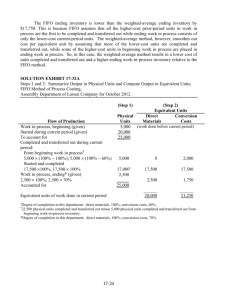

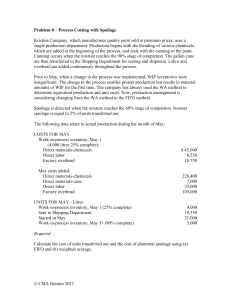

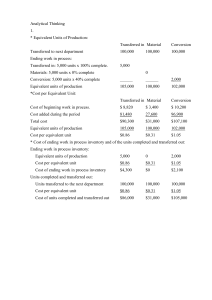

TABAO, JOANNA J. BSA4 INTEFAR 2. Using the average method, compute the cost of completed and transferred to Tabulation Operation. a.1,729,520 b.2,077,760 c.1,730,250 d.1,926,000 Multiple Choice Question 1 and 2 Unilab Pharmaceutical Company manufactures a tablet for allergy suffers. All ingredients are added at the beginning of the Blending Operation. Conversion costs flow uniformly throughout the process. Tabulating and coating are operations downstream from Blending. Information on the blending Operation for October are as follows: Work in Process – Blending Operations Oct 1, Balance (100,00 units, Completed and Transferred 40% complete for conversion cost) 151,760 to Tabulating: Direct Materials added (1,000,000 units) 1,310,000 Units - ? Direct Labor Cost ? Costs - ? Factory Overhead (applied at 180% of direct labor cost 396,000 Oct 31, balance (200,000 units, 70% complete for conversion cost ? The October 1 balance consists of the following cost elements: Direct Materials: P128,000 Direct Labor 8,800 Factory Overhead 14,960 Total Cost P151,769 1. Using the FIFO method, compute the cost completed and transferred to Tabulation Operation. a.1,729,520 b.2,077,760 c.1,730,250 d.1,926,000 3. The Biondle Dye Company manufactures hair rinses and colourings. Direct materials are introduced into production at the 50% stage of completion in Department A. Direct Labor and Factory Overhead are incurred evenly throughout the process. Because of the timing of certain chemical processes, units are often at different stages of completion. Management uses the FIFO costing method in an effort to analyze cost. Beginning units in process in Department A for May were at the following stages of completion. 40% of the units were 10% complete 15% of the units were 40% complete 20% of the units were 50% complete 25% of the units were 70% complete Beginning Units in process amounted to 26,000 units, with a total costs of P37,700. During May, 68,000 units were started in process. The following costs were incurred: direct materials P47,092; direct labor P34,658; and factory overhead P51,987. Ending units in process for May amounted to 6,000 units. They were at the following stages of completion: 35% of the units were 25% complete. 50% of the units were 45% complete. 10% of the units were 75% complete. 5% of the units were 95% complete. There were no spoiled units during the month. Determine the cost of work in process inventory ending. a.4,565.50 b.3,825.25 c.4,250.75 d.3,354.75 4. C Corporation is a manufacturer that uses average costing to account for costs of production. C manufactures a product that is produced in three separate departments: Molding, Assembling, and Finishing. The following information was obtained for the assembling department for June: Work in process, June 1 – 2,000 units, composed of: Amount P32,000 5. Magnolia Chicken Farms raises chicks to the egg-laying stage and then moves the hens to the laying sheds. Information about the Chick Raising Operation for March is: a. Beginning inventory of chicks is 12,000 100% complete for chicks and 20% for raising costs b. Beginning inventory costs are P129,600 for chicks and P11,530 for raising costs c. Chicks added during March totaled 20,000 d. Costs incurred during the month are P200,000 for chicks and P121,800 for raising costs e. Ending inventory at March 31 consisted of 2,000 chicks, 100% complete for chicks and 70% for raising costs Determine the cost of hens transferred to laying sheds during March. a.25,000 b.437,050 c.26,550 d.436,300 Degrees of Completion 100% Transferred in from the molding department Cost added by the assembling department Direct Materials 20,000 100% Direct Labor 7,200 60% Factory Overhead 5,500 50% The following activity occurred during June. a.10,000 units were transferred in from Molding Department at a cost of P160,000 b.P150,000 cost were added by the Assembling Department: direct materials, P96,000; and factory overhead P18,000 c.8,000 units were completed and transferred to the Finishing Department At June 30, 4,000 units were still in work in process, with the following degrees of completion: direct material 90%; direct labor 70%; and factory overhead 35%. Determine the cost transferred out during the month of June. a.260,000 b.114,700 c.113,500 d.261,000 6. Alberta Instrument Company uses a process costing system. A unit of product passes through three departments – molding, assembly, and finishing – before it is completed. The following activity took place in the Finishing Department during May. Work in process inventory, May 1 1,400 units Units transferred in from the Assembly Department 14,000 units Units transferred out to finished goods inventory 11,900 