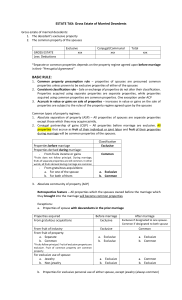

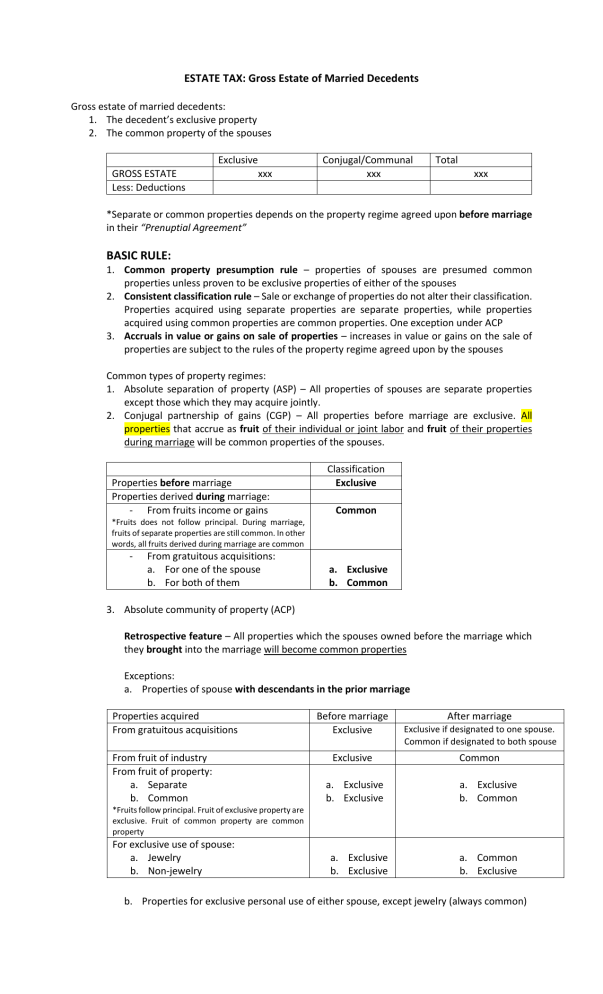

ESTATE TAX: Gross Estate of Married Decedents Gross estate of married decedents: 1. The decedent’s exclusive property 2. The common property of the spouses Exclusive GROSS ESTATE Less: Deductions xxx Conjugal/Communal xxx Total xxx *Separate or common properties depends on the property regime agreed upon before marriage in their “Prenuptial Agreement” BASIC RULE: 1. Common property presumption rule – properties of spouses are presumed common properties unless proven to be exclusive properties of either of the spouses 2. Consistent classification rule – Sale or exchange of properties do not alter their classification. Properties acquired using separate properties are separate properties, while properties acquired using common properties are common properties. One exception under ACP 3. Accruals in value or gains on sale of properties – increases in value or gains on the sale of properties are subject to the rules of the property regime agreed upon by the spouses Common types of property regimes: 1. Absolute separation of property (ASP) – All properties of spouses are separate properties except those which they may acquire jointly. 2. Conjugal partnership of gains (CGP) – All properties before marriage are exclusive. All properties that accrue as fruit of their individual or joint labor and fruit of their properties during marriage will be common properties of the spouses. Properties before marriage Properties derived during marriage: - From fruits income or gains Classification Exclusive Common *Fruits does not follow principal. During marriage, fruits of separate properties are still common. In other words, all fruits derived during marriage are common - From gratuitous acquisitions: a. For one of the spouse b. For both of them a. Exclusive b. Common 3. Absolute community of property (ACP) Retrospective feature – All properties which the spouses owned before the marriage which they brought into the marriage will become common properties Exceptions: a. Properties of spouse with descendants in the prior marriage Properties acquired From gratuitous acquisitions From fruit of industry From fruit of property: a. Separate b. Common Before marriage Exclusive Exclusive a. Exclusive b. Exclusive After marriage Exclusive if designated to one spouse. Common if designated to both spouse Common a. Exclusive b. Common *Fruits follow principal. Fruit of exclusive property are exclusive. Fruit of common property are common property For exclusive use of spouse: a. Jewelry b. Non-jewelry a. Exclusive b. Exclusive a. Common b. Exclusive b. Properties for exclusive personal use of either spouse, except jewelry (always common) Prospective feature – all properties which the spouses may acquire during the marriage from their separate or joint labor or industry are common properties Exceptions: a. Gratuitous acquisition received by either spouses (if designated for both = common) b. Fruits of exclusive property c. Properties acquired for exclusive personal use of either of spouse, except jewelry Properties acquired From gratuitous acquisition Before marriage Common After marriage From fruit of industry From fruit of property a. Separate property Common Common a. Common a. Exclusive b. Common b. Common Exclusive if designated to one spouse. Common if designated to both spouse *Gratuitous acquisitions of properties during marriage is a separate property, fruit of separate property is separate property. Fruits follow principal b. Common property For exclusive personal use of either spouse a. Jewelry b. Non-jewelry a. Common b. Exclusive a. Common b. Exclusive Note: 1. A jewelry acquired through gratuitous acquisition during marriage is exclusive property because it is a gratuitous acquisition regardless of the property acquired and a jewelry acquired using exclusive property, e.g. jewelry acquired using cash donated during marriage, is still exclusive