the asset, but only if the gift's total failure would be inconsistent with the testator's manifested estate plan or otherwise contrary to the testator's intent. RCW 11.12.060. Agreement to convey does not revoke. Property is subject to contract to sell. An agreement made for a valuable consideration by a testator to convey any property in any last will previously made, shall not be deemed a revocation of such previous devise, but such property shall pass by the devise, subject to the same remedies on such agreement, for specific performance or otherwise, against devisees as might be had by law against the heirs of the testator or his or her next of kin, if the same had descended to him or her. Stock Under the UPC, if a will devises a specific number of securities to a person, that person is entitled to any additional securities that the testator acquires after executing the will due to owning the devised securities—subject to the testator’s contrary intent. This includes stock split, dividend reinvestment, merger, acquisition, etc., but not dividend payments. Satisfaction of General Pecuniary Bequests Satisfaction is a doctrine under which lifetime gifts from the testator to a devisee under the will may be deducted from the devise. Satisfaction applies only to the extent that the testator intended for the lifetime gift to apply in lieu of the devise. Satisfaction does not apply to gifts made before the will's execution. ● ● Does not apply to specific gifts. UPC requires contemporaneous writing (similar to Advancements) Exoneration of Liens Unless the will says the mortgage/lien will be paid otherwise (I.e. exonerated out of the estate), the devisee takes the property subject to the mortgage/lien. The UPC provides, however, that general language in a will indicating that all debts be paid from the estate are insufficient to exonerate mortgage. RCW 11.12.070. Devise or bequeathal of property subject to encumbrance. When any property subject to a mortgage is specifically devised, the devisee takes the property subject to the mortgage unless the will provides that the mortgage be otherwise paid. The term "mortgage" as used in this section shall not include a pledge of personal property. A charge or encumbrance upon any real or personal estate for the purpose of securing the payment of money, or the performance of any covenant or agreement, shall not be deemed a revocation of any will relating to the same estate, previously executed. The devises and legacies therein contained shall pass and take effect, subject to such charge or encumbrance. Abatement Abatement applies if the estate is too small to satisfy both (1) all rightful claims against it, and (2) the gifts to devisees. In that event, the gifts must be reduced to the extent necessary to satisfy the claims, so that all claims are paid in full before any gifts are distributed. In the absence of an indication in the will of how devises should abate, devises ordinarily abate in the following order: 1. (1) residuary devises are reduced first, 2. (2) general devises are reduced second, and 3. (3) specific and demonstrative devises are reduced pro rata. Washington follows this general rule. Trusts The creation of a trust requires: ● (1) intent by the settlor to create a trust; ● (2) ascertainable beneficiaries who can enforce the trust; ○ “Friends” is too vague. ○ Remedies: ■ Precatory: the donee gets to keep the money even if the donee refuses to carry out a request, so beneficiaries can’t enforce. ■ Power of Appointment ○ Settlor as Beneficiary: One person may serve as the settlor, the trustee, and the beneficiary, but there must be at least one beneficiary who is not the sole trustee. ● (3) specific property (res) to be held in trust. If the trust is testamentary or is to hold land, then to satisfy the Wills Act or Statute of Frauds, the trust must be in writing. Otherwise, it can be oral. Sometimes, one may try to convert a failed gift into a trust, but in doing so, you need the intent to create a trust. Trusts are under the rule of perpetuities, and thus can only last a maximum of 21 years, unless it qualifies as a charitable trust. Intent The settlor need only manifest an intent to create the fiduciary relationship known by the law as a trust. Testamentary Trust A testamentary trust is created by will. Thus, if the will itself fails to comply with the applicable testamentary formalities, then the will is invalid and hence no trust is created. If a testator's intent to create a trust is not stated clearly, it may be inferred from the language and structure of the will in light of all the circumstances. Deed of Trust (Inter Vivos Trust) The settlor transfers to the trustee the property to be held in trust. On the settlor’s death, the trust property is distributed or held in further trust in accordance with the terms of the trust. In the interim, the settlor is free to revoke the trust and take back the trust property. Unless otherwise specified by statute, no specific formalities are required to create an inter vivos trust. All that is needed is for the settlor to manifest her intent that a trustee hold specific property in trust for one or more ascertainable beneficiaries. Declaration of Trust Under a declaration of trust, a settlor declares himself to be trustee of certain property. A declaration of trust of personal property requires no particular formalities. The settlor need only manifest an intention to hold certain of the settlor's property in trust for an ascertainable beneficiary. Outright Gift. An outright gift requires the donor to deliver the property to the donee. Delivery can be constructive or symbolic, rather than physical, but delivery of some kind is required. Intention alone is not enough to perfect the gift. Consequently, if a donor manifests an intention to make a gift but fails to complete delivery, the question may arise whether the manifestation can be recharacterized as a declaration of trust. Property A trust may consist of virtually any type of property, whether real, personal, tangible, or intangible. However, a trust may not consist of a mere expectation or hope of receiving property in the future, such as property an individual expects to inherit from another. Is a Transfer of Property Necessary? A trust may be created by declaration of trust without a transfer of property. All that is necessary is a manifestation of intent by the settlor to hold certain of his property, over which he already has legal title in trust for one or more beneficiaries. Ascertainable Beneficiaries The Beneficiary Principle For a trust to arise or continue, the trust must designate at least one beneficiary who either (1) is ascertainable at the time or (2) will become ascertainable in the future and within the period of the rule against perpetuities. As long as a beneficiary will become ascertainable in the future, it is not necessary that one be living when the trust is created. Power of Appointment: May be better to use in cases where beneficiary is not ascertainable, because this power is “nonfiduciary” and thus the beneficiaries do not need to be immediately ascertained. Pet and Other Noncharitable Purpose Trusts The UTC and Washington law allow trusts for noncharitable purposes. Under Washington law, pet must have vertebrae (spine). Pet Trust. A pet trust provides for the care of one or more animals that are alive during the settlor's lifetime. These are provided for by state statute. A pet trust will terminate upon the death of the last animal for which the trust was established to provide, but must be within the Rule Against Perpetuities (life in being plus 21 years), which is 21 years for pets (not considered life in being, so just 21 years). Honorary Trusts. if a named trustee is willing to take the obligations on, the trust can go forward. If the trustee refuses, the money goes to the next in line to take. The heirs have standing to go after the trustee if the trustee is not using trust as obligated to. ● The transferee is not obligated to carry out settlor’s purpose; ● If the transferee declines, she holds the property on resulting trust and property reverts to settlor or settlor’s successors. Common Law: Enforceable if the trustee agrees to carry out; otherwise, property passes to the grantor's heirs. UTC: Allows noncharitable purpose trusts (including pet trusts). These are in contrast to precatory gifts, where the donee gets to keep the money even if the donee refuses to carry out a request. (“I give the property to X with the hope that he uses it for my daughter’s education.”) Seawright: A bequest for the care of a specific animal is valid as long as the person receiving the gift for the benefit of the animal (1) accepts the gift and (2) agrees to carry out the wishes of the testator, and (3) the will properly limits the period of time in which the bequest is to be carried out. Statutory Purpose Trust. Statutory trust for pet animal or other noncharitable purpose. Typically authorizes court to reduce excessive trust property and provide for enforcement by settlor. Written Instrument Evidence of Trust Agreement. Oral Inter Vivos Trusts of Personal Property As a general rule, an inter vivos trust of personal property need not be in writing. An oral trust may be established by clear and convincing evidence (Washington includes “cogent”). UTC Sec. 406. Evidence of Oral Trust. Except as required by a statute other than this Code, a trust need not be evidenced by a trust instrument, but the creation of an oral trust and its terms may be established only by clear and convincing evidence. An oral trust that provides for the disposition of personal property at the death of the settlor may be proved by oral testimony. Secret Trusts and the Wills Act Secret Trusts. A secret trust is a type of trust in which property is devised to a person in a will document. The property is to be held by the trustee based on the understanding that they will hold the property and then transfer it to the rightful beneficiary when the testator dies. Enforceable if the intended beneficiary can prove terms. ● Devise is absolute on its face. ● Extrinsic evidence is necessary to prove intent, and to prevent unjust enrichment of the promisor/trustee. ● Court will impose a constructive trust on the trustee/promisor. Semisecret Trusts. A semisecret trust is a trust that a will mentions, but whose terms are not set forth in the will. Trust violates Statute of Wills, is invalid and not enforceable. Thus, the property reverts back to the testator’s estate, and passes to the decedent’s intestate heirs or residue. ● Intent to create a trust appears on face of will. ● Terms are unstated. ● Extrinsic evidence not needed to prevent unjust enrichment of trustee. ● Extrinsic evidence may not be used to prove the terms of an intended trust and thus it will fail for indefiniteness. Rights of Beneficiaries General rule is that creditors cannot force a trustee to exercise discretion and make a distribution. Alienation of the Beneficial Interest Discretionary Trusts (UTC 504) A creditor of a discretionary trust beneficiary has little recourse against the beneficiary’s interest in the trust, and the beneficiary cannot voluntarily alienate his interest. The UTC provides that, subject to an exception for claims by a child or spouse for support or alimony, a creditor of a discretionary trust beneficiary cannot compel a distribution even if the beneficiary could do so. A creditor can obtain an order requiring that, if any distributions are to be made to or for the benefit of the beneficiary, the creditor shall be paid first. Spendthrift Trusts (UTC 502) These protect assets only while in trust. A spendthrift provision is valid only if it restrains both voluntary and involuntary transfer of a beneficiary’s interest. If a beneficiary’s interest is subject to a valid spendthrift provision, the