units Raw material is added at the beginning of processing in the Finishing Department. The work in process inventory was 70% complete as to conversion on May 1 and 40% complete as to conversion on May 31. Alberta instrument company uses the weighted-average method of process costing. The equivalent units and current period costs per equivalent unit of production for each cost factor are as follows for the finishing department. Transferred in Cost Raw Materials Conversion Cost Equivalent Units 15,400 15,400 13,300 Current Period Cost per Equivalent Unit P 5.00 1.00 3.00 Calculate the cost of units transferred to finished goods inventory during May and the cost of Finishing Department’s work in process inventory on May 31. Finished Goods a. P107,100 b. P107,100 WIP Inventory P25,200 6,300 Finished Goods c. P126,000 d. P126,000 WIP Inventory P6,300 P25,200 7. Department MK had 5,000 units in process on April 1 which were 60% complete for conversion cost. Materials are added at the beginning of the departmental processes, and conversion costs are added uniformly throughout the process. On April 30, the in-process inventory consisted of 8,00 units that had 25% of the workout completed. There were 83,000 equivalent units of output for the period with respect to materials. The company is using the FIFO method. Calculate the equivalent units for the period with respect to conversion cost. a. 79,000 b. 80,000 c. 81,000 d. 77,000 Questions 8 and 9 are based on the following: Hubert Products Company produces Dalandan fruit drink. The units and equivalent units (in liters), as well as unit costs, for the initial Mix Department are as following: Materials Conversion Equivalent units in beginning work in process 6,000 1,200 Units started and completed 40,000 40,000 Equivalent units in ending work in process 3,000 1,800 Unit Costs P6.50 P10.50 8. Assuming the company uses the FIFO method. If the beginning work in process inventory was valued at P126,000, what would be the cost of goods completed? a. 770,000 b. 896,000 c. 644,000 d.857,600 9. Assuming the company uses the weighted average method. If the beginning work in process inventory was valued at P126,000, what would be the cost of ending work in process inventory? a. P19,500 b. P18,900 c. P38,400 c. P51,600 10. Old motors is engaged in the production of a standard type of electric motor. Manufacturing costs for April totaled P660,000. At the beginning of April, inventories appeared as follows: Motors in production, estimated 80% complete (250,000 units) Motors on hand and in finished goods (1,200 units) P320,000 P192,000 During the month, 5,500 completed units were placed in finished stock. At the end of April, inventories were: Motors in production, estimated 50% complete Motors on hand, completed and finished goods 12. Emerald Inc. produced 280,000 units of products and 10,000 incomplete units (50% complete). Direct materials which are added at the beginning of the process, cost P435,000 and conversion costs applied uniformly were P142,500. There were no beginning inventories. The total cost absorbed by the 280,000 complete units must be: a. P567,368 b. P577,500 c. P420,000 d. P560,000 1,000 units 1,400 units The company uses FIFO costing for production and goods sold. In costing finished goods, the unit cost for units completed from beginning work in process inventory is kept separate from the unit cost of motors started and completed during the month. Compute the cost of goods sold. a. P861,000 b. P858,500 c. P669,000 d. 776,000 13. Karen Company had 3,000 units in work in process at April 1, 2011, which were 60% complete as to conversion cost. During April, 10,000 units were completed. At April 30, 4,000 units remained in work in process, which were 40% complete as to conversion cost. Direct materials are added at the beginning of the process. How many units were started during April? a. 9,000 b. 9,800 c. 10,000 d. 11,0000 11. The materials equivalent production units for June is 27,500. Material costs beginning P55,000. Materials added this month is P220,000. Cost of units transferred to next department is 82,500. How much is the material unit cost in June? a. P3 b. P8 c. P10 d. P2 Questions 14 and 15 are based on the following: Jethro Company manufactures top-of-the-line ice skates in a five-production-department process. Department 3 had no beginning work in process inventory and transferred in 18,000 units from Department 2, each with an equivalent unit cost of P12.50. Within Department 3, unit costs for direct materials, direct labor, and factory overhead (applied) were P8.00, P9.75, and P4.00 respectively. Direct materials in Department 3 are added at the beginning. Department 3 has 4,800 units in ending work in process inventory which are 65% complete as to conversion costs. 