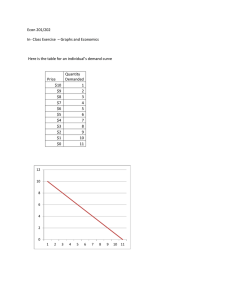

ECON 310 Class Notes 23 August 2017 Producer theory: how firms make decision; we want to maximize profit ● How do firms make decisions? ○ How to produce? ○ What to produce? ○ How much to produce? ○ How much to charge for it? ○ How to compete with other firms? Thinking about costs… Cost: value measured by what must be given or done or undergone to obtain something. This class addresses economic cost… what you give up to make the good. ● Direct costs are involved in the production process ● Indirect costs are costs that the firm has to experience participating in the market ○ For this class we are going to focus in direct costs ● In modern economies we have to think about human capacity & technology. Modern economies aren’t simple. ○ Think Google, Facebook → Capital must include human capital Economic costs ● Lebron James starting a pizza shop would have a huge opportunity cost ○ When would it be optimal for the professor or Lebron James to open a pizza shop ■ Class won’t focus on opportunity cost; it’s too case specific ■ We want to remove the company specifics and just look at the equation itself ● Economic costs are all about finding the best alternative To determine if one option is the best alternative, we need only compare it to the best alternative. ● Assuming economic costs requires us to explicitly solve for only one profit level to determine if one is the best 25 August 2017 Producer theory 2 step process How to produce & how much to produce ● How firms make optimal decisions on capital & labor Production process Production Function: It’s an abstract concept. ● Inputs (L & K) → Production function → outputs (goods to be sold) ● Capital + Labor = finished product ○ Raw materials aren’t included as they are considered fixed costs ○ Also known as the technology function; math.? Function ● Equivalent to how efficient labor and capital are working together This is a production function: *This equation informs efficiency Firms/ Managers must... Produce on the function so there is no waste & use the right level of inputs. Need the most efficient and most output producing function. *the later is wasting labor! 1 ● Highest amount produced at certain bundle or lowest amount of inputs for highest output Productive measures help determine best place on the production function: Total product: TP = the maximum level of output that can be produced with a given number of inputs ● Measures the maximum output th can be produced with a given input. ● This is equivalent to Q aka it is a certain amount of products Average Product of Input: AV1 = total product/ quantity used of input ● For instance, Average product of Capital = APK = Q/K ● Measures, on average, how much each unit of input contributes to the total output of the firm. Marginal Product of Input: think growth rate! ● MP1= Change in Total Product/ Change in Quantity Used of Input ● For instance, Marginal Product of Labor = MP1 = ΔQ / ΔL ● This measures how much each additional unit of input contributes to the total output of the firm. ○ If labor increases a little bit what will be the effect on the product… the increase of the 101st worker ○ The growth rate as you increase labor or capital ○ Based on inputs (K or L); as you inputs Q increases and grows faster. ● The curvature or slope is the marginal increase ● Slope is the acceleration of the total product, the highest speed is right before marginal product is zero. Only at zero will it start to fall. ● Incentive to fire labor starts at negative returns (negative slope) ○ Higher (K & L) will increase productivity to a certain point (where the lines cross) ■ This will always be the peak Returns to an input: ● Observational principle: As the usage of an input increases, its value to a production process initially increases, then begins to decline, and eventually becomes negative. ○ Firms that have increasing production should scale 28 August 2017 Marginal Product of Labor (MPL) is determined by the slope of the Total Product curve; how fast a product grows as you add labor ○ Where MPL is negative there are decreasing gains Example 2.1 - K is fixed, only decision is how much Labor ● *Note: Q = TP!! If Q @ 3 K=4 and L=1 → Q = −1 + 1.5 * 10 TP 24 So… AP1 = L → 1 = 2.4 2 1 − 3(1) + 4 → Q = 2.4 −23 + 1.5 * 22 − 3(2) + 4 → Q 10 So… AP2 = TLP → 322 = 1.6… ΔQ −24 Then… MPL = ΔL → MP2 = 3 22−1 = 018 = 0.8 If Q @ K=4 and L=2 → Q= = 3.2 *MPL is the change in TP from the last worker* 2 Use the right level of inputs: Value of Marginal Product of Input: ● VMP = Price x MP ○ Price is the price of the good you sell (not the price of the machine to make it, etc.) P ΔQ ● Value Marginal Product of Labor = VMPL = ΔL This measures how much value each additional unit of input contributes to the firm. ○ What are the benefits in dollars? How much extra money is made form an additional unit? Common Sense Principle: ● An input should only be used up to the point where its marginal benefit equals its marginal cost in the range of diminishing marginal product. ○ Example: Once your business is established, you should hire more employees until the value of another employee is exceeded by the wage you would have to pay him. ■ “More of the same” is generally a poor management style. ○ How much output to produce is the same question as how much of an input to use… production function gives us output. Example: ● Blue line is the contribution of each additional worker in dollars ○ Assume the firm is a price taker in the market (see wage line!) Labor: Optimal choice ● P * MPL > wage → incentive to increase labor ● P * MPL < wage → incentive to decrease labor ● P * MPL = wage → firm has to incentive to deviate ○ Is is the optimality condition! This equates to zero marginal profits, as profit from the last worker is zero. However profits from the previous workers was positive, so this condition will equate to peak total profit! ■ Note: workers contribute what they cost ○ P * MPL → VMPL (value of marginal product of labor) ■ The firm’s choice variable is labor, as it is a price taker ■ ● 3 “An input should only be used up to the point where its marginal benefit equals its marginal cost in the range of diminishing marginal product” ● Our assumptions about the shape of the TP curve, MP eventually has to fall, so it crosses MC twice or never. The first time it crosses signifies operating at a loss. ● With a labor only technology: ○ Choose L* such that P * MPL = wage ■ (L* = optimal amount of labor) ○ So F(L*) = Q* *Always make decisions in the range where MPL is decreasing* When Q=F(L) and the VMPL and wage intersect, labor is maximized. Marginal Product per dollar should be equal: Using the last principle, we know: ● We should hire employees until a new employee’s additional value equals the wage rate. ● We should purchase capital until a new machine’s additional value equals its cost. ○ However, when a tradeoff exists between “labor” and “capital”, how many of each should we utilize? Restaurant example: What is the optimal input allocation? ● Imagine you are opening a restaurant ● All job candidates are either cooks or waiters ○ Cooks are very rude ○ Waiters don’t know how to cook ● Compare: ○ 6 cooks, 1 waiter ○ 2 cooks, 2 waiters ○ 1 cook, 3 waiters 30 August 2017 Isoquants: Iso is a prefix that means same. ● Goal: fix Q, so we can plot all the capital and labor allocations that yield Q. ● Need to address capital and labor, but can’t graph in 3-D, so we need to fix Q… which is done through isoquants: a set of K,L that produce the same amount of output ● The shape of an isoquant reflects the ease with which a producer can substitute among inputs while maintaining the same level of output. K L Q 2 ½ 1 1 1 1 ½ 2 1 ● ● ● As you increase labor your marginal product of K increases, as you have to decrease the amount of K Where the isoquant is very steep you are willing to give up more K for L, but as it flattens this decreases Want to use? The L & K where the contribution equals the marginal cost. 4 ○ Slope of isoquant = marginal rate of technical substitution (MRTS) = ΔK ΔL ● Isoquants always have a negative slope 1 September 2017 Isoquants: way to represent all possible allocations of K + L for all the same outputs. ● Where the isoquant is steep, there is more willingness to give away more capital ΔK ΔL ● MRTS = ● Also equivalent to MRTS = ○ → amount of K you have to give up to get one unit of labor; this is also the slope… aka MPL MPK rise run When L goes up, K decreases; we are in an area where marginal returns are decreasing Which one is an isoquant? Not the blue circle as it isn’t smoothly declining The red line; has an irregular slope and is very inefficient; NO! ● The green lines IS as it is smooth and has a decreasing/negative slope -------------------------------------------------------------------------Remember: ● The isoquant represents all combos of capital and labor that have the same input ● The line represents one fixed level of output and all the ways to get that level ● This allows us to avoid the third dimension ● The shape of an isoquant reflects the ease with which a producer can substitute among inputs while maintaining the same level of output. ● ● So if I get rid of one machine, how much labor must I hire to produce the same level of output? There are 8 sewing machines and one employee… If there is a disproportionately large number of machines, it shouldn’t take too many additional employees to offset the loss. SO the steepness of the isoquant tells us something about the trade-off. ● The tradeoff between inputs at a given output level is the slope of the line tangent to the curve. ● This can be calculated through MRTS… 5 So what is slope? Marginal Rate of Technical Substitution (MRTS) ● The rate at which inputs (such as labor and capital) can be substituted for each other to maintain a given output level. ● The slope of the line tangent to the isoquant corresponding to a given output level. ● MRTSKL = ΔK ΔL = MPL MPK For instance, MRTSKL is the number of employees that can be fired with the addition of a single unit of capital (and still have the same level of output) ● By the 3 worker, the company is already saturated with labor, so by L=4 the MRTS is decreasing. Now suppose Q=2K+L and the manager must produce 5 units of output. ● ● ● The MRST is -0.5 The slope stays the same, it’s a linear isoquant! ○ This means it is a perfect substitute quantity The outcome for a production function like this is to choose what is cheapest. Substitutability Inputs can be: ● Perfect complements *Inputs that go into a perfect complement are fixed. ● Complements/Substitutes ● Perfect substitutes → linear production function These are determined by looking at the MRTS → these are the 3 types of isoquants you can have Isoquants → to realistically mimic actual production processes, we assume isoquants are convex (bowed in toward the origin), and increasing in output as more inputs are used. Isocosts Lines: → same cost combination of L + K that costs the same 6 ● Illustrates the combinations of inputs (K,L) that cost the producer the same amount. ● The steepness of an isocost line reflects how much more expensive one input is relative to the other. W = price of labor r = price of capital ● C r = labor cost ; C w = capital cost → C r C w = w r ● As the slope of the isocost tells us how many units of K you must sell reflective of cost and labor 6 September 2017 Isocost lines → same cost **Price and labor are assumed to be fixed** ● Because trade-off is always the same, the slope of the isocost must always be the same. Example: ● ● ● ● ● ● You can do this for other costs as well. As the slope of these lines are also ● ● ● ● Assuming price and labor are fixed r=5 w=3 C = $15 The line is easy to draw, as you just need 2 points. Spend all on capital, all on labor and connect. w r . Note the slopes of the isocost lines are w/r, where w is the wage rate and r is the price of a unit of capital. This intuitively makes sense bc the tradeoffs should be based on the ratio of the prices The increases in cost shift the isocost curve to the right, but keep the same slope The slope will only change if the inputs? Change The slope of the isocost lines are w/r which is found by… → This is just rise over run! What happens to the isoquants if an input cost changes? What happens to the isocost if an input cost changes? Assume capital costs $5/unit and labor now costs $7.50/unit (instead of $3). What different combinations of capital and labor will cost the producer exactly $15? 