CAPM & Financial Formulas: Return, Risk, Correlation

advertisement

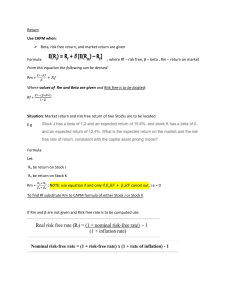

Return Use CAPM when: Beta, risk free return, and market return are given Formula: ; where Rf – risk free, β – beta , Rm – return on market From this equation the following can be derived: Rm = 𝐸𝑟−𝑅𝑓 𝛽 + 𝑅𝑓 Where values of Rm and Beta are given and Risk free is to be located: Rf = 𝐸𝑟−(𝛽∗𝑅𝑚) 1−𝛽 Situation: Market return and risk free return of two Stocks are to be located E.g Formula: Let: Rₐ be return on Stock J Rₓ be return on Stock K Rₐ+ Rₓ Rm = 𝛽ₐ+ 𝛽ₓ ; NOTE: use equation if and only if 𝛽ₐ𝑅𝐹 + 𝛽ₓ𝑅𝐹 cancel out, i.e = 0 To find Rf substitute Rm to CAPM formula of either Stock J or Stock K If Rm and β are not given and Risk free rate is to be computed use: Use variance when: Return in N occurrence and expected return, probability of occurrence are given Use Covariance when: Measuring relation between to assets Use correlation when Measuring relationship between two assets Note: Range is always within – 1 to + 1. The closer to zero the lesser the relation between assets Addendum: correlation and covariance are related BUT correlation is easier to analyze because of its limited range i.e -1 to +1 Other formulas to take note of: Risk and return Coefficient of variation : Beta: 𝛽 = 𝑐𝑜𝑣𝑎𝑟𝑖𝑎𝑛𝑐𝑒 𝑜𝑓 𝑠𝑡𝑜𝑐𝑘 𝑡𝑜 𝑡ℎ𝑒 𝑚𝑎𝑟𝑘𝑒𝑡 𝑉𝑎𝑟𝑖𝑎𝑛𝑐𝑒 𝑜𝑓 𝑡ℎ𝑒 𝑚𝑎𝑟𝑘𝑒𝑡 Weighted average of Portfolio Expected return for an individual investments Regression: Correlation: Regression analysis: