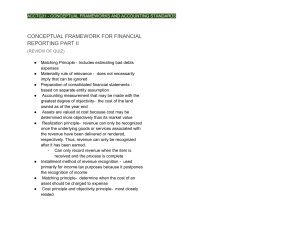

CONCEPTUAL FRAMEWORK FOR FINANCIAL REPORTING PART II

advertisement

ACCTG31 - CONCEPTUAL FRAMEWORKS AND ACCOUNTING STANDARDS CONCEPTUAL FRAMEWORK FOR FINANCIAL REPORTING PART II (REVIEW OF QUIZ) ● ● ● ● ● ● ● ● ● Matching Principle - Includes estimating bad debts expenses Materiality rule of relevance - does not necessarily imply that can be ignored Preparation of consolidated financial statements based on separate entity assumption Accounting measurement that may be made with the greatest degree of objectivity- the cost of the land owned as of the year end Assets are valued at cost because cost may be determined more objectively than its market value Realization principle- revenue can only be recognized once the underlying goods or services associated with the revenue have been delivered or rendered, respectively. Thus, revenue can only be recognized after it has been earned. - Can only record revenue when the item is received and the process is complete Installment method of revenue recognition - used primarily for income tax purposes because it postpones the recognition of income Matching principle- determine when the cost of an asset should be charged to expense Cost principle and objectivity principle- most closely related