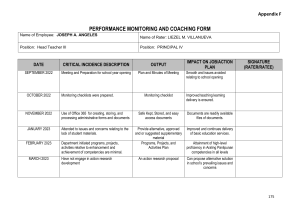

2023 Metalcasting Outlook Business Forecast 2023 Metalcasting Outlook To evaluate the state of the industry we surveyed foundry and diecasting managers and decisionmakers about their activities during 2022 and their expectations for 2023 — asking them to identify how they are faring and the challenges they face, and how they plan to continue their progress. A Staff Report T he end of one year and the start of a new one present a natural moment for inquiry: What has been accomplished? What can be expected? This sort of evaluation is not confined to the clock or calendar, of course: we see it happening daily in finance, quarterly in technology and business. Many people make such a personal evaluation daily. A business like metalcasting needs regular reevaluation too, and that’s why we present the FM&T Metalcasting Business Outlook. Metalcasting is more than a business, of course, and its status or progress is tracked over decades or centuries. Metalcasters themselves understand this. They know what is working well and what needs to be enhanced. They know how the industry and technology is vulnerable to competition, and they recognize the particular strengths that metalcasting can rely on to thrive. Metalcasters our source of understanding for just that reason. Each year, Foundry Management & Technology surveys our metalcasting readers to gain some perspective – if not consensus – on the state of affairs in North America’s foundry and diecasting operations. We’re proud of the audience we have developed and maintain, and we rely on their insights about the work they do. We collect facts, but we find discern knowledge from the concerns expressed, and the expectations or concerns raised, by men and women working in foundries and diecasting plants. It’s an effort to go beyond the facts, to understand not only the present circumstances of these operations, but also the underlying conditions shaping those businesses. We also seek to understand how these facts are received and understood by metalcasting decision-makers. We want their assessments of current conditions and we want to record the issues that give them confidence or concern, in their own businesses, in their supply chains and markets, and in the economy. We want to learn what 2 2 0 2 3 M E TA L C A S T I N G O U T L O O K | F O U N D RY M A G . C O M decisions they face in the business cycle just ahead, and to understand better their expectations for the future of their enterprises. We surveyed readers by email over a period of four weeks during Q4 2022. We are confident that the 2023 Outlook respondents reflect the metalcasting industry we cover, and reliably represent the range and variety of operations included in it. As has been the case in this annual series, the 2023 survey respondents represent the overall metalcasting industry, namely: aluminum foundries and diecasters (20.7%), gray iron foundries (13.29%), ductile iron foundries (26.58%), brass/bronze casting operations (19.61%), steel foundries (15.03%), and producers of multiple and/or other metals and materials (4.8%.) Other metals cast by survey respondents include stainless steels, magnesium, high-chrome iron, and nickel-based super-alloys. Similarly, and as in the past, the responses to the 2023 survey give a representative view of individuals working in metalcasting operations across of all sizes. Thus, 5.45% of respondents are employed by operations comprising more than 250 people; and 21.13% represent operations with 100 to 249 employees. Of the rest, 29.85% of respondents are employed by metalcasting operations with 50-99 employees; 34.42% are with businesses 20.70% 19.61% 26.58% 13.29% 15.03% 4.80% How many employees work in your metalcasting operation? Under 20 20 to 49 50 to 99 100 to 249 250 and over 9.15% 34.42% 29.85% 21.13% 5.45% How will your 2022 casting shipments (tonnage) compare with 2021 shipments? Stay the same Increase Decrease 29.80% 57.40% 12.80% FM&T’s annual Outlook survey begins by determining the metalcasting respondents’ sense of current business conditions, setting 2022 casting shipment volumes (tonnage) as a frame not just of the conditions as they are but also to gauge expectations for the future. How much tonnage they have shipped, and how much they expect to ship, is a proxy for their satisfaction and confidence about their businesses. We asked respondents to compare the current (2022) year’s casting shipments to the 2021 total, and more than half (57.40%) of all respondents report an increase, something less than a third of them (31.5%) expect the year-over-year results to be unchanged. Less than one-eighth (12.8%) of respondents expect lower shipment volumes for 2022 versus 2021. The confident portion of the respondents are more than a little Stay the same Increase Decrease 33.48% 50.68% 15.84% Please estimate your total planned capital expenditures for 2023 Less than $100,000 $101,000 to $250,000 $251,000 to $500,000 $501,000 to $1 million $1 million to $5 million More than $5 million 10.49% 18.53% 31.25% 22.32% 14.51% 2.90% What types of capital expenditures are you planning in 2023? New Plant New Equipment Expansion/Addition to existing plant None 26.91% 55.61% 30.27% 7.40% What are your borrowing plans for 2023? How do you expect your 2023 casting shipments (tonnage) to compare with 2022 shipments? Stay the same Increase Decrease Reading the results How will your 2023 capital expenditures compare to your 2022 capital expenditures? What is the principal metal that you cast? Aluminum Brass/Bronze Ductile Iron Gray Iron Steel Other that have 20 to 49 workers; and 9.15% of respondents represent metalcasting businesses that have 20 or fewer employees. The range of the products they cast and the scale of their organizations validate these survey respondents as representative of the metalcasting industry during 2022. 31.53% 54.95% 13.51% Increase debt Retire debt Stay about the same Not currently carrying any debt Seeking new equity investment 3 2 0 2 3 M E TA L C A S T I N G O U T L O O K | F O U N D RY M A G . C O M 14.35% 21.19% 38.85% 17.88% 7.73% Metalcasting Outlook bit optimistic about the scale of the improvement in shipment volume underway in 2022, as 36.7% of them foresee a rise of 11-25%; and 24.88% of them expect an increase in the 26-50% range. Another 15.52% put the improvement at 51-75% over last year’s shipment total. Somewhat smaller portions expect 76-90% or even +90% increases over last year’s shipment totals. To explain the current year’s growth in shipments, most of the Outlook survey respondents pointed to the fact that 2021 continued to bear the effects of Covid-19 restrictions on production activity, on the volume of orders, and the supply chains that are essential to keeping casting orders on track. “Issues with COVID are mostly resolved and business has been steadily increasing during 2022,” one respondent reported. Another pointed to “Increases in purchase orders from our large customers. Some of it has to do with U.S. government spending that is resulting in demand for firefighting equipment, hose valves and couplings, and electrical transmission and distribution parts. There is pent-up demand for machinery parts, railroad cars/locomotives and consumer products driving this volume of orders.” Do you plan to purchase any of the following types of equipment in 2023? Air compressors Automatic pouring system Blast cleaning equipment Continuous mixers Conveyors Coremaking machines Cranes/hoists Cutoff equipment Design software/hardware Diecasting machines Grinding equipment Heat treating equipment Investment casting system Lab equipment Lift trucks or loaders Lost foam system Machine tools Melting equipment Molding machines Permanent mold system Pollution controls Power control equipment/systems Process computers Rapid prototyping equipment Robots/manipulators Sand Prep equipment Sand reclamation equipment Shakeout/punchout equipment Simulation software Testing/inspection equipment Other 16.14% 17.27% 20.00% 21.14% 19.09% 23.64% 16.14% 15.68% 17.73% 12.73% 17.95% 9.77% 9.77% 12.50% 10.91% 8.41% 7.95% 8.64% 12.50% 7.27% 9.77% 8.18% 10.23% 9.77% 11.36% 11.36% 9.32% 4.09% 6.14% 9.32% 2.50% For that 12.8% of all respondents who expect 2022 shipments to decrease year-over-year, the largest portion (29.63%) expect the drop to be in the 26-50% range, and 24.7% peg the decrease to be in the 11-25% range. A further 19.44% are expecting a 51-75% decrease in shipments, year over year, while 17.3% of these respondents are prepping for a 0-10% shortfall, and 7.72% foresee a 76-90% decrease. These respondents offer somewhat more specific analyses of their 2022 drop in shipments: “Inflation causing rising interest rates has caused the economy to slow down and demand for our product to decrease,” one foundryman explained. According to another, “Recent order status overall has been dipping during the past two months, and the recession effects are making it difficult to forecast sales ahead.” Ready to rise? The Outlook survey takes the same approach to evaluate the prospects for metalcasting industry growth in 2023. Asked, “How