beneficiary may not assign his interest in the trust, and his creditors may not attach his interest prior to the beneficiary receiving the distribution from the trust. This is true even if the beneficiary is entitled to mandatory distributions from the trust. Under traditional law, a trust is not spendthrift unless the settlor includes a spendthrift clause in the trust instrument. Unlike a discretionary trust, a creditor of a spendthrift trust beneficiary cannot obtain an order attaching a future distribution to or for the benefit of a beneficiary. Scheffel: The provisions of a spendthrift trust shall not apply to a beneficiary's interest in a trust to the extent that the beneficiary is the settlor and the trust is not a special needs trust established for a person with disabilities. Thus, under the plain language of the statute, a spendthrift provision is enforceable unless the beneficiary is also the settlor or the assets were fraudulently transferred to the trust. Exceptions Tort Creditors. There is no exception to spendthrift provisions for tort victims. Children and Spouses. Judgement for child or spousal support can be enforced against the debtor’s interest in a spendthrift trust in a majority of states and under the UTC. A child or spouse can attach future distributions to the beneficiary. Washington State enforces child support and necessity of life exceptions. Other. A claimant who provided services necessary to protect a beneficiary’s interest in a trust can recover against the beneficiary’s interest. And a claimant who provided a beneficiary with necessities, such as medical care or food, can recover as well. Station-In-Life Rule In some states, a beneficiary’s creditors can reach spendthrift trust income in excess of the amount needed for the support of the beneficiary. Under this Rule, creditors can only reach the amount in excess of what is needed to maintain the beneficiary in his station in life. This rule rendered excess-income statutes useless to creditors of beneficiaries who are accustomed to luxury. Bankruptcy Bankruptcy Code excludes from a debtor’s bankruptcy estate any beneficial interest in trust that is not alienable under nonbankruptcy law, which includes state trust law. Pension Trusts ERISA provides that benefits provided under a plan may not be assigned or alienated. ERISA also provides however that these benefits may be reached for child support, alimony, or marital property rights. Self-Settled Asset Protection Trusts (UTC 505) Under traditional law, a person cannot shield assets from creditors by placing them in a trust for her own benefit. A creditor will be able to reach the maximum amount that the trust could pay to the settlor or apply for the settlor’s benefit. Affordable Media: Because there was no clear error in the federal district court's finding that telemarketers remained in control of their trust and could repatriate the trust assets, the district court did not abuse its discretion in holding them in civil contempt of court after the telemarketers failed to comply with a preliminary injunction. Exception Creditors Most APT states recognize exception creditors who can recover against the settlor’s interest in an APT. Fraudulent Transfers It is actual fraud to make a transfer with the intent to hinder, delay, or defraud creditors, and constructive fraud to make a transfer without receiving equivalent value if the transfer leaves the debtor with insufficient assets to pay anticipated debts. Trusts for the State Supported In determining whether an applicant is under the disqualifying threshold for public support benefits, the question sometimes arises whether a trust in which the applicant has a beneficial interest should be counted as a resource available for the support of the applicant. Self-Settled Trusts A trust is self-settled, and therefore considered in the qualification decision if assets of the individual were used to form the trust, and the trust was established by the individual, the spouse, or by a court or person who has legal authority to act on behalf of the individual. If the trust is revocable by the individual, the principal and all income of the trust are considered resources available to the individual. If the trust is irrevocable, any income or principal that could be paid or applied for the benefit of the individual are considered resources of the individual. Exceptions ● A discretionary trust created by the will of one spouse for the benefit of the other spouse is not deemed a resource available to the other spouse. ● A trust will not be considfed a resource available to a Medicaid applicant if it is established for a disabled individual from the individual’s property by a parent, grandparent, guardian of the individual, or by a court, and the trust provides that the state will receive upon the individual’s death all amounts remaining in the trust up to the total amount of medical assistance paid by the state. Trusts Created by Third Parties With respect to a trust established by a third person for the benefit of the applicant, trust income or principal is considered available both when actually available and when the applicant or recipient has a legal interest in a liquidated sum and has the legal ability to make such sum available for support and maintenance. Institutionalized Beneficiary: For a trust that has been set up by a third party for an institutionalized beneficiary, courts have generally followed the common law rules applicable to creditors of mandatory, support, and discretionary trusts. If the beneficiary has a right to trust income or principal, the state can reach it. A spendthrift clause does not bar recovery because the state is furnishing necessaries for the beneficiary. Modification & Termination of Trusts General Rule Start with the presumptive rule that a trust is irrevocable and can’t be changed. ● A. If settlor is available, trust may be modified or terminated: ○ If power to revoke/modify omitted by mistake, or ○ If settlor and all beneficiaries agree. Even if it's a spendthrift trust. ● B. If settlor is unavailable, you need to distinguish between modification and termination. ○ If Modification, then between: ■ Administrative deviation: a change that does not affect distribution or beneficial interests, i.e. type of investment or early withdrawal. One can go to a judge and seek a change, and does not need consent from other beneficiaries. ○ Distributive deviation: means a trustee's authorized or unauthorized departure from the express distributional terms of a trust, i.e. who gets the money. Traditional rule is that this is only allowed if: ■ Unforeseen circumstances, that would defeat or substantially impair accomplishment of trust purposes, and ■ change is justified to carry out trust purposes, and all beneficiaries agree, and ■ court agrees and gives approval. ● Termination ○ Claflin rule: Even if you have consent of all beneficiaries, termination is not allowed if contrary to the material purpose of the settlor. ■ UTC § 411: ● Preserves material purpose test. ● Weakes requirement of beneficiaries’ unamity. ○ Authorizes termination if interests of absent beneficiaries will be adequately protected. ■ Restatement § 65 ● Weakens material purpose. ○ Authorizes termination if reason outweighs material purpose. ● Preserves the requirement of beneficiaries’ unamity. ■ Washington law: Termination is nearly impossible because all trusts are spendthrift trusts, however, under TEDRA, if all interested parties (including trustees, and potential beneficiaries [minors and unborn beneficiaries]) agree, there are no restrictions. Nothing has to be proven (similar to England rule, not giving deference to wishes of the deceased). Minor and Unborn Beneficiaries ● Doctrine of Virtual Representation ○ If there’s an adult that has identical interests to the minors, then consent can be given. ● Appointment of Guardian or Guardian Ad Litem ● Appointment of Special Representative ○ The Claflin doctrine isn’t absolutely dead under Washington rule, because if one cannot get the trustee to agree, for example, then termination has to be sought in the court and the court will apply the Claflin doctrine. Courts do deem spendthrift clause to be material purpose. RCW 11.96A Contains procedural rules for Title 11, trusts, probates, intestacy, etc. ● The Common Law is still good law, but recognizes Virtual Representation. Decanting Decanting means the authority of a trustee to distribute income and principal of a first trust to one or more second trusts, or to modify the terms of the first trust. Washington’s new decanting law applies to irrevocable or express trusts in which the trustee or another fiduciary has discretionary power to make distributions of principal. RCW 11.107. Removal of Trustee Generally only allowed for cause, such as: ● Serious breach of trust; ● Dishonesty; ● Lack of capacity to administer; ● Friction between trustee & beneficiaries not enough; ● Hardest to remove when appointed by settlor; ● Terms of trust can specify grounds for removal and/or give people authority to replace; ● Note: UTC generally expands ability to remove trustee; adds settlor as having power. Charitable Trusts General ● Must have charitable purpose, ● Can be perpetual, ● does not need ascertainable beneficiaries, ● can be modified under Cy Pres, ● enforced by the state attorney general; grantor has no standing (common law rule). Trusts set up for a charitable purpose. Charitable trusts are not subject to the rule against perpetuities; thus, if a trust does not satisfy the requirements to be a charitable trust, then it is subject to the RAP and can last a maximum of 21 years. UTC states that a charitable trust may be created for the relief of poverty, the advancement of education or religion, the promotion of health, governmental or municipal purposes, or other purposes the achievement of which is beneficial to the community. Taylor: Trust to children at a school to use “for educational purposes” was not deemed to be a charitable trust. The drafter could have instead made the school the beneficiary for use of the children, or it could have expressed a long time limit, such as 100 years, to add presumed intention that it’s supposed to be charitable and not subject to the RAP. “Candy Trust”: The “candy trust” was not considered charitable, but was instead just “nice.” There wasn’t a specific reason that supported the “general charitable intent.” Bishop: “Broken Trust” published by prominent community leaders, calls for investigation of trustee selection and administration of the trust. ● IRS audits and found: ○ Estate not operated primarily for charitable purposes; ○ Improper involvement in political campaigns; ○ Trustees’ fees in gross excess of value of services; and ○ Numerous instances of private benefit. James Brown: The role of the trustee is important, especially when the trust is an artist’s, because that person wields a lot of power over the artist’s art, music catalog, etc. Cy Pres Rule Courts can modify charitable trust if: (1) grantor had general charitable intent and (2) implementation as written is impracticable or impossible. The aim is to look for a way to accommodate the general intent of the charitable purpose. RCW 11.96A.127 Washington has gotten rid of the “general charitable intent” prong. It just considers whether the charitable intent is impracticable. Enforcement A donor does not have standing to enforce a charitable trust unless she retains an interest in the trust property. Instead, the state attorney general has primary responsibility for enforcing charitable trusts. Settlor Standing A majority of states allow a settlor of a charitable trust to enforce the trust. Persons with a Special Interest in the Trust The standing of an attorney general is not exclusive. A person who has a special interest in the enforcement of the trust may be able