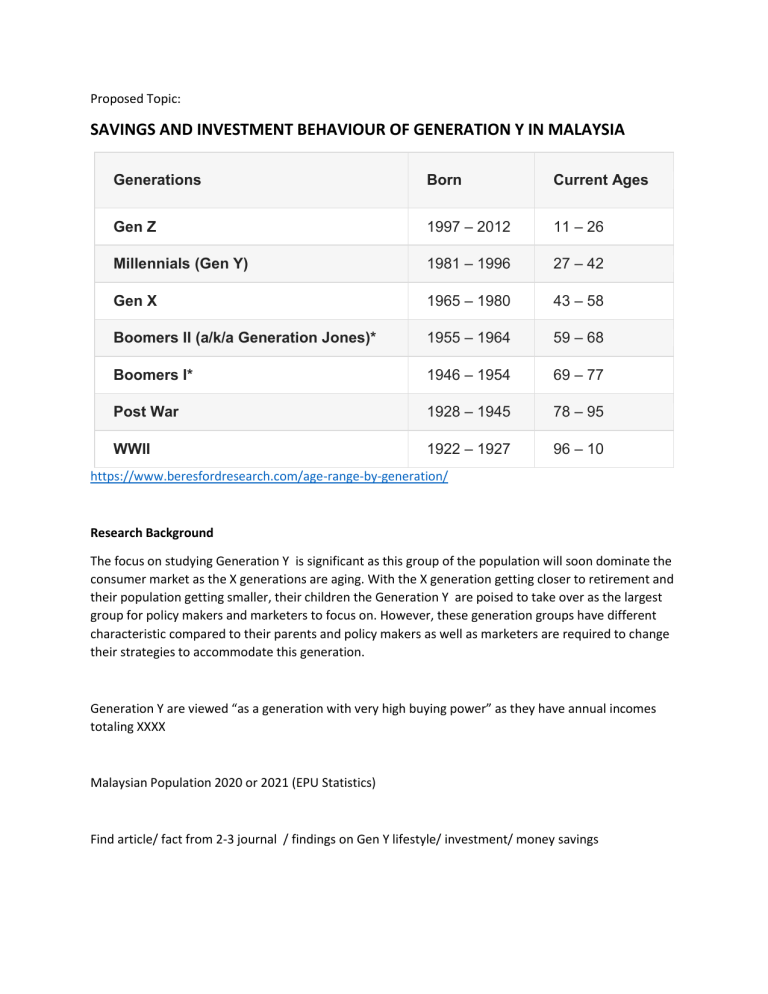

Proposed Topic: SAVINGS AND INVESTMENT BEHAVIOUR OF GENERATION Y IN MALAYSIA Generations Born Current Ages Gen Z 1997 – 2012 11 – 26 Millennials (Gen Y) 1981 – 1996 27 – 42 Gen X 1965 – 1980 43 – 58 Boomers II (a/k/a Generation Jones)* 1955 – 1964 59 – 68 Boomers I* 1946 – 1954 69 – 77 Post War 1928 – 1945 78 – 95 WWII 1922 – 1927 96 – 10 https://www.beresfordresearch.com/age-range-by-generation/ Research Background The focus on studying Generation Y is significant as this group of the population will soon dominate the consumer market as the X generations are aging. With the X generation getting closer to retirement and their population getting smaller, their children the Generation Y are poised to take over as the largest group for policy makers and marketers to focus on. However, these generation groups have different characteristic compared to their parents and policy makers as well as marketers are required to change their strategies to accommodate this generation. Generation Y are viewed “as a generation with very high buying power” as they have annual incomes totaling XXXX Malaysian Population 2020 or 2021 (EPU Statistics) Find article/ fact from 2-3 journal / findings on Gen Y lifestyle/ investment/ money savings Problem Statement The main purpose of this study is to get to know more about Malaysian Generation Y and to fill the knowledge gap on their spending, saving and investment behaviours. 1.3 Research Questions In order to attain the above-mentioned purposes of this study, the following research questions will be answer: Question 1: What are the preferred channels of communication of Malaysian Generation Y ? Do they prefer to obtain information on saving and investment through Bank representative or through online resources? Question 2: Are Malaysian Generation Y saving habits is influence by information that they received from the media? Question 3: Do female Malaysian Generation Y spend more than male generation Y? Question 4: Do Malaysian Generation Y usually spent out of their budget? Question 5: What is the average saving rate of Malaysian Generation Y? Question 6: What are the preferred methods of saving by Malaysian Generation Y ? Question 7: Have Malaysian Generation Y started saving for their retirement? Question 8: What are the preferred type of investment of Malaysian Generation Y (Islamic/ Conventional)? Question 9: Do Malaysian Generation Y have a diversify investment portfolio? Question 10: Do Malaysian Generation Y invest their money in risky market? Research Objectives General Objective The objective for this research is to explore the demographic of Malaysia’s Generation Y , specifically in investigating their saving and investment habits. Specific Objective This study attempts to accomplish six main objectives as follows: 1. To identify the income and spending patterns of Generation Y. 2. To determine the level of saving and the forms of saving performed by Generation Y. 3. To study the method and type of investments (if any, such as equities, real estate, unit trusts and others, Islamic/ Conventional ) practiced by Generation Y. 4. To assess the awareness of risk management in investment of Generation Y. 5. To determine the effective channels of communication with Generation Y. 6. To make recommendation for appropriate selling/marketing channel of investment linked products target Generation Y, based on the preferred channel selected from the survey.