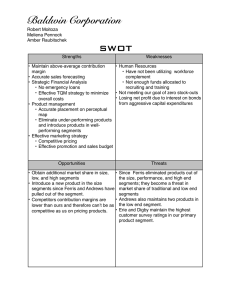

BADM 2001-10: Introduction to Business- Fall 2020 Instructor: Dr. Rehab Abdel Aziz Assignment 3 Due date: Saturday, October 24th, 2020 Points: (30 points) Look at the three financial statements on page 3 excerpted from the Foundation FastTrack Industry ID F117065, Rd 4. Answer the following questions explaining the reasons and justification for your answers. 1) Calculate the ROS for the six companies. Which company is the most profitable? Why? (6 points). Return of sales = (Profit / sales) x 100 Andrews: 5752/74875 = 7.68% Baldwin: 824/72522 = 1.14% Chester: 507/67154 = 0.75% Digby: -309/67296 = -0.459% Erie: -3160/67433 = -4.69% Ferris: 6611/89546 = 7.38% Company Andrews is the most profitable since it has the highest return on sale percentage. In other words, this company produces the highest profit with regard to its sales. 2) Calculate the contribution margins of the 6 companies. Which company has the best contribution margin? Is this good enough? Why or why not? (6 points). Contribution margin = sales – variable cost Contribution margin ratio = contribution margin/revenue Andrews: 74875 – 47730 = 27145 27145/74875 = 36.3% Baldwin: 72522 – 51718 = 20804 20804/72522 = 28.7% Chester: 67154 – 46891 = 20263 20263/67154 = 30.2% Digby: 67296 – 49522 = 17774 17774/67296 = 26.4% Erie: 67433 – 48674 = 18759 18759/67433 = 27.8% Ferris: 89546 – 58310 = 31236 31236/89546 = 34.9% Company Andrews has the best contribution margin ratio of 36.3%. This is good enough since the acceptable value is 30% or higher However, the higher the better 3) Calculate the Net Margins for the 6 companies. Which company has the highest net margin? Is this good enough? Why or why not? (6 points). Net margin ratio = (CM – FC) /sales Andrews: 11566/74975 = 15.43% Baldwin: 4049/72522 = 5.58% Chester: 3651/67154 = 5.44% Digby: 3047/67296 = 4.53% Erie: -1309/67433 = 1.94% Ferris: 13872/89546 = 15.49% Company Ferris has the highest net margin ratio of 15.49% No, this is not good enough. Since the recommended ratio is 20% However, the higher the better 4) Explain why company Erie got an emergency loan worth $ 9,854? (6 points). It ran out of cash, so it had a forced emergency loan. Inventory is negative in the cash flow statement o Which means that the inventory increased by exactly $13874 o Cash is trapped in inventory Early retirement of long-term debt decreased the cash available by $1733 They did not finance the for their investment well o Investment of $17779 o Financing with common stock $6000 o Financing with long term debt $5000 o Difference between investment and financing it is almost $7000 5) Look at the income statement survey. Explain the reasons why Andrews and Baldwin Companies have approximately achieved similar total sales values (Andrews $74875 and Baldwin $72,522), yet company Andrews was able to achieve a net profit of $5,752 while company Baldwin has only achieved a net profit of $824. (6 points). The variable cost of Baldwin is higher than that of Andrews May be caused by increased labor cost, material cost, or inventory carrying cost It is probably mainly because of the inventory carrying cost, since Baldwin had inventory at year end costing 16,465$ while Andrews had only 3,697$ worth of inventory o This decreases the contribution margin of Baldwin o Which decreased the amount left to finance the fixed costs, the interest, and the taxes