to enforce a charitable trust. To have a special interest standing, a person must show that he is entitled to receive a particular benefit under the trust that is not available to the public at large. Nonprobate Transfers Will substitutes are modes of transfer that operate outside the state operated transfer system of probate administration. A will substitute is valid without Will Act formalities. If nonprobate transfer fails, then will go to estate—or to whomever if a will exists; if not, then to intestate. Creditors: Creditors can reach most nonprobate assets (not life insurance), but, with limits, joint tenancy and revocable trusts. There are five major types of will substitute: 1. Revocable Inter Vivos Trust 2. Life Insurance 3. Pay-on-Death (POD) 4. Transfer-on- Death (TOD) 5. Pension/Retirement Accounts 6. etc. Nonprobate Transfers on Death A provision for a nonprobate transfer on death in a written agreement is nontestamentary; it goes to who is defined in the agreement. Revocable Trusts Nonprobate Transfers in General: ● Must be valid in some other way, such as contract. Creditors Creditors can reach assets. Section 505(a)(1) of the Uniform Trust Code provides that “[d]uring the lifetime of the settlor, the property of a revocable trust is subject to claims of the settlor’s creditors.” Deed of Trust (Inter Vivos Trust) The settlor transfers to the trustee the property to be held in trust. On the settlor’s death, the trust property is distributed or held in further trust in accordance with the terms of the trust. In the interim, the settlor is free to revoke the trust and take back the trust property. Unless otherwise specified by statute, no specific formalities are required to create an inter vivos trust. All that is needed is for the settlor to (1) manifest her intent that a trustee hold (2) specific property in trust for one or more ascertainable beneficiaries. Testamentary: If a transaction is labeled “testamentary,” that means the formalities of a will are required (i.e. two witnesses, etc.). Settlor’s will work to avoid this in order to ensure that an intended trust is not void. Declaration of Trust Under a declaration of trust, a settlor declares himself to be trustee of certain property for his own benefit during his life, with the remainder to pass at his death in accordance with the terms of his declaration. A declaration of trust of personal property requires no particular formalities. The settlor need only manifest an intention to hold certain of the settlor's property in trust for an ascertainable beneficiary. ● Settlor keeps: ○ Right to Revoke, ○ Right to Income, ○ Right to Principal, and ○ Right to Change Beneficiary UTC Sec. 603. Settlor’s Powers; Powers of Withdrawal (a) While a trust is revocable, rights of the beneficiaries are subject to the control of, and the duties of the trustee are owed exclusively to, the settlor. (b) During the period the power may be exercised, the holder of a power of withdrawal has rights of a settlor of a revocable trust under this section to the extent of the property subject to the power. ● Note: The trustee of a revocable trust does not owe a duty to remainder beneficiaries. Thus, a beneficiary of a revocable trust has no legally enforceable interest while the trust is revocable. Fulp. The Pour-Over Will A pour-over will is one that devises all or some part of the probate estate to a separate trust for disposition under the terms of that trust. These wills are essentially “clean up” wills and account for all property that may be acquired after, or is not accounted for by the already existing trust; can provide that this property is to go into the existing trust as well. Pour-over dispositions are generally used to administer property outside the sometimes cumbersome, lengthy, and costly probate process. Validity Most states have statutes validating pour-over dispositions. Without a validating statute, a pour-over disposition is generally invalid unless the separate trust (1) satisfies the relevant testamentary formalities on its own, (2) or would qualify for inclusion in the will under incorporation by reference (writing clearly referenced in the will and exists when will is executed) or as an act of independent significance (trust is funded with property during settlor’s lifetime). Revoking or Amending a Revocable Trust The modern, majority view today is that an inter vivos trust is revocable unless declared to be irrevocable. Specifically, a revocable trust can be amended or revoked in any manner that cleary manifests the settlor’s intent to do so, unless the trust instrument specifies a particular method of amendment or revocation and makes that method exclusive. Under Common Law, a trust is irrevocable unless it says it’s revocable (WA follows this). UTC flips the presumption; a trust is revocable unless it says it’s irrevocable. Exclusive Means for Amendment: A settlor need not comply with the amendment requirements of a trust unless such terms are deemed the exclusive means for amendment. As long as the amendment clearly evidences the settlor’s intent, then it’s valid. Patterson. UTC Sec. 602. Revocation or Amendment of Revocable Trust. ● (a) Unless the terms of a trust expressly provide that the trust is irrevocable, the settlor may revoke or amend the trust [in any manner]. This section does not apply to a trust created before the Code. ● (c) The settlor may revoke or amend a revocable trust: ○ (1) by substantial compliance with a method provided in the terms of the trust; or ○ (2) if the terms of the trust do not provide a method (silent) or the method provided in the terms is not expressly made exclusive, [then can also revoke or amend] by: ■ (A) a later will that expressly refers to the trust or later devises property that would otherwise pass in accordance with the trust; ■ (b) any other method manifesting clear and convincing evidence of the settlor’s intent. ● (d) Upon revocation of a revocable trust, the trustee shall deliver the trust property as the settlor directs… RCW 11.103.030 - Need a writing. ● ● Presumption is that a trust is not revocable unless it says that it is (opposite of UTC). If the terms of the trust do not provide a method (silent) or the method provided in the terms is not expressly made exclusive, [then can also revoke or amend] by: ○ (A) a later will that expressly refers to the trust or later devises property that would otherwise pass in accordance with the trust; ○ (b) a written codicil that evinces clear and convincing evidence of the settlor’s intent. Capacity The capacity required to make a donative transfer is higher in most states for a lifetime transfer than for a deathtime transfer (will). Lost Trust If a trust cannot be found, there is no presumption that the settlor intended the trust to be “torn up” like there is with a will. Creditors ● ● Creditors can reach assets in trust set up by grantor for grantor while grantor is alive. RCW 19.36.020. Creditors can reach assets in a trust after a grantor dies. A trust for a decedent’s use of which the decedent is also the grantor is subject to a creditors claims, to the extent that it was immediately before death. RCW 11.18.200(e). Subsidiary Law of Wills The settlor’s power to revoke the trust and take back the trust property is regarded as equivalent to ownership and, hence, the trust property is subject to the claims of the settlor’s creditors during life and at death. Reiser: Where a settlor of a trust retains the power to amend and revoke the trust or power to control the principal and income during his lifetime, his creditors may reach the assets of the trust after his death to the extent that the assets of his estate are insufficient to pay his debts. RCW 11.18. RCW 19.36.020. All deeds of gifts, conveyances, and transfers made in trust by a person for the benefit of the same are void (not immune) to creditors. Limits Though creditors may reach property in a revocable trust, they cannot reach certain other nonprobate transfers, including: ● jointly held property after a joint tenant’s death (can reach in WA to the extent that the deceased joint tenant owed the property before the other joint tenant gained their interest; can go after whatever it could go after while the person was alive), ● life insurance proceeds if payable to a spouse or child, ● and retirement benefits. Revocation on Divorce Under the UPC, a nonprobate transfer to a former spouse would typically be revoked upon divorce, as with a gift or appointment under a will. Without an explicit statute, though, courts have reached different conclusions as to whether the revocation-upondivorce rule extends beyond wills to nonprobate transfers. Clymer: Applies to unfunded trusts only; would only revoke upon divorce if trust was unfunded. Lifetime Considerations ● ● ● Can facilitate property management by a fiduciary. Can be used in planning for incapacity. May be useful in keeping title clear. Deathtime Considerations ● ● ● ● ● ● ● ● Privacy and more difficult to set aside than will Continuity in property management Avoid ancillary probate (property in another state) More leeway than a will in a choice of law May be able to avoid forced share in certain states Not subject to ongoing court supervision Uncertainty about subsidiary law of wills Probate nonclaim statute may not be applicable Other Will Substitutes Life Insurance Life insurance is a type of will substitute, as the proceeds pass directly to the beneficiary under the terms of the life insurance policy and outside probate. The proceeds are thus never a part of the insured’s probate estate and cannot be reached by creditors, unless the estate is named as the beneficiary. Beneficiary can be a trust if for instance, for example, one’s wife were to predecease the individual. The trust could be set-up for minor children. Term Life Insurance: ● Contract that obligates the insurance company to pay the named beneficiary if the insured dies within the policy’s term. ● Less expensive than permanent insurance because no saving feature or cash surrender value. Whole Life Insurance: ● Contract that obligates the insurance company to pay the named beneficiary when the insured dies. ● Policy eventually becomes paid up/endowed, after which no further premiums are owed. Revocation on Divorce In many states, the statute that revokes a will provision for an ex-spouse does not apply to life insurance contracts, so it’s important to change beneficiary at divorce. ERISA overrides Revocation on Divorce. The UPC revokes life insurance on divorce. Change Life Insurance Beneficiary in a Will Cannot change a life insurance beneficiary through a will, without going through the procedures required by the life insurance. Pension and Retirement Plans These plans are a form of will substitute; the named holder owns these accounts during life, but on the holder’s death, the death-benefit feature vests the account in a named beneficiary. The account passes entirely outside probate under the terms of the governing documents. ● Defined Benefit Plan. A retired employee typically receives a regular pension check for life or the joint and several lives of the employee and the employee’s spouse. ○ If benefit is annuitized, no remainder to pass at death. ● Defined Contribution Plan. The employer or the employee, or both, make contributions to a specific account for the employee. The employee usually makes the investment decisions for her account, typically choosing from a menu of mutual funds and other such investment vehicles. Once retired, the former employee controls the size and timing of distributions from the account. ○ Remainder passes outside of probate to designated beneficiaries. ● Individual Retirement Account. An IRA is the main form of tax-advantaged retirement saving for many self-employed persons. An IRA owner controls the timing and amounts of withdrawals. ○ Remainder passes outside of probate to designated beneficiaries. Succession: The majority rule is that a will is ineffective to change a life insurance beneficiary designation. Multi-Party Bank Accounts ● Joint Tenancy: Banks prefer this because they don’t like agency-like accounts; however, this can be against what the individual really wants. For example, an older person may want to assign one of their children as an agent, just to be able to pay various bills for her, but not actually make the child a Joint Tenant because she may have other children who she wants to have a share when she passes away. Varela: Where a joint bank account is created with funds belonging to one person, a gift of the funds to the other person is presumed and the presumption may only be rebutted by clear and convincing evidence. Pay-on-Death and Transfer-on-Death Contracts Pay-On-Death Accounts A POD account is a financial account (1) that is carried in a depositor’s name and (2) whose governing document provides that the account balance is payable to a designated beneficiary on the depositor’s death. Upon the depositor’s death, the funds pass according to the governing documents. Thus, a POD account is a form of will substitute; the funds pass outside probate and thus are never part of the depositor’s estate. Multiple-Party Bank and Brokerage Accounts Where a joint bank account is created with funds belonging to one person, a gift of the funds to the other person is presumed and the presumption may only be rebutted by clear and convincing evidence. Antilapse Statutes The UPC imposes a requirement of survivorship on beneficiaries of POD bank accounts. The UPC also includes an antilapse provision for nonprobate transfers which substitutes the surviving descendants of a predeceased named beneficiary. Transfer-On-Death Deed A TOD allows an individual to transfer real estate to a designated beneficiary upon the individual’s death while retaining ownership of the property during life. Generally, TOD deeds are revocable and thus do not affect the transferor or transferee’s interests or rights until the transferor’s death. The deed must clearly state that the real estate should not be transferred to the beneficiary until the time of the individual’s death. Otherwise, the transfer will occur upon delivery of the deed to the transferee. In a majority of states, statutes authorize a transfer-on-death deed as valid even without will formalities. UPC A provision for TOD is non-testamentary (i.e. does not need formalities because it’s a contract). RCW 11.02.1091 An otherwise effective written instrument of transfer may not be deemed testamentary solely because of a provision for a nonprobate transfer at death in the instrument. ● This section does not make an instrument effective that would not otherwise be effective. ● (4) This section only eliminates a requirement that instruments of transfer comply with formalities for executing wills. ● (5) This section does not limit the right of a creditor under other laws of the state. Joint Tenancy Joint tenancy features a right to survivorship, meaning that when one concurrent owner dies, that owner’s interest instantly vanishes. Thus, it cannot be subject to probate or transferred by will. The other concurrent owner’s interests then enlarge proportionately, which passes to them outside probate. Creditors As a general rule joint tenancy real assets cannot be reached by creditors after death because the deceased joint tenant’s property interest ceases at his death. Planning for Incapacity Property Management Conservatorship A conservator typically has broad powers to manage the person’s property similar to those of a trustee, and is also typically subject to fiduciary duties of loyalty and care. The main drawback to conservatorship is that it imposes substantial private and social costs. Process Because imposition of a conservatorship is a deprivation of liberty that requires due process, the UPC and related laws provides for an elaborate court procedure to protect the alleged incompetent. A conservatorship typically begins when an interested party files a petition with the appropriate court. A court may appoint a conservator if it finds by clear and convincing evidence that the person “is unable to manage property and business affairs because of an impairment in the ability to receive and evaluate information of make decisions,” and by a preponderance of evidence that the person “has property that will be wasted or dissipated unless management is provided or money is needed for the support [and] care … of the person. A conservator can thus be appointed against the wishes of the person for whom the conservator acts. Priority Priority for appointment as conservator is typically given to someone chosen in advance by the person, an agent under durable power of attorney, or the person’s spouse, adult child, or parent, in that order. Waiver Avoiding a conservatorship can be done in advance through revocable trusts and durable power of attorney, which are in effect a waiver of the conservatorship process. Revocable Trust The donor will commit certain property to a trustee for the benefit of a beneficiary, directing the trustee to pay the income to a beneficiary for the donor’s life, then transfer the principal to that same or a different beneficiary upon the donor’s death. A funded revocable trust may be used to avoid a conservatorship and to provide continuity in the event of the settlor’s incapacity. Even if the settlor had been the sole trustee, upon incapacity a successor trustee can take over without court involvement. ● The trustee can act only with respect to property put in the trust by the settlor before becoming incapacitated. For other property held by the settlor outright, only a conservator or an agent under a durable power of attorney will have the legal power to act. ● A mechanism for determining whether the settlor has become incapacitated should be included. A familiar solution is to put the determination in the hands of the settlor’s physician and one or more additional named persons, such as the settlor’s spouse or children. A provision like this reduces the risk of litigation. Standing The trend is toward denying standing to beneficiaries to enforce the trust during the settlor’s incapacity (lifetime). Durable Power of Attorney Unlike an ordinary power of attorney, a durable power of attorney remains effective during the incapacity of the principal and until the principal dies. A durable power of attorney can be drafted to be effective immediately upon signing or only upon the principal’s incapacity (a springing durable power of attorney). In the absence of a statute, common law imposes fiduciary duties of loyalty and care on an agent and supplies the default terms for the agency relationship. An advantage of a durable power of attorney is that the agent can be authorized to act with respect to any of the principal’s property, including property that was acquired after execution of the power. Intention: An attorney-in-fact has the authority to create a trust on behalf of the principal if the power of attorney indicates that the principal intended the attorney-in-fact to have such authority. Kurrelmeyer. Standing Because an incapacitated principal cannot monitor the actions of an agent, making a power of attorney durable to survive incapacity gives rise to an increased risk of abuse by the agent. To alleviate this problem, the UPC and statutes in some states give standing to sue an agent to a spouse, parent, descendant, presumptive death beneficiary of the principal, and to other persons interested in the principal’s welfare. Gift Giving In most states, an agent cannot make a substantial gift without specific authorization. In many states, and under the UPC, the grant of such power is subject to enhanced formality requirements, such as requiring the principal to initial next to the provision giving an agent the power to make gifts. Healthcare Default Law A person may make an advance directive (living will) that states her wishes about refusing or terminating medical treatment or that appoints an agent to make such decisions for her. In the absence of an advance directive, responsibility for an incompetent patient’s health care decisions usually falls to the patient’s spouse or next of kin. When making health care decisions for an incompetent patient, an agent is held to a substituted judgment standard of what the patient has chosen or would have chosen in that situation. Priority To give clear order of priority among potential decision makers, many states have adopted statutory hierarchy; the Uniform Health Care Decisions Act provides that in the absence of an advance directive, decisions are to be made by surrogates in the following order: 1. Spouse, unless legally separated. 2. Adult child. 3. Parent; or 4. Adult sibling (if there is more than one person in the class, the majority controls). Advance Directives Advance directives are of three basic types: 1. Instructional directives: such as a living will, which specify either generally or by way of hypothetical examples of how one wants to be treated in end-of-life situations or in the event of incompetence; 2. Proxy directives: such as health care proxy or durable power of attorney for health care, which designate an agent to make health care decisions for the patent; and 3. Hybrid or combined directives: incorporating both of the first two approaches, directing treatment preferences, and designating an agent to make substituted decisions. Disposition of the Body Post-Mortem Remains Majority of states codify power that gives a person something more than hope, but not a complete assurance that his wishes will be carried out at death. If a person dies by violence or in suspicious circumstances, statutes in all states require an autopsy regardless of the wishes of the deceased person or next of kin. Organ Donation Most states have enacted routine request statutes, requiring hospitals to request from families of prospective donors at the time of death permission to remove organs for transportation. Others have favored establishing a mandated choice in which every person would be required to answer, one way or the other, whether the person was willing to donate organs for transplantation after death. Still another idea is to presume that a deceased person has consented to donation. Under such a presumed consent or opt out system, unusable organs would be routinely removed from cadavers unless an objection had previously been made, either by the deceased person during life or immediately after the decedent’s death by a person acting on behalf of the decedent. Protection of the Family Surviving Spouse Community Property ● ● ● Gifts of CP require agreement of both spouses (in WA). At death, however, each spouse is free to give away his or her share of CP to whomever she/he chooses. ○ Exception (Quasi-CP): Property acquired in a common-law (separate) state that, had it been acquired in the same manner in a communityproperty state, would be classified as community property. At death of married person, the estate includes his/her SP plus his/her one-half of the CP. The other one-half of the CP is owned by the surviving spouse and is not subject to distribution. Protection of Spouse in CP State ● Spouse is owner of one-half of all CP that comes into the marriage. ● Spouse has no right to claim property of deceased spouse at death except for homestead and support award. ● If couple had no CP, then if S/S survives rich spouse, rich spouse can completely disinherit poor spouse. Prenup is a solution. The fundamental principle of community property is that during marriage all earnings of the spouses are community property unless both spouses agree to separate ownership. Property that is not community property is the separate property of one spouse or the