7 ● ● ● As a result the line is a lot steeper. This steeper line means that the capital is now cheaper relative to labor. When the cost of an input good changes, the isocost lines rotate i.e. the line pivots around the cost that stays the same. Optimal choice of K and L Assume you want to produce the quantity level represented by the isoquant, below. If the price of capital is $5 and the price of labor is $3, what is the cheapest way to produce? (Note: want input blend that will give q (optimal output) as cheap as possible) ● ● ● ● ● The linear lines are isocost; the curve is the isoquant @ Red there the bundle is cheap, but it’s not producing enough output (orange curve) The slope of all isocosts are parallel The optimal choice is the lowest isocost that intersects with the isoquant. This is where the isocost is tangent (intersecting only once) with the isoquant. Any isocost below the isoquant is not feasible, anything above the tangent isocost is not optimal, it’s too expensive. ○ In order to be tangent the slope of both curves must be the same. Cost Minimization Principle: ● The mix of labor and capital used to minimize the costs of a production process is that mix which ensures the slope of the isocost lines is tangent to the slope of the isoquant passing through that point. In other words... ● The mix of labor and capital used to minimize the costs of a production process is the mix that ensures… ○ MPL MPK ■ = w r → MPL w = MPK r → cost minimization principle! The cost minimization principle is the marginal product per dollar spent should be equal for all inputs. Aka the optimal bundle will be found where the marginal product per dollar spent is equal for all inputs. MP This is from the slope of the isoquant = M P L and the slope of the isocost = wr . K ■ b/c in order for the isocost and isoquant to be tangent the slope of BOTH curves must be the same! The value per dollar of input spent should be equal for all inputs. Using this, if I know how much value each of my inputs is adding, I can determine how much more/less I should use of each. ● Consider this: If the last employee hired provided a value of $10 to the firm and cost $5, you are receiving $2 value/$1 spent on labor. If the last machine purchased provided a value of $30 to the firm at a cost of $10, you are receiving $3 value/$1 spent on capital. You would have been better served to spend your labor money on additional machines, getting more value per spending dollar. Sample questions: ■ ● ● Suppose it became illegal to hire illegal immigrants. How will this affect low-wage U.S. born workers? Suppose tax laws are written that make capital cheaper for companies. How will this affect workers? 8 Optimal Input substitution: A firm initially produces Q0 by employing the combination of inputs represented by point A at a cost of C0. Suppose w0 falls to w1. ● ● The isocost curve rotates counterclockwise; which represents the same cost level prior to the wage change. The slope of the new isocost line represents the lower wage relative to the cost of capital. To produce the same level of output, Q0, the firm will produce on a lower isocost line (C1) at a point B. ○ This equates to hiring more employees and fewer machines. Which makes sense as if you employ two inputs and one gets cheaper… wouldn’t you use more of the cheaper one? Input Substitution Principle: ● If an input gets cheaper, the firm should use more of that input and less of other inputs (since it is relatively cheaper). ● If an input gets more expensive, the firm should use less of that input and more of other inputs (since it is relatively more expensive). Example: Assume you are utilizing an optimal input mix when Congress unexpectedly increases the minimum wage. You should: A. Invest in more equipment and fire some employees. B. Invest in less equipment and hire more employees. C. Keep your input mix the same. D. Invest in more equipment and more employees. This is a shock to the market, as the price of labor goes up. So the economy must move to a more capital intensive labor w/ employment levels falling. So A? Rule of thumb: Whenever inputs change, shift to the more relatively cheaper option. 8 September 2017 Review: the optimality condition is the contribution of each add’l cost of labor is equal to the contribution of another add’l increase in capital. However, there are exceptions to this… Cases in which M RT S = wr will not work: ● 1. Perfect Substitutes → Firms will always, in this situation, choose either all labor or all capital. ● ● ● ● ● ● Labor is much more expensive than capital due to the steep slope. The best choice is no labor and all capital due to the slope of the isocosts. The slope of the isocost relationship between isocost and isoquant forces the firm to choose all capital. It is steeper than the isoquant or the MPL This is a linear isoquant $1 spent on capital brings a higher return than $1 spent on labor. MPL MP ○ < rK w If the isoquant and the isocost have the same slope, all conditions on the slope will be optimal. 2. Perfect Compliments ● Here there is only one optimal point. Cost Function - ppt 3 9 Production functions: the production process whereas cost functions are a company's costs ● A cost function can summarize all the costs “The harder it is to produce a given level of output the more it costs the firm” ● “Harder it is to produce” → production function ● “More it costs” → cost function Economists are only concerned with two cost measures: fixed costs and variable costs. Total costs: ● TC(Q) = Total Cost of producing Q units of output ● TC is the lowest possible cost ○ Fixed costs: ■ FC = Costs that do not vary with output ■ Plug in 0 at Q will give you fixed costs ○ Variable costs: ■ VC (Q) = Costs that vary with output. ● Example: TC(Q) = 100 + 4Q + 5Q2 ○ 100 = FC ; 4Q + 5Q2 = VC(Q) Example 3.1 → this will be on exam. Assume 4 machines have been purchased that each cost $3. The following chart shows the output that can be generated with these machine and various labor levels. The wage rate is $2/worker. Note: capital isn’t always fixed. Here the MPL is going up, but cost of labor is fixed, so the production cost will decrease as you add labor. Cost and Productivity Recall the assumption: As the usage of an input increases, its value to a production process initially increases, then begins to decline, and eventually becomes negative. This is a production function. Question: If the value to production of an input starts small, then increases, then becomes small again, what does that mean for the cost of manufacturing the good? ● A: It will start out expensive, then it will get cheaper, then it will get expensive again. 10 ○ ○ ○ At first, we will need lots of inputs in order to out first units of output. Thus, the first few units of output are expensive. As we move on to produce more output, our inputs become more effective and thus cheaper. Then inputs become ineffective again…becoming more expensive. Cost function Up until the 6th output, the MPL is decreasing, after it starts increasing. Notice total cost is on the y-axis and output is on the x-axis (output MUST be on the x-axis). This graphically shows the answer from before. ● The first units of the good cause a large jump in cost. ● Think of start-up companies. CEO may have to answer his own phone and do his own paperwork. Not buying in bulk….etc. ● The next units do not cost much extra. ● Specialization takes over, can buy in bulk,etc. WANT TO BE HERE. ● The last units once again cause a large jump in cost. Need major investment in R&D, new locations, etc. ● We name these three regions “Startup, Efficient, and Oversized”. Assume fixed costs are $3: The VC line is the difference from the TC and the FC, thus the distance between the TC and the VC at any point is always the FC. ● The curvature of the TC curve will be the same shape as the VC curve, TC gets its shape from the VC. ● The VC will be the FC minus the TC. Now lets use these curves to deconstruct a firm's cost and the importance of those costs as it grows in size ● Fixed costs originally make up most of a startup company’s costs. So what does this mean for a new company debating entry? ● After it has produced a sufficient number of units, the fixed cost is spread out through the units, and the major costs that matter are the variable costs. ● The that FC are very important at the birth of a company. Note that this is often when companies are looking for investors. As the company grows the FC become less and less important and operating costs (i.e. variables costs) dominate their optimization problem. Cost Measures: Total Cost: 1. TC(Q)=Total Cost of producing Q units of output 2. TC(Q)=FC + VC(Q) Average Total Cost: 1. ATC: Total Cost/ Units of Output or C(Q)/Q 2. Measures, on average, how much each unit of output contributes to the total const of the firm. I.e. just per-unit cost Marginal Cost: 1. MC = Change in Total Cost/ Change in Output 2. Measures how much each additional unit of output costs to the firm. a. This isn’t usually calculated, but it is critical to how a manager should make output decisions. 11 September 2017 Cost function will always be a function of output/ how many units are being produced. ● Cost functions are always increasing… it costs more to make more 11 Cost Measures (continued): T C(Q) ● ATC = Q → TC(Q) is the TC of producing Q units ● MC = ○ ΔT C ΔQ → can also be written as MC = ΔV C ΔQ FC isn’t a function of Q, it’s just a number, so MC can = ΔT C ΔQ OR ΔV C ΔQ . Total Variable Cost: 1. VC = Costs that vary with output Average Variable Cost: 1. AVC = Total Variable Cost/ Units of Output 2. Measures, on average, how much each unit of output contributes to the total variable cost of the firm. These are just like total/average/marginal cost, but with Variable. Total Fixed Costs: 1. FC = Costs that do not vary with output Average Fixed Cost: 1. AFC = Total Fixed Cost/ Units of Output 2. Measures, on average, how much each unit of output contributes to the total fixed cost of the firm NOT SURPRISINGLY… ATC = AVC + AFC ● TC = VC + FC ● TC/Q = VQC + FQC → ATC = AVC + AFC Question: Having defined Marginal (Total) Cost, why don’t we need to also define Marginal (Variable) Cost and Marginal (Fixed) Cost? ● A: Increasing production does not affect fixed cost, so MFC = 0, so MVC = MC. ● In other words… MFC is always zero, because of this MVC is MC. Average Total Cost (ATC) Curve The ATC curve will be high for low levels of production, as a larger quantity will lower the AFC. I.e. Large scale can lower fixed costs! ● The more you produce the lower your ATC will be. ● AVC will depend on the production function ● A firm is only maximizing profit if it's minimizing cost If AFC approaches zero, and ATC = AFC + AVC, then what do we know about AVC when output is large? 