do you expect your 2023 casting shipments (tonnage) to compare with 2022 shipments?”, 54.9% of respondents anticipate increased output next year, and 31.53% are expecting next year’s shipments to be comparable to the current year. Just 13.5%, a little above one-eighth of all respondents, believe that 2023 shipments will decline versus 2022. Indicate which of the following issues have been significant problems for your operation during 2022. Availability of Capital Energy Costs Energy Shortages EPA Requirements Human Resources Imported Castings Interest Rates Labor Costs Labor Shortage Lack of Orders Material Shortages Medical/Insurance Costs On-Time Delivery of Castings OSHA Requirements Plant Management Plant Operations Product Liability Product Marketing/Sales Quality of Castings Raw Materials Cost Skills Shortage Supply Chain Disruptions Tariffs Training Workers' Compensation Costs Other 4 2 0 2 3 M E TA L C A S T I N G O U T L O O K | F O U N D RY M A G . C O M 16.00% 30.44% 23.11% 24.00% 28.89% 14.00% 13.33% 23.33% 24.67% 13.78% 18.00% 10.00% 10.44% 9.56% 9.56% 12.22% 5.33% 9.56% 10.00% 20.67% 17.33% 14.89% 6.67% 8.44% 2.89% 1.11% Did you purchase any of the following types of equipment during 2022? Air compressors Automatic pouring system Blast cleaning equipment Continuous mixers Conveyors Coremaking machines Cranes/hoists Cutoff equipment Design software/hardware Diecasting machines Grinding equipment Heat treating equipment Investment casting system Lab equipment Lift trucks or loaders Lost foam system Machine tools Melting equipment Molding machines Permanent mold system Pollution controls Power control equipment/systems Process computers Rapid prototyping equipment Robots/manipulators Sand Prep equipment Sand reclamation equipment Shakeout/punchout equipment Simulation software Testing/inspection equipment Other 20.77% 21.22% 23.25% 21.22% 23.48% 13.54% 20.54% 17.61% 16.48% 12.87% 19.41% 9.71% 11.06% 16.70% 13.54% 6.77% 15.12% 14.22% 11.74% 9.03% 12.87% 9.93% 9.93% 11.06% 7.90% 10.61% 8.35% 9.03% 7.90% 8.35% 2.26% Digging into these responses, we discover that 30.5% of those anticipating increased casting shipments in 2023 expect the rise to be in the 11-25% range, and 28.4% it to be in the 26-50% range. Another 16.4% believe the improvement will be 0-10% year-over-year, 13.0% expect an increase of 51-75%, and 9.4% are looking ahead to a 76-90% rise in 2023 shipments. Where do they draw their confidence about next year? Reshoring and/or onshoring of orders was cited by a number of respondents. “Discussions with our customers have indicated increased demand moving into the 3Q 2023,” one of them explained, while another one offered: “We believe the manufacturing economy will be stable in 2023… near capacity.” Still another said: “We have been trending that way – except for 2020, at the pandemic’s peak. The unfortunate closings of other small foundries helped.” Of that smaller number of respondents who believe 2023 shipments will decrease over 2022, the largest portion (32.4%) put the coming shipment decline in the 26-50% range, and 26.0% see 11-25% drop in shipments ahead. 15.76% of these respondents are prepping for a 0-10% decrease, 14.5% are set for a 5175% decrease, and 10.0% of them believe their shipments will fall 76-90% versus 2022. “The economy will remain stagnant or in recession into 2023, regaining momentum in the second or third quarter,” a respondent wrote. What is the plan? Optimism or pessimism are good indicators, but what is on the metalcasters’ agenda for 2023? Specifically, what are their investment and spending plans. Confident businesses prepare for good opportunities. They make capital investment plans. When we asked Outlook survey respondents to estimate their businesses’ 2023 capital expenditures, compared with 2022 spending, 50.7% of them indicated the investment levels will increase, and 33.5% reported the spending totals will remain about the same as in 2022. 15.8% reported capital spending will decrease next year. For those metalcasting operations where CapEx spending is planned to increase, 33.85% of respondents told us the yearover-year increase will be in the 26-50% range, and 27.7% put the increase at 11-25%. 16.15% see an increase of 51-75% over last year, and 11.8% see the rise in the 0-10% range. Of the smaller number of respondents who reported decreased CapEx plans for 2023, 33.85% gauged that coming drop at 2650% year-over-year, and 27.7% pegged it falling by 11-25%. Another 16.15% said the decrease will be 51-75%, 11.8% are expecting a spending drop of 0-10%, 8.5% see the decrease at 76-90%, and 2.0% say it will be a drop of more than 90%. It’s always intriguing to know how next year’s capital spending will be directed, and 55.06% of respondents reported that new plant equipment is on order. 