other, or, in the case of a tenancy in common or joint tenancy, of both. Separate property includes property acquired before marriage and property acquired during marriage by gift or inheritance. In community property states, the living spouse gets a share of earnings during the marriage, so a downfall is that if a spouse comes into a marriage with money, the living spouse has no claim because the money came before the marriage. Tracing. If property has been commingled, or acquired from both separate and community funds, tracing determines the portion of the property that is community. If there is insufficient evidence to establish the source of the funds, the presumption in favor of community property applies. Agreement as to Status: To avoid tracing problems, a couple can make an agreement that will control the character of their community property (community, joint tenancy, tenancy in common, sole ownership). RCW 26.16.120. Community Property with Right of Survivorship. Under this form of community property, the decedent spouse cannot dispose of his share by will; instead it passes under a right of survivorship to the surviving spouse. Tax Issues: If a married couple buys an asset at a certain price, and one of the spouses dies, the property gets stepped up to the “at death” value. Some noncommunity property states offer this benefit, but they aren’t actually community property states. At Death: Each spouse is free to leave all of his/her SP and his/her ½ of CP to anyone. Exception (Quasi-CP): Property acquired in a common-law (separate) state that, had it been acquired in the same manner in a communityproperty state, would be classified as community property. Management and Disposition of Community Property Either spouse in a community property state can dispose of his or her own half of the couple’s community property at death. In most states, each spouse generally has the power to manage community property, but there are exceptions for which both spouses are necessary—for transactions involving real property, for example. In other states, each spouse is given exclusive management over his or her earnings and property acquired with those earnings as long as they are held in the name of the earning spouse. Creditors. Under a managerial state, the creditor has recourse against all community property subject to the debtor’s spouse’s control. Under the community debt system, the creditor’s claim is characterized as separate or community, and the creditor’s rights follow accordingly. Gifts. Neither spouse can make a gift of community property without the consent of the other spouse. Various remedies are available to a spouse who did not consent to a gift. Ownership. Item theory is where each of the spouses own equal shares in each item of community property. Under an aggregate theory, followed by some of the states, a spouse may be able to dispose of one asset, such as a life insurance policy, to someone other than the spouse if the spouse receives onehalf of the total community property. Migrating Couples and Multistate Property Holdings The traditional conflict of laws rules used to determine which state law governs marital property are as follows. 1. The law of the situs controls problems related to land. 2. The law of the marital domicile at the time that personal property is acquired controls the characterization of the property as separate or community. 3. The law of the marital domicile at the death of one spouse controls the survivor’s rights. Moving from Separate Property to Community Property Quasi-community property is property owned by the husband or the wife acquired while domiciled elsewhere, which would have been characterized as community property if the couple had been domiciled in the community property state when the property was acquired. During the continuance of the marriage, quasi-community property is treated as the separate property of the acquiring spouse. However, in a state that recognizes quasi-community property for probate purposes, one-half of the quasi-community property belongs to the surviving spouse at death, with the other half subject to testamentary disposition by the decedent. Real property situated outside the state is not treated as quasi-community property because the spouse retains in it any elective share or dower given by the law of the situs. Moving from Community Property to Separate Property Community property brought into the state remains community property for purposes of testamentary disposition, unless the spouses have agreed to convert it into separate property. In a state that has not adopted the act, a court might automatically convert any community property the spouses exchange in that state into a form of common law joint ownership. Homestead & Support Social Security A spouse can generally draw his own earned benefits, if any, or one-half of the other spouse’s benefits, whichever is greater. At the death of the other spouse, the surviving spouse is entitled to his own earned benefits, if any, or the full amount of the decedent spouse’s benefits. Pension and Retirement Accounts If a private retirement account, the spouse has survivorship rights, and is entitled to 100% of the deceased spouse’s account. If the employee dies before retirement, the surviving spouse may be entitled to a preretirement survivor annuity. Boggs: ERISA preempts state law allowing a spouse to transfer by testamentary instrument an interest in undistributed pension-plan benefits. Homestead Most states have a homestead law that is designed to secure the family home to the surviving spouse and minor children, free of the claims of the decedent’s creditors. Although the details of these laws vary, the surviving spouse will often have the right to occupy the family home for his lifetime. Personal Property Set-Aside The surviving spouse has the right to receive tangible personal property of the decedent, up to $15,000 under the UPC. These items, which are usually exempt from creditors’ claims, usually include household furniture and clothing, but may also include a car and farm animals. The set-aside is usually subject to several conditions and limitations, but, if these are met, the decedent usually has no power to deprive the surviving spouse of the exempt items. Family Allowance A family allowance is a portion of the estate that a surviving spouse may claim for shortterm support, usually taking the form of periodic payments over time from the estate. As with the homestead and personal property set-aide, any family allowance— maintenance and support—is in addition to whether other interests pass to the surviving spouse. Both the personal property set-aside and family allowance are personal to the surviving spouse and do not pass to the survivor’s estate. Elective Share An elective share is a portion of the deceased spouse’s estate that a surviving spouse may choose, by law, to take instead of the amount specified in the will. The typical elective share is one-third of all of the decedent’s probate property, plus certain nonprobate transfers. This is to ensure that spouses cannot completely be disinherited; they at least get a third. Spouses may waive their elective share rights by premarital or marital agreements. The amount of elective share varies greatly, but is usually less than the intestate share because the spouse, in intestacy, typically gets the estate, if no parents. Once the amount of the elective share has been determined, the surviving spouse is usually credited with the value of all other interests received under the will. If those amounts do not satisfy the elective share, the difference must be made up either pro rata contributions from all the other beneficiaries. Common Law State ● One spouse’s share of the other’s property is recognized at the end of the relationship, either through divorce or death. ● Elective share is enforceable against all assets of deceased spouse, include inherited money and money acquired before marriage. Community Property State ● There is no elective share, because each spouse owns one-half of the earnings of the other spouse during the marriage. ● Spouse has claim only on earnings. Creditors Creditors cannot force spouse to take elective share. Must the Surviving Spouse Accept a Life Estate? If the surviving spouse renounces the life estate and elects to take her share in fee simple, she is not charged for the value of the life estate. Subsequently Deceased Surviving Spouse In most states, the right of election may be exercised by the surviving spouse or a representative of the surviving spouse only during the surviving spouse’s life. Incompetent Surviving Spouse A majority of states hold that all the surrounding facts and circumstances should be taken into consideration when determining whether a guardian or other representative of an incompetent surviving spouse can elect against the decedent’s will. Augmented-Estate Formula In many states, the surviving spouse may elect to receive a fractional share of the marital-property portion of the augmented estate. This entails a four step process: 1. Determine the value of the augmented estate; 2. Determine the marital-property portion, which depends on the length of the marriage; 3. Multiply the augmented estate’s value by the marital-property portion; and 4. Multiply the resulting value by the statutory fractional share, which is one-half under the UPC. Value of Augmented Estate ● The decedent’s net probate estate, i.e. what remains in the estate after any enforceable claims, support allowances, and administration costs have been paid; ● The decedent’s nonprobate transfers to the surviving spouse and others; and ● The surviving spouse’s property and nonprobate transfers to others. Nonprobate Property Sullivan: For purposes of determining an omitted spouse’s share, where the decedent spouse created an inter vivos trust during the marriage and only the decedent spouse had the general power of appointment under the trust, the trust assets shall be treated as part of the probate estate. Myers: Pay-on-death assets are not included in a surviving spouse’s elective share. Prenup ● Must be procedurally or substantively fair at the time of signing. ○ Procedural Fairness: Full disclosure of what parties are giving up, plus full disclosure of legal rights that are being affected. A spouse can waive her right to an elective share in advance. All separate property states enforce a waiver of right of election by premarital agreement, and almost all also enforce a waiver agreed to during the marriage. Under the UPAA, the party opposing enforcement must prove that the agreement either (1) was not voluntary, or (2) was unconscionable when executed and the party opposing enforcement did not have fair and reasonable disclosure of the other party’s property and finances. Reece: An antenuptial agreement will be enforced even where a party failed to disclose the value of a substantial asset as long as the contesting party was not misled and had an opportunity to discover the value of the asset. Omitted Family Members ● ● ● Must be born after the date of the will. Omitted party typically receives a intestate share. See exceptions. The assumption is that you would have wanted to include the omitted family members, but one never got around to updating the will. ● Must be born after the date of will. If there’s a codicil, this means that the omitted family member must be born/added after the date of the last codicil, or else this assumption does not exist. ● Intestate share. If you qualify as an omitted family member, you will usually receive an intestate share. The next step is to then see if there is an intestate share for that omitted family member. Under WA, for example, the spouse receives all of the community property, so there would not be an intestate share for the child to claim (RCW 11.12.091). Intestate share is usually larger than an elective share. ● Exceptions. Statutes often contain many exceptions, such as intentional omittance, provided for during life, etc. ● Probate. These statutes only apply to probate assets, not to nonprobate assets. After Acquired General Rule 1. First pay creditors off of the top. 2. Then the intestate share of the Omitted family member. 