12 The marginal cost curve will look like the following. ● Write the equation for marginal cost on the board and step quickly through it’s shape (show in relation to the TC curve). ● Once again, we see the relationship between Average and Marginal. In particular, the only way Average Total Cost could be decreasing is if each additional unit had a cost that was lower than the current average. ● ● ● ● ● For completeness (and because we’ll be using it in the future), we also add the AVC curve. For the same reasons , the MC cost curve intersects it at its minimum. Note why the shape of the average variable cost curve makes a lot of sense. Go back to ATC=AVC+AFC. What happens to AFC over time? The AVC in this case begins to upward slope as it has reached its optimal output. Where the MC and the AVC intersect is optimal The MC pulls the AVC down, and after they intersect the AVC is basically stationary. Sunk Costs ● A cost that cannot be recovered ○ NOTE: Sunk costs are a subset of fixed costs ○ b/c the cost is gone, it shouldn’t affect any decision making. ○ In economics all rational decisions are made on the margin. Only marginal cost and marginal benefits matter. Long-Run Costs ● Short run: the timeframe in which fixed costs cannot be adjusted ● Long Run: the timeframe in which fixed costs can be adjusted. All costs are variable! ○ Fixed costs are not always fixed; in the long run, all costs are variable thus the question is how does one optimally decide how much capital to invest ● Think entry and exit time-frames as defining the short-run and long-run ○ Note: long-run could be 1 day (a lemonade stand owner can turn over their fixed costs almost immediately) or it could be 10 years (a multinational corporation sells off all its subsidiaries) ● ● ● ● ● The ATC curve for a small company should have reasonable fixed costs (thus ATC for small quantities isn’t “too” large), but due to its lack of efficiency, it will likely get very expensive at high output levels. ○ This is a short-run cost curve, since it assumes a small factory will be used. The Medium-sized factories will cost more per unit at low-output levels due to the increased fixed costs. However, at higher output levels it will be significantly cheaper due to the efficiency gains. The size of the factory is determined by how much stuff you intend to produce. ○ This is a story of fixed costs and efficiency gains. Large factory will have extremely expensive upfront costs, but will have lower per-unit costs at high output levels due to the extreme efficiency. For small output levels, small factories will be cheapest (per unit) due to the low fixed costs. For medium output levels, medium factories will be cheapest because the don’t have the fixed costs of large factories but have more efficiency gains than small factories. For high output levels, large factories will be cheapest due to the efficiency gains. 13 Long Run Average Cost Curve ● ● ● ● If we could have factory sizes between Small and Medium, between Medium and Large, and between every other size level, this envelope would “smooth out”. We call this envelop the Long Run Average Cost Curve, since it shows us the cheapest way to produce each level of quantity, assuming we can adjust the fixed costs. The black line represents the lowest possible cost for each scale of production. Economies of scale (gets cheaper to produce another) is achieved where the LRAC is downward sloping Long Run Average Cost Curve (LRAC): A representation of the minimum average cost of producing alternate levels of output, allowing for the optimal selection of all variables of production (both fixed and variable). ● Once we have this curve, you’ll notice that producing at different levels leads to different average cost levels…even in the LR. We have come up with terms to describe the relationship between output and average costs. Economies of Scale (Increasing Returns to Scale): The range of a LRAC curve for which increasing the size of operation decreases the minimum average cost ● If we scale our facilities up, we will increase our returns since average costs will drop. Diseconomies of Scale (Decreasing Returns to Scale): The range of a LRAC curve for which increasing the size of operation increases the minimum average cost. ● If we scale our facilities up, we will decrease our returns since average costs will increase. Constant Returns to Scale: The range of a LRAC curve for which increasing the size of operation does not change the minimum average cost. ● Means that scaling our facilities up will result in identical average costs. ● Note: the “relevant range” that is often discussed in business texts tends to imply a CRS. For small changes, most operations are in the CRS range. One extra pound of cheese produced at a Kraft plant won’t really have an almost identical average cost to the previous pound. However, 200,000 extra pounds will likely cause average costs to increase since additional facilities would be needed. Long Run Average Cost Curve (LRAC): A representation of the minimum average cost of producing alternate levels of output, allowing for the optimal selection of all variables of production (both fixed and variable). ● CRS range is where the line is flat i.e. costs not increasing w/ output. ● Diseconomies of scale starts where marginal cost intersects the actual cost ● Economies of scale is less expensive to produce, diseconomies of scale is where it is increasingly expensive to produce. ● LRAC: For every scale of production, what is the lowest cost of production Question: Would you expect the software industry to have decreasing, increasing, or constant returns to scale? ● Is that marginal costs are effectively zero once the software is written. Thus, the more you sell the cheaper they are per unit since the fixed costs of development is spread over more and more units. This is true in any industry with extremely high upfront costs and very low marginal costs, such as power companies or cable companies. ● Fixed costs drive the cost function after the FC there is almost no other costs ● A: Increasing returns to scale. 13 September 2017 Economies of Scale: The condition in which an expansion of output results in a lower long-run average cost. ● Lower per-unit cost by increasing output. Think Wal-Mart. Economies of Scope: The condition in which the total cost of producing two goods together is less than the cost of producing each of the two goods separately. “Lower per-unit cost by producing something else” ● Sometimes it is cheaper to produce two goods then just one good. Ex. Wendy’s makes chili as they have a lot of ground beef from the hamburgers, but Chick-Fil-A doesn’t make chili as it doesn't as they don’t have beef intensive products. ● This demonstrates that “sharing resources” is one way economies of scope can occur. 14 Economies of scope usually occur bc either the products share inputs (national & local wireless) or there are cost complementarities. Economies of scope can be difficult to achieve. For the last corollary, consider the employees you are looking to fire. If, for instance, they are very nice people and they make all your employees happier and more productive, maybe they are actually better than a more “competent” employee. ● Synergy Principle: Exploit cost synergies for competitive advantage. ● Corollary: Be aware of strategic acquisitions that can result in economies of scope. ● Corollary: Be aware of a resource’s effect on your entire business, not just its primary mission. New Slide deck: Specialized Investments Transaction Costs: Costs in addition to labor & capital 1. Costs in excess of the actual amount paid in a transaction. 2. Costs not directly relatable to the value of a market transaction. 3. Non-productive costs. These all mean the following: -For the producer/seller: “all cost not directly related to the creation of the TV.” -For the buyer: “all costs paid in addition to the transaction cost.” ● Search and information costs ○ Searching for the best deal (buyer) or advertising (seller) ● Bargaining costs ○ Labor negotiations in the NBA (both producers and sellers), legal fees are huge as well as lost profit from not playing ● Enforcement costs ○ Quality control ○ Seller of organic foods must certify that they are organic to the buyer ● *Specialized investments* needed to facilitate the exchange ○ This is what we are really interested in. Specialized investments ● Investments that only have value within the context of a relationship-specific exchange. ○ An investment that only has value if you have a relationship with another firm ○ Only makes sense to buy this input if you need it. Only profitable between the firm that makes it and the direct seller. ● Site Specificity: Buyer and seller of a good must locate their facilities close to each other. ○ Ex. the only way that the investment into a coal power plant is worthwhile is if there is a coal mine nearby ● Physical Asset Specificity: Capital equipment is specific to a particular purchasing firm. ○ As a seller, I need a supplier to make me something that is exactly to my specifications and only to my specifications. This happens a lot in manufacturing and IT. ○ This is an actual input good itself. ● Dedicated Assets: General investment is only profitable if a particular buyer purchases the good produced with the investment. (Similar to physical asset specificity, but on a larger scale) ○ A physical asset that is specific and sold to only one company and only one market. If Walmart stops buying, the factory’s capital will be worthless. ● Time-Specificity: Investment only has value if final product can reach the user in a short period of time. ○ Similar to site specificity. Ex. A fishermans investment in a boat only has value if they can get to a market in a reasonable enough time to sell the fish. ○ Lower transportation costs have made this less of an issue. ■ When it is beneficial to make a contract with a firm than buy it off the market. ● Human Capital: Specific skills necessary for work in a firm that are not transferable to other firms. Skills that are only useful for a particular market. Question: In the presence of specialized investments such as site specificity, physical asset specificity, dedicated assets, time specificity, and/or human capital, why are transaction costs such as bargaining expected to be significantly higher? In other words, these things make transactions costs much higher, why? ● A: One consequence of specialized investments is that buying the capital are sunk costs. You can’t get them back. So you want to build as cheap a plant/physical asset as possible. ● 15 Think about dedicated assets example (factory only has value if Walmart sells toy). Why would bargaining costs then be higher once the plant is constructed? (1) Walmart holds all of the cards…they know the other will go out of business without them so they can demand a low price. This is how Walmart prices that are so low. The Hold-Up Problem: Once a firm makes a specialized investment, the other party may attempt to “rob” it of its investment by taking advantage of the investment’s sunk nature. ● Costly Bargaining: ● Attorney costs ● Opportunity cost of time ● Possible lost exchange Underinvestment: ● Lost exchange ● Increased search costs Firms have bargaining power in relation to their level of specialty each producer more does. So if you want high quality product signing a contract to establish cash flow is best. ● Think about the NFL negotiations. Players make an investment in their body…which is only valuable in the NFL. Owners make investment in stadiums, which are only valuable with good players playing. Both are trying to hold-up one another, making bargaining very expensive. ● Because we know that firms behave this way, firms protect themselves at times by under-investing. Industry Structure and Transaction Costs ● Spot exchange: ● few rules ● no long term contracts ● Why low enforcement costs? If tobacco looks right and price is right then transaction takes place. ● Why high on the other costs? No specialized investment. Contacts: ● Can fix some of these problems ● Long term agreement makes bargaining costly and force of law makes enforcement costly ● Search and hold-up are small because contract protects parties. ● Many non-formal (implicit) contracts exist to keep people in check. Game theory talks about this a lot. Vertical Integration ● Buyer and seller or seller and supplier ● With a bigger, more diverse company it becomes increasingly difficult to make sure that your workers are doing what you want (often why with buyouts old employees stay in place). ● Firm produces its inputs inself. This depends on expenses + marginal cost & benefit. Enforcement Bargaining Search Hold-Up Spot Exchange Low High High High Contract Medium Medium Medium Medium Vertical Integration High Low Low Low 16 Industry Makeup Principal: Transaction costs are a main driver in observed industry structure. ● Purchased Inputs Intensity (PII) is the ratio of input costs to sales price at whatever stage of the production cycle a firm is in. The PII can be interpreted as the amount of value a firm adds to a production process. The lower the PPI, the more “value” the firm is adding to the input goods. As firms vertically integrate, we would expect them to include more of the production stages in their operations, increasing the value the firm is adding to its input goods (thus lowering its PPI). The “theory” we have proposed would indicate that in areas where transaction costs are most likely, vertical integration would be more likely. This should manifest itself in low PPI’s. If we look at assorted industries throughout the nation, in the area where most employees exist (implying low transaction costs since the industry is geographically concentrated in that area), PPI’s are consistently higher than in neighboring areas. In other words, vertical integration is most likely when it’s hard to find suppliers (in this case due to geographical constraints). Contract Terms - Specificity ● ● ● ● ● ● ● ● ● ● ● Marginal Benefit is the avoidance of hold-up costs. Assume MB is independent of contract length Avoid same amt. of hold-up costs each year MC is increasing because, the farther out you contract, the more complex the contract gets. If you have more specialization, it makes more sense to write a longer contract. Due to the need for specialization, will need larger contract The intersection of MB & MC will inform length of contract What if the contracting environment becomes more complex? (i.e. there is another possible supplier in the future). If the production becomes more complex, a firm might want a shorter contract for more flexibility. A more difficult/ complex market or uncertain future will shift the MC of the contract itself ○ It makes it more expensive b/c the uncertainty. Now it's the same cost, but for a much shorter contract 15 September 2017 Contracting Principle: Utilize Contract Terms to minimize input costs How to extract more effort from workers… ● ● Paying employees more can make the firm more profitable ○ Note: Not all incentive schemes are created equal, b/c this some are better with regard to different types of workers. The firm is better off sharing profits with the employee… pay more to make more. 17 Types of Incentive Contracts Profit sharing: Profit sharing means that pay is tied to profits. This is suitable for top managers and small firms ● Ex. Stock options at startups ● Good strategy when workers can directly impact the profits. It is better when workers can impact revenue and cost. Revenue Sharing: If worker can’t impact cost, revenue is a better option ● It’s important to recognize that this incentive contract can be risky if increased sales would imply significantly higher costs. ● In addition, it’s important that the sales teams do not have significant pricing power. As they would lower the price considerably in order to make the sale. ○ Consider, for instance, an individual who tends to tip very well. It is not uncommon for wait staff to notice this and start reducing the price of items to nothing. While the wait staff receives fantastic tips (i.e. revenue sharing), the firm is actually losing profits. Generally used for salesmen and service-oriented professions. Ex. Real estate agent → house is priced before the agent enters the picture. Piece Rates: the more you produce, the more you get paid. ● Suitable when productive is “if effort, then output” ● Need some way to ensure that output meets a standard. ● ● It is very important to incorporate a quality check in these contracts. ○ i.e. if you told me you’d pay me $1000 per song I wrote, I’d have 20 albums worth of material in about a day. Each song would sound suspiciously like “row-row-row your boat”, unfortunately. Individuals would trade quality for quantity. Bonus/ Raise Based on Spot Checks: Instead of measuring every sale/unit produced/profit level, managers can instead make spot checks. If it’s high quality, giving them a bonus or raise. ● This lowers enforcement costs significantly. The key is that the checks must be random. Otherwise, you will only put forth your best effort when you know you will be monitored. On the flip side, you will shirk when you know you will not be monitored. When they get out into the working world, note what happens when the manager leaves for the afternoon. *For all Incentive Contracts, beware of perverse incentives! ● No Child Left Behind ○ Testing focused on things that can be easily quantified ● Sales people offering excessive discounts ○ Selling on price instead of value ● Overbilling if you are paid hourly and not monitored ● Competition instead of cooperation between employees ○ Fighting over a promotion or bonus pool Tournament/ Prize Style of Pay: Pay a few people at the top lots of money. Everyone else works harder to try to get to that spot. ● Good if you can only monitor the relative performance of your employees ● Encourages risk-taking ● Pits employees against each other ● One justification for high CEO pay Besides an incentive contract, why might a worker avoid shirking? 18 September 2017 - Notion of Industry (Last topic of exam #1) The size of firms sales size the industry, but that isn’t always true for all markets. This can be misleading. ● Typically focusing on revenue here ● Looking at the biggest firm gives us a good idea of how big the industry is. By looking at measures of technology, we might get an idea of the productivity of capital and the future growth prospective (fewer employees needed). However, the difficulty is that technology within an industry is hard to gauge. 18 Supply and Demand Perfect competition occurs in a market in which: 1. There exists many small firms (HHI very low). 2. There exists many individual buyers. 3. Firms sell “identical” products. 4. Every buyer and every seller has full information about the price and quality of goods. 5. Transaction costs are very low. 6. No barriers to entry/exit. Or, more simply, a market in which every participant recognizes they are too small to have the ability or desire to affect the market price. Basically, there are many small firms. ● These types of markets aren’t very realistic, but provide a good baseline for analysis ● This is essentially what occurs when more and more firms enter a market and we’re assuming more realistic assumptions (our monopolistic competition discussion will cover this) ● “perfect competition” is the “best” outcome in a very specific economic environment (no externalities). Two Rules for Demand Consumer preferences are assumed given, but that they are… 1. Complete: Property of preferences a. Can always make a decision between two things; I can always make a decision i. Indifference is okay. 2. Transitive: Internally consistent a. If I’d rather have an Apple than a Banana and I’d rather have a Banana than a Cookie, then I’d rather have an Apple than a cookie b. A > B and B > C implies that A > C Problem with non-transitive preferences A>B>C>A ● Money Pump: ○ Two players: Scammer and Sucker ○ Sucker starts with C ○ Scammer: I’ll give you B if you give me C plus a penny ○ Scammer: I’ll give you A if you give me B plus a penny ○ Scammer: I’ll give you C if you give me A plus a penny Sucker has exactly what he started with (C), but paid $.03 Scammer can repeat this until the Sucker is out of money Individual Demand *The demand function maps price of good and quantity demanded* ● “Law” of Demand: As price decreases, individuals demand more and more of the good. ○ This really just says that the demand curve slopes down…or in other words, in order to get people to buy more of a good, the price has to be lowered. ○ A theory bc it isn’t always true. Imagine an item whose value is inherently tied to its price (Jewelry and other status goods) Market Demand Note that if we know individual demands, we can determine the market demand curve by horizontally adding the quantities at each price. ● Market demand is the summation of all the demands; summation of everyone’s demand ● Thus, if Individual A would purchase 40 units of the good if the price were $20 (which is the dual interpretation of the behavioral “black box”) and Individual B would purchase 13 units of the good if the price were $20, then both individuals together would purchase 53 units of the good if the price were $20. ● When plotting P & Q any changes in price will be reflected in the cure, other changes will impact the intercept. ● Only shocks to price will impact quantity demanded; if you change income then the whole demand curve will shift. 22 Demand Function: In general, assume demand functions are in the form: *Everything else: cultural, weather, etc. Literally anything else that impacts demand. Demand is the correspondence between a set of prices and quantity demanded at their cost points ● We will not address Giffen goods → goods that violate law of demand ● ● Note: Demand vs Quantity demanded are different. From a stationary point, Qd only changes if the price changes. Income rises... *A change in demand (i.e. incomes change) means the whole curve moves* ● Income leads to a change in demand, not Qd (which only results from a change in price). Note that a change in demand results in a shift of the entire demand curve. ● Willingness to pay for the good actually changes (at every level of consumption) ○ This is a normal good. As you get richer, you demand more. Rule: ● If something changes that can be found on an axis, you are dealing with a Change in Quantity Demanded. The underlying consumer “willingness to pay” has not changed. ● If something changes that is NOT found on an axis, you are dealing with a Change in Demand. The underlying consumer “willingness to pay” has changed. Ask yourself “for a given quantity level, would the consumer be willing to pay more or less for the good?”