30.3% indicated their plans include plant expansions or additions, and 27% of all respondents revealed plans for new plants in 2023. (The total – which represents the results of a multiple-choice question, so responses exceed 100% – also includes 7.4% of respondents who are not planning for new plants, expansions, or equipment in 2023.) Asked to estimate their operations’ total planned capital expenditures during 2023, 2.9% of respondents reported the figure is over $5 million, and 14.5% projected it at $1 million to $5 million. 22.3% reported spending plants in the $501,000-$1 million range; and 31.25% pegged the number at $251,000-$500,000. 18.5% told us the spending plan ranges from $101,000 to What percentage of “normal” plant capacity is represented by your 2022 average monthly casting production? 0-50% 51-60% 61-75% 76-90% 91-100% over 100% 5 2 0 2 3 M E TA L C A S T I N G O U T L O O K | F O U N D RY M A G . C O M 12.78% 22.20% 23.77% 28.92% 9.42% 2.91% Metalcasting Outlook $250,000, and 10.5% put the number at less than $100,000. Where will the money come from? 14.35% of respondents indicate their operations plan to increase debt levels during 2023, and 21.19% expect to see debt retired next year. 38.85% expect the level of debt carried by their operations to remain about the same as in 2022, and 17.9% report their operations are not carrying debt, while 7.73% are seeking new equity investments. What do you need? Metalcasting operations have innumerable ways to invest to improve their processes, for product quality, efficiency, productivity, and other objectives. We presented survey respondents with an extensive choice of equipment options for their investments, in 2022 and 2023 – multiple choice questions that yield totals in excess of 100%. The totals, however, tell us some of the needs for foundries and diecasting operations. Recalling their 2022 equipment spending, respondents’ top choice was “conveyors”, selected by 23.5% of the field – indicating a need to handle processed materials and/or parts efficiently. Close in second place, selected by 23.25% of all respondents is “blast cleaning equipment”, suggesting a need to increase or improve high-volume cleaning of castings. Also drawing investment spending during the past year have been “automatic pouring systems” and “continuous mixers”, tying for the third place with 21.22% of all respondents; “air Indicate which of the following issues are likely to be significant problems for your operation in 2023. Availability of Capital Energy Costs Energy Shortages EPA Requirements Human Resources Imported Castings Interest Rates Labor Costs Labor Shortage Lack of Orders Material Shortages Medical/Insurance Costs On-Time Delivery of Castings OSHA Requirements Plant Management Plant Operations Product Liability Product Marketing/Sales Quality of Castings Raw Materials Cost Skills Shortage Supply Chain Disruptions Tariffs Training Workers' Compensation Costs Other 20.09% 27.15% 25.61% 19.21% 23.18% 18.54% 18.10% 19.21% 24.50% 9.27% 16.56% 9.93% 12.14% 9.71% 7.73% 10.60% 9.93% 7.28% 9.05% 19.21% 17.22% 12.36% 3.75% 4.86% 3.31% 0.44% compressors”, for 20.77% of all respondents; and “cranes and hoists”, for 20.54% of respondents. Other high-ranking investment choices for 2022 were “grinding equipment” (19.4%) and “cut-off equipment” (17.6%.) Where are the top spending targets for next year? The most popular selection, by 23.64% of all respondents, is “coremaking equipment”, suggesting that production volumes and/or efficiency standards will be rising for complex castings. Other common choices for Outlook survey respondents are “continuous mixers” (21.14%), “blast cleaning equipment” (20.0%), “grinding equipment” (17.95%) and “design software/ hardware” (17.73%.) “Automatic pouring systems” (17.27%) and “air compressors” (16.14%) will continue to draw investment spending from survey respondents in 2023. What’s your problem? The Outlook survey also seeks to determine the issues and concerns that are shaping metalcasting operations in 2023, those that are driving the decisions that owners, executives, and managers must make. We asked respondents to identify the issues they have faced during the past year, those that have challenged their operations’ performance, and which ones they expect to face in 2023. (Once again, the