3. Then Will beneficiaries. Remedies and Priorities These claims are usually treated as coming after creditor (incl. contract) claims but before Will beneficiaries. Omission of a Child An omitted child (pretermitted child) is a child who is not included in a parent’s will because (1) the child was born or adopted after the parent executed the will, or (2) the parent mistakenly believed the child to be dead. A child has no statutory protection against intentional disinheritance by a parent. Unlike a spouse, there is no requirement that a testator leave any property to a child. Omitted-Child Doctrine An omitted child is entitled to an intestate share of the estate if the testator had no children when the will was executed. If the testator had living children at execution, then the omitted child is entitled to an equal share of the combined devises made to the testator’s then-living children, abating the other children’s devises ratably as necessary. Gray: An omitted child born after execution of the decedent’s will is not entitled to an intestate share under the omitted child statute if the decedent parent omitted all of his children from the will and left the entire estate to the omitted child’s other parent. Exceptions to Doctrine An omitted child is not entitled to an intestate share if: ● The testator intentionally omitted from the will any descendants the testator had at execution or may have had later; ● The testator provided for the child with a nontestamentary transfer and intended for the transfer to be in lieu of a testamentary devise; or ● The will devises substantially all of the estate to the omitted child’s other parent, and that parent survives the testator and is entitled to take under the will. No Elective Share Unlike a surviving spouse, a surviving child has no right to an elective share. For an omitted child, this means that if there is no property in the probate estate when the decedent dies, then the omitted child will receive nothing by way of an intestate share. Revocable Trusts Some statutes only refer to wills, and not to revocable trusts. Statutes that only refer to wills, and not revocable trusts, cannot be applied to a revocable trust used as a will substitute. Jackson. RCW 11.12.091. Omitted child. (1) If a will fails to name or provide for a child of the decedent who is born or adopted by the decedent after the will's execution and who survives the decedent, the child must receive a portion of the decedent's estate … unless it appears either from the will or from other clear and convincing evidence that the failure was intentional. (3) The omitted child must receive an amount equal in value to that which the child would have received if the decedent had died intestate, unless the court determines on the basis of clear and convincing evidence that a smaller share, including no share at all, is more in keeping with the decedent's intent. In making the determination, the court may consider, among other things, the various elements of the decedent's dispositive scheme, provisions for the omitted child outside the decedent's will, provisions for the decedent's other children under the will and otherwise, and provisions for the omitted child's other parent under the will and otherwise. Omission of a Spouse from Premarital Will An omitted spouse is a surviving spouse who is omitted from the decedent’s will. A spouse is typically omitted if the decedent spouse marries after executing a will and fails to provide for the new spouse before death by amending the will or executing a new one. Cannot disinherit a spouse in a common law state. Omitted-Spouse Doctrine (UPC Sec. 2-301) An omitted spouse is generally entitled to an intestate share of the testator’s estate, unless: ● The will was made in contemplation of the marriage to the surviving spouse; ● The will provides that its terms remain effective of any subsequent marriage; or ● The testator provided for the spouse with a nontestamentary transfer and intended the transfer to be in lieu of a testamentary devise. Prestie: Where a will does not provide for a surviving spouse who married the testator after his will was executed, the presumption of revocation may only be rebutted by evidence of a marriage contract or a provision in the will that either provides for the surviving spouse or indicates an intention not to provide for the spouse. Portion of Estate to which Omitted-Spouse Intestate Share Relates An omitted spouse’s intestate share is a share of the entire estate, but the value of the estate is reduced by the value of any testamentary gifts, including those under trust, to any of the testator’s child who are not also children of the surviving spouse and were born before the testator married the surviving spouse, as well as their descendants. RCW 11.12.095. Omitted spouse or omitted domestic partner. (1) If a will fails to name or provide for a spouse of the decedent whom the decedent marries after the will's execution and who survives the decedent … the spouse must receive a portion of the decedent's estate … unless it appears either from the will or from other clear and convincing evidence that the failure was intentional. (3) The omitted spouse must receive an amount equal in value to that which the spouse would have received if the decedent had died intestate, unless the court determines on the basis of clear and convincing evidence that a smaller share, including no share at all, is more in keeping with the decedent's intent. In making the determination the court may consider … the spouse's property interests under applicable community property or quasi-community property laws, the various elements of the decedent's dispositive scheme, and a marriage settlement or settlement in a domestic partnership or other provision and provisions for the omitted spouse or omitted domestic partner outside the decedent's will. Trust Administration A trustee holds legal title to the trust property and owes fiduciary duties to administer the property in the best interest of the beneficiaries, who in turn have standing to enforce the trustee’s obligations. Three Kinds of Trusts Business trusts for commercial deals. Business trusts are common law or statutory trusts created for a commercial purpose such as organizing a mutual fund or facilitating asset securitization. Because business trusts are not donative in purpose, but rather are integral to a commercial deal, they involve an exercise of freedom of contract, not freedom of disposition Revocable trusts for nonprobate transfers. A revocable trust need not have property, at least not initially, if it is to be funded by a pour-over will. The trustee of a revocable trust does not owe fiduciary duties to the beneficiaries, but rather is subject to the control of the settlor, to whom the trustee’s duties run. Irrevocable trusts for ongoing fiduciary administration. An irrevocable trust involves ongoing fiduciary administration of property by a trustee in accordance with the settlor’s intent. Trustees’ Powers Under the UTC (Sec. 815), in addition to the “powers conferred by the terms of the trust,” by default a trustee has “all powers over the trust property which an unmarried competent owner has over individually owned property,” plus “any other powers appropriate to achieve the proper investment, management, and distribution of the trust property.” A trustee has the same default powers in dealing with trust property as would an outright owner. However, a trustee’s powers is subject to the trustee’s fiduciary duties. RCW 11.98.070. Power of trustee. Trustees powers are spelled out in this statute, and are generally very broad. Powers: ● To acquire or sell property; ● To deposit trust money in an account in a regulated financial-service institution; ● To pay or contest any claim; and ● To sign and deliver contracts; plus many more. Duties of a Third-Party Dealing with a Trustee The UTPA protects third-parties who deal with a trustee, without the knowledge that the trustee is exceeding their power. Specifically: ● A person who in good faith assists a trustee without knowledge that the trustee is exceeding or improperly exercising the trustee’s powers is protected from liability as if the trustee properly exercised the power; ● A person who in good faith deals with a trustee is not required to inquire into the extent of the trustee’s powers or the propriety of their exercise. Co-Trustees Co-trustees may act by majority decision, unless provided otherwise in the terms of the trust. Each co-trustee remains under a duty to take reasonable steps to prevent a breach of trust by her co-trustees if necessary by bringing an action for instructions or an injunction. UTC Sec. 703 “Even in matters for which a trustee is relieved of responsibility, … if the trustee knows that a co-trustee is committing or attempting to commit a breach of trust, the trustee has a duty to take reasonable steps to prevent the fiduciary misconduct. The Duty of Loyalty A trustee acts solely in the best interests of the beneficiaries, which means that the trustee’s interests cannot be considered. This doesn’t mean that the trustee cannot be paid, but its actions must be in the interests of the beneficiaries. A trustee’s duty of loyalty has four prongs. A trustee must: ● Subject to the trust’s terms, administer the trust solely in the beneficiaries’ interest; ● Avoid self-dealing and conflicts of interest; ● Deal fairly with beneficiaries, making sure to communicate to them all material facts that are or should be known to the trustee regarding a matter anytime the trustee interacts with them in any capacity; and ● Segregate trust property. Hartman: It is well settled that an executor, like a trustee, cannot purchase from himself without leave of the court and the same limitation is imposed on a purchase by his wife. Self-Dealing / No-Further-Inquiry Rule Self-dealing is prohibited. If a trustee undertakes a transaction that involves a conflict between the trustee’s fiduciary capacity and personal interests, no further inquiry is made; it is irrelevant whether the transaction is fair. While fairness is a defense in the corporate context, it’s not with self-dealing in trusts context. If it was self-dealing, the beneficiaries have their choice of remedy. The goal is deterrence. Scope of Self-Dealing encompasses... ● The trustee’s purchase or lease of trust property for her own account; ● Sale of trust property to a third person with an understanding that the third person then will sell to the trustee; ● Sale of trust property to a corporation in which the trustee is a substantial owner or serves in a management capacity; ● Sale of the trustee’s individually owned property to the trust; ● Purchase by a corporate trustee of its own stock as an investment for th trust; ● Appropriation of a trust opportunity; ● Statutory exceptions. The only defenses that the trustee may raise are that: (a) the settlor authorized the particular conflict in the terms of the trust; (b) the beneficiary consented after full disclosure; or (c) the trustee obtained judicial approval in advance. Even if the rule does not apply, the beneficiary is still entitled to judicial review of whether the trustee acted fairly and in good faith. Gleeson: A trustee who engages in self-dealing breaches his fiduciary duty regardless of whether he was acting in good faith and the trust suffered no injury as a result. Rothko: If a will’s executor sells estate property for inadequate value due to a conflict of interest, the