. This will dictate the direction of the shift. Graphically, what happens… ● to the demand for peanut butter if jelly becomes cheaper? → Decreases ● to the demand for ramen noodles if your income increases? → Decreases (inferior good) ● to the demand for pizza if the price of pizza drops? → increases ● to the demand for houses if you know a tax credit goes into effect next month? → Demand shifts up. Income: → remember: this stuff shifts the ENTIRE CURVE. ● Normal Good: A good whose demand increases (shifts up/right) when consumer incomes rise. Examples: cars, clothes (in general), electronic equipment. ● Inferior Good: A good whose demand decreases (shifts down/left) when consumer incomes rise. Examples: ramen noodles, discount clothes, bus travel. ○ So why do companies do this? To provide insurance against the business cycle. Not everyone will be rich all the time. 23 Price of related goods: ● Complementary Goods (Complements): Goods in which a price decrease of one good results in an increased demand of another good. Examples: Gas/SUVs, hotdogs/buns, bicycles/helmets ○ If you buy more of one, you’ll need more of the other. ↑ Py = ↓ Qxd ● Substitute Goods (Substitutes): Goods in which a price decrease of one good results in a decreased demand of another good. Examples: Coke/Pepsi, chicken/beef, Mac/PC. ○ Can replace one with the other. ↑ Py = ↑ Qxd Advertising and consumer tastes: Companies try to impact attitude towards a good, which will shift the whole demand schedule ● Informative Advertising: Advertising designed to increase consumers’ demand through information about the existence or quality of a product. I.e. Little kids love iPads! ● Persuasive Advertising: Advertising designed to increase consumers’ demand through appealing to their emotions and general sensibilities. I.e. Nike running: just do it. Number of consumers ● Population: more consumers = increase in demand; more people will shift the demand to the right ○ Think about demand for homes in a town after a new car factory is built. ● New Market Segment: Find new consumers for your product ○ Think about demand for iPads after parents realized that it was portable entertainment for kids. Consumer Expectation: ● If you expect prices to go up in the future, your demand for the good will increase today; consumers are forward thinking Consumer Surplus: ● The “extra” value a consumer gets over and above the amount they have to pay for it. ● The area between the demand curve and the price ● The demand curve is “willingness to pay at different quantity levels.” At any quantity, if I actually pay what I am willing to pay then you can think of the purchase as being a wash (because I was indifferent between the money and the item at that price). ● If I get the item for less than WTP, then I am really better off by purchasing. ● In this case will consume 7 units; the area underneath the demand curve is the consumer surplus. The richer you are the more consumer surplus you have. Firm Theory: ● Firm decision making process: given the market price, how much do I want to produce? ○ While consumers maximize “utility,” firms maximize profits ○ Profit is a much more concrete concept than utility ● With demand we assumed that consumers could somehow convert items into dollars, so that for every quantity level, there was a price that would induce them to purchase the quantity. ● With supply, we will assume that there is a minimal price that a manager requires to produce different quantities of a good. ● While there is a black box here, as well (managers are just people, after all), we actually know a little more about what’s going on underneath the curtain. This is because we know the ALL managers are profit maximizers. So by understanding the input costs, transaction costs, contracts, etc. we understand their optimization problem a bit better. ● Perfect competition: revenue = P * Q ○ Price is fixed for every Q. Profit Function: π (Q) = P * Q − C (Q) ● π → Profit ● P * Q → revenue; depends on the economic environment ● C(Q) → cost function; depends on the w,r and Q=F(K,L) ● Economic environment, firm (input and technology) ● P is determined in the market i.e. an individual firm has no market power/can’t set prices ● The revenue function P * Q is linear by Q. The marginal revenue is equal to P. 24 Supply: *The yellow line is price → This is perfect competition* ● What should the firm do if the price of a good is $4? ● Will sell until the amount the firm will produce is $8, where price=MC ● Price is fixed as varying Q doesn’t impact price. So you just want the intersection of MC and Price. ○ Which in this case is 8. P=MC also impacts the supply curve The price is set at $2... If the firm is committed to producing, then the intersection is the best they can do (Price = MC) ● The per-unit price is below the average (per-unit) variable cost. Thus, they are losing money and they’d be better off if they didn’t produce. ● Why look at AVC instead of ATC? ● ● ● ● The green rectangle is revenue = P * Q The red is total variable cost = AVC * Q → AVC = VC/Q Revenue and costs on the graph so negative profit When price is high enough to reach the lowest part of the AVC then it can operate. Even though it can’t cover fixed costs ○ b/c MC is a function of Q, firms, even if they aren’t super efficient are encouraged to produce more/enter the market at this point. Firm Decision Making Process: In other words, a firm’s supply curve is their MC curve above the AVC curve. This leads to the decision rule. The red line is the supply curve. The supply curve tells us for a given price, this is the amount that a seller is willing to supply. ● Question: The “Law of Supply” states that supply curves are upward sloping. In terms of Marginal Cost, what is this law really saying? ○ Marginal cost slopes up, indicating that, at some point, there is diminishing productivity. ● Demand slopes down; supply slopes up. If prices are higher you will have more sellers but fewer buyers. ○ I.e. minimum wage laws Supply function: Use a mathematical function to summarize this decision in a similar manner to demand ● A production substitute is something that you could produce with roughly the same inputs as what you already have (think farmer, who could produce corn instead of tobacco). Tie this to opportunity cost. ● Price will cause the curve to shift up and down, everything else will impact the intersection. 25 Change in the quantity supplied: ● ● For a given input price level (W), price of production substitutes (Pr), and “everything else” (H), a change in the quantity supplied (Qs) results from a change in the sale price of the good (Px). Just like we had to change in quantity demanded, now we have a change in quantity supplied. Change in supply: ● This is nothing but the MC curve. What happens to marginal costs if input costs rise? ○ If prices increase, the curve will shift up and assuming price is constant the firm will just produce less. ○ Left/in and right/out with supply ○ Decrease → left (up) Rule: If something changes that can be found on an axis, you are dealing with a Change in Quantity Supplied. The underlying ability/willingness to produce has not changed. ● If something changes that is NOT found on an axis, you are dealing with a Change in Supply. The underlying ability/willingness to produce has changed. Ask yourself “for a given quantity level, would the marginal cost increase or decrease?”. This will dictate the direction of the shift. Graphically, what happens… 1. To the supply of cars if rubber prices increase? → shift left, decrease car production as cost of input increasing 2. To the supply of houses if more development firms enter a market? 3. To the supply of cigarettes if the government imposes a $1.00 sales tax? → shift left 4. To the supply of 12” oil pipes if the price of 14” oil pipes increases? → decrease 12” production, increases 14” production; this could be a preference shock (shift along the curve) The opportunity cost is stressed since this is the reason firms would reduce supply now if they expect prices to increase in the future. Always focus on the marginal cost interpretation. Note for the #4, this is the marginal opportunity cost. 27 September 2017 Under perfect competition → this is the solution to the firm’s problems 1. R = MC → Q* 2. Given Q*, choose K,L such that MPL MPK = w r Input Prices: As input price increases, marginal costs increase. This is a “decrease/inward-shift” in supply. ● Input prices are already included in the cost function ● Just like with demand we can name all of the shifters. Recommended that you make a list of these. Technology: A technological advancement reduces marginal cost, “increase/outward-shift” in supply. Government Regulation: A government regulation limiting the use of technology increases marginal cost, “decreasing” supply. ● With government regulation, think of technology as anything that allows one to produce more efficiently. Currently, we have technologies that are efficient, but they pollute. Cap and trade will force companies to trade these efficient technologies for less efficient ones, meaning higher marginal costs. Number of firms: As more firms enter a market, the market supply will increase. ● As firms leave a market, market supply will decrease. This can be caused by natural disasters, bankruptcy, industry migration, etc. Substitutes in production: As similar products are sold for a higher price, firms will change production to produce the alternative goods. ● This shows how a producer can use the same inputs to produce different goods. ● Whichever good has the higher price, the firm has a greater incentive to produce that good. Taxes: A tax on a firm is just an additional marginal cost the firm has to pay. Thus, an increase in the tax rate will result in a decrease in supply. 26 There are different ways to analyze taxes in a supply/demand framework. We will take the easiest approach and assume it always gets charged to the producer. ● Spend some time to talk about tax incidence. Doesn’t matter who is taxed or which curve you shift. ● We assume taxes are during the production process. ○ Marginal costs will increase, supply will decrease. Expectations: If a firm expects to be able to sell its good for more tomorrow, the opportunity cost of selling today increases. Thus, an increase in expected future prices will result in a decrease in supply today. ● Think of selling your house. If you expect high housing prices next year then this is equivalent to a high opportunity of selling now. Thus, increase in marginal cost. ● Agents expectations about the future will impact behavior today. Producer Surplus: 1. The firm’s benefit over-and-above the 2nd best alternative on which the firm could have spent the variable cost. 2. The firm’s “profit”. 