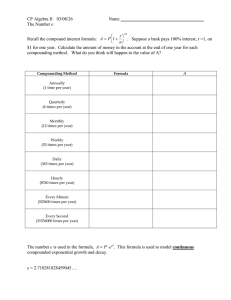

BASIC FINANCIAL CONCEPTS 1. TIME VALUE OF MONEY - The time value of money is a financial principle that states the value of a peso today is worth more than the value of a peso in the future. - This philosophy holds true because money today can be invested and potentially grow into a larger amount in the future. 2. DIVERSIFY YOUR RISKS AND INVESTMENTS - If you invested all of your money into one company’s stock and it plunged, you'd lose some if not all your money. If you put all of your money into a single bond and the issuer declared bankruptcy, you'd lose some if not all your funds, too. Diversification helps mitigate the risk to you about such scenarios by choosing different investments and types of investments. Diversification doesn’t guarantee investment returns or eliminate risk of loss including in a declining market. 3. THE COMPOUNDING EFFECT OF MONEY. - Compounding is a powerful investing concept that involves earning returns on both your original investment and on returns you received previously. For compounding to work, you need to reinvest your returns back into your account. For example, you invest $1,000 and earn a 6% rate of return. In the first year, you would make $60, bringing your total investment to $1,060, if you reinvest your return. - Next year, you would earn a return on your total $1,060 investment. If your return were once again 6%, you’d make $63.60, bringing your total investment to $1,123.60. - Over the long term, compound growth can multiply your initial investment exponentially. In our hypothetical example, if your return stayed at 6%, by year 30, your annual earnings would be $325.10. That’s more than five times the $60 return you earned the first year — just for sitting by and letting your money grow. 4. UNDERSTAND THE STOCK MARKET - - The stock market provides a venue where companies raise capital by selling shares of stock, or equity, to investors. Stocks give shareholders voting rights as well as a residual claim on corporate earnings in the form of capital gains and dividends. Individual and institutional investors come together on stock exchanges to buy and sell shares in a public market. When you buy a share of stock on the stock market, you are not buying it from the company, you are buying it from an existing shareholder. What happens when you sell a stock? You do not sell your shares back to the company, but instead, sell them to another investor on the exchange. Why Companies Issue Shares? To make the transition from an idea germinating in an entrepreneur's brain to an operating company, they need to lease an office or factory, hire employees, buy equipment and raw materials, and put in place a sales and distribution network, among other things. These resources require significant amounts of capital, depending on the scale and scope of the business. 5. KEEP A HOUSEHOLD BUDGET The importance of making a budget is a financial lesson that cannot be overemphasized. If you and your family want financial security, following a budget is the only answer. 6 Reasons why you need a budget A. It Helps You Keep Your Eye on the Prize. A budget forces you to map out your goals, save your money, keep track of your progress, and make your dreams a reality. B. It Helps Ensure You Don't Spend Money You Don't Have C. It Helps Lead to a Happier Retirement D. It Helps You Prepare for Emergencies E. It Helps Shed Light on Bad Spending Habits F. It's Better Than Counting Sheep. Following a budget will also help you catch more shut-eye. How many nights have you tossed and turned worrying about how you were going to pay the bills? People who lose sleep over financial issues are allowing their money to control them. Take back the control. When you budget your money wisely, you'll never lose sleep over financial issues again. 6. OPPORTUNITY COSTS - Opportunity costs represent the potential benefits that an individual, investor, or business misses out on when choosing one alternative over another. Because opportunity costs are unseen by definition, they can be easily overlooked. Understanding the potential missed opportunities when a business or individual chooses one investment over another allows for better decision making. 7. INTEREST RATES - The interest rate is the amount charged on top of the principal by a lender to a borrower for the use of assets. - An interest rate also applies to the amount earned at a bank or credit union from a deposit account. - Most mortgages use simple interest. However, some loans use compound interest, which is applied to the principal but also to the accumulated interest of previous periods. - A borrower that is considered low risk by the lender will have a lower interest rate. A loan that is considered high risk will have a higher interest rate.