sale is void, and the executor is liable for the property’s appreciated value at the time of trial. Exceptions: ● A corporate trustee is allowed to deposit trust assets with its own banking department and to invest the trust assets in a mutual fund operated by the trustee or an affiliate. ● A trustee is allowed to take reasonable compensation. ● The rule is inapplicable to structural conflict, such as if a trust has shares in a company, and the named trustee is a board member of that same company. Remedies for Breach ● In the event of a breach of duty, a beneficiary is entitled to compensatory damages to restore the trust estate and distributions to what they would have been but for the breach, as well as to disgorge the trustee of any profit made on the breach. ● If a trustee has sold his own property to the trust, a beneficiary may compel the trustee to repay the purchase price and take back the property. If the trustee bought property from the trust, the beneficiary may compel the trustee to restore the property to the trust. ● A beneficiary may also enforce a constructive trust or equitable lien against a third party who acquires trust property through the trustee’s breach of trust, or if a trustee acquires trust property through the wrongful disposal of trust property. Duty of Care (Prudence) Imposes on a trustee an objective standard of care. “A trustee shall administer the trust as a prudent person would, by considering the purposes, terms, distributional requirements, and other circumstances of the trust. In satisfying this standard, the trustee shall exercise reasonable care, skill and caution.” UTC Sec. 804. Distribution Function Involves making distributions of income or principal to the beneficiaries in accordance with the terms of the trust. In a mandatory trust, the trustee must make specific distributions. In a discretionary trust, the trustee has discretion over when, to whom, or in what amounts to make a distribution. Discretionary Trust A court will not interfere with a discretionary judgment of a trustee so long as the trustee acts reasonably and in good faith. Even in trusts where the settlor grants a trustee broad discretionary power, a trustee must act honestly and in a state of mind contemplated by the settlor. The court will not permit the trustee to act in bad faith or for some purpose or motive other than to accomplish the purposes of the discretionary power. Marsman: A trustee directed by the trust to use his discretion in determining the amount of trust principle to distribute for the support of the beneficiary must inquire into the needs of the beneficiary in order to exercise his discretion with the sound judgment required of a fiduciary. Farr, the attorney and trustee, breached his duty. Exculpatory Clauses These clauses excuse trustees from liability, except for willful neglect or default. The Restatement provides, however, that these clauses are presumptively unenforceable. The presumption is rebuttable, and the clause will be given effect if the trustee proves that the clause was fair and that the existence of the clause is adequately communicated to, and understood by, the settlor. Investment Function Involves the duty to invest prudently. The overarching idea is that a trustee needs to be relatively conservative when managing a trust. Prudent Investor Rule Trustee looks at the needs of the beneficiaries and implements an investment strategy with an appropriate risk/return. The rule shifts the risk onto the trustee. When the trustee invests in a diversified portfolio, the risk then shifts to the trust itself. Key changes from earlier rules: ● Increased sensitivity to tradeoff between risk and return. ● Diversification is required (although diversification is not always the best strategy, if the basket that all of one’s eggs is in is doing better). ● Delegation is allowed, if done responsibility. This means that a trustee can delegate investment responsibilities to a professional in the field (i.e. investment manager). Exceptions: ● Trustor waives duty to diversity, or requires retention of certain assets. ● Inception Assets: Some states permit the trustee to keep the assets as it was given to him. However, there’s an exception to the exception, if it would be imprudent to do so. ● Small Trusts: If trust is small (i.e. $100k), there’s less of a burden on a trustee to diversify assets because there’s not enough to do so effectively. The Duty to Diversity and Inception Assets A trustee must diversify a portfolio and otherwise reallocate the trust portfolio within a “reasonable time” of taking office as necessary to bring the trust into compliance with the prudent investor rule. ● Limited Exceptions: ○ Trsutor waives duty to diversify, or requires retention of certain assets. ○ Inception assets: small trust, or if particular circumstances indicate reasons not to diversity. An executor is deemed to have acted imprudently in retaining concentrated investment in a single security when the executor has knowledge and should have known to have divested from that security based on information obtained. Janes. Just because a settlor didn’t sell stock during his limetime due to tax consequences doesn’t mean that a trustee is able to hang his hat on that and not sell when appropriate. This is because when the settlor dies, the trust gets the assets at a step-up basis, so there’s less tax consequences for a trustee to sell. Wood. “Reasonable Time”: What constitutes “reasonable time” is determined on a case-by-case basis, and depends on factors such as: ● The nature of the property involved; ● The reason the trustee is required to sell it; ● Whether appraisals are necessary; ● Whether there is a ready market for the property; and ● The relative degree of price efficiency in that market. Compensatory Damages for Imprudent Investment An award of compensatory damages can be on a theory of capital lost plus interest—which is the value of the investment on the date that the investment should have been divested, plus compound interest, or on a theory of total return—which compares the actual performance of the imprudent portfolio against the performance of a hypothetical prudent portfolio, and to award damages in the amount of the difference. Permissive Retention A trust may contain a provision that grants a trustee permissive power to retain an undiversified portfolio. However, the prevailing view is that this permissive authorization does not excuse the trustee from liability if not diversifying was imprudent. Tax Consequences: Just because a settlor didn’t sell stock during his limetime due to tax consequences doesn’t mean that a trustee is able to hang his hat on that and not sell when appropriate. This is because when the settlor dies, the trust gets the assets at a step-up basis, so there’s less tax consequences for a trustee to sell. Directed Retention and Deviation If a settlor clearly directs the trustee to retain certain assets, the trustee must do so, and the trustee may be subject to liability for disposing of them if they subsequently increase in value. A trustee’s duty to conform to the terms of the trust is qualified by a duty to petition the court for appropriate modification of or deviation from the terms of the trust if conforming will cause substantial harm to the trust or its beneficiaries. Beneficiary Authorization Because a trustee stands in a fiduciary relationship with the beneficiaries, a release from liability given by a beneficiary to a trustee is enforceable only if the beneficiary knew of her rights and of the material facts. Custodial and Administrative Functions The custodial function involves taking title and custody of the trust property and properly safeguarding it. The administrative function includes recordkeeping, bringing and defending claims held in trust, accounting, and giving information to the beneficiaries, and making tax and other required filings. Duty to Collect and Protect Trust Property Trustee must collect and protect property without unnecessary delay. Duty to Earmark Trust Property A trustee has a duty to earmark trust property, designate it as trust property distinct from the trustee’s own property. A trustee is liable for breach only if the loss results from the failure to earmark, and is not liable if the loss results from general economic conditions. Duty Not to Mingle Trust Funds with the Trustee’s Own A trustee must keep trust property separate from the trustee’s own property. A trustee who commingled trust property with his own is in breach of trust even if the trust does not use the trust funds for his own purposes. Duty to Keep Adequate Records of Administration A trustee must maintain adequate records of the trust property and the administration of the trust, including documentation of important decisions and actions and the trustee’s reasoning for those decisions and actions. Duty to Bring and Defend Claims A trustee is under a duty to take reasonable steps to enforce claims of the trust and to defend claims against the trust. If a trustee improperly refuses or neglects to bring a claim held in trust against a third party, the beneficiary may bring the action against the third party, combining it with an action against the trustee for unreasonably failing to do so. Duty of Impartiality Where there are multiple beneficiaries, the duty of impartiality requires a trustee to give due regard to the beneficiaries’ respective interests as defined by the settlor in the terms of the trust. A trustee must construe the trust instrument to determine the respective interests of the beneficiaries. ● ● ● Trustee must be equally fair with all beneficiaires. Trustee can address the conflict in the trust agreement. Also need to be fair to same-level beneficiaries. Principal and Income The duty of impartiality constrains the trustee by requiring “due regard” to the interests of principal and income. Only when beneficial rights do not turn on a distinction between income and principal is the trustee allowed to focus on total return without regard to the income component of that return. ● “Income to A for life, remainder to B” ○ Old approach: Unproductive property remedy. ○ New approach: Trustee has power to label something as “income” (trustee/beneficiary doesn’t have the power). Unitrust The settlor may set a percentage of the value of the trust corpus that must be paid to the income beneficiary each year. A unitrust frees the trustee to focus on risk and return without regard for the form in which that return comes. The percentage to be distributed need not be fixed, and can be tied to the rate of inflation or interest rates, for example. A trustee-beneficiary may convert to a unitrust, subject to judicial review to assure the fairness of the trustees’ election. Heller. Duty to Inform and Account A trustee is under an ongoing duty to keep the beneficiaries informed about the administration of the trust, in particular, by providing information needed by the beneficiaries to protect their interests in the trust. Thus, a trustee has a duty to inform a beneficiary that a trust has been set up in their name. Responding to a Request for Information A trustee is under a duty to respond promptly to a beneficiary’s request for information related to the administration of the trust. The theory is that, for a beneficiary to be able to protect her interest in the trust, the beneficiary must have access to information reasonably related to that interest. The information sought by Plaintiffs—including accounting— was reasonably necessary to enforce their rights under the trust, and therefore could not legally be withheld. Allard. RCW 11.100.140 Cannot Negate a Beneficiary’s Information Right A settlor cannot override a beneficiary’s right to information reasonably necessary for the protection of the beneficiary’s interest in the trust. Relevant Disclosure The duty