3. The area below the price and above the supply (MC) curve. ● Just like with demand we spoke about consumer surplus…now we talk about producer surplus. ● Can think of PS as profit. ● Recall the supply curve is the marginal cost curve above the minimum of the AVC curve. If we draw the full MC curve out, we can ask “how much profit will be made on the 1st unit of the good?”, then “on the 2nd?” and so on, until we get the entire PS. ● The area below the demand curve and actual price → this is profit! ○ The overall profit is the profit from the each possible outcome. ● Alternatively, we can start with revenues and subtract out the costs. ● The point of this slide is to introduce the fact that revenue can be read off the graph as the area of the price/quantity rectangle. NEW SLIDE DECK Competitive Equilibrium ● ● ● ● ● At the high price, there are more sellers than buyers, so there is pressure to lower the price. When the price is lowered there are two effects: ○ Some sellers are no longer interested in selling ○ Some buyers are not interested in buying that were not before at the high price. Over time prices will continue to drop until quantity demanded is equal to the quantity supplied. Surplus: original difference in demand and supply ○ Firms are producing too much of the good. This puts pressure to sell at a lower price. Surplus: The market condition in which the quantity supplied exceeds the quantity demanded. “Market pressure” Results in pressure on suppliers unable to sell their goods to undercut the suppliers who can, driving prices down. Prices will not be stable if a surplus exists Prices don’t move because they are “supposed to”… market pressures force prices down. If a surplus exists, there will be pressure to decrease the price. This will cause suppliers to provide less and buyers to want more of the good. Ultimately, prices will go down until every seller who wants to sell the good will be able to. Then, no one will have an incentive to offer a different price. Surplus → DWL 27 ● ● ● ● Shows a surplus. Note the consumer and producer surplus at this level. Adding these two gives us some measure of societal welfare (whether or not this is a good measure is hotly debated…no metric for equality here). / The deadweight loss is a consequence of not having an equilibrium Shortage: The market condition in which the quantity demanded exceeds the quantity supplied. ● Results in pressure on buyers unable to purchase a good to offer more money to the limited suppliers, driving prices up. ● Prices will not be stable if a shortage exists. ● Jargon: Focus on the fact that prices will not stay the same. There will be pressure to rise. ● So we have seen that if the price is below the intersection of S&D that we are not in equilibrium because prices are not stable. We’ve also seen that they aren’t stable above the crossing. So where does an equilibrium exist? ● Price ceilings are not a good idea bc of this. They create artificial shortages. ● If a shortage exists, there will be pressure to increase the price. This will cause suppliers to provide more and buyers to want less of the good. Ultimately, prices will go up until every consumer who wants the good will have one. Then, no one will have an incentive to offer a different price. ● ● ● ● Now that price is $20… the quantity supplied is less than the quantity demanded. This is a shortage ○ Upward pressure on prices. Consumers will pay more for the good Note that the result of this shortage will be that buyers offer higher prices, as prices rise due to this market pressure more sellers will be interested in selling and fewer buyers will be interested in buying. Market Equilibrium: The price at which: 1. Quantity demanded equals quantity supplied. 2. No shortage exists 3. No surplus exists 4. There is no pressure on any buyer or seller to change the price. Market Equilibrium Principle: In a perfectly competitive market, buyers and sellers acting in their best interests will result in a stable price/output combination. ● Actually quite a significant prediction: people acting entirely in their best interests will end up with a predictable, stable outcome. ○ Price acts as a signal of value. Comparative Statics ● Comparative: We only want to compare two scenarios; we don’t need numbers ○ A is more than B, rather than A=10 and B=3 ● Statics: Static means not moving. ○ We just want a snapshot of A and a snapshot of B ● Something changes. How are price and quantity affected? → how do shocks impact the equilibrium quantity? Question: How will the equilibrium price/quantity of corn change if ethanol is used as a primary alternative energy source? ● A: The demand curve shifts up, demand increases. Supply isn’t impacted. Remaining at the old price market can’t last, it must move the equilibrium up. ● Will likely result in an increase in corn prices and the amount of corn being produced. 28 QD = 200 - 8P , QS = 2P a. Find P*, Q*, TS b. Implement price floor P = 22. Find the surplus, shortage and DWL. c. Implement price ceiling P = 18. Find the surplus, shortage and DWL. a). MCC → QD = QS (market clearing condition → equilibrium condition) ● 0= 200 - 8P → 8P = 200 → P = 25 ; Q= 200 - 8(0) → Q = 200 ● 200 - 8P = 2P → 10P = 200 → P* = 20 ● Q* = 2(20) = 40 = Q* ● CS = 5 * (40/2) = 100 ● PS = 20 * (40/2) = 400 ● TS = 100 + 400 = 500 = TS b). P = 22 - Price Floor ● Surplus: QS - QD @ P = 22 ○ QS = 2 * 22 = 44 ○ QD = 200 - 8 (22) = 24 ○ QS - QD = 44 - 24 = 20 = 20 (the # of items the firm has produced) ● CS = ½ (25 -22) * 24 = 36 = CS ● QS @ 24: 24 = 2 - P → P =12 ● PS: ½ (12 * 24) = 144 + (22-12) * 24 = 240 → PS = 384 ○ PS = area (A) + area (B) ● TS: 384 + 36 = 420 = TS ● DWL: ½ (10 * 16) = 80 = DWL c). P = 18 - Price Ceiling 2. @ P = 18: QS = 2(18) = 36 ○ QD = 200 - 8(18) = 56 ○ QD= 56 - 36 = 20 ● PS = ½ (18-36) = 324 ● @QD = 36: 36 = 200 - 8(P) → P = 20.5 @ QD = 36 ● CS: a + b = CS ○ A: (20.5 -18) * 36 = 90 + b: ½ (25-20.5) *36 = 81 ○ CS= 90 + 81 = 171 ○ TS: 324 + 171 = 495 ● DWL: ½ (20.5-18) * 40 = 5 ● This policy could be used to make the people happy bc ppl gets cheap goods, but firm will be v unhappy Price floor: A government imposed minimum price at which a good can be sold. ● If the price floor is above the equilibrium price, a surplus will ensue. (binding) ● If the price floor is below the equilibrium price, the market is unaffected. (non-binding) ● A price floor prevents things from going down. ● Ex. minimum wage, agricultural price supports Price ceiling: A government imposed maximum price at which a good can be sold. ● If the price ceiling is below the equilibrium price, a shortage will ensue. (binding) ● If the price ceiling is above the equilibrium price, the market is unaffected. (non-binding) ● Prevents things from going up. ● Ex. rent control, gas/natural gas price ceilings. ● 30 Perfectly Competitive Short-Run Shut Down Decision: In a perfectly competitive environment, during the time frame in which a firm’s expenditures are sunk, the firm should Shut Down (not operate) if the market price is below the Average Variable Cost curve. Perfectly Competitive Short-Run Shut Down Decision: IF... ● Perfectly competitive environment ● During the time frame in which a firm’s expenditures are sunk, THEN... ● The firm should Shut Down (not operate) if the market price is below the Average Variable Cost curve. Perfectly Competitive Long-Run Exit Decision: In a perfectly competitive environment, the firm should Exit the market if the market price is below the Average Total Cost curve. Note no expenditures are sunk in the Long-Run. ● Q: Which firms will be able to “wait out” the market if the market price is below the Average Total Cost? ○ It’s harder to sell assets so long-run is longer time frame. ■ Shut down is also more expensive ○ Larger firms have large cash streams which allow them to eat negative profits for a longer period of time. Large firms have savings and can get loans to be able to afford their fixed costs while they hold off on producing. Until price rebounds to a point that they can make a profit. 25 October 2017 Relaxing the assumptions around Perfect Competition. A market in which: 1. 2. 3. 4. 5. There exists many small identical firms (HHI very low). → breaking the “identical” part. There exists many individual buyers. Firms sell “identical” products. Every buyer and every seller has full information about the price and quality of goods. Transaction costs are very low. 6. No barriers to entry/exit. → Now we are doing Not-Quite Perfect Competition. Barriers to Entry: Assume there are costs over and above the standard fixed costs required to operate in an industry. For instance, suppose there are 1-time legal fees, regulatory obstacles, or a necessary initial name-recognition advertising campaign. ● The reason we assume these are not “fixed costs” is because PC assumes all firms have identical cost structures (including fixed costs). Thus, we’ll assume these are “extra” costs. ○ Ex. if Pepsi introduces a new product, we trust if. If a new company introduces a new product, we might not trust it & additional advertising is different. This additional cost would be a barrier to entry. ● ● Slide #5, firms will continue entering the market, but eventually the small available profits won’t be enough to justify the cost of entering the market. By slide #7 & #8, firms already in this market will want higher barriers to entry, as this ensures long run profits. At this point, profits aren’t big enough to enter for those with a barrier to entry. 42 30 October 2017 - Advanced Pricing Strategies Constant MC Markup Rule: If your Marginal Costs are roughly constant in a relevant range, the profit maximizing price is: ● If given single price, but have pricing power (& the MC is constant) the optimal price is: ● This is simple, but analytically is not the best pricing strategy. ● ● ● Money is still left on the table! (see orange triangle) There is a gap between price and MC. When we price in this manner, note the consumer still ends up with a surplus. We’d like to take that surplus as firms and turn it into profit. First Degree Price Discrimination: Charging different customers different prices for the same good. Charging each customer the maximum price they would be willing to pay. ● This is the best case scenario. The firm can actually pin down what is each individual's willingness to pay. ○ This means each consumer pays a different price! ● This effectively pulls out all surplus as profit. ● If we could price discriminate at every fraction of quantity, we could theoretically get all the surplus as profits. ● Note that the old profit maximizing level and price are still optimal if only one price can be charged. Note how much bigger this profit is. ● So this begs the question, why don’t all firms do this with their products? Most every retailer has some degree of market power. Why don’t we see more examples of first-degree price discrimination? ○ Seller must know the individual’s demand curve. This is hard. Consumers lie. ○ Consumers hate this. We put up with it with cars and homes because they are large rare purchases. What if we had to haggle for our groceries? Another firm could potentially earn higher profits by setting a fixed cost and offering consumers a more pleasant experience. First Degree Pricing Rule: If you can charge each individual different prices and you can determine each consumer’s willingness to pay, you can achieve maximal profits. Second Degree Price