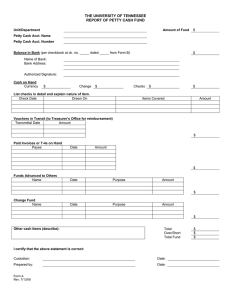

CHAPTER 3 CURRENT ASSETS What is Current Asset? A current asset is an item on an entity's balance sheet that is either cash, a cash equivalent, or which can be converted into cash within one year. What are financial assets of businesses? Financial Assets are an assets that can be readily converted into cash. These include cash and bank accounts, account receivable plus securities and short term investment accounts. These assets can be converted into cash in a reasonably short period of time - one year at most, but less time in many cases. 1. What is cash? Cash is a medium of exchange which a bank will accept for deposit and immediate credit to the depositor’s account. It is the most liquid of all assets and the most readily available to pay debts. It is central to the operating cycle because all operating transactions eventually use or generate cash. The criteria generally used to define cash are it should be a medium of exchange, it should be available immediately for the payment of current debts, and It should be restriction management from using obligations. Because free from any contractual which would prevent of the business enterprise it to meet any and all of the role of cash plays in financial transactions, internal control of cash is needed. Account Receivable Account receivables are relatively liquid assets, usually converting into cash within a period of 30 to 360 days. Account receivables are current assets. The period used to defined Current assets is typically one year or the company’s operating cycle, which ever is longer. The operating cycle which defined the normal period required to convert cash into inventories, inventories into account receivable and account receivables into cash. Cash Control Methods The following ways are used as controlling method of cash: Bank statement Imprest systems Petty cash Change Fund Bank Statements It Shows the beginning bank balance, deposits made, checks paid, other debits and credits in the month, and the ending bank balance. The cash balance indicated on the monthly bank statement seldom agrees with the cash balance indicated by the depositor’s ledger account for cash. Bank Reconciliations A bank reconciliation is a necessary step in internal control. A bank reconciliation is the process of accounting to reconcile the difference between the balance on a company’s bank statement and the balance in its Cash account. This process involves making additions to and subtractions from both balances to arrive at the adjusted cash balance. The following are the transactions that most commonly appear in a company’s records but not on its bank statement: 1.Outstanding checks: These are checks that a company has issued and recorded but that do not yet appear on its bank statement. 2.Deposits in transit: These are deposits a company has sent to its bank but that the bank did not receive in time to enter on the bank statement. Transactions that may appear on the bank statement but not in the company’s records include the following: 1. Service charges (SC): Banks often charge a fee, or service charge, for the use of a checking account. 2. NSF (nonsufficient funds) checks: An NSF check is a check that a company has deposited but that is not paid when the bank presents it to the issuer’s bank. 3. Miscellaneous debits and credits: Banks also charge for other services, such as printing checks. The bank notifies the depositor of each deduction by including a debit memorandum with the monthly statement. A bank also sometimes serves as an agent in collecting on promissory notes for the depositor. When it does, it includes a credit memorandum in the bank statement, along with a debit memorandum for the service charge. Reconciling the Bank Statement Balance per Bank Balance per Depositor + Deposits in Transit + Deposits by Bank (credit memos) - Outstanding Checks - Service Charge - NSF Checks ± Bank Errors ± Book Errors = Adjusted Balance = Adjusted Balance Reconciling the Bank Statement Example Instruction:- Prepare a July 31 bank reconciliation statement and the resulting journal entries for the Simmons Company using the given information below. Given:- The July 31 bank statement indicated a cash balance of $9,610, while the cash ledger account on that date shows a balance of $7,430. Additional information that are necessary reconciliation are shown on the next slide. for the CONT.. Outstanding checks totaled $2,417. A $500 check mailed to the bank for deposit had not reached the bank at the statement date. The bank returned a customer’s NSF check for $225 received as payment ofan account receivable. The bank statement showed $30 interest earned on the bank balance for the month of July. Check 781 for supplies cleared the bank for $268 but was erroneously recorded in our books as $240. A $486 deposit by Simian Company was erroneously credited to our account by the bank. Reconciling the Bank Statement Example Balance per bank statement, July 31 Additions: Deposit in transit Deductions: Bank error $ 486 Outstanding checks 2,417 Adjusted cash balance $ 9,610 Balance per depositor's records, July 31 Additions: Interest Deductions: Recording error $ 28 NSF check 225 Adjusted cash balance $ 7,430 500 2,903 $ 7,207 30 253 $ 7,207 Imprest Systems Imprest system is a kind of financial accounting system, and is most commonly used for petty cash. It consists of a cash balance which is replenished at the end of the period or when circumstances require it Most companies need to keep some currency and coins on hand for small payments. These currency and coins are needed for paying expenses that are impractical to pay by check, Thus, this helps to control a cash fund and cash advances. PETTY CASH FUND a petty cash fund is established at a fixed amount. It is a common form of imprest system. The fund is periodically reimbursed, based on the documented expenditures, by the exact amount necessary to restore its original cash balance. Example: Assume that on January 1, 2011 ABC company established a petty cash of Birr 250. On January 20, 2011 the Cashier requested replenishment for the bills paid during the period. The following itemized list of payments from petty cash was presented on January 20 for replenishment and on January 31, 2011 in connection with the month end audit. List Cash in fund Jan. 20 Jan.31 Birr 9.00 Birr 150.00 Office sup. Exp. 171.00 77.00 Miscl. Expenses 65.00 25.00 5.00 (2.00) Birr 250.00 Birr 250.00 Cash (over) & short Total What should be the entry on January 1, January 20 and December 31, 2011? January 1 Establishment of petty cash Debit Credit Petty cash 250.00 Cash at Bank 250.00 To record the establishment of petty cash fund To record the replenishment of petty cash Jan. 20, 2011 Office supplies expenses 171 Miscellaneous expenses 65 Cash over and short 5 Cash 241 To record expenses incurred since Jan. 1 replenish petty cash The cash over and short account is classified as revenue when it has a credit balance and expense when it has a debit balance. Cash Over and Short is debited for shortages and credited for overages. Jan. 31, 2011 Office supplies expanses 77 Miscellaneous Expenses 25 Cash over and short 2 Cash 100 To record expenses incurred since Jan. 20 and to replenish petty cash The petty cash fund should be replenished at the end of the accounting period so that the expenses paid from the fund are recorded in the proper period and the end cash balance is stated correctly. CHANGE FUND Change Fund:- A change fund is an imprest fund used to facilitate the collection of money from customers. The amount of the change fund is deducted from the total cash on hand at the close of business each day to determine the daily cash collection. The cash should be counted and checked against the cash register tape daily. ………. END