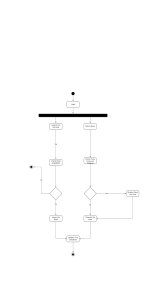

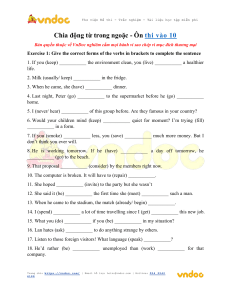

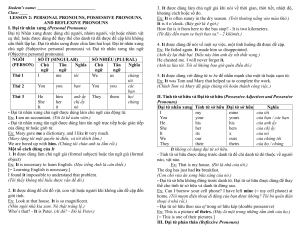

BỘ GIÁO DỤC VÀ ĐÀO TẠO TRƯỜNG ĐẠI HỌC KINH TẾ - TÀI CHÍNH THÀNH PHỐ HỒ CHÍ MINH The Economics of Money, Banking, and Financial Markets Chapter 3: WHAT IS MONEY? TRẦN NGỌC THANH thanhtn@uef.edu.vn 1 Đại học Kinh tế - Tài chính thành phố Hồ Chí Minh Learning 0bjectives ● Describe what money is ● List and summarize the functions of money ● Identify different types of payment systems ● Compare and contrast the M1 and M2 money supplies 2 Table of contents 01 Meaning of money 02 03 Functions of money 04 Evolutions of money Measuring money supply 3 What is money? ● Money (or the money supply): anything that is generally accepted as payment for goods or services or in the repayment of debts. ● Wealth: the total collection of pieces of property that serve to store value. ● Income: flow of earnings per unit of time (a flow concept) 4 Evolution of the Payments System 5 Evolution of the Payments System ● Barter economy: without money, goods and services are exchanged directly for other goods and services. ● Commodity Money: is made up of precious metals or another valuable commodity ● Fiat Money: paper money decreed by governments as legal tender ○ Not backed by a physical commodity and its value depends on demand and supply ○ uneasy to transport with a large amount. ● Check: an instruction to your bank to transfer money from your account ● Electronic Payment (e.g. online bill pay) ● E-Money (electronic money): Debit card, stored-value card (smart card), Ecash (zalopay) ● Cryptocurrencies: Bitcoin 6 Functions of money ● Medium of Exchange: it is used to pay for goods and services ○ Reducing time and transaction costs spent in exchanging goods and services => economic efficiency. ● A medium of exchange must: ○ be easily standardized ○ be widely accepted ○ be divisible ○ be easy to carry ○ not deteriorate quickly 7 Functions of money ● Unit of Account: ○ Used to measure value in the economy ○ Reduces transaction costs ● Store of Value: ○ Used to save purchasing power over time. ○ Other assets also serve this function. ○ Liquidity is the relative ease and speed with which an asset can be converted into a medium of exchange. ○ Money is the most liquid assets but loses value during inflation. 8 Measuring Money Supply ● There are some ways to measures of the money supply monetary aggregates, basing on liquidity. 9 Measuring Money Supply ● M1 (most liquid assets) = currency + traveler’s checks + demand deposits + other checkable deposits ● M2 (adds to M1 other assets that are not so liquid) = M1 + small denomination time deposits + savings deposits and money market deposit accounts + money market mutual fund shares 10 Measuring Money Supply 11 Measuring Money Supply 12 Measuring Money Supply ● M1 versus M2: Does it matter which measure of money is considered? ● Conclusion: the choice of monetary aggregate is important for policymakers. 13 Measuring Money Supply 14