Discrimination: Offering a schedule of declining prices for different ranges of quantities. ● Charge a lot for the first unit, much less for the second unit. A pricing rule that depends on how many units the consumer is willing to buy. ● Second degree price discrimination involves setting a menu that every customer can select from. ● Customers will then self-select on how much they want to buy. ● For the individuals that will purchase more, you are getting a higher level of surplus for the first units. ● Note that this one is more realistic and there are a couple of ways that it can be done: ○ iPad story (Charge a premium to people who want to get the latest and greatest tech) ○ Buy one pair of shoes get one half off ○ Parking garage (in big cities often times first hour is the most expensive). Second Degree Pricing Rule: If you can estimate the market demand curve, you can implement a staggered price schedule that can increase your profits over a single-price. *So it’s not as good as FDPD, but it's easier to implement. Third Degree Price Discrimination: Charging different customer segments different prices. ● Customers have (1) an exogenous, verifiable, legal characteristic and ● (2) it’s not easy to resell the good between markets. i.e. age, students, faculty ● A change in prices in different markets. I.e. student prices vs. regular Question: What is the arbitrage opportunity? ● Same good being sold for different prices in different markets ○ Can buy in cheaper market and sell in higher priced market → the firm needs to protect against this! 47 Peak Load Pricing: Charging different prices at times during which demand is sufficiently different. ● Similar to 3rd degree price discrimination: Segment the market into two groups, then charge the optimal price for each group. ● The firm charges different prices according to seasonal preferences ● MR = MC for the two different set of prices. Peak-Load Pricing Rule: If demand for your good differs throughout time, offering time-dependant pricing can increase your profits over a single, higher price. Cross-Subsidies: ● By lowering the price of burgers & driving up consumption, the demand for soft-drinks significantly increases. ● This is actually the business strategy of a lot of fast food places. Soft-drinks are just boxes of sugar-water and carbonated water. Marginal cost is almost nothing. Thus, offer cheap food & hope people buy the drinks. Cross-Subsidization Pricing Rule: If two goods are complements, lowering the price of one might increase the demand for the other by enough that overall profits are increased. ● Might depends, on how good the firm is at determining preferences. 3 November 2017 Game Theory → My decision affects your payoff; your decision affects my payoff. ● All you need for a game: plays, strategies, actions & payoff. Normal-Form Game: ● A set of players ● Moves each player can make ● Payoffs the players might receive under each combination of moves ● Played simultaneously; the whole point is to figure out what likely outcome will happens given the incentives. ○ Maximizing profit is best guess my opponents choices. 6 November 2017 Dominant Strategies: A move that provides a higher payoff (than any other possible move) regardless of how a player’s opponents play. ● It is the best strategy is the best regardless of what other player is doing ● Start by asking the question “if the other player is playing ______, then what should I do”? ○ If your SO goes to Franklin, your best response is to go to Franklin ○ If your SO stays home, your BR is to go to Franklin. ■ Thus you have a dominant strategy ● Dominant Strategy Solution Concept: ○ All players will play a dominant strategy, if it exists. Otherwise, All players without a dominant strategy will assume their opponents are playing dominant strategies (if they exist) and will respond accordingly. ● A reasonable way for a game with a dominant strategy to end is to have each player play their dominant strategy, and each other player respond accordingly. In this case, that would make (Franklin, Franklin) a dominant strategy equilibrium. 49 IESDS ● Dominant Strategy: A move that provides a higher payoff (than any other possible move) regardless of how a player’s opponents play. ○ Dominant strategy equilibrium is based on the concept of “I’ll play what’s always best for me, or I’ll respond to what’s always best for my opponent” ○ Never yield highest pay off regardless of what the other player does. → Never best strategy ● Strictly Dominated Strategy: A move that will never provide the highest payoff regardless of how a player’s opponents play. ● IESDS is based on the concept of “I won’t play what’s worse, and I’ll assume my opponent will do the same”. We first need to introduce the concept of a strictly dominated strategy. Instead of “always best”, it’s “never best”. Iterated Elimination of Strictly Dominated Strategies (IESDS) Solution Concept: 1. If I have a strictly dominated strategy, I will never play it. 2. Knowing this, my opponents will determine if they have a strategy that is never the best strategy regardless of the strategy I select from those I have not eliminated. If so, they will never play it. 3. Knowing this, I will determine if I have a strategy that is never a best strategy regardless of the strategy my opponents select from those they have not eliminated. If so, I will never play it… 4. And so on… In other words, I only consider the strategies you might play, assuming you’ll never play a strictly dominated strategy. Then I only play those strategies that are never best responses to these strategies. You, in turn, do the same, only considering those strategies I might play. ● Top for player 1 is dominated strategy, center is strictly better than top. ○ Can get rid of top. So right becomes dominated for player 2. ○ (14,7) → single outcome. ● Can do this for starting with player 2. IESDS will always result in the same answer, regardless of which player you start with. Good way to check answers on tests! Critique of IESDS: The other problem is that IESDS, while providing more concrete answers than dominant strategy equilibrium, still doesn’t give us tight predictions. In many cases, there is no predicted outcome, which means our game theoretic response to “how will this game resolve itself” will be “anything’s possible” Nash Equilibrium (NE) Solution Concept: ● If a set of strategies is such that no player has an incentive to unilaterally deviate, it is a Nash Equilibrium. ● “Unilaterally” just means that each player is acting on their own ● In a NE, the following is true for both players: ● “Given your strategy, I’m doing the best I can.” & “No regrets” In particular, a NE says “IF we happen to play a Nash equilibrium, we will have no reason to deviate”. It’s agnostic about how this happens, and there are different explanations for why this might be the case. Nash is nice because it doesn’t require us to assume the other players are thinking through a large number of steps in the game. Instead, it just says “if we happen to find ourselves in a situation where neither of us want to deviate, we won’t”. NASH → all players are playing their best response In example 1, (8,2) is a NASH equilibrium & player 1 has a dominant strategy in B. → Example 2: (14,7) 50 Prisoner’s Dilemma: The category of games in which players have a dominant strategy to “cheat”, preventing beneficial cooperation from occurring. ● (-6,-6) is the Nash equilibria. The better choice would be to choose -1, -1, but b/c the players have an incentive to deviate they play A,a ● The problem (and the key to the prisoner’s dilemma) is that each individual has an incentive to deviate from the “better” outcome. In particular (in this case), each individual has a dominant strategy to play A. Example: 2 criminals are arrested under suspicion of committing a crime. The DA has enough evidence to convict on a smaller charge, but needs a confession to get the larger charge. They take the two prisoners, put them into different cells, and tell each the following: ● If you confess & your partner doesn’t, you’ll go scott free. ● If neither of you confess, we’ll charge you both with the lesser crime. ● If you both confess, you’ll get the larger crime punishment, but with some leniency. ● If you don’t confess and your partner confesses, we’re throwing the book at you In the business world, an ex is price wars. Both players have an incentive to play an outcome that is not beneficial. To Prevent the Prisoner’s Dilemma: Increase the punishment for deviating ● If we’re in a situation where we know we’re going to end up in a situation that’s worse for both players BECAUSE of the incentive to deviate, then we need to “change the game” by increasing the punishment or reducing the benefit of cheating. ● Consider how the mob handles the “confess, confess” problem. In particular, they kill you and your family. That’s an increase in the punishment. **This is also why we see price guarantees, with a price guarantee, you’re reducing the benefit of the other firms from deviating (offering low prices). In particular, it will cut into their profits, but they won’t actually get any new customers. Also, if you respond with a price war across all products, you can make their incentive to deviate even weaker. 15 November 2017 Coordination Games: The category of games in which multiple Nash Equilibria exist, each corresponding to each player doing what the other players are doing. ● (11,11) & (0,0) are Nash. If everyone is going to invest, you should invest. However, if other people aren’t investing, you shouldn’t. This is exactly what happens in markets. ● Note that when this game is played in the lab we find that more times than not people choose not to invest. Psychologists and behavior economists have found that many people have a large aversion to losing than desire to gain. Other coordination games: ● Union strikes: If everyone walks out, so will you. If no one walks out, neither will you. ● Cheating: If everyone in the class is cheating, you might as well. If no one in the class is cheating, neither should you. ● Technology Standards: If everyone is using Blu-Ray, so should you. If everyone is using HD DVD, so should you. ● Social Norms: If a company’s employees all value honesty and punish cutthroat actions, you should too. If a company’s employees are all cutthroat, you should be too. ● Peer Pressure: If everyone else is binge drinking, so will you. If no one else is, you won’t either. ● Bank Runs: If everyone is taking their money out of a bank (so it will likely fail), I should too. If everyone is keeping their money in a bank, I should too. Managing Coordination Games: “Pushing” a coordination game into a “good” equilibrium can be achieved through costless expectations. However, your employees must believe you are willing to pay if the equilibrium does not occur; your threat must be credible. ● Examples: Businesses must be sincere in their desire to punish dishonest employees ● From a managerial perspective, the key is that you have to have individuals believe you’ll live up to your promise in order to push a coordination game into a “good” equilibrium. Sometimes, this means that no matter how good a manager is, a new one needs to be brought in simply to make employees think a new sheriff is in town. ● Consider coaches in sports. When one “loses his team”, a new one is brought in and you tend to see immediately better results like “smarter play”. Hawk/Dove Games: Games with multiple Nash Equilibria, where corresponds to one player being “strong” and the other being “weak.” aka game of chicken. ● Payoff is highest when you don’t do what everyone else is doing. ● The equilibria is that one person yields and the other doesn’t. You don’t want to go to full-out combat & if the other person yields, you want to be the strong one. ● Show that we have two Nashes & that they occur where one is good for one individual and the other is good for the other individual (no agreement). Commit to being the strong player to win. Managing Hawk/Dove Games: To be the “Hawk” in a Hawk/Dove game, commit irreversibly to the strong position. If the game is repeated and both players are stubborn, consider a compromise. 