of a trustee to furnish a copy of the trust instrument that a beneficiary upon request is not mandatory. A settlor can therefore direct that a beneficiary be shown only those portions of the trust instrument that are relevant to the beneficiary's interest. Affirmative Disclosure Statutes in many states impose on a trustee a duty of periodic accounting to the beneficiaries regarding the administration of the trust. Even in the absence of a statute, a beneficiary may compel a trustee to render an accounting. The trustee must inform beneficiaries of all material facts in connection with a nonroutine transaction which significantly affects the trust estate and the interests of the beneficiaries prior to the transaction taking place. Allard. Nonroutine Transactions RCW 11.100.140. Notice and procedure for nonroutine transactions. ● Requires both written advance notice and appraisal before entering into a significant nonroutine transaction. ● A “significant nonroutine transaction” is: ○ Transactions affecting contributed RE that is at least 25% of total trust assets. ○ Sale of contributed tangible personal property whose value is at least 25% of total trust assets. ○ Sale of closely held stock representing a 25% or greater interest in the corporation. ○ Sale of stock causing trust to lose controlling interest. Accounting and Repose Judicial Accountings A trustee is not liable to a beneficiary for a breach of trust if the facts of the breach are fairly disclosed in a formal accounting of the administration of the trust filed with the court, notice of the accounting is properly served on the beneficiary, and the beneficiary does not object is barred from later bringing a claim against the trustee. Where marital status of testator's widow was fact susceptible of precise knowledge and trustee made no effort during administration of testamentary trust to ascertain if widow had remarried, trustee's misrepresentation that her status had not changed justified reopening of previously allowed accounts of trustee. Cambridge. Liability for Distribution to Ineligible Person A trustee has a defense for mistaken delivery of trust property to an ineligible person, including a defense of “diligent, good faith efforts … or reasonable reliance. Informal Accounting and Release An informal accounting to a beneficiary shall have the same effect as a judicial accounting if the beneficiary does not object to the informal accounting within a certain period of time. Under the UTC, a trustee is required to send the beneficiaries an annual “report” of the administration of the trust. All that is essential is that the “report provides the beneficiaries with the information necessary to protect their interests.” A beneficiary who receives such a report has one year to object, otherwise the trustee obtains repose as to all matters fairly disclosed in the report. The Restatement says that approval of such report shall discharge the trustee from liability only if (1) the other person in giving approval acts neither in bad faith nor in casual disregard of the interests or rights of the non assenting beneficiaries and (2) the accounting appropriately discloses material issues about the trustee’s conduct The UDTA states that several beneficiaries may be empowered to approve an informal accounting by a trustee, however, the beneficiary who approves the account is subject to fiduciary duties of loyalty and prudence to the other beneficiaries in approving that accounting. Construction of Trusts Future Interests Classification Future interests fall into two categories. The interests are called future interests because a person who holds one of them is not entitled to current possession or enjoyment of the property. Instead, the person may become entitled to possession or enjoyment in the future. All future interests fall into one of two categories: ● Retained (Reversionary) Interests: retained by the transferor. ○ Reversion ○ Possibility of Reverter ○ Right of Entry for Condition Broke ● Interests in Third Persons (Nonreversionary): Interests given to the transferee. ○ Vested Remainder ○ Contingent Remainder ○ Executory Interest Future interests always follow some present interest; but nothing follows fee simple absolute. Future Interests in the Transferor Reversion: A reversion is the interest remaining in the grantor who transfers a vested estate of a lesser interest than the grantor had. Possibility of Reverter: The future interest that remains in a grantor who conveys a fee simple determinable; a fee estate that will terminate automatically upon the happening of a specified event. ● Interest of donee is defeasible (open to cancellation). ● “To the school board so long as the land is used as a school.” ● “So long as,” “while,” “until” — all words of limitation; conditions precedent ● Interest of grantor: possibility of reverter; i.e. right to property if condition is violated. ● Right is automatic. However, if not brought up until way later, adverse possession could take effect. Right of Entry: The future interest that is retained by a grantor who conveys a fee simple subject to a condition subsequent. ● “To the school board, but if the property is not used as a school, then to Sylvia.” ● Language is conditional rather than limitational. Must take action, within a reasonable time, to enforce the right of entry; not automatic. Future Interests in Transferees Remainder A remainder is a future interest in a transferee that will become possessory upon the natural expiration of all prior interests simultaneously created. Vested and Contingent Remainders: ● A remainder is vested if it (a) is given to a presently ascertained person, and (b) is not subject to a condition precedent other than the termination of the preceding estates. ● A remainder is contingent if it: (a) is not given to a presently ascertained person, or (b) is subject to a condition precedent in addition to the termination of the preceding estates. ○ “Those of A’s children who survive him, but if none survive, then to B” Vested Subject to Partial Divestment (Defeasance): If a remainder is given to a class of people, only some of whom are ascertained, the ascertained people are subject to partial divestment or subject to open by additional people coming into the class by being ascertained. Executory Interests An executory interest divests a preceding estate prior to its natural expiration. An executory interest that may divest the transferor in the future if a specified event happens is called a springing executory interest. An executory interest that may divest another transferee if a specified event happens is called a shifting executory interest. (Don’t worry about springing and shifting) ● “To the school board as long as used as school, if not, to the church. ● Subject to the Rule Against Perpetuities (RAP doesn’t apply to interests retained by grantor) Survivorship “To A for life, then to C.” ● ● Under the traditional approach, C has a vested remainder. If C dies before A, then C’s estate owns the vested remainder. UPC inserts requirement that there be an express condition of survivorship until vesting, which in essence converts to contingent remainders. Construction of Trust Instruments Don’t use “heirs” unless you’re very specific and careful. RCW 11.12.180 Rule Against Perpetuities Interests in property must be able to vest, if at all, within 21 years after the death of a life in being at the time that the interest was created. “To A, then to A’s children:” If A is still alive, it means that they could have more children, which would violate RAP because it could extend beyond 21 years at the time the interest was created, if A’s children die, for example. “To Amanda for life, remainder to Amanda’s first child to reach 30 years old”: (Amanda is alive, B is 5, C is 7): Violates RAP, because B and C could die, Amanda could have more children, and that would be beyond life and 21 years. One can choose a (class) life in being in order to extend the life of a trust. The measuring life must be ascertainable (in the case of a famous person, that is easy because everyone will know when the person passes away). Usually want to pick younger people because they are likely to live the longest. ● RAP also applies to Goods & Services Tax (GST). RCW 11.98.130. Rule Against Perpetuities. Washington law places a 150 year limit on trusts. RCW 11.98.150. Distribution of assets after 150 years. If, at the end of the 150 years any of the trust assets have not by the terms of the trust instrument become distributable or vested, then the assets shall be distributed as the superior court having jurisdiction directs, giving effect to the general intent of the creator of the trust or person exercising a power of appointment in the case of any further trust or other disposition of property made pursuant to the exercise of a power of appointment. RCW 11.98.160. Effective date of irrevocable inter vivos trust. The effective date of an instrument purporting to create an irrevocable inter vivos trust is the date on which it is executed by the trustor, and the effective date of an instrument purporting to create either a revocable inter vivos trust or a testamentary trust is the date of the trustor's or testator's death. Perpetuities Reform Saving Clauses The purpose of a Saving Clause is to protect against an overlooked violation of the Rule Against Perpetuities. Under this clause, the trust will terminate not later than 21 years after the death of all beneficiaries, originally or subsequently named, who were in being when the trust became effective. The principal is then distributed as provided in the saving clause. Reformation (or Cy Pres) Allows a court to modify a trust that violates the Rule Against Perpetuities as necessary to carry out the testator’s intent within the perpetuities period. In exercising this power, the court might insert a saving clause adapted to the particular possibility that causes the gift to be invalid. REVIEW (Private) Trusts ● (1) intent by the settlor to create a trust; ● (2) ascertainable beneficiaries who can enforce the trust; ○ “Friends” is too vague. ● (3) specific property (res) to be held in trust. If the trust is testamentary or is to hold land, then to satisfy the Wills Act or Statute of Frauds, the trust must be in writing. Otherwise, it can be oral. Community Property ● Gifts of CP require agreement of both spouses (in WA). ● At death, however, each spouse is free to give away his or her share of CP to whomever she/he chooses. ● At death of a married person, the estate includes his/her SP plus his/her one-half of the CP. The other one-half of the CP is owned by the surviving spouse and is not subject to distribution. ● If a couple had no CP, then if the S/S survives the rich spouse, the rich spouse can completely disinherit the poor spouse. A prenup is a solution. Elective Share An elective share is a portion of the deceased spouse’s estate that a surviving spouse may choose, by law, to take instead of the amount specified in the will. The typical elective share is one-third of all of the decedent’s probate property, plus certain nonprobate transfers. This is to ensure that spouses cannot completely be disinherited; they at least get a third. ● In common law state, one spouse’s share of the other’s property is recognized at the end of the relationship, either through divorce or death. ● Poorer spouse must survive the richer in order to get any dispositive control at death over the marital property. After-Acquired Family Members ● Creditors are paid out first, than intestate share, then will beneficiaries. Trust Administration ● Duty of Loyalty ○ Prohibition against self-dealing. ○ ○ ● Remedies Exception ■ The grantor can excuse. ■ The beneficiaries can waive. Duty of Care ○ Duty to inquire. ○ Duty to invest prudently. ■ Prudent Investor Rule ■ Duty to Diversity/Exceptions