14. If 620 spoiled units were removed from Department 3 at Jethro’s inspection point where conversion costs were 45% complete, what was the total spoilage cost, assuming spoilage is handled as a separate element of cost? a. P8,796.25 b.P11,325,25 c. P13,818.25 d. P16,546.25 15. At Jethro’s Department 3 inspection point, which is located halfway through Department 3’s conversion process, 1,200 spoiled units were removed from production. Normal spoilage was 800 units. If total spoilage cost was P32,850 how much of that amount should be allocated to ending inventory? a. P0 b. P5,821 c. P7,320 d. 8,760 Production Data Beginning inventory (100% complete as to transferred-in; 100% complete as to assembly material; 80% complete as to conversion) Transferred in during the year (100% complete as to transferred in) Transferred to Packaging Ending Inventory (100% complete as to transferred-in; 50% complete as to assembly material; 20% complete as to conversion) Cost Data Transferred- In Beginning Inventory P82,200 Current Period 1,237,800 Direct Materials P6,600 96,840 3,000 units 45,000 units 40,000 units 4,000 units Conversion Cost P11,930 236,590 Damaged bicycles are identified on inspection when the assembly process is 70% complete; all assembly material has been added at this point of the process. The normal rejection rate for damaged bicycles is 5% of the bicycles reaching the inspection point. Any damage bicycles above the 5% quota are considered to be abnormal. All damaged bikes are removed from the production process and destroyed. 16. Compute the amount of the total production cost of P1,672,020 that will be associated with normal damaged units. a. P69,167 b. P65,793 c. P59,500 d. P74,228 Question 16 and 17 are based on the following: APCO Company manufactures various lines of bicycles. Because of the high volume of each type of product, the company employs a process cost system using the weighted average method to determine unit costs. Bicycle parts are manufactured in the Molding Department and transferred to the Assembly Department where they are partially assembled. After assembly, the bicycle is sent to the Packing Department. Cost per unit data for the 20-inch dirt bike has been completed through the Molding Department. Annual cost and production figures for the Assembly Department are presented below. 17. Compute the amount of the total production cost of P1,672,020 that will be associated with abnormal damaged units. a. P65,793 b. P69,167 c. P59,500 d. P60,732 18. The Jake Department is the first of a two-stage production process. Spoilage is identified when the units have completed the Jake process. Costs of spoiled units are assigned to units completed and transferred to the second department in the period spoilage is identified. The following information concerns Jake’s conversion costs in May 2013: Units Conversion Cost Beginning work in process (50% complete) 2,000 P10,000 Units started during May 8,000 75,500 Spoilage – normal 500 Units completed and transferred 7,000 Ending work in process (80% complete) 2,500 Using the Average method, what was Jake’s cost transferred to the second department? a. P59,850 b. P64,125 c. P67,500 d. P71,250 19. A company produces plastic drinking cups and uses a process cost system. Cups go through three departments – mixing, molding, and packaging. During the month of June, the following information is known about the Mixing Department: Work in process at June 1 10,000 units An average ¾ complete Units complete during June 140,000 Work in process at June 30 20,000 An average ¼ complete Materials are added at two points in the process: Material A is added at the beginning of the process and Material B at the midpoint of the mixing process. Conversion costs are incurred uniformly throughout the mixing process. Under the FIFO costing flow, the equivalent units for Material A, Material B, and Conversion costs respectively for the month of June (assuming no spoilage) would be a. 150,000; 130,000; and 137,500 c. 160,000; 130,000; and 135,000 b. 150,000; 140,000; and 135,000 d. 160,000; 140,000; and 137,500 20. Assume that process conversion costs are uniform but a number of materials are added at different points in process. Material 1 is added at the beginning of the process. The transferred-in costs are added at the 20% point in the process. Material 2 is added uniformly from the 50% to 70% points in the process. Material 3 is added at the 75% point in the process, and Material 4 is added uniformly at the 90% to the 100 points in the process. The beginning work in process was 10,000 units 60% complete, 60,000 units were added, and an ending work in process was 20,000 units 95% complete. What was the Material 2 equivalent units for the month? FIFO Weighted Average FIFO Weighted Average a. 50,000 60,000 c. 65,000 70,000 b. 60,000 70,000 d. 63,000 67,000