51 Mixed Strategy NE → No pure strategy nash equilibria exist. (Pure strategy is yield or don’t yield) Question: What if you knew I was perfectly randomizing between rock, paper, and scissors. (playing each 1/3 of the time) What would your best response be? ● Play Rock always: win 1/3, lose 1/3, tie 1/3 ● Play Paper always: win 1/3, lose 1/3, tie 1/3 ● Play each 1/3 of the time: win 1/3, lose 1/3, tie 1/3 Every strategy I choose gives the same results. So, every strategy is a best response. Mixed Strategy Nash Equilibrium: A Nash equilibrium in which one or both players are randomizing their strategy. Every pure strategy is also, technically, a mixed strategy, where you play one strategy 100% of the time. ● This does not mean randomizing with equal weight on every option! It just means that I play each option with some probability. ● Note then that every pure nash is also mixed. Managing Using Mixed Strategies: If your competitor can gain a competitive advantage by knowing your strategy, randomize to keep them guessing. Quick note about Strictly Dominated Strategies: ● Strictly Dominated definition: Strategy A is strictly dominated by Strategy B if the payoff for B is greater than the payoff for A for every possible strategy of the opponent. ● Strictly Dominated => Never Best Response (NBR), but NBR ≠> Strictly Dominated. ● Using IESDS, eliminating NBR may eliminate mixed strategy Nash equilibria. 17 November 2017 Normal Form Games: Set of strategies is discrete (countable) and finite. Continuous Form Games: Set of strategies is a continuum. Duopoly: Two firms produce an identical good; Barriers to entry ensure they keep their market power. ● Market supply: Q = q1 + q2 (two firms!) ● P= a - bQ → P = a - b(q1 + q2) ● GOAL: Max P(Q) - q1 - C(q1) given q2 → this is maximizing profit! Monopoly: Optimal quantity is the peak of the profit curve given consumers tastes Duopoly: Optimal quantity is the peak of the profit curve given consumers tastes and q2. ● When we maximize profit give what the opponent is doing... remember P(q1 + q2)q1, aka firm 2 affects firm 1’s revenues through price. ○ P = a - b(q1 + q2) ● q1*: Best response to q2 ● q2*: Best response to q1 → q2*: Best response (q1*) → here is a nash equilibria. (this is game theory!) Isoproftis: ● Firm 1’s profits: π1 ● Firm 1 and firm 2 face inverse demand P= a - bQ. Since Q=q1 + q2, firm 1’s profits are given by ○ Π1 = [a - b(q1 + q2)] + q1 - c(q1) ○ Π1 = aq1 - bq1,q2 - bq;2 - c(q1) ● FC or VC doesn’t matter for C bc Q* doesn’t change! Just P*. If q2 increases quantity. Profit for q1 is falling → ● *Profits decrease as curve shifts up!! ● If curve shifts down π1 increases! ● The closer you get to the x-axis, π increases. π1* is where π is tangent to q 2 → Isoprofit lines, which are just like Isoquants, but with profits. ● In particular, they are the Firm 1 & Firm 2 combinations that give Firm 1 the same level of profits. With a few assumptions we’ll ignore (but are reasonable), the isoprofit lines will look something like “hills”. It’s important to recognize that isoprofit lines represent higher profits for Firm 1 the lower the are. The reason is that a lower isoprofit line indicates that Firm 2 is producing less. Thus, Firm 1 has more flexibility & is guaranteed to be better (it’s like having a small competitor in a market). 52 A neat remnant of the Cournot model (we won’t get into the details) is that if there are N identical firms competing in this way, the optimal price for each firm will be. ○ Note when N=1, this is the exact monopoly condition we’ve found. ○ Note when N=∞, this is P=MC, the perfect competition condition. ● Thus, Cournot oligopoly bridges the gap between everything we’ve done (all of it has been some form of Cournot). One thing to note in Cournot games is that the NE isn’t the best possible outcome for each player. ● Much like the prisoner’s dilemma, both firms could do better if they agreed to reduce production (driving up prices). ● In particular, they could act like one monopoly firm, then split the profits. This is what OPEC does. Collusion in a Cournot Game: If firms competing in quantity (Cournot) can agree to limit their production, thereby increasing the market price, they can achieve higher profits. The firms are effectively acting “as a monopoly”, splitting the monopoly profits. ● Much like the prisoner’s dilemma, there’s always an incentive to deviate. If your competitor is under producing, you’ll want to flood the market. ● Both firms are at a higher profit level ○ Each firm has an incentive to expand production to increase market share ○ Agreement by firms to produce at a lower produce and quantity → firms at as a monopoly Question: Why don’t all firms participate in collusion? Collusion Failure in a Cournot Game: The temptation to deviate from a collusive agreement can make sustaining collusion difficult. ● This is just like prisoners dilemma. Two people cannot agree to lie because there is always an incentive to deviate. ● Note that collusion is against the law in the US. Justice Department. ● Still happens though. Not always purposeful and often the government doesn’t get involved. ● Example: sometimes a large firm that possesses a majority of the market will set high prices then all small firms don’t undercut because they do not have the capacity to produce with the increase in sales. Stackelberg game: Firms choose quantity sequentially. 1. Firm 1 (the leader) selects a quantity to produce. 2. Firm 2 (the follower), seeing Firm 1’s decision, selects its quantity to produce. 3. Once all firms select a quantity, the market price is dictated by the market demand curve (specifically, the price will ensure all the units will sell). Question: Who has the advantage in the Stackelberg Game? ● The Leader has an advantage in the Stackelberg game, since they can “control” the behavior of the Follower. We call this advantage the “First-Mover Advantage”. ○ This ability to “control” what the 2nd-mover does gives the first-mover an advantage. At worst, the NE can be achieved because if Firm 1 selects his NE strategy, by definition of NE we know Firm 2 will also select his NE strategy. However, now there are additional possibilities. ○ It is very important to realize it’s not always better to go first. For instance, if there is a large cost to innovate a market, then a second mover might be able to piggyback on the efforts of the first-mover. This is beyond the scope of this course, but they should consider the implications. ● Assume you’re Firm 1. Because you can calculate Firm 2’s BR function as easily as Firm 2 can, you know exactly what Firm 2 will do given any output level you select. Thus, when selecting your output level, you’re effectively selecting Firm 2’s output level as well. By doing this, you can produce an output level that will maximize your profits, recognizing that Firm 2 will be responding per their BR function. Can someone find a strictly better point? ● If Firm 1 increases output, it will end up with higher profits (lower isoprofit) at the expense of Firm 2 (more right isoprofit). Firm 1 essentially crowds the market and Firm 2 can only take what’s left over. By choosing first F1 can force F2 to produce at a certain level. As F2 has no incentive to choose a different production level. (both firms have same MC) P(Q) = a - SQ → a - b (q1 + q2*(q1)) 54 Bertrand Games: Firms choose price. Can be a concentrated industry, but firms compete on price i.e. produce at P = MC. Price wars!! ● Each firm chooses a price ● Consumers choose who to buy from ● Quantity produced and sold by each firm adjusts to meet demand Firms simultaneously select the price of an identical good & The firm with the lowest price sells their good to the entire market. All other firms do not sell their good. ● Different class of continuous games. Firms compete in PRICES. Assumptions that make this reasonable are: ○ Firms can quickly produce a large number of units ○ It’s fairly inexpensive to produce a larger number of units ○ Firms can sell as few or as many units as they want at any given price ○ Products are effectively the same, and consumers shop only based on price ○ Each firm is able to supply the entire market ● Examples include software, telephone service, cable service, etc. Use the exact same technique, but forming the BR functions will require some consideration. First, draw the 45 degree line. As before, ask the question “If Firm 1 offers to sell the good at $10, what is Firm 2’s best response?” ● Firm 2 should sell the price at $9.99, undercutting Firm 1 just enough to get all the customers. If Firm 1 prices at $15, Firm 2 should sell at $14.99 etc. ● Note this is why we have the 45 degree line, because immediately under that will be a price slightly lower that Firm 1’s price. ● Recalling MC=0, what is Firm 2’s BR if Firm 1 offers the good at $0? Should also offer it at $0 (or above), since any less would have them losing money. ● As before, if we did this at every price level, could map out Firm 2’s BR. ● We can then do the same for Firm 1’s BR given every possible Firm 2 price level. Now a slightly lower price will be a point immediately to the left of the 45 degree line. The question then becomes “where is the NE?” Question: In a Bertrand Game, what is the Nash equilibrium price level if each firm has Marginal Costs of $0? ● Answer: Both firms charge $0 and receive no profits. ● Even in the case of only 2 firms, could actually have an outcome identical to the PC result. That’s one of the reasons why PC is viewed as a baseline case. It also why the FTC needs to be so thorough. Just bc an industry is highly concentrated doesn’t necessarily mean it will be anticompetitive. Question: How can a firm avoid the zero-profit Bertrand outcome? ● Differentiate its product ● Collude ● Impose switching costs: Costs associated with switching suppliers. Can be very important in maintaining customers. ○ If you can make it costly for customers to switch companies, that allows you to retain profits as well. ○ Example: What if a rival firm charges $2 less than you, but it costs customers $3 to switch firms? ■ Effort needed to tell friends/families/employers your new phone number. ■ Time required to convert all Microsoft documents to Apple formats. ■ Penalty for early DirecTV contract cancellation. ■ Training necessary to learn a new software. 1 December 2017 Cournot Duopoly Q = q1 + q2 Suppose firm 1 maximizes profits given q2. ● P(Q) = a - bQ → P(Q) = a - b(q1 + q2) ● P(Q) = a - bq2 - bq1 ○ a - bq2 → intercept Compute best response to q2 → need to maximize profit given q2 55