The Three Skills of Top Trading Behavioral Systems Building, Pattern Recognition, and Mental State Management (Wiley Trading) ( PDFDrive.com )

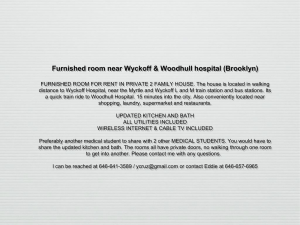

advertisement