multiple-choice questions result in survey totals that exceed 100%.) Asked to indicate the “significant problems” their operations faced during 2022, the survey respondents’ most-selected issue is “energy costs” (30.4%), followed by “human resources” (28.9%), “labor shortages” (24.7%), “EPA requirements” How are imported castings affecting your business? No effect Imported castings remain a competitive factor Tariffs have impacted our customers’ demand for castings 17.26% 45.29% 30.49% Imported castings are becoming less of a competitive factor 21.97% We’re developing our own export business 9.42% No days of production lost 22.64% Have you gained new orders from reshored manufacturing programs? Yes 81.12% No 18.88% Do you plan to increase employment totals during 2023? Yes 82.72% No 17.28% 6 2 0 2 3 M E TA L C A S T I N G O U T L O O K | F O U N D RY M A G . C O M (24.0%), and “labor costs” (23.3%) completing the top five. Other common issues facing metalcasters during the past year were “energy shortages” (23.1%), “raw materials costs” (20.67%), “material shortages” (18.0%.) We presented the same choices and asked respondents to identify the issues they expect will challenge their operations in 2023. Again their most-commonly selected issue is “energy costs” (27.15%), followed by “energy shortages” (25.6%), “labor shortages” (24.5%), “human resources” (23.2%), and “availability of capital” (20.1%.) Three more issues drew an equal number of selections from respondents: “EPA requirements” (19.2%), “labor costs” (19.2%), and “raw materials costs” (19.2%.) Some issues are persistent in the challenge they present to metalcasters, and for decades one of those issues has been casting imports. The Outlook survey asked respondents how imported castings have affected their operations during 2022, and 45.3% of all respondents confirmed that imports remain a competitive factor for them; 21.9% reported that imported castings are becoming less of a competitive factors, and 17.3% reported imports have had no effect on their business. 30.5% reported that import tariffs have affected customers’ demand for castings. Related to the issue of imported castings is the more recent factor known as “reshoring” – meaning production programs that once involved manufacturing overseas being relocated to the U.S. The reshoring trend may be the most consequential development in metalcasting in recent decades – reallocating production programs to domestic suppliers, and justifying an overdue reinvestment in metalcasting capacity. We asked Outlook survey respondents if their businesses have gained casting orders thanks to reshored manufacturing programs: 81.1% confirmed they have gained orders as a result, and 18.9% indicated they had not. What happens next? Reshoring may also be the way to demonstrate to the larger manufacturing community what metalcasters have always known: that the process, the industry, and the products have a permanent place in any civilized society. There are competing processes and alternative choices for various applications – but for reliability and scale of production, for cost competitive manufacturing, there is no option other than metalcasting. So what is the potential for expansion of metalcasting? We asked Outlook survey respondents to indicate what percentage of their normal plant capacity is represented by 2022’s average monthly casting production: 12.8% reported they have operated at 0-50% of capacity in 2022; 22.2% of respondents have operated at 51-60%; 23.8% have operated at 61-75%; 28.9% have operated at 76-90%; and 9.4% have operated at 91-100%. In addition, 2.9% of respondents indicated they have operated above 100% capacity during 2022. Asked to project how the overall U.S. economy (GDP) will perform during 2023 compared to 2022, 4.32% expect a significant decline, and 19.15% expect a less significant decline. 27.62% of respondents expect 2023 to continue in about the same way as 2022, while 33.4% are looking forward to some improvement next year, and 15.6% expect significant improvement. Are they preparing for their own improved performance in 2023? When asked if they expect to increase their operation’s employment total next year, 82.7% of all survey respondents answered affirmatively. The FM&T Business Outlook survey seeks to learn what metalcasters know about their industry, and what they sense about the economy in which they work. It’s the product of their effort – for which we offer thanks and wish them continued success. 7 2 0 2 3 M E TA L C A S T I N G O U T L O